Introduction to QuantInsti

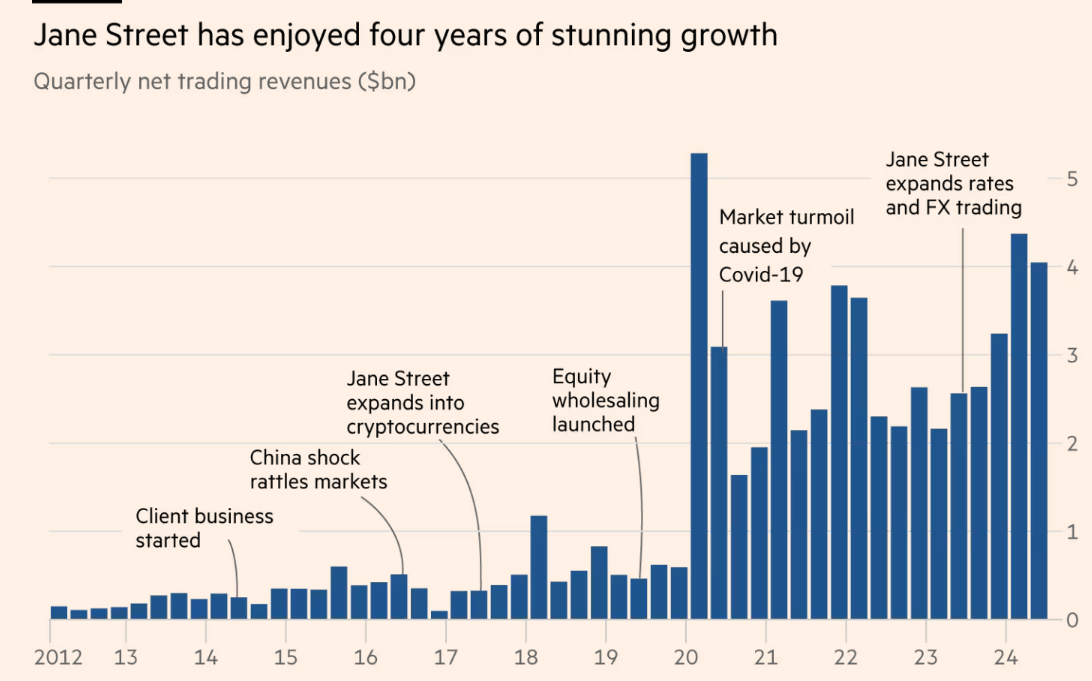

Recently crore-plus packages offered by Jane Street Capital were in the news. What are these companies and why are they paying so much?

Technology has been reshaping how traditional markets work and how investors and traders make money in the last few decades. From the dematerialization of securities to high-frequency algorithmic trading and quantitative trading, technology has reshaped how the fast-paced securities markets work.

Quantitative and algorithmic trading are used across various asset classes by employing mathematical models and automated systems to identify and exploit trading opportunities. These trading mechanisms can be used to facilitate statistical arbitrage, factor investing, high-frequency trading, and order routing in stocks, while in Options and Derivates markets, quant trading can be used for pricing and volatility trading, while algorithmic trading can be used to automate strategy execution.

In this article, we will review Quant Trading Courses offered by QuantInsti. However, before we jump into that, we will first discuss what quant trading is, how quant trading is shaping up in India and around the world, opportunities in this area, and how you can benefit from learning the intricacies of quantitative trading from a structured course.

What is Quantitative Trading?

Quantitative trading uses mathematical models and statistical analysis to identify and exploit trading opportunities across different asset classes in financial markets. Traders develop algorithms that analyze historical data, market trends, and economic indicators to predict price movements. These algorithms then automatically execute trades based on predefined rules, minimizing human emotion and maximizing speed. You can use quantitative trading strategies to maximize your benefit from predictable price movements, etc., in stocks, bonds, derivatives, and commodities. However, designing mathematical models requires varying degrees of technical knowledge of different domains like mathematics, statistics, and programming.

