In recent years, the world of finance has been buzzing with excitement over the emergence of cryptocurrencies, with Bitcoin leading the charge. Among cryptos, Bitcoin & Ethereum have gained widespread attention as potential investment assets. However, navigating the world of cryptocurrencies can be daunting for many investors, especially in countries like India where there is too much negativity about Bitcoin as an asset class and lack of regulations.

This is where Bitcoin Exchange-Traded Funds (ETFs) come into play, offering a convenient way for investors to gain exposure to Bitcoin without the complexities of owning and storing the digital currency. In this article, we’ll understand what Bitcoin ETFs are, why you should consider investing in them, highlight the top 5 Bitcoin ETFs, discuss how to invest in Bitcoin from India and provide a concluding overview.

Bitcoin Investing in India- Current Scenario

Bitcoin investing in India has witnessed a surge in popularity amid the evolving financial landscape. With a growing number of Indians turning to cryptocurrencies as an alternative investment option, Bitcoin has emerged as a frontrunner. Despite regulatory uncertainties and occasional crackdowns, the appetite for Bitcoin investment remains robust, fueled by factors like potential high returns and diversification opportunities.

While the Indian government has shown interest in exploring blockchain technology for various applications, its stance on cryptocurrency regulation remains ambiguous. There have been raids and investigations initiated against several crypto exchanges by government agencies on charges of money laundering, improper KYC, etc. Coming to taxation, gains in crypto trading are taxed at 30% in India apart from 1% tax deducted at source on transactions exceeding Rs.50,000. All these factors cast a shadow of uncertainty over the future of Bitcoin investing in the country.

One of the best options available to Indian investors who are interested in investing in Bitcoins is to opt for investing in Bitcoin ETFs listed on US exchanges. Further in this article, we will understand what those are exactly and how one can invest in them.

What are Bitcoin ETFs?

Bitcoin ETF, as the name suggests, is an Exchange Traded Fund (ETF) that tracks the price of Bitcoin. Instead of purchasing and storing Bitcoin directly, investors can buy shares of a Bitcoin ETF through their brokerage account, just like they would with traditional stocks. These ETFs are traded on major stock exchanges, making them accessible to a wide range of investors.

The Bitcoin ETF issuing company (also called an asset management company or AMC) buys and stores the bitcoins with a custodian. A custodian is like a trustee who plays an important role in storing and managing the assets the ETF holds. ETF shares or units represent the total pool of Bitcoins the ETF holds. When you buy units of the ETF, you buy a certain proportion of the total pool of the assets held by the ETF.

Bitcoin ETF works the same way just like any other traditional ETF—the price of one unit of the ETF would fluctuate depending on the price of Bitcoin. If Bitcoin increases in value, so does the ETF, and vice versa. But instead of trading on a cryptocurrency exchange, the ETF trades on a market exchange like the NYSE.

Advantages of Investing in Bitcoin ETFs (Instead of Crypto Exchanges)

Having read about What are Bitcoin ETFs and how they work, now let us understand their advantages over the traditional method of buying & selling ETFs on the crypto exchanges.

- Regulated Instruments: Bitcoin ETFs are typically regulated investment products by relevant financial authorities. This regulatory framework provides investors with a layer of protection and helps mitigate risks associated with potential fraud or market manipulation often seen in unregulated crypto exchanges.

- Convenience: Investing in Bitcoin ETFs is as straightforward as buying shares of a stock through a traditional brokerage account. This accessibility makes it easier for both retail and institutional investors to participate in the cryptocurrency market without the technical complexities of managing digital wallets and navigating crypto exchanges.

- Security and Custody: Bitcoin ETFs typically hold Bitcoin in secure custody solutions provided by reputable custodians. This eliminates the need for investors to worry about the security risks associated with self-custody or storing digital assets on crypto exchanges, where hacks and thefts are not uncommon.

- Liquidity and Transparency: Bitcoin ETFs trade on major stock exchanges, offering liquidity and transparency to investors. Unlike some crypto exchanges that may suffer from low liquidity and opaque trading practices, Bitcoin ETFs allow investors to buy and sell shares at market prices throughout the trading day.

