This type of loan is widely used by professional investors, traders, and business owners to maintain liquidity while preserving long-term investment compounding.

In this comprehensive guide, we cover:

-

How a loan against mutual funds works (step-by-step process)

-

Loan-to-Value (LTV) explained with examples

-

Collateral, lien creation, and registrar role (CAMS, KFintech, NSDL, CDSL)

-

Margin calls, collateral monitoring, and liquidation risk

-

Detailed review of VoltMoney, Zerodha Capital, Groww, AbhiLoans, Yenmo, Mirae, and Dhan

-

Comparison vs home loan, loan against property, and Margin Trading Facility (MTF)

-

Which loan type is cheapest and safest

Interest Rate Comparison: All Major Loan Types in India

Understanding loan costs across categories helps determine when LAMF makes sense.

| Loan Type | Interest Rate | Collateral | Risk | Best Use |

|---|---|---|---|---|

| Home loan | 7.5% – 9% | Property | Lowest | Buying property |

| Loan against mutual funds | 8% – 12% | Mutual funds | Low | Investor liquidity |

| Loan against property | 9% – 14% | Property | Low | Large liquidity |

| Loan against shares | 10% – 14% | Stocks | Medium | Trading liquidity |

| Gold loan | 7% – 15% | Gold | Medium | Emergency liquidity |

| Margin Trading Facility | 12% – 18% | Stocks | High | Leveraged trading |

| Personal loan | 12% – 20% | None | High | Consumption |

| Credit card loan | 24% – 36% | None | Very high | Emergency only |

Key takeaway:

-

Home loans are cheapest overall

-

Loan against mutual funds is the cheapest liquidity loan

-

Personal and credit card loans are most expensive

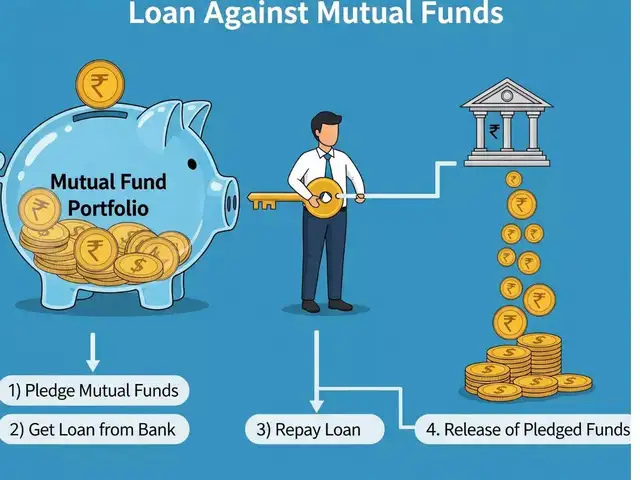

What is a Loan Against Mutual Funds?

A loan against mutual funds is a secured loan where your mutual fund units are pledged as collateral in exchange for a credit line or loan.

You still retain ownership of mutual funds. They continue generating returns.

Example:

-

Mutual fund portfolio value: ₹10 lakh

-

Allowed LTV: 60%

-

Loan eligibility: ₹6 lakh

You pledge mutual funds and receive a ₹6 lakh credit line.

Understanding Loan-to-Value (LTV)

Loan-to-Value determines maximum borrowing allowed.

Formula:

LTV = Loan Amount ÷ Mutual Fund Value

Example:

Loan = ₹6 lakh

Collateral value = ₹10 lakh

LTV = 60%

Higher LTV means higher risk of margin calls.

Typical LTV by Mutual Fund Type

| Fund Type | Typical LTV |

|---|---|

| Debt mutual funds | 70% – 90% |

| Hybrid mutual funds | 60% – 75% |

| Equity mutual funds | 50% – 65% |

Debt funds have higher LTV because of lower volatility.

Equity funds have lower LTV due to market risk.

