The new financial year started with a fresh high for the Global and Indian markets but was soon followed by volatility. The same was seen in the crypto assets as Bitcoin reached an all-time high before giving up the gains.

This is one of the unique times we live in where almost all assets have scaled new heights, from Interest rates to gold to Equities and crypto.

There have been some positive developments in the Alternative investment world :

- Reduced Minimum Size for private placement

In a significant overhaul of India’s bonds market, the SEBI, the capital market regulator, has approved a proposal to reduce the minimum investment amount for bonds to Rs 10,000 from the previous Rs 1 lakh.

This decision is expected to encourage greater involvement from retail investors in the Indian bond market. Previously, 99% of bonds had a minimum investment requirement of Rs 1 lakh, rendering this asset class inaccessible to many investors due to the high ticket size.

- SM REIT guidelines introduced

The Securities and Exchange Board of India (SEBI) has introduced amendments to the REIT Regulations 2014, outlining guidelines for the establishment of Small and Medium Real Estate Investment Trusts, referred to as SM REITs.

This initiative aims to regulate the fractional ownership sector and protect the interests of investors by incorporating both commercial and residential properties under the new framework.

In this setup, SM REITs are permitted to raise funds starting from ₹50 crore by issuing units to a minimum of 200 investors. These funds will be utilized for the acquisition and management of real estate assets, thereby generating income for the investors.

The ownership structure of these assets will be organized through one or more schemes, each operating under special purpose vehicles (SPVs).

One shortcoming is that currently, it does not include residential real estate and land which is a more attractive proposition for investors.

Telegram channel for the Latest Alternative Investment News

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently below are the key new updates on the various delays across Alternative Investment platforms.

- Growpital SEBI Order Update

- Tapinvest Melorra and Exampur Delay

- Arzoo Altgraaf Default

- Bigspoon Gripinvest Default

Growpital SEBI Outcome

SEBI had dismissed Growpital’s plea to unfreeze the accounts however their accounts are unfrozen now. Below is the summary of the SEBI order on Growpital prepared by an investor(Maulik)

Growpital recently conducted a webinar to update investors on the current status. The summary of the webinar is below:

- A loss of 100 crores has been indicated due to crops being left unattended as a result of SEBI’s interim order dated 29/01/2024.

- Various issues arising from SEBI’s order dated 26/04/2024 have been addressed, mainly emphasizing that all requested details and information have been provided.

- Expressing surprise at SEBI’s order dated 26/04/2024 rejecting the proposal for agribusiness in Assam/Nagaland and the utilization of 25.5 crores from bank accounts, with plans to challenge the order.

- Founder Rituraj has assured that he has no intentions of absconding from the situation and will remain with his family.

- Refusal to share any documents or proof requested by partners to allay apprehensions regarding the agribusiness, citing that these cannot be provided currently due to the matter being sub judice.

- Regarding the return of investors’ funds, no assurances can be given at present, with the possibility of determining the amount and timeline only after SEBI issues the final order.

It seems SEBI is not very convinced with the information shared by Growpital and will need more time and data from them to come to any positive decision.

