For decades, bond investing in India has operated in two parallel worlds.

On one side were institutions, treasuries, and large wealth desks with access to primary issuances, live yields, and secondary market liquidity. On the other side were retail investors, largely restricted to fixed deposits, debt mutual funds, or opaque “yield products” sold through distributors.

Direct bond investing technically existed, but it was fragmented, difficult to access, and poorly explained.

That gap is now narrowing.

Regulatory changes, exchange-led bond platforms, and demat-based settlement have quietly laid the foundation for a more transparent retail bond market. Alongside this shift, new platforms are emerging that focus not on selling products but on making fixed income understandable.

One such platform is BondScanner.

This article explores:

- Why bond investing is gaining relevance for Indian investors

- How direct bonds compare to traditional debt options

- What BondScanner actually does

- Who is behind the platform

- And, most importantly, where the risks still lie

This is not a recommendation. It’s an attempt to help investors think clearly about fixed income in a post-indexation, higher-rate environment.

Why Bonds Are Back on the Retail Investor’s Radar

Three structural changes have brought bonds back into serious portfolio conversations.

1. Higher Interest Rates Are Meaningful Again

After years of suppressed yields, listed government and corporate bonds are now offering ~9% to 15%+ yields, depending on credit quality and maturity.

For long-term investors, this reintroduces fixed income as a real return-generating asset, not just a parking tool.

2. Debt Mutual Fund Tax Changes

The removal of indexation benefits for most debt mutual funds has forced investors to reassess whether pooled debt products still justify:

- Interest rate risk

- Credit events

- Fund-level opacity

Direct bonds, where cash flows and maturity values are defined upfront, are now being actively compared.

3. Growing Demand for Predictability

After years of volatility across equities and alternative assets, many investors are prioritising:

- Known maturity dates

- Visible cash flows

- Lower behavioural stress

Bonds fit that requirement — if the investor can clearly understand what they are buying.

What Is BondScanner?

BondScanner operates under Sustvest Broking Private Limited, a SEBI-registered stock broker in the debt segment and an NSE-authorised Online Bond Platform Provider (OBPP) .

