Let me start this Marketfeed review with something most trading apps and “premium communities” won’t tell you upfront:

Options trading is not easy.

Not in India. Not anywhere.

And no matter how good Marketfeed is (or any platform), it cannot magically turn a losing trader into a profitable one unless the trader also fixes the real problems: risk management, position sizing, execution discipline, and mindset.

So this will be a real Marketfeed review — not a marketing pitch.

In this post, I’ll cover:

-

What Marketfeed actually is

-

what it’s genuinely good at (options + context)

-

What it offers beyond options (ETFs, gold, equities, baskets)

-

social media feedback (what users praise + complain about)

-

who should subscribe (and who shouldn’t)

What is Marketfeed?

Marketfeed is an India-focused markets platform that combines:

-

trader education + market commentary

-

strategy content (especially options)

-

investment products/baskets including exposure to assets like ETFs, equities, and gold-related content

Originally, Marketfeed was known mostly for daily Nifty/BankNifty options insight, but over time, it has broadened into a platform that touches both:

-

trading (short-term, derivatives)

-

investing (portfolio-style baskets and asset allocation ideas)

The hard truth first: Options trading isn’t about knowledge alone

Before reviewing Marketfeed features, we need to say this clearly:

A trader can learn:

-

Greeks

-

strategies

-

charts

-

OI analysis

…and still lose money.

Because most retail traders lose due to behavioural issues:

-

overtrading (especially weekly expiry)

-

Revenge trading after losses

-

increasing size emotionally

-

no stop-loss discipline

-

Taking low-quality setups out of boredom

-

confusing “market opinion” with “trade execution.”

Even if Marketfeed gives great market insights, it won’t stop you from:

buying 4 lots more because “it will come back”

That’s not a platform problem. That’s a trader problem.

Marketfeed Review: What it does well

1) Marketfeed is genuinely good at market context

This is Marketfeed’s strongest feature.

Most retail traders have access to too much data, but lack interpretation. Marketfeed does a decent job summarizing:

-

the narrative of the day

-

sentiment shifts

-

key levels to watch

-

event-day risk (CPI/Fed/RBI expiry days)

For beginners, this alone can reduce stupid trades.

2) Options-focused content for Indian weekly expiry traders

Marketfeed is clearly designed around Indian derivative markets.

It focuses heavily on:

-

weekly expiry structure

-

Nifty / BankNifty behaviour

-

How OI positioning changes

-

range vs breakout context

If you trade Indian index options, Marketfeed will feel relevant.

3) Beginner-friendly education

Many education platforms fail because they are overly technical.

Marketfeed content is:

-

short

-

practical

-

simple language

-

focused on “what matters today.”

So if you’re new to options, this is a big plus.

4) Better than random Telegram/Instagram trading tips

This matters a lot in India.

If the alternatives are:

-

Telegram “sure shot.”

-

WhatsApp option calls

-

Instagram reels promising 90% accuracy

Then Marketfeed is far better because it’s:

✅ curated

✅ structured

✅ less scammy

✅ more educational

The “other stuff”: ETFs, Gold, and diversified baskets

Now, coming to your question, yes, Marketfeed includes more than options trading content.

This matters because not everyone should be 100% in derivatives, and adding some “investing-like” structure can help.

Here’s what Marketfeed’s expanded offering typically includes:

5) ETF & equity exposure (investing-style baskets)

Marketfeed has been expanding into investment baskets that can include:

-

index exposure

-

equity baskets

-

ETF-style long-term allocations

Why this is useful:

Options-only traders often take excessive risk. ETF/equity baskets introduced:

-

diversification

-

less volatility than weekly options

-

long-term participation

Honest truth:

This is not Marketfeed’s core identity yet (options is still primary), but these baskets help if you want a more balanced approach.

6) Gold/commodities: educational coverage (not full trading terminal)

Marketfeed covers topics like:

-

Why gold moves

-

commodity cycles

-

macro triggers (USD, inflation, rates)

This is valuable because Indian traders usually ignore macro effects.

