I have covered various high yielding assets which can be used in the portfolio to enhance returns. Most people do not know that they can use their existing long term stock or ETF holding to generate yield. One of the easiest strategy is called Buy Write.

This is a good strategy for people who think market have really heated up and they don’t expect a major bull run in next 6 -7 months .They are happy with a good 1.5% monthly income on the portfolio with some downside protection.

What is a Buy-Write Strategy?

Buy-write strategies, also known as covered calls, involve buying a stock (or ETF) and selling a call option with a strike price generally at or above the current price of the stock. If the stock price rises above the strike you are able to cover the option with the stock you own; if the stock price decreases or stays flat, the option expires worthless. Either way, you get to keep the option premium, which provides a source of income and leads to reduced volatility relative to owning just the stock.

Now lot of people get scared thinking of options as a nuisance. The truth is people lose money not because of the option structure but because of the leverage.

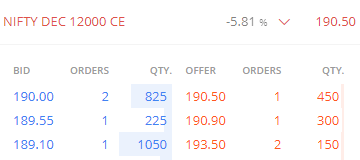

If we take the example of Nifty. One call option has lot size of 75. Which means if I buy a 12000 Strike CE my total exposure is 12000*75 = 900,000 INR. Therefor by using one option you can take lot of exposure ,hence if you take too much exposure you can lose or gain a lot!

If we take calculated exposure and create a strategy in line with our goal ,risk is minimal!

A Simplified Analysis of Buy-Write Strategy

To understand how these strategies work, let’s look at a simple buy-write strategy on the NIFTY 50 Index. In our portfolio, we will hold shares of Nifty and an equal amount of short call options.

So let’s say I have 900,000 worth of NIFTY ETF( 12000* 75= 1 lot of call option exposure at current Nifty value) in my portfolio or some large cap Nifty Mutual Fund of that amount. I will write one option every month

To simplify things further, we will consider market base as 10000 Nifty for the strategy. We will price the call options using the Black-Scholes formula with the Historical IV as an estimate of the volatility and the risk-free interest rate and NIFTY dividend yield. We will rollover the call options every month. On that day, we settle any currently outstanding call options and sell a new one-month call option. Selling the option generates a premium payment but does not change the portfolio value since we are now short the option. The proceeds from the sale are invested in high yield debt .Any P&L at the end of the month will be settled using a cash reserve we will maintain.

eg if we have 9 Lakh of Nifty 50 ETF .We sell a december 10000 call option. Premium would be approx 1.5% i.e

Three things can happen .

- Market stays around 10000

- Market crosses 10200

- Market goes below 9800

- Market stays at 10000. You make 1.5-1.9% monthly premium( around 18000 INR which you can invest in high yield assets)

- Market goes to 10200 . You make 150 point through premium. You lose 50 rs in call option .you make 200 points in Mutual fund(approx). In totality you made 150 points (50 points lower than if you had only MF)

- Market goes to 9800 . You make 150 points in premium. You lose 200 points in Mutual Fund. In total you lose just 50 points compared to 200 points in only MF position.

This would have given you an idea. In choppy market you make good monthly income. In bull market you make less than “Only MF position”. In bear market you save some downside!

Now if I do this strategy monthly how will I fare in various market? I will also compare it with selling Quarterly options also instead of Monthly(3 month maturity)

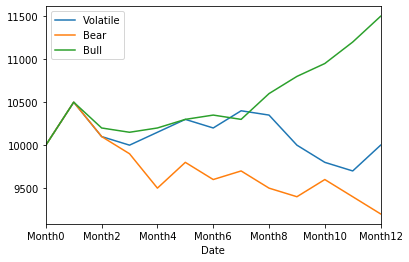

In the Bull scenario market goes up 15% while in bear market drops 8% in a year while in volatile market stays flat.

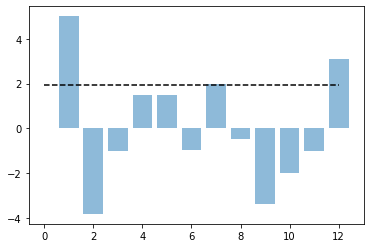

Volatile Market Buy Write Performance:

The Dashed line is the option premium. The Blue bars are underlying returns each month. It is evident that in only 2 scenario you ended up paying more than the option premium. In many months you pocketed full premium when underlying performance less than zero.

Total Return = Option Premium of 12 Months + Underlying Index P&L – short call option loss

= 23%+ 0%-13% =10% ( As market was choppy option were expensive and we got good premium selling it.

