How many of us are always scared of losing our job while a huge mortgage is hanging like a sword of damocles over our head.

One of the main purpose of investing is to achieve a decent corpus which can help us to be financially Independent. Lot of people in pursuit of this invest based on retirement goals. Theoretically it sounds like a good plan but there are lot of practical shortcoming in it.

One important mistake people make is they think Financial independence is a binary process and on a certain date they will have a certain amount in their bank account and get an epiphany to quit their job. Alas it’s not how it happens in reality as our expense keep changing throughout our life and it’s impossible to plan 15 years in advance .Also until we have enough passive income to pay our expenses retiring is a sweet dream

How many of us had imagined what we are doing today 10 years back. Maybe some of us who had impeccable foresight but not the majority.

So how do we go about planning our Financial Independence?We will realize how important asset allocation is in this process!

3 most important things which will be the primary driver in this are:

- At what Rate we grow our earning

- How much we Save

- How fast we replace our active Earning with passive Earning.

The first point depends on growing yourself which is beyond the scope of investment advice.

Saving is more important than investment. A penny saved is a penny earned.How being cognizant about your savings can drastically improve your chances of early financial freedom can be understood in detail from this article.Insurance(both health and Life are a must)

When we have replaced all our money requirement through passive income is the day when we would be 100% independent.

So instead of categorizing ourselves as Independent or Not we will assess what percentage of Independence we have achieved!

I will illustrate it with example :

For our Calculations I will assume that the person is 35 years old ,Earning around 20 Lakhs per annum after tax and say 30000 PF every month and has amassed a corpus of 30 lakh by now.

People can use this as a benchmark and change the numbers based on their current status.

Scenario I : Conventional Goal Based Approach

The issue with goal based approach is that we use our knowledge of historical performance of mutual funds and put the number say 13% in our calculation.

The number is the average performance of the stock market when it is held for a very long time. It implies that there would be years of large draw downs and years of extraordinary gains.

We can not use this corpus to offset our liability in short period. There is always a mismatch between our Equity investment Tenor and our immediate monthly requirement for which we use active income to support

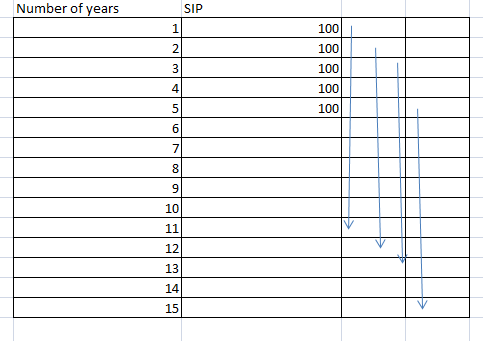

One thing people need to understand is that when they invest in SIP that each SIP is like a cashflow and each cashflow should atleast stay invested for 10 years to get close to historical average. It means that if you stop your sip by 40 years of age then by 45-50 age you should expect 10% Returns with a given confidence.

To understand volatility of Mutual Funds Read:

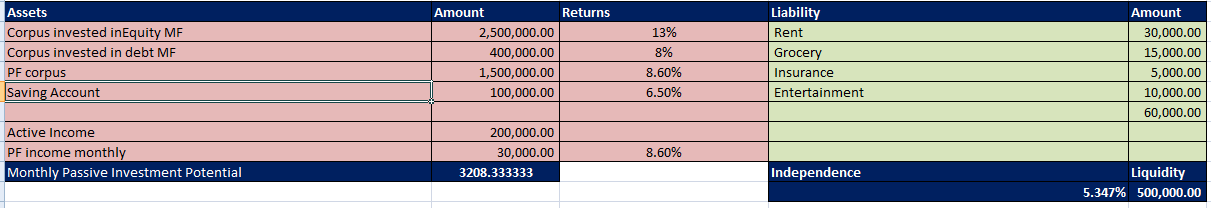

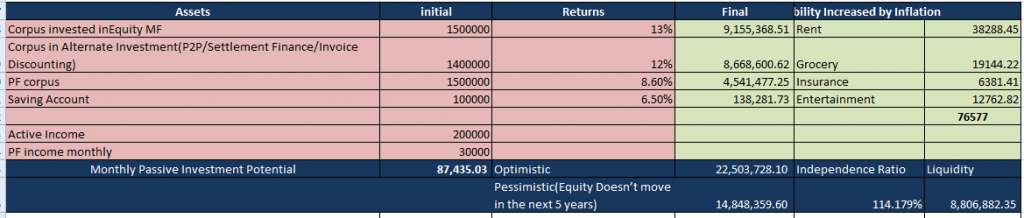

In our example we assume that out of 30 Lakh , he has put 24 Lakh in Equity MF and Rest in debt

I have calculated the Financial Independence Ratio

= Current interest Income/Current Liability

It means the money which I get from debt income and saving account ,which can be used immediately for offsetting my expenses and hence provide me independence

Now fastforward 5 years later. We assume the person invest 50% in debt and 50% in equity, salary remains same(hypothetical) and inflation stays 5% for the period.

