Global & Indian Economy, Asset-Class Performance, What Worked, What Didn’t — and the Way Forward

2025 was not a year of easy beta. It was a year of dispersion, structure, and discipline.

At Random Dimes (RD), this year reinforced a belief we’ve repeated often: returns don’t come from being right on the macro story — they come from where and how risk is expressed. This wrap-up is deliberately long-form and data-oriented, because 2025 deserves nuance, not headlines.

1. The Global Economy in 2025: Stable, But Uneven

From a macro lens, 2025 will be remembered as a year when the global economy refused to break — but also refused to reward everyone equally.

-

No global recession

-

No inflation shock

-

No synchronized bull market

Instead, we saw regional and asset-class divergence driven by policy, valuation, and capital flows.

United States: The Soft Landing That Paid (Selectively)

The US economy delivered what many thought was improbable:

-

Inflation cooled without a growth collapse

-

Corporate balance sheets remained strong

-

Capex — especially AI-linked — stayed resilient

But markets rewarded selectivity, not passivity.

What worked

-

Earnings-driven sectors

-

Companies with pricing power

-

Productivity-linked narratives

What didn’t

-

Over-owned defensives

-

High-multiple growth without cash flows

US equities became RD’s single largest return contributor in 2025.

Brazil: The Textbook Rate-Cycle Trade

Brazil was a classic example of macro + valuation alignment:

-

Real rates peaked

-

Inflation moderated

-

Equity valuations were already compressed

Foreign capital returned quietly, and returns followed.

Brazil emerged as one of the best risk-adjusted equity markets globally, especially for globally diversified portfolios.

South Asia (ex-India): Under-Owned, Over-Delivering

Several South Asian markets benefited from:

-

Manufacturing relocation

-

Demographic tailwinds

-

Lower speculative crowding than in India

Returns were less volatile but surprisingly consistent, making them ideal complements to US exposure.

