Hi everybody,

From this month I will publish my monthly P2P returns and performance.Also I will show how to perform analysis to make the most out of your investment.

Portfolio Synopsis: I have been investing in 3 platforms actively for the past 11 months. I will evaluate all the 3 platforms and how I manage risk associated with this investment class.

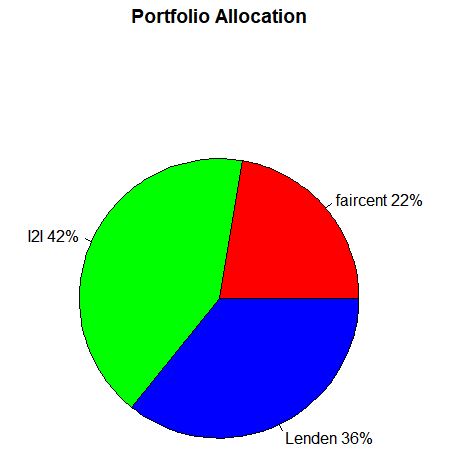

Portfolio Composition

As we can Portofolio allocation is maximum in I2I and lowest in Faircent .Now I will take you through steps in managing Portfolio like an investment firm. Our objective is to make consistent returns while minimising risk.

- Calculating Portfolio Performance:

Most P2P lending provide expected income in their dashboard. This does not provide a clear picture of the portfolio performance. There are 2 methods to calculate our portfolio performance

Net Annualized Return(NAR) : In this method we calculate the monthly interest computed on the available principal that month and then annualize the returns.In other words we calculate principal weighted annualized Interest.

XIRR: In this method we consider in all the cashflows debited or credited in the account and thus come up with an interest rate to achieve the closing balance. Advantage of this method is that it factors in the cash lying in account which is not deployed and thus loss due to cash drag.

Used NAR method (will compare with XIRR in future).

- Non Performing Assets: Biggest risk in P2P lending is non performing assets.Its hard to predict npa beforehand and most P2P report NPA post 180 days delay which might give an investor an inflated ROI figure because of under reporting. How to ideally factor in NPA? There are 2 ways:

- Providing loss factor for delinquent loan depending upon how much they are delayed. Eg: 25% loss factor for 60 days past due and 50% for 90 DPD.

- Taking a more conservative figure of NPA i.e having a smaller cutoff delay date for considering a loan NPA. Eg take all loan 60 days past due as NPA .

I have used the second method for NPA.

Now with these methods I have done my portfolio analysis .I will post individual as well as portfolio level performance.

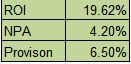

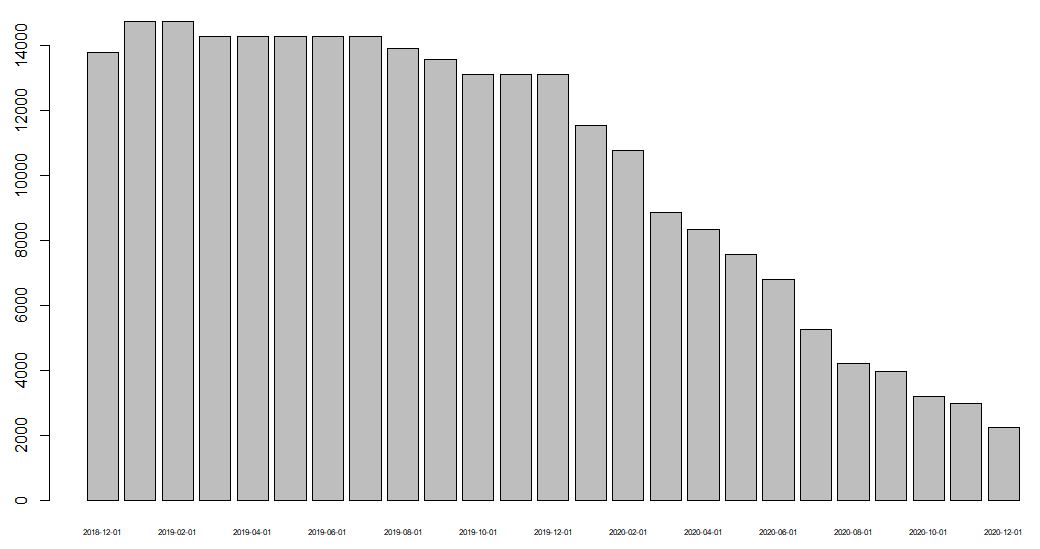

LendenClub (use code LDC11989 to get discount) :

Provision I have kept as the amount of NPA I can tolerate to get 10% Return on my investment, below that investment is futile.

