People who have been investing in P2P for a while would agree how difficult it becomes beyond a point to find new borrowers.The only way to tackle is to find more platforms and spread your capital across them.In this process I have recently started investing in OMLP2P . It is too early to comment how my NPA will fare in the long run but I would like to describe my experience in terms of quality of Loans, Fees and where it fits among the other Platforms.

Background:

OML P2P was setup in 2016 and is registered as NBFC-P2P company. The promoters and board of directors have a decent pedigree in the Lending business. Details of the promoters is available

https://www.omlp2p.com/board-of-directors

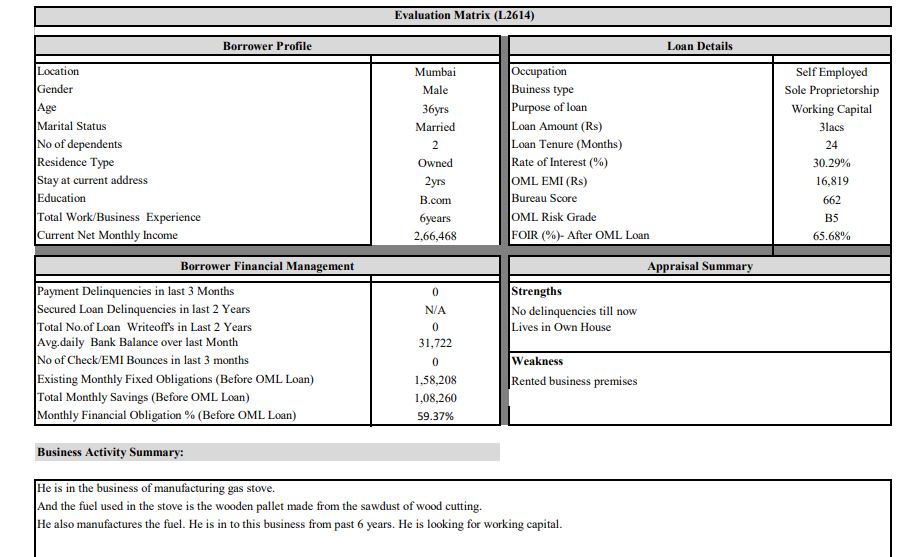

Types of Loans: OML caters to both salaried and business loans and on a given time you can expect to have 6-8 loans to choose from .They publish an appraisal sheet of each borrower in which the key parameters

- Cibil score

- Salary

- Average Daily Balance

- Write off

- Bounces

- Details of Loans.

Minumum Ticket size is 5000 as of now.

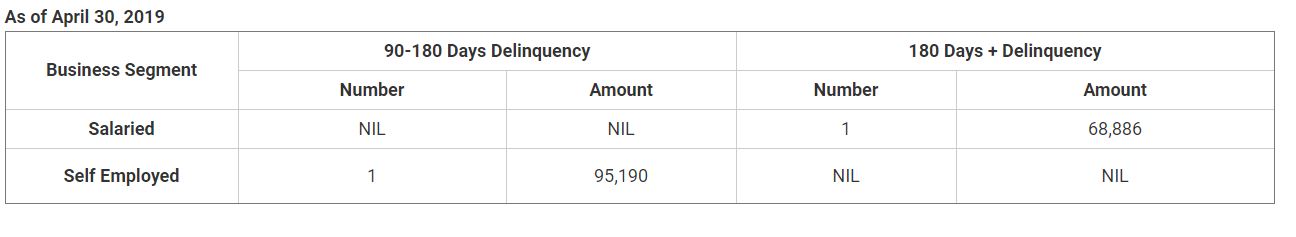

Average ROI : The ROI range is quite high in OML.Ranging from 15-30% . If I compare it with I2I and RupeeCircle the borrowers spread on OML is a combination of the two.

In I2I we have either Business loans or Government employees as occupation for 90% borrowers

RupeeCircle generally has people with salary less than 25000 or business loans.

In OMLP2P I see either business loans or salaried people which salary mostly >25000.

Therefore ROI in OML for most salaried loans < RupeeCircle (approx 2-3%) because of more stable jobs

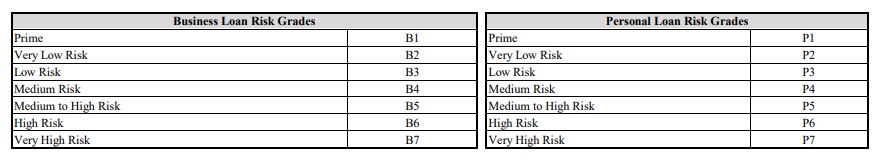

The ROI is generally higher than I2I . For a P3 category loan you can expect around 24-25% Interest which is generally unavailable in I2I but again it’s not an apple to apple comparison as I2I you have access to lower risk people at 20%. To sum up the various range available in the platforms are:

- Not considered ultrashort loans (<4 months)

Some of the loans will fall out these range but they are a minority.

As you can see I dont go for the riskiest in each platform mostly but target 80 percentile in terms of risk as I find it to be the sweet spot. Offcourse some one with a smaller portfolio should start with lower risk and gradually move on to higher once you have built up capital.

Fees: In terms of fees its exactly like I2I where they charge 1% upfront Fees which makes it a better platform for 18 Months plus loans. I had compared upfront fees with EMI based fees earlier.

You can register free of cost at OMLP2P.

http://randomdimes.com/2019/p2p-lending-platfrom-fees-comparison/

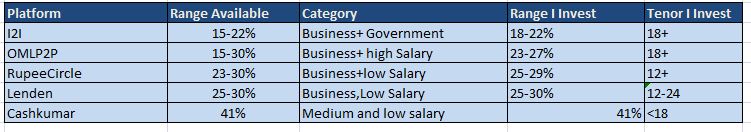

NPA : I have details of the historical performance of the platform.The numbers look promising but I can comment on my performance only after 5-6 Months .

The platform has disbursed more than 3 Cr of Loans and at 1.5 Lakh delinquency the NPA is staggeringly low . This number will definitely go up but at the current NPA it seems like a steal.I think one reason for this trend is that once platform grows the pressure to find new loans is immense and delinquency increases which is not the case with new platforms.

Conclusion: Based on the various parameters I find it to be a good platform for people who are already investing in I2I and rupee circle and want to add another platform as off late finding loans has become tough due to increasing number of Investors in various platforms.

Some of the things which can be improved are:

- Reducing ticket size to 2000

- Adding names of the borrower which help to track them via social media account.

- Having an app which will make investment process easier

I will be covering monthly performance of this Platform along with others.

PS:Lender Referral Link for OMLP2P:

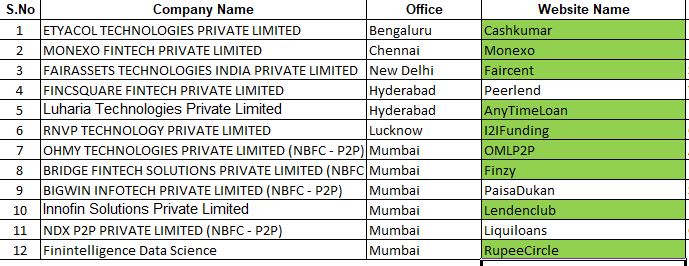

List of P2P companies in India which have received the NBFC-P2P registration from RBI .Good starting point for people who want to explore new P2P platforms. I have marked in green the ones which I have tried at some point in time