Does China’s ETF make sense? While the Indian economy has been working tirelessly towards achieving the $5 Trillion mark, our very rich neighbors – China – sit holding the 2nd rank only behind the obviously the USA. China’s Economy during the 1960s was said to be almost 5 times poorer than India’s economy but due to great decisions taken by their autocratic government, they soon shifted the course of the sea and jumped above India to now be almost 5 times richer than it. This highly functioning country has given many countries a run for their money and with a stable

GDP growth rate would be looking to continue this long-time trend. China is a growing influence on other developing economies through trade, investment, and ideas and this has caught investors’ eye compelling them to invest in the second-largest economy in the world, albeit diversification being a key motivator.

Economy and Financial centers of China

Sitting at an eye-watering – $18.32 trillion GDP, the world’s most populous country is also the world’s largest manufacturing economy and exporter of goods. China’s main sector contributors to GDP are – The Service Sector (51.6%), the Industrial sector (40.5%), and the Agricultural sector (7.9%).

Over the past few years, growth has moderated in the face of structural constraints, including declining labor force growth, diminishing returns to investment, and slowing productivity growth. The challenge going forward is to find new drivers of growth while addressing the social

and environmental legacies of China’s previous development path. Over the medium term, China’s economy continues to confront a structural slowdown. Potential growth has been on a declining trend, reflecting adverse demographics, tepid productivity growth, and rising constraints to a debt-fueled, investment-driven growth model. In the face of these challenges, macroeconomic policies need to be carefully calibrated not to exacerbate financial risks. Structural reforms are needed to reinvigorate the shift to a more balanced high-quality growth. China has three of its four stock exchanges, namely – Shanghai, Hong Kong, and Shenzhen – in the world’s ten largest stock exchanges by both market capitalization and by trading volume. Out of the three, the first two have a presence in the Indian investing circle through foreign funds, fund of funds.

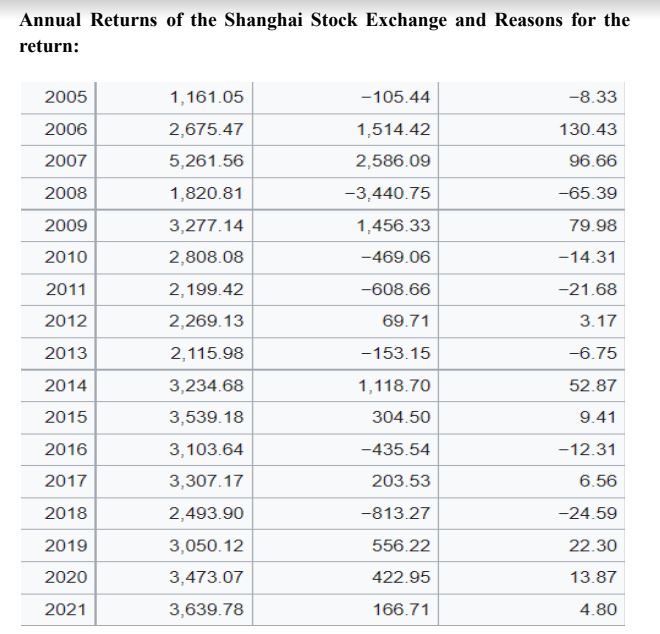

Annual Returns of the Shanghai Stock Exchange

A look at the Annual returns of the SSE Composite Index – The stock market index of all the stocks traded at the Shanghai Stock Exchange. The total profit return since 2005, starting without inflation and dividends, is 213.49% As we can see since 2005 the returns have seen tremendous ups and downs from as big as 130% to fall as much as 65% in a calendar year, the index as of the last closing has potentially given zero returns since 2009 or to give perspective, after the Great financial crisis.

The stagnancy as mentioned has been speculated to be a by-product of the way the Chinese Economy is crafted which is socialist in nature – it believes in increasing the wages of the laborers during times of bull runs and focusing on giving back to the public rather than focusing on the market capitalization of companies and its stock market. Another reason is that most investors feel the want and need to invest in the equity market if they see the future to be brighter and have increased profitability but a common hindrance that many investors feel will the colossal effect the Chinese government has on its economy, promoting and discarding any industry they feel like. China recently also shut down a lot of its industrial units and parks (No official figures) after it released its ‘zero-covid’ policy leading to a huge decline in exports.

