Indian investors are increasingly exploring new ways to diversify beyond traditional products like Fixed Deposits, Debt Mutual Funds, and Bonds. Among the options gaining visibility is a specialised category known as Pre-Owned Life Insurance Policies.

These policies are originally purchased by one individual and later transferred to another through a legally recognised assignment process.

This guide, created for RandomDimes in collaboration with The Policy Exchange, explains how these policies work, their structure, the risks investors should consider, and how they fit within a diversified portfolio.

What Are Pre-Owned Life Insurance Policies?

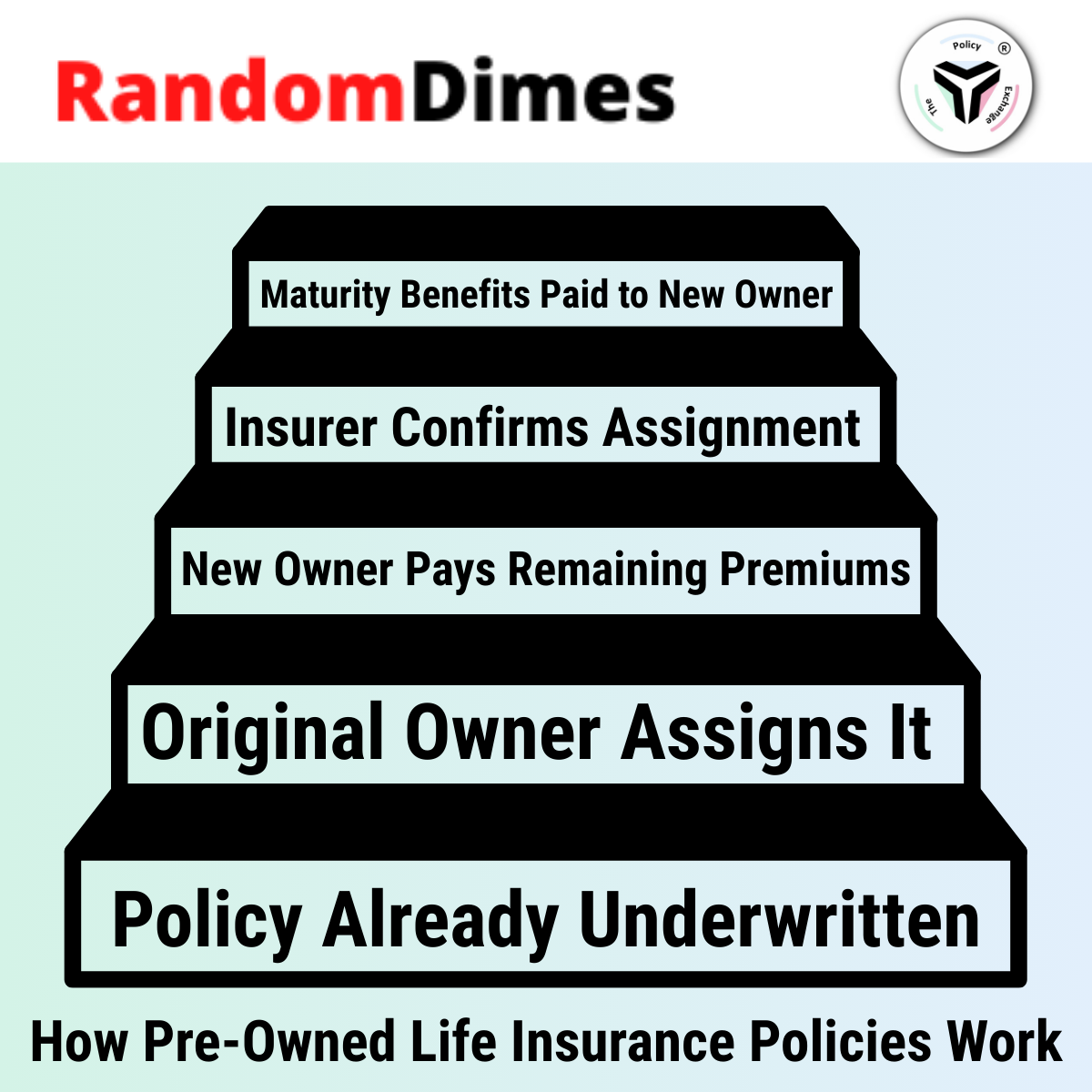

A pre-owned life insurance policy is an existing policy that the original policyholder chooses to transfer instead of surrendering. The new owner becomes the assignee, while all contractual terms of the policy remain unchanged.

Key characteristics:

- The policy was already underwritten at the time it was issued.

- It has a remaining tenure that is often shorter than fresh policies.

- Any remaining premiums, if applicable, must be paid by the new owner.

- The assignment is processed and confirmed by the insurer.

- The assignee receives the contractual maturity benefits from the insurer directly.

This structure is permitted under Indian insurance regulations (Section 38 of the Insurance Act of India) and follows standard assignment procedures.

