Looking for an honest TokenMetrics review in 2025?

With so many AI-powered crypto tools out there, it’s natural to wonder if TokenMetrics really helps you find the next 10x altcoin.

In this deep dive, we’ll cover what TokenMetrics is, pricing, features, performance history, pros/cons, and alternatives—so you can decide if it’s worth your money.

Quick Verdict: TokenMetrics is one of the most established AI-driven crypto research platforms, combining data, backtests, and predictive models. If you’re a serious crypto investor looking for an edge, the subscription cost can pay off—especially if you leverage its portfolio builder and AI ratings.

What is TokenMetrics?

TokenMetrics is a crypto research and AI analytics platform launched in 2018 by Ian Balina, a well-known blockchain investor.

Its goal is simple:

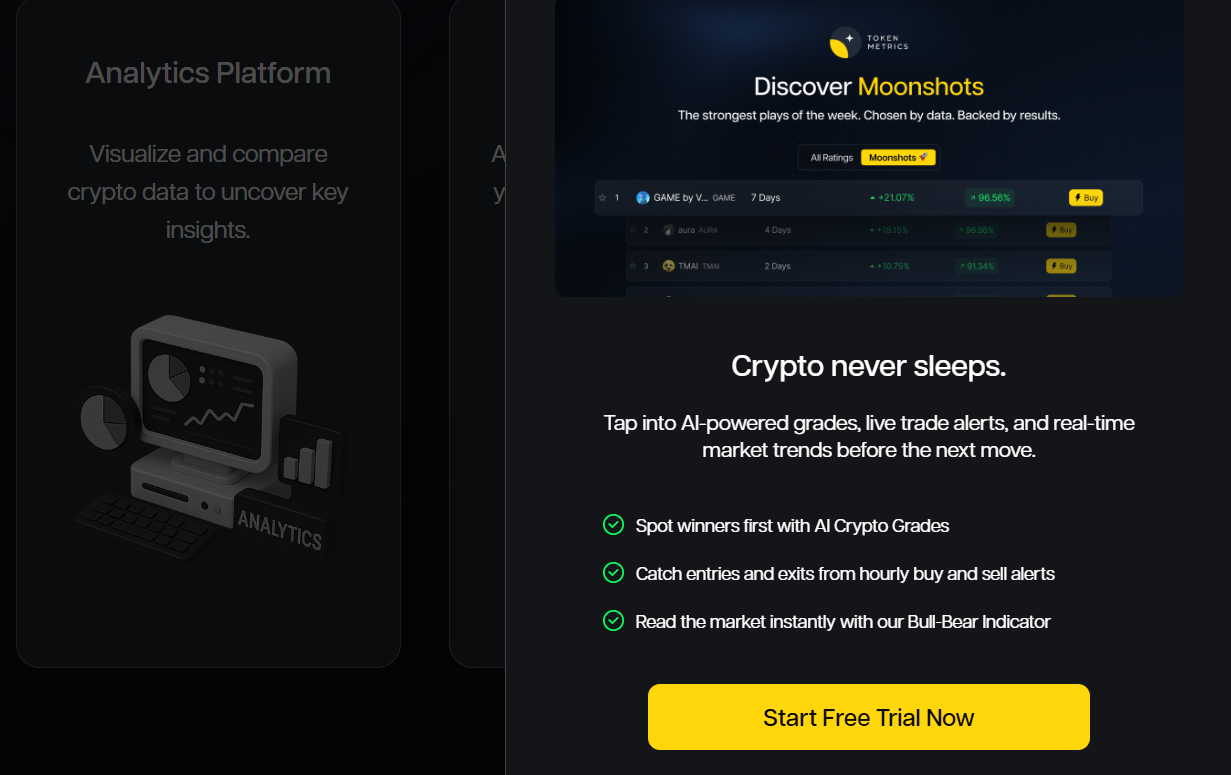

Use AI, machine learning, and data science to help retail investors identify undervalued cryptocurrencies before the crowd.

Core features include:

-

AI Ratings → Score every token (0–100) for investment potential.

-

Portfolio Builder → Automated portfolios based on risk & goals.

