Why IPV? Over the past few years, India has witnessed a remarkable surge in the startup ecosystem. There have been over 100 startups that are termed as Unicorns (startups valued at $1 Billion or more). Events like Shark Tank India have also made investing in startups ‘cool’.

While investing in startups involves higher risk, the potential rewards can be significant if the company succeeds. In this post, we will understand in brief about investing in startups in India & explore in depth- Inflection Point Ventures (IPV)- an angel investing platform in India that allows individuals to invest in startups with minimum capital.

Why invest in startups? (Startups as an alternative investment asset class)

Investing in startups, despite the inherent risks and low success rates, can be appealing for several reasons:

High Potential Returns: While the odds of success may be low, successful startups can offer astronomical returns on investment. A single successful investment can generate significant profits, making up for losses in other ventures.

Diversification: Including startups in your investment portfolio can provide diversification. Traditional investments like stocks and bonds may not offer the same level of diversification as startups, which operate in various sectors and niches.

Personal Fulfillment: Supporting and investing in startups can be personally fulfilling, especially if you believe in the founders’ vision and the impact their product or service can have. It allows you to contribute to the growth of innovative ideas and potentially make a positive difference in the world.

Networking and Connections: Being involved in the startup ecosystem provides opportunities to network with entrepreneurs, industry experts, and other investors. These connections can be valuable for future investment opportunities, collaborations, or gaining industry insights.

What is Inflection Point Ventures (IPV)?

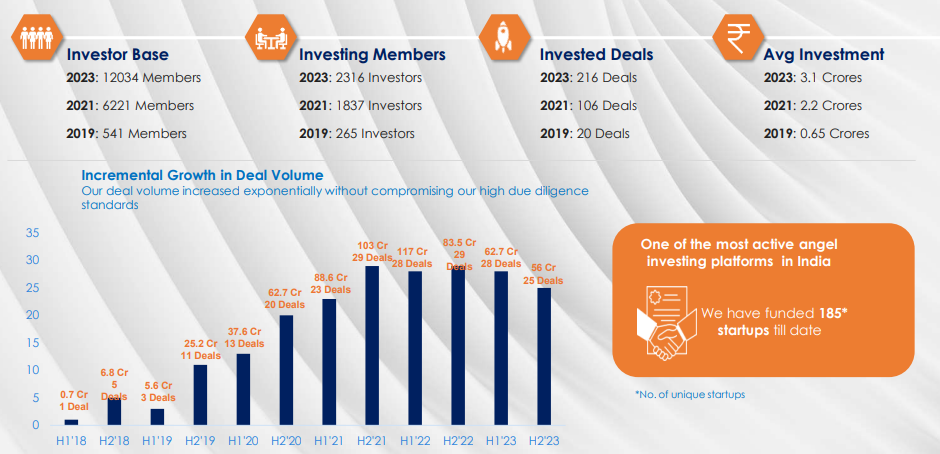

Inflection Point Ventures (IPV) is an angel investing firm founded in the year 2018. The firm is 7000+ angels strong. As of March 31, 2023, IPV has evaluated more than 9,900 startup ventures. Out of these, 594 have been introduced to the members, leading to investments in 160 startups. Additionally, IPV has successfully exited 10 startups, executed 12 partial exits, and undertaken 33 follow-on investments. Some of their successful exits include companies like Bharatpe, Qbera, Hospace, etc.

Inflection Point Ventures Investing Process

Deal Selection

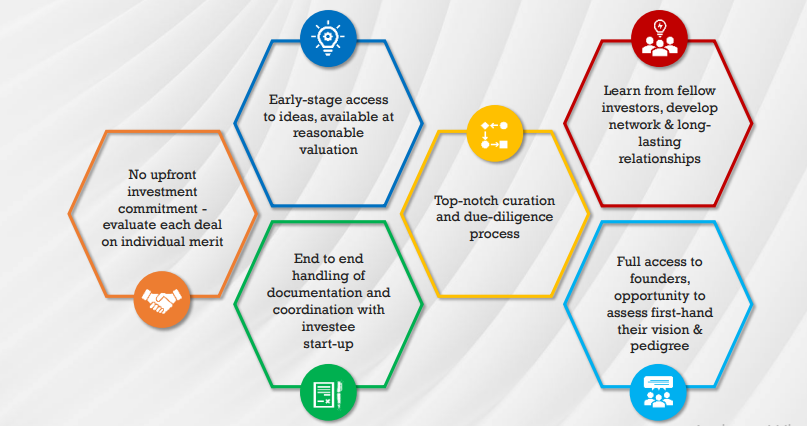

Inflection Point has an intensive process to select the deals as have access to a large number of deals through their network giving them the luxury to choose only the best deals. Only about 1% of deals are finally selected for investment.

