Leverage is a powerful concept in finance, used by individuals and institutions to amplify their investment outcomes. From large corporations funding new projects with borrowed capital to real estate investors using mortgages, leverage is everywhere in the financial world.

At its core, leverage means using borrowed money to amplify the potential returns on an investment. Banks use it to fund expansions, businesses use it to boost growth, and real estate investors use it to buy properties they otherwise couldn’t afford. For retail investors, the same principles can be applied to boost potential returns, provided the risks are managed wisely. By borrowing money or using financial instruments that offer exposure beyond their cash investment, retail investors can potentially accelerate their wealth-building journey. However, while leverage can multiply gains, it can also magnify losses, making it essential to understand how and when to use it.

In this article, we’ll explore what leverage means in investing, how renowned investors have used it, and how everyday investors can tactically employ leverage to enhance their portfolios.

What is Leverage in Investing and Trading?

Leverage, in simple terms, means using borrowed money to increase the potential return of an investment. It allows investors to control a larger position in an asset than they could with their own capital alone.

In finance and especially in investing, leverage is commonly used in several ways. For example, in real estate, investors often put down a fraction of a property’s value as a deposit and finance the rest with a mortgage. If the property appreciates, the return on the investor’s initial equity is amplified, as they benefit from the gain on the entire property value, not just their own cash investment. The same principle of using leverage in real estate can be modified and applied to equity investments. Instead of taking big risks on volatile stocks, you can use moderate leverage to invest in beaten-down but fundamentally strong indices or blue-chip stocks. This way, you’re not betting on risky assets, but using leverage to amplify returns from safer investments.

In the stock market, leverage is commonly used through margin trading. Here, an investor puts up a portion of the trade’s value (the margin) and borrows the rest from a broker. For example, if you have ₹10,000 and use 2:1 leverage, you can buy ₹20,000 worth of shares. If the stock rises, your gains are doubled, though losses are also magnified.

Another example is Loan Against Securities (LAS), where investors pledge existing shares or mutual funds as collateral to borrow money, which can then be reinvested. This allows investors to access liquidity without selling their holdings, and potentially earn higher returns if their investments perform well.

Leverage is also integral to derivatives trading, such as futures and options, where you can control large contracts with a relatively small upfront margin. These tools let investors speculate or hedge with much greater exposure than their actual cash outlay.

While leverage can boost returns, it also increases risk. If the investment moves against you, losses can exceed your initial investment. That’s why understanding how leverage works and using it judiciously is crucial for every investor.

How Famous Investors Use Leverage

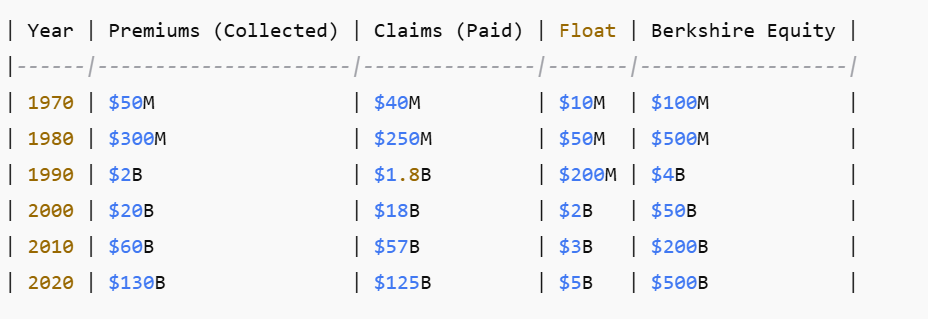

Many of the world’s most successful investors have used leverage as a key part of their strategy. Warren Buffett, for example, is renowned for his disciplined use of leverage. Through Berkshire Hathaway, Buffett has long used insurance “float”—the pool of premiums collected before claims are paid—as a low-cost source of funds to invest. According to research, Berkshire typically leveraged its capital by about 60%, significantly boosting returns. This “double leverage”, borrowing at the company level and using insurance float, has been a major factor in Buffett’s exceptional track record, allowing him to invest larger sums and compound returns over decades.

Buffett’s approach highlights the power of using cheap, stable sources of leverage to enhance long-term returns, as long as the risks are carefully managed and the investments are sound.

An example of how Buffett used Leverage

What is Insurance Float?

Float is the money an insurance company holds between the time it collects premiums and the time it pays out claims. During that time, the insurer can invest this money.

-

Customers pay premiums now.

-

Claims are paid later.