-

Indices → Curated “model portfolios” that mimic hedge-fund style investing.

-

Market Timing Indicators → Helps determine entry/exit signals.

-

Education → Access to crypto reports, podcasts, and strategy guides.

TokenMetrics Pricing (2025)

TokenMetrics offers three tiers:

-

Starter Plan (~$19/month)

-

Basic AI ratings

-

Limited portfolio tracking

-

Good for beginners

-

-

Advanced Plan (~$99/month)

-

Full access to indices & ratings

-

DeFi & NFT analytics

-

Stronger portfolio management features

-

-

Professional Plan (~$249/month)

-

All features unlocked

-

Advanced signals & deep data

-

Designed for full-time traders or funds

-

Note: Prices can change—check TokenMetrics official site for current deals. They occasionally run 20–30% discounts for annual plans.

⚡ Key Features of TokenMetrics

1. AI Ratings (Core Value)

Every crypto asset gets an AI score (0–100) based on fundamentals, technology, team, and market data.

-

Example: A coin with a score of 85+ is considered high conviction.

-

Scores are updated regularly as data shifts.

2. Portfolio Builder

Tell TokenMetrics your risk level, time horizon, and goals → it builds a diversified crypto portfolio for you.

-

Conservative → BTC, ETH heavy.

-

Aggressive → Altcoin & DeFi exposure.

[Image Placeholder: Portfolio allocation pie chart]

3. Indices (Model Portfolios)

TokenMetrics runs hedge-fund style portfolios based on strategies:

-

DeFi Index

-

NFT Index

-

Long-term Investor Index

-

Trader’s Index

These indices are backtested and published monthly.

4. Performance History

TokenMetrics claims that its AI models have consistently identified top performers ahead of major runs.

-

Example: Flagged ETH & SOL early.

-

Indices historically outperformed BTC and ETH alone.

5. Education & Research Reports

Subscribers get deep research content, newsletters, and AI-driven podcasts.

✅ Pros & ❌ Cons of TokenMetrics

Pros

-

✔️ AI-driven scores simplify crypto analysis.

-

✔️ Portfolio builder removes guesswork.

-

✔️ Indices provide hedge-fund style exposure.

-

✔️ Covers hundreds of tokens across DeFi, NFTs, and Layer-1s.

-

✔️ Established brand (founded 2018, trusted by 250,000+ investors).

Cons

-

❌ Expensive compared to free tools like CoinGecko.

-

❌ Best suited for active investors (casual HODLers may not need it).

-

❌ Market risk still applies—AI can’t predict black swan events.

TokenMetrics vs Alternatives

How does it stack up against rivals?

-

Messari → Better raw data, weaker AI predictions.

-

Santiment → Strong community/social data, less portfolio focus.

-

CryptoQuant → Great for on-chain data, no AI ratings.

If you want predictive AI + portfolio guidance, TokenMetrics leads.

Who Should Use TokenMetrics?

-

Beginners who want structured portfolios → Starter/Advanced plan.

-

Active traders who chase altcoin runs → Advanced plan.

-

Serious investors/funds → Professional plan with advanced analytics.

If you’re simply buying BTC/ETH and holding long-term, you might not need it.

❓ TokenMetrics FAQs

Q: Can TokenMetrics guarantee profits?

No—AI can improve odds, but crypto remains risky.

Q: Does it cover NFTs and DeFi?

Yes—indices include NFT & DeFi sectors.

Q: Is there a free trial?

No free trial currently, but they offer a money-back guarantee on annual plans (check terms).

Q: How many tokens are covered?

Hundreds of major and emerging assets.

Final Verdict: Is TokenMetrics Worth It in 2025?

If you’re serious about crypto investing and want an AI-backed edge, TokenMetrics is absolutely worth considering.

-

Starter → Best for beginners ($19/mo).

-

Advanced → Best value for most investors ($99/mo).

-

Professional → Built for hedge-fund style traders ($249/mo).

Bottom Line: If you act on its AI signals and structured indices, the subscription can pay for itself with a single well-timed trade.

Next Step

Ready to try TokenMetrics?

Check TokenMetrics pricing & plans here