IndiaP2P Founded in 2021, is a P2P investment platform that has got an RBI license of P2P-NBFC. The platform offers up to 18% return on investments. Generally, I am wary of investing in individual loans on retail loans on P2P Platforms but this platform has some unique features which I find attractive and want to try out. Read this IndiaP2P Review ahead to get to know the complete details.

What is IndiaP2P?

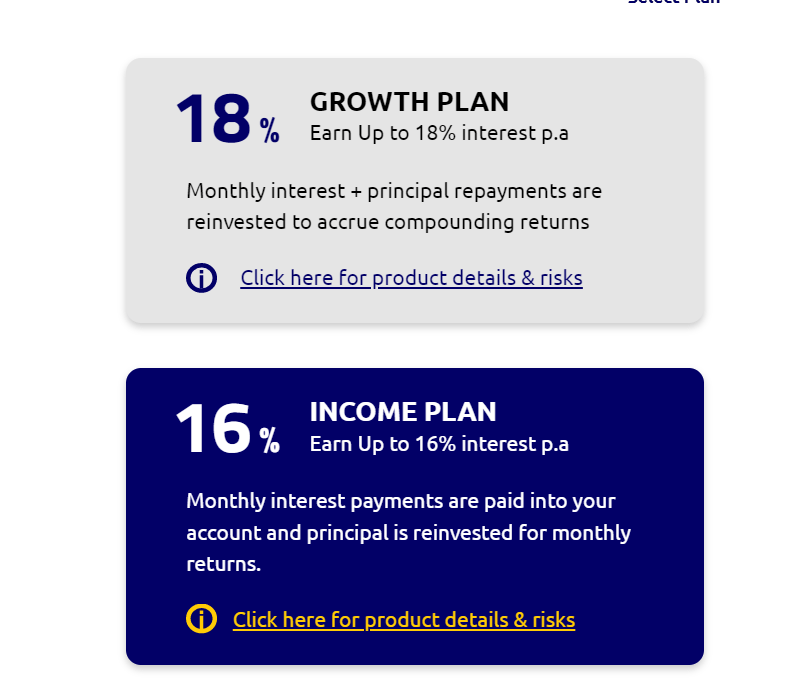

IndiaP2P is an RBI Certified NBFC- P2P which has created an investment product comprised of diversified, high-quality, directly sourced retail loans. The features of the product are :

•High-Quality Curation

•Monthly Returns

•Downside Risk Reduction using IndiaP2P’s portfolio engine

IndiaP2P is a Microfinance focussed P2P that targets women Joint Liability Group (JLG) borrowers for lending. Women borrowers have a much lower default level compared to Men. Some of the features of this category for 2020

•110 Million Loans, Avg. Loan $480

•1.3 % NPA ,30% CAGR growth

•Over 60% of Portfolio funded by Banks (Private + Public)

IndiaP2P Business Model

All loans you invest in via IndiaP2P repay in form of a monthly EMI. Loans are only given to repeat borrowers i.e. borrowers with a successful track record of taking and repaying at least one prior loan from a bank. The loans are given through partner branches and not disbursed online which means direct connection with the borrower and better KYC and collection.

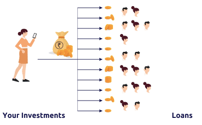

Your investment is spread across multiple, diversified loans that repay with interest every month over a 12-month lock-in. This interest income is re-invested every month to compound. The money invested by us is distributed in a pool to increase diversification and reduce individual default risk. You can start with as low as INR 5000

