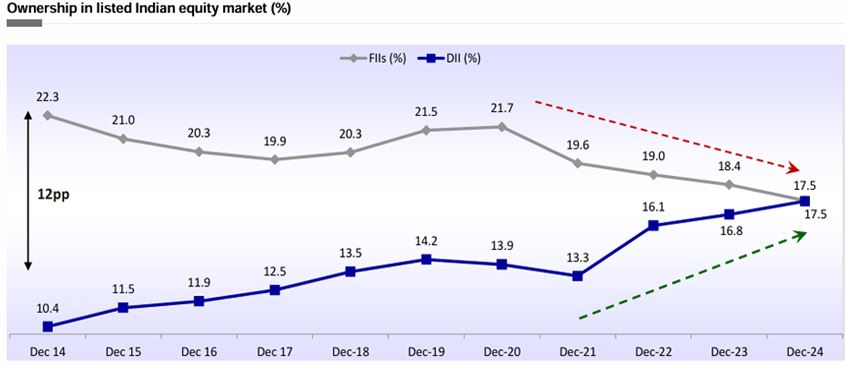

The current market scenario has gradually shifted from euphoria in September 2024 to fear in February 2025!

It’s natural to feel uneasy about the recent market correction. However, periodic declines of 10-20% or more have always been a normal part of equity markets. These fluctuations have persisted for decades, and long-term wealth is built by navigating multiple market cycles. While volatility has been relatively subdued in recent years, it remains an inherent feature of equities.

Though predicting short-term market movements is challenging, history suggests that this correction, like others before it, will eventually pass. Encouragingly, incremental data points indicate improvements at the ground level, suggesting we are emerging from a mid-cycle slowdown, supported by government spending and monetary policy measures.

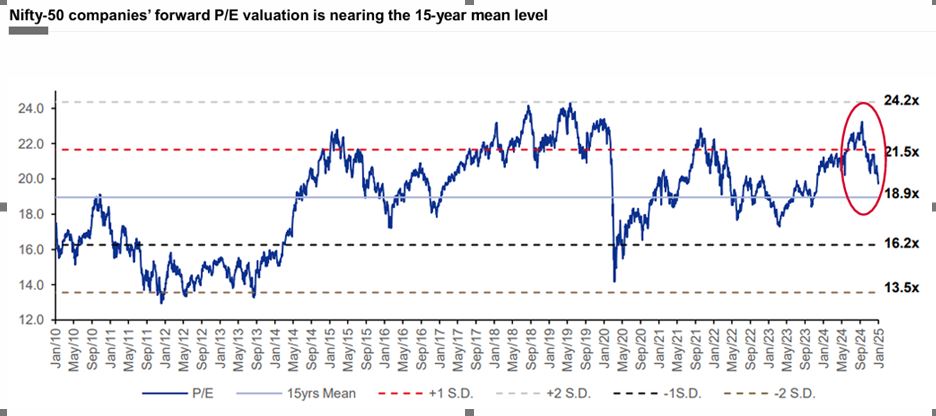

One positive aspect of this correction is that valuations are becoming more reasonable, helping to remove excess froth. While market sentiment can swing between optimism and pessimism, sustainable wealth creation comes from patience, discipline, and maintaining a long-term perspective.

During periods of volatility, resilience is key to long-term success. As John Bogle wisely said, “Stay the course. No matter what happens, stick to your investment program… It is the most important single piece of investment wisdom I can give to you.”

It is not just the equity market but many covenants have been breached in the debt market showing broader stress in the market. However, investors should use this opportunity to logically add or reallocate capital.

This drawdown also gives us a perspective on volatility and risk. There are proponents of investing only in Equity. Though it is very tempting during bull markets volatility is hard to digest in bear markets. Most fund managers show monthly returns and in that process, even periods like COVID drawdown don’t look too bad but in reality, if someone had been an investor at that time they would have seen 20-30% of their wealth evaporate in a week or so.

If you are an investor and can avoid looking at your account, you witness less volatility (on a standard deviation basis)! This is an argument for ignoring the path. A balanced allocation can make it easier to have a sustainable portfolio and avoid a roller coaster ride.

New Alternate Investment Platform- Fundbezzie

Fundbezzie is the new addition to our alternative investment portfolio. Some of the salient features of this platform are

- Part of Pantomath Group, an established capital market company

- Unique High Yield Opportunities across asset classes.

