Modern-day stock markets are inherently technology-driven at every stage of the whole investing experience. Technological advancement has completely revolutionized how investing in the stock markets works over two or three decades, from dematerialized shares to shorter settlement cycles, and now advanced technologies like blockchain and AI.

Artificial Intelligence (AI) is the talk of the town now, and it has astounding capabilities to identify patterns and generate responses based on the processing of gazillions of data. The use of AI in the stock markets is something investors and other stakeholders have been both skeptical and excited about.

This article will look at a detailed review of JARVIS Invest, a Big Data and AI-enabled autonomous stock advisory platform. It is an Artificial Intelligence-based Equity Advisory Model with an in-built Risk Management System. In this article, we will look at what JARVIS Invest is, the team behind the venture, and its key features, and compare it with other alternatives in the market.

What is JARVIS?

JARVIS is a Big Data and AI-enabled autonomous stock advisory platform. Ventugrow Consultants Pvt Ltd., a SEBI Registered Investment Advisor based out of Mumbai, Maharashtra, offers the platform. The company describes JARVIS as India’s first AI-based equity advisory model with an in-built risk management system.

With over seven years of track record of employing AI in the Indian stock market, JARVIS has developed a robust AI engine that continuously analyses around 40 million data points to help investors make wise and informed investment decisions based on AI-driven insights. JARVIS essentially provides stock market insights for retail investors to invest wisely and also gives recommendations on Stocks for Trading, Stocks for Portfolio, and Alerts on Existing Portfolio Stocks. It creates customized portfolios of Equity Stocks, liquid BeES, Gold BeES, etc. for investors.

The stated mission of JARVIS is to unravel and unleash the power of AI in stock trading and investing, offering an enriched experience to retail investors. The company aims to provide unparalleled advisory services and use technology as a delivery platform.

The platform has investors with funds totaling over RS. 100 crores, and has partnered with 25+ leading broking houses.

Some of the key offerings of JARVIS are as follows; we will look at them in greater detail in the coming sections:

- AI-powered stock selection from 2000+ stocks.

- Personalized portfolio with an inbuilt 24/7 risk management system.

- Ongoing stock recommendations specific to your portfolio.