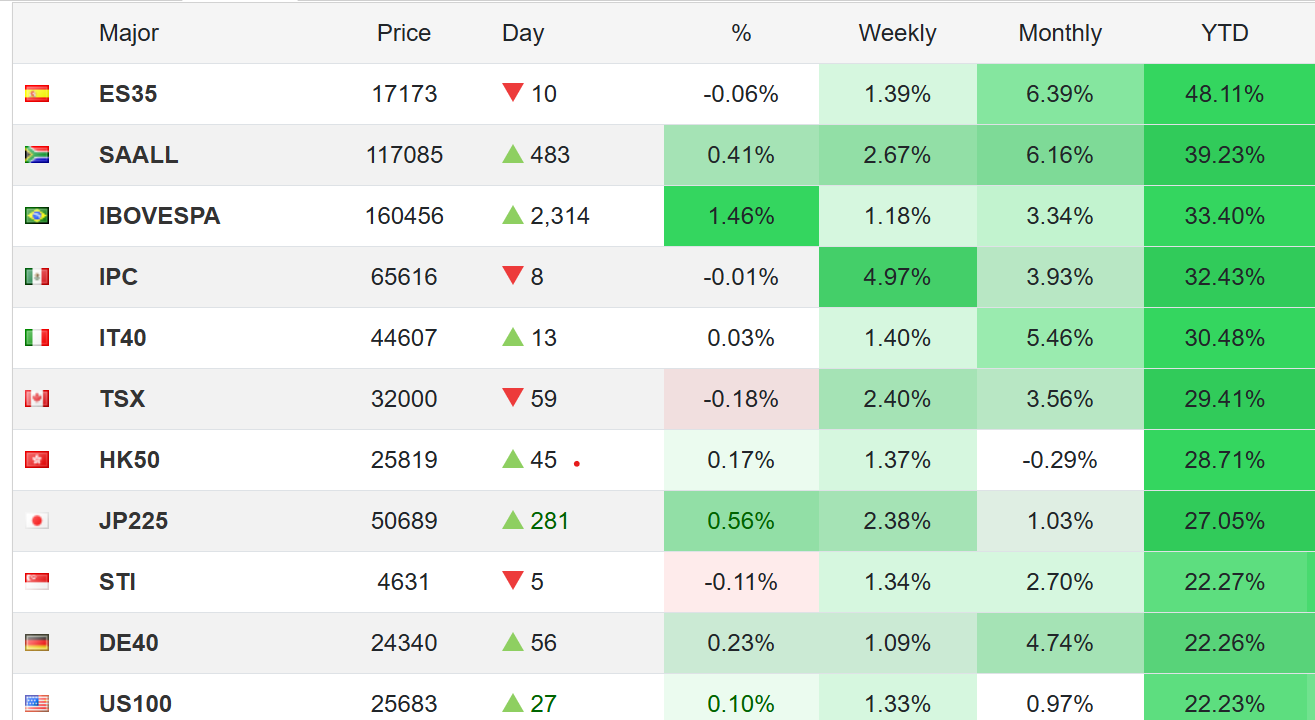

Global Macro Summary

| Region | Economic Outcome | Market Outcome |

|---|---|---|

| US | Stable growth | Strong (Selective) |

| Brazil | Improving cycle | Very strong |

| South Asia ex-India | Structural growth | Strong |

| Europe | Weak growth | Mixed |

| India | Strong GDP | Weak equity translation |

Key lesson:

Macro stability does not guarantee equity returns.

2. Indian Economy 2025: Strong Growth, Muted Markets

India’s economic story in 2025 was objectively impressive:

-

One of the fastest-growing large economies

-

Strong public capex

-

Healthy banking system

-

Robust credit growth

Yet equity investors were left underwhelmed.

Why the disconnect?

-

Valuations were already pricing perfection

-

Retail participation crowded popular themes

-

Earnings growth struggled to exceed expectations

- Rupee’s massive devaluation

Outcome

-

Index returns: low-to-mid single digits

-

Risk-adjusted returns: poor

-

Alpha opportunities: narrow and stock-specific

2025 reinforced a hard truth for Indian investors:

A great economy does not always make a great stock market.

3. Asset-Class Performance in 2025: A Comparative View

| Asset Class | 2025 Return | Risk Profile |

|---|---|---|

| US Equities | 22-30% | Medium |

| Brazil Equities | 35%+ | Medium |

| South Asia Equities | 20–30% | Medium |

| Indian Equities | 5–13% | Medium |

| Silver | 100%+ | Very High |

| Gold | 35–45% | Medium |

| Bonds | 6–7% | Low |

| Real Estate (Private) | 10–14% | Low |

| Policy / ID Deals | 11–13% IRR | Medium |

| IPO Listing Trades | 8–50% per trade | Medium |

| Trading | High IRR | High |

2025 was not about chasing the highest return — it was about maximizing return per unit of risk.

4. Alternatives

️ Insurance Assignment Investing via Policy Exchange

Through Policy Exchange, RD accessed a segment most investors ignore.

Why it worked

-

Returns backed by contractual insurance cash flows

-

Defined maturity

-

Minimal mark-to-market volatility

Comparison

-

Outperformed traditional bonds

-

Delivered equity-like IRRs with debt-like predictability

In 2025, this became a core stabilizer within RD portfolios.

Invoice Discounting Deals

We chose Invoice discounting over bonds because of high liquidity in the market, credit was easy, and default risk was low in the short term. Bonds’ yield had fallen a lot, and short-term Invoice discounting offered better risk-reward.

We preferred a lot of Trade Insurance-backed Invoice discounting to the high-yield ones.

Real Estate: Yield Replaced Fixed Income

Platforms like Altdrx and Per Annum filled a crucial gap.

| Metric | Real Estate Alts | Bonds |

|---|---|---|

| Yield | 10–14% | 6–7% |

| Cash Flow | Predictable | Fixed |

| Duration Risk | Low | High |

Real estate did not compete with equities — it replaced part of the bond portfolio.