The latest Dwarka opportunity is a testament to that and can be explored by investors looking to buy land in a high-growth geography. Many investors are keen to invest in cities where the potential is good but have been deterred by the heavy capital it requires and secondly, it is tough to perform due diligence, etc in places far from you.

Fundbezzie has allowed this to be possible as they allow investment as low as INR 10 Lakh. They have done the due diligence and created a sound legal structure to invest.

Investors interested in Dwarka can show their interest through the below Google form

Altifi offers unlisted NCD to selected investors but won’t be available publically, you need to connect with the Altifi RM after registering here.

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

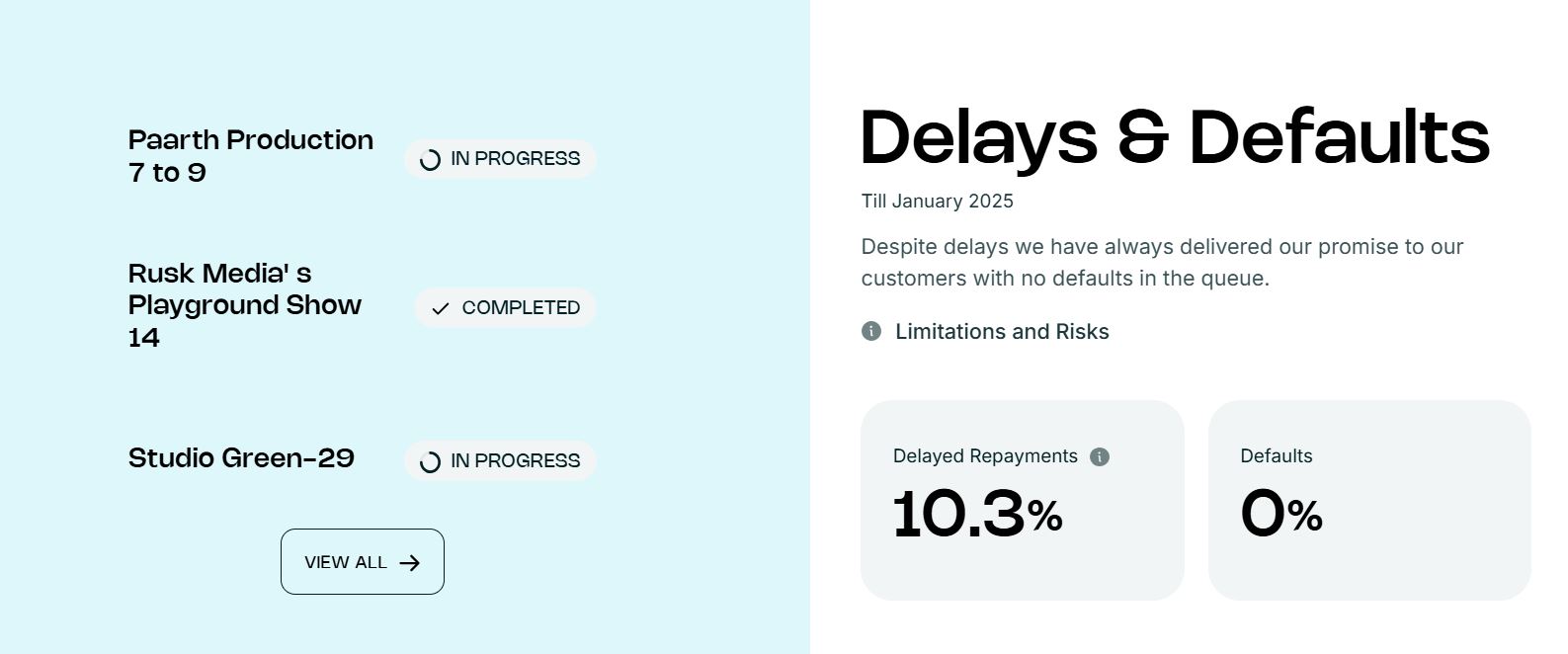

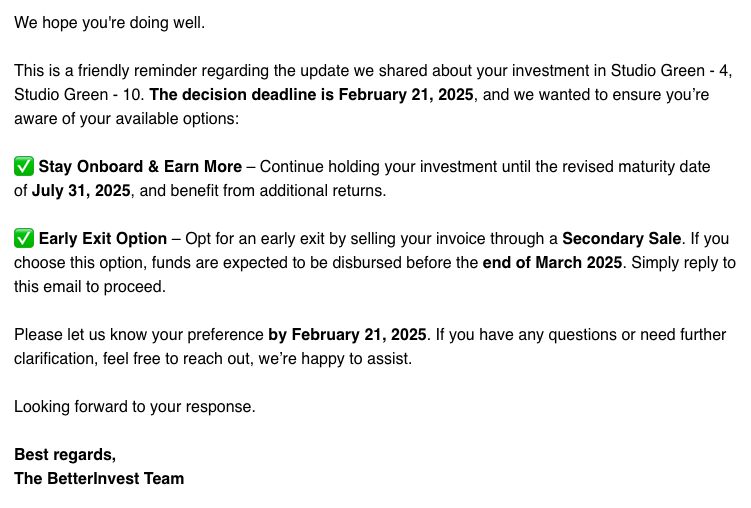

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently below are the key new updates on the various delays across Alternative Investment platforms.