But to be clear:

Marketfeed is not an MCX trading tool.

It’s more like education + research commentary.

So gold exposure here is more:

✅ learning and portfolio thinking

rather than

❌ “live commodities trading signals.”

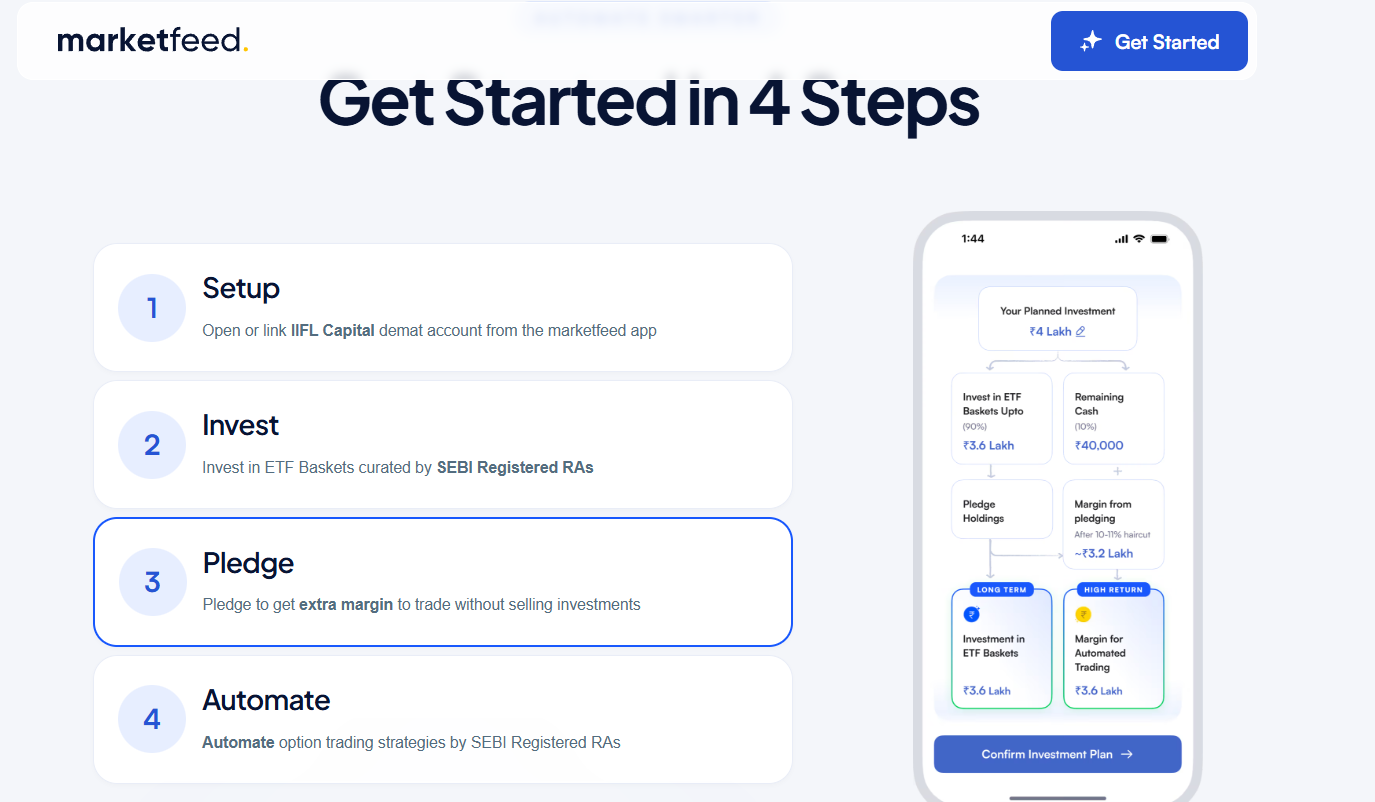

7) Automated/systematic strategies (big attraction, but misunderstood)

Another part that attracts a lot of attention is automation / systematic strategies.