Quant Trading Market in India and Around the World

With technology reshaping the trading landscape globally, quant trading and algorithmic trading are making strides in financial powerhouses worldwide. As per available data, the global algorithmic trading market is estimated at around $17 billion in 2023. There are projections for significant growth to reach $65.2 billion by 2032, driven by the increasing adoption of algorithmic trading by institutional investors and hedge funds. In India, the algorithmic trading market is projected to witness a CAGR of 11.65% during the forecast period FY2025-FY2032, growing from USD 1.08 billion in FY2024 to USD 2.61 billion in FY2032.

However, the quant trading market in India is still relatively small compared to other major markets like the US, with quant strategies holding only around 1-2% of the total market share, indicating significant room for growth, while algorithmic trading is gaining traction, with over 60% of trading in India now powered by algorithms, most of the quant funds manage a significantly lower percentage of assets compared to global counterparts. Some platforms like Bigul are offering quant trading algo infrastructure for free.

Opportunities in Quant Trading

The quantitative trading market offers diverse career opportunities. Quantitative traders develop and implement algorithmic trading strategies, while quantitative analysts research and create new models. Data scientists are required in this field to manage and analyze large datasets for trading insights while software developers build and maintain trading infrastructure. Risk managers oversee trading risks, and portfolio managers use quantitative strategies to manage asset portfolios. These roles exist within financial institutions like hedge funds and investment banks, each demanding a unique blend of skills in mathematics, statistics, programming, and finance.

While most of these career opportunities require you to be skilled in different fields, you can become a quant trader by learning the intricacies independently without attending a university. As a skilled quant trader, you must develop and implement trading strategies and automate trade executions through algorithms. Owing to their advanced skill set, professional quant traders engaged by top-end financial institutions earn handsome remunerations.

Why take a Course from Quantinsti?

To become a successful quant trader, you need to be well-versed in specific skill-based disciplines to be able to devise mathematical models and implement them using computerized algorithms. These include knowledge of programming languages like Python, data analysis, specific mathematical and statistical concepts, financial markets and trading mechanisms, etc.

While the level of proficiency required in each of these areas to become a quant trader varies, one can start learning these concepts with no specific educational background or eligibility prerequisites. Taking up a course can help you learn everything from the basics to the advanced level without a track record in coding or trading. Additionally, having a certification from a trusted institution would increase your chances of employability and teach you the know-how of the trade.

Courses Offered by QuantInsti

Quantra, launched by QuantInsti in 2016, offers over 50 trading courses on Quantitative & Algorithmic Trading applicable across asset classes, including Stocks, Options, Derivatives, Futures, Commodities, and more.

