In this Wisex(earlier MYRE Capital) Review, I will cover the details of the platform and my experience investing through the platform. Commercial real estate has been the preferred asset class for institutional investors and HNIs due to a stable rental income (8-10% yields) and appreciation potential(15 %-25% IRR).

This asset class has a high barrier to entry because of which it has traditionally been an opaque, illiquid,

and unaffordable investment option for most retail investors. Wisex is democratizing commercial real estate ownership.

Wisex Introduction

Wisex, a venture by Morphogenesis, is a proptech platform that provides easy access, transparency, and liquidity to a curated selection of rent-yielding commercial real estate assets. Before we go into details of Wisex, let’s first understand what is Morphogenesis.

Morphogenesis overview

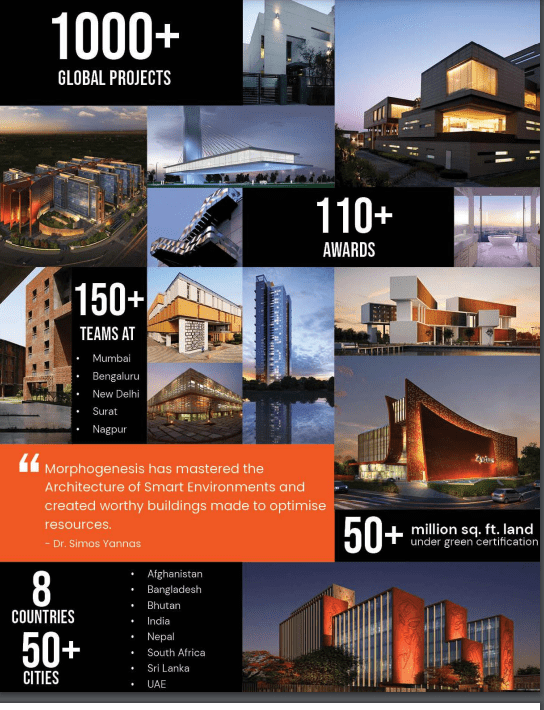

Established by Sonali and Manit Rastogi in 1996, Morphogenesis is globally recognized for its diverse work that encompasses a range of specialized practice areas – Master Planning, Residential, Commercial, Workplace, Institutional, Hospitality, and Houses, through in-house integrated project delivery in Sustainability, Interiors, Landscape, Digital Technologies and Design Management. The practice operates in India, Nepal, Bhutan, Bangladesh, Sri Lanka, South Africa, Afghanistan, and the UAE.

With projects in 8 countries, 95 International and National Awards, and 750 plus publications globally, it is the first Indian Firm to be awarded the Singapore Institute of Architects Getz Award for its vision and commitment to making a significant contribution in shaping the changing landscape of Asia.

Having a parent coming with strong expertise in real estate has been instrumental in giving MYRE capital an edge in finding the right properties

