In today’s fast-paced financial world, technology plays a pivotal role in shaping the future of trading. Algorithmic trading, also known as algo trading, has emerged as a powerful tool for traders and investors. In this article, we will explore what algorithmic trading is, its legal status in India, and the reasons why algorithmic trading platforms are essential. Furthermore, we will provide a comprehensive list of the top ten best algo trading platforms in India to help you make informed decisions in your trading journey.

What is Algorithmic Trading?

Algorithmic trading, often referred to as algo trading, is a method of executing trades using pre-programmed software with a defined set of instructions. These instructions, also known as algorithms, are designed to analyze market data, identify trading opportunities, and execute orders automatically. Algo trading relies on various mathematical models and statistical analysis to make quick, efficient, and precise trading decisions.

One of the primary advantages of algorithmic trading is its ability to execute orders at high speeds, which human traders may find challenging to achieve. Algo trading systems can process vast amounts of data, monitor multiple market conditions, and execute orders without human intervention. This results in reduced human errors and allows traders to take advantage of fleeting market opportunities.

Is Algo Trading Legal in India?

Yes, algorithmic trading is legal in India. The Securities and Exchange Board of India (SEBI), the regulatory authority overseeing the Indian financial markets, has established guidelines and regulations for algorithmic trading to ensure transparency, fairness, and market integrity.

However, SEBI has laid down certain rules and requirements that market participants, including brokers and traders, must adhere to when engaging in algo trading. These regulations are designed to prevent market manipulation, protect investors, and maintain the stability and integrity of the financial markets.

Traders and brokers must register with SEBI and comply with specific risk management and surveillance controls to minimize the risks associated with algorithmic trading. These regulations are essential to maintain the confidence of investors and ensure the efficient functioning of Indian financial markets.

Why Do We Need Algorithmic Trading Platforms?

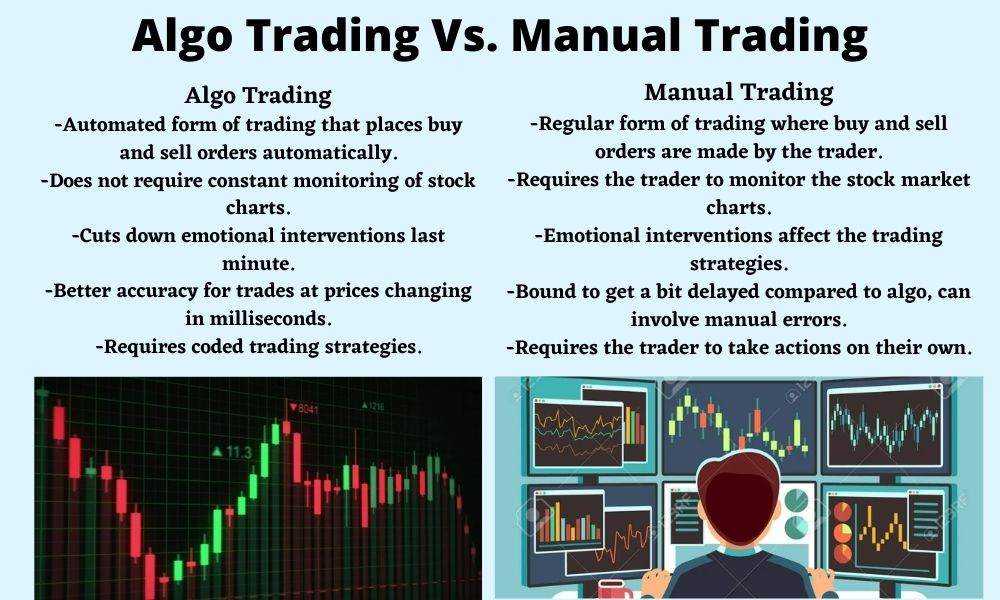

Speed and Efficiency:

Algorithmic trading platforms offer unmatched speed and efficiency in executing trades. With the ability to analyze market data in real time and make split-second decisions, algo trading platforms can capitalize on market opportunities that manual traders might miss.

Risk Management:

Algorithmic trading platforms come equipped with sophisticated risk management tools. These tools help traders control their exposure and minimize losses, making it a valuable asset for risk-averse investors.

Eliminating Emotional Bias:

Human emotions can cloud judgment and lead to poor trading decisions. Algorithmic trading removes the emotional element from trading, ensuring that trades are executed based solely on data and predefined algorithms.