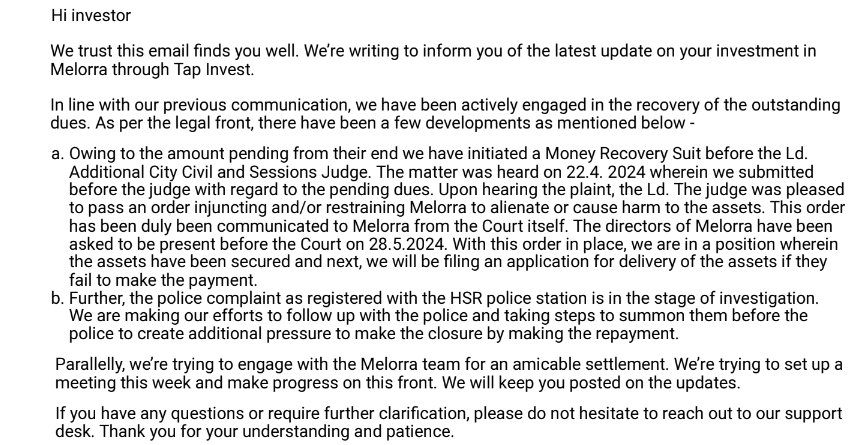

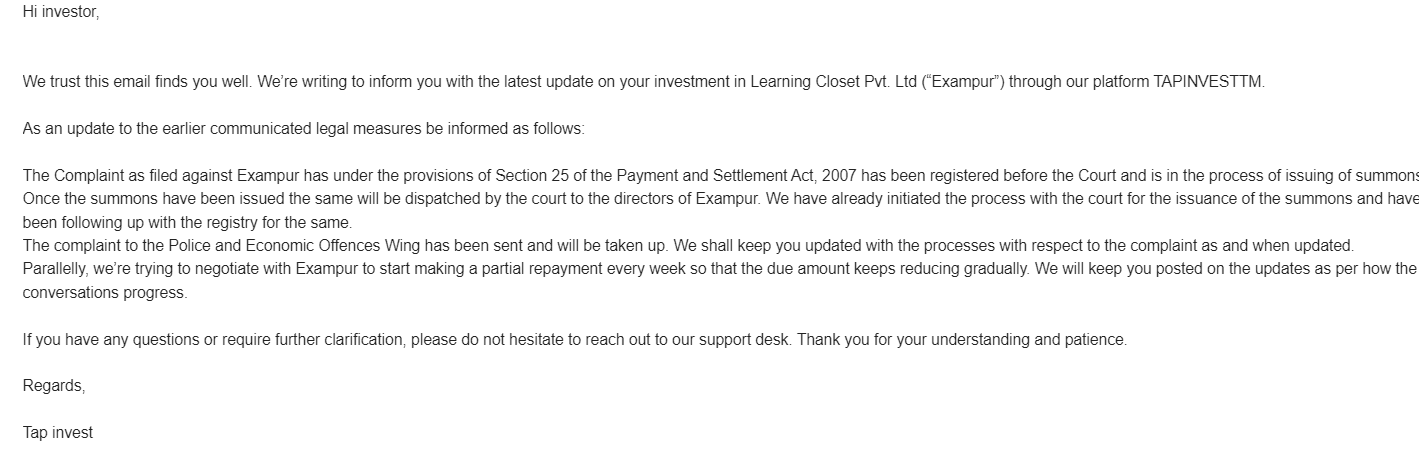

Tapinvest Exampur and Melorra Delay

Tapinvest has filed a complaint against both parties while parallel communication is also being done to resolve the issue amicably. Below is the latest communication shared by Tapinvest.

Altgraaf Arzooo

Recently Altgraaf conducted a webinar for the Arzooo delay. Below is a summary of the key points.

- Arzooo sought capital from Altgraaf for the Diwali season in 2022, which proved to be successful for them.

- Similarly, in 2023, Arzooo approached Altgraaf again for additional capital. However, they overestimated the demand, leading to an excess of inventory that they couldn’t sell. This marked the beginning of their decline, as they struggled to match up with lenders. HSBC, one of their major lenders, froze their debt due to overdue payments, resulting in Arzooo being unable to make any payouts, including employee salaries.

- With no repayment timeline in sight, Altgraaf initiated legal action. TrustLaw, a law firm, deems Altgraaf’s case strong based on their documentation, recommending this course of action for now.

- Concerns have been raised regarding Altgraaf’s due diligence on Arzooo, especially considering that other lenders, such as Capsave, two venture capitalists, and other NBFCs, approved Arzooo’s capital requirements for that season.

- Currently, Arzooo is operating at reduced capacity, having had to let go of many employees, with some remaining unpaid since January.

- Arzooo is actively seeking a rescue, such as a buyout or investment from an entity willing to acquire a significant equity stake, estimated at around $4 million.

- Altgraaf believes that this $4 million buyout could serve as the primary solution for retrieving the principal.