-

In the meantime, that money can be invested, and Buffett has done that better than anyone

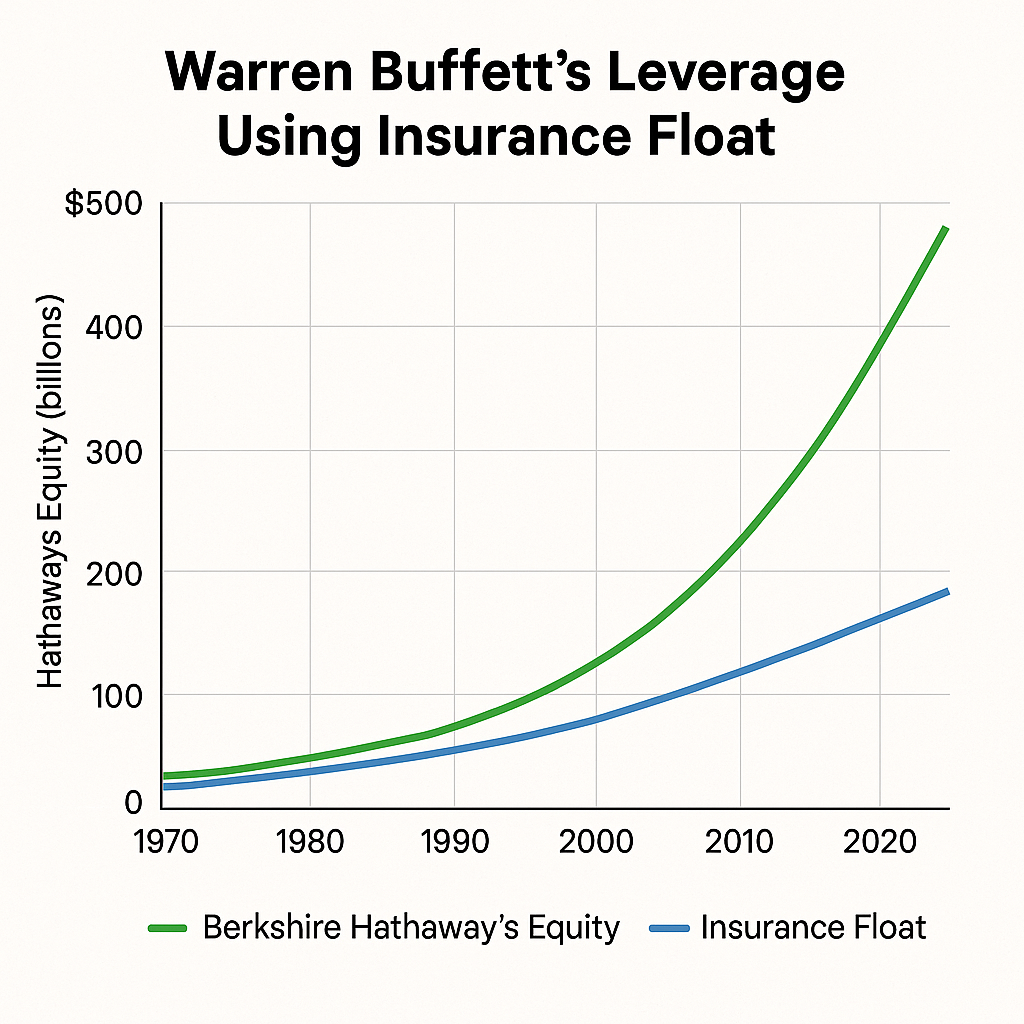

Visual Graph: Buffett’s Leverage via Float

Let’s visualize this simplified over time.

Why It’s Leverage

Buffett gets to invest with money that doesn’t belong to him (yet) — and sometimes he even gets paid (via underwriting profits) to do it.

Traditional Leverage = Borrowing at X% to earn Y% return

Buffett’s Float Leverage = Holding billions in float at ~0% cost, investing it for ~10%+ returns

Key Points

-

Buffett’s success isn’t just stock picking — it’s capital structure mastery.

-

Float acted like an interest-free loan.

-

If underwriting is profitable, the float is better than free.

How Leverage Can be Used by Retail Investors

Leverage isn’t just for Dalal Street titans or financial institutions; retail investors have several ways to tactically use leverage to enhance their portfolios. Let’s explore the most practical methods, their benefits, and how much leverage is appropriate.

-

Margin Trading in Equities

The most direct way for retail investors to use leverage is through margin trading. Here, you borrow funds from your broker to buy more shares than you could with your own money. For example, with ₹1 lakh and 5:1 leverage, you can control ₹5 lakhs worth of stocks. If your chosen stocks rise by 10%, your gains are multiplied, but if they fall, your losses are also magnified.

Margin trading is best suited for short- to medium-term strategies and should be used with strict risk controls, such as stop-loss orders. It’s important to remember that brokers will require you to maintain a minimum margin; if your investments drop in value, you may face a margin call and be forced to add more funds or sell assets.

