The world of investment has significantly changed since the COVID-19 pandemic waned away. The pandemic has taught investors the need for diversification, which is probably why there’s a new interest in fixed-income alternatives like Non-Convertible Debentures or NCDs, especially among average retail investors who were earlier restricted to traditional investments like stocks, mutual funds, and bonds. Let’s see what Earnnest.me has to offer!

In this article, we are going to look at a detailed review of Earnnest.me, a real estate non-convertible debenture investment platform offered by Certus Capital. We’ll look into the benefits of investing in real estate NCDs while covering how Earnnest offers you a platform to explore secured Non-convertible Debentures backed by real estate projects in prime locations across India.

What Are Real Estate Non-Convertible Debentures (NCDs)?

Real Estate NCDs are debt instruments issued by real estate developers or promoters to raise money from investors for real estate projects at fixed interest rates for a pre-determined period (called “tenor”). The issuer pays fixed interests to the NCD holders periodically throughout the tenor while also repaying the principal amount. Fixed interest payments can be dispersed on a monthly, quarterly, half-yearly, or annual basis for the tenor.

Secured NCDs, in simple terms, are those that are backed by the issuer company’s assets. This is to ensure that the investor’s principal amount remains secured. At the same time, secured NCDs often provide a buffer over and above the principal amount. When it comes to real estate, secured NCDs are backed by real estate assets in the form of land, plots, or apartments with significant security covers.

Now, let’s look at how Earnnest provides you with an online platform to explore and invest in fixed-interest NCDs secured by real estate.

Online Real Estate NCD Platform: Earnnest.me

Real estate investment online platforms have truly democratized how these traditionally restricted avenues worked. Alternatives like commercial real estate investing were once restricted to only high-net-worth individuals or institutional investors. Online investment platforms have opened up these avenues to the average investor. At the same time, a good investment platform also offers investors all the knowledge they need to make an informed choice.

What is Earnnest.me?

Earnnest. me is a secured debt investment platform for real estate investors launched in February 2022 by Certus Capital, which has been offering real estate capital solutions and investment opportunities since July 2018.

The platform lists curated opportunities and connects investors looking for opportunities that are secured, regular paying investments, and can generate 5% – 10% more than Fixed Deposits or Debt Mutual Funds without the volatility of equity markets.

With a gross commitment of INR 385 crores, Earnnest has over 700+ investors on the platform, with 70% showing repeat investment interest. Earnnest is a venture of Certus Capital, which has its group entities licensed as NBFCs and AIFs, regulated respectively by the Reserve Bank of India and the Securities and Exchange Board of India.

How Earnnest Works?

Earnnest lists curated investment opportunities that offer fixed annual returns secured by real estate projects. The platform provides investors with all the information needed to make an informed investment decision, where the investor can review deal documents with detailed information on each investment opportunity.

Besides offering a secure online transaction experience, Earnnest also provides investors with a dashboard to track the performance of their investments and underlying projects. Before listing an opportunity on the platform, the team behind Earnnest reviews each investment opportunity through an institutional-focused screening process.

To start investing in real estate NCDs using Earnnest, you must create an account on the platform and sign in. Earnnest investors include professionals, business owners, high net-worth investors, institutional investors, corporates, trusts, and family offices looking for stable returns in high-quality fixed-income investment opportunities. Minimum investment typically starts from INR 10 Lakhs and can go up to a maximum of INR 5 Crores, depending on the type of opportunity. Ticket sizes, however, may vary for each opportunity listed on the platform.

Team Behind Earnnest

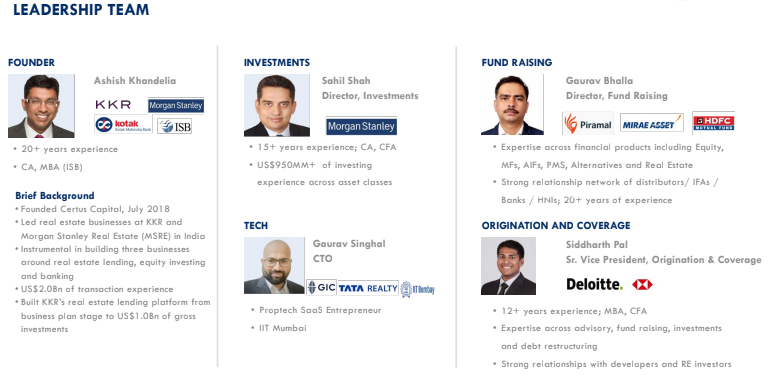

It is very important to have a strong team behind such complex real estate transactions and that’s where Earnnest shines!