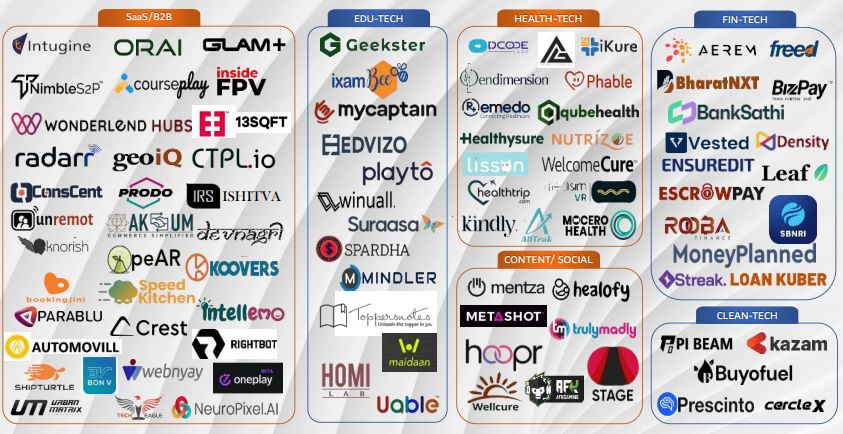

IPV Sector Focus

The platform is sector-agnostic and boasts a portfolio that has investments from SAAS to logistics. This makes it easier for them to double down on the hot sectors, unlike funds that are sector-focused.

IPV Network

IPV has angel investors from some of the top companies in India. A combination of investors with deep sector knowledge and seasoned entrepreneurs gives it a strong capability to groom the startups they have invested in and also help in raising future funds.

Inflection Point Ventures (IPV) Portfolio & Performance

IPV has invested $80M+ in more than 170 companies at the time of writing the article. Out of the 100+ startups invested in until May 2022, they have got 11 exits, 22 partial exits and 59 have gone for follow-up rounds. The overall IRR (including write-offs) is around 44%.

Some of the popular ones in which they invested and got a full exit are Bharatpe, Card91, Fitso, Qbera, Hobspace, Toch, etc with an average IRR of 125%. Invested companies in which they got a partial exit are Samosa Part, geoIQ, OORJAA, Clensta, Phable, etc with an average IRR of 191%. Many more startups have gone for follow-on rounds like Blusmart, Edvizo, Kazam, etc giving them an average IRR of 111% on follo on round companies.

*Data mentioned above is sourced from IPV presentation deck when writing the article.

How to invest in startups through Inflection Point Ventures (IPV)?

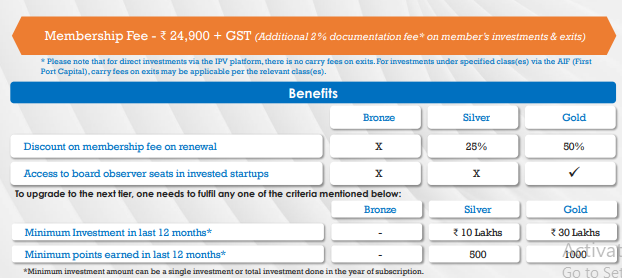

IPV has encouraged a subscription-based approach as it helps in building a community to evaluate deals and collaborate more effectively. Investors who invest actively are given a waiver on annual membership. If you looking to subscribe directly you can pay here and register

If you want a call from the team to understand the platform in detail register below

Investors have two ways to invest:

Direct Investment

Members can invest directly in a startup, holding shares directly. The transaction details, terms, and conditions are worked out between the member and the startup, guided by IPV’s core leadership team. This involves using documents like Standard Term sheets, Valuation, and Evaluation Sheets. However, there are limitations; only 200 investors are allowed on the cap table, and startups might already have many investors. Direct entry can be complicated for NRIs due to RBI compliances, depending on the founder’s expertise. The minimum investment per deal in INR 1 Lakh for this.