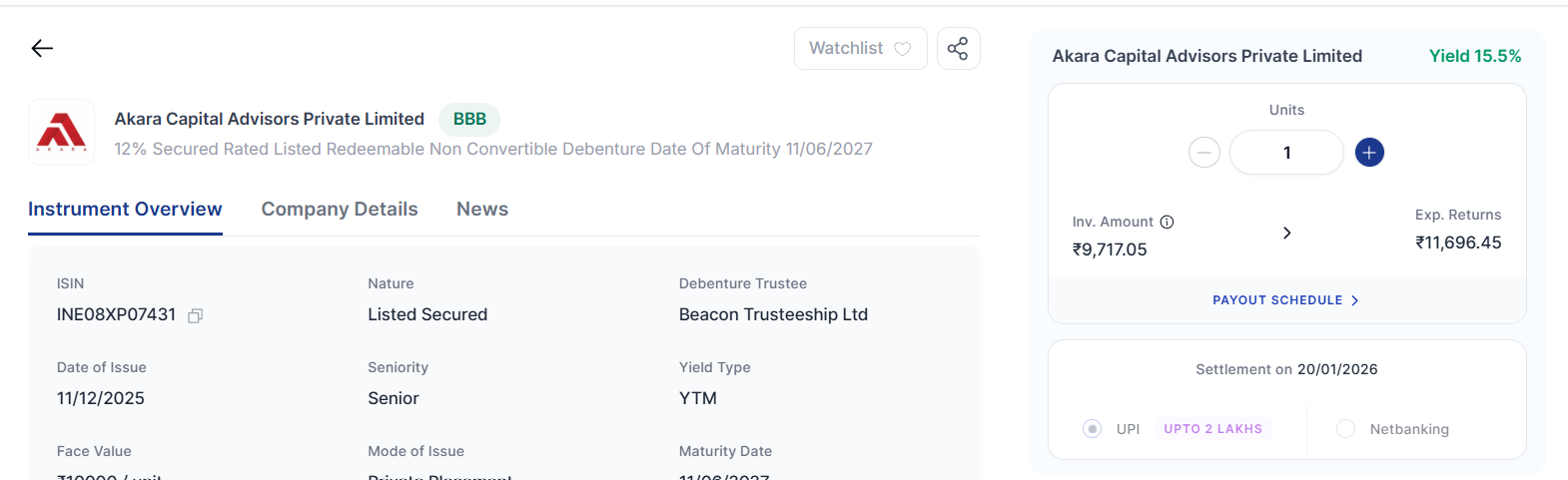

At a functional level, BondScanner allows investors to:

- Discover listed government and corporate bonds

- Compare bonds by credit rating, yield, tenure, and payment structure

- Invest directly into bonds credited to their existing demat account

But the more important distinction is philosophical.

BondScanner is built around an information-first model. The platform does not push inventory or optimise for yield headlines. Instead, it focuses on helping investors see:

- Who the issuer is

- How long the bond runs

- What the cash flows look like

- And what risks are being taken

This distinction matters in fixed income more than in equities.

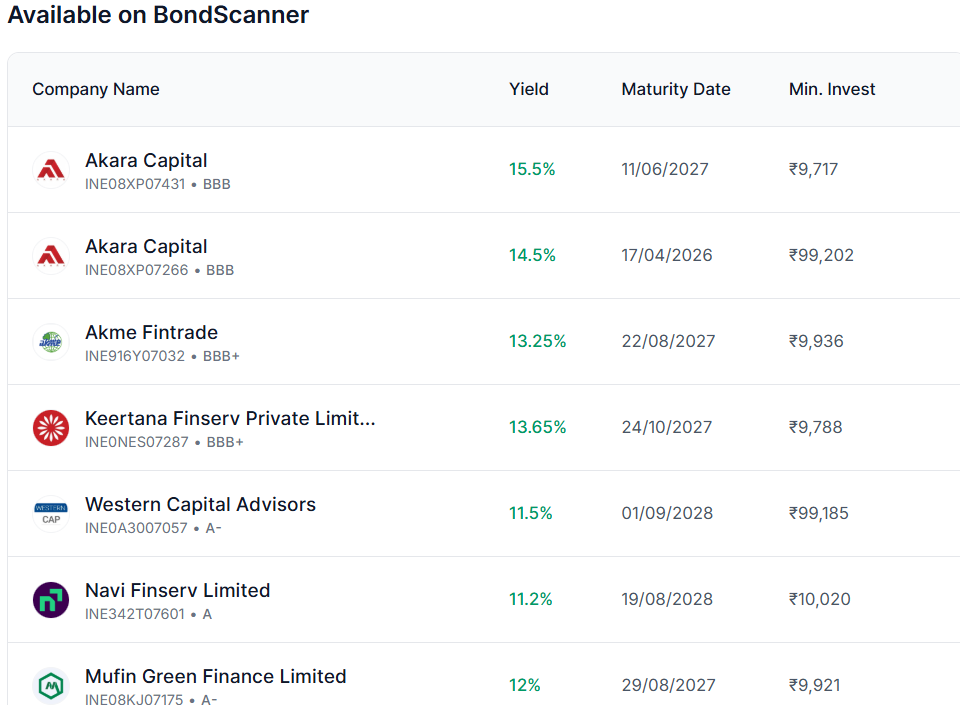

What Kind of Bonds Are Available?

BondScanner lists exchange-traded government and corporate bonds, credited directly to the investor’s demat account, similar to equity shares.