A 20-member team leads Earnnest with over 130 years of combined experience with leading global financial institutions and over USD 3 billion in transaction experience.

Earnnest is headed by its founder, Mr. Ashish Khandelia, who has over 20 years of experience working with global institutions in the field of real estate investing and lending. Ashish founded Certus Capital in July 2018 with a vision to build an integrated real estate investment management platform. Ashish is an alumnus of the Indian School of Business, Hyderabad, and a Chartered Accountant. Besides Ashish, the rest of the team also carries an impressive professional profile, having worked with globally acclaimed institutions like Morgan Stanley, Deloitte, HSBC, TATA Realty, Ernst & Young, etc.

Real Estate investments advised by the team at Certus Capital have given a return of 14% to 16% per annum. The team behind Earnnest boasts a combined investing experience of over INR 9000 crores and advisory experience of over INR 10,000 crores. When it comes to real estate specifically, the team has an aggregate of over INR 11,000 crores in real estate credit, including investing and advisory experience.

Due Diligence & Security Cover Offered by Opportunities on Earnnest

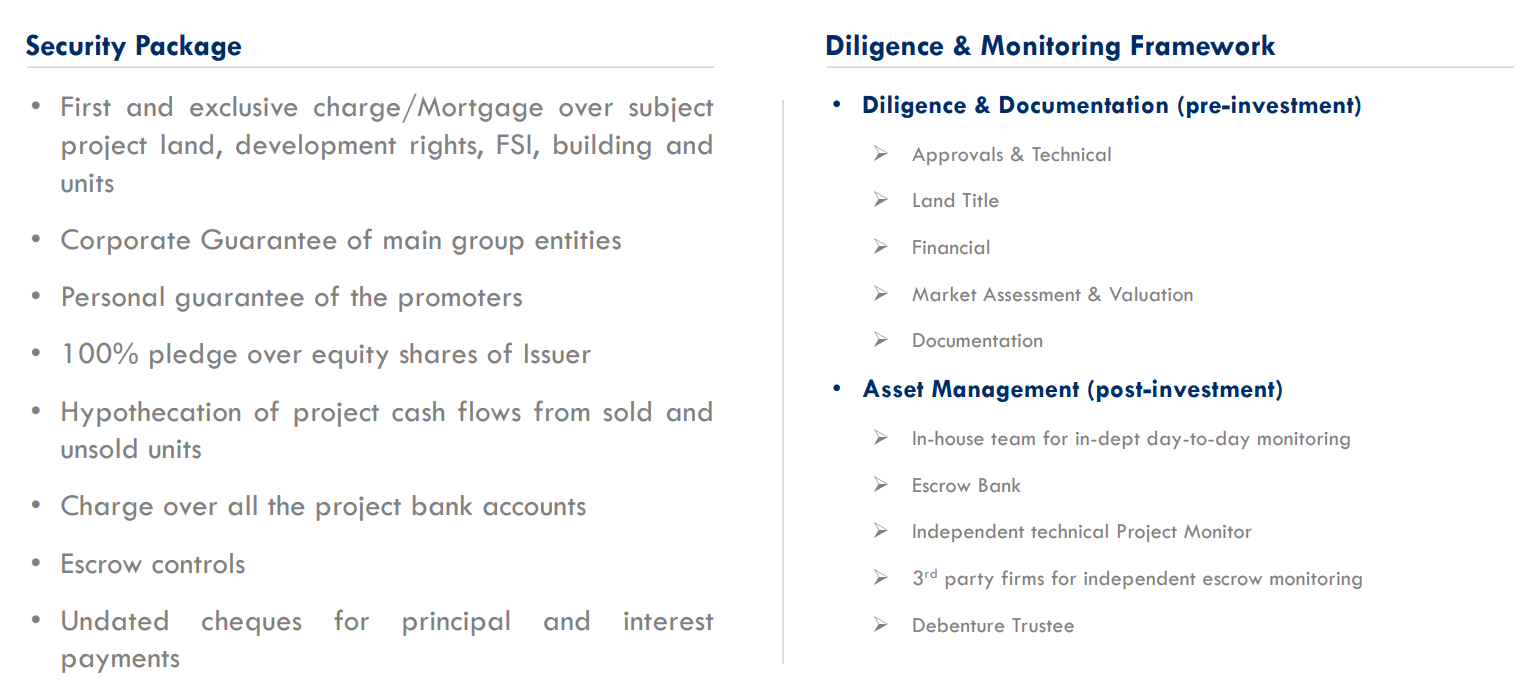

Earnnest’s due diligence involves a thorough review of approvals, land titles, financials, and documentation, as well as market assessment and valuation. A typical security package offered by investment opportunities listed on the platform includes- first and exclusive charge/Mortgage over subject, project land, development rights, FSI, building and units; corporate guarantee of main group entities along with personal guarantee of the promoters; as well as a charge over all the project bank accounts. Post-investment, an in-house team is tasked with day-to-day monitoring, along with independent technical project monitoring or escrow monitoring by third-party firms.