Team behind JARVIS

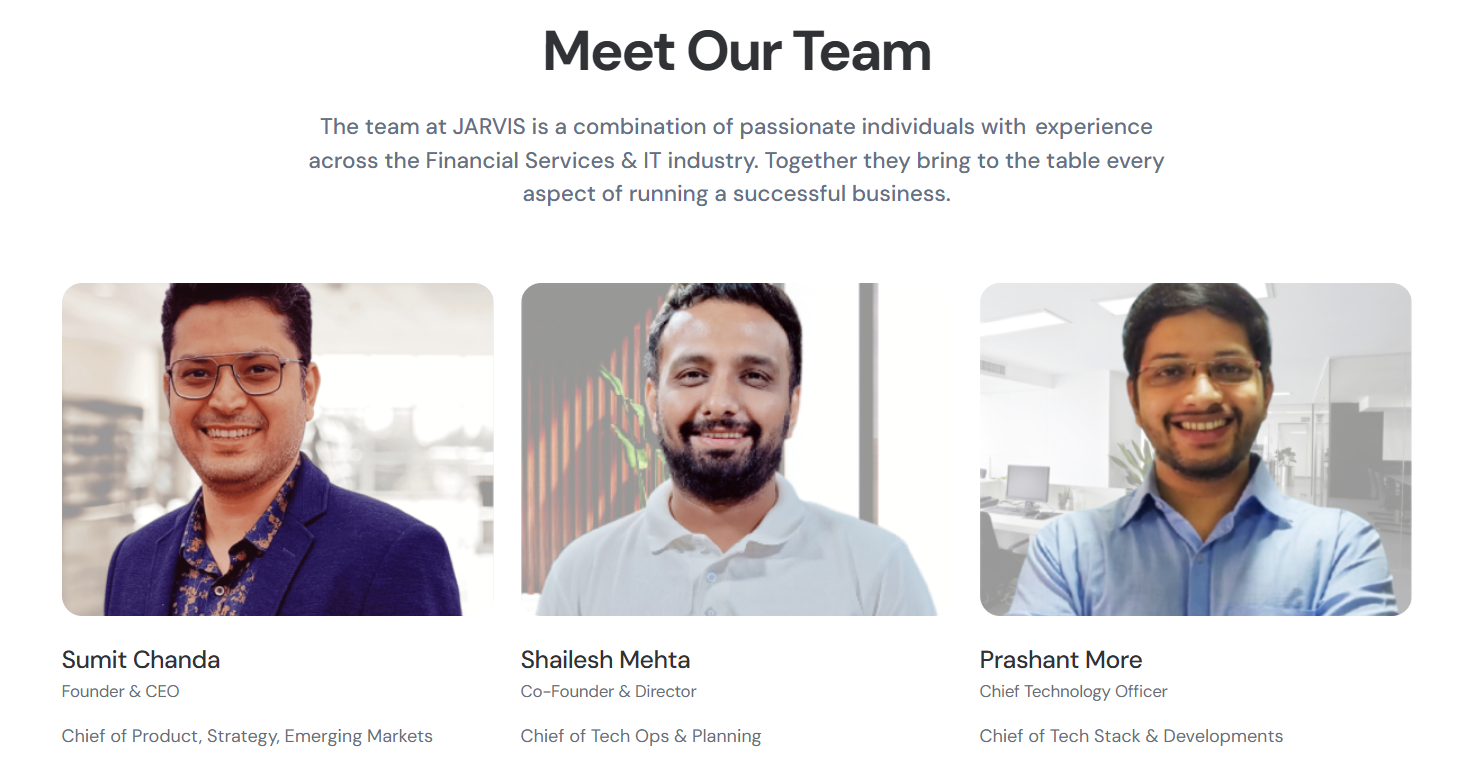

The team behind JARVIS is a combination of professionals with experience across the financial services and IT sectors. Founder and CEO Sumit Chanda has over 18 years of experience in the banking, financial services, and insurance (BFSI) industry and has previously worked with the likes of ICCI Prudential Life Insurance and PNB MetLife.

Co-founder and Director Shailesh Mehta acts as the Chief of Tech Opps and Planning, while Prashant More serves as the Chief Technology Officer and has previously worked with brands like Maple, Micromax, Oneplus, and more. CMA and CS Advocate Shreerang Ketkar serves as the Chief Compliance Officer for JARVIS and looks after SEBI and statutory compliance.

How does JARVIS Work?

JARVIS Invest is using artificial intelligence to assist investors in making informed choices by analyzing 12 million financial parameters to build and manage a customized portfolio, with an inbuilt 24X7 risk management system to mitigate the risk in its portfolios. The platform creates a unique equity portfolio for each user based on individual risk profiles, investment horizons, and investment amounts. Additionally, the AI model keeps a round-the-clock watch on the investor portfolio to mitigate the possible risks involved at the earliest instance. Further, the platform recognizes patterns and commonalities in investor portfolios and keeps on analyzing market trends to identify and recommend money-making opportunities that match the interests of the investor.

You need a trading account and a demat account to execute trades and make investments as recommended by the platform. However, there is no need for a new or separate trading and demat account, as JARVIS has partnered with top brokers in India, allowing you to incorporate your existing accounts into the platform.

JARVIS allows the investor to choose between two investment strategies. The investor can choose either a Complete Equity Strategy, where the portfolio will consist only of equity stocks, or an Asset Allocation Strategy, where the portfolio will be a combination of Equity, Liquid BeES, & Gold BeES. JARVIS works on a predictive analysis model that predicts the stock’s movement over various time horizons. The final combination of the stocks recommended by the AI model is created keeping in mind the investment horizon along with the investor’s risk profile and investment amount. The 24/7 Risk Management System that tracks the portfolio once invested also factors in the investment horizon before recommending any changes. Besides creating personalized portfolios, the 24X7 inbuilt risk management process helps to protect the portfolio from volatile markets based on the user’s risk profile. The investor is free to choose his/her risk profile; however, the platform’s risk questionnaires help accurately reflect one’s risk profile.

