I have been investing in several alternative investment platforms across the globe to diversify and earn passive income. Over the last 5 years, I have generated a net return of >18% on my Portfolio of investments and trading strategies with calculated risk.

I share all my insights and firsthand experiences on this blog. If you are new to alternative investments, start with this post!

Join Telegram group or Whatsapp group for latest Deals

Follow our Youtube Channel for Insights on New Platforms

Alternative Investment Types in India

Generate 2-3x Returns then Fixed Deposits

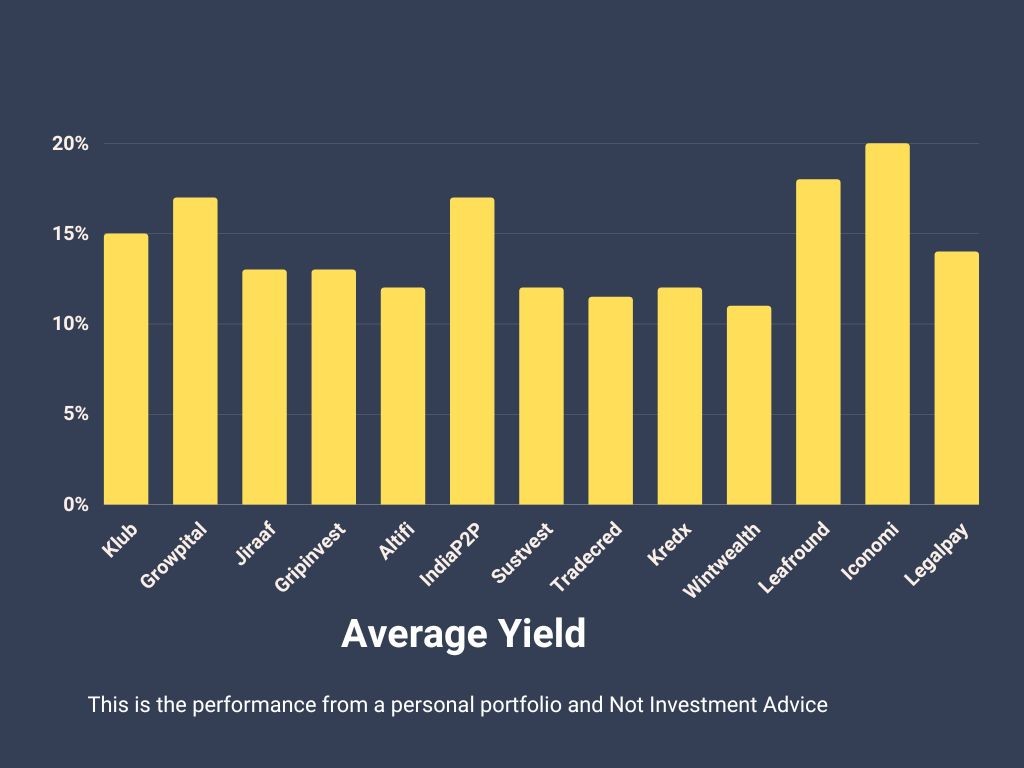

Ideal for beginners as a starting point. Someone who is from India and wants to create an alternative investment portfolio. The following are the top alternative investment platforms in India.

| Platform | Description | Minimum Investment | Avg Returns | Detailed Review |

|---|---|---|---|---|

| Jiraaf(Altgraaf) | All in one platform for Alternative Investment Opportunities-corporate bonds, invoice discounting, asset leasing, etc. | Rs.100000 | 12-20% | Jiraaf( Altgraaf) Review |

| TradeCred | Invest in invoices of bluechip companies | Rs.50000 | 12-13% | TradeCred Review |

| Tapinvest | Platform to Invest in Pre-Tax leasing, Invoice Discounting | Rs 50,000 | 12-20% | Tapinvest(LeafRound )Review |

| Grip Invest | Invest in physical assets like Ebikes, equipment's leased to startups and large companies | Rs.20000 | 12-13% (Tax Exempted) | Grip Invest Review |

| Wint Wealth | Invest in Covered Bonds offered by various regulated companies | Rs.10000 | 10-11% | Wint Wealth Review |

| Altifi | Invest in High Yield Bonds | Rs.5000 | 10-13% | Altifi Review |

| Klubworks | Revenue based financing to popular and funded Indian startups | Rs.250000 | 17-24% | Klubworks Review |

| Lendbox | P2P Loans, Invoice Discounting, Settlement Financing Opportunities | Rs.10000 | 10-14% | Lendbox Review |

Apart from the above-mentioned platforms, several other platforms and alternative Investment Strategies are worth investing in India. Most of them are listed below.