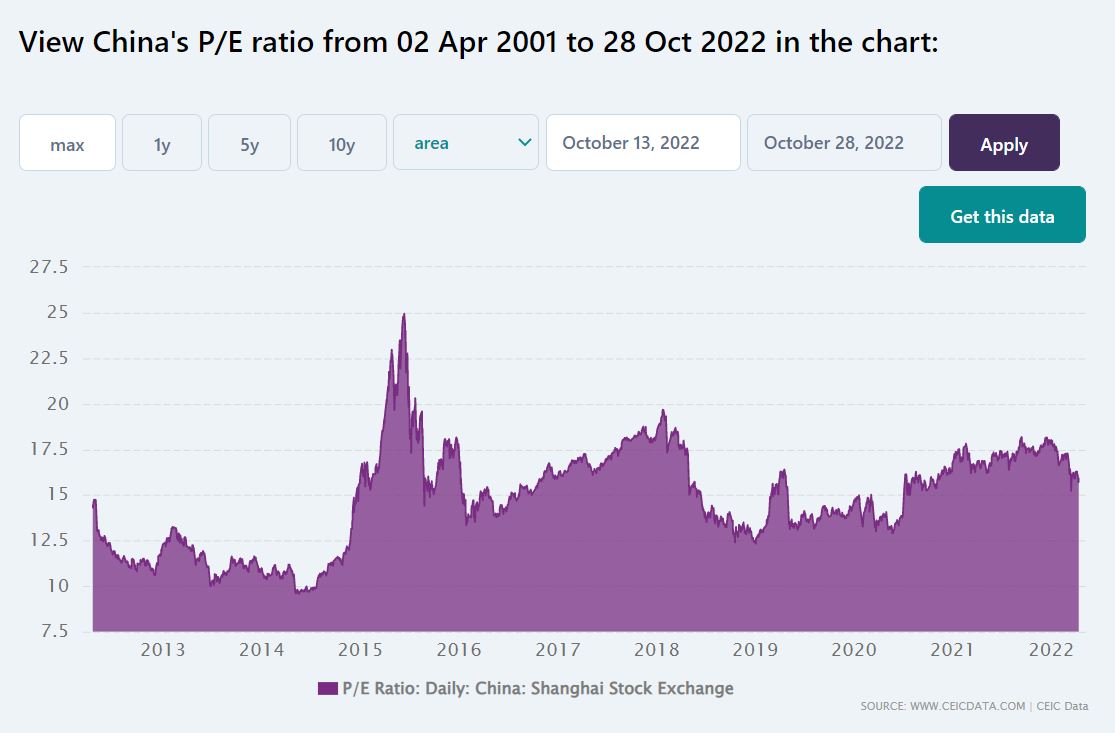

China ETF after market Crash in 2022

2022 has been a horrible year for the Chinese stock market. Hangseng is 35% down YTD and is the worst-performing benchmark in the world. The stock market is at 13 year low currently!

Some of the reasons for the crash are :

- Property crisis in China

- China Zero Covid Policy

- Distrust in their government effort

- Weather conditions leading to the energy crisis

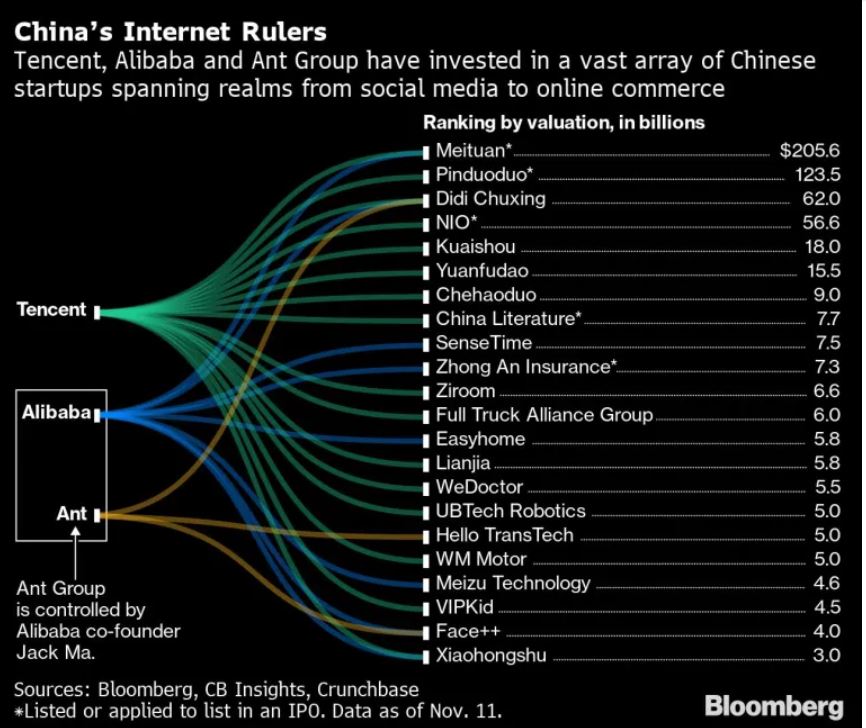

- China tech companies crash after the government went after Alibaba and Edtech companies.

For many investors, the volatility would be too much to digest but for investors, with a good risk appetite, this might seem like a long-term bet considering the stock prices are at attractive levels.