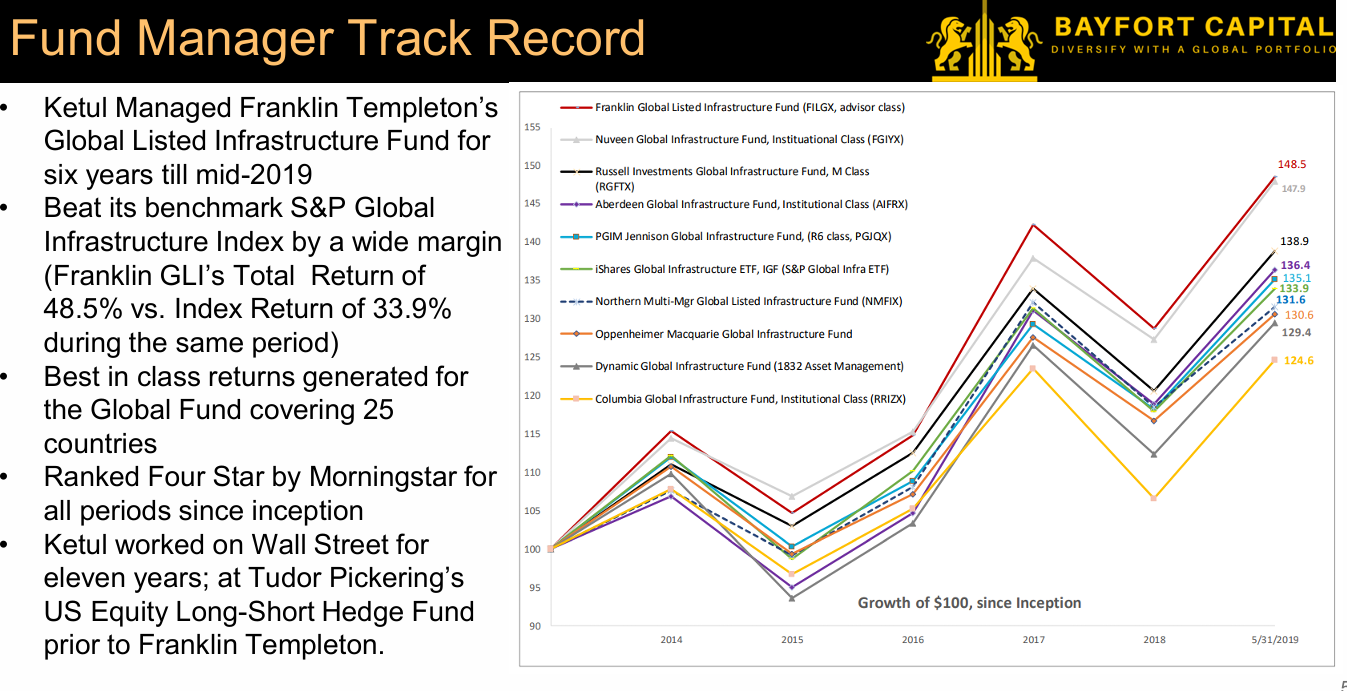

5. Global Allocation: RD’s Biggest Edge in 2025

One of RD’s strongest portfolio decisions was meaningful global exposure through MF, ETF, and PMS, like Bayfort

Illustrative Comparison

-

India-only portfolio → ~6%

-

Global + Alts diversified portfolio → 13–15%

Why global worked

-

Better valuation starting points

-

Broader sectoral opportunity

-

Lower behavioral excess

Geography was alpha.