Earnnest’s Track Record

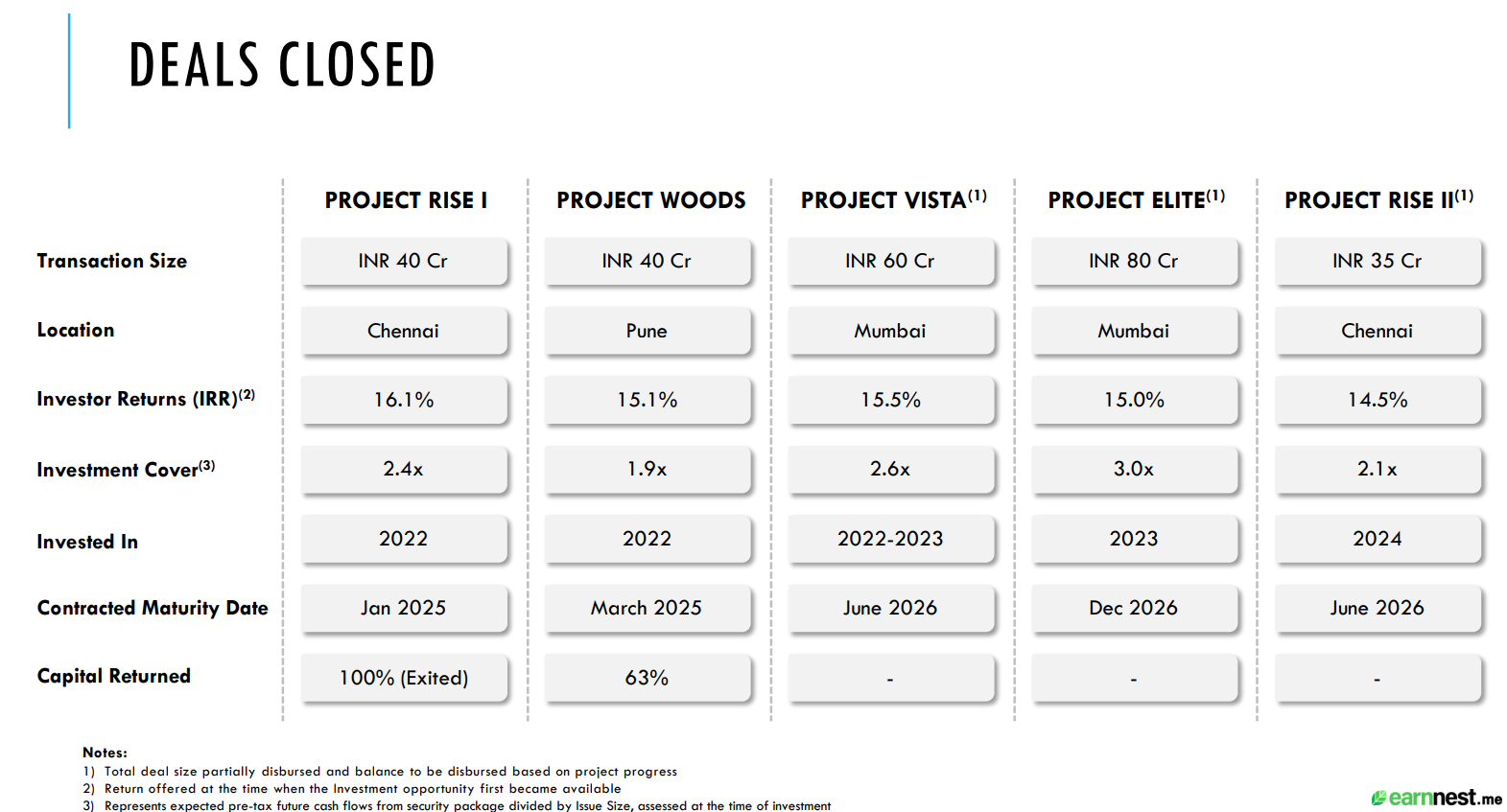

With a gross commitment of close to INR 400 crores, Earnnest has 2500+ registered users on the platform who have done more than 800 investment trades. ~75% of investors have shown repeat investment interest. In the past, Earnnest has successfully closed five deals covering real estate projects in Mumbai, Pune, and Chennai. The following image shows the key metrics of the opportunities previously closed on the real estate-secured debt investment platform.

