But in 2025, is Finviz still worth using? This comprehensive guide dives into everything Finviz offers — including its free and Elite plans — and compares it with other tools to help you decide if it’s right for your investing style.

What Is Finviz?

Finviz, short for Financial Visualizations, is a browser-based financial platform offering a wide suite of tools for:

- Stock Screening (fundamental and technical filters)

- Market Visualization (heat maps, bubble charts)

- News Aggregation

- Portfolio Tracking

- Technical Charting

It’s popular because it’s fast, intuitive, and requires no installation. While free users get access to most features, serious traders often upgrade to Finviz Elite for real-time data and deeper analysis.

✅ Finviz Free vs Finviz Elite: Side-by-Side Comparison

| Feature | Finviz Free | Finviz Elite |

|---|---|---|

| Screener | ✅ Limited real-time | ✅ Real-time, advanced filters |

| Charts | ✅ Delayed, static | ✅ Intraday, overlays, dynamic |

| Alerts | ❌ | ✅ Email alerts |

| Backtesting | ❌ | ✅ Strategy tester included |

| Data Delay | 15-20 mins | Real-time |

| Price | Free | $39.50/month or $299/year |

Verdict:

If you’re an occasional investor or long-term holder, the free version is powerful enough. But for active traders who need real-time scanning and alerts, Finviz Elite is a valuable upgrade.

⚖️ Who Should Use Finviz?

- ✅ Retail Investors: Use it to scan for undervalued or dividend stocks.

- ✅ Swing Traders: Great for momentum screeners and technical setups.

- ✅ Day Traders: Use Finviz Elite for real-time alerts and intraday charts.

- ✅ Fundamental Analysts: Quickly sort stocks by ROE, P/E, debt/equity, and more.

Finviz fits nearly all user profiles except for those who require automated trading execution — it’s an analysis tool, not a brokerage.