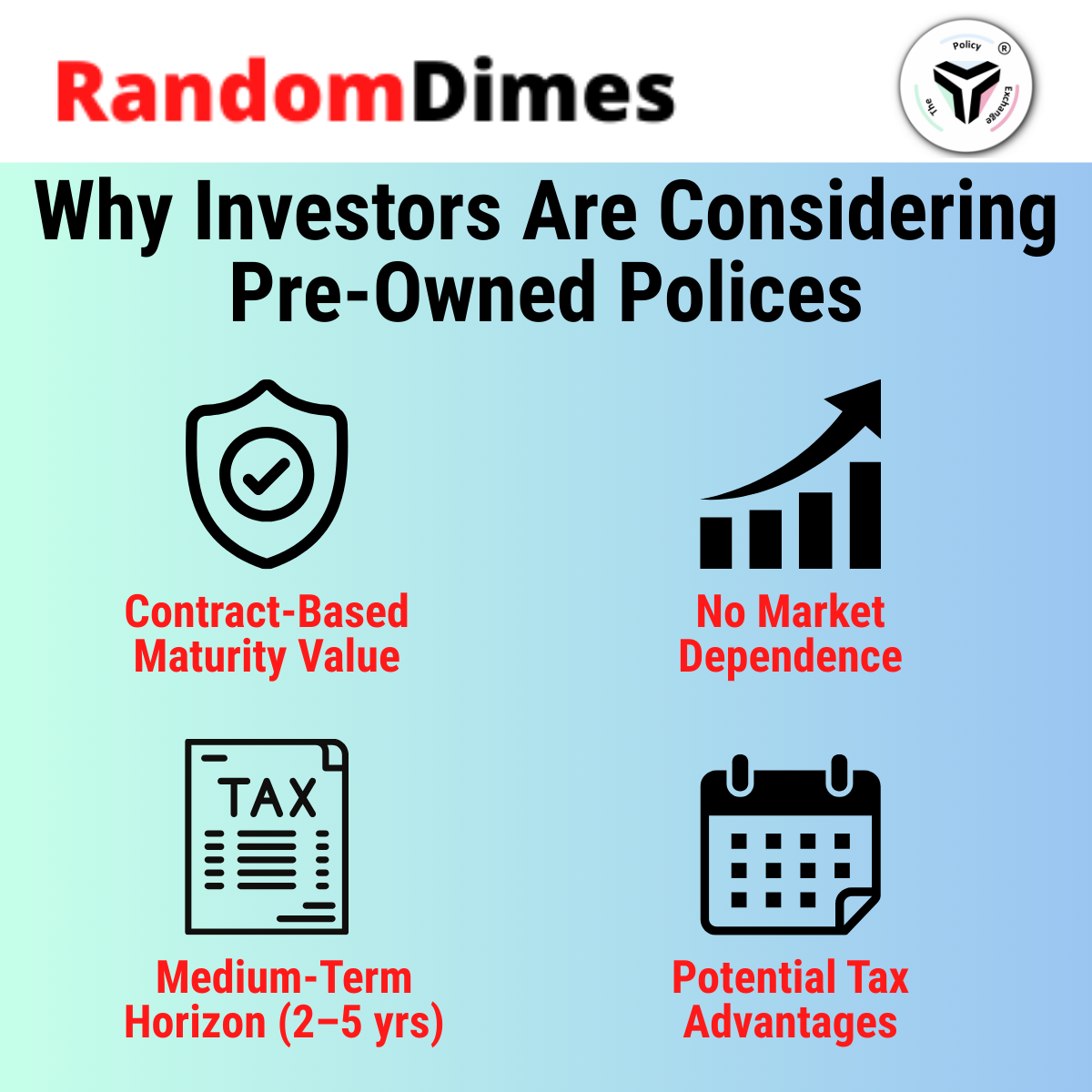

Why Investors Are Considering This Category

Investors exploring fixed-income and predictable cash-flow strategies often evaluate this category for the following reasons:

1. Contract-Based Maturity Value

The payout is defined within the policy document.

2. Lower Dependence on Market Conditions

By utilising the feature of “Switching” in ULIP policies, which enables investors to move their investment to debt funds from risky equity-based funds.

3. Medium-Term Time Horizon

Many curated policies have a remaining duration of 2–5 years, depending on the policy type.

4. Potential Tax Considerations

Under certain structures and conditions, tax treatment may be favourable.

(Investors should consult a qualified tax professional for individual guidance.)

5. Transparent Documentation Trail

Assignment paperwork, insurer confirmation, and policy records are part of the process.

How Assignment Works

Assignment is the legal transfer of rights of a life insurance policy from one party to another.

This process generally includes:

- Execution of an assignment deed

- Submission to the insurer for approval

- The insurer updates the records.

- Confirmation issued to the new assignee

- Future communication and payout directed to the new owner

This process is commonly used for loans, business transfers, and policy restructuring.

Role of The Policy Exchange

The Policy Exchange is a specialised platform that facilitates pre-owned life insurance policy transactions.

Their role typically includes:

- Sourcing & Screening: Identifying policies suitable for assignment.

