November was a steady, confidence-building month for risk assets. India continued to outperform on the back of soft inflation and robust domestic flows, while global markets started positioning for a friendlier interest-rate environment in 2026.

In the alternative-investment space, performance was mixed: some platforms strengthened their liquidity buffers, while a few originators again showed stress.

Here’s the complete breakdown of India + Global macro, markets, and alternative-investment trends for November 2025.

1. India – Cooling Inflation, Strong Markets, Stable Macro

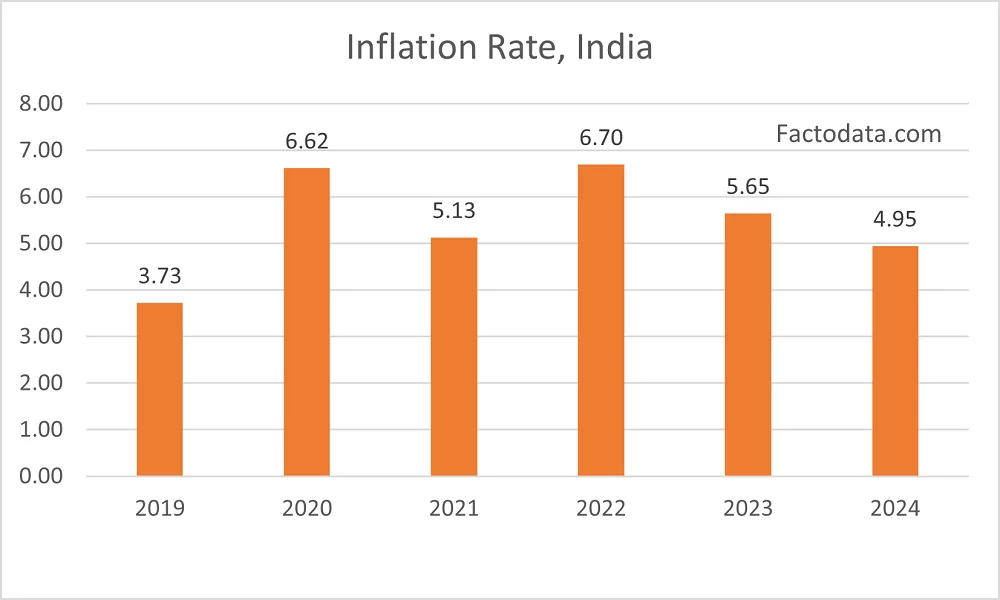

Inflation hits a new multi-year low

India’s CPI cooled to 2.4% in November — the lowest print since 2021.

Core inflation also eased meaningfully, driven by:

-

Lower food prices

-

Soft commodity input costs

-

Better supply-chain normalization

With inflation comfortably in the band, the RBI has room to guide toward a more accommodative stance in early 2026, though no cut has been announced yet.

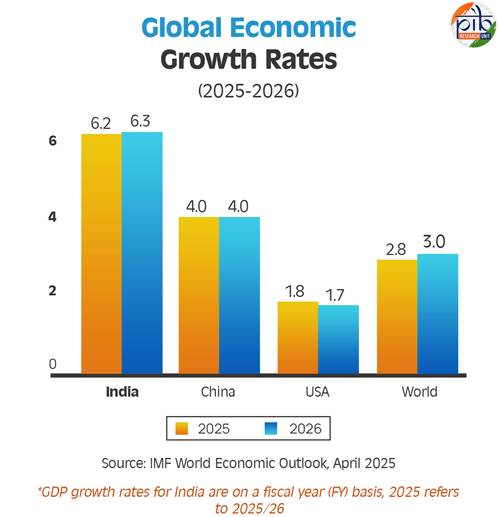

Growth momentum continues

Q2 FY26 GDP is tracking 7.6–7.8%, supported by:

-

Strong credit growth

-

Manufacturing output stabilisation

-

High government capex

-

Healthy consumption in Tier-2/3 cities

India remains one of the strongest macro stories globally.