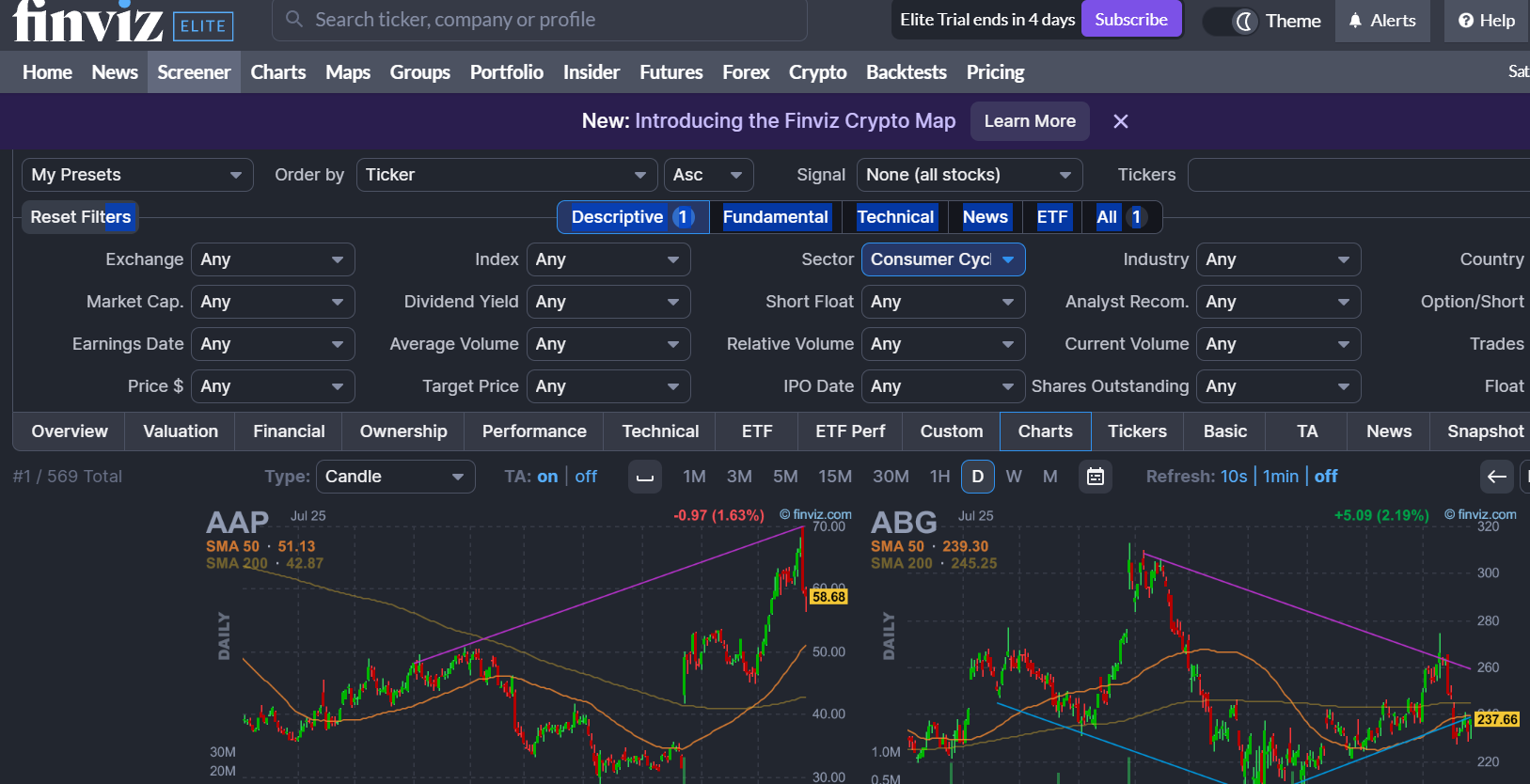

How to Use Finviz Screener Like a Pro

One of Finviz’s strongest features is its stock screener. You can filter stocks by over 60+ fundamental, technical, and descriptive criteria.

