Algo trading is no longer a “pro traders only” game in India.

In 2026, retail participation in options, systematic strategies, and rule-based trading has surged—mainly because platforms like Tradetron and Streak have made automation simple, affordable, and (mostly) code-free.

But if you’re deciding between the two, you’re probably asking the real question:

Should I use Tradetron or Streak for algo trading in 2026?

Both platforms help you automate strategies without coding, both are used by thousands of Indian traders, and both claim to simplify trading. Yet, the experience, strengths, and ideal use-cases are very different.

In this comparison guide, I’ll break down Tradetron vs Streak across all important factors—features, broker integration, options strategy capability, ease of use, backtesting, pricing style, marketplace, and who should choose what. Read our complete review of Tradetron

Let’s dive in.

Quick Verdict: Tradetron vs Streak (Which is better in 2026?)

If you want the short answer:

✅ Choose Tradetron if:

- you want multi-leg options automation

- you like exploring a marketplace of strategies

- you want more flexibility in execution logic and adjustments

✅ Choose Streak if:

- you use Zerodha

- you want clean, beginner-friendly strategy building

- your focus is simple rule-based strategies + fast deployment

My recommendation (2026)

- Beginners on Zerodha: Start with Streak

- Options sellers / multi-leg traders: Prefer Tradetron

- Advanced traders: Neither is perfect — consider Python + broker API

Tradetron vs Streak Comparison (2026)

| Feature | Tradetron | Streak |

|---|---|---|

| Best For | Options automation + multi-leg strategies + marketplace | Beginners + Zerodha traders + simple rule-based strategies |

| Ease of Use | Moderate learning curve | Very beginner-friendly ✅ |

| Marketplace Strategies | Yes ✅ (big differentiator) | No (mostly DIY) |

| Options Multi-leg Support | Strong ✅ | Decent (better for simpler setups) |

| Backtesting Experience | Useful but not as smooth | Very smooth + beginner-friendly ✅ |

| Broker Flexibility | Multiple brokers ✅ | Best for Zerodha ✅ |

| Deployment & Execution | Powerful but broker/API dependent | Simple and reliable (especially on Zerodha) |

| Pricing Style | Platform subscription + optional marketplace cost | Subscription/limits based on plan usage |

| Best Recommendation (2026) | Options sellers + systematic traders | Beginners + Zerodha-first traders ✅ |

What is Tradetron?