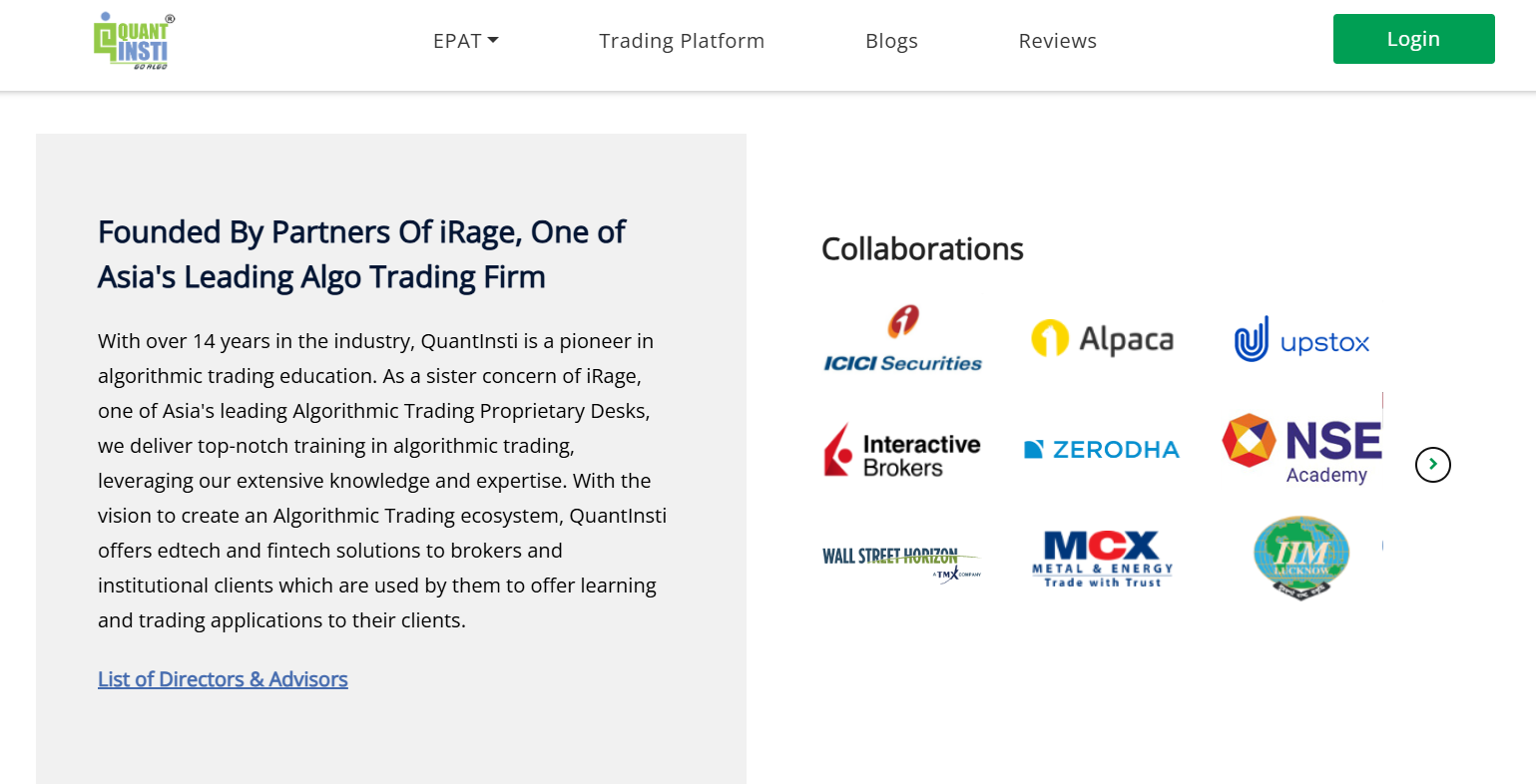

QuantInsti is a well-known institute in algorithmic and quantitative trading that was established in 2010. QuantInsti offers edtech and fintech solutions to brokers and institutional clients, which they use to offer learning and trading applications to their clients. Quantra offers courses by leading brokerage houses and exchanges, including the National Stock Exchange, Multi Commodity Exchange of India Limited (MCX), etc.

Quantra offers over 50 courses on quantitative and algorithmic trading. These courses are primarily designed on the pillars of trading, Python, and quant maths and cover different aspects of quant trading, such as options & futures, machine learning, and portfolio management. These courses cover both the basics and advanced-level concepts. You can choose your course by selecting your specific “learning track” on Quantra, a course bundle that helps you achieve a specific learning goal.

