India, the fifth-largest equity market in the world, has increased its market capitalization by more than $1 trillion in the past six months. This growth has been propelled by strong macroeconomic indicators and bullish investor sentiment, pushing the domestic equity benchmarks, Sensex and Nifty 50, to fresh record highs.

In June alone, the Nifty 50 has risen by about six percent, on track for its best month this year. This surge is attributed to policy stability post-Lok Sabha election results, promising economic growth forecasts, and the resurgence of foreign investments.

Meanwhile, SEBI has reduced the minimum investment size for bonds from Rs 1 lakh to Rs 10,000, marking a significant reform in the debt securities sector.

In a circular issued on July 3, SEBI stated that market participants believe a lower ticket size for debt securities could encourage more non-institutional investors to engage in the corporate bond market, thereby enhancing liquidity.

“The issuer may issue debt securities or non-convertible redeemable preference shares on a private placement basis at a face value of Rs 10,000,” the SEBI order stated.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital Freeze Update

- Tapinvest Mellora Update

Growpital Freeze Update

Growpital had a SAT hearing for business continuity on 5th July and a new date of 10th July was again proposed. The matter seems to be going nowhere and the hope of recovery is becoming bleaker. Below is the summary of the latest SAT hearing by Mr Upadhyaya who has done a great job of visiting the hearing.

Some of the key allegations against Growpital are:

- Reckless Investments: Significant financial losses due to investments made without proper due diligence or legal paperwork, such as an INR 18 crore investment in Nagaland’s tribal belt based solely on assumptions about government tenders.

- Misleading Investors: Using new funds to cover interest payments instead of focusing on profitability. The strategy was to sustain for 2-3 years and then attract new investors by inflating business valuation. An attempt to sell to Capri Global failed due to discrepancies in financial records.

- Exaggerated Profit Claims: Only about 10% of farm projects were profitable, yet the business was falsely claimed to be making 60-70% profit margins, supposedly sufficient to meet all fixed interest commitments and capital guarantees.

- Lack of Transparency and Governance: Key decisions were made by a select few, such as Rituraj Sharma and his close associates, without consulting the entire founding team. This led to the departure of Krishna Joshi and the HR Head.

- Risky Investments with Investors’ Money: The founding team’s investment was around INR 10 lakhs, while they took significant risks with investors’ funds.

- Legal Troubles: FIRs have been filed against Rituraj by investors. He is attempting to cover expenses by selling crops offline and has sought assistance from investors/partners, who have declined due to ongoing SEBI investigations. Rituraj blames SEBI for the business’s difficulties.

- Acquisitions Without Oversight: Various businesses were acquired without proper governance or consideration for investor interests, leading to missing documentation and legal paperwork. Acquisitions include companies in pesticides, finance, rubber plantations, Jaipur Chakki (Jaipur), and a coffee estate (Chikmagalur).

We will figure out the course of action after the next SAT hearing

Tapinvest Mellora Update

Tapinvest has agreed with Mellora to buy back the assets and pay the pending interest amount. Below is the communication shared by the company.

Dear Investors,

We’re pleased to share positive news regarding your investment in Melorra. We’ve successfully recovered a portion of the repayments, specifically the outstanding rental payments of investors whose early buybacks have not been processed.

Recovery Details:

Our negotiations with Melorra addressed three components: rentals, buybacks, and penalties. We have received all the outstanding rental payments of assets that weren’t bought back and are processing the same shortly.

Next Steps:

Pending Buyback: Investors who received an early buyback and less than their full Internal Rate of Return (IRR) will receive pending dues through remaining buyback collections. We would request your patience as the recoveries for the buyback amount will follow after the recovery for the rental amount.

Penalty amount: Once the due buyback amount is processed, we will move toward recovery of the interest penalty amount.

The investors who will be receiving their rental amount will also receive a separate communication once the transaction is done from our end.

We appreciate your continued confidence and patience in our recovery process. Should you seek any clarification, please feel free to reach out to us.