- Documentation & Verification: Ensuring policy authenticity and compliance.

- Risk Assessment: Evaluating tenure, premium obligations, and policy conditions.

- Investor Support: Assisting with onboarding, KYC, and assignment execution.

- Policy Servicing: Tracking documentation, premium schedules, and maturity coordination.

Comparison With Traditional Options

|

Feature |

Fixed Deposits |

Debt Mutual Funds |

Pre-Owned Policies |

|

Risk |

Low |

Moderate to High |

Low |

|

Liquidity |

High |

Moderate–High |

Moderate |

|

Tax Treatment |

Standard |

Standard |

Tax Efficient* |

|

Return |

7-8% |

6-7% |

8-12% |

|

Duration |

1-5 Years |

1 Day to 7+ Years |

2-5 Years or more |

This is not a replacement for traditional instruments — it is an additional option some investors evaluate.

Suitability

Pre-owned policies may be evaluated by investors who:

- Prefer predictable, contractual structures.

- Want to diversify beyond traditional fixed-income

- Are comfortable with limited liquidity

- Understand assignment-based assets

- Prefer medium-term horizons

Caution: Suitability varies by individual, and investors should conduct their own assessment.

How the Investment Process Generally Works

A typical process through The Policy Exchange includes:

- Investor Profiling & Discussion

- Policy Selection based on tenure & premium structure

- Documentation Review

- Execution of Assignment Deed

- Notarisation & Insurer Submission

- Insurer Confirmation

- Servicing Until Maturity

All communication and documentation follow insurer guidelines.