As we can see in an optimistic scenario Equity gave 13% return and we ended up with 2.1 Cr. But in pessimistic Equity dint give return in the short run and we ended up with 1.3 Cr.

Though in the long run our equity will catch up but at this point our interest income can only offset 54% of our liability and we are nowhere near being Financially Independent.

Selecting Mutual Funds

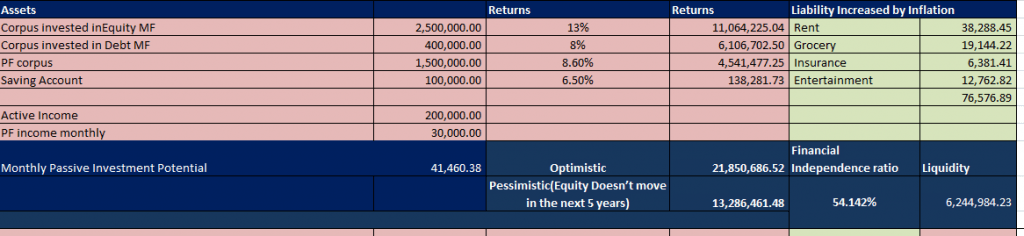

Scenario II: Offsetting Liability Base Approach

In this approach we put a part of money in Equity based products for long term capital appreciation and a part in alternate income generating assets to offset our liabilities and make us financially independent.

We take the same example as in our last approach

I have assumed my alternate will give me 12% interest. Historically my alternate portfolio has given north of 13% but I would prefer to take a more conservative approach.

To check out my alternate investment Portfolio read this:

2 things are evident:

- We have higher Independence ratio at 24%

- We have more liquid portfolio

Still we are a long way off from reaching full independence. Now 5 years later how will the portfolio look.

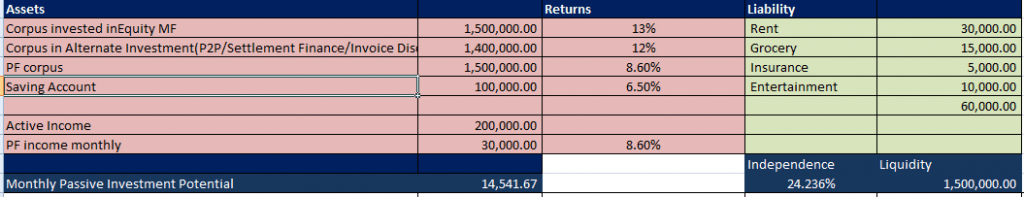

In 5 years we invested 50% of salary in alternate and rest in Equity MF.

In optimistic scenario as well as in the pessimistic we are better off than first scenario.

At 114% we are financially independent. Which implies that even without our current active salary we can manage through our interest income for months ,even years or we can pursue new opportunities even at lower income without the fear of meeting our day to day expenses.

Though the intention is not to be jobless but to have the peace that we can survive without a job for long duration! Offcourse if we just stop working or inflation will gradually wipe away our gains in the long run.

Actually this is the way how lot of NBFC make money, by giving retail loans, invoice discounting etc. They are highly leveraged hence they make more money ( also take much more risk).

Why does Alternate Investment provide higher Return than normal debt Funds?

The reason is most companies which raise money through debt are NBFC eg: HDFC , Bajaj Finance, Tata Capital etc.

They take money from you and pay 8-9% and lend it to either retail borrower or corporate borrower at 15-20% and profit from the difference.

With the rise of fintech we have eliminated the mid party(NBFC) and thus can get access to the end clients. If we manage diversification astutely it can become a great source of income

How much to put in Alternate Investment?

As a crude ballpark I consider alternate generating 1% per month (12% per annum) and Equity generating 1.1% per annun( 13.2% per annum)

The difference is Equity is locked for 10-15 years while alternate are for short term.Now 0 .1% is a lot in the long run so we should definitely have decent equity exposure.

When we are young and have no liabilities we can have say higher equity exposure and lower alternate and then gradually keep building alternate.

So if we have 20 K of expenses in a month we need to have approx 20L alternate investment to get 20K (1%) in a month to achieve Financial independence .

As our liability keep growing we also keep building alternates while equity will take of long term corpus building along with it.

Footnotes:

For alternate investment you can use these links

I2I Referral Link

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link

(Use Code MNJ6547)

Mail me to get Cashkumar Referral

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For other Invoice discounting platform ping me on 9967974993 or mail me on rohanrautela9@gmail.com

Alternative investments give 12%, but taxed normally, so, for 30% slab, the return is 8.4% only. But equities returns are not taxed (upto 1 lakh, 10% after that). So, isn’t alternative ones always giving less returns? Why didn’t you factor in tax?

I agree tax is a factor but tax is very subjective.

People who are retired dont have to pay tax.

People who have other tax liability can offset tax through alternate earning income !

Losses in derivative can lower your liability of long term tax.

People can invest through money gifted to parent who dont earn!

Tax optimization and final benefit/cost is at the hand of end user.