How Collateral Pledge Works (CAMS, KFintech, NSDL, CDSL)

-

Investor

-

Platform (VoltMoney, Zerodha, Groww, etc.)

-

Lender (Bank or NBFC)

-

Registrar or Depository

Registrars manage ownership records.

Key registrars:

-

CAMS (Computer Age Management Services)

-

KFintech

-

NSDL and CDSL (for demat mutual funds)

Step-by-Step Process: Loan Against Mutual Funds

Step 1: Fetch mutual fund holdings

Investor logs in using PAN and OTP.

The platform retrieves holdings from the registrar.

Time required: instant.

Step 2: Loan eligibility calculation

Loan limit calculated using LTV.

Example:

Portfolio value: ₹10 lakh

Eligible loan: ₹6 lakh

Step 3: Loan approval

Lender performs:

-

KYC verification

-

Risk assessment

-

Collateral validation

Approval time:

-

Fintech platforms: 5 minutes to few hours

-

Banks: 1–2 days

Step 4: Lien creation (pledge)

A lien is created electronically.

The investor still owns mutual funds.

But mutual funds cannot be sold until the loan is repaid.

Step 5: Credit line activation

The loan becomes available as an overdraft credit line.

Step 6: Withdraw funds

The investor withdraws any amount within the limit.

Interest is charged only on the used amount.

Overdraft Structure: Major Advantage

Example:

Approved limit: ₹6 lakh

Withdrawn amount: ₹2 lakh

Interest charged only on ₹2 lakh.

This makes borrowing cost-efficient.

Margin Call Risk Explained

Collateral value fluctuates with the market.

Example:

Initial collateral: ₹10 lakh

Loan: ₹6 lakh

LTV: 60%

Market falls:

Collateral: ₹7 lakh

New LTV: 86%

Margin call triggered.

Investor must:

-

Repay part of the loan

OR -

Add more collateral

Liquidation Risk

If the margin call is ignored, the lender may liquidate mutual funds.

To reduce risk:

Use a conservative LTV of 40–50%.

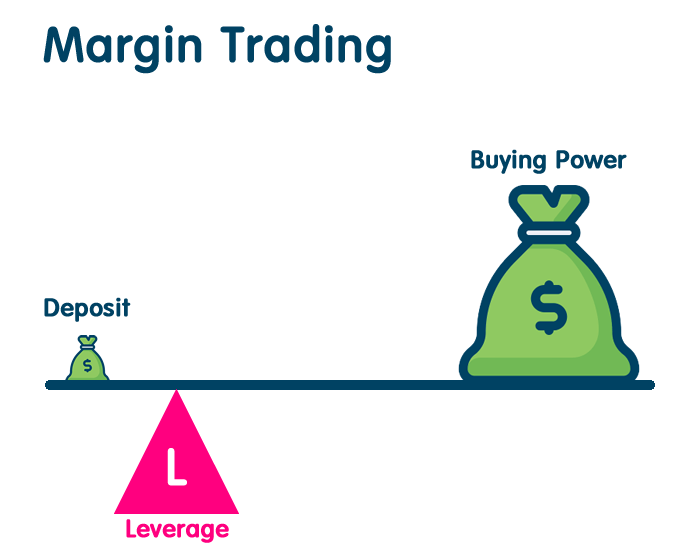

Loan Against Mutual Funds vs Margin Trading Facility (MTF)

Example:

Capital: ₹5 lakh

Borrowed: ₹5 lakh

Total exposure: ₹10 lakh

If the stock falls 30%:

Value: ₹7 lakh

Loan: ₹5 lakh

Loss: ₹3 lakh (60%)

Leverage amplifies losses.

LAMF is safer because it is used for liquidity, not leverage.

Best Loan Against Mutual Funds Platforms in India (Detailed Review)

VoltMoney — Best Overall Platform

VoltMoney is India’s leading LAMF fintech infrastructure platform. In-depth article on Voltmoney

Lending partners

VoltMoney connects borrowers with banks and NBFCs such as Tata Capital.