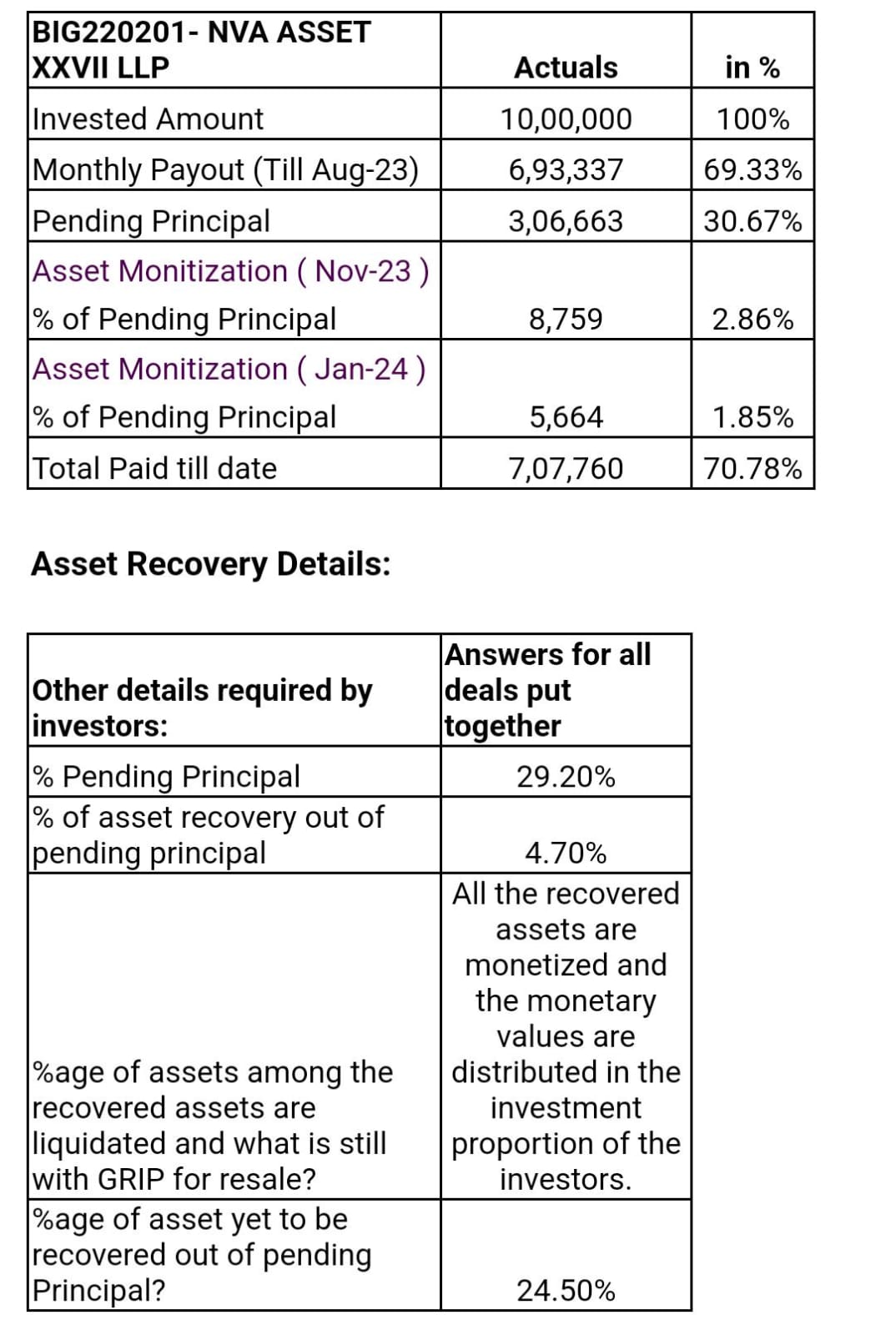

Gripinvest Bigspoon Default

Grip has recovered around 75% of the principal from Bigspoon through asset sale and liquidation. They have proceeded with litigation against the founders as well as the kitchens that are holding the assets.