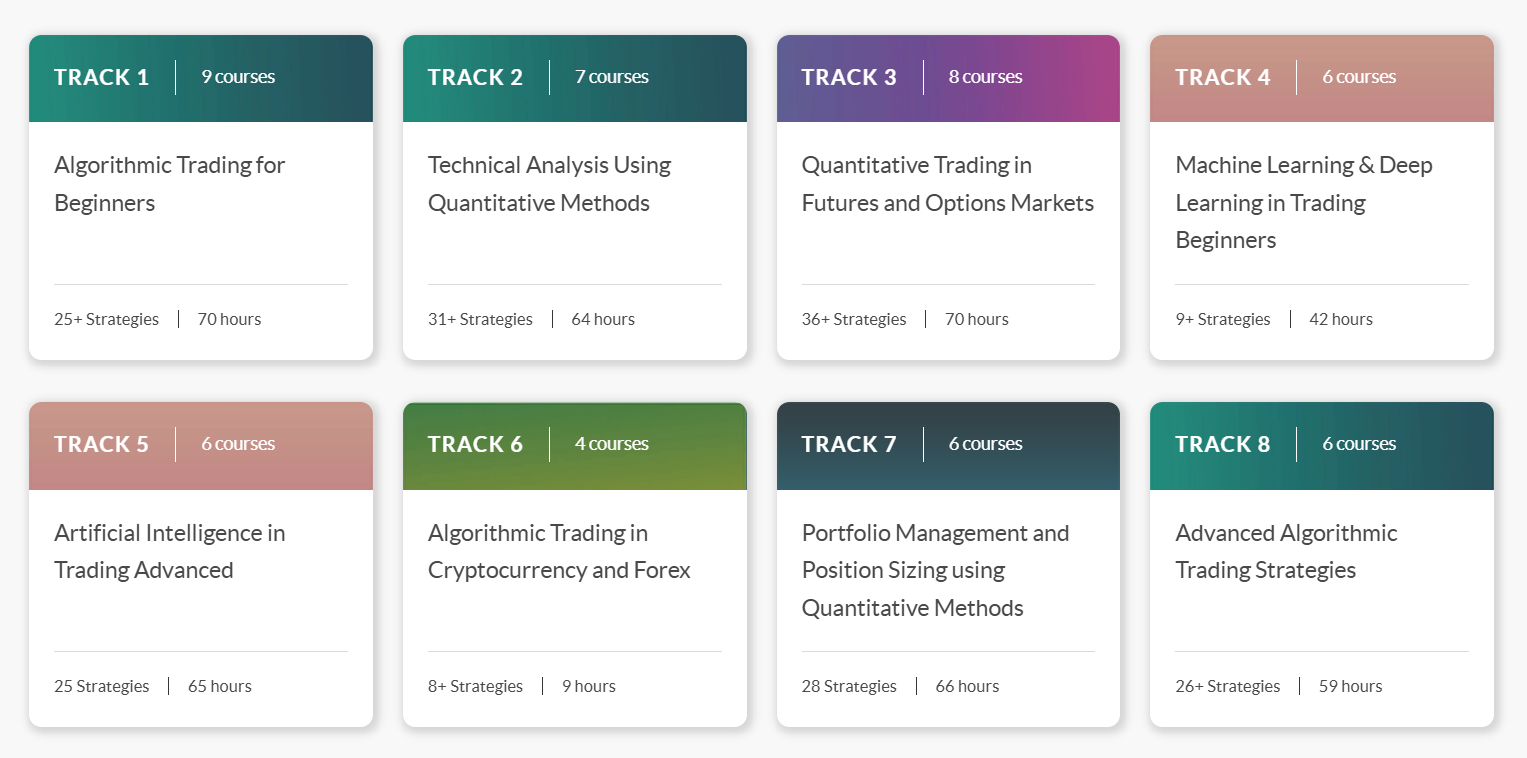

There are a total of 8 learning tracks focusing on different skill sets and levels of proficiency, starting with the basics of algorithmic trading for beginners. You can also opt for an all-course bundle covering all 8 tracks with over 50 courses and perks like placement assistance, etc.