Key characteristics include:

- Credit ratings typically from BBB+ to AAA

- Both short-term and long-term maturities

- Regular coupon and zero-coupon / maturity payout options

- Minimum investments starting as low as ₹1,000 in select cases

This structure allows investors to:

- Match bond maturities to future liabilities

- Build income-focused portfolios

- Ladder investments across time

These are things retail investors usually struggle to do using pooled products.

Why Do BondScanner Yields Look Higher?

Yields displayed on BondScanner often appear higher than what investors see on bank deposits or many distribution-led platforms.

The reason is structural, not promotional :

- No brokerage charged by the platform

- No hidden commissions baked into pricing

- Yields shown are market-linked, not post-fee adjusted

- Transactions are exchange-settled

This doesn’t eliminate risk. It simply means pricing is not smoothed or masked.

For informed investors, that transparency is a feature, not a bug.

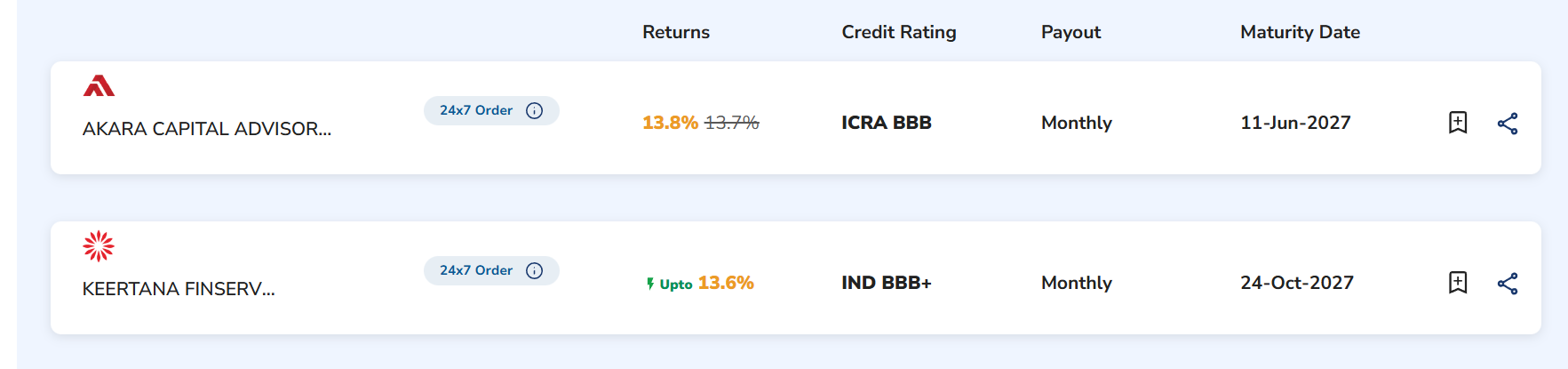

Comparison of Yield with Other Bond Platforms

Bondscanner yield of similar bonds is higher than Goldenpi, Indiabonds, etc!

Platform Design: Practical Over Flashy

BondScanner’s feature set reflects how fixed income is actually used by long-term investors .

Same-Day Settlement (T+0)

Eligible bonds can be credited to the demat account on the same day, improving execution confidence.

