Randomdimes collaboration with Aspero is bringing the best yields! Read more to find out

Investing in bonds has always been a medium of choice for investors preferring low-risk and stable returns. However, selecting the right bonds for investments hasn’t been easy, especially for newbies. We have already done several articles in the past covering several platforms to buy bonds & the importance of having an allocation to bonds- especially high-yield bonds as a part of investing in the alternative investments asset class.

In this article, we review Aspero, another platform for buying bonds. Read this article to know in depth about Aspero, its benefits, how to sign up, get additional benefits through Randomdimes & start investing with Aspero, and answers to some common questions you might have about the platform.

Why Should You Explore Multiple Platforms to Buy Bonds?

A question that might arise among investors is why should one always explore multiple platforms and compare yields while buying bonds. Here’s why it’s worth looking around:

- More Choices: Each platform offers different types of bonds. Some might focus on government bonds, while others provide corporate bonds or NCDs. Checking multiple platforms means you’ll have a bigger selection to choose from.

- Better Deals: Prices of bonds can vary slightly between platforms. By comparing, you might find bonds with better yields or lower fees.

- Simplicity of Use: Some platforms are easier to use than others. You might prefer one with a simpler app, better customer support, or having a dedicated relationship manager.

- Better Liquidity: Some platforms allow you to sell your bonds before maturity, making it easier to get your money back when needed.

- Additional Features: Advanced tools like bond ratings or risk calculators can help you analyze better. Exploring different platforms can help you find one that suits your needs.

What is Aspero?

Aspero is a platform that offers fixed-income instruments. It is part of the Yubi Group and focuses on fixed-income investments. The platform offers a variety of bonds, including Commercial Papers, Corporate Bonds, Pass-Through Certificates, and Alternative Investment Funds (with plans to launch other products like government securities, bond baskets, etc.)

With a minimum investment of just ₹300, Aspero is accessible to new and experienced investors. It is registered with SEBI as an Online Bond Platform Provider (OBPP).

About Yubi Group

Aspero Advantages

Aspero has some great features that make it a standout choice for investors:

- Better Rates: Yubi group is the provider (originator) of bonds for several platforms. Most other platforms in the market work as distributors. This allows you to get better yields on the bonds.

- Wide Selection: Aspero offers many options, from high-return corporate bonds to commercial papers. More products, like bond bundles, SGB & government securities, are also being added.

- Competitive Returns: Bonds listed on Aspero often have attractive interest rates, going up to 14% in some cases.

- Growing Features: It is working on allowing users to sell their bonds to others on the platform, making it easier to access your money when needed.

- Safe and Secure: It lists only regulated and rated bonds so that you are sure about the quality of investments.

- Easy to Use: The platform is simple to navigate, whether you’re using the app or the website. It categorizes bonds based on things like returns and risk, helping you find what’s right for you.

- Backed by Experts: It is part of the Yubi Group, which has a prominent name in the finance domain and a strong network. This means the bonds available are sourced from trusted companies.