Equity markets stay near record highs (~26,000–26,300)

The Nifty spent most of November trading between 26,000 and 26,300, closing the month near lifetime highs.

Key drivers of the rally:

-

Robust SIP flows (₹19,000+ crore)

-

Solid Q2 earnings, especially in BFSI, Autos, Capital Goods

-

Lower inflation boosting sentiment

-

FII inflows returning late in the month

Risks that re-emerged:

-

Brent crude rising above $96 per barrel

-

Flat GST collections vs previous months

-

Rural wage growth still below pre-pandemic trend

Despite this, India’s macro stability remains considerably stronger than other emerging markets.

2. Global Markets – Preparing for Softer Rates in 2026

Federal Reserve shifts dovish

After the October rate cut, the Fed signaled that another 25 bps cut could come in December or January as:

-

Labor markets soften

-

Wage growth slows

-

Inflation expectations cool

This triggered:

-

US 10-year falling to 3.42%

-

European yields dropping 15–20 bps

-

EM currencies are strengthening moderately

Global growth remains uneven

-

US GDP trending near 1.9%

-

Eurozone near 0.4%

-

China stabilized but not accelerating

-

Global trade still pressured by US–China tariff tensions

Supply-chain re-shoring continues to affect Asia, especially electronics and chemicals.

Alternative Investments, Defaults, and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently, below are the key new updates on the various delays across Alternative Investment platforms.

- Grip LoanX Delay Update

- Afinue Evage Default

Summary of the Up Money – LoanX Apr’26 Update (as of Nov 2025)

1. What Has Happened So Far

-

Until July 2025, all interest and principal payouts were made on time by Up Money.

-

Since August 2025, Up Money stopped remitting pool collections into the Trust account, causing missed payouts from Aug–Oct 2025.

-

This is a breach of transaction documents and also a violation of RBI’s securitization guidelines.

-

In September 2025, the Trustee liquidated the Cash Collateral (CC) and used it for partial repayment.

-

So far, 35.5% of the total investment (including interest) has been recovered.

-

Up Money has also defaulted with 55+ other lenders and is currently negotiating debt restructuring with them.

2. Proposed Repayment Plan by Up Money (Under Discussion)

Up Money has informally proposed:

-

Monthly repayments starting November 2025

-

Request for a haircut on outstanding principal due to low collections (≈34% of pool impacted by floods)

-

Extension of the repayment tenure to manage liquidity

Investor stance:

The platform has rejected any principal haircut and will share the revised proposal by 25 Nov 2025 for investor approval.

3. Actions Taken So Far

a) Performance Verification of the Loan Pool

-

An independent bureau analysis (CRIF HighMark) of all 4,100+ underlying loans (vehicle + MSME) is underway.

-

This will help determine actual borrower performance and strengthen the case for recovering dues.

b) Appointment of Backup Servicer

-

Discussions with multiple financial institutions completed.

-

One large institution shortlisted to act as an alternate/backup servicer if needed.

c) Regulatory & Legal Action

-

Trustee issued an Event of Default (EoD) notice on 2 Sep 2025.

-

A formal complaint has been filed with RBI for breach of guidelines.

-

RBI has already sent a notice to Up Money.

-

Preparations are underway for additional legal remedies, including a police complaint against the promoters.

4. What Happens Next

-

Revised repayment plan to be shared with investors by 25 Nov 2025.

-

Updates on pool performance analysis (CRIF), servicer appointment, and regulatory/legal escalations will follow.

-

The platform commits to full transparency and real-time communication.

Afinue EVAGE Mobility Pvt Ltd – Default & Recovery Update (November 2025)

This update covers the ongoing default recovery process involving the following LLPs:

-

UPSD Leaseown 19

-

UPSD Leaseown 24

-

UPSD Leaseown 26

1. NCLT Hearing Delayed

-

The NCLT case scheduled for 17 November 2025 was not taken up despite the presence of two legal counsels.