Backtesting and Optimization:

Algo trading platforms allow traders to backtest their strategies using historical data. This feature helps traders refine their algorithms and optimize their trading strategies for better performance.

Diversification:

Algo trading platforms enable traders to diversify their portfolios across various asset classes and markets. Diversification reduces risk and enhances the potential for consistent returns.

Now, let’s explore the top ten best algo trading platforms in India that can help you harness the power of algorithmic trading:

Top Algo Trading Software in India

Zerodha Streak

Zerodha Streak is a powerful algo trading platform that caters to both beginners and experienced traders. It provides a user-friendly interface and a range of customizable tools for creating and testing trading strategies. Traders can backtest their strategies and execute them on Zerodha’s Kite platform seamlessly.

Upstox Pro

Upstox Pro offers an intuitive algo trading platform that integrates with their trading application. With Upstox Pro, traders can design and implement automated strategies using a drag-and-drop interface, making it accessible to traders of all skill levels.

AlgoTrader

AlgoTrader is a robust institutional-grade algo trading platform that offers a wide range of features and tools for quantitative traders. It supports a variety of asset classes and integrates with multiple exchanges, making it an ideal choice for professional traders.

5paisa Algo Trading

5paisa, a well-known discount broker, provides an algo trading platform with features that appeal to traders looking for automation and customization. It allows traders to create rule-based strategies and execute them across various asset classes.

AmiBroker

AmiBroker is a popular technical analysis and algo trading software. It offers advanced charting, technical analysis tools, and the capability to build and test trading strategies. Traders can integrate AmiBroker with their preferred brokerage platform for seamless execution.

Interactive Brokers

Interactive Brokers is a global brokerage firm that offers an algo trading platform with a wide range of trading tools. It caters to both retail and institutional traders, making it a versatile choice for those seeking access to global markets.

Kite Connect

Kite Connect is an API-based trading platform offered by Zerodha. It is designed for developers and traders who wish to create custom trading algorithms. Kite Connect provides a robust infrastructure for algo trading and supports trading on various Indian exchanges.