- Falcon Fraud

- Growpital SEBI Order Update

- Betterinvest Delay

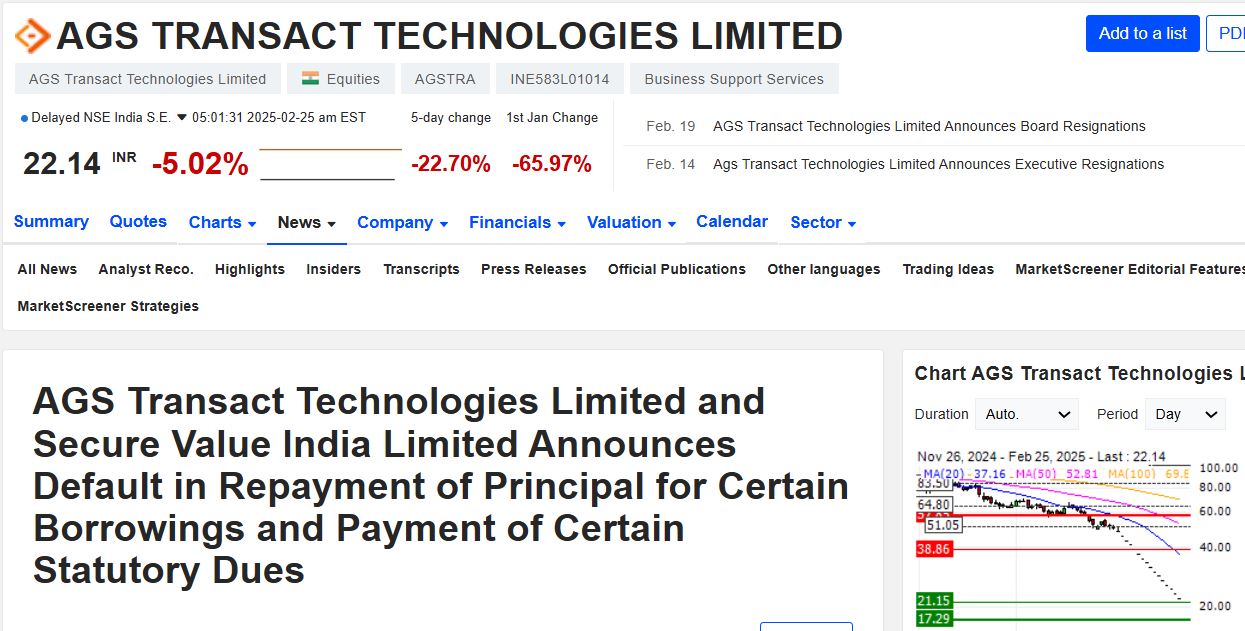

- AGS Transact Default

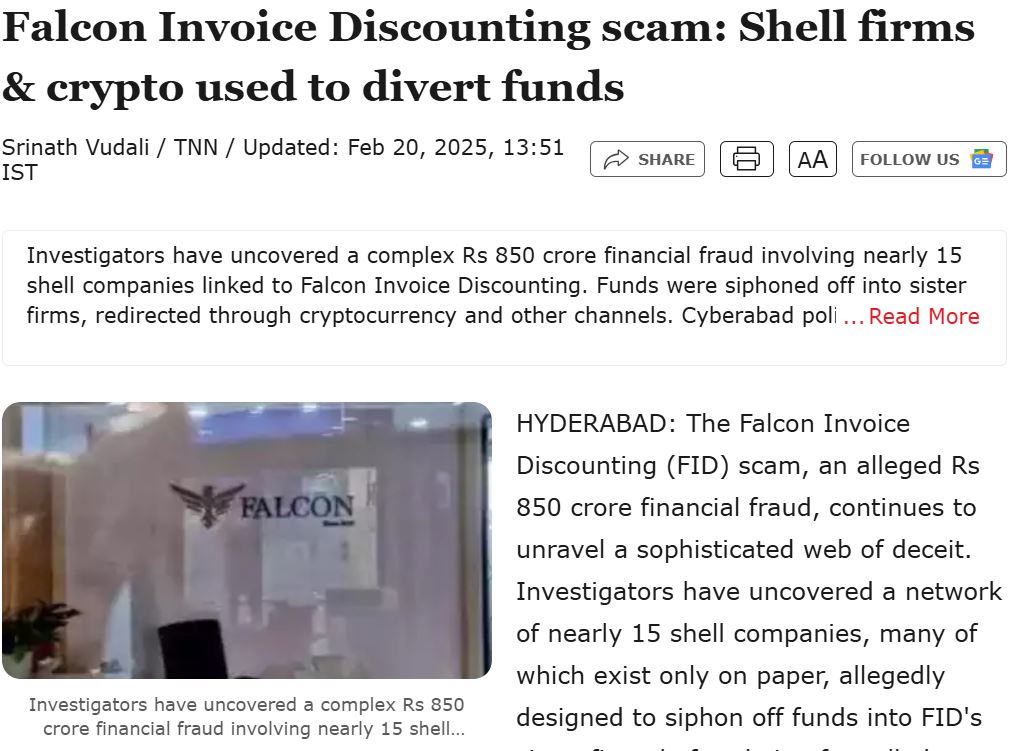

Falcon Fraud

The fraud by Falcon was recently unearthed when they stopped paying many investors. When investors could not reach representatives they tried contacting people in the office only to find that the management was nowhere to be found. The biggest shock is that many investors ended up putting their life savings in a platform without any proper due diligence.

This is one platform that we had flagged a long time back. It had to tell tales of signs of something fishy. Some of our concerns where

- No proper management structure

- Money is raised by a related entity

- Credit cards etc being accepted for investment

- ROI is much higher than other platforms in similar asset class

- Hardly any employee with a finance background on Linkedin.

Growpital SEBI Outcome

A new twist has come in the Growpital saga in the form of a new investor that has proposed SEBI that it will take over Growpital parent company and repay all outstanding liabilities to the investor! The name of the company is RPJ Tea!

We are not really in the position to make out anything from this. On one hand, this is a godsend information for investors who up till now were expecting to salvage only 25-30% of the investment but on the other hand, logically it seems an odd choice for an investor to buy out investor liability for a company that supposedly doesn’t have any current operational business or lot of hard assets.

The next hearing is scheduled for 3rd Feb 2025. Below is the interview of the founder of the company who has proposed this deal.

Betterinvest Delay

Studio Green repayment has been delayed for some users while for some it is still pending. There was an early exit option for a few people mostly for Studio 13 and 17 deals. Few others have been communicated that payment would be done by February end.

AGS Transact Debt Default

AGS Transact Technologies Limited and Securevalue India Limited have defaulted in the payment of principal repayment obligations for certain outstanding borrowings of the Company and SVIL; (ii) the Company, SVIL and India Transact Services Limited (`ITSL’), material subsidiary of the Company have defaulted in the payment of certain statutory dues. All the outstanding AGS transact debt facilities have been downgraded. Grip Invest has SDI on this underlying. Till now payments have been on track. According to Grip even in case of default, they have recourse as the underlying assets are ATMs that are deployed at large banks and they can find buyers for these.

Alternative Investment Portfolio Updates

Hope you have explored Randomdimes<> Aspero collaboration and its benefit to investors. You can use the randomdimes registration link to avail best prices.

AltDRX Partial Profit Booking

Alt DRX has completed 1 year. All the opportunities are doing quite especially considering that the broad market did not give any return last year!