-

The court did not grant an urgent hearing, and the next date is now 12 February 2026.

-

This delay highlights the practical challenges of relying solely on insolvency processes for timely resolution.

2. Parallel Actions Initiated (to avoid dependence on NCLT timelines)

A. Filing Arbitration in Mumbai High Court

-

An arbitration petition will be filed next week under the Arbitration Act.

-

This is expected to move faster than NCLT and will not conflict with NCLT proceedings due to the 3-month gap.

-

Earlier, arbitration was avoided in the hope that NCLT would act quickly.

B. Criminal Complaint Against EVAGE Directors

-

A senior Chandigarh lawyer is coordinating with the Punjab Police to register a criminal case against EVAGE’s directors for not returning assets even after default.

-

This complaint will be filed through a separate LLP so that criminal proceedings can continue irrespective of the NCLT outcome.

3. Next Steps

-

Updates on both the Arbitration filing and Criminal complaint will be shared once traction is seen.

-

The team assures that all efforts are being made across multiple legal avenues to ensure asset recovery.

Bonds Risk Status Update

Bonds where covenant breaches occurred this year

- Sammunati

- Spandana Spoorthy

- Moneyboxx

- Trucap

- Finkurve

- Criss Financials – Early Repayment Done

- Dvara KGF

- Lendingkart

- Satin

- Resolution – Trucap

Additionally, Keertana was under stress. Founder and Microlending veteran Padmaja Reddy is set to exit the unsecured lending business by the end of the fiscal year as she pivots Keertana Finserv toward a predominantly secured model. Citing a “structural crisis” in the microfinance sector, Reddy is repositioning the company to focus on gold-backed lending, a segment she believes offers superior risk-adjusted stability.

Under the transition plan, Keertana Finserv’s portfolio will shift to 94% secured loans by year-end, with gold loans projected to account for 95% of total assets under management by FY26. The move aligns with Reddy’s broader goal of transforming Keertana into a fully secured lender with a more resilient, low-volatility asset mix.