| Platform | Description | Avg Returns | Detailed Review |

|---|---|---|---|

| BetterInvest | Invest in Movie Rights (Use Code TXRHTH to get early access) | 18% | Betterinvest Review |

| Altius Investech | India’s biggest unlisted Shares platform | Equity Exposure | Altius Review |

| KredX | Invoice Discounting, Bonds and Digital Gold | 12-14% | KredX Review |

| Liquiloans | Secure peer to peer lending | 9-11% | Liquiloans Review |

| IndiaP2P | India's first P2P with physical branches and only women loan | 16-18% | IndiaP2P Review |

| ALTDRX | Buy 1 Square Feet of Land online | 12-20% | ALTDRX Review |

| I2Ifunding | Oldest P2P platform in India (Referral code discount50@i2i) | 13-16% | I2Ifunding Review |

Upcoming Platforms

Below is a list of new and upcoming platforms which can offer high returns. If you are already invested in Alternative Investments and are looking to add new products you can check out the below list.

| Platform | Description | Minimum Investment | Avg Returns | Detailed Review |

|---|---|---|---|---|

| Sustvest | Invest in Green Assets such as Solar Panels | Rs.5000 | 10-14% | Sustvest Review |

| Alyf | Fractional Holiday Homes Investment | Rs.10,00,000 | 13-17% | Alyf Review |

| Incred Money | Multi Asset Alternative Investing Platform | Rs.100,000 | 12-20% | Incred Money Review |

| Upcide | Fractional Assets Investment (use Promo code MR630878) | Rs.100,000 | 12-13% (Tax Exempted) | Upcide Review |

| Leasify | Leasing Investment with Pretax Return | Rs.100000 | 15-23% | Leasify Review |

| Wisex | Fractional Real Estate Investment(earlier Myre) | Rs.1000000 | 10-15% | Wisex Review |

| Capitall.Club | SME funding P2P | Rs.10000 | 15% | Capitall Club Review |

| LendPartnerz | Invoice discounting to blue chip companies | Rs. 100,000 | 15% | Lend Partnerz Review |

| 13 Karat | P2P platform with short term loans | Rs. 500 | 13% | 13Karat Review |

Borrow Against Mutual Funds

You can borrow against your mutual funds to meet liquidity or enhance returns based on your requirement. Check out the instant Eligibility Calculator

Algo Trading Strategies

| Month(2023) | April | May | June | July | Aug | Sep |

| Return | 2% | 1.30% | 1% | 4% | 5% | 4.50% |

Over the last 5 years, I have tested multiple algorithms for trading. The reason for options trading to generate yield is

- You don’t need to deploy cash, you can pledge your existing stocks and mutual funds to trade. It’s like zero-cost funding for your business

- You can generate returns in any market conditions, hence a bull market is not required.

- You can generate cash flow which can be deployed in long-term assets.

Below is the verified Performance of my portfolio. To get a detailed understanding of how I run the algo reach out on telegram

Investors interested in testing Algo trading with smaller capital can use Tradetron

Global Alternative Investments

Spread out risk and invest with alternative investment platforms across the globe

Suggested for intermediates once you have invested in the alternative investment funds in India mentioned in the previous section.

| Platform Name | Description | Minimum Investment | Avg Returns |

|---|---|---|---|

| EstateGuru | Europe’s best platform for Real Estate backed Lending | 50 Euro | 10-12% |

| Evostate | Aggregator of top Real Estate back Lending Platform | 50 Euro | 10-13% |

| Heavyfinance | P2P Loans secured by Farm Machinery | 50 Euro | 11-14% |

| Lendermarket | P2P Platform with Buy Back Guarantee and Short term loans | 10 Euro | 14% |

| PeerBerry | Another great P2P Platform with buyback guarantee | 50 Euro | 11-12% |

| Reinvest24 | Invest in fractional Real Estate in Europe | 50 Euro | 12-14% |

| Raison | Pre IPO investment in top global company | 50 Euro | 20-30% |

Investing in Crypto Currency

To invest in a cryptocurrency like Bitcoin, Ethereum, and several altcoins, you need to create an account with either one of the following crypto exchanges from India. Once you have made an account with the exchanges, deposit INR using your bank account, buy stablecoin USDT (similar to USD), and use it to buy/invest in crypto assets of your choice. You can also choose to copy top Altcoin traders or trade derivatives

| Name | Description | Detailed Review |

|---|---|---|

| Iconomi | Copy Top Traders Altcoin Portfolio automatically | Iconomi Review |

| Deribit | Crypto Option Trading Platform | Deribit Review |

| Binance | Largest Crypto Exchange |

About Me

The author is a finance enthusiast who enjoys exploring innovative asset classes and platforms. With an experience of 13+ years in derivative trading strategies, portfolio construction, derivative overlays, and quantitative tax optimization.

Also, join us on Facebook, Linkedin, Or Telegram to get constant updates on alternative investments in India and never miss a post!

Mail me your queries at info@randomdimes.com

*Please Note we do not provide any financial advice. The above reviews and investments are solely based on personal experience.