Alternative Investment Portfolio Updates

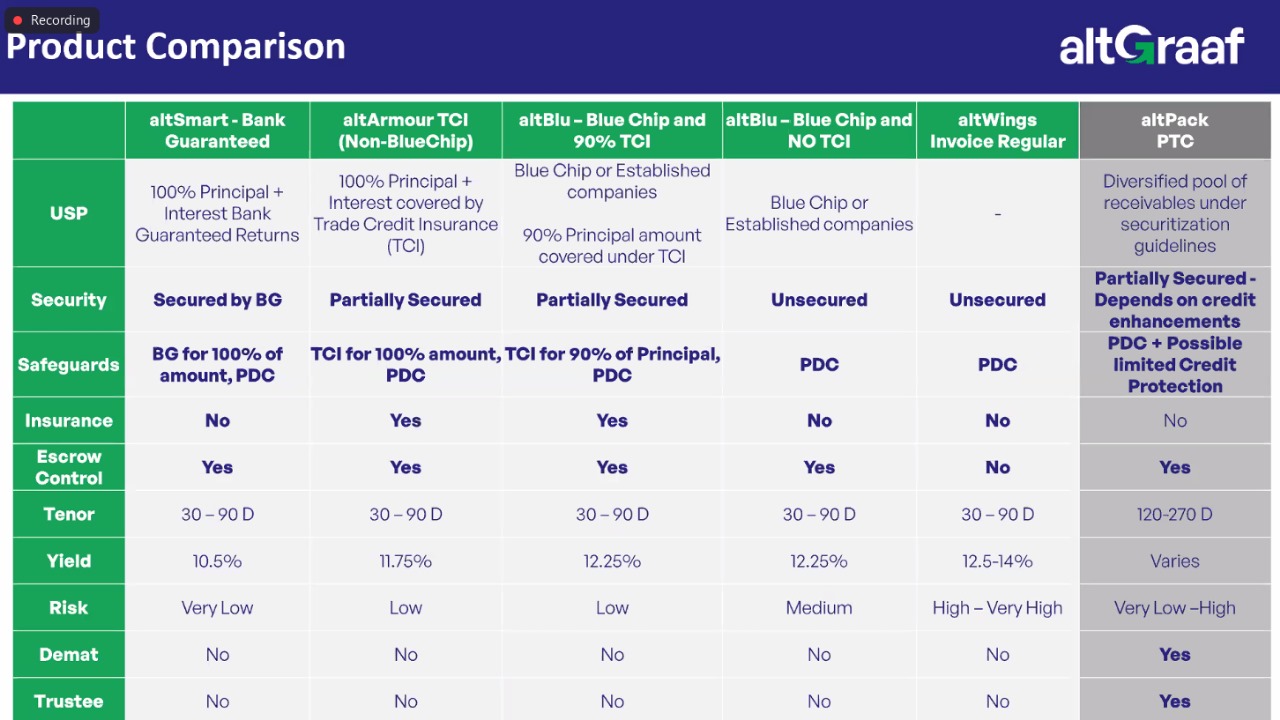

Altgraaf has recently segregated its invoice discounting products based on risk factors which makes it easy for investors to choose the one that fits their risk appetite. The various categories of products in the invoice discounting are :

Please do note that very low risk does not mean zero risk.

Lending Investment

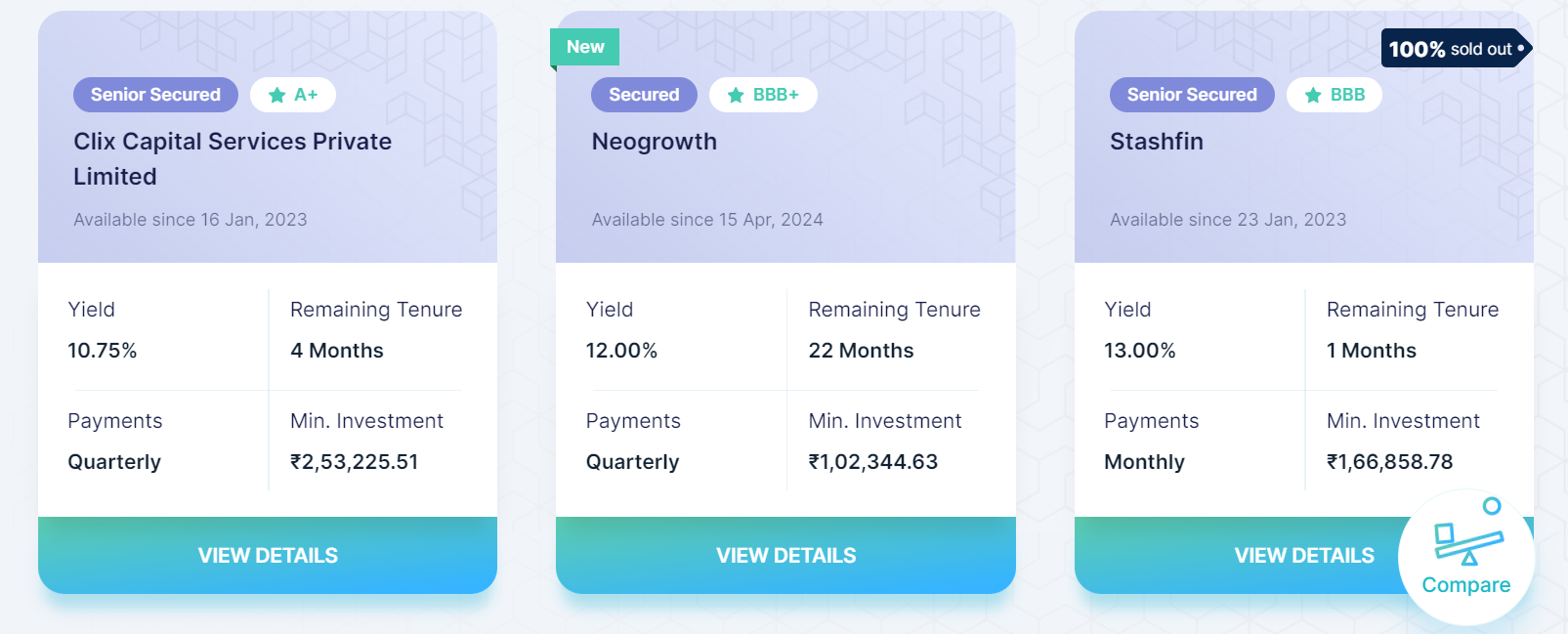

Some of the investments for this month include High Yield Bonds and Real Estate NCD