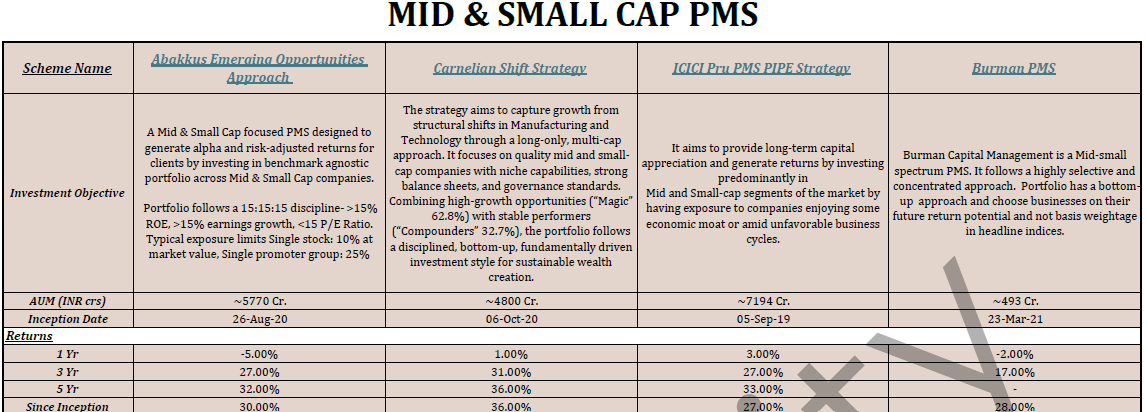

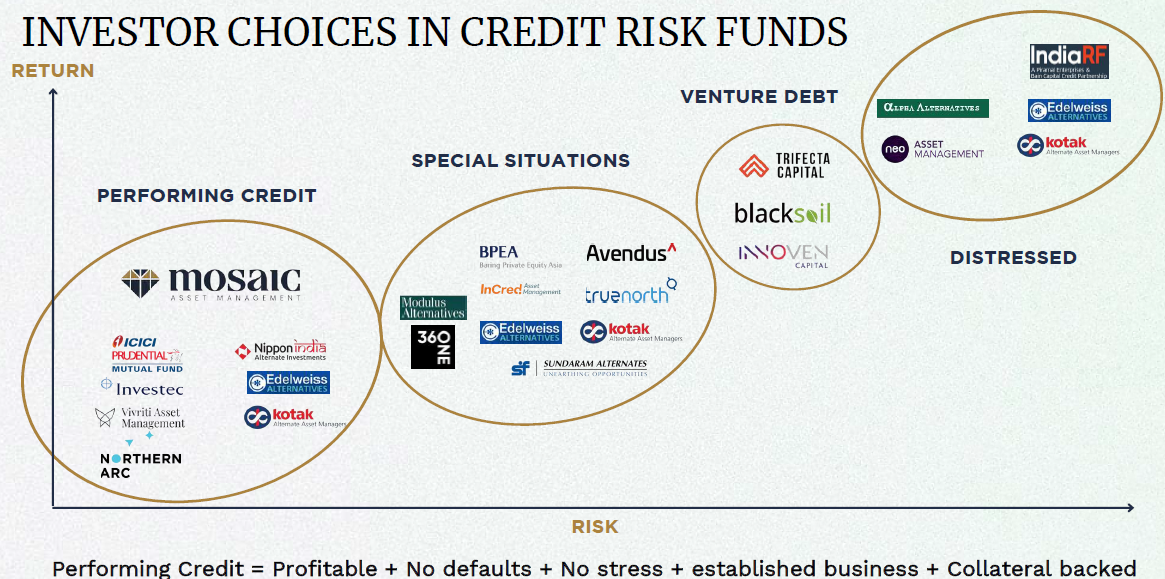

Alternative Investment Funds and PMS

In our endeavor to enhance knowledge about Alternative Investment Funds and PMS in India, we covered sessions with experts on various funds. We recently arranged a webinar with the experts as well.

Popular AIF in various categories for November

- High Yield Debt (20-25)% – Neo Special Credit Opportunity Fund CAT II

- Mosaic Multi Yield Performing Credit Fund (18-20% ) CAT II

- Real Estate Funds for CRE (18-21%) – ICICI CRE Fund CAT II

- Absolute Return Funds (13-15%)- ASK CAT III

You can register below to get access to the webinar and details about the product

Telegram channel for *the Latest Alternative Investment News

Top PMS Platforms

Below is a snapshot of the popular PMS in India. Investors can also explore global investing through Bayfort. Fill out the form below to download the latest information available on the funds below.