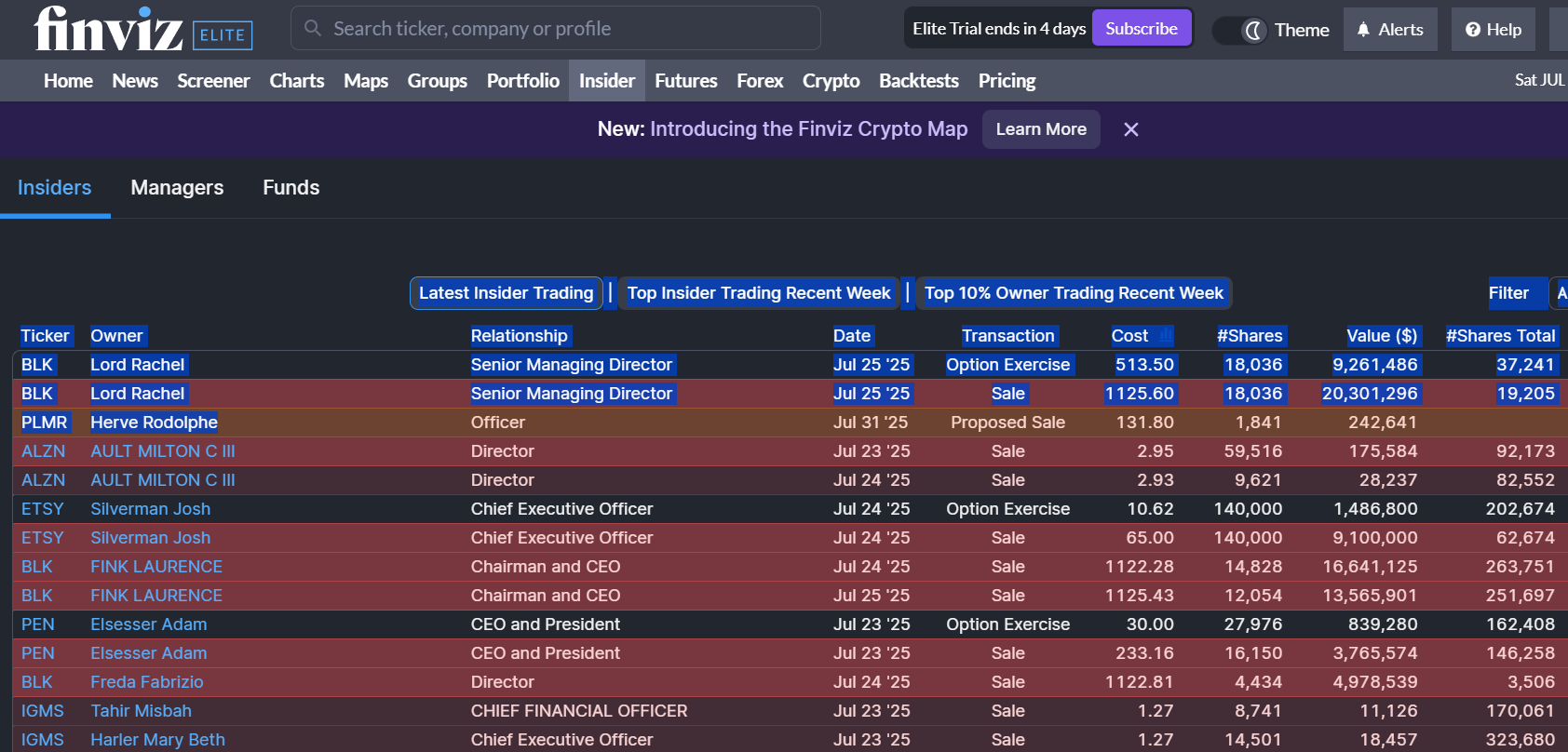

Example 1: Find Oversold Tech Stocks With High Insider Buying

Step-by-Step Setup:

- Go to Screener > All

- Set Sector: Technology

- RSI (14): Oversold (below 30)

- Insider Transactions: Positive

- Average Volume: Over 500k

- Price: Over $10

This type of scan can uncover potential rebound plays backed by insider confidence.

Example 2: Swing Trade Breakout Strategy

- Screener > Technical

- Price above SMA50 and SMA200

- Average volume: Over 1M

- RSI(14): Between 50–70

- Performance: Week +5% or higher

This setup can help identify momentum breakouts early in the trend.

Example 3: Value Dividend Stocks

- Market Cap: Mid ($2B – $10B)

- Dividend Yield: Over 3%

- P/E: Under 15

- Payout Ratio: Under 60%

Great for long-term investors looking for consistent dividend payers with upside potential.