- Risk Management: By investing in Bitcoin ETFs, investors can potentially mitigate some of the risks associated with owning cryptocurrencies directly. These risks include regulatory uncertainty, technological vulnerabilities, and the lack of recourse in the event of loss or theft. Bitcoin ETFs provide a regulated and structured investment vehicle that can help manage these risks more effectively.

- Better Price – As we are all aware the price of BTC on Indian exchanges is generally at a premium of 5-7% it makes more sense to invest directly in Bitcoin ETF

- No TDS – Each transaction on the Indian exchange requires 1% TDS to be deducted which means you cannot trade bitcoin in India, hence it makes more sense to trade the ETF rather than Bitcoin in India.

| Pros of Bitcoin ETFs | Cons of Bitcoin ETFs |

| Convenience: Easily tradable on traditional stock exchanges, providing accessibility to a wider range of investors. | Volatility: Bitcoin itself is volatile, and the value of Bitcoin ETFs can fluctuate significantly, potentially leading to substantial losses. |

| Regulated Instrument: ETFs are regulated investment vehicles, offering investors a sense of security and oversight compared to investing directly in cryptocurrencies. | Limited Market History: Bitcoin ETFs are relatively new investment products, with limited historical data available for analysis, making it challenging to assess long-term performance and risks accurately. |

| Accessibility: Bitcoin ETFs allow investors to gain exposure to Bitcoin without the technical complexities associated with purchasing and storing cryptocurrencies securely. | Fees: ETFs typically charge management fees, which can eat into returns over time, especially if held for the long term. |

| Liquidity: Bitcoin ETFs offer liquidity, allowing investors to buy and sell shares throughout the trading day at market prices. | Market Risk: The performance of Bitcoin ETFs is tied to the price of Bitcoin, which can be influenced by various market factors, including regulatory changes, technological developments, and macroeconomic trends. |

| Tax Efficiency: ETFs generally offer tax advantages compared to directly owning cryptocurrencies, such as potential tax deferral through capital gains treatment. | Lack of Control: Investors do not have direct control over the underlying assets held by the ETF, relying on the fund manager’s decisions regarding asset allocation and rebalancing. |

| Potential for Regulatory Changes: Regulatory uncertainty surrounding cryptocurrencies and ETFs could lead to changes in laws or policies that may affect the investment landscape. |