Aspero x Randomdimes

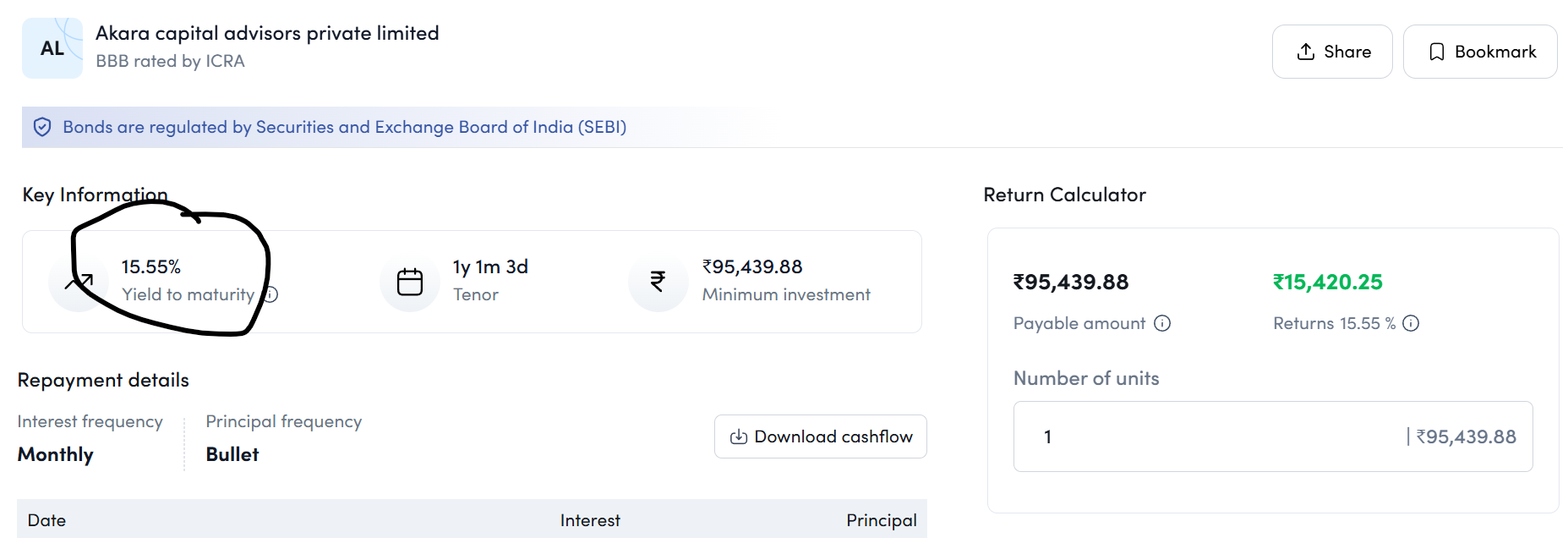

We are pleased to announce that Randomdimes has partnered with Aspero to offer various bonds to Randomdimes users. Through a collaboration between Randomdimes and Aspero, readers will soon be able to browse and invest in bonds on Aspero at the highest yields. Unlike Randomdimes most other platforms incur distribution and operation costs. As Randomdimes.com investors can directly purchase from YUBI (b2b platform) the acquisition cost for them is nil. Due to this model, the prices are much better, thereby increasing your returns.

All investments and operations will happen through the Aspero website. Randomdimes just provides the Aspero link to invest in bonds at a higher yield than other alternatives!

Register on Aspero using the link below. You need to create a different account if you already have one. You can bookmark the link below to buy bonds.

Just update your credentials in the form after you have registerd through Randomdimes if you are not a current subrscriber as this only for subscribers.