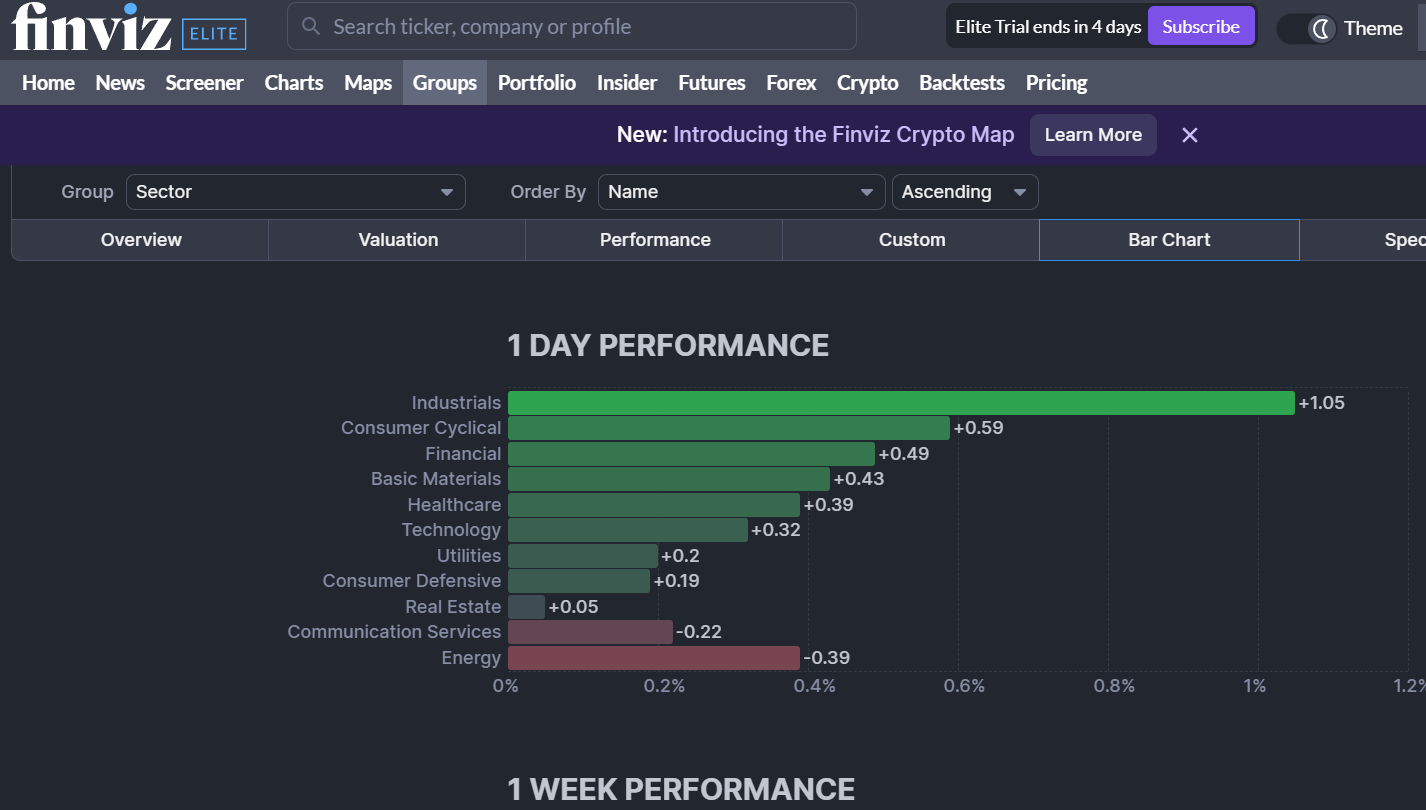

Finviz Heat Maps: Sector Performance at a Glance

The Heat Map is one of Finviz’s standout features. It gives you a quick overview of:

- Sector-wise performance

- Market breadth

- Stock price movement by market cap

You can filter it by:

- 1-Day Performance

- Week, Month, Yearly Trends

- Fundamentals (P/E, EPS, PEG)

- ETF-specific or S&P500-only views

This is incredibly useful for sector rotation strategies or just spotting which areas are outperforming.

Is Finviz Good for Technical Analysis?

Yes — especially in Elite.

Finviz offers charting with:

- Candlesticks, line, bar charts

- Indicators: RSI, MACD, Moving Averages, Bollinger Bands

- Drawing Tools: Trendlines, channels, support/resistance

- Intraday (1/5/15/30 min) charts in Elite

While it’s not as advanced as TradingView or Thinkorswim, Finviz charts load extremely fast, which is perfect for pre-market or end-of-day analysis.

Real User Reviews (from Reddit, Twitter, and Forums)

“Finviz Elite is the only tool I use daily. I have custom alerts set for all my swing trade setups. The speed and filtering options are unmatched.” — @TradeTactician (Reddit)

“I use Finviz free to track macro trends with heatmaps and find growth stocks under the radar. For a free tool, it’s incredibly powerful.” — @JeffTrades (Twitter)

“If you’re serious about trading, get Elite. Real-time filters helped me catch 3 earnings breakouts this quarter alone.” — @MarkVincent (Quora)

These reviews highlight why Finviz has such a strong and loyal user base, especially among DIY traders.