- Stashfin -13% Altifi

- Slice – 11.25% Altgraaf

- Sri Parvata and Best Realty – 17.25% Altgraaf

- YNOT Netflix -16.5% Betterinvest

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks | 20%+ | 0.15% | 1.00% |

| WintWealth | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Pyse | 10-11%(Post-Tax) | 0.00% | 0.00% |

| Growpital | SEBI Pause | SEBI Pause | N.A. |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.00% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz | 13.00% | 0% | 0% |

| Faircent | 11% | 0% | 0% |

| KredX | 12% | 0% | 0.75% |

| 13 Karat (new) | 13% | 0% | 0% |

The RBI order on p2p lending platform to stop liquid funds model has made all platforms stop the instant liquidity model

- Currently Invested in 2 deals on Tapinvest – Boat and Attic

- Invested in KFC on Lenderpartnerz

- Invested in Amazon on Tradecred

- Invested in Infosys on Kredx

- Lendbox per annum performance has been as per expectation. I avoid high-yield investments on it.

Crypto Investing

Bitcoin halving is a once-every-four-year software update on the Bitcoin blockchain. The much-anticipated event slashes the reward for mining a new Bitcoin in half.

The first Bitcoin halving happened on November 28, 2012, the second on July 9, 2016, and the third on May 11, 2020. The latest installment of the event happened a couple of weeks back on April 19, 2024. Miners now get 3.125 BTC for mining 1 BTC.

Historically, halvings have been preceded by an increase in BTC’s price in the short term and succeeded by fluctuations and then a gradual price increase as reduced supply meets sustained or growing demand

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

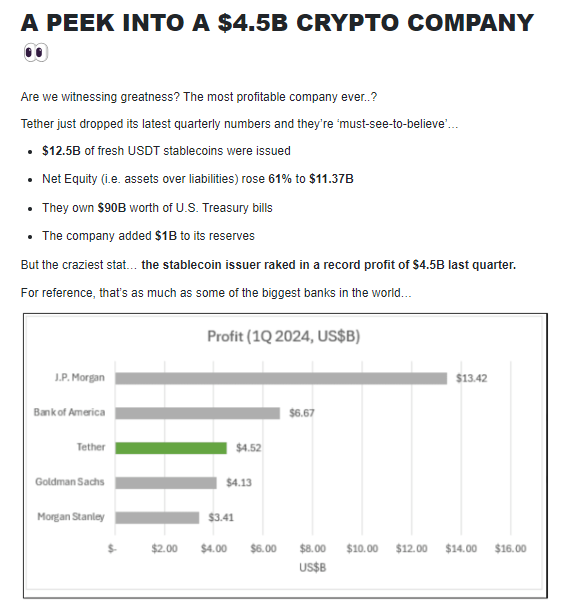

In other news – Tether, the stablecoin company has made 4.5 Billion USD in profit over the quarter and is approximately making 45 million USD per employee compared to 100k USD per employee profit for Goldman Sachs !!

P2P Investment

Current allocation:

- India P2P – 50%

- I2IFunding- 20%

- Finzy-10%

- Faircent Pool Loan -15%

- 13 Karat – 5%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans, education loans, Group loans | 13.7% | 4.5% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 16% | 1.8% |

| FINZY(Paused) | Prime Borrowers, High Salary, A category | 13% | 4% |

| 12 Club (paused) | Only Minimum amount | 12% | 0% |

- My Indiap2p performance has been fine. Some people faced issues in March due to delayed collection

- Planning to do a detailed review on I2Ifunding (Referral code discount50@i2i) as I have been using this since 2017 and can share my personal experience.