As an investor on the platform, you are required to enter into an agreement as required by SEBI with the parent company, Ventugrow Consultants Pvt Ltd., which outlines details of the scope of the advisory provided by JARVIS and the associated costs.

Let’s have a look at the different products offered on the platform based on the services offered and their associated costs.

Products on JARVIS Invest

JARVIS offers three different products. Let’s have a look at each of their key features.

-

Jarvis Portfolio

Jarvis Portfolio allows you to build and manage an AI-powered equity portfolio with an inbuilt 24X7 risk management process. The portfolio curated is unique for every investor based on the individual investment style, investment horizon, and risk tolerance of each investor.

For Jarvis Portfolio, users need a minimum investment amount of Rs. 30,000 and it can go up to Rs. 25 lakhs. The average tenure of investment portfolios on the platform is between 4 to 5 years. Even though the portfolios offered by JARVIS do not have a lock-in period, investors are advised to stick to the recommended investment tenures to get the best results.

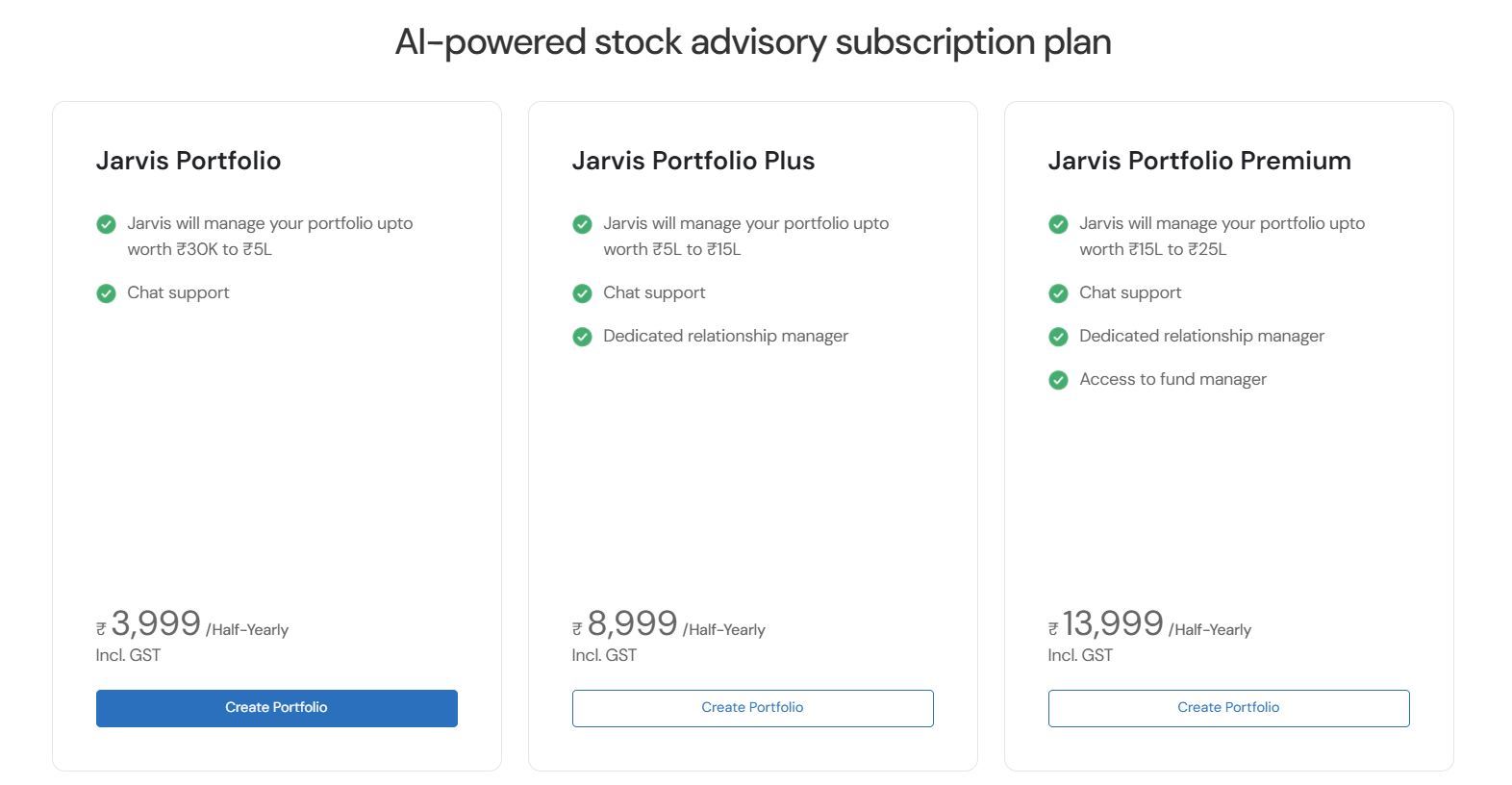

The three different subscription plans offered under Jarvis Portfolio are as follows:

-

Jarvis Protect

Jarvis Protect helps you book profits and cut losses from the stocks from your underperforming stock portfolio to make the most of your existing investments. This product is for investors having underperforming portfolios with at least five stocks. There is no minimum investment tenure or minimum investment amount. Jarvis Protect helps you understand the right time to exit from a stock. It gives you timely alerts about when to realize profits or cut losses from specific stocks.