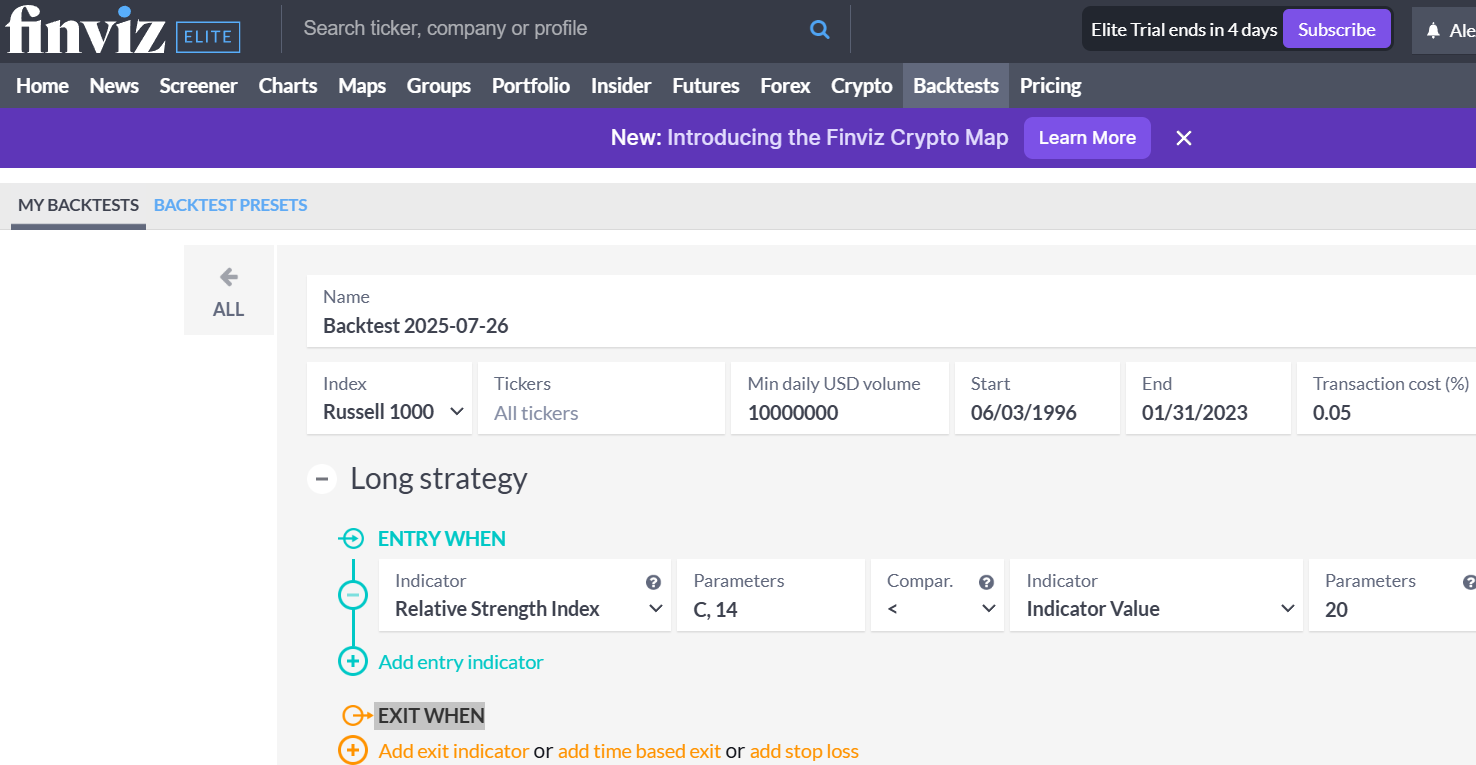

✨ Finviz Elite Features: Are They Worth It?

If you trade regularly, Finviz Elite pays for itself. Here’s what you get:

- ⏱ Real-time Screener: Find setups as they happen, not delayed.

- ✉️ Email Alerts: Get notified when stocks hit key technical or fundamental levels.

- Advanced Charting: Intraday data + overlays and patterns.

- ⚖️ Backtesting Tool: Test strategies like “RSI cross + MACD divergence.”

- Correlation Tool: Great for hedging and pair trading.

For under $1/day (annual plan), Elite is one of the most affordable premium tools for retail traders.

Finviz vs Competitors (2025 Edition)

| Tool | Best For | Real-Time? | Price | Notable Features |

| Finviz | Screener + Heatmaps | Elite only | Free/$39.50 | Visual filters, news, charts |

| TradingView | Technical analysis | Yes | Free/$14+ | Best charting + Pine Script |

| CheddarFlow | Options flow | Yes | $85/month | Dark pool & unusual flow |

| MarketSmith | Fundamental investing | Yes | $1,500/yr | IBD ratings & stock ideas |

| StockRover | Deep fundamental research | No | $7.99+ | Custom metrics, scoring |

Using Finviz for Options Trading

Finviz isn’t built specifically for options trading, but it’s a great first step in the process:

- Use the screener to find high IV (implied volatility) stocks.

- Filter earnings stocks or breakout setups.

- Then export the list to your options platform (e.g. TOS, Interactive Brokers) to structure verticals, spreads, or earnings trades.

Combining Finviz with tools like OptionsStrat or CheddarFlow makes for a powerful options research setup.

Pros & Cons

Pros:

- ✅ Blazing-fast screener with 60+ filters

- ✅ Visual heat maps and charting tools

- ✅ Trusted by millions of users

- ✅ Affordable Elite plan

- ✅ Combines fundamental + technical filters efficiently

Cons:

- ❌ No mobile app

- ❌ Charts aren’t as customizable as TradingView

- ❌ No direct brokerage integration

- ❌ No true multi-leg options analysis

❓ FAQs

Is Finviz accurate? Yes. Finviz sources data from Nasdaq, NYSE, and SEC filings. It’s highly trusted by retail and institutional users alike.

Is Finviz good for day trading? The free version is limited, but Elite is ideal for scanning and alerting real-time breakouts.

Can I screen penny stocks on Finviz? Yes. Use filters like price < $5, volume > 1M, and float under 100M.

What is the best Finviz screener strategy? A combo of price breakout + volume spike + insider buying is a powerful screen.

Does Finviz work for crypto or forex? Finviz now includes futures and forex data, but it’s not optimized for crypto trading yet.

Final Verdict: Is Finviz Worth It in 2025?

Absolutely. Finviz continues to lead as one of the fastest, most intuitive, and cost-effective stock screeners in the world.

- ✅ Use the Free version for long-term investing and heatmaps.

- Upgrade to Elite if you trade actively, need alerts, or want intraday scanning.

Rating: ⭐⭐⭐⭐⭐ (4.8/5)