Real Estate NCD Investing on Earnnest.me

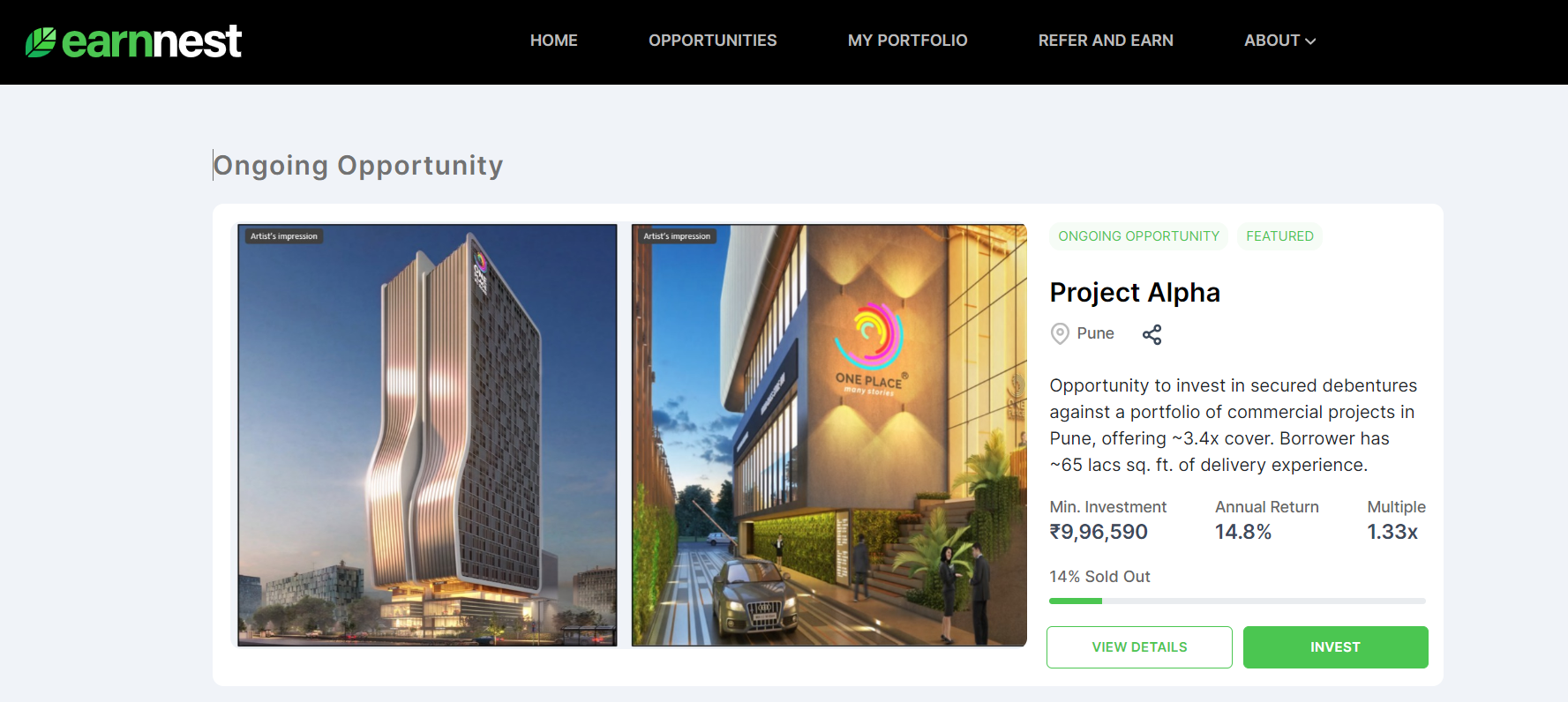

To understand the Earnnest better and how secured NCDs work, let’s explore “Project Alpha”, an opportunity to invest in secured debentures against a portfolio of commercial projects in Pune listed on Earnnest. In doing so, we’ll also look at the key aspects one should consider when investing in real estate NCDs