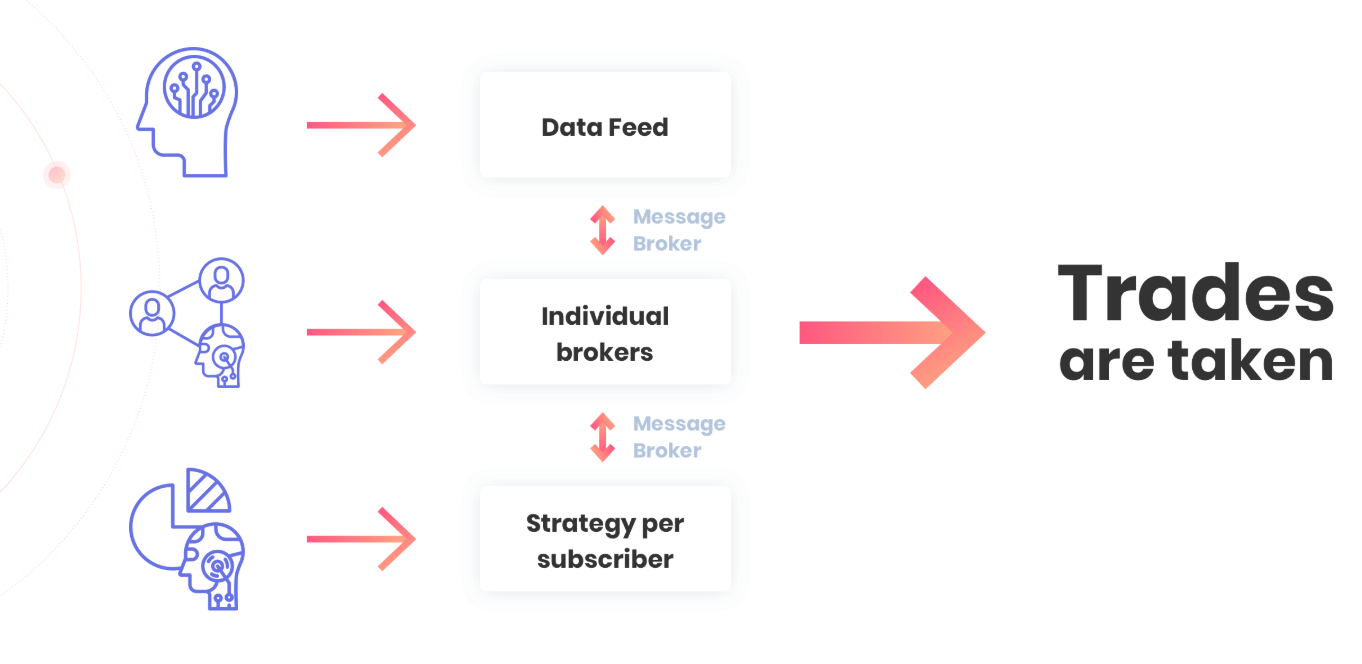

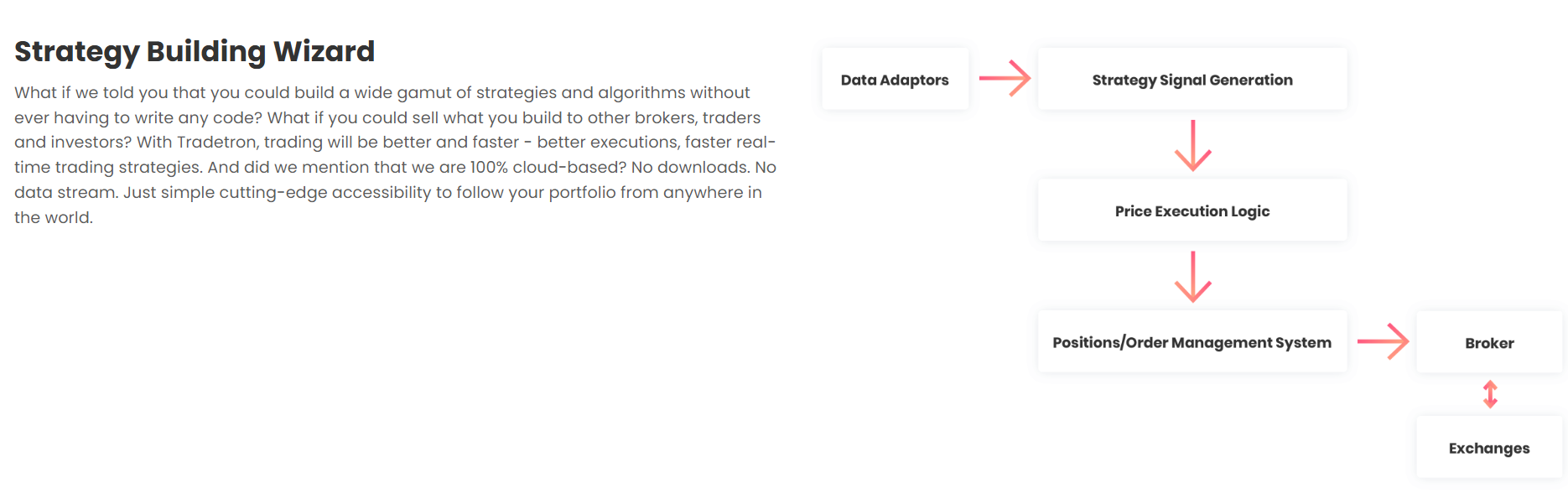

Tradetron is an algo trading platform that combines:

- a no-code strategy builder

- a strategy deployment system via broker APIs

- a well-known marketplace where traders sell/rent strategies

It’s popular especially in India’s options community because Tradetron supports:

- multi-leg options strategies

- conditional execution and adjustments

- “deploy and forget” automation (with risk limits)

It is best understood as:

an automation platform + algorithm marketplace

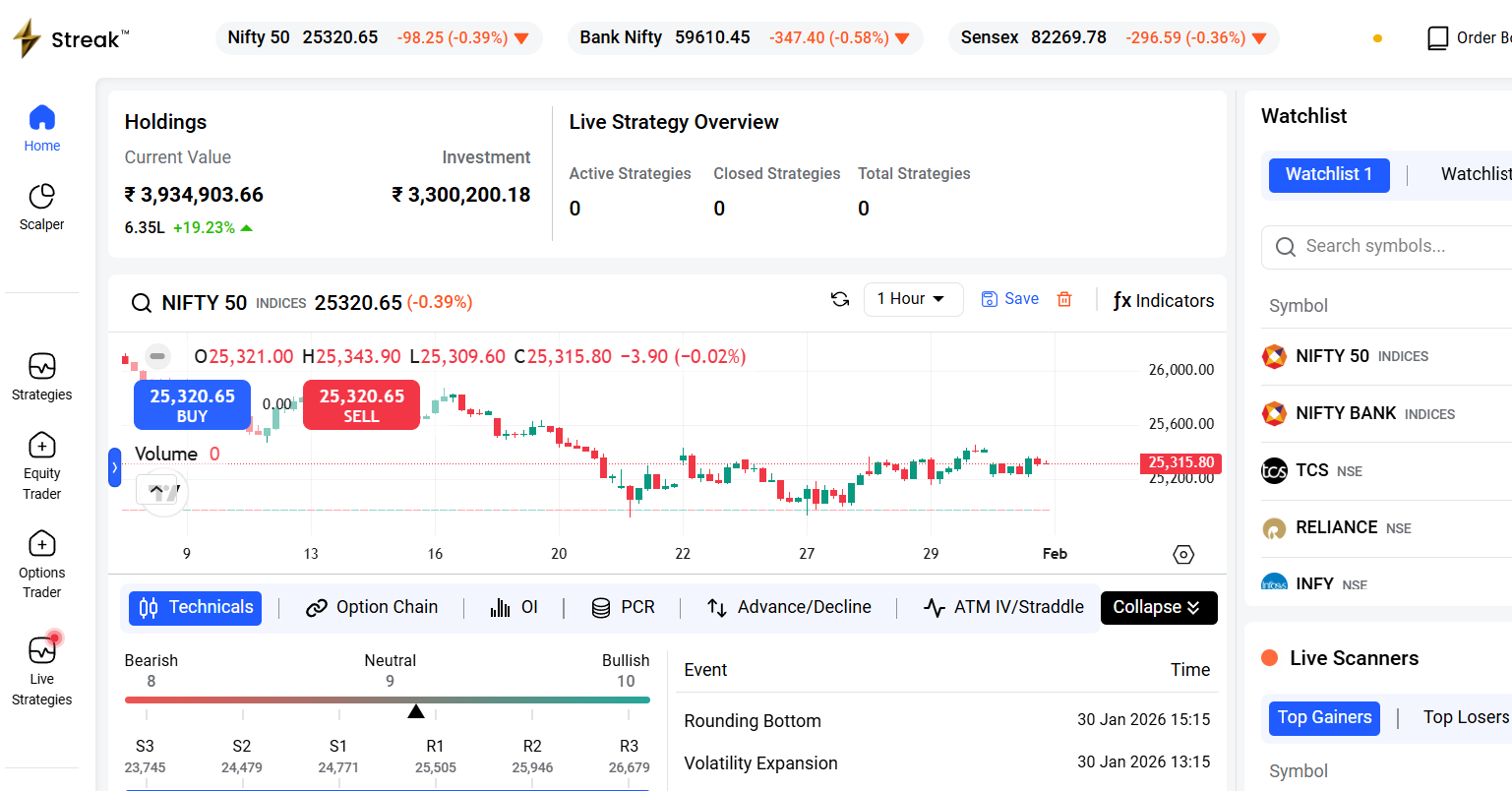

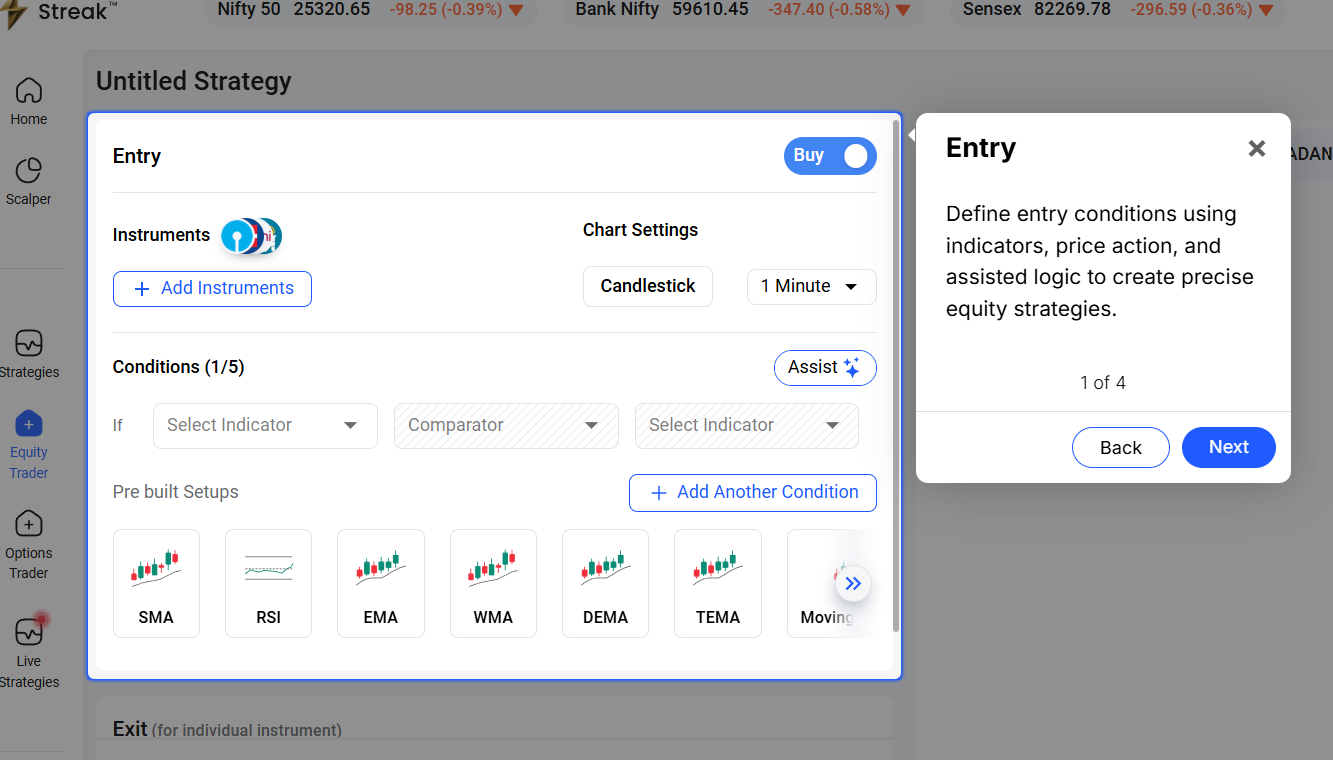

What is Streak?