Wisex Business Model

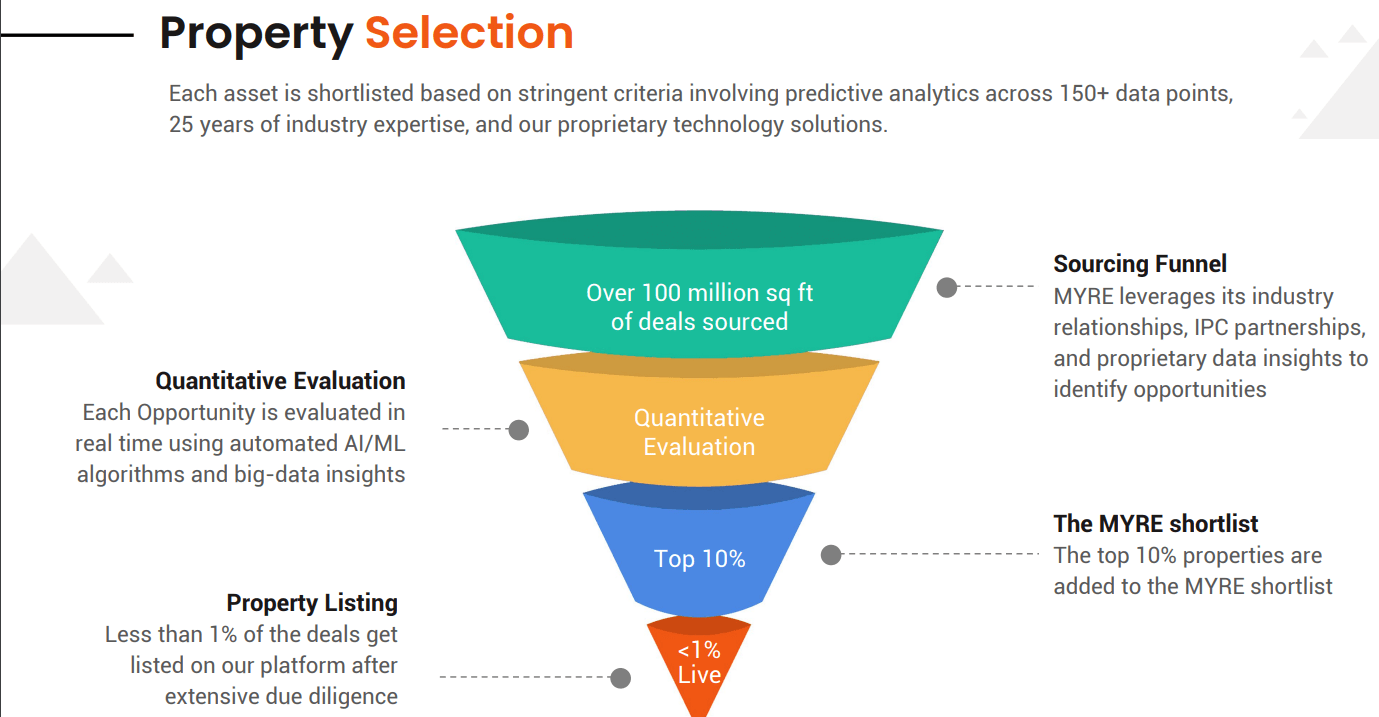

At Wisex, each property is extensively evaluated with a focus on ensuring the long-term stability, viability, and performance of the asset. The selection process is based on stringent criteria involving predictive analytics across 30+ data points, 25 years of industry expertise, and our proprietary tech processes

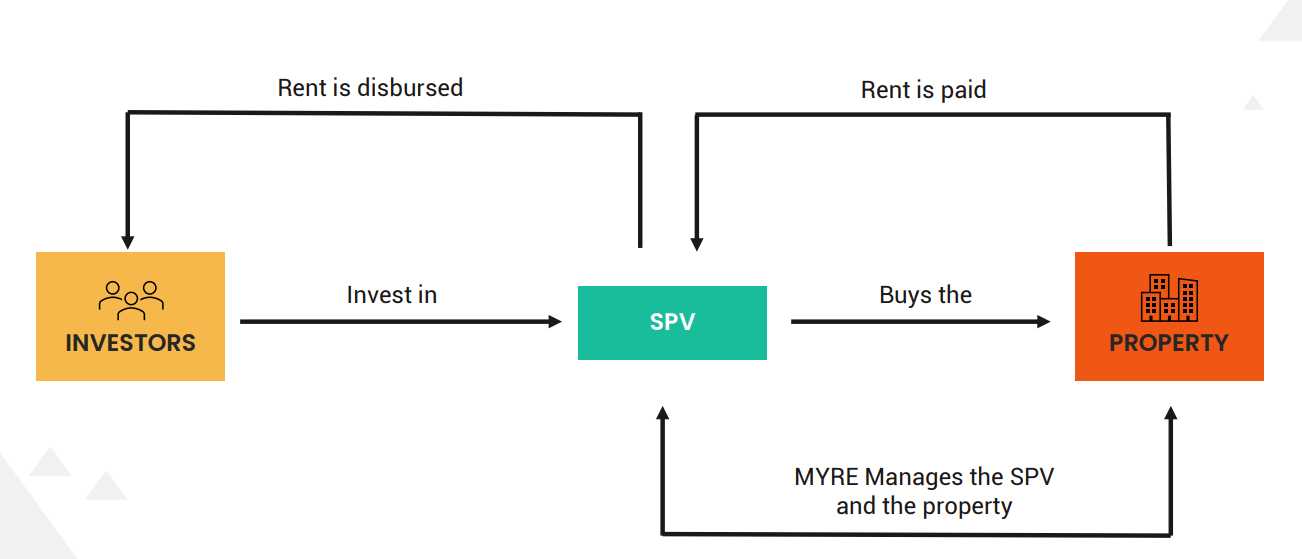

Wisex strongly believes in its asset selection and long-term performance. Wisex remains a co-owner in each of its opportunities with the other fractional owners Wisex will be assigned as the asset manager to the SPV and will be responsible for the management of the property, tenant, SPV, and investors.Wisex charges an annual asset management fee amounting to 1% of the initial investment amount. The asset management fee will be treated as an expense in the SPV and will be deducted from the rental income prior to distribution to the investors. For any untenanted period of the asset, the asset management fee will be waived. Wisex charges a 20% performance fee above a hurdle rate of 12% IRR at the time of exit. Wisex only earns this performance fee at the time of exit if Wisex is able to deliver the performance of above 12% IRR for the investor(s).