Project Alpha

Project Alpha offers fixed return debentures secured by two prime commercial real estate projects in Pune, India. It offers a pre-tax Internal Rate of Return (IRR) of 14.8% per annum, with principal repayment spread over seven quarterly installments over a 16- to 34-month period of the tenor. The project offers a significant security cover of 3.4x the principal amount invested in case the borrow defaults. Additionally, a minimum of 5% of outstanding debentures will be held by Earnnest’s team or its affiliates till maturity. The platform also lists the project risks and mitigants for investors to take an informed call.

Both the commercial projects are in prime, sought-after locations in Pune, with excellent connectivity and developed social infrastructure. The borrower is an experienced and well-capitalized promoter group with over 25 years of experience in real estate development in and around Pune. Additionally, the promoter has a track record of completing 26 projects with over 65 lakh square feet in commercial and residential projects.

The first project is a mid-stage commercial building with the construction of the 10th floor ongoing out of the total 17 floors, while the second is prime city center freehold land with an approximate value of INR 121 crores.

Once an investor purchases the NCDs offered by the project at a certain price, the NCDs will be credited to the investor’s demat account in demat form. The borrower will offer a fixed annual return of 14.8%, and both the interest as well as principal amount will be credited to the investor’s bank account linked to the demat account.

Thus, to summarise, Project Alpha offers a fixed annual return of 14.8%, with a security cover of 3.4x the principal investment, along with a principal repayment window spread over seven installments between the 16- to 34-month period of the tenor. The table below highlights the key information one needs to consider:

| Underlying projects: | Two commercial projects in prime, city-centric locations in Pune. |

| Total Funding Size: | 130 crores (Initially, security will be over Project 1, and funding will be restricted to INR 80 Cr. Subsequently, Project 2 will be added to the security cover, with an additional INR 50 Cr disbursed). |

| Instrument type: | Senior Secured (exclusive charge) Non-convertible debentures. |

| Pre-tax Returns to Investors: | 14.8% Fixed Annual Return (IRR). |

| Pay-out Frequency: | Quarterly basis. |

| Investment cover (Principal): | 3.4x |

| Earnnest team Investment: | 5% of outstanding debentures (committed hold-to-maturity). |

| Developer experience: | 65 lakhs+ square feet of residential and commercial real estate projects for 25+ years across 26 different projects. |

Final Verdict on Earnnest

Real Estate NCD investment has its own risk thus it is essential to choose a platform with a strong expertise in this asset class rather than just acting as a tech marketplace. Earnnest is run by a capable team that has skin in the game. However, investors should do their due diligence for each deal to understand the risk and make the investment allocation in line with their total portfolio.

We will be covering the performance of the deals in subsequent monthly platform and portfolio reviews.

Getting Started on Earnnest

- Register on Earnnest

- Fill out the form to get a 1:1 Call to understand the product

- Complete the KYC and Use Code PX64XW while investing to get 0.5% of your total investment as a reward!

Fill out the below form to get a detailed call on the product

Frequently Asked Questions on Earnnest.me

What investment opportunities does Earnnest offer?

Earnnest offers fixed-income investment opportunities in the form of high-quality, regular-paying, non-convertible debentures backed by real estate projects and assets.

Is Earnnest.me safe?

The team behind Earnnest reviews each investment opportunity prior to offering it on the platforms. This includes a thorough review of the technical aspects, legal compliances, finances, etc. Besides, Earnnest provides a secure and safe mechanism for investing online in a seamless way. Investors have access to a dashboard where they can browse through documents containing detailed information on each investment. Even though opportunities on Earnnest typically offer impressive security cover, it is always advisable for investors to do proper due diligence.

Who can invest on Earnnest.me?

Investors on Earnnest include professionals, business owners, high net-worth investors, Institutional investors, corporates, trusts, and family offices looking for stable returns in high-quality investment opportunities.

What is the minimum investment on Earnnest.me?

Minimum investment typically starts from INR 10 Lakhs and and the maximum amount depends on the type of opportunity. However, the ticket size may vary for different opportunities listed on Earnnest.