October was a happening month for the global economy and the markets. Most of the developed markets showed a strong recovery in October but emerging markets fell. Chinese equities have become one of the worst performers in the world and the weakness continued as the Communist Party Congress signaled no let-up in the zero-Covid policy and reinforced President Xi’s authority. In the UK, bond yields finally calmed down as markets welcomed the appointment of Rishi Sunak as prime minister.

The US has been going as per its rate hike plan while the RBI took a breather and decided to not hike the rate in this meeting. It is to be seen how inflation pans out in the next few months and the monetary controlling bodies have to take stronger measures. Economists have been the Cassandra, making predictions about recession every year. Markets sometimes fall much before the recession and bounce back when the actual recession starts.

Lending Investment

| Platform | Returns | NPA |

| Grip Invest | 10-12%(Post-Tax) | 0% |

| Klubworks | 15-17%+ | 0% |

| WintWealth | 10-11.5% | 0% |

| Jiraaf | 12-15% | 0% |

| Pyse | 10-11%(Post-Tax) | 0% |

| Legalpay | 14-16%(Post-Tax) | 0% |

| Growpital | 14%(Tax-Free) | New (9 Payments) |

| Leafround | 18% | New (6 Payments) |

| Altifi | 12.50% | 0% |

- Received payment from Growpital on time

- All my cash flows in Klubworks, WintWealth, Pyse, Leafround, and GripInvest are as per schedule.

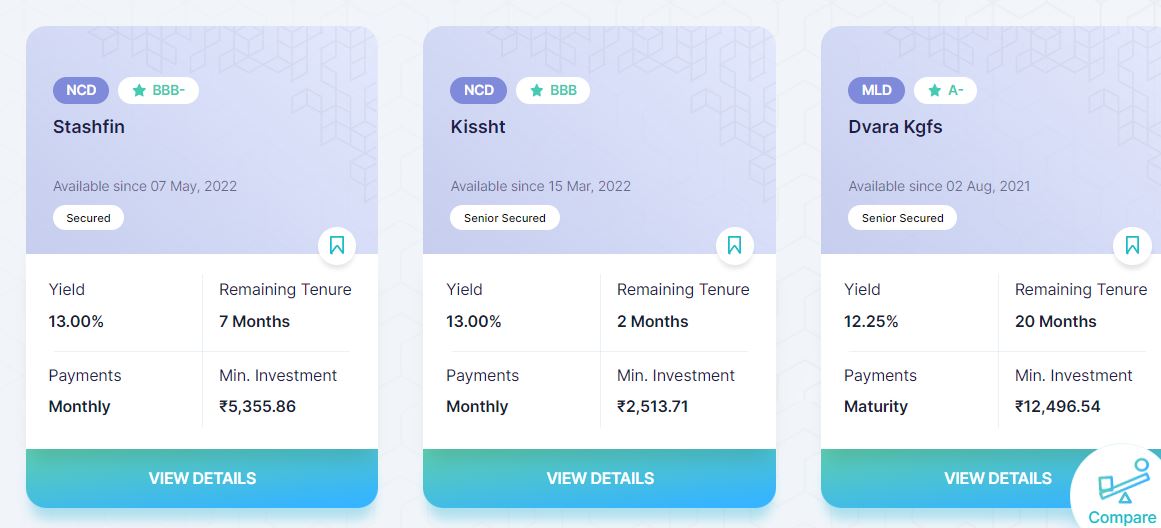

- Invested in Origo Commercial Paper on Altifi at 14%. Stashfin on Altifi has a better yield than Wintwealth.