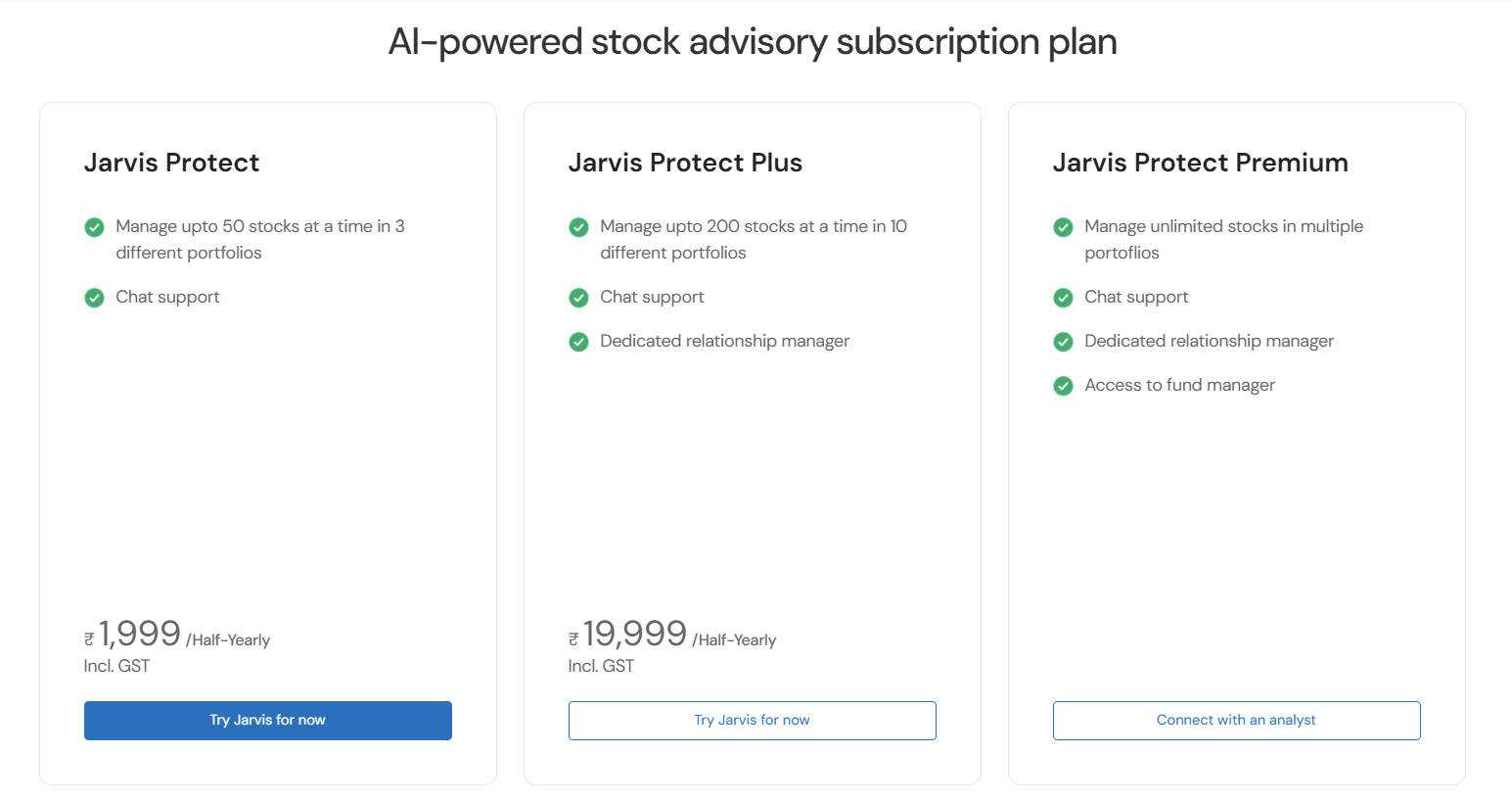

The following are the three different subscription plans under Jarvis Protect:

-

Jarvis One Stock

Jarvis One Stock lets you book profits from individual stocks in the short term of 15 to 30 days. It gives you stock alerts to book quick profits in the short-term for one stock. This feature is especially beneficial for short-term investors who are looking to book profits on a monthly basis. The platform gives you timely notifications to buy stocks and about when to sell it to realize short-term gains.