Why RandomDimes Is Featuring Pre-owned Policies

RandomDimes covers alternative investments extensively

Pre-owned policies are emerging as another structured, documentation-based category worth understanding.

This guide aims to:

- Explain the mechanism clearly.

- Highlight risks without exaggeration.

- Present a neutral, research-based overview.

- Help investors evaluate whether this category is relevant to their goals.

Frequently Asked Questions

- Are pre-owned life insurance policies legal in India?

- Yes. Policy assignment is permitted under Section 38 of the Insurance Act when completed with proper documentation.

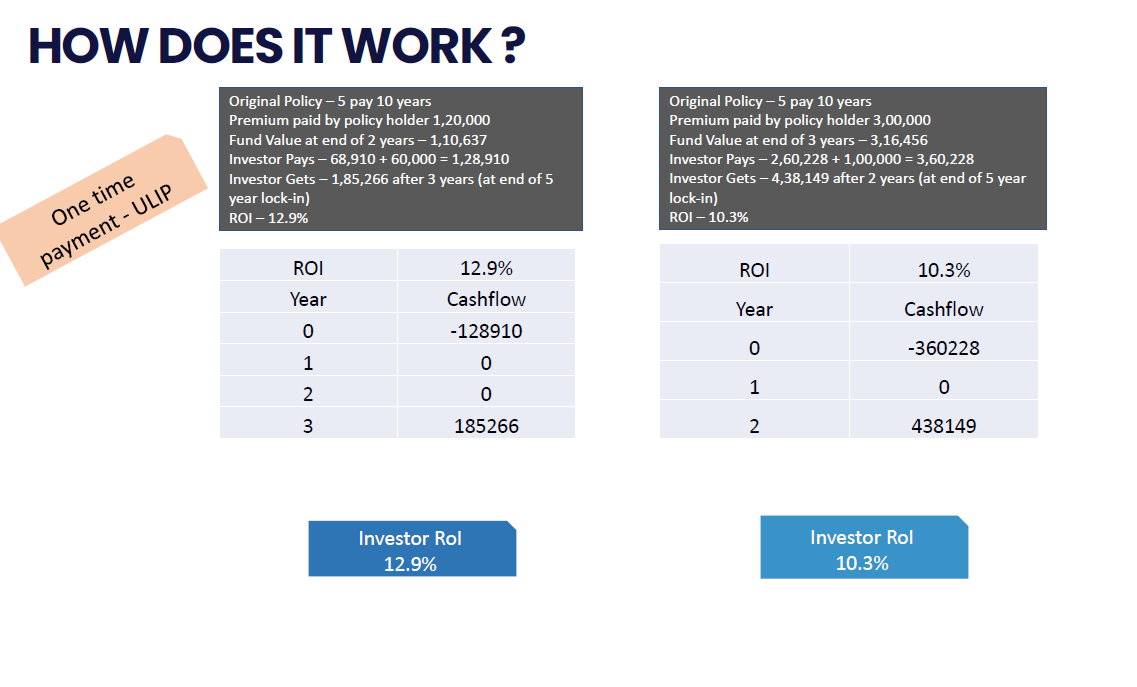

- Is this a market-linked product?

- Yes and No. Funds are typically shifted to debt at issuance to enhance the likelihood of achieving the illustrated IRR. If you choose to remain in equity or hybrid funds, you may do so with the understanding that you assume full market-related variability in returns.

- How are assigned policies taxed?

- Tax treatment remains the same as for a new policy. For example, all traditional policies issued prior to 1st April 2023 are completely tax-free provided they are compliant under section 10(10d) of the Income Tax Act.

- Can a policy deliver a higher return than assured?

- It depends upon the underlying policy. Generally, the returns showcased are illustrative.

- Are there any deductions at the time of maturity/liquidation?

- If the assignee’s PAN is updated with the insurance company and the policy is section 10(10d) compliant, then there is no deduction.

Learn More About Structured Pre-Owned Policy Opportunities

Visit The Policy Exchange for detailed information.