Equity Market

PreIPO Stocks

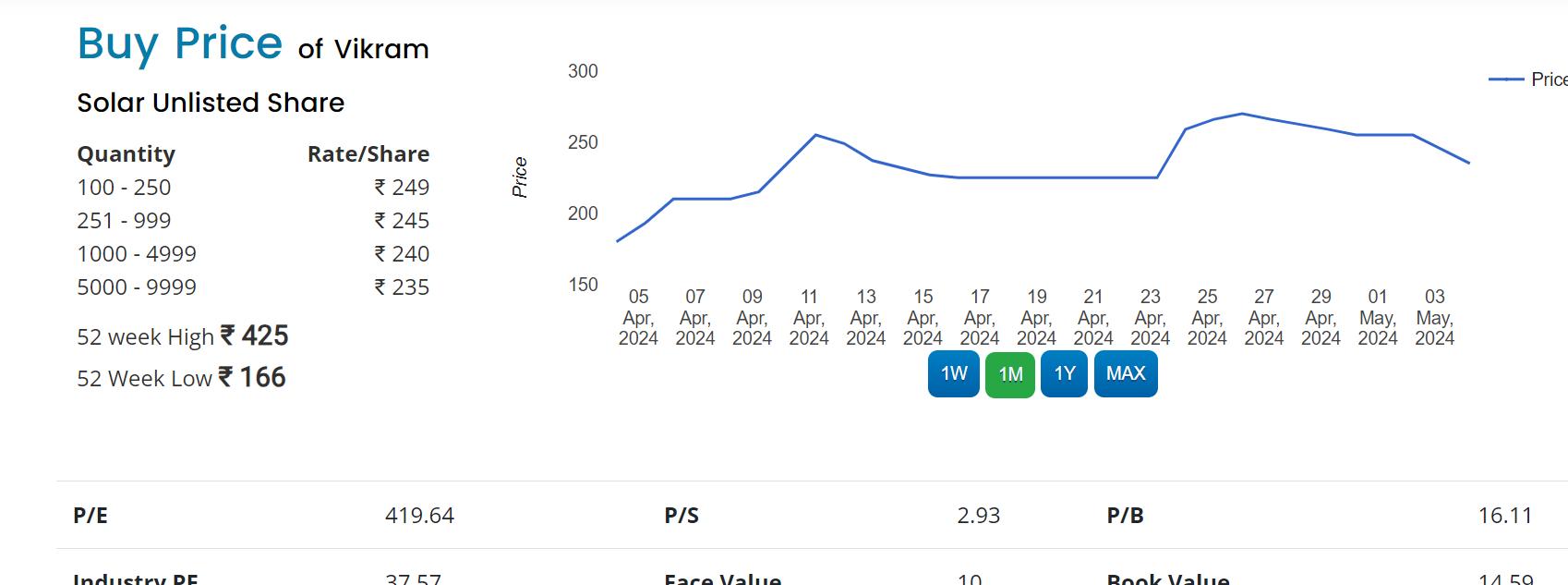

We had recently highlighted that Vikram Solar has been in demand in the grey market. The price of Vikram Solar has jumped from 180-190 to 250 in a matter of 1 month. This is also due to its comparison to Waree Energy, the largest solar company in India that had stock price appreciation in the unlisted market.