Streak is a popular algo trading platform closely integrated with Zerodha (Kite). It allows traders to:

- build strategies via a visual interface

- backtest strategies easily

- deploy alerts and live strategies with a few clicks

Streak is known for being:

- easy to use

- clean UX

- perfect for people who want automation but not complexity

Streak feels more like:

a powerful “strategy builder + backtesting + deployment” tool for Zerodha traders

Tradetron vs Streak: Key Differences (2026)

Here’s the big-picture comparison:

✅ The simplest way to explain it

- Streak = “I want to build my own strategy and deploy on Zerodha”

- Tradetron = “I want automated options strategies + marketplace strategies”

1) Ease of Use & Learning Curve

Streak (winner for beginners ✅)

Streak is extremely beginner-friendly. Most traders can:

- create a strategy

- backtest

- deploy

…within the first 1–2 sessions.

It also uses a very clean interface—less intimidating, fewer moving parts.

Best for: beginners, intermediate traders, Zerodha users.

Tradetron (more flexible but complex)

Tradetron has more depth:

- more conditions

- more deployment options

- multi-leg execution

- marketplace subscription layer

This flexibility adds complexity, especially for:

- beginners

- people who don’t understand margins

- users expecting plug-and-play profitability

Best for: traders who are willing to spend time understanding it.

✅ Verdict: Streak wins ease of use

2) Broker Integration

Streak broker support

Streak is strongly built around Zerodha. That’s both a strength and limitation.

✅ Pros:

- smoother integration

- fewer deployment issues

- better reliability for Zerodha users

⚠️ Cons:

- if you don’t use Zerodha, Streak becomes less relevant

Tradetron broker support

It supports multiple brokers (this changes over time, but generally):

- Zerodha

- Angel One

- Dhan

- Upstox

- Alice Blue etc.

✅ Pros:

- flexibility—choose brokers based on margin and brokerage

- better reach beyond Zerodha

⚠️ Cons:

- execution depends on broker API stability

- issues can occur during volatility/expiry

✅ Verdict: Tradetron wins on broker flexibility

But Streak wins for Zerodha reliability.

3) Strategy Marketplace (Biggest Differentiator)

Tradetron (clear winner ✅)

The marketplace is what made it famous.

You can:

- browse strategies

- subscribe monthly

- deploy quickly

This appeals to traders who want:

- ready-made strategies

- automation without creating logic themselves

⚠️ But marketplace also creates risk:

Many subscribers don’t understand:

- strategy drawdowns

- deployment settings

- slippage reality

- performance decay over time

Still, marketplace is a huge advantage for idea generation.

Streak (no real marketplace)

Streak doesn’t have a Tradetron-like marketplace where strategies are sold as products. It’s more of a:

- DIY strategy building platform

✅ Verdict: Tradetron wins by a mile for marketplace.

4) Options Trading Capability (Multi-Leg Strategies)

Tradetron (winner ✅)

It is built for options traders.

It supports:

- multi-leg strategies

- hedge legs

- spreads

- adjustments

- conditional entries/exits

- time-based exits

- rolling style logic (limited but useful)

This matters because in India, most algo traders are options sellers.

Streak (limited for advanced options strategies)

Streak supports options strategies too, but Tradetron tends to handle:

- complex multi-leg logic

- adjustments

more naturally.

Streak is fantastic for:

- single-leg strategies

- simple conditions on options

✅ Verdict: Tradetron wins for serious options execution

5) Backtesting: Which is more reliable?

Streak backtesting (better UX ✅)

Streak’s backtesting is:

- easy

- visual

- fast

- beginner-friendly

It’s designed for traders who want quick insights.

Tradetron backtesting (usable but not perfect)

Tradetron’s backtests are useful but:

- can feel less smooth

- can confuse beginners

- may not reflect realistic execution conditions

The truth (important)

No platform backtest = real performance.

Your live results will differ due to:

- slippage

- delays

- market gaps

- API downtime

- spreads in options

✅ Verdict: Streak wins on backtesting simplicity

But both need real-life caution.