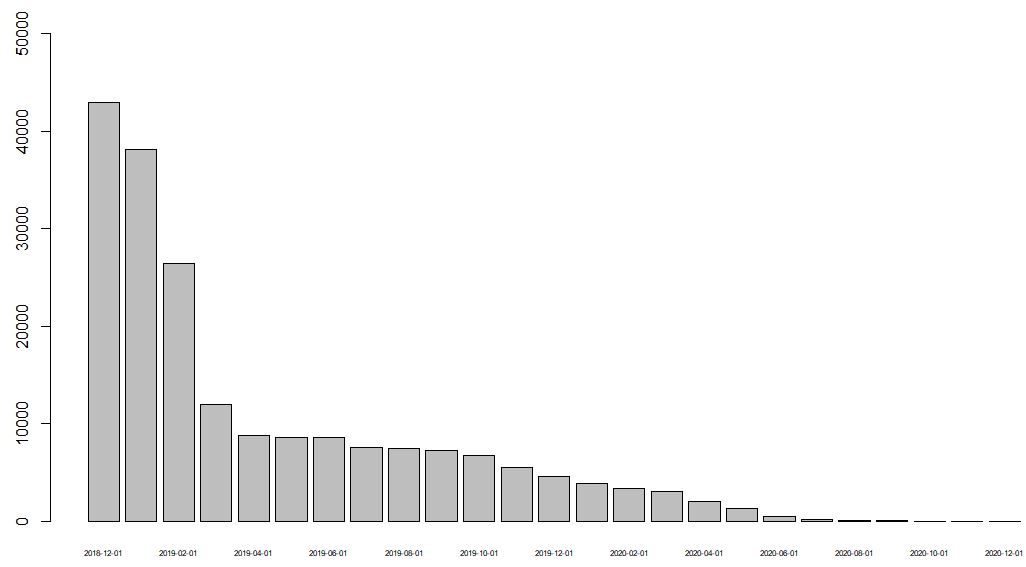

Future EMI

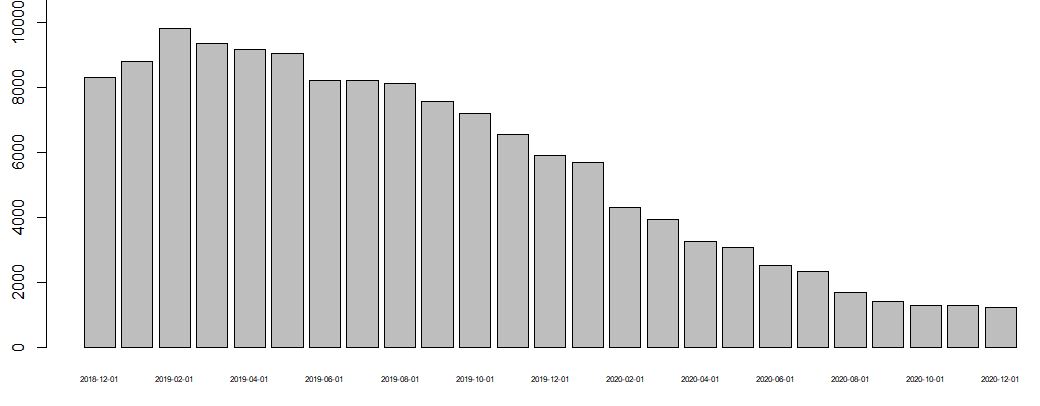

I2I has more provision than Lenden simply because I2I has showed lower NPA for a longer vintage and I have collected more interest in that period thus I can afford to lose more in the next few months

Future EMI:

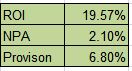

Faircent:

Faircent has been a disappointment with barely managing 4.9%!Almost equivalent of a saving account L

I should have started this portfolio analysis earlier to prevent this mishap

Future EMI

:

Now lets see Total portfolio Performance and Strategy

Returns look fine considering I have been Conservative in my calculation. Now lets see the future EMI

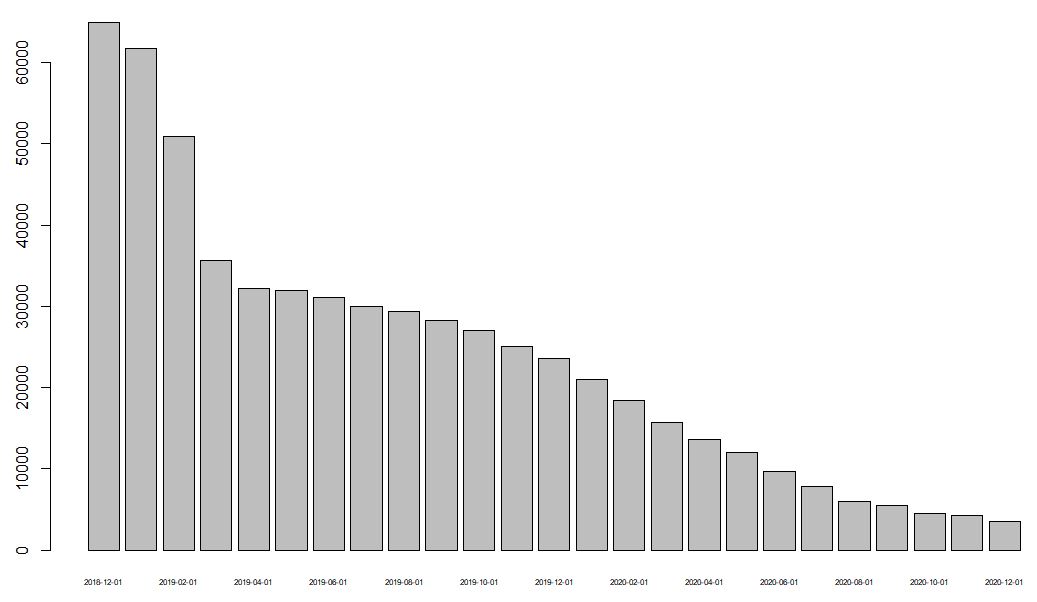

As I had invested more in short term I have lot of inflows in the near future and thus need to balance out my lending

Strategy Going Forward:

- Move all Faircent EMI to Lendenclub(better risk adjusted Return)

- Start Investing in RupeeCircle(use code PIND145 while registering to get portfolio analysis reports)

- Increase investment in I2I (use referral to get portfolio analysis https://www.i2ifunding.com/referral/ud8cwng83/invest )

- Need to reduce EMI outflow in near month .For this I will go long dated loans in Faircent,medium dated in Rupee circle and short dated in Lenden.

- Will Run Portfolio analysis next month again and compare results

People who wish to construct a quantitative P2P portfolio can mail me.