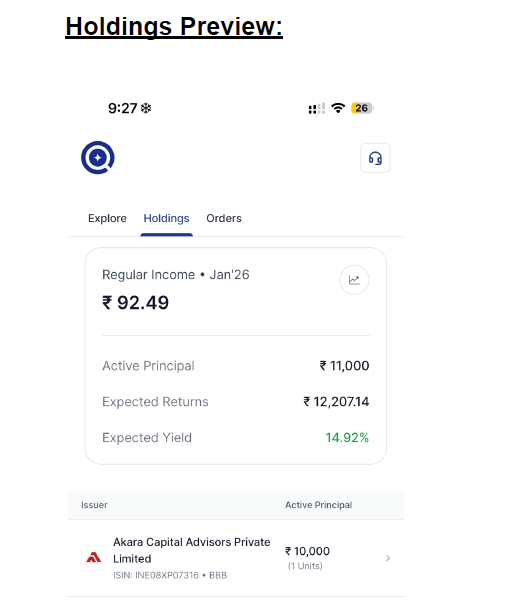

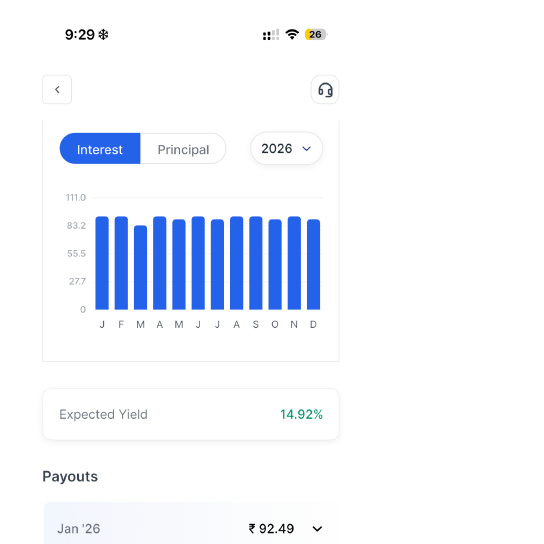

Holdings Dashboard

A consolidated view showing:

- Active investments

- Expected coupon payouts

- Maturity timelines

- Estimated interest income

This is particularly useful for investors managing bonds as a cash-flow instrument, not a trading asset.

Watchlist & Comparison

Investors can track bonds before investing, compare yields and tenures, and wait for better entry points.

Security & Compliance

Transactions route via NSE-valid payment handles, with TPV-enabled bank transfers, ensuring funds move directly to the exchange rather than sitting with the platform.

The Team Behind BondScanner

In fixed income, execution quality and regulatory discipline matter as much as technology.

BondScanner is run by a lean team with 10+ years of combined experience in fixed income markets, spanning:

- Corporate bond markets

- Capital markets and investment banking

- Wealth and advisory-led investing

This background shows up in how the platform is built — with emphasis on issuer clarity, cash-flow visibility, and demat-based settlement rather than aggressive sales funnels.

Founding & Leadership Team

BondScanner’s leadership team brings complementary skill sets across markets, products, and operations:

-

Shreshth Babbar – VP

Background in fixed income markets and bond investing, with experience across market instruments and issuer analysis. -

Divya Gupta – Designated Director

Focused on governance, compliance, and operational execution within regulated financial services. -

Avnish Singh – AVP

Fixed income specialist with hands-on exposure to credit markets and debt structuring. -

Atharva Joshi – Product Manager

Responsible for translating fixed income workflows into a retail-friendly product experience without oversimplifying risk.

The team’s positioning is notably markets-first, not marketing-led — a meaningful signal in a segment where mis-selling has historically been common.

Who Is BondScanner Best Suited For?

BondScanner works best for investors who:

- Want predictable cash flows

- Are willing to understand credit risk

- Prefer defined maturity over perpetual products

- Are building long-term, diversified portfolios

It is particularly relevant for:

- Equity-heavy investors looking to diversify

- Investors with lump-sum inflows

- Income-seeking investors who don’t want to liquidate principal

It is not ideal for:

- Short-term traders

- Investors expecting FD-like guarantees

- Those unwilling to assess issuer risk

Risks Investors Must Still Understand

Transparency does not eliminate risk.

Investors using BondScanner are still exposed to:

- Credit risk (issuer default or downgrade)

- Interest rate risk if selling before maturity

- Liquidity risk in thinly traded bonds

- Reinvestment risk on coupon flows

The platform reduces information asymmetry, not financial risk. That distinction is critical.

Final Thoughts

BondScanner reflects a broader shift in Indian investing — away from opaque distribution models and toward direct, information-led access.

It does not promise outsized returns.

It does not hide complexity.