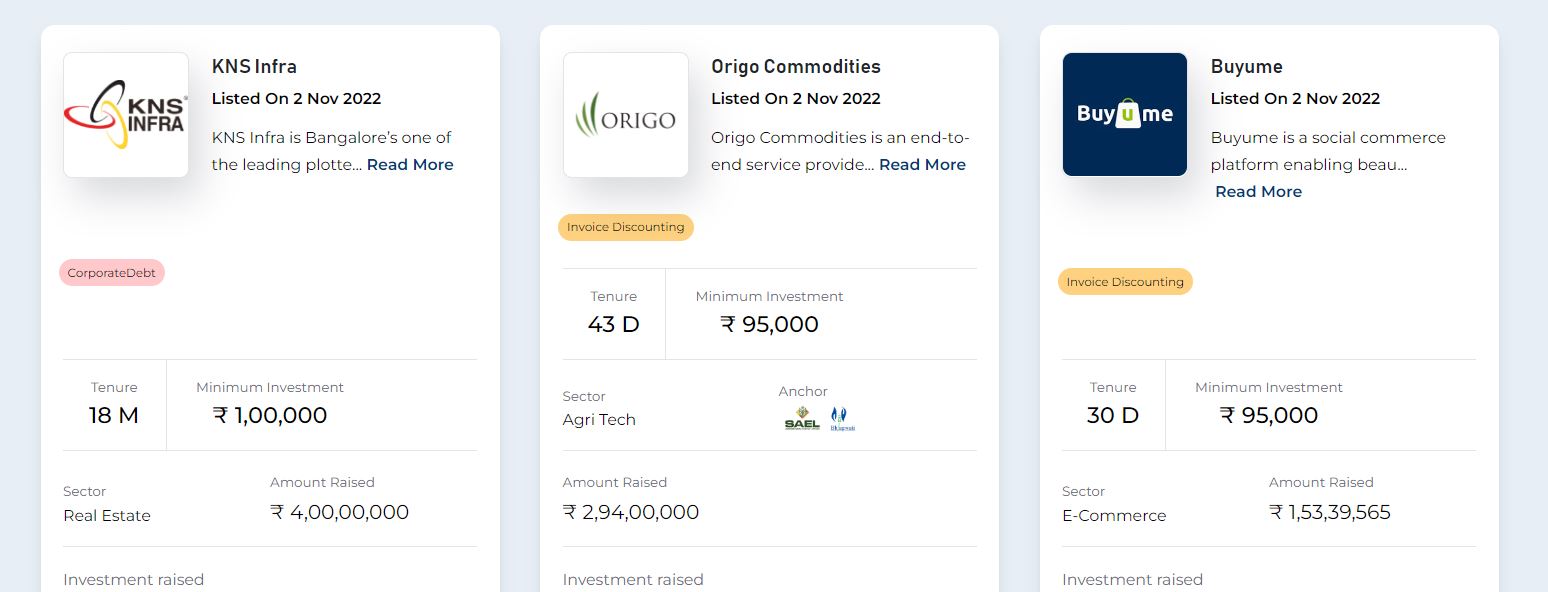

- Invested in BuyuMe and KNR Infra on Jiraaf at 16%

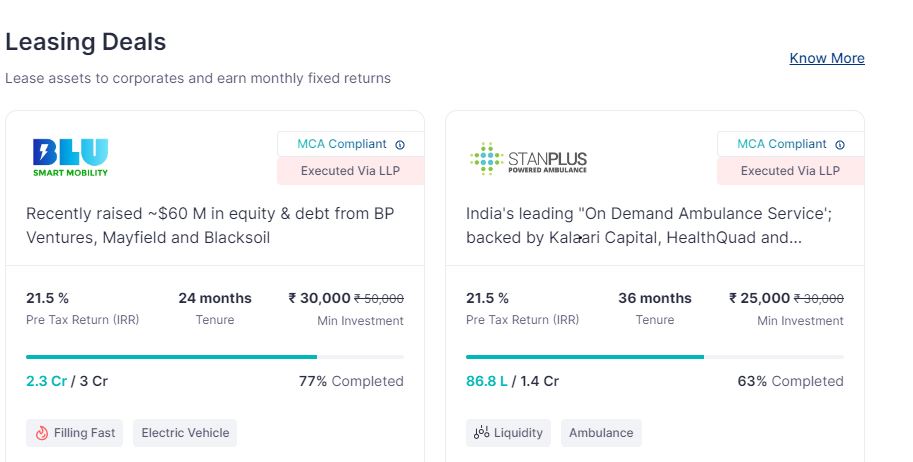

- Invested in 2 more Leasing deals on Gripinvest at 21% PreTax

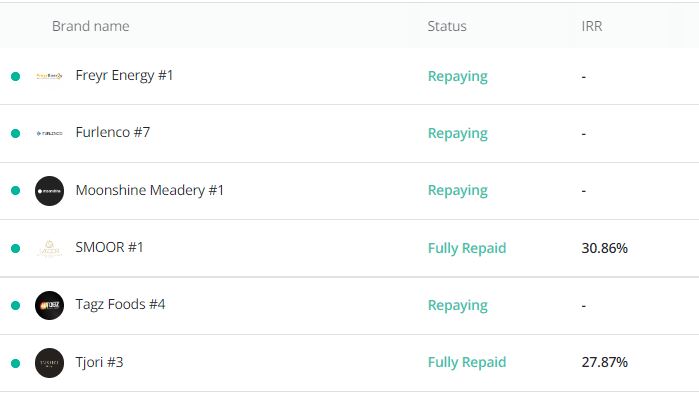

- Added Furlenco Deal on Klubworks at 25% IRR

- There is a litigation finance opportunity in legal pay

- Adding a few more deals on Leafround this month

New Deals

Invoice Discounting and Pooled Loans

| Platform | Returns | NPA |

| Liquiloans (Liquid Fund Substitute) | 9-10% | 0% |

| Tradecred | 11.50% | 0% |

| Lendbox (Per Annum +Settlement Finance) | 11.50% | 0% |

| Cashkumar(Elastic Run) | 11.50% | 0% |

| KredX | 12% | 0% |

- Lendbox settlement finance returns and Per Annum returns are as per expectations