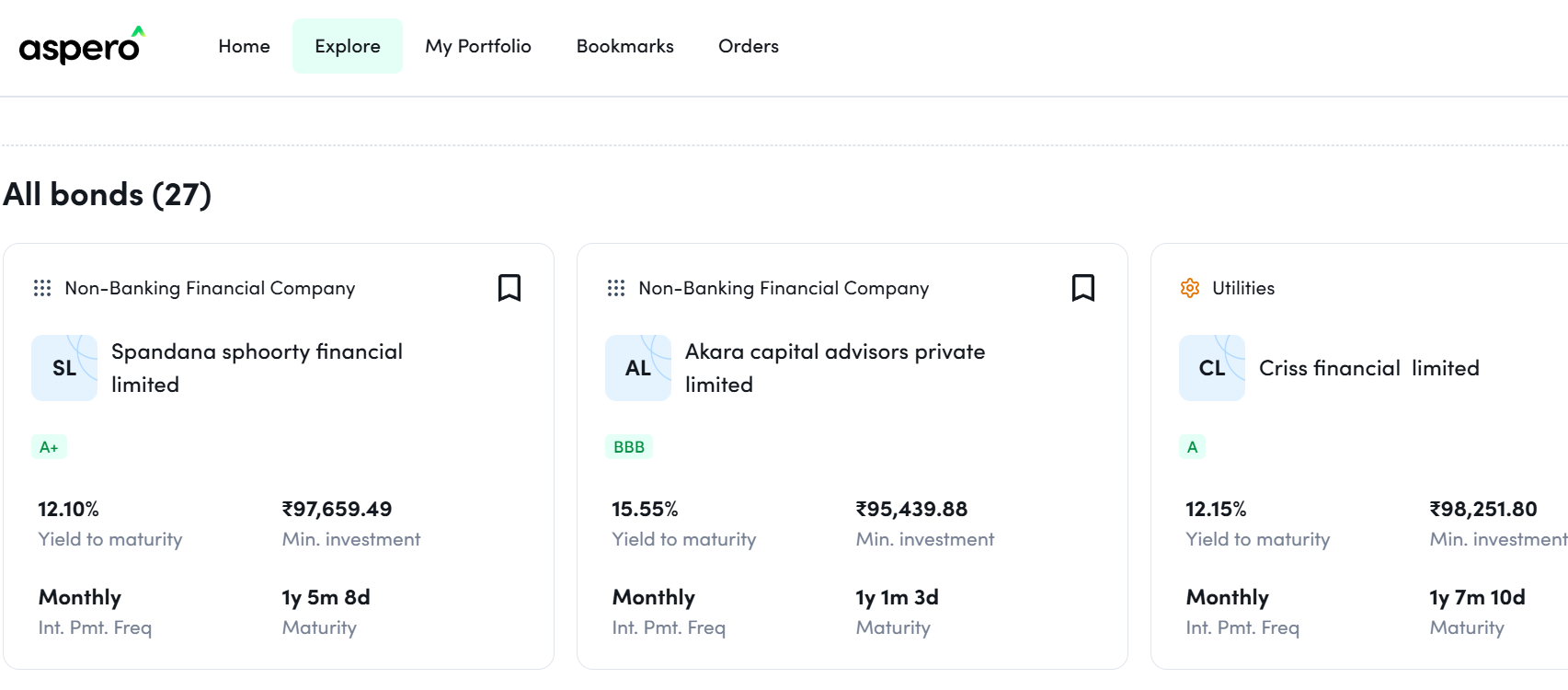

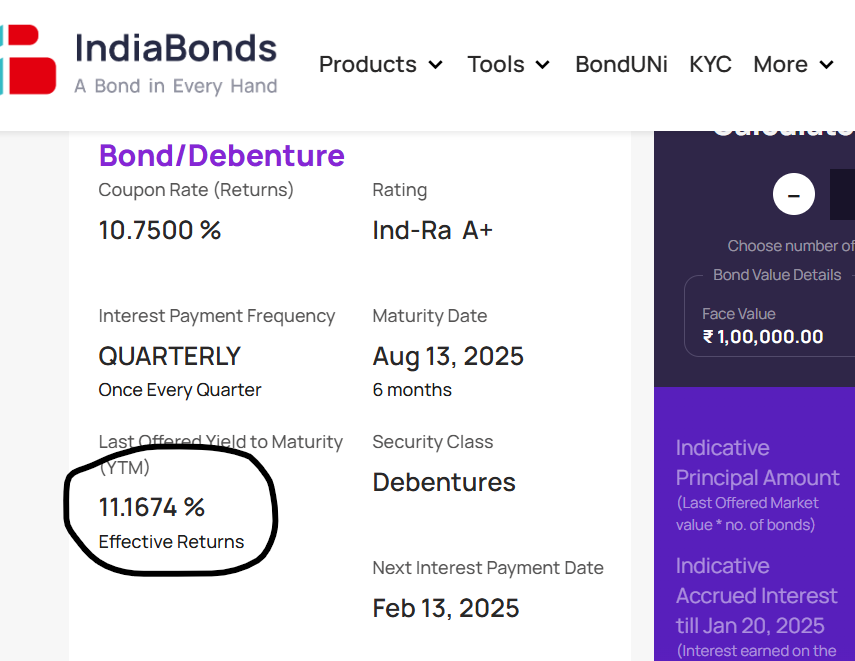

Comparison of Yields

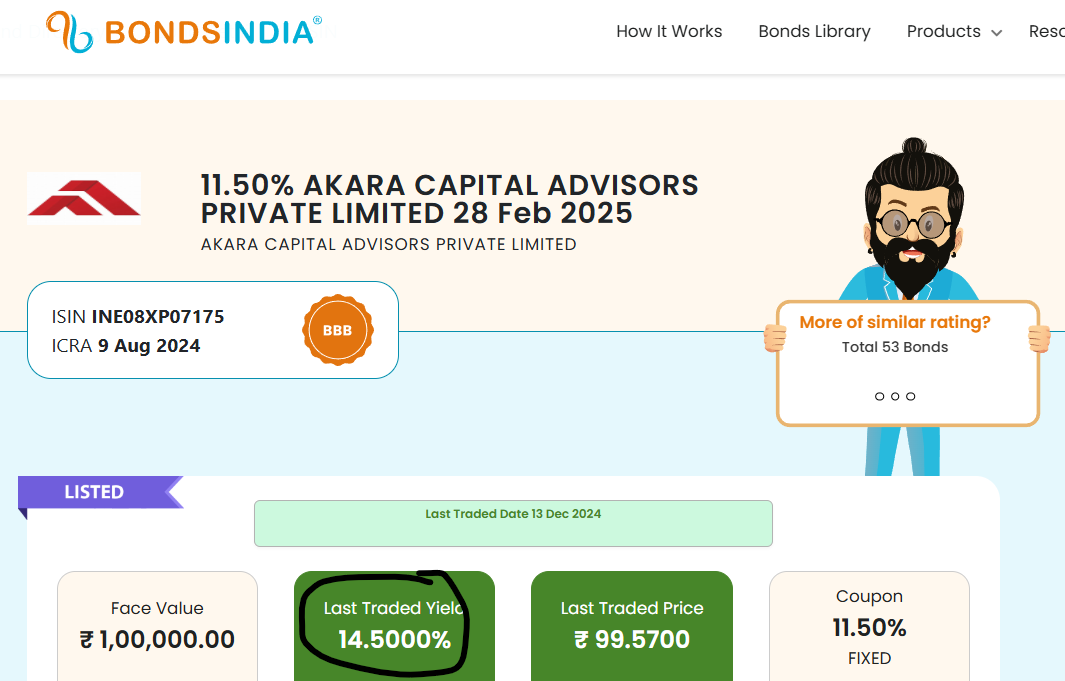

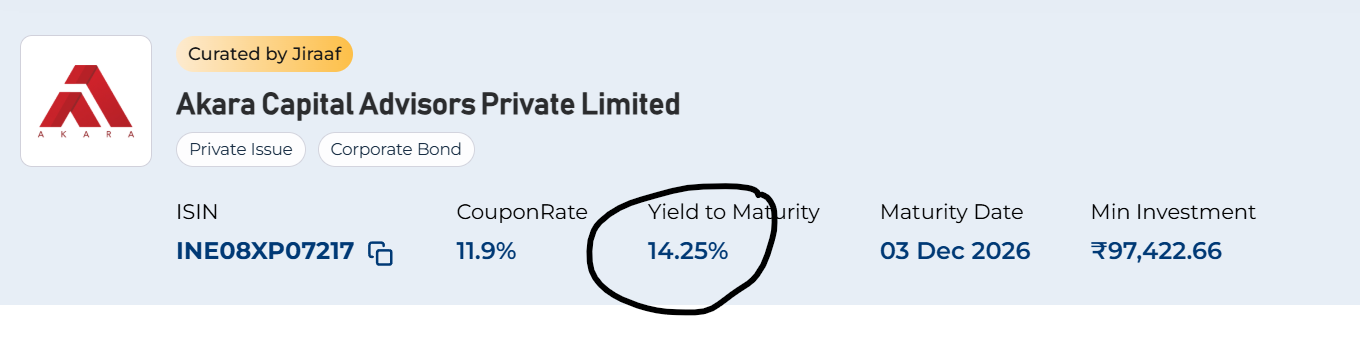

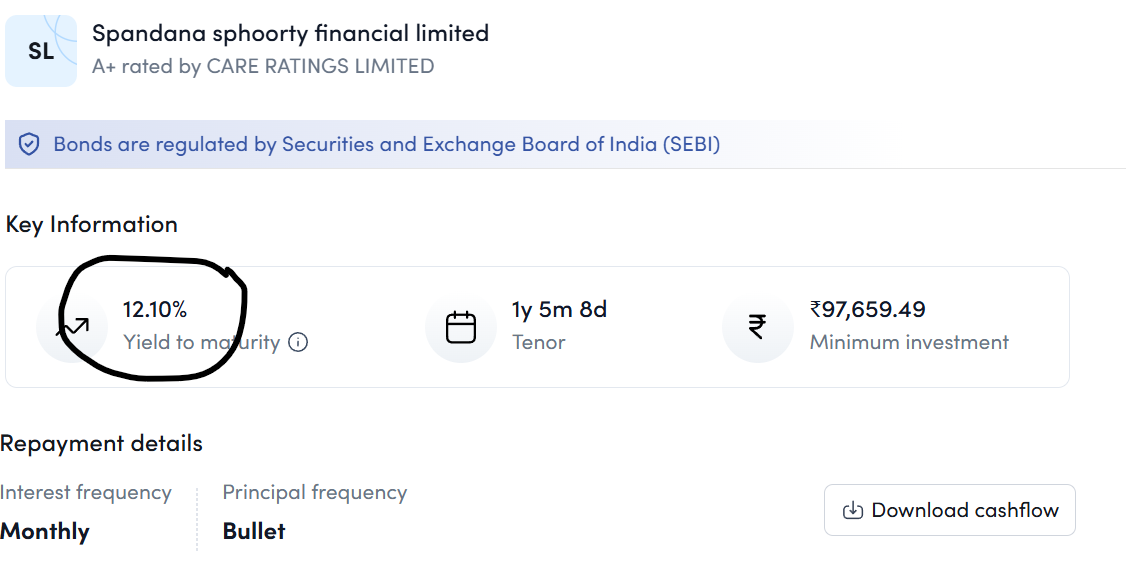

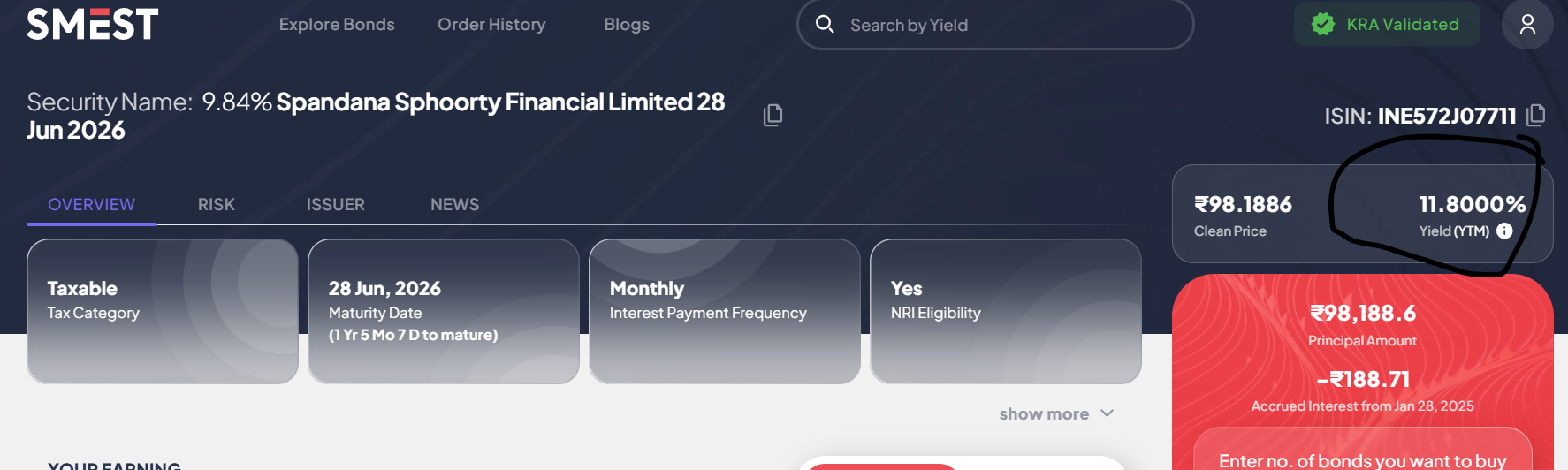

Let’s compare the yield we are getting from the collaboration compared to other platforms. As evident below for the 2 bonds Akara and Spandana we are getting the highest yield through Randomdimes.

Akara Capital Yield Comparison

Spandana Spoorthy Yield Comparison

Aspero Alternatives

If you’re exploring platforms beyond Aspero, here are some noteworthy alternatives in the fixed-income investment space:

- Grip Invest: One of the best platforms in India offering corporate bonds, securitized debt instruments (SDIs), bond & SDI pools & high yield fixed deposits.

- Altifi: From the house of Northern Arc Financial Group, this platform lists various types of bonds, commercial papers, etc.