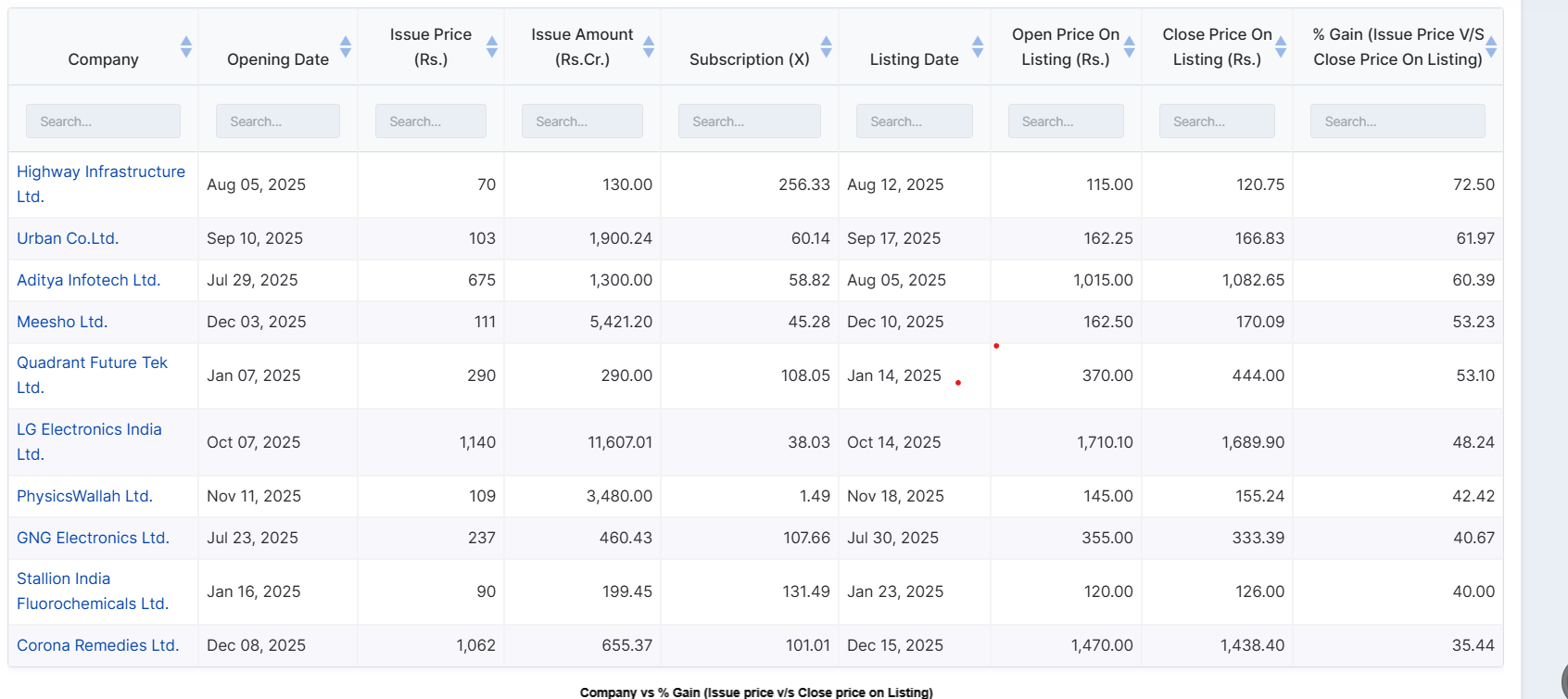

6. IPO Listing Gains: Event-Driven, Not Emotional

RD approached IPOs as short-duration trades, not long-term bets.

Process

-

Focus on QIB demand

-

Compare issue pricing vs listed peers

-

Exit during peak liquidity

Outcome

-

High single-digit to double-digit gains per IPO

-

Capital turned multiple times per year

-

Better IRR than passive equity exposure

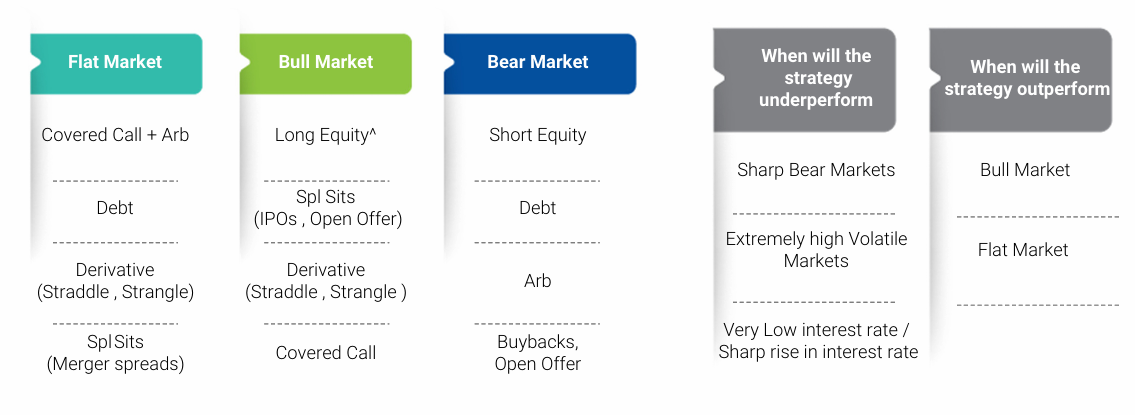

7. Options Strategies

2025 was a graveyard for directional conviction — and fertile ground for volatility-based strategies.

What worked

-

Volatility carry

-

Skew-aware strategies

-

Event-linked option structures

Why

-

Sideways markets

-

Intermittent volatility spikes

-

Poor trend persistence

Convexity mattered more than conviction.

8. Commodity Rally in 2025

The commodity market had an excellent year, with platinum and silver emerging as the best asset classes of 2025. Some of the reasons for this were :

-

Rate-cut expectations: Markets expect the Federal Reserve to start cutting rates, which boosts non-yielding assets like gold and silver.

-

Weaker US dollar: Lower rate expectations pressure the dollar, making precious metals more attractive globally.

-

Safe-haven demand: Rising geopolitical and macro uncertainty is driving investors toward gold and silver.

-

Silver’s industrial demand: Strong usage in solar, EVs, electronics, and AI infrastructure adds an extra tailwind for silver.

-

Momentum & supply tightness: Breakout to record highs has triggered momentum buying, especially in silver’s smaller, tighter market.

Despite the stellar performance, RD was not able to get significant alpha from this due to only a 10% allocation to commodities!

9. Misses of 2025: Opportunity Cost Was the Real Loss

There were asset classes and opportunities where we either made a loss or could not capitalize on the gains. Hence importance of diversification becomes even more paramount. Some of the misses for 2025 are below

❌ Crypto

-

High volatility, low persistence

-

Liquidity narratives faded

-

Poor risk-adjusted returns

❌ Low-Yield Bonds

-

Inadequate real returns

-

Duration risk uncompensated

-

Inferior to real estate & policy deals

❌ Indian Broad Equity Indices

-

Crowding

-

Valuation drag

-

Limited upside despite strong GDP

❌Limited Commodity Exposure

-

Got the asset right, but the allocation was small

-

Position sizing is more important than return!