In total we made around 10% + dividend from underlying which is not bad for a year when our MF dint give any return.

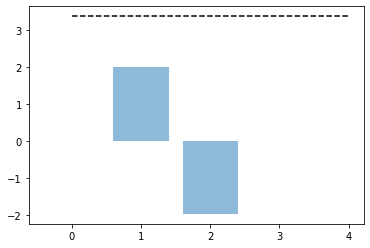

If we would have sold quarterly Options:

None of the quarter had higher returns then our premium .

Total Return = 13.4% -2% +0% =11.4%

It seems that quarterly strategy was more successful but the reason for that was the market was really very choppy and even though it dint move much over quarterly period( total premium is more in monthly but Index losses also high)

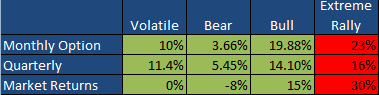

Similar Strategy for other markets will yield these results:

I have added one more scenario when Index moved 30% in a year to show this strategy will trail broad market in a one sided bull market!

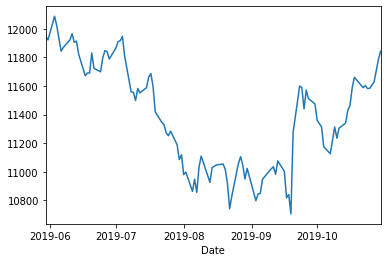

Let’s see how this strategy would have done in last 6 months which were pretty much volatile:

I have taken option and Index data from 29th May 2019 to 30th Oct and will cover 5 monthly options

Market was 2 % down for the period and was very volatile.

Let’s See the Option Premium we accumulated and losses we made in selling call options.

Option Premium for At the Money monthly options:

2019-05-30 197.95

2019-06-27 215.8

2019-07-25 170.35

2019-08-29 215.55

2019-09-26 399.45

Total Premium collected = 1200

Loss on short Option Position =

2019-05-30 0

2019-06-27 0

2019-07-25 0

2019-08-29 -621

2019-09-26 -18Market went down for the first 3 months suddenly spiked (After Tax Waiver was announced).

In total we made 560 points after factoring in the loss due to short option position.

Total Return = Option Premium – Option Loss + Index performance = 2.9%

So we made 2.9% in the month compared to loss of -2.2% of the underlying Index. Hence our strategy beat Index by 5.1% in 5 months which is a significant out performance!

Benefit: There are 2 major benefit of this strategy

- Income generation in choppy and uncertain market scenario

- Tax Benefit

One of the biggest benefit of this strategy is that you can offset all your losses in option Trading against any gains other than salary which means:

- Offset against short term capital gain (Debt and Equity)

- Long Term capital gain

- Alternate Investment gain(P2P,invoice Discounting,REIT)

- FD and saving bank Interest gains

Eg: if you made 50,000 loss in the financial year on your option Portfolio and your interest income for taxation is 60000 you can offset 50000 loss against it which means 15000 benefit in Tax!! You can carry forward loss to 8 years!

How to do it ?

Zerodha provides the perfect platform for it. In Zerodha you can buy Direct Mutual Funds for Free

You can buy ETF at zero brokerage cost

Now you can collateralize those ETF or a part of it which can be used as margin for Trading for just 60 bucks!

Converting long term Holding to Margin Collateral

setting up an account on zerodha is cheap and easy. You can use the link:

Buying and Selling Options is super easy:

Conclusion: This is one of the many strategy which can be used by investors to generate yield from their holdings. If you understand the rationale of doing it you will be happy with the outcome. When you become better at understanding mechanism of options you can implement more strategies using the long term holding collateral and generate more yield.

Eg selling Call Spreads , Put spreads, Iron Condor etc.

It’s important you start with the easy strategy and then gradually implement more complicated ones.

In USA you have many ETF embedded with this strategy

https://www.zacks.com/stock/news/295606/buywrite-etfs-for-a-topsyturvy-market

Footnotes:

To setup account on zerodha for low cost trading use

For alternate investment in P2P and Invoice Discounting you can use these links

(First Use the link to register then add the Code I2I50%DISCOUNT while paying to get 50% off)

Rupee Circle Referral Code- PIND145

Rupee Circle

LendenClub Referral Code – LDC11989

LendenClub

OMLP2P Referral Link OMLP2P

FinancePeer (Use Code MNJ6547)

Invoice Discounting Platform TradeCred Link:

https://buy.tradecred.com/onboarding/apply-now/TC0152

For other Invoice discounting platform ping me on 9967974993 or mail me on rohanrautela9@gmail.com