We were able to book partial profit in Bangalore opportunity with 20%+ IRR. We sold the units on Tradex. We will do a detailed article on our 1-year journey.

The AltDRX 1% cashback is still available for all Randomdimes investors of ALTDRX

Telegram channel for *the Latest Alternative Investment News

Medium Term Investment

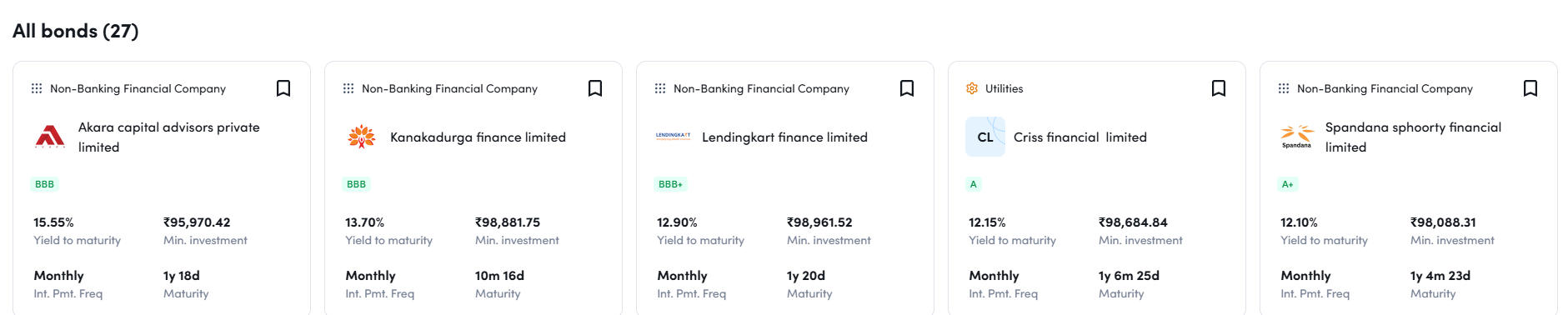

Policy Exchange will be adding new policies in March as they are currently onboarding new partners. Some of the top high-yield opportunities for this month