-

Loan Against Securities (LAS)

Another popular strategy is taking a loan against your existing stocks or mutual funds. This lets you unlock liquidity without selling your holdings, which can be especially useful if you want to reinvest or need funds for other purposes. The interest rates on LAS are typically lower than personal loans, and you continue to earn returns on your pledged assets. However, if the value of your pledged securities falls, you may need to provide additional collateral or repay part of the loan.

Unlike margin funding, LAS can be used for different purposes also than just stock trading.

-

Leveraged ETFs and Derivatives

Retail investors can also access leverage through financial products like leveraged Exchange-Traded Funds (ETFs), mutual funds, futures, and options. Leveraged ETFs aim to deliver multiples of the daily performance of an index, using derivatives and debt.

For example, a 2x leveraged ETF aims to deliver twice the daily return of its underlying index. These products can be useful for tactical plays, but they’re best suited for experienced investors due to the compounding effects and higher volatility.

However, in India, Leveraged ETFs are not available!

Private Equity Replication with Publicly Traded Stocks

Research by Harvard Business School shows that replicating Private Equity (PE) with publicly traded small-cap value stocks and modest leverage produces comparable returns to gross PE index returns.

Private equity replication with leveraged small-cap value stocks is an investment strategy that aims to mimic the returns of PE funds by building a public market portfolio of small and mid-sized companies that share similar characteristics to those targeted by private equity, such as low valuations and higher leverage. Instead of investing directly in PE targets, investors use a systematic approach to select publicly traded stocks, typically smaller firms with strong value metrics and higher debt levels, and may apply additional financial leverage to these holdings to further align the risk and return profile with that of PE deals.

This method offers the potential for PE-like returns but with greater liquidity, lower fees, and easier access compared to traditional PE funds, making it an attractive option for investors seeking similar benefits without the complexity and high costs of direct PE investing.

How Much Leverage Should You Use?

The amount of leverage you should use depends on several factors: your risk tolerance, investment horizon, market outlook, and the cost of borrowing. Financial advisors often recommend starting with modest leverage—typically no more than 20-30% of your portfolio value—to avoid excessive risk.

It’s also wise to apply leverage to diversified portfolios rather than individual high-risk assets. This approach can improve your risk-adjusted returns, as the impact of any single investment going wrong is reduced. Using leverage on an index is sometimes compared to building a large individual stock position because both approaches can result in outsized gains or losses due to amplified exposure. However, leveraged index investing still benefits from diversification, whereas individual stock positions are exposed to both market and company-specific risks.

Suppose you have ₹10 lakhs and use 1.5x leverage to invest ₹15 lakhs in a diversified index fund. If the index rises by 10%, your portfolio grows to ₹16.5 lakhs. After repaying the borrowed ₹5 lakhs (plus interest), your net gain is higher than if you had invested only your own capital. However, if the index falls by 10%, your losses are also amplified.

Benefits of Using Leverage in Portfolio

Using leverage in an investment portfolio can offer several compelling benefits:

- Enhanced Returns: Leverage allows you to amplify gains on your investments, potentially achieving higher returns than with your own capital alone.

- Access to Larger Opportunities: It enables you to invest in high-value assets, such as real estate or blue-chip stocks, that might otherwise be out of reach.

- Capital Efficiency: By using borrowed funds, you can free up your own capital for other investments or needs, improving overall portfolio efficiency.

- Diversification: Leverage can help you diversify your portfolio by allowing you to take multiple positions across different assets, reducing concentration risk.

- Liquidity: Tools like LAS provide liquidity without requiring you to sell your investments, which can be tax-efficient and convenient.

How to get LAS in India quickly?

There are many banks and NBFCs that provide LAS, such as Bajaj Finance etc. However, based on my personal experience, convenience and speed matter more than a slight difference in rate if the requirement is leverage.

Let’s take the recent Nasdaq crash when the market fell 25% in a week and recovered 10% in a week. We have 2 platforms

- A with a 9% LAS rate but 7 days to credit

- B with 10% LAS rate but 1 day to credit

Nasdaq recovers 10 % in a week. Interest rate difference between 2 platforms = 1% *

7/365 = .02% approx, about INR 2,000 for 1a Cr loan, while the opportunity cost loss would be INR 10 lakh in platform A.

Volt Money provides an instant and hassle-free credit line. Detailed article on using Volt Money.

Conclusion

With interest rates relatively low and a wide range of tools now available, this is an opportune time for investors to consider using leverage thoughtfully in their portfolios. When applied prudently, leverage can help enhance returns, improve portfolio efficiency, and accelerate wealth creation. However, it’s essential to understand the risks, start with modest leverage, and focus on diversified investments.