AIF (Alternative Investment Fund): To overcome the limitations of direct investment and provide a smoother experience, IPV introduced CAT-I Angel Alternative Investment Fund (AIF), regulated by SEBI. The trust, named FirstPort Capital, serves as a pooled vehicle to gather funds from investors, whether Indian or foreign. These funds are then invested in startups through an investment scheme. Investors receive units in each scheme they invest in. Specific qualifying criteria, minimum investments, and regulatory requirements apply. Investors can invest INR 2.5 Lakh per deal through this mode.

The minimum investment amount for individual investors to start investing in startups through IPV is just Rs.1 Lakh.

Inflection Point Ventures Team

Inflection Point Ventures is steered by a dynamic quartet of founders: Vinay Bansal, a seasoned finance professional and turnaround specialist with two decades of experience in Fortune 50 companies, private equity, and startups; Ankur Mittal, a Chartered Accountant, and MBA from Georgetown University, USA, with a rich background in investment banking and a portfolio of over 20 angel investments; Mitesh Shah, a startup veteran, leveraging his extensive experience from Ola and Bookmyshow to mentor early-stage startups; and CA Vinod Bansal, bringing over four decades of diverse expertise in banking, investment, and business development. This accomplished team, with strong domain expertise, collectively drives Inflection Point Ventures towards success and provides invaluable mentorship to burgeoning startups.

Pros & Cons of Investing in Startups

As mentioned previously, startup investing is a risky affair. The odds of winning are quite less but if you win, the gains can be exponential. Following are a few pros and cons of startup investing in India which will help you make an informed investment decision.

| Pros of of Startup Investing | Cons of Startup Investing |

| High Returns: Potential for significant profits. | High Risk: Many startups fail, leading to potential losses. |

| Innovation: Involvement in disruptive technologies. | Lack of Liquidity: Investments are often illiquid. |

| Diversification: Adds variety to the investment portfolio. | Limited Information: Due diligence is challenging with limited data. |

| Active Involvement: Opportunity for hands-on contribution. | Time Horizon: Requires patience for long-term returns. |

| Tax Benefits: Potential tax incentives for investors. | No Dividends: Startups typically don’t pay dividends. |

| Personal Satisfaction: Fulfilling to support and contribute to a startup’s growth. | Market Volatility: Influenced by economic downturns and market fluctuations. |

| Management Risks: Success depends on effective execution by the management team. |

Keep in mind that the decision to invest in startups should be based on thorough research, risk tolerance, and investment goals. Investors should weigh these factors carefully before engaging in startup investments.

Inflection Point Ventures – Our Verdict

Inflection Point Ventures seems to be a great platform for someone looking to be an angel investor. It is much better compared to solo investing as you get the benefit of the rich experience and expertise of the network. However, this product is suitable for only certain people such as

- Mature Investors who understand the risks and rewards of investing in startups and understand the ecosystem

- Investors should have a large networth as a minimum INR 25 Lakh commitment is required to create a diversified portfolio of startups

Investors looking for fixed-return investments only can consider other platforms from the below list

Conclusion

As mentioned previously, startups are a lucrative asset class to invest in due to the staggering returns it can generate. Yet, it’s important to note that it comes with high risks. My personal opinion is that you should consider startup investing only if your net worth is high & have a high investible surplus. IPV platform can be a good starting point for individuals looking to enter in the world of startup investing.

Rohan,

Have you invested in any of the deals?

IF you have, have you invested through DIRECT of AIF mode?

How is taxation computed?

All the members entering in a specific deal gets exactly the same return or all investors can exit at different times, if yes how can they exit? Is there a secondary market for it?

What are other fees associated with each deal? How does the platform makes its fees? Is it the skin in the game for the platform?

Hi,

I have done some direct deals in the past but I recommend using AIF as in AIF they allow minimum of INR 1 lakh per deal for first 5 deals compared to direct deal that require 2.5 L. ALso you dont have to do paperwork for every deal in AIF

Taxation is same as equity 20% short term capital gain and 10% LTCG.

If there is a complete exit of fund then all will exit same time. If there is a new round then there will be option for exit investor to exit or continue at the valuation at time.

The platform charge 24k annual fees that is reduced if you invest in few deals. Apart from that 2% management fees and 16% carry on profit. This is standard industry model.

Platform invest in each deal from its own balancesheet also.

For more details just sign up here and their team member will guide you.

https://forms.office.com/Pages/ResponsePage.aspx?id=rZe188MjJUy1byVZwEPoK7WjRUYW8wVGnTw0exUOHmhUM0dEMk9ZUUgwT1ZNR1NEMEUyWTZFTTBKMi4u