Thanks

Tapinvest

Alternative Investment Portfolio Updates

This month we have added a new platform Hbits. Though we have been following the platform for a long time we have explored it in more detail recently. Detailed post on HBITS.

Some of the key deals we are exploring in this month are

- Altdrx Munnar Opportunity

- Assetmonk NCD Opportunity

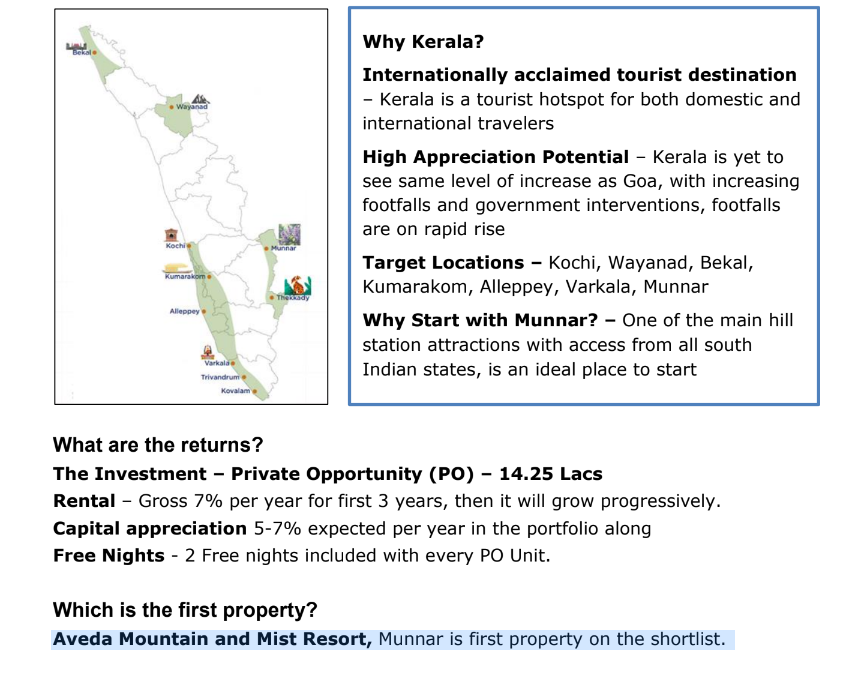

ALTDRX Kerala Opportunity (15-17%IRR)

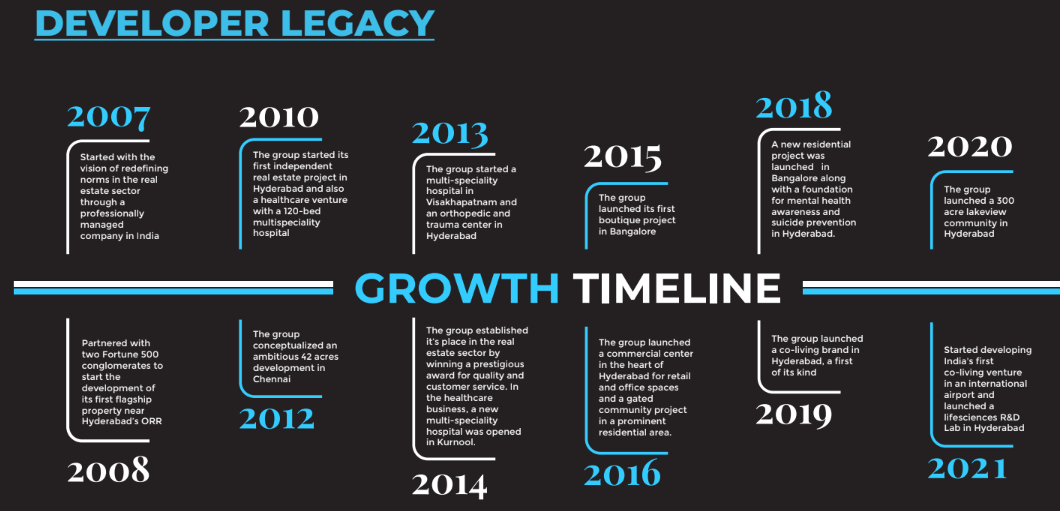

This is the third opportunity with Altdrx that we are exploring as we have participated in Hyderabad and Bangalore. The reason for investing has been good past performance and the rich experience of the investment team.