The SPV for the opportunity will be a Private Limited Company. The investors are assigned

securities of this SPV proportionate to their investment amount. The issued securities for each

investor will comprise of 10% worth of Equity holding in the SPV and 90% worth of Compulsorily

Convertible Debentures (CCDs). The net rental & other income will be distributed to the investors as interest on CCDs. The Coupon Rate of the CCDs would be adjusted to match the net annual yield. Any change in the income of the property will proportionately impact the coupon rate. If the rental escalates, the Coupon Rate of the CCDs would increase. Therefore, investors would draw monthly net rental

and other income, as applicable, proportionate to the size of their investment as Interest on

Debentures

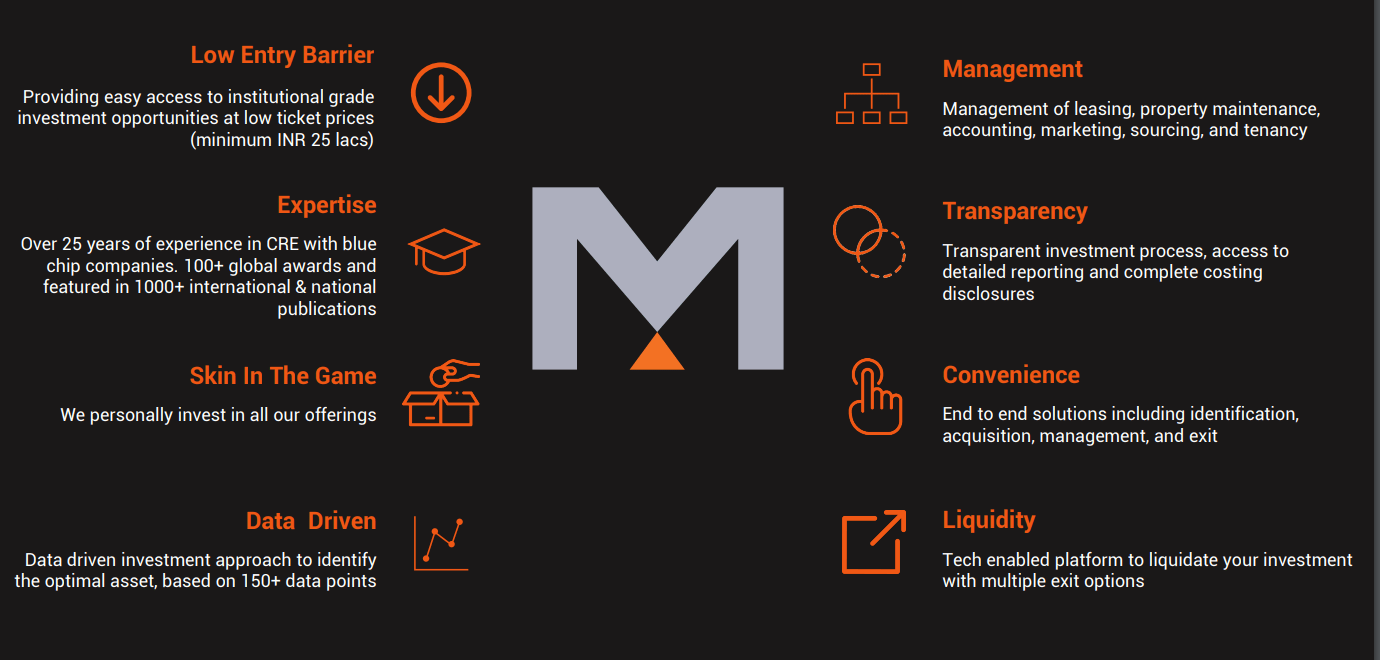

Investing in rent-yielding Commercial Real Estate (CRE) properties withWisex is a seamless digital process. Wisex is a tech-driven asset management platform that offers a curated selection of pre-leased CRE assets along with end-to-end management for investors.