6) Deployment & Execution Quality

Streak deployment (more straightforward ✅)

Since it’s closely aligned with Zerodha ecosystem, Streak deployment feels:

- cleaner

- less error-prone

Tradetron deployment (more customizable)

Tradetron allows deeper deployment logic like:

- conditional order placement

- handling multi-leg execution

- trade frequency control

- custom exits

But the downside is:

- more variables can break

- broker API issues can show up

- mismatch complaints are common

✅ Verdict: Streak is easier, Tradetron is more powerful.

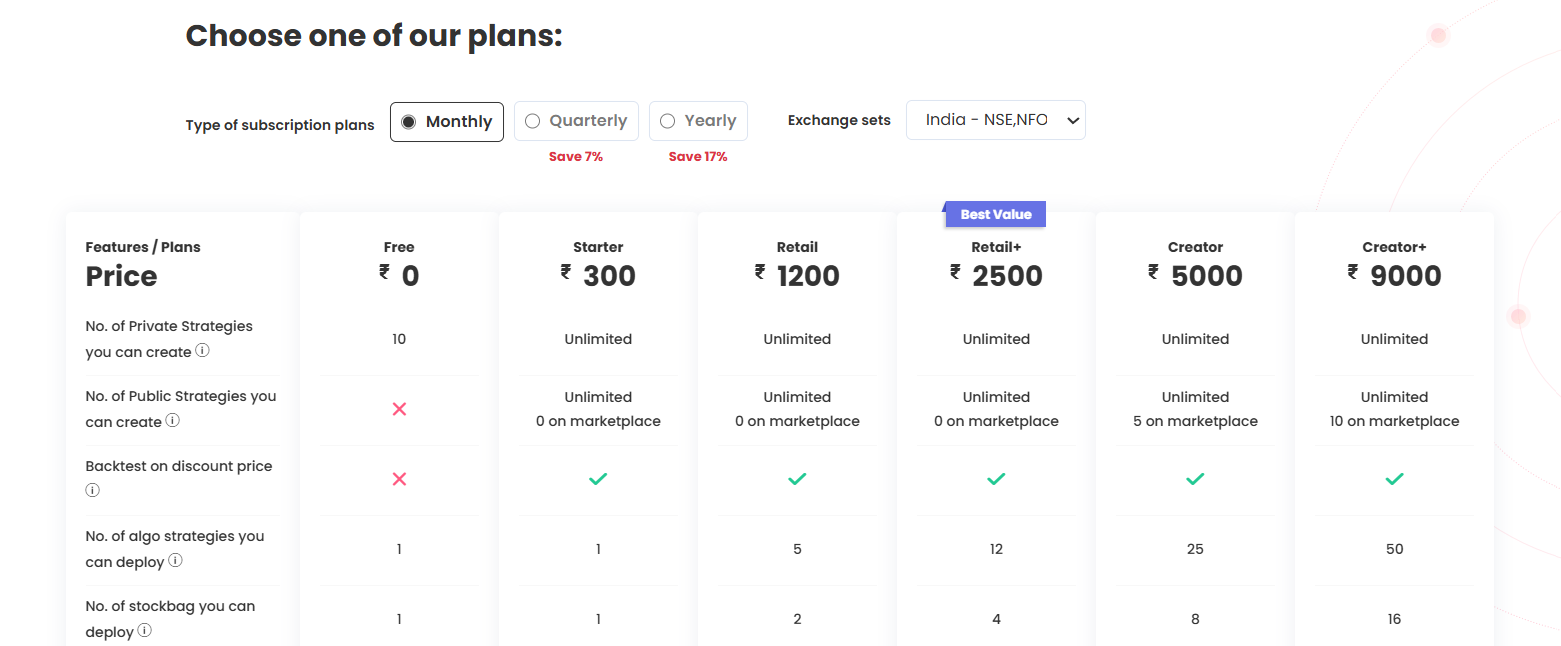

7) Pricing: Which is cheaper in 2026?