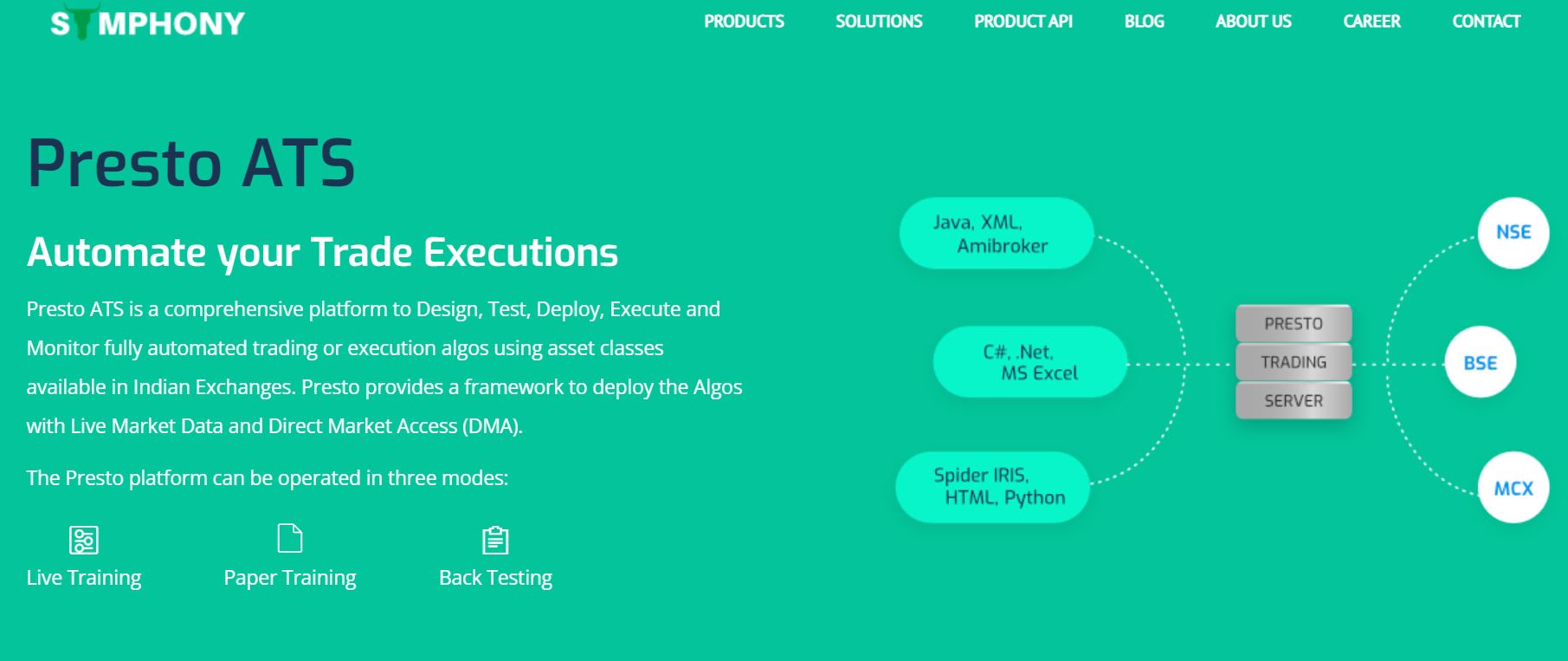

Symphony Presto

Symphony Presto is a comprehensive algo trading platform designed for professional traders and institutions. It provides a vast array of features, including algorithm development, backtesting, risk management, and real-time monitoring.

MetaTrader 4

MetaTrader 4 (MT4) is a widely used trading platform for forex and CFD trading, but it can also be employed for algo trading in India. Many brokers in India offer MT4, and traders can use Expert Advisors (EAs) to automate their trading strategies.

Algostudio

Algostudio is a dedicated algo trading platform for Indian markets. It allows traders to design and deploy trading algorithms with ease. The platform offers several technical indicators and charting tools for strategy development.