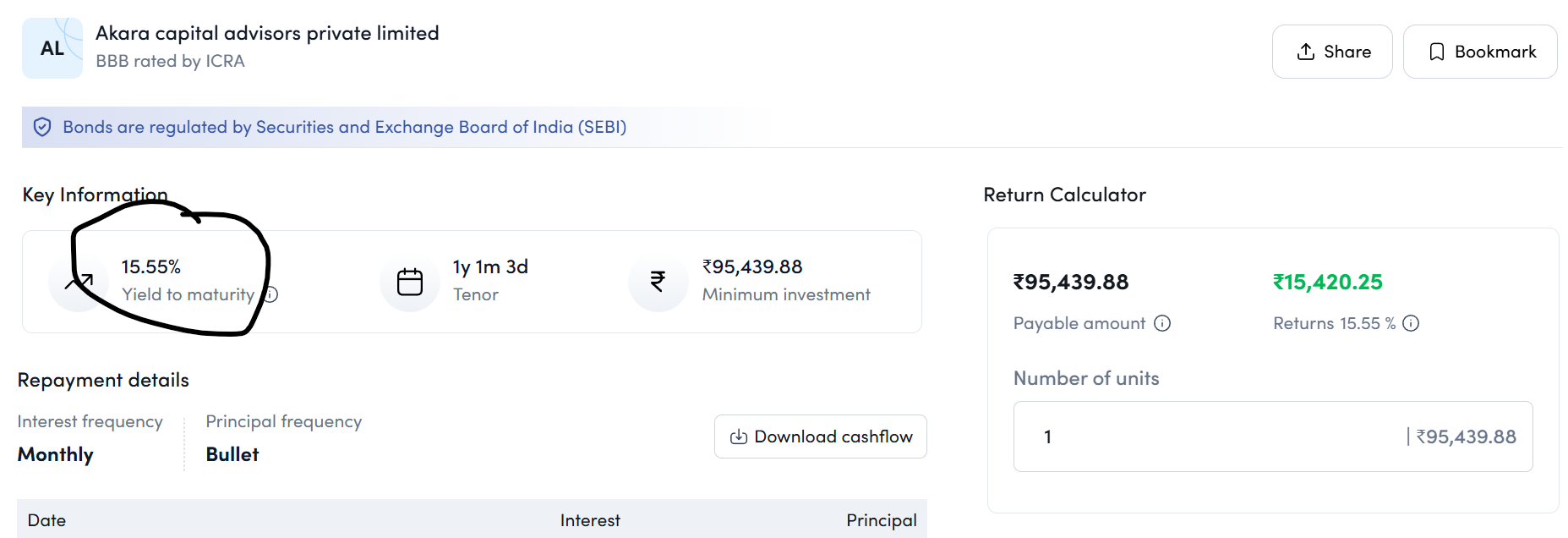

- Randomdimes<>Aspero – 15.55% Akara

- Grip Invest – 13.5% Indel Money

- Tapinvest – 18% IRR Torq Leasing

Below is the list of bonds currently Offered on Randomdimes<>Aspero.

Aspero Randomdimes Page

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks (stopped) | 20%+ | 0.15% | 1.25% |

| WintWealth (paused) | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.4% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

- Only invest in microfinance or unsecured lender company bonds if the yields are attractive as the sector is stressed and it does not make sense to risk capital for low returns.

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

| Faircent (paused) | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 2% |

| 13 Karat (Paused) | 13% | 0% | 0% |

- Currently Invested in 2 Invoice deals on Tapinvest

- Invested in 1 deal on Tradecred

- Invested in 1 deal on Monytics

Crypto Investing

This has been a month with mixed news for Crypto. While overall acceptance of crypto is growing making it a more conventional asset the safety of our funds still remains a question after the latest Bybit Hack happened.

Lazarus group based out of North Korea is supposedly behind the hack. Hackers stole digital tokens worth about $1.5 billion – in what may be the biggest crypto heist of all time – CEO Ben Zhou wrote on X that it has replenished its reserves. Bybit was able to do this through a mix of emergency loans and large deposits.

Zhou told users that their funds were “safe,” and that the firm would refund anyone affected. Less than 72 hours later, Zhou said Bybit had restored the exchange’s balance and kept customer withdrawals open, although he did not account for the stolen crypto.

The scale of the Bybit theft surpasses the previous record of a $615 million heist of Ethereum and U.S. coins from the Ronin Network in 2022.

Check out Bitsave, a platform to invest in crypto index funds managed by Bloomberg from India

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 40%

- I2IFunding- 30%

- Lendbox -30%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 13.10% | 5.5% |

| Lendbox Per Annum | Low Risk Short Duration only | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category i.e Urban Clap Loans

- It seems Indiap2p is facing higher NPA due to overall stress in the microfinance sector and may take few months to improve NPA again.

Equity Market

PreIPO Stocks

Lot of online unlisted equity platforms provide prices that are way off from the traded value of these stocks.

These platforms do not update prices frequently, which means they don’t account for the impact of listed market performance during the bear phase.

When the listed market is down considerably it implies that even unlisted stocks price should be somewhat lower!