Interest rate

9%–11% typical range.

Structure

Overdraft credit line.

Interest is charged only on the used amount.

Platform infrastructure

Supports 8000+ mutual funds across CAMS and KFintech.

Advantages

-

Fastest approval (minutes)

-

Lowest rates

-

No prepayment penalty

-

Fully digital

Best for

Most investors.

If you are looking to become a loan distributor, you can register below

2. Zerodha Capital — Best for Traders

Zerodha Capital provides loans against mutual funds and stocks through Incred Finance.

Interest rate

10%–11% typical range.

Maximum loan

Up to ₹10 crore.

Process

-

Select securities

-

Digitally pledge

-

Approval within 24 hours

-

Cash credited to the bank account

LTV

Typically around 45–60%, depending on fund type.

Advantages

-

Best for Zerodha users

-

Supports stocks and mutual funds

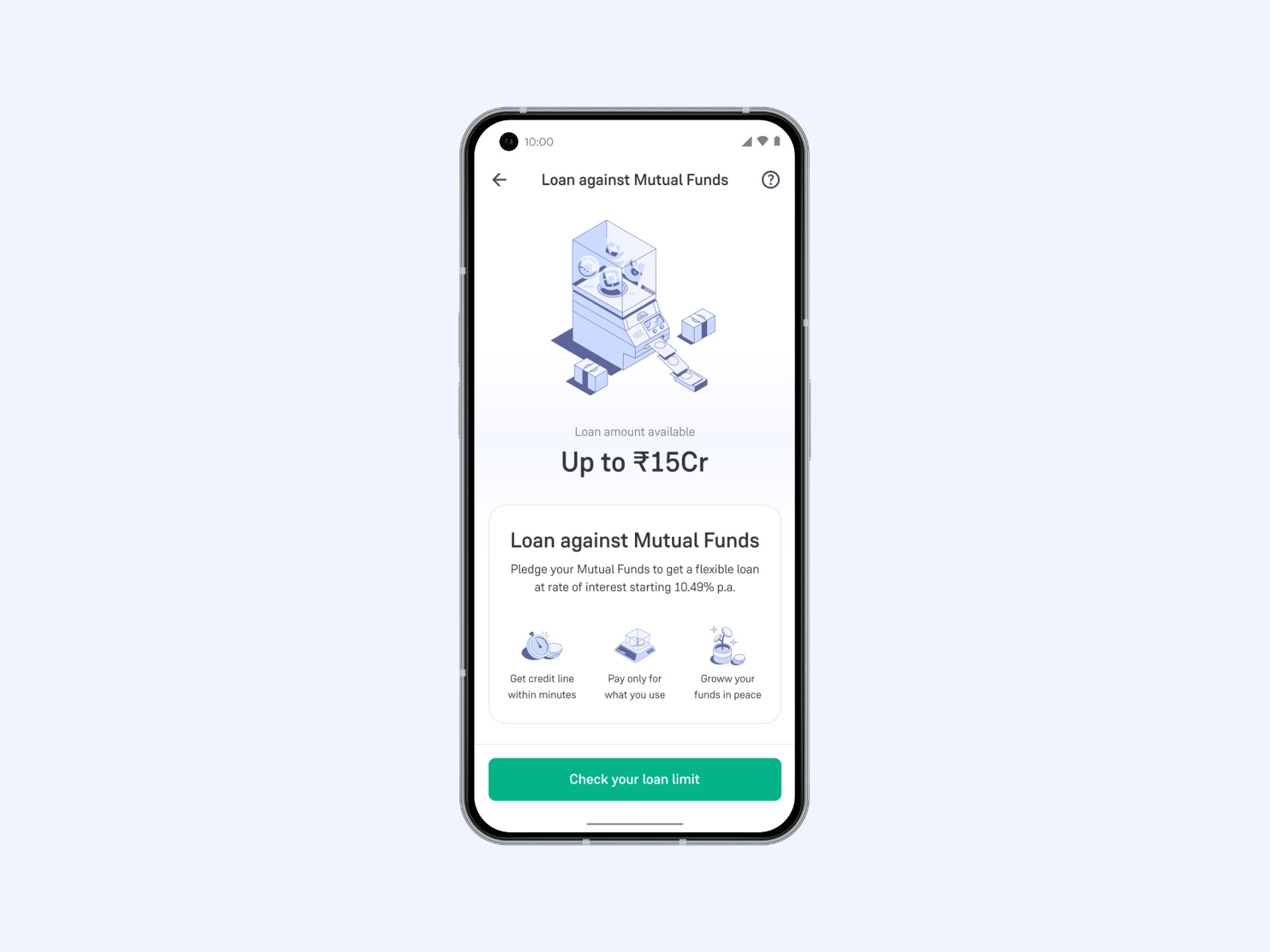

3. Groww Credit — Best for Groww Users

Groww Credit provides an integrated LAMF facility.

Maximum credit line

Up to ₹15 crore depending on portfolio.

Advantages

-

Seamless Groww integration

-

Continue earning mutual fund returns

4. AbhiLoans — Lowest Interest NBFC

Interest rates start from ~11%.

Direct NBFC lender KNAB Finance

Advantages:

- Direct lending infrastructure

5. Yenmo — Flexible Platform

Interest rate around 10.49%. Partner is Bajaj Finance

Advantages:

-

Flexible repayment

-

No penalties

6. Mirae Asset Financial Services

Features:

-

Digital approval

-

Reliable NBFC

7. Dhan (DhanLAP)

Interest rate starting from ~10%.

Fully digital application process.

Multiple lending NBFCs onboarded, such as Bajaj, Sriram Credit

Platform Comparison Summary

| Platform | Interest | Best For |

|---|---|---|