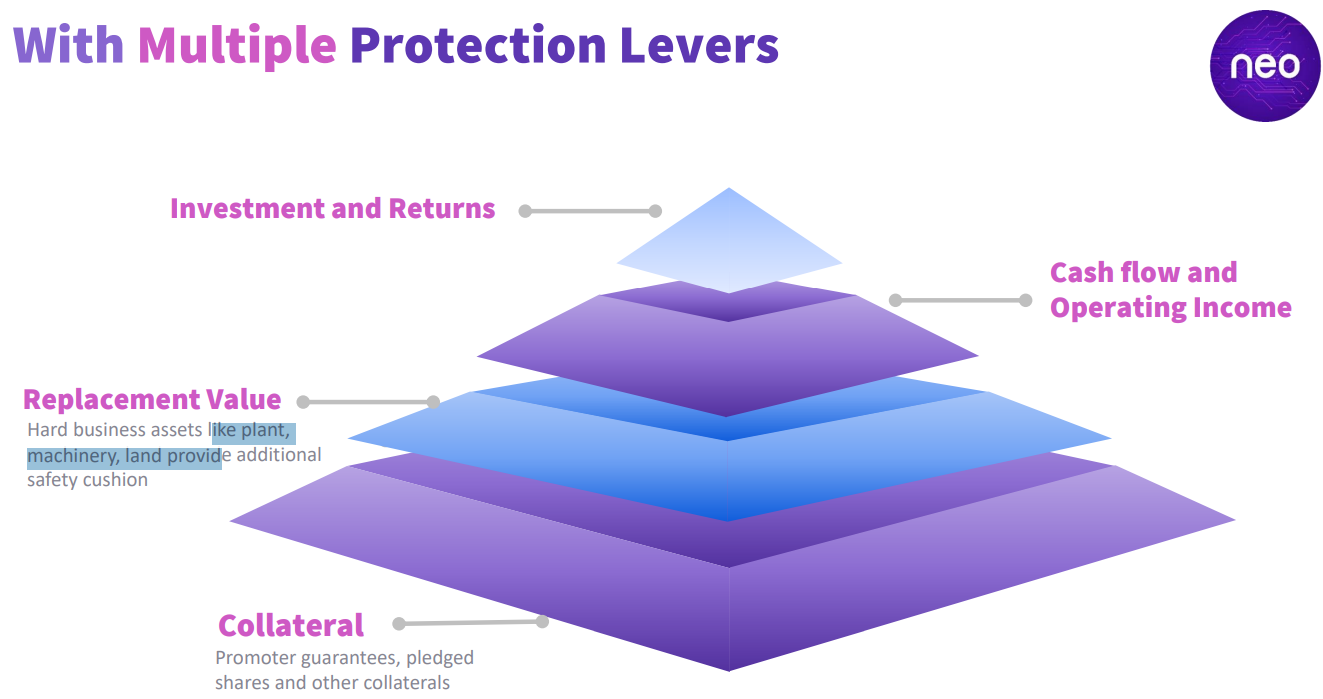

10. Way Forward: AIFs, SIFs & Smarter Allocation

AIFs (Alternative Investment Funds)

RD expects AIFs to shift from satellite to core allocation.

Focus areas:

-

Credit & special situations

-

Market-neutral strategies

-

Sequity & derivatives

Objective: Smooth equity curve + downside protection.

SIFs (Specialized Investment Funds)

SIFs bridge a real gap:

-

More flexible than mutual funds

-

More transparent than PMS

Best use cases:

-

Yield enhancement

-

Options-based income

-

Global or sectoral mandates

11. RD Portfolio Blueprint (2026+)

| Allocation | Role |

|---|---|

| Global Equities | Growth |

| Indian Equities/Commodity/Bonds | Selective |

| AIF / SIF | Alpha |

| Policy / ID Deals | Stability |

| Real Estate | Yield |

| Options | Additional Return on Collateral |

Final Reflection

If there was one defining lesson of 2025, it was this:

Good portfolios are built, not predicted.

At Random Dimes, we remain focused on:

-

Measurable edges

-

Defined payoffs

-

Global opportunity sets

Noise fades. Structure compounds.

A key takeaway for next year is that you should invest meaningful size in high conviction ideas with good risk reward, while keeping asset allocation and risk appetite in check!