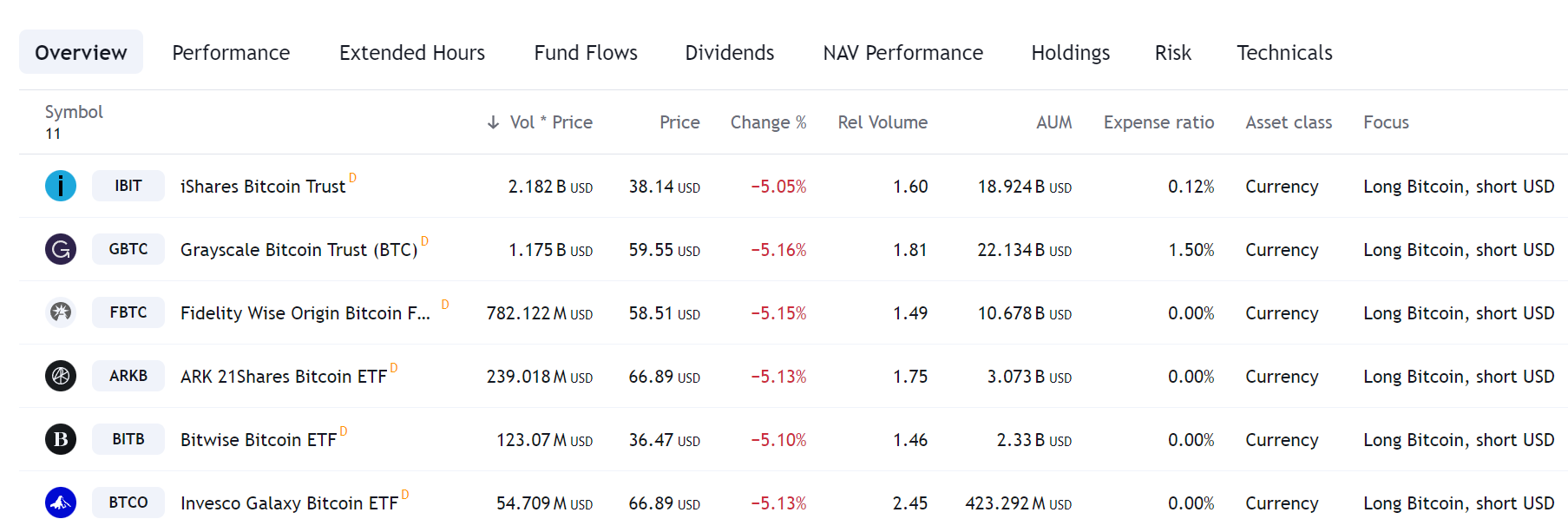

Popular Bitcoin ETFs in India

Since there are no Bitcoin ETFs from Indian AMCs, we will have to rely on Bitcoin ETFs listed in the US market. We will learn in the future how to invest in Bitcoin ETFs in India.

Following are some of the popular Bitcoin ETFs available in the market.

- ARK 21Shares Bitcoin ETF (ARKB)

- Bitwise Bitcoin ETF (BITB)

- Fidelity Wise Origin Bitcoin Trust (FBTC)

- Franklin Bitcoin ETF (EZBC)

- Grayscale Bitcoin Trust (GBTC)

- Hashdex Bitcoin ETF (DEFI)

- Invesco Galaxy Bitcoin ETF (BTCO)

- iShares Bitcoin Trust (IBIT)

- Valkyrie Bitcoin Fund (BRRR)

- VanEck Bitcoin Trust (HODL)

- WisdomTree Bitcoin Fund (BTCW)

*Please note unlike ETF, trusts are close-ended products and you can do early redemption hence there can be a difference in price between its NAV and underlying asset.

How to invest in Bitcoin ETFs from India?

If you are an Indian national like me, one of the best & easiest ways to invest in Bitcoin ETFs is through platforms allowing you to purchase US-based securities. One of the popular ones which I also use is STOCKAL.

Stockal is a global investment platform allowing investors in India to invest in US-based securities. Under its LRS scheme, RBI allows outward remittance of $250,000 yearly for all resident Indians. This amount can be utilized for investing in foreign securities.

Opening an account with Stockal is hardly a 10-15 minute process. You just need your PAN card & Aadhar card to start your investment account.

Their brokerage partner- DriveWealth is a member of the Securities Investor Protection Corporation (“SIPC”) which currently protects the securities in your account up to $500,000. With this, you can be sure about the securities held by you.

Commissions charged are just 5 cents/share in their free plan. It is worth it since it will open up a plethora of investing options for you- investing in securities of US-based companies-many of which have a strong global presence and a strong moat. They also have pre-configured buckets of stocks & ETFs that you can invest in with a single click. These allow you to diversify your holdings & rebalance automatically from time to time.

You can CLICK HERE to create a free account with Stockal and start your journey of investing in US-based securities like stocks and ETFs- including Bitcoin-based ETFs.

Another option for long-term HODLERS can be to purchase a hardware wallet on etherbit and store crypto in it. It depends if your goal is to trade or be a long-term investor and accordingly ETF or wallet can be chosen.

To read more about hardware wallets check out our post – Etherbit Review

Conclusion

Bitcoin ETFs offer a simplified and regulated way for investors to gain exposure to the cryptocurrency market. With benefits such as convenience, safety, and liquidity, Bitcoin ETFs have become increasingly popular among investors seeking to participate in the digital asset space.

However, investors must conduct thorough research, understand the risks involved, and consider consulting with a financial advisor before investing in Bitcoin ETFs or any other financial product. As the cryptocurrency market continues to evolve, Bitcoin ETFs are poised to play a significant role in shaping the future of digital asset investing.

Bitcoin ETFs offer a simplified and more regulated way for investors to gain exposure to the cryptocurrency market. With benefits such as safety, accessibility, and liquidity, Bitcoin ETFs have become increasingly popular among investors seeking to participate in the digital asset space. However, investors must conduct thorough research, understand the risks involved, and consider consulting with a financial advisor before investing in Bitcoin ETFs or any other financial product. As the cryptocurrency market continues to evolve, Bitcoin ETFs are poised to play a significant role in shaping the future of digital asset investing.