Salient features of this investment are :

- Private opportunity to invest in multiple resorts in Kerala

- The first property is Aveda Mountain and Mist Resort

- 7% rental Income with appreciation post 3 years.

- Capital gains potential up to 10-11%.

- Acquisition of property at a discounted rate.

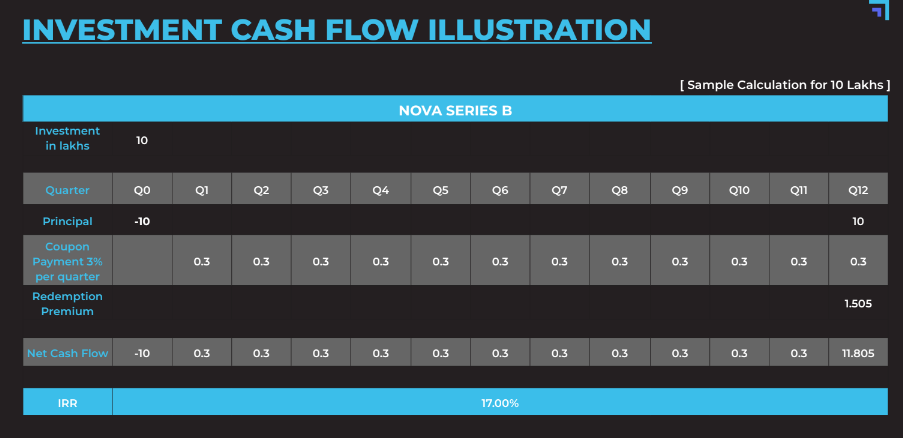

Assetmonk Nova Structured Debt (17% IRR)

Assetmonk has recently listed a real estate debt with a 17% IRR. The opportunity is for NCD issued by Incor group which has multiple businesses including pharma and hospitality.

Lending Investment

Some of the investments for this month include High Yield Bonds and Real Estate NCD

- Betterinvest-Box Office Studio 16.5%

- Earnnest – Project Alpha 14.8%

- Gripinvest – Basket SDI 13.7%

- Altgraaf – Billore Ventures 18.4%

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.15% | 1.00% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

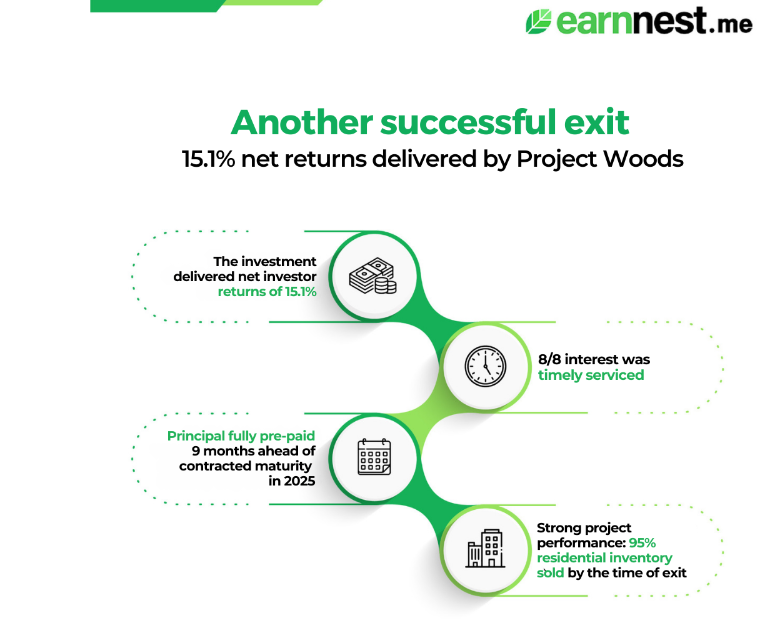

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

- Earnnest has successfully returned capital with interest for its Project Woods.2 other opportunities are also live. You can use the below code to get 0.5% Extra!