- The Fixed Income: This platform specializes in multiple types of bonds: private/PSU bonds, tax-free bonds, etc. Backed by Tipsons Group- one of the top bond houses in India.

- India Bonds: With a wide variety of government and corporate bonds, India Bonds caters to retail investors looking for secure and diverse investment options.

- Wint Wealth: Wint Wealth offers bonds backed by secured assets, most of them being high-yield bonds.

- BondsKart: Backed by JM Financial, BondsKart is an intuitive platform offering bonds and debentures.

Conclusion

If you’re thinking about investing in bonds, Aspero is a platform to consider. With strong backing from the Yubi Group and a user-friendly platform, it’s a good choice for anyone looking to invest in bonds. Randomdimes collaboration can get you better deals from the platform and enhance your portfolio return!

However, don’t forget to compare the yields across multiple platforms to find the ideal platform offering the best yield for the bond you have chosen to invest in.

Frequently Asked Questions (FAQs) on Aspero

Q1: What is the minimum amount of investment needed for Aspero?

You can start investing with just ₹3,00 on Aspero- as mentioned on their website.

Q2: Are the bonds on Aspero safe?

Yes, all bonds on Aspero are rated and regulated to ensure investor safety.

Q3: Can I sell my bonds early if I need money?

Aspero is working on adding a feature for selling bonds before they mature, which will make accessing your funds easier. However, at the moment, it is not available.

Q5: Is Aspero safe?

Yes, Aspero offers regulated and rated instruments. It is a SEBI-registered OBPP platform & is backed by Yubi Group. So it’s safe to assume that it’s a reasonably safe platform,