- Invested in Diptab Ventures on Tradecred. Investors should compare the net IRR between Kredx and Tradecred

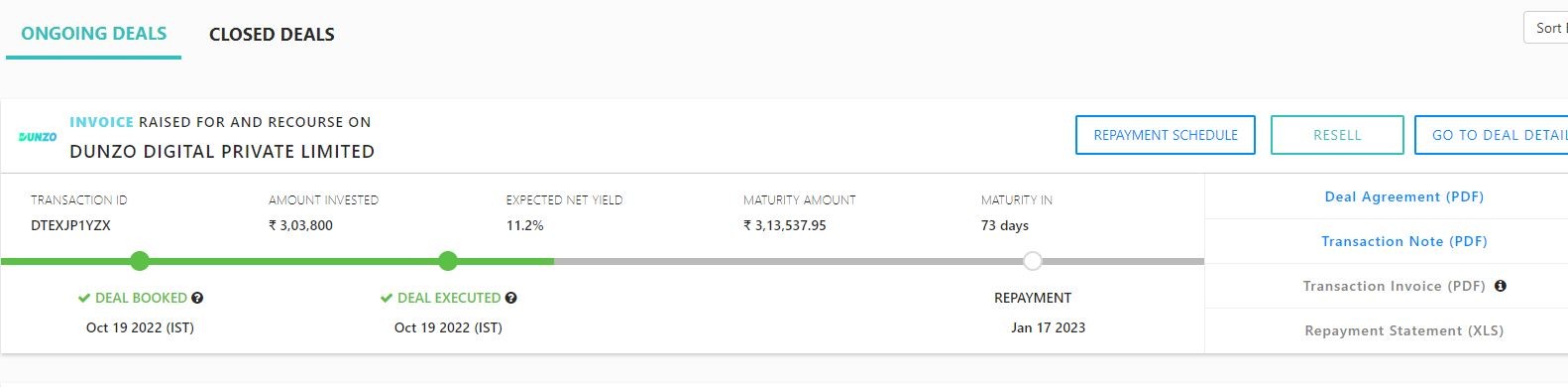

- I have invested in Dunzo on KredX for 11.2 % which is yet to mature.

Crypto Investing

JP Morgan executed its first live trade on a public blockchain, a significant step toward integrating with the plumbing underlying the world of cryptocurrencies.

The bank issued tokenized S$100,000 ($71,000) as part of the Singapore central bank’s pilot programs exploring the use of decentralized finance, or Defi, in the banking sector. Gradually crypto is becoming more mainstream. In the next 4-5 years these gradual changes will lead to large projects and a gradual rise in cryptocurrency prices in the long run. It’s hard to predict which token will benefit hence it’s best to spread across multiple tokens.