Listed Stocks

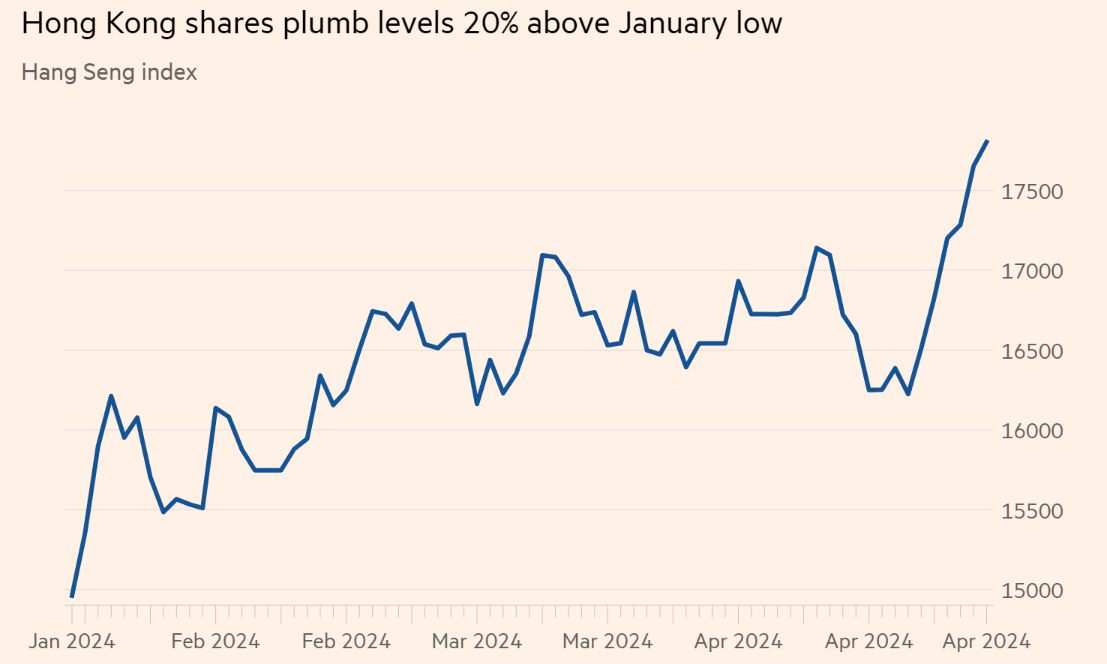

My investment in Hangseng seems to have started giving a decent payoff though it’s too early to predict and I am prepared to add more capital if the market falls from current levels.

After a weak start to the year, the Hang Seng index entered a technical bull market, touching a level 20 percent above its January low, with an influx from international funds

Indian market seems to be more volatile due to global factors and upcoming election results in May end.

Algo Trading

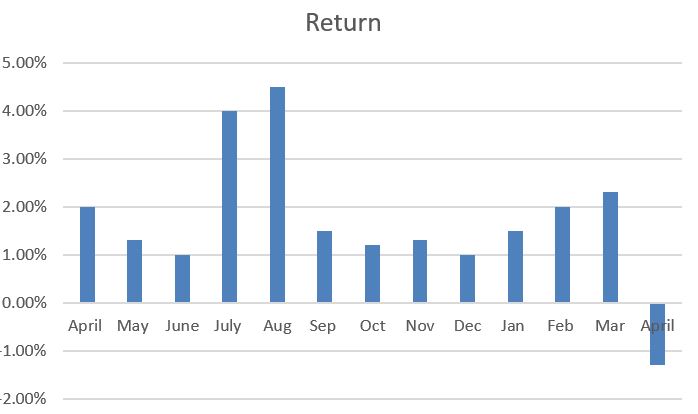

April did not prove to be a great month as I couldn’t make any money in the market. The options market has become riskier due to sudden sharp intraday moves. Many people are attributing this to the recent news of Jane Street manipulating the Indian option market to profit from it. Nevertheless, profit and loss are part of this game.

Investors who are just starting algo trading can explore tradetron as it requires a minimum learning curve and marketplace to copy traders.

Investors with INR 30+ Lakh deployable capital can reach out to inquire on more sophisticated algos

Other Alternative Investment Assets and Platform Updates

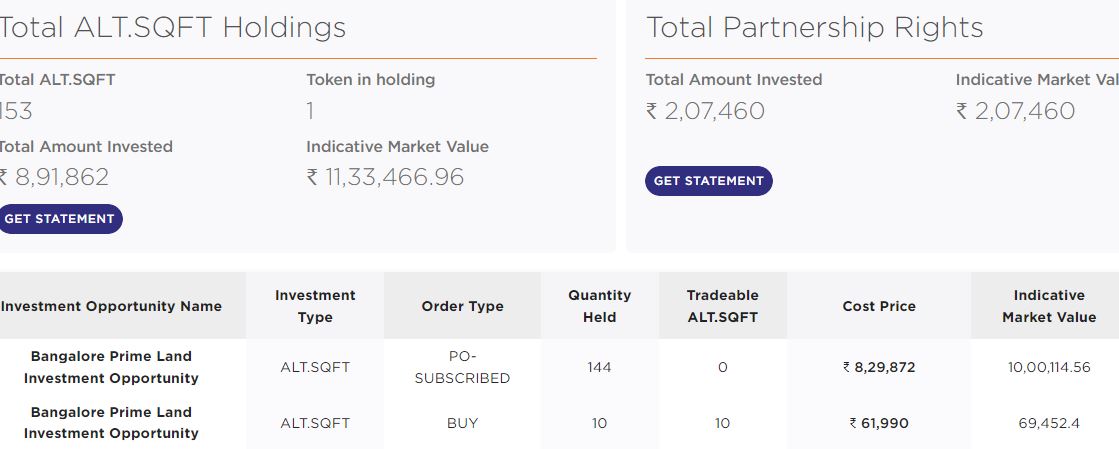

ALTDRX – I was able to liquidate a part of my existing investment on Altdrx with 10%+ profit over the last 3 months. I am waiting for the valuation report on the Hyderabad property. Will be investing in this property also with a time horizon of 1-2 years as Hyderabad seems to be a more attractive market.