And it does not push products.

Instead, it enables investors to understand fixed income the way institutions always have.

For long-term investors willing to engage with bonds thoughtfully, platforms like BondScanner represent a meaningful step forward in India’s evolving debt market.

Frequently Asked Questions (FAQ)

What is BondScanner and how does it work?

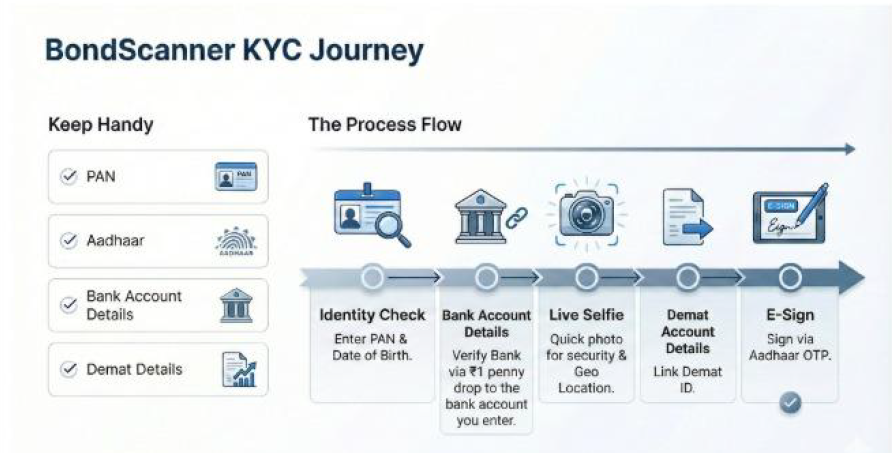

BondScanner is a SEBI-registered online bond investment platform operating under the Online Bond Platform Provider (OBPP) framework. It allows investors to discover, evaluate, and invest in listed bonds through a transparent, exchange-led process. Bonds purchased on the platform are credited directly to the investor’s registered demat account.

You can learn more about the platform and its philosophy on the About Us page.

Which bonds can I invest in on BondScanner?

BondScanner provides access to a wide range of listed fixed-income instruments, including:

- Corporate Bonds

- Government Bonds

- Perpetual Bonds

- Bonds with regular income payouts

- Bond laddering and structured maturity options

The available bonds span different credit ratings, tenures, and yield profiles. Investors can explore live offerings through the Bond Listing Page and detailed Bond Product Pages.

Is BondScanner SEBI-registered?

Yes. BondScanner operates under a valid SEBI registration and is authorised as an Online Bond Platform Provider (OBPP). The platform follows exchange-led processes and maintains internal compliance standards in line with regulatory requirements.

Why should I invest in bonds using BondScanner?

BondScanner is designed for investors who want clarity and control while investing in fixed income. The platform focuses on:

- Transparent pricing and yield visibility

- Exchange-settled transactions

- Direct demat credit of bonds

- Information-first decision-making

Rather than pushing products, BondScanner enables investors to understand bond fundamentals before investing. Investor discussions and experiences can be explored via the Community Forum.

Does BondScanner charge any fees for investing?

BondScanner maintains transparency in pricing and does not embed hidden platform charges into bond prices. Yields displayed are market-linked and reflect exchange pricing. Any applicable charges, if relevant, are disclosed upfront.

More details are available on the Invest With Demat page.

How does BondScanner ensure investor security?

Investor security is handled through:

- Exchange-routed transactions

- SEBI-compliant KYC and onboarding

- Regulated payment mechanisms

- Strict internal compliance and verification protocols

Funds are routed through authorised exchange channels, and bonds are credited directly to the investor’s demat account. Additional details are available in the Support FAQs.

Does BondScanner offer customer support?

Yes. Investors can raise queries and service requests through the Support Centre. BondScanner also maintains a community forum where investors can participate in discussions, share experiences, and learn more about bond investing.