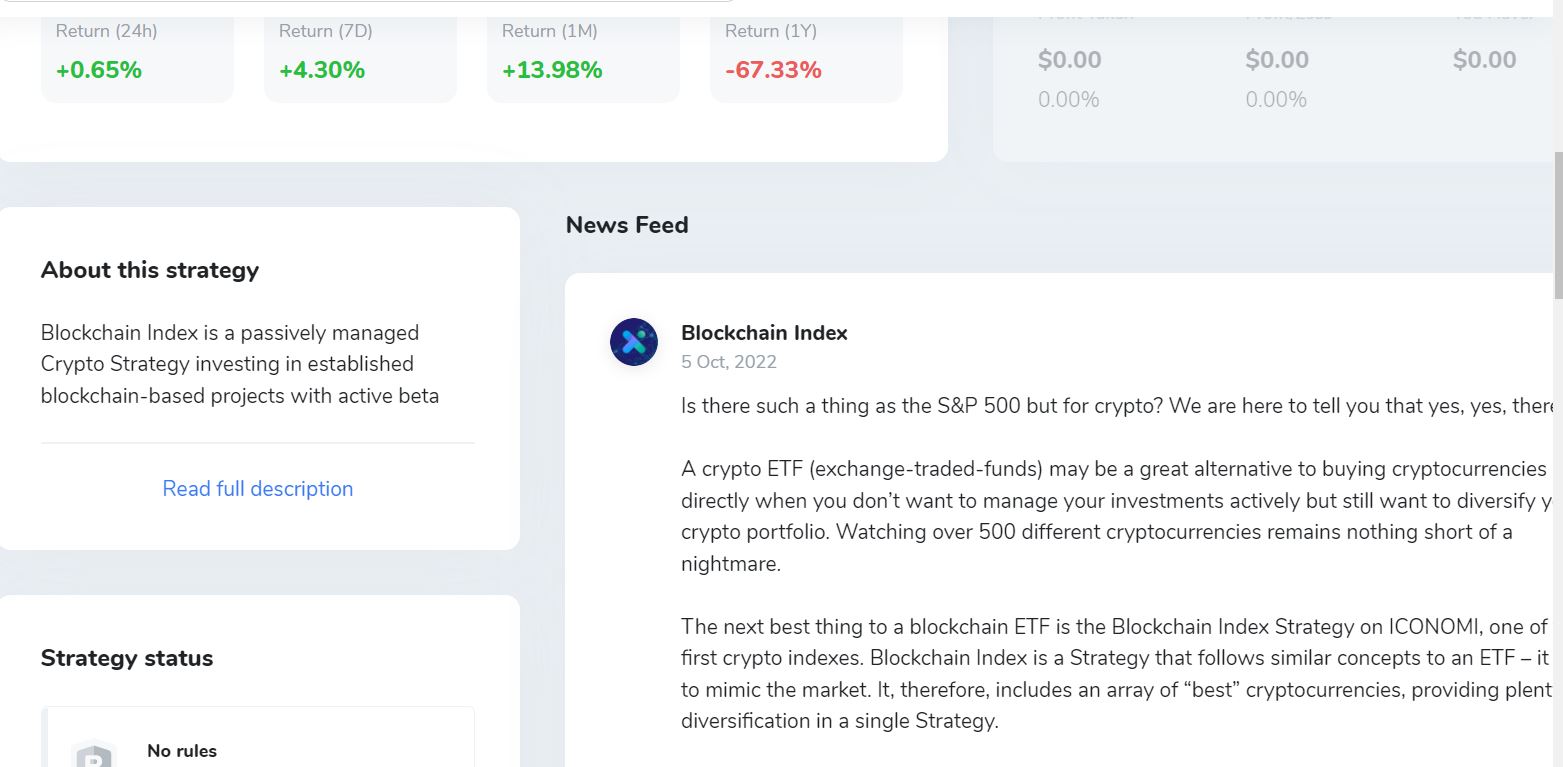

- Adding a small amount of monthly SIP to Blockchain Index on Iconomi .This will help to diversify across multiple currencies