Earnnest.me- The platforms seem promising and there has been a good demand for Pune property. Investors can use the below code while investing to get 0.5% extra on their investments.

Flagged Alternative Investment Platforms

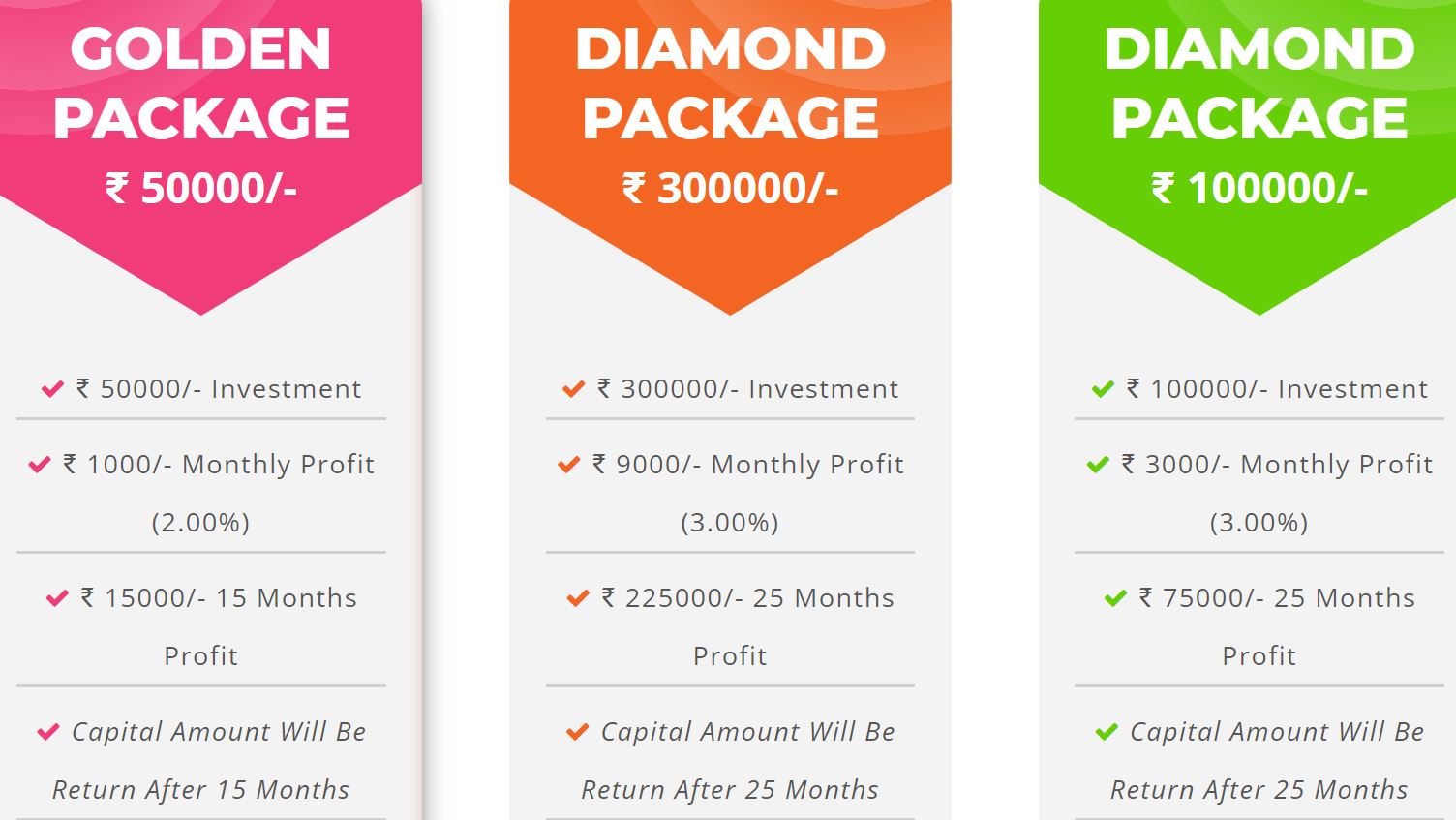

Have added “citydhancapital.com” to the list of “Flagged” platforms. The platform boasts of providing assured 2% returns.

The team has stock images from the internet. There are no business model details provided. It is best to avoid such platforms.

If there are other platforms that you feel might be too risky to invest in, please do comment and we will explore and add them to the list