I have been publishing my P2P portfolio every month .Another arsenal people can add to their investment portfolio is Credit Risk Fund.

Why to use? Everybody does not have a 10-15 year horizon which is the requirement for an equity portfolio to get decent returns.Even then a large cap fund will not deliver more than 11-12% return.

People who want to invest for a shorter horizon tend to stick with RD or Liquid Fund which give out around 7%.P2P is one platform where we can get superior return in short tenor ,but its best to diversify in other asset classes too to have a balanced portfolio.

Return vs Investment Horizon

Risk? Interestingly Credit Risk Funds and P2P have similar risk . In P2P risk is of individual lender defaulting while in credit risk funds risk is of individual companies defaulting. Companies have more credibility than individuals hence the lower return.

How to Invest? The bottom line is if something is giving me around 10% .I have around only 2-2.5% of margin of risk i.e I can afford to lose only 2.5% otherwise I am better off putting in liquid fund which gives 7-7.5%.

So how do I go about doing that!

I will first create such portfolio and then explain what will happen when a credit default event happens.

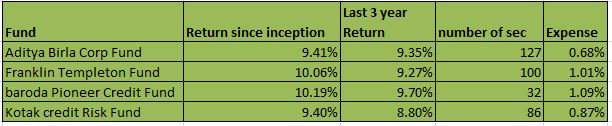

I am choosing 4 funds for the analysis. Things to look before investing

- Expense ratio is not too high : around 1% max

- They are diversified (not concentrated in 4-5 securities)

- Historically fund has performed well

As we can see its quite evident that Aditya birla is most diversified and has good expense ratio too.Now what have we have to do is download portfolio holding details .You can use value research,AMC site etc.

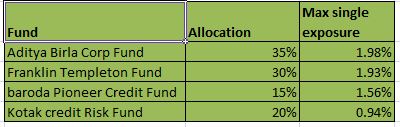

Now my goal is to allocate money to various funds in a ratio so that in my complete portfolio no single security has more than 2% exposure.

This is the calculated portfolio .

It means that if I have 1lakh to invest I will put 35k in aditya birla,30k in franklin ,25k in kotak and 15k in Baroda. These number are a ball park figure.Based on your risk reward preference you can deviate slightly but ensure you don’t increase exposure more than 3% in a fund.

Stressed portfolio:What will happen if some bond defaults .We already have a precedent ILFS. How have returns changed after that.

Lets assume we had ILFS in our portfolio and exposure was 2%

So 2% drop in my NAV right.

How will portfolio perform now

What did I just see.Due to a default yield went up and our bond portfolio is giving 12.53% annualised yield which more than compensate for 2% loss in default.

So if we have a well diversified credit portfolio we can get decent returns and it emerges as good investment vehicle for medium term.Infact this these days due to inflated yield its an ideal time to buy credit funds

- People who are retired or have decent corpus (8 lakh plus) to invest and want equity exposure can use Credit Risk Fund with Options to Create principal protected Large Cap Mutual Fund.

- How to do it? We have established 9% plus return from Credit fund. 1 year ATM call option cost around 7% at current yield. If we invest lets say 8.5 lakh in large cap we take complete downside risk.Instead of that buy ATM option which will cost 68000 . put the rest 7.8 lakh in credit fund. you will make 72000. Now you have exposure of large cap with principal protection