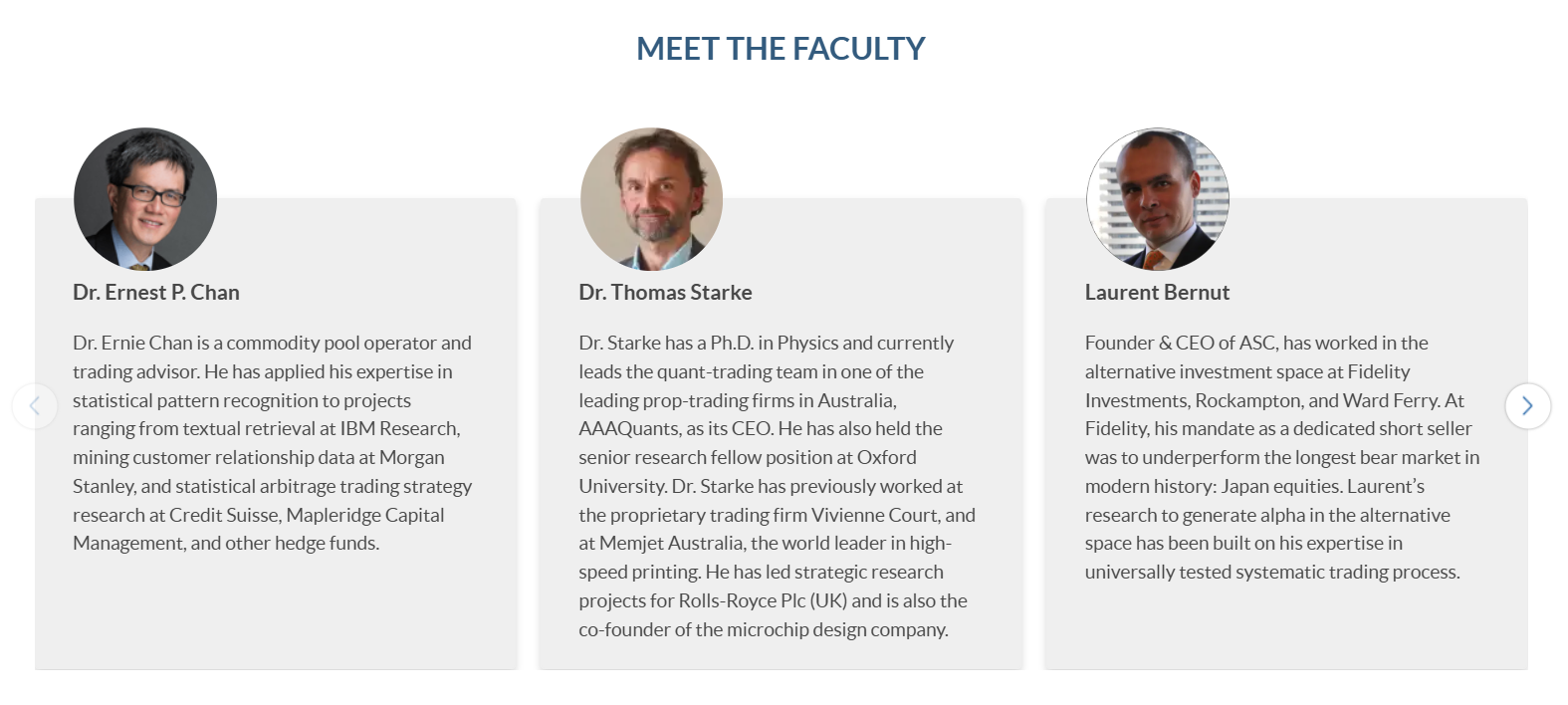

These courses are designed and authored by experts in algorithmic trading and are designed in collaboration with reputed financial institutions, etc.