- Will add a larger amount if large-cap coins correct another 25-30% from the current level

| Platform | Quarter Return |

| Crypto Hedge Fund Iconomi | 15% |

| Crypto Hedge Fund Ember | – |

| Crypto Hedging Deribit | 5% |

| Bitcoin Trading(Binance/CoinDCX/FTX) | 15% |

P2P Investment

Current allocation:

- India P2P – 40%

- 12Club – 5%

- I2IFunding- 35%

- Finzy-20%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding | Urban Clap Loans, education loans, Group loans | 13.5% | 4.85% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 0% |

| FINZY | Prime Borrowers, High Salary,A category | 14.2% | 3.5% |

| 12 Club | Only Minimum amount | 12% | 0% |

- IndiaP2P performance has been consistently positive till now with negligible NPA. Have increased allocation and will continue to monitor

- Have been investing in Urban Clap Loans on I2IFunding

- The systematic investment plan loan on Faircent ( Only SIP Loan) is doing well

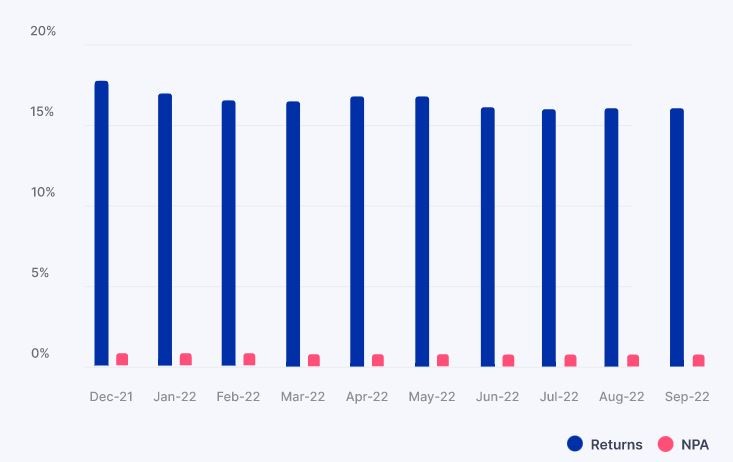

IndiaP2P Performance

International Real Estate and P2P

| Platform | Return | Current NPA |

| Heavyfinance | 11.5% | 1% |

| Lofty (Tokenized Real Estate) | 13% | New |

| EstateGuru | 10% | 1.5% |

| PeerBerry | 9.5% | 2% |

| Evostate (Aggregator Platform) | 12% | |

| Bulkestate | 11% | 2% |

| Lendermarket | 12% | 2% |

| RealT US High Yield Property(crypto-based) | 11% | Rental yield |

| Reinvest24 | 12.5% | Rent+capital gain |

- With the current crisis going on in Europe I feel its best to not increase allocation to Europe-based platforms