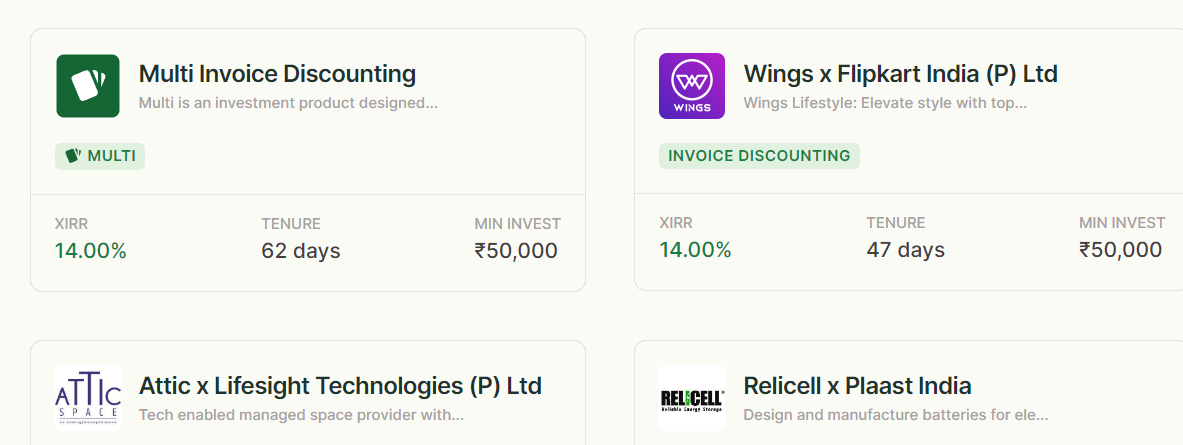

- Tapinvest has recently started Multi, a diversified bucket of invoice discounting.

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent | 11% | 0% | 0% |

| KredX (Stopped) | 12% | 0% | 1.5% |

| 13 Karat (new) | 13% | 0% | 0% |

Stopped Kredx due to many defaults faced by multiple investors.

- Currently Invested in 3 Invoice deals on Tapinvest

- Invested in KFC on Lenderpartnerz

- Invested in Amazon on Tradecred

- Invested in Altarmour deal on Altgraaf

- Lendbox per annum performance is satisfactory. (Only Low Yield)

Crypto Investing

June has been bad for crypto with almost all cryptocurrencies losing 20-30% market cap. The major reasons for this are

- Fed Rate cut uncertainty

- Selling by the German Federal Criminal Police Office (BKA) worth more than 400 Mn USD that they had seized these BTC from only illegal companies.

- Spot ETF outflow

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 50%

- I2IFunding- 23%

- Finzy-7%

- Faircent Pool Loan -10%

- 13 Karat – 510%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.8% | 4.5% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 1.8% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 4% |

| 12 Club (paused) | Only Minimum amount | 12% | 0% |

- Planning to do a 1-year review of Indiap2p

- Detailed Review of I2Ifunding (Referral code discount50@i2i)