Quantitative Trading for Beginners: Features

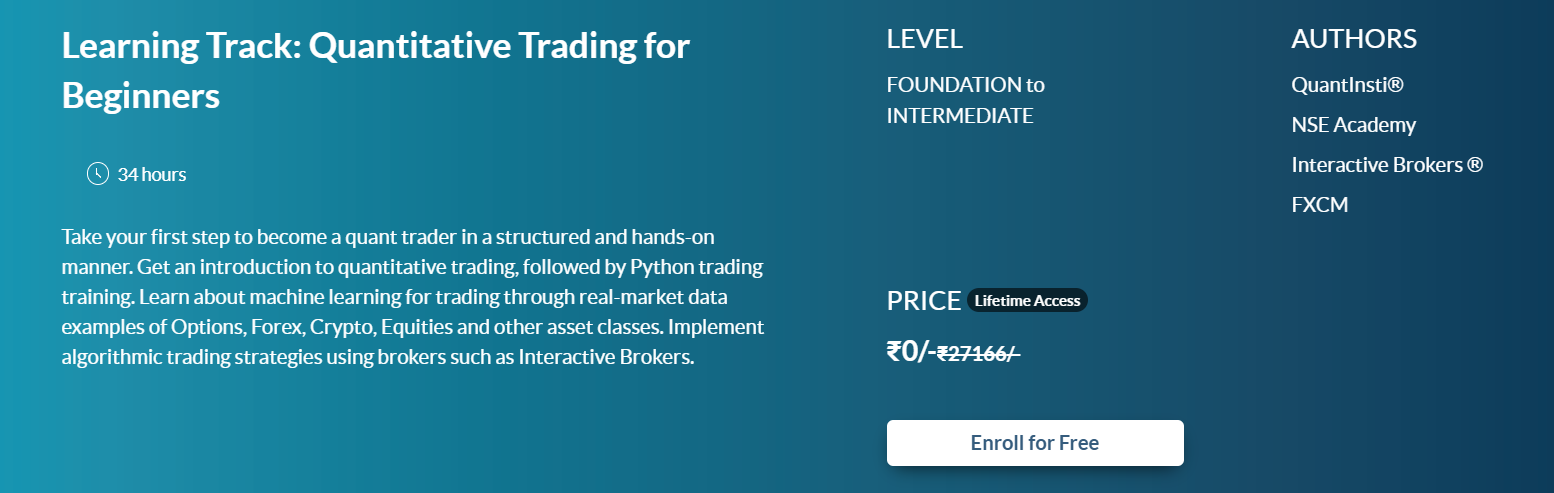

Let’s look at one of the learning tracks available for Free on Qunatra. This 8-course guide on Quantitative Trading for Beginners is a comprehensive guide for someone looking to explore what quant trading entails and learn the basics of the trade.

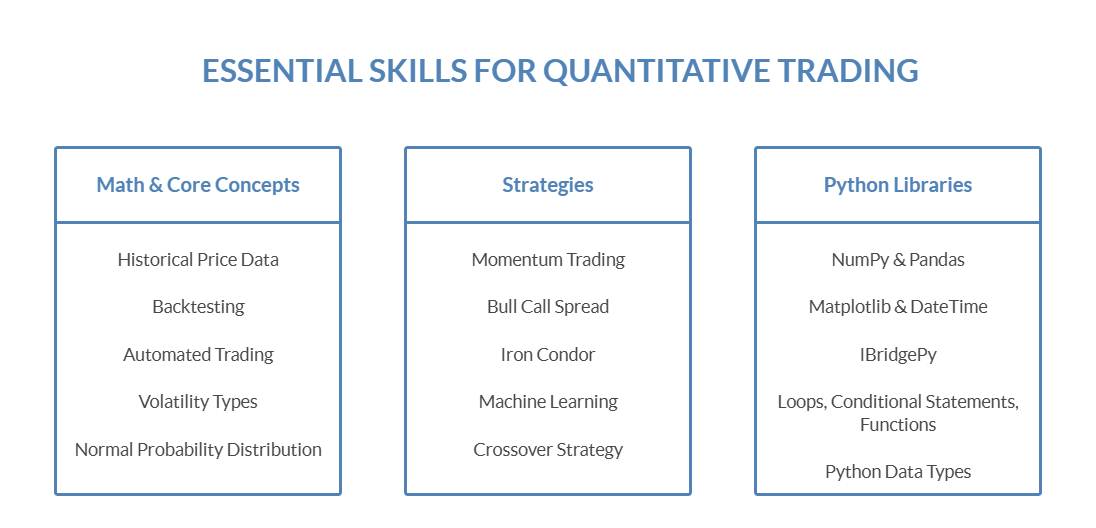

The course introduces basic concepts of some of the most essential skills for quant trading, divided into the three areas of Math and Core concepts, Strategies, and Python.