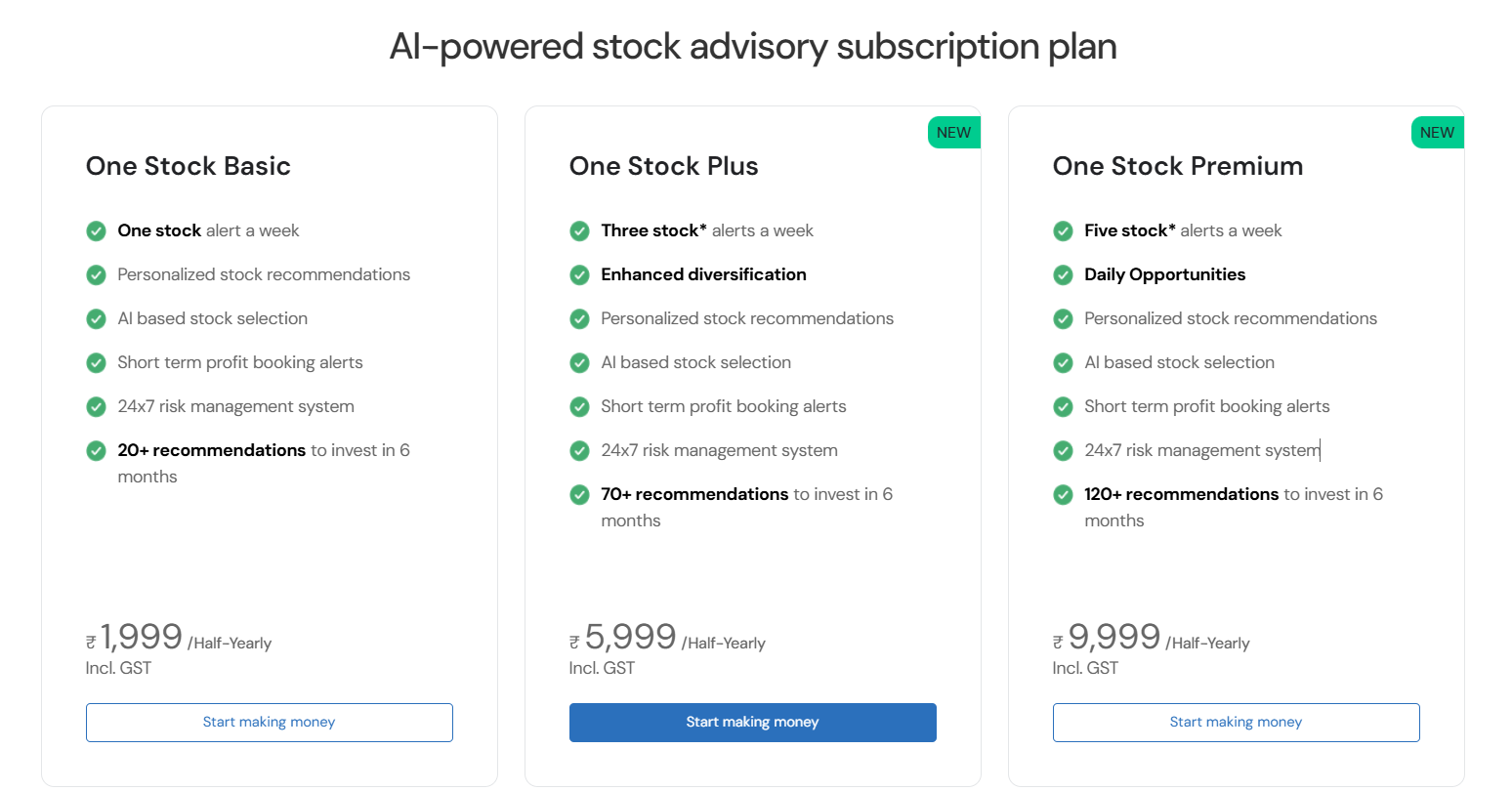

The following are the three different subscription plans available under Jarvis One Stock with features ranging from one stock alert a week to up to five stock alters a week:

Drawbacks of AI Stock Advisory Services

While AI stock advisory platforms offer convenience and data-driven insights, they come with potential drawbacks.

One major concern is the reliance on historical data, which may not accurately predict future market trends, especially during periods of significant volatility or unprecedented events.

Additionally, AI algorithms can be susceptible to biases present in the data they are trained on, leading to potentially flawed recommendations. Furthermore, these platforms often lack a nuanced understanding of human emotions and market psychology, which can significantly impact investment decisions.

Investors should exercise caution and consider these limitations before solely relying on AI-powered advice. Besides, the use of AI in stock investing is still at a very nascent stage, and the technology is likely to take time to mature into a more efficient and robust investing tool. It’s advisable to complement AI insights with thorough research, expert opinions, and a sound understanding of personal financial goals and risk tolerance.

JARVIS Invest Alternative

While JARVIS Invest brings something new and fresh to the Indian stock investing ecosystem, there are others offering similar services as well.

-

Liquide

Liquide is one such platform that offers AI-powered and expert-supervised market advisory services.

Unlike JARVIS, Liquide offers several other services than solely focusing on AI-based stock recommendations and advisory. Liquide simplifies portfolio tracking and management, identifies concerns, and provides detailed performance insights. While JARVIS only allows you to curate Equity, Liquid BeES & Gold BeES portfolios, Liquide also allows you to track and manage your mutual fund portfolios. Besides the AI Assistant feature, Liquide also offers intraday, short and long-term stock trade recommendations curated by SEBI Registered Experts, along with automated BUY/SELL alerts and different trading tools.

Detailed review of Liquide app

-

Bigul

Bigul offers an AI-Powered Stock Advisor designed to analyze the market and backtest investment strategies using large datasets under various conditions. Bigul’s AI-Powered Stock Advisor is powered by JARVIS and offers similar services, including AI-based stock recommendations, Portfolio management, and Risk management process. However, besides AI Advisory, Bigul also offers services in the domain of algo trading, offering automated trading strategies. The platform also offers Stock Baskets, which are designed based on thematic criteria using automation for curating stock baskets.

People interested in creating their own trading rules can check out Tradingview.

Fundamental Investors can check out this article.

Conclusion

Data significantly drives financial markets. Everything from price history to technical charts and financial reports of individual companies. It is not humanly possible to analyze and draw conclusions from the gazillion of data dominating the world of investing. This is where advanced technologies like Big Data and Artificial Intelligence can step in to provide market insights. However, it is crucial to take such insights with a pinch of caution and to apply your own mind. JARVIS Invest brings innovative AI-based stock recommendation and advisory solutions for retail investors in India who do not have the time or requisite knowledge to manage portfolios on their own. While the platform offers innovative and promising products, it’s better to exercise caution and get help from professional advisors.

Want to explore other investment platforms . Check below