Streak pricing style

Streak pricing generally depends on:

- number of strategies deployed

- alert usage

- plan tier

Most people find Streak reasonably priced if they:

- trade 1–3 strategies

Tradetron pricing style

Tradetron has:

- platform subscription cost

- marketplace subscription cost (extra)

So if you subscribe to multiple strategies, Tradetron can become expensive.

✅ Verdict:

- DIY single-strategy users: Streak often cheaper

- Marketplace subscribers: Tradetron cost can rise quickly

8) Who should choose Tradetron?

Choose Tradetron if you are:

- an options trader (especially multi-leg)

- someone who wants systematic trading but not coding

- okay with experimenting and learning

- looking for marketplace strategies for ideas

- willing to manage drawdowns and execution reality

It is perfect for:

✅ iron condor / strangle style automation

✅ hedged positional systems

✅ multi-leg deployment

✅ strategy marketplace exploration

9) Who should choose Streak?

Choose Streak if you:

- trade mainly via Zerodha

- want a smooth beginner-friendly UI

- want quick backtests and strategy creation

- use simple strategies (EMA crossover, RSI, breakout)

- want minimal complexity

Streak is perfect for:

✅ beginner automation

✅ Zerodha traders

✅ fast strategy build-test-deploy

✅ simple rule systems

Common Mistakes (Avoid these in 2026)

Whether you choose Tradetron or Streak, avoid these mistakes:

❌ Mistake 1: Deploying big capital on Day 1

Run with small quantity. Track execution.

❌ Mistake 2: Trusting backtests blindly

Backtests don’t include real slippage and downtime.

❌ Mistake 3: Ignoring drawdowns

Even “good” strategies can see deep drawdowns.

❌ Mistake 4: Not using risk management

Always add:

- daily stoploss

- max trades per day

- time exits

Tradetron vs Streak: Pros and Cons (2026)

| Platform | Pros ✅ | Cons ❌ |

|---|---|---|

| Tradetron |

|

|

| Streak |

|

|

My final recommendation (2026)

Here’s the smartest approach:

✅ If you are a beginner

Start with Streak + 1 strategy.

Keep your setup simple.

✅ If you’re an options trader

Go for Tradetron.

Especially if you need multi-leg and adjustments.

✅ If you want to build a serious edge

Eventually you’ll outgrow both platforms and move to:

- Python

- server execution

- proper risk control

- better backtesting and data

Conclusion: Tradetron vs Streak (2026)

Both Tradetron and Streak are excellent for Indian retail traders—but they solve different problems.

- Streak is the best “clean” beginner-friendly platform—especially for Zerodha users.

- Tradetron is the better choice if you’re serious about options automation and want marketplace strategies.

If your goal is sustainable trading in 2026, don’t focus only on platform choice. Focus on:

✅ strategy robustness

✅ drawdown tolerance

✅ risk limits

✅ live execution quality

Because the platform can automate your system—but it cannot create an edge for you.

FAQs: Tradetron vs Streak

Which is better: Tradetron or Streak?

Tradetron is generally better for options trading and multi-leg automation, while Streak is better for beginners and Zerodha traders who want a clean strategy build + backtest + deploy experience.

Is Tradetron marketplace safe to use?

Marketplace strategies can be useful, but they are not guaranteed. You should understand the strategy logic, expected drawdowns, and start with small capital because live execution may differ from backtests.

Is Streak only for Zerodha?

Streak is primarily designed for Zerodha users and works best inside the Zerodha ecosystem. If you don’t trade with Zerodha, Tradetron may offer better broker flexibility.

Which is better for options selling?

Tradetron is usually better for options selling because it supports multi-leg strategies, hedging, and more structured automation for spreads and adjustment-based strategies.

Can I do algo trading without coding in both?

Yes. Both Tradetron and Streak allow algo trading without coding using a visual strategy builder.

Do Tradetron or Streak guarantee profits?

No. Both are tools that automate trading rules. Profits depend on your strategy quality, risk management, and market conditions.