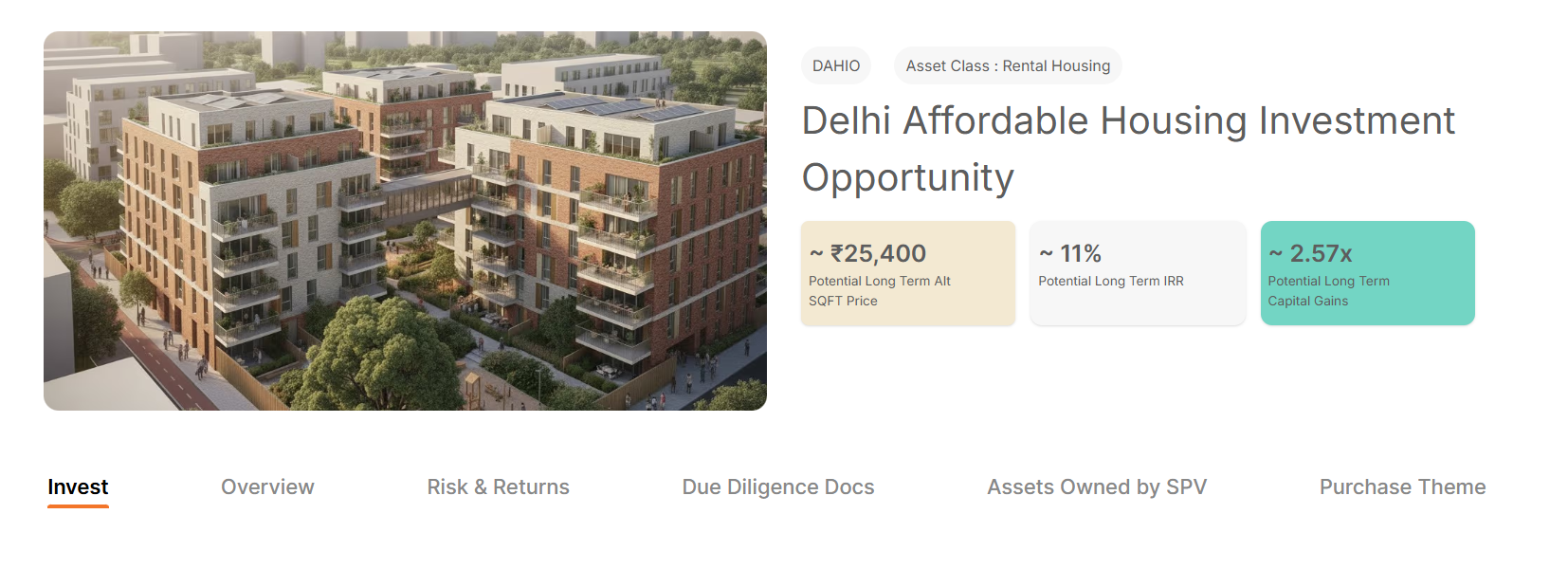

Real Estate Investments

Per Annum New Opportunities

Jacob & Co. Residences Noida – Project Summary

The upcoming Jacob & Co Residences in Noida represent one of the most luxurious real-estate launches in India this decade. Developed by M3M India in collaboration with the iconic New York–based haute-horlogerie brand Jacob & Co, this project brings global craftsmanship, design innovation, and true collector-grade exclusivity to NCR for the first time.

With only ~270 ultra-luxury homes across 3, 4 and 5 BHK formats, the project is positioned as a landmark address for buyers who value rarity, aesthetics, and world-class engineering.

Project Location & Overview

Located in Sector 97 on the Noida Expressway, the towers overlook nearly 300 acres of open green landscapes, offering privacy and an unobstructed skyline. The development features G+34 high-rise towers with very limited residences per floor, ensuring exclusivity and spacious living.

Connectivity is one of the strongest selling points—IGI Airport, AIIMS, Select CityWalk, Amity University, Greater Noida, and Okhla Bird Sanctuary are all within easy driving distance.

Luxury Amenities Curated by Jacob & Co

The project focuses heavily on lifestyle and experiential luxury, with amenities rarely seen in NCR’s real-estate market:

-

Sky Cinema

-

Music Lounge & Events Pavilion

-

Conservatory Garden

-

Temperature-Controlled Indoor Pool

-

Garden Lounge

-

Alfresco Terraces

Every space reflects Jacob & Co’s philosophy—bold design, statement aesthetics, and artistic detail.

Investment Structure & Returns

The payment plan has been designed to suit both end-users and investors:

-

25% at booking

-

25% within 21 months

-

25% on superstructure completion

-

25% at the time of applying for OC

Minimum contribution: ₹10 lakh

Investment horizon: 2–3 years

Targeted returns: 40%+

This structure allows fractional investors to participate without the capital strain of full ownership.

Why Estates by Per Annum?

This opportunity is being offered through the Estates fractional real estate platform, which focuses on premium Grade-A developments. Their model provides:

-

Exclusive entry pricing negotiated with the developer

-

Construction-linked flexibility to lower holding risk

-

Fractional ownership access to luxury real estate

-

Backed by dedicated SPVs for legal clarity and a smooth exit

-

Strong due diligence and developer selection

SPVs ensure that each project is ring-fenced, and profits are distributed transparently when the asset is sold.