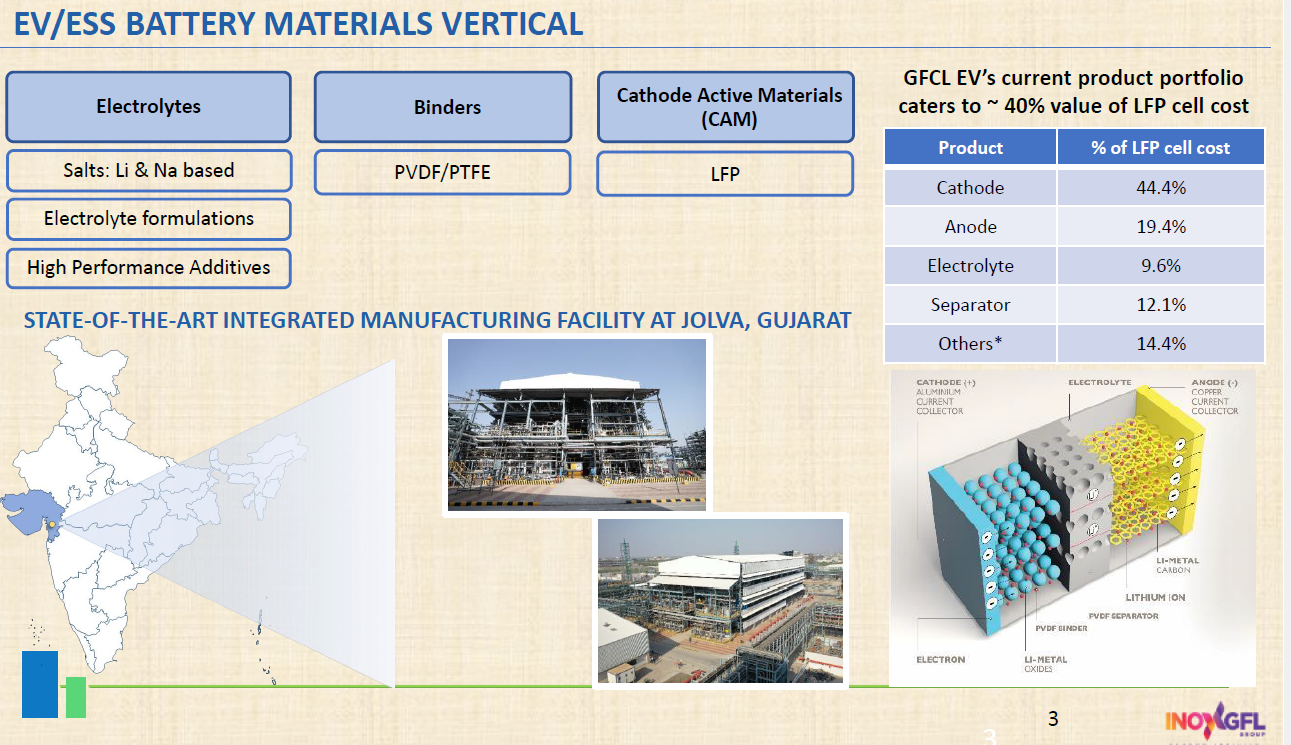

Hence for unlisted equity, we prefer our network to source deals. The latest deal we are evaluating is GFCL

GFCL Business Update

* Raised Rs. 1000 crore in its EV subsidiary at an equity valuation of Rs. 25,000 crore.

* The battery salt plant reached a global quality benchmark and is in the ramp-up phase.

* Engaging in customer visits and audits (Indian and Global) with product sampling and validation.

* Initial validations show positive results, with ongoing discussions likely leading to commercial agreements. Commercial supplies are anticipated to start from Q4 FY25.

* LFP plant commissioning is on schedule for a Q4 FY25 production start.

Key Investment Points

* Targeting a total capex of Rs. 5,000 crore for the EV business by FY27 and Rs. 6,000 crore by FY28.

* Funding strategy includes internal accruals, market fundraising, and investment from a sovereign wealth fund. Already invested Rs. 1,000 crore from the parent and raised another Rs. 1,000 crore externally. Discussions with a sovereign wealth fund for a ~ $100 million investment are underway.

* Preparing commercial-scale plants for customer qualification and commercial deal closures, with capacity expansions planned as per customer needs.

* Anticipating internal accruals of Rs. 1,500 – Rs. 2,000 crore for EV business capex by FY26.

* GFCL expects notable improvements in the Fluoropolymers market, driven by specialized, high-value products in the automotive, semiconductor, and EV sectors.

* Consolidated EBITDA margins are projected to remain around 35% moving forward.

Some notable investors in the GFCL EV primary round

RPSG family office: 100cr

Hero family office: 100cr

Manyavar family: 60cr

Naresh trehan (Medanta): 10cr

Devyani International promoter: 25cr

Shyam Metallics promoters: 90 Cr

RJ Corp (Varun Beverages): 25 Cr

Motherson Sumi promoters: 13cr

India Opportunities fund: 25cr

Kejriwal family: 10cr

Rikeen Dalal: 25cr

Sunil Singhvi: 5cr

Interested investors can reach out to us for further details. We hope to invest in a few more opportunities and will share their details for others to evaluate.

Listed Stocks

Indian stock market has been on a one-way downward trajectory for the last few months. The valuations now seem better than what they were a few months back and for long-term investors this could be a good opportunity to add capital.

However, the market is still not extremely cheap hence we prefer a staggered approach.

OptionTrading

February was another good month for short volatility trading strategies as the market was slow and choppy benefiting range-bound strategies. . We have started covering some top traders and firms on YouTube.

We covered Quantinsti one of the top quant trading course providers in India. It is really helpful for someone looking to enter this field.

Starters can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.