China ETF and Funds with exposure in China

Funds with exposure to china in the form of international funds or exchange-traded funds available to invest in India by Indian investors are given as follows:

Edelweiss Greater China Equity Off-Shore Fund

● Fund type – Fund Of Funds

● NAV – Rs. 29.049

● Fund Size – Rs. 1,440.8 Cr.

● Fund Statement – ‘An investment option enabling you to invest in good

companies from China, Hong Kong, and Taiwan.’

● Expense Ratio – 1.44%

● Past 5 Years return (Absolute) – 11.39%

● Past 10 Years return (Absolute) – 128.14%

● Portfolio – 99.81% in Mutual Fund units, namely – JPMorgan Funds – Greater

China Fund (Underlying Fund) and the rest in TREPS

● Sharpe Ratio – 0.89

● No. of Investors – 72,000+

Nippon India ETF Hang Seng BeES

● Fund type – Exchange Traded Fund

● NAV – Rs. 210.0159

● Fund Size – Rs. 109.1 Cr.

● Fund Statement – ‘The investment objective of Nippon India ETF Hang Seng BeES is to provide returns that, before expenses, closely correspond to the total returns of Securities as represented by the Hang Seng Index of Hang Seng Data Services Limited, by investing in the Securities in the same proportion as in the index. There can be no assurance or guarantee that the investment objective of the Scheme will be achieved.’

● Expense Ratio – 0.98%

● Past 5 Years return (Absolute) – -23.57%

● Past 10 Years return (Absolute) – 36.99%

● Portfolio – 99.17% in Stocks that are a part of the Hang Seng index in the same ratio as in the index and the rest in TREPS

Mirae Asset Hang Seng TECH ETF

● Fund type – Exchange Traded Fund/ FOF

● NAV – Rs. 9.887

● Fund Size – Rs. 102.29 Cr.

● Fund Statement – ‘An Open-ended scheme replicating/tracking Hang Seng TECH index. The investment strategy would revolve around reducing the tracking error to the least possible through regular rebalancing of the portfolio, considering the change in weights of stocks in the Index as well as the incremental collections/redemptions in the Scheme. A part of the funds may be invested in debt and money market instruments, to meet the liquidity requirements.’

● Expense Ratio – 0.49%

● Past Returns – Since inception (07/12/21) (Absolute) – -41.66%

● Portfolio – 99.5% in Stocks that are a part of the Hang Seng TECH index in the

same ratio as in the index and the rest in TREPS

● Listed in NSE and BSE

● Tracking error (27th October 2022) – 0.28%

Axis Greater China Equity Fund of Fund

● Fund type – Fund Of Funds

● NAV – Rs. 5.73

● Fund Size – Rs.102.32 Cr.

● Fund Statement – ‘To provide long-term capital appreciation by predominately investing in units of Schroder International Selection Fund Greater China, a fund that aims to provide capital growth by investing in equity and equity-related securities of the Peoples’ Republic of China, Hong Kong SAR, and Taiwan companies. The Scheme may also invest a part of its corpus in debt, money market instruments and/or units of liquid schemes in order to meet liquidity requirements from time to time.’

● Expense Ratio – 0.42%

● Past Returns – Since inception (11/02/21) (Absolute) – -33.52%

● Portfolio – 95.67% in Mutual Fund units, namely – Schroder International

Selection Fund Greater China X Acc USD and the rest in TREPS

China ETF Direct Investments

Investors who have access to platforms like Stockal or Vested can directly invest in China ETF using their broking account. This is a better method for investors who want to have a large allocation to global equity and are keen to include geographies like USA and China among others. Some China ETFs are :

- The iShares China Large-Cap ETF (FXI) is made up of 50 Hong Kong-listed names

- IShares’ MSCI China ETF (MCHI) offers a broader mix of the mainland, Hong Kong, and U.S.-listed stocks

- KraneShares’ popular CSI China Internet ETF (KWEB) holds both Hong Kong and U.S.-listed names

- The SPDR S&P China ETF (GXC) buys ex-mainland China stocks

Conclusion

An economic behemoth, a steady and steep correction, and a rising GDP – China is ticking all the correct boxes for making investors around the world know that it might be one of the best options in the financial world in the long term after it came out of the COVID-19 pandemic, Russia- Ukraine war issues and internal political quagmire. While the entire world is on its knees, China may show a steady and solid comeback. However, this does come with a high risk for more short-term pain. This stock exposure is suited only for investors with a large appetite for risk and volatility.

Thanks for the Nice Article.

With China +1 policy, Vietnam going to be benefit a lot. How to Invent in Vietnam Market from India.

Hi Shyam, You can invest in Vietnam through the below ETF available on Stockal and Vested

https://www.vaneck.com/us/en/investments/vietnam-etf-vnm/

Do keep in mind that Vietnam is just 360 Bn USD GDP and hence is more susceptible to economic shocks. Higher risk and probably a higher return if the bet goes right.