Who Is This Project Ideal For?

-

Investors seeking luxury real-estate exposure without full-ticket capital

-

NRIs looking for a branded, globally recognized asset

-

Collectors who appreciate Jacob & Co’s design philosophy

-

Long-term investors expecting capital appreciation in the Noida Expressway micro-market

-

Fractional investors wanting stable, premium real-estate opportunities

Final Thoughts

Jacob & Co’s entry into Indian real estate marks a major milestone for NCR’s luxury segment. With international-grade design, limited inventory, a strong partner in M3M India, and a curated SPV investment structure, this project has all the elements to become a flagship branded residence in the region.

We did a detailed article on Estates – How does Estate work?

Alt DRX Private Opportunity

AltDRX has launched a new property in Delhi. Opportunities allow co-investment in a mix of developed and select under-construction residential apartments in Delhi-NCR, shortlisted and analyzed by Colliers from top developers, ensuring best-in-class quality, amenities, and specifications.

Last month, I visited one of the investment opportunities highlighted on their website in Munnar that many people had participated in – Aveda Munnar.

It was a great experience, covered in my post in detail.

AltDRX has also revamped its website. You can now view details, along with a performance chart, of your investments on the platform portal. Investors looking to get an offer on a private opportunity can reach out through Randomdimes.com

Altdrx OpportunityBond Investment

Below are the top-listed and unlisted bonds currently available in the market. We try to get the best rates from the platforms and funds that sell these bonds. For the listed bonds, you can use the link below to buy. For the unlisted, please add your details in the form, and we will connect you to the seller.

Listed Bonds List

For listed bonds, you can check the bonds from the link below. Best yields in the market!

Aspero Randomdimes Page| Issuance | Rating | Coupon | Yield (XIRR) | Issuance Date | Maturity Date |

| AKARA CAPITAL ADVISORS PRIVATE LIMITED | ICRA BBB | 9.85% papm | 15.00% | 30-Apr-2025 | 30-Oct-2026 |

| Indel Money Limited | CRISIL BBB+ | 11% papm | 13.95% | 11-Apr-2025 | 11-Nov-2026 |

| Indel Money Limited | CRISIL BBB+ Stable | 11.00% papm/11.57% XIRR | 13.95% | 7-Mar-2025 | 7-Oct-2026 |

| Satya Microcapital Limited | ICRA BBB+ | 10.40% papm | 13.00% | 23-Aug-2024 | 23-Feb-2026 |

| Spandana Sphoorty Financial Limited | CARE A+ | 9.84% papm/10.30% XIRR | 12.75% | 12-Sep-2024 | 28-Jun-2026 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 2-Apr-2025 | 2-Apr-2028 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 12-Mar-2025 | 12-Mar-2028 |

| Criss Financial Limited | IND A | 10.50% papm/11.02% XIRR | 12.60% | 30-Aug-2024 | 30-Aug-2026 |

| Satin Finserv | ICRA A– | 10.80% papq/11.25% XIRR | 12.60% | 20-Sep-2024 | 20-Sep-2026 |

| Navi Finserv Limited (“Navi”) | CRISIL A (Stable) | 10.60% papm | 11.70% | 21-Feb-2025 | 21-May-2027 |

Unlisted bonds List

| Issuance | Rating | Coupon | Yield(XIRR) | Issuance Date | Maturity Date |

| True Credits Private Limited | CRISIL BBB | 11.71%papm | 18.00% | 4-Apr-25 | 09-Apr-26 |

| Branch International Financial Services Private Limited | Acuite BBB- | 10% papm | 17.50% | 4-Mar-25 | 9-Mar-26 |

| True Credits Private Limited | CRISIL BBB | 11.71%papm/ 12.36% XIRR | 17.50% | 8-Nov-2024 | 13-Nov-25 |