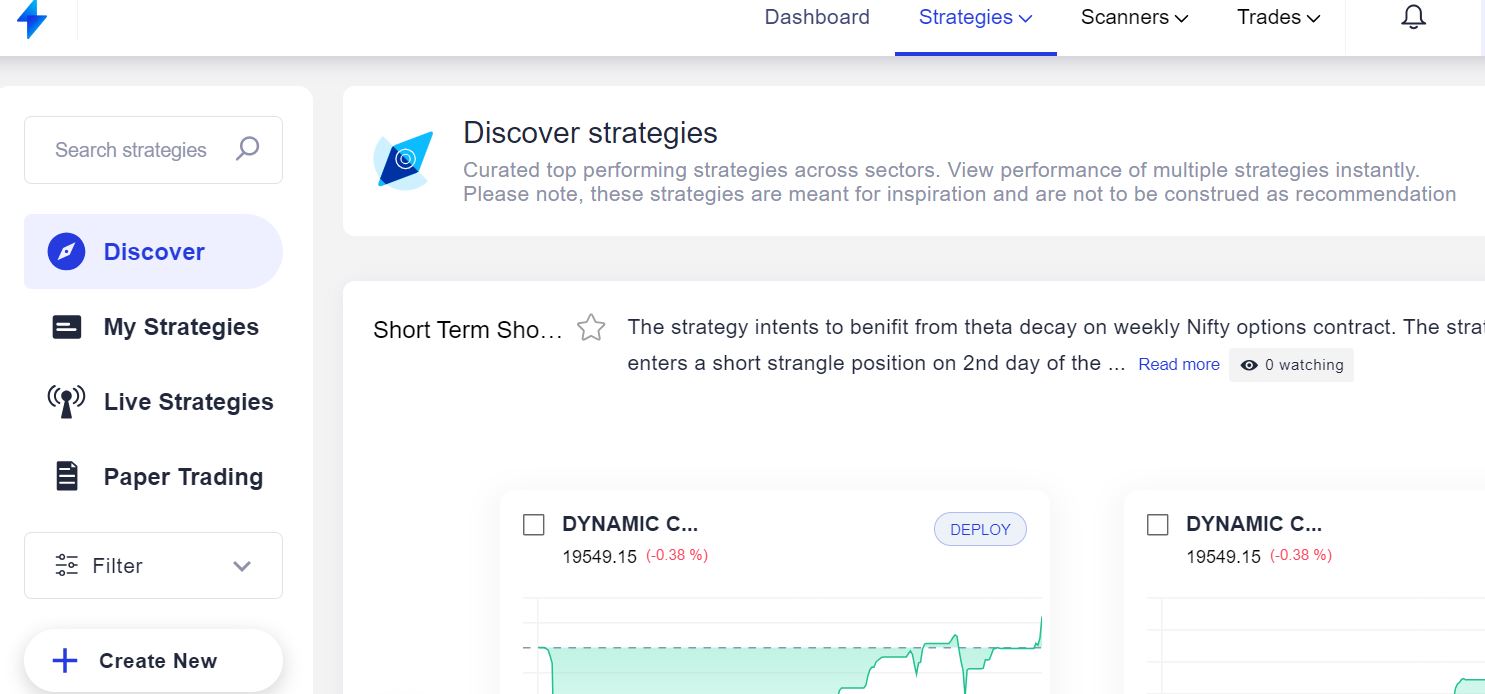

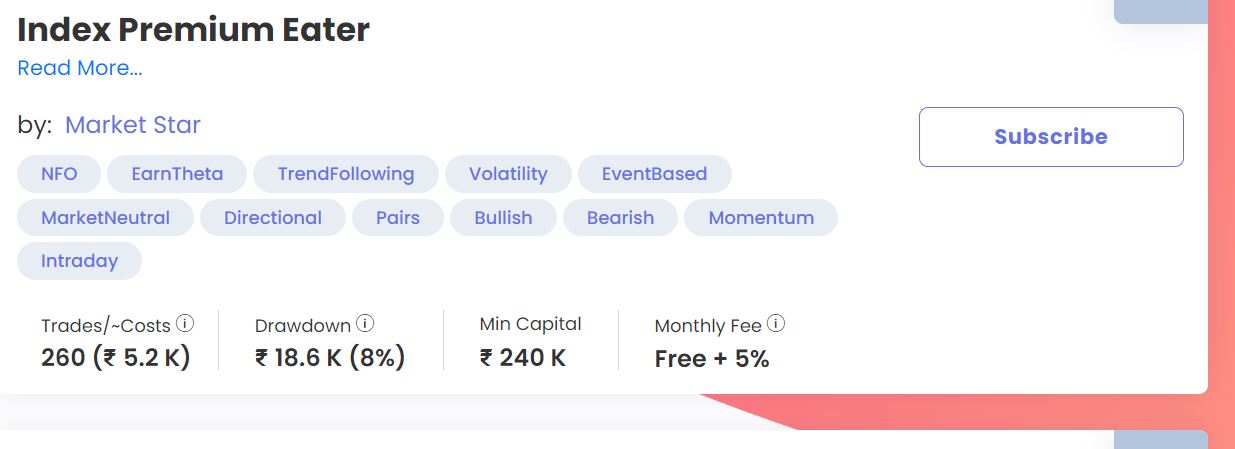

Tradetron

Tradetron is a platform where you can develop algo strategies using a no-code algorithm. Apart from that it has some large algo desk providing the option to copy their strategy. Some popular strategy providers are

- Marketstar

- Algo Edge

My verdict on Algo Trading

I have been using Kite connect API to automate my strategy and it is a great tool for someone looking to run algo strategies. If you are a professional trader symphony can be a good alternative. Tradetron has the best marketplace for copytrading strategies.

Check out our review of Tradetron

Our Experience using Algo Trading

I have been trading derivatives for more than 10 years and have worked both on discretionary as well as algo trading systems. If someone is interested in algo trading they should first understand discretionary trading. This will help to develop a deeper understanding and improve trading psychology.