| VoltMoney | 9–11% | Best overall (Speed+competitive Rate) |

| Zerodha Capital | 10–11% | Traders |

| Groww Credit | 10–12% | Groww users |

| AbhiLoans | 11-12% | Multiple Partners |

| Yenmo | 10–12% | Flexible repayment |

| Mirae Asset | ~10.25% | Trusted NBFC, Best for MTF |

| Dhan | ~10% | Dhan users |

Loan Against Mutual Funds vs Home Loan

But LAMF is better for liquidity.

| Feature | Home Loan | Loan Against MF |

|---|---|---|

| Interest | Lower | Slightly higher |

| Approval time | Weeks | Hours |

| Flexibility | Low | High |

Example: Real Cost Comparison

Borrow ₹10 lakh for 1 year.

| Loan Type | Interest Cost |

|---|---|

| Home loan | ₹80,000 |

| Loan against MF | ₹1,00,000 |

| Personal loan | ₹1,50,000 |

| Credit card loan | ₹3,60,000 |

LAMF saves high cost vs unsecured loans.

Professional Investor Strategy

Professional investors use LAMF to:

-

Avoid selling investments

-

Maintain compounding

-

Access liquidity efficiently

Safe LTV used: 40%–50%

This reduces margin call risk.

Final Ranking: Cheapest Loan Types in India

From cheapest to most expensive:

-

Home loan

-

Loan against mutual funds

-

Loan against property

-

Loan against shares

-

Margin Trading Facility

-

Personal loan

-

Credit card loan

Final Verdict

Loan against mutual funds is one of the best liquidity tools available for Indian investors.

It offers:

-

Low interest rates

-

Fast approval

-

Flexible overdraft structure

-

Lower risk compared to MTF

-

No need to sell investments

Platforms like VoltMoney and Zerodha Capital make the process fast, efficient, and investor-friendly.

For investors needing liquidity while preserving investments, this is one of the most efficient financing options available today.