Equity Market

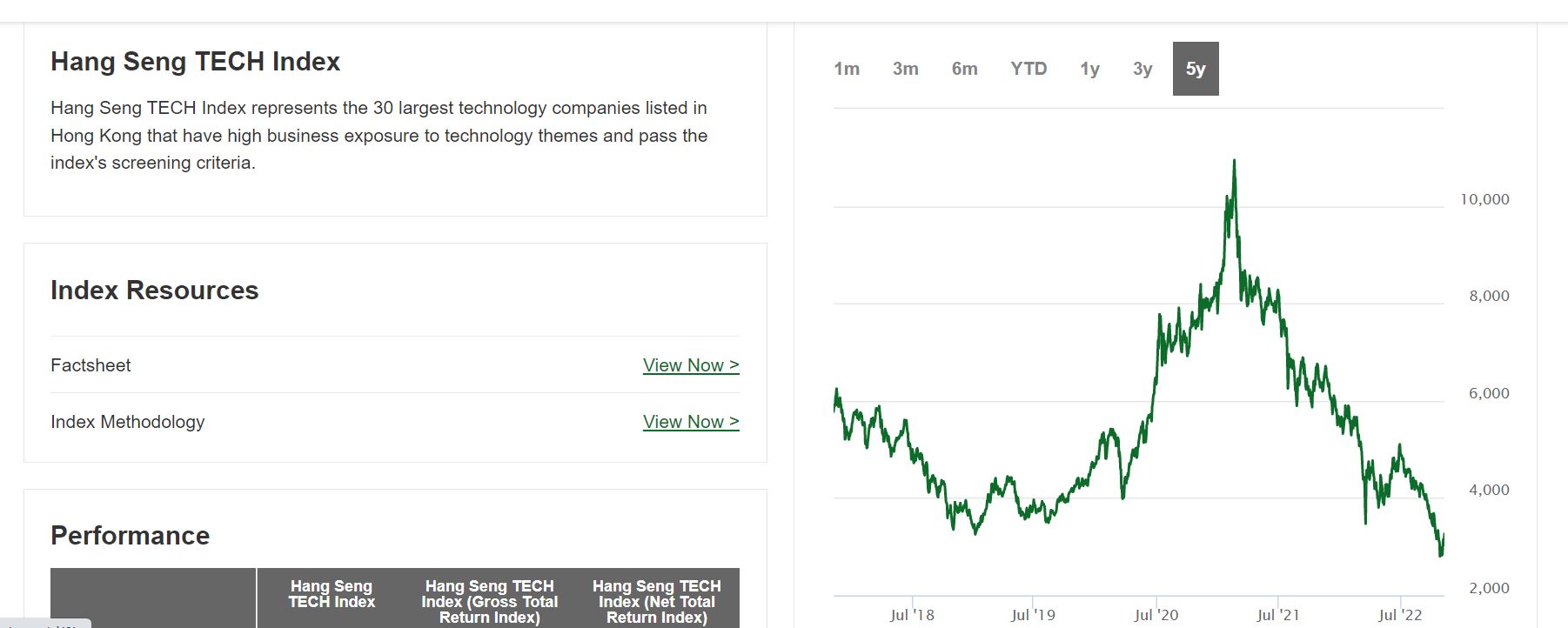

My investment in the US market in the last month as highlighted in the last report has done well as the US market has rebounded from lows. I do not mind a further drop in the market as it will give me the opportunity to double down on my bets. Have added some exposure to China stocks also. Due to the current economic and political turmoil, Chinese equity is at the 2009 level. It is a risky bet but the valuation is at an attractive level currently.

- Invested in Nasdaq 100 FOF operated by Navi Mutual fund

- Invested in China ETF through Stockal and Mirae Mutual Fund.

Other Alternative Assets and Platform Updates

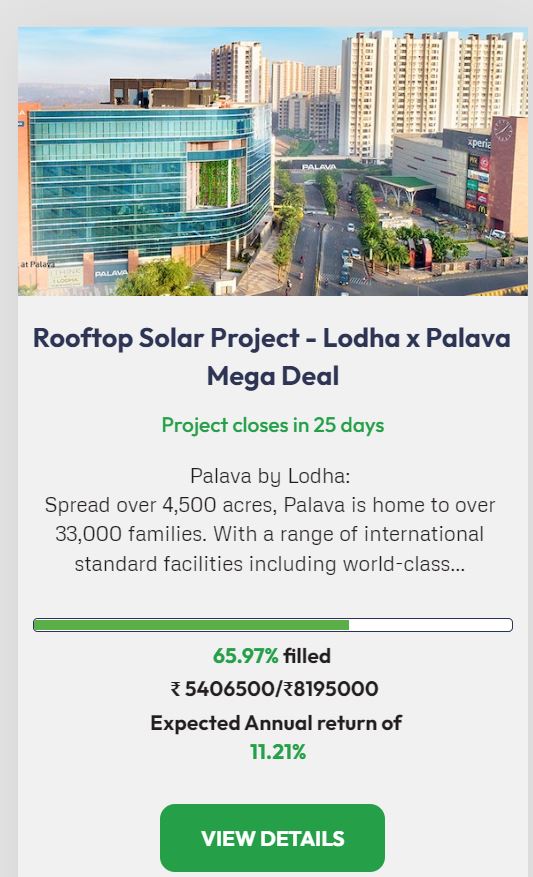

Sustvest Investment – Have invested in the latest Lodha opportunity on Sustvest. The payout has been consistent till now for my other investment.