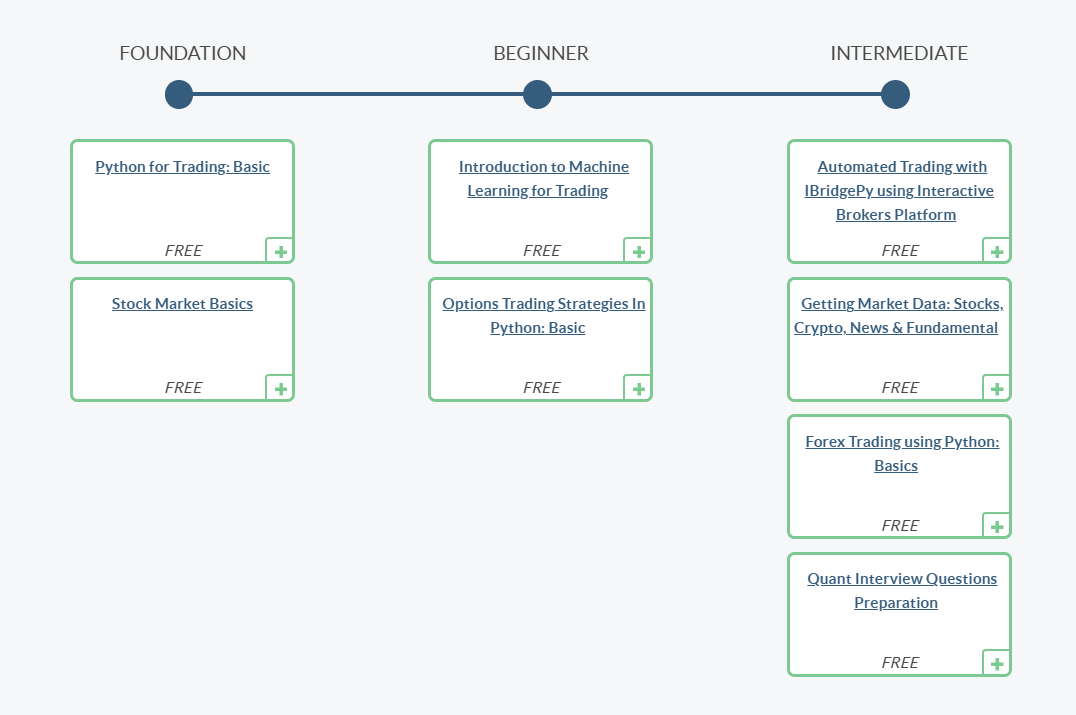

The learning track for this 8-course guide is divided into three stages: Foundation, focusing on the basics of Python for trading and the basics of stock markets; Beginner, introducing learners to machine learning in trading and options strategies using Python; and the Intermediate level which address more advanced areas like automated trading, market data, basics of forex trading using python and interview preparation modules of quants.

These 8 courses are authored by QuantInsti, NSE Academy, Interactive Brokers, which is a US-based brokerage firm, and FXCM or Forex Capital Markets, which is a retail broker for the foreign exchange market.

You can join this course without any specific prerequisite or knowledge of coding or trading. Qunatra offers faculty support on dedicated community forums, along with an opportunity to practice coding and trading strategies.

Conclusion

Quantitative and algorithmic trading is simply the final boss level of engaging in the financial markets with advanced skills, strategies, and computerised algorithms. By nature, quant trading demands specific skills in mathematics, financial markets, trading, coding, etc. However, learning these trades and practising them can open up several in-demand opportunities for you that are lucrative both financially and professionally. Quantra by QuantInsti offers several of courses to help you acquire the requisite skillsets and certifications. QuantInsti has a proven track record and has been collaborating with leading financial institutions, educational institutions, brokers, exchanges, etc. making their curriculum both enriching and rewarding.