Depending on the current product design, this typically means:

-

you connect broker

-

You deploy a pre-designed strategy basket

-

The system executes trades based on defined rules

Why people like it:

Because it reduces:

-

emotional trading

-

impulsive trades

-

decision fatigue

But here is the real warning:

Automated does not mean safe.

Automated also does not mean profitable.

Automated strategies still face:

-

drawdowns

-

regime changes

-

tail events

-

sudden volatility spikes

Many social media complaints come from users thinking:

“If it’s automated, it should never lose.”

That expectation is incorrect.

Where Marketfeed is weak

1) Marketfeed cannot give you an edge

Marketfeed gives insights.

But profitability comes from:

-

having a repeatable edge

-

execution rules

-

risk limits

-

position sizing

So if you buy Marketfeed expecting:

“Now I will become profitable”

…you’ll be disappointed.

2) People treat it like a signal product

This is the biggest reason for negative reviews.

Users expect:

-

exact entry-exit

-

guaranteed success

But Marketfeed’s best use is:

✅ context + learning

not

❌ tip service

3) Dependency risk

Daily market content comes with a risk:

You stop thinking independently.

You wait for:

-

their bias

-

their levels

-

their framework

Long-term, that’s bad for any trader.

4) Repetition fatigue

Markets repeat.

So daily content starts feeling repetitive after a point. That doesn’t mean it’s useless — it just means you’ve matured past the “daily commentary dependency stage.”

Social Media Feedback (What people really say)

What people praise

✅ “clear explanation.”

✅ “good for beginner traders.”

✅ “better than Telegram calls.”

✅ “helps avoid impulsive trades.”

These are fair positives.

What people complain about

❌ “not worth the subscription.”

❌ “content feels repetitive.”

❌ “still losing money”

❌ “expected sure-shot calls.”

Most negativity comes from wrong expectations — not necessarily poor content.

Marketfeed vs alternatives

Marketfeed vs Sensibull

-

Sensibull = tools + strategy builder

-

Marketfeed = context + education + commentary

✅ Many traders use both.

Marketfeed vs Opstra

-

Opstra = deep options analytics

-

Marketfeed = interpretation + narrative

If you’re an advanced options trader, Opstra may be more useful.

Marketfeed vs TradingView

TradingView is charts.

Marketfeed is commentary + learning.

Not substitutes.

Who should subscribe?

✅ Subscribe if you are:

-

beginner/intermediate trader

-

Weekly expiry trader who lacks structure

-

trying to reduce overtrading

-

wants a mix of trading + investing exposure (ETFs/baskets)

❌ Avoid if you are:

-

Looking for guaranteed profit

-

expecting exact buy/sell calls

-

gambler-style trader

-

unwilling to respect risk management

Final Verdict (Real Review)

⭐ Marketfeed rating: 7/10

Marketfeed is a high-quality learning + context platform for Indian market participants.

Its expansion into:

-

ETFs / equity baskets

-

gold/macro education

-

systematic/automated strategies

…is a good direction because it encourages diversification.

But the truth stays the same:

✅ Marketfeed can improve your thinking

❌ Marketfeed cannot make options trading easy

If you treat it as education + structure, it’s worth it.

If you treat it as a profit guarantee, you’ll hate it.

FAQs

Is Marketfeed good for beginners?

Yes — it’s beginner-friendly and structured.

Does Marketfeed give sure-shot calls?

No. Don’t treat it like that.

Can Marketfeed automation make money automatically?

Automation can reduce emotions, but it can still lose money. Drawdowns are normal in any strategy.

Is Marketfeed useful for investors (not traders)?

Partly — especially because it now includes baskets and ETF/equity exposure. But long-term investors may still prefer pure investing research platforms.