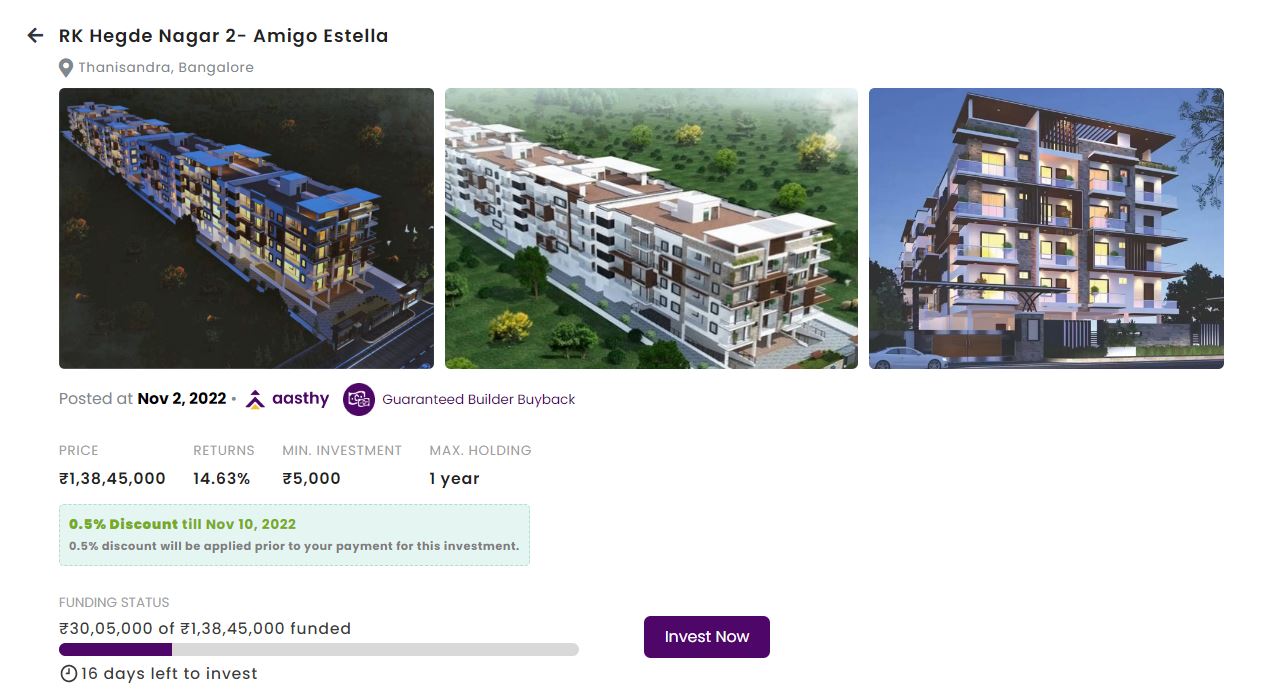

Fractional Real Estate Update- My investment in MYRE Capital Vaishnav Park has been performing as expected. I have received 9 cashflows on time. People who are interested in a lower minimum (INR 1 lakh) can invest in Real Estate on Grip Invest.

| Platform | Returns | Payment Received on time |

| Myre Capital | 10% | 9.00 |

how do you plan tax filling with so many investment tools? Your answer will be really helpful. thanks

Will do an article on Tax soon!

Why don’t you invest more heavily in 12% club given that it is a very liquid platform and allows you to withdraw money whenever you want? Isn’t it better compared to some other platforms which have significant login periods?

Hi Pulkit,

Couple of reasons I don’t invest much in 12% club

1) Bharatpe was going through a forensic investigation for mismanagement of money which makes it risky.

2) It has partnered with Rupeecircle for 12% club. My experience has not been good with Rupeecircle.

how to apply in Pre-tax deal in Grip, I have tried multiple times but it never lets you to apply in pre-tax

Agreed!Pre Tax deal subscription is a challenge on Grip due to limited capacity. I, therefore, invest in Leafround for the pretax deals as it availability is higher.

Lendbox has stopped offering settlement finance for new users. I wanted to try out the platform first with a small amount as per annum minimum investment is 50k. Will you still recommend to go straight for per annum?

I have been investing per annum for 8-9 months now. So far performance has been up to mark. I suggest always start with the minimum investment and when you feel confident then only increase capital