| Smartpaddle Technology Private Limited (Bizongo) | Unrated | 11.50% papm/12.12% XIRR | 17.50% | 22-Feb-2024 | 22-Feb-2026 |

| Akara Capital | ICRA BBB | 9.85% papm | 16.40% | 30Apr25 | 30Oct26 |

| Hella Chemical | IND A- | 11.80% papm/ 12.46% XIRR | 15.00% | 28-Feb-2025 | 28-Feb-2028 |

| Evernest Infratech Private Limited (“Strata”) | Unrated | 13.50% papm/14.37% XIRR | 15.00% | 5-Sep-2024 | 5-Sep-2026 |

| Si Creva Capital Services Private Limited | CRISIL BBB+ | 10.40% papm/10.91% XIRR | 14.80% | 29-Jul-2024 | 3-Aug-2025 |

Register to get details of unlisted bonds

Short-Term Investments

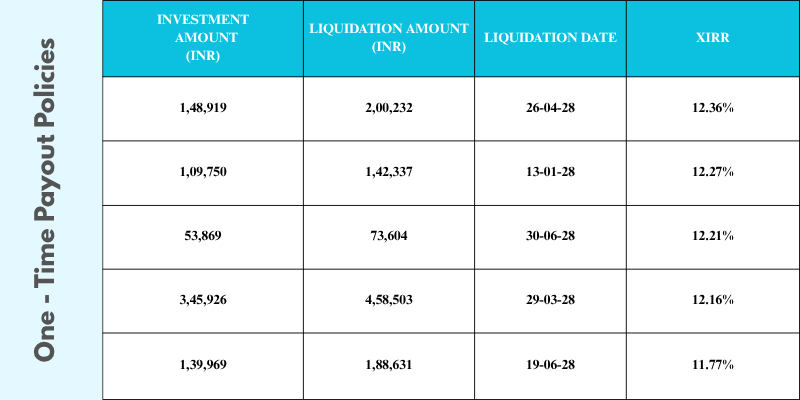

PolicyExchange seems like a decent product to target a 12% tax-free investment in a portfolio of Government bonds. Considering the lacklustre performance of Indian Equities, we plan to invest some amount of fixed income allocation in it.

Investors should match their investment with their time horizon to get the best fit for them.

I will be participating in some of these opportunities. Latest post on Policyexchange.

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.55% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.35% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.25% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.50% |

| Altifi | 12.50% | 0.00% | 0.30% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Tradecred | 11.50% | 0% | 0.8% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

- Finally got some new policies on Policyexchange with high irr

- Currently invested in 2 Invoice deals on Tapinvest

- Invested in 1 deal on Amplio

- Invested in Altwings on Altgraaf

Crypto Investing

We recently covered an Altcoin research platform –Tokenmetrics, where you can find all the metrics and information required for analyzing altcoins.

The crypto market entered a turbulent phase in November after hitting new highs earlier in the year. Key highlights:

-

Bitcoin fell roughly 17%+ during November, marking one of its worst months in 2025.

-

From its October peak (above ~$120,000), Bitcoin pulled back over 30% at one point, driven by heavy outflows from spot-Bitcoin ETFs and broader risk-asset sentiment reversing.

-

The total crypto-market capitalisation retraced significantly, erasing gains and exposing underlying leverage and structural fragilities.

-

On-chain and technical signals show that Bitcoin found some support in the ~$84,000-$90,000 zone, but real fresh buyer demand remains weak, meaning the bounce may be shallow unless sentiment improves.

-

Regulatory and structural risks remain front-of-mind: regulators are still warning about gaps in crypto governance and tokenization frameworks.

✅ What this means for investors

-

The drawdown is not necessarily a signal that crypto is dead — many analysts say such pullbacks (~25-30%) are typical even in bull markets for crypto.

-

That said, the risk environment has clearly worsened: spot ETF outflows, weak retail participation, and macro headwinds (rates / risk-off mode) make short-term upside harder.