Equity Market

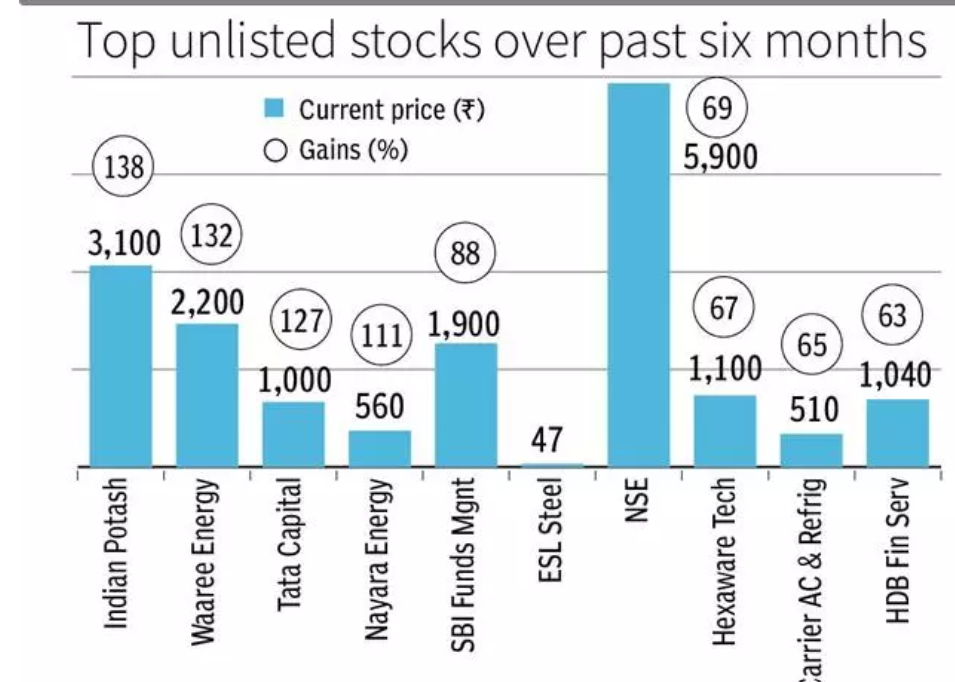

PreIPO Stocks

The unlisted market has also heated up in the last few months and has outperformed Nifty Index. The stocks currently in demand in the grey market are

- Waree Energy

- Swiggy

- First Cry

Listed Stocks

The Nifty 50 is on track for a record ninth consecutive year of gains. Shares of smaller and mid-sized companies have surged, now making up about 40% of the total market valuation, according to Reuters.

Since the start of 2024, India’s equity market capitalization has increased by 24.5% to $5.23 trillion, joining the ranks of the US, China, Japan, and Hong Kong. In contrast, China’s market cap dropped by $1.06 trillion, while Japan’s remained flat and Hong Kong’s added $428 billion, according to Bloomberg. This surge in India’s market is the largest since 2007.

We are adding small amounts every month in the China and Brazil markets through the MF route with a 5-year horizon.

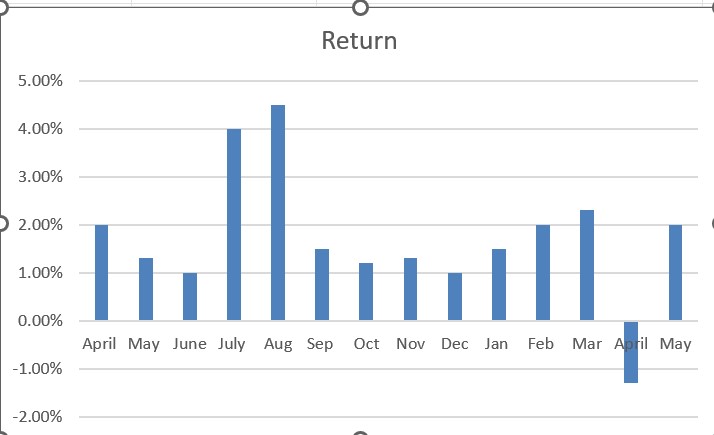

OptionTrading

We have started doing discretionary trading along with Algo as the market regime has shifted and solely relying on Algo is becoming more challenging. We were able to achieve 2.5% returns in June because of the crazy volatility.

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

Investors with INR 30+ Lakh deployable capital can reach out to discuss more sophisticated algos

Hey Sir,

You have been onboarding various platforms for investment in real estate to earn a decent returns from commercial investment. I read about all of the here but now I git confused through which platform should I start to invest. Soni request Can you make a small comparison how all of them are unique and different from each other. Also inform is the best amoung all according to you and where you have also invested.

Thank you.

Hi Tarun,

I agree with so many platforms its difficult to choose the best platform as per your requirement. Let me do a comprehensive post on the different type of platforms available and kind of deals along with the associated risks!

Thanks