Is Wisex Safe?

Some of the features which make Wisex safer than its peer are:

- Invest only in A-grade commercial real estate

- Very long term lease to reduce risk of vacancy

- Invest in each project to ensure skin in the game

- Backed by a large parent company that not only provides financial stability but also expertise in choosing the best properties.

- Wisex works with Tier-1 firms to conduct all research, diligence, and regulatory compliance

standards. A valuation report and audit of the SPV are conducted annually and are available to all

investors for their review. - Relevant documents are filed with the registrar of companies (ROC) and are available in the MCA portal as per the current statutory and regulatory requirements. All documents, agreements, and contracts are structured and vetted by independent TIER-1 law & accounting firms.

- Soon Wisex Secondary Market will be launched. Investors can list their fractional ownership on sale via the proprietary secondary market offered by Wisex. The secondary market will be actively managed by MYRE Capital and will be accessible to all the users on the Wisex platform.

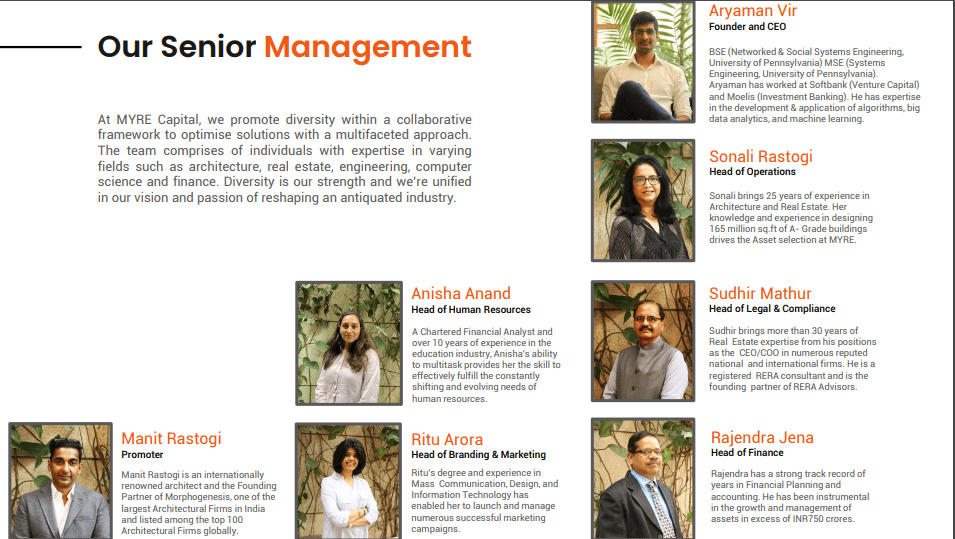

Wisex Team

Aryaman Vir is the CEO and founder of the company. Promoters of Morphogenesis hold key positions in the company. The team comprises individuals from diverse backgrounds.