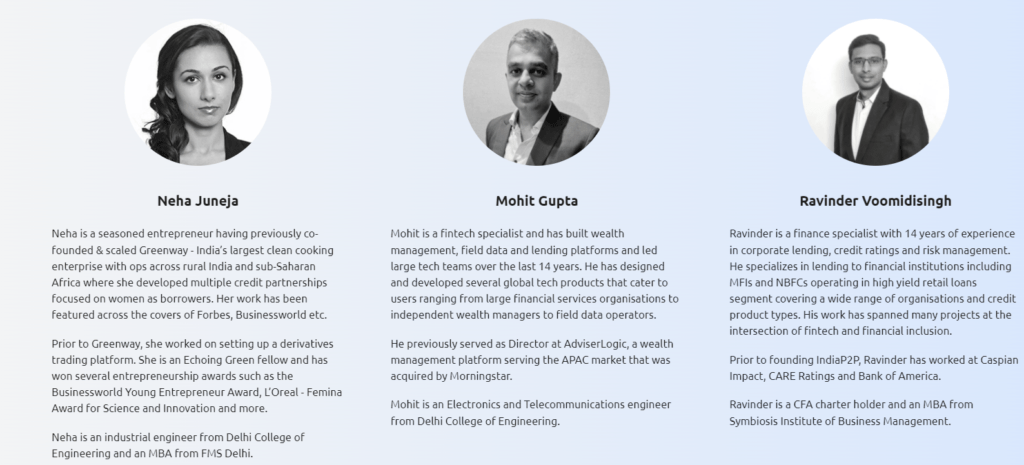

IndiaP2P Team

IndiaP2P is run by Neha Juneja who has rich experience working in credit focussed on the lower-income group space. The company has recently raised pre-seed funding from Antler – a global early-stage VC firm that builds and invests in groundbreaking technology companies

Is IndiaP2P Safe?

As the company is regulated under RBI, the company needs to perform and maintain the minimum required criteria as laid down by the regulator. Risk is mitigated via multiple parameters which include

- 3 filters for partner underwriting & selection, cohort-based analysis, focused underwriting, and social/group history.

- Product creation further minimizes risk by deep diversification (geography, income source, etc.) amongst qualified loans.

- Limited correlation with conventional asset classes/market psychology.

- Pooling of loans to reduce the concentration

- Focus on physical meetings before disbursement.

IndiaP2P Alternatives

There are platforms that provide P2P investments. I have focussed on platforms that focus on High-Quality Prime Borrowers with defined end use like Liquiloans, Lendbox Per Annum, and Cashkumar.

For High Yield Loans, Finzy and I2IFunding are two options that have decent track records.Non-P2P high yield platforms include GripInvest, Jiraaf, and Klubworks among others.

IndiaP2P Review

IndiaP2P is a new high Yield P2P platform that is trying to create a niche for itself by targeting low-risk demographics. If the platform is able to deliver consistent returns it can be a good platform to complement other alternative investments. I am investing a small capital and will publish IndiaP2P Review monthly cash flow and share it in my periodic posts.

Thank you for providing such excellent blogs. One suggestion to improve further is to add if any upfront cost involved like few platforms request registration charges and all. That way it ll provide complete review of the platform.

keep up the good work.

Hi Ravindra , Thanks for the feedback. For most platforms, I ensure either registration is waived for my referrals or they get some joining benefit.

For any platform, if that is not the case I will do add in my future posts!

I checked their website but couldnt find any portfolio performance data.

Hi Kushal, They are new platform. It will take 3-4 months for results to show up.

You can see portfolio performance for indiap2 in their site footer – https://indiap2p.com/portfolio-performance

Yes, correct , The platform would need some vintage for loan book to mature which will give better picture

Hi, nowhere on their website can I find a calculator or any return schedule of any sort like every other investment site shows.

How do I know what amount will I be getting back from any of their plans without an excel or a table of some sort which shows the investment, date of payment if interest and so on.

Can you help? @randomdimes

TIA

Hi Arun, I will be sharing the Excel to monitor investments to all users shortly.

Thanks

Hi,

Please share the excel and your experience with IndiaP2P

Sure Priyank, Will be doing review this month. Will drop a mail with excel template if you have registered

Do you know how it will be taxed ?

Hi Piyush, You need to fill ITR3 with the details of LLP which would be provided by Sustvest. All returns are post-tax

Hi Piyush, This will be considered as income from other sources and added to your total income and taxed at the marginal tax rate

How has been the experience and returns so far till 2023 for IndiaP2P

(since this post is from 2022)?

Returns are satisfactory till now ! I will be doing a new post covering the investment journey soon!

I’ve been an investor here from January last year.

Tried both the plans with monthly returns and cumulative returns with 1yr lock-in. Got the interest on time and got regular updates via email as well.

Happy to assist anyone or take doubts.

Hi Ayush, my P2P investment through Indiap2p has been good till now. I have invested for a year

Hi Rohan,

I’m planning to start my first investment in IndiaP2P next week. I wanted to know if you have your referral code that I can use because I only decided to start my journey in alternative investments after going through your website.

Dear Prakash,

Please find the joining link https://invest.indiap2p.com/register?ref=MRT5Q

Thank You !