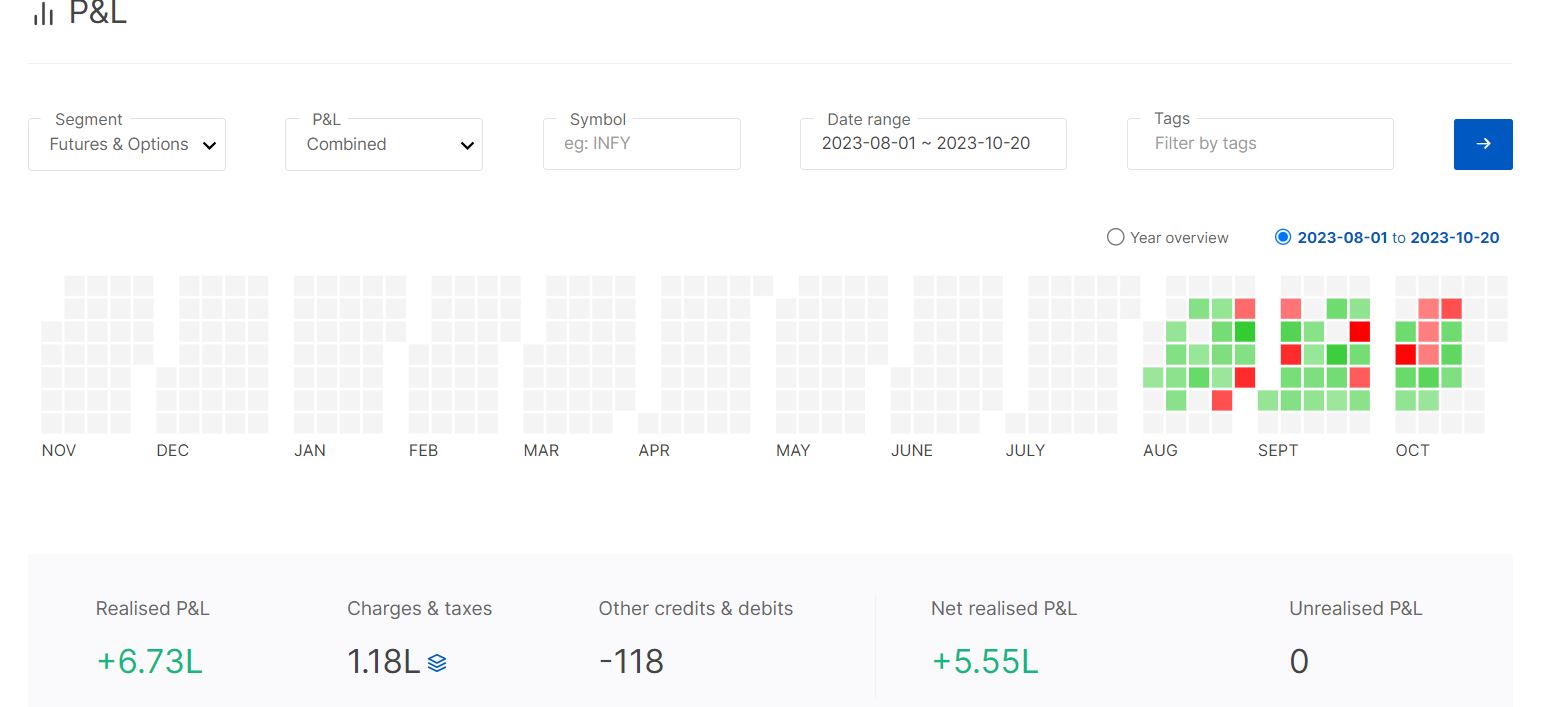

I have been using the algo strategy developed by my colleagues along with manual trading. myself The results have been decent. Below is a link to the results of the last 3 months trading. It is important to understand it’s not the algo that makes a strategy successful but the brain behind is the key parameter. One of the best benefits of option trading is that you can pledge your equity mutual funds and get margin absolutely free hence any return on your mutual fund is extra income!!

Hence if you are interested in algo trading

- Develop your own strategy on a platform

- Copy strategy of a trusted trader

Do not blindly copy or give money to frauds posing as traders or influencers asking to take courses!

Below is the performance of my last 3 months of trading If somebody is interested in discussing how I manage algo you can reach out by whatsapp given below or mail or telegram

Conclusion

Algorithmic trading has become an integral part of the financial markets, providing traders with speed, efficiency, and precision. It is legal and regulated in India, thanks to SEBI’s guidelines. Whether you are a retail trader or a professional, the choice of the best algo trading platform in India depends on your specific needs, expertise, and preferences.

Each of the top ten best algo trading platforms in India offers unique features and capabilities. It’s essential to consider your trading goals, level of experience, and the assets you intend to trade when selecting a platform. Ultimately, the right algo trading platform can empower you to enhance your trading strategies and make informed decisions in the dynamic world of finance. Best algo trading platforms in India are your gateway to a world of possibilities, enabling you to take full advantage of algorithmic trading’s benefits.

You can also connect with us to start your algo journey as we understand it seems overwhelming to get started with trading.Check out other investment options below