Wisex Investment Experience

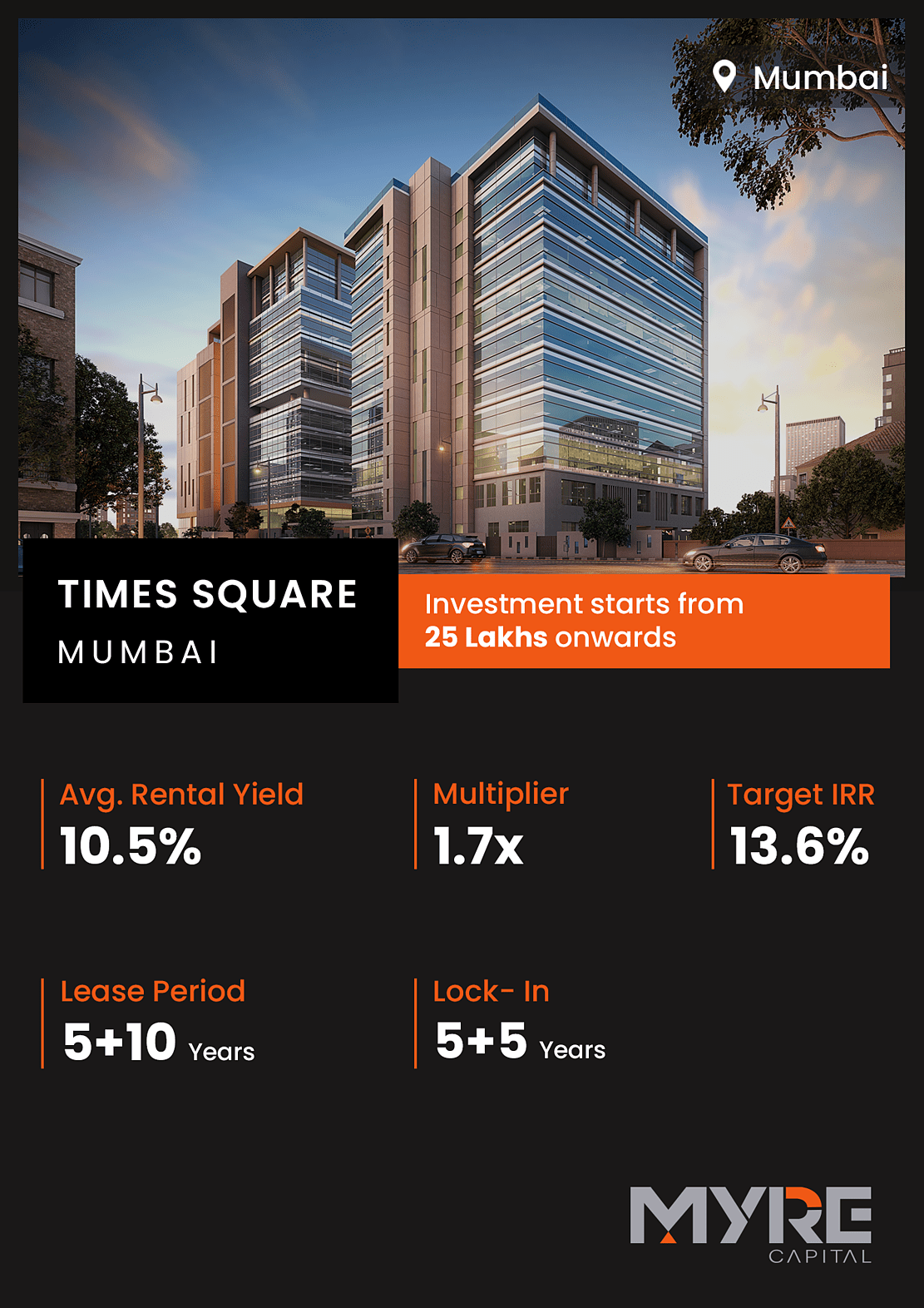

I invested in Times Square Opportunity through Wisex. I was interested in the opportunity because of 3 reasons

- Stable Tenant– The entire tower is leased to Smartworks, the market leader in Managed Workspace

Solutions. Smartworks has subleased premises to Indian Financial Technology and Allied Services (IFTAS), a Reserve Bank of India (RBI) subsidiary. - High Yield – 10.5% + capital Appreciation

- Great Location – Times Square is located in one of Mumbai’s largest commercial micro-markets,

Western Suburb 1, has seen the highest tenant absorption, proximity to airports and highways.

*currently rent cashflow as expected

Current Deals on Wisex

Currently, there is a new listed opportunity, Navratana SDI which looks quite promising. The Expected Yield is 13.26% and it is a listed product with collateral as security. Check out the details on the website below

Wisex Alternatives

There are a few other players in Fractional Real Estate in India like Strata, Prop share, etc. Some of the other platforms where we have invested are

Other alternative asset categories in High Yield are Tapinvest, Grip Invest, and Jiraaf which have good opportunities while Lendbox provides quick liquidity options.

Wisex Review

In this Review, we covered Is Wisex Safe, the business model, My experience, etc. Among the Proptech platforms in India, Wisex is one of the top ones. My Investment has been performing as expected. The Min ticket of INR 10 Lakh would be high for some investors. People should invest according to their allocation goal. The opportunity is great for investors who wish to add real estate to their investment portfolio.

You missed comparing Myre with REIT investment. Minimum ticket size and taxation.

Thanks Rupesh. Valid points. Will incorporate in the update post soon!

Also take a look at “Bhive” which is giving a lot more choice at lower ticket sizes. Would love to see your take on it.

I have seen Bhive. Yet to do a deep dive. One thing which I feel creates moral hazard is that they provide revenue on their own run business properties. Hence an independent party that vets those numbers is important.

what is the valuation of Myre capital ?

HI Each deal has it own valuation and terms on Myre