-

For portfolio construction: this is a moment to review sizing, de-leverage where necessary, and avoid assuming that crypto will merely “go up” like in previous years.

-

From an alternative-asset perspective (which aligns with your blog focus), crypto remains an option if sized carefully, combined with strong risk controls, and ideally as part of a diversified “convexity” bucket rather than core allocation.

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

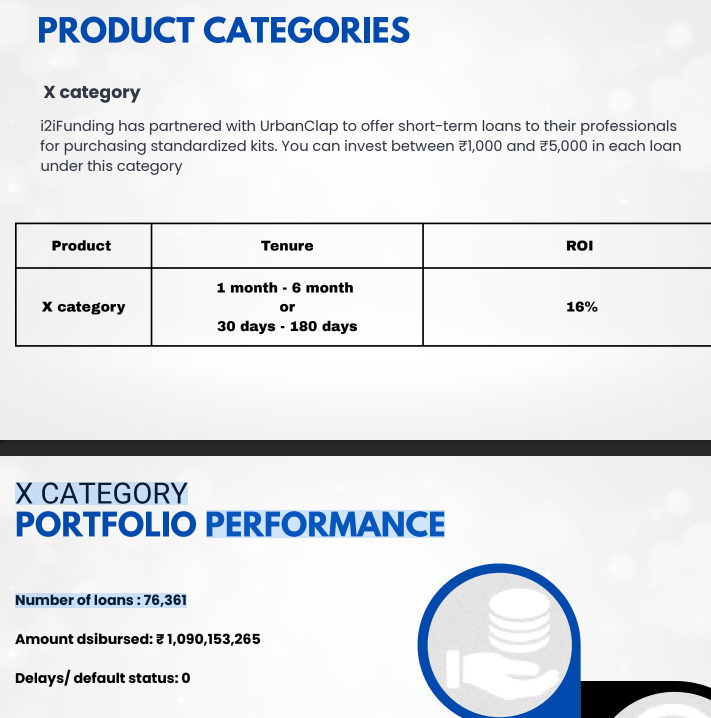

P2P Investment

We recently received the performance report from I2Ifunding. Below is a snapshot of the deals.

Current allocation:

- India P2P – 30%

- I2IFunding- 55%

- Lendbox -15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 12.6% | 5.9% |

| Lendbox Per Annum | Paused | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category, i.e, Urban Clap Loans.

- There are fresh deals available on I2ifunding now. Other P2P only does redemption and no fresh deployment!

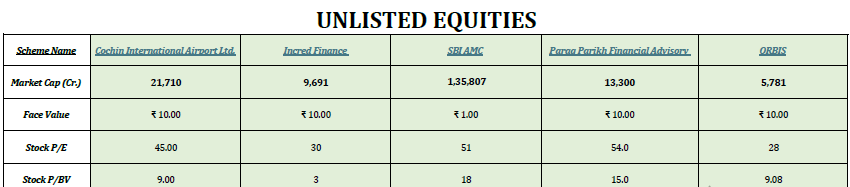

Equity Market

Pre-IPO Stocks

Listed Stocks

The Indian stock market remained resilient in November, with the Nifty hovering near the 26,000–26,300 range and closing the month close to its all-time highs. Softer inflation, strong domestic SIP flows, and steady Q2 earnings helped maintain bullish sentiment despite global volatility. Banking, autos, capital goods, and select mid-caps continued to lead the rally, while IT and export-oriented sectors remained range-bound due to weak global demand. FII flows turned modestly positive toward the end of the month, adding further support. Overall, November was characterized by stable momentum, improving breadth, and healthy risk appetite, setting a constructive tone heading into December and early 2026.

We recently did an article on how tactical leverage can improve returns of portfolio

Option Trading

Nov was a decent month with total returns of 2.5%. Trades involving Spreads were profitable this month. Option premiums were low, hence purely selling options seemed risky.

Quantinsti is one of the top quant trading course providers in India. Beginners can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.