When it comes to building long-term wealth in India, mutual funds have become one of the most preferred choices among retail investors. Thanks to the wide range of schemes, the power of compounding, and the expertise of fund managers, even newbies can start investing confidently. However, it is important to note that successful mutual fund investing doesn’t start by just doing SIPs; it begins with research.SIPs in any fund will not yield the desired returns. Research and analysis are crucial while selecting a mutual fund best suited for your requirements. In today’s digital world, there are many platforms and tools that offer detailed mutual fund analysis.

So, which is the best site to analyse mutual funds in India? In this comprehensive guide, we will evaluate several top mutual fund analysis platforms in India based on multiple parameters such as ease of use, data accuracy, tools offered, features, and suitability for different types of investors. Read ahead to know our analysis and comparison of mutual fund platforms.

Why Do You Need a Mutual Fund Analysis Platform?

Before we go further into the actual list, it is important to first understand why you need an ideal mutual fund platform in the first place.

- Compare returns for various schemes across different time periods.

- Evaluate risk parameters such as volatility, beta, and Sharpe ratio.

- Understand the fund’s current portfolio and sector allocations.

- Track performance vs benchmarks and peers.

- Check expense ratios, fund manager details, and more.

Factors to Consider While Analysing Mutual Funds

When you look at the best tools to analyse mutual funds, it is important to understand some important factors you need to keep in mind. The following are some of the important points:

- Fund Category- Ensure the fund’s type (equity, debt, hybrid) & strategy (aggressive, passive, hybrid) align with your goals and risk profile.

- Past Performance- Check returns over multiple time ranges against benchmarks and peers. Though it is only indicative of future performance, but an important factor to look at.

- Risk Measures- Look at standard deviation, beta, and Sharpe ratio to learn about risk and consistency.

- Expense Ratio- Expense ratio is an annual fee charged by mutual funds. Lower expense ratio means better cost efficiency, which adds up to your returns, especially for long-term investments.

- Fund Manager’s Track Record- A seasoned manager with a good performance history gives you a confidence boost about fund performance, though the fund manager might change in the future for your scheme in future.

- Portfolio Composition- Review top holdings of the schemes periodically and understand allocation to different sectors to understand concentration and diversification.

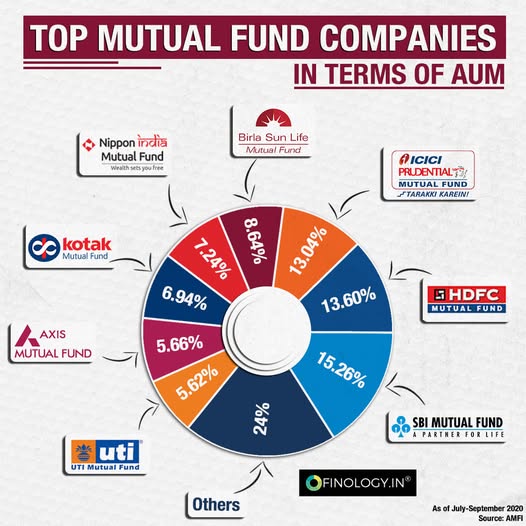

- AUM (Assets Under Management)- Select schemes ideally with Moderate AUM is ideal—too low may signal risk & non-popularity, too high may affect agility due to issues with deployment.

- Exit Load & Taxation- Be aware of exit loads charged by many schemes if you exit before a certain time period. and tax rules based on fund type and holding period.

Choosing the right fund involves balancing all these factors, which top mutual fund analysis websites make available at a glance.

With that context in place, let’s explore the top contenders. Please note, the platforms below are not listed in any particular order.

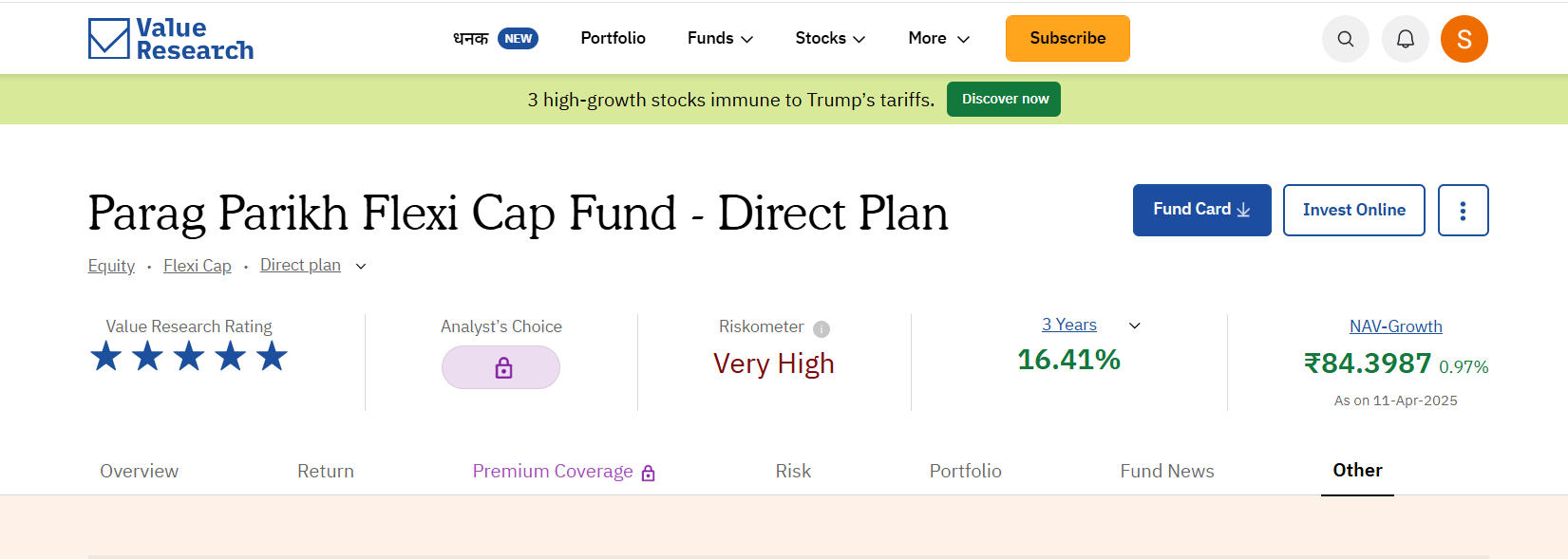

1. Value Research Online (Website: ValueResearchOnline.com) for mutual funds

Value Research Online, popularly referred to as VRO among investors, is one of the oldest and most popular platforms for mutual fund research in India.

Key Features:

- Fund Ratings: 5-star rating system based on risk-adjusted returns.

- Overview: Expense ratio, AUM, returns, category averages, fund manager & details at a glance.

- Fund Compare Tool: Compare up to 5 funds across various metrics.

- Portfolio Insights: Holdings, sectoral allocation, and churn rate.

- Fund Screener: Easy search using multiple filters for fund categories, ratings, AMCs, active vs passive, direct vs regular, etc.

- Fund Card: A Fund Card for each fund provides complete details in a single PDF.

Pros

- Detailed analysis of each fund.

- Dedicated section- Dhanak for Hindi content

- Offers editorial content and fund recommendations.

- User-friendly even for beginners.

Cons

- Sign-up/login is necessary for accessing the entire website

- The interface feels slightly outdated.

- Ad-heavy model- multiple ad formats are used, impacting a smooth user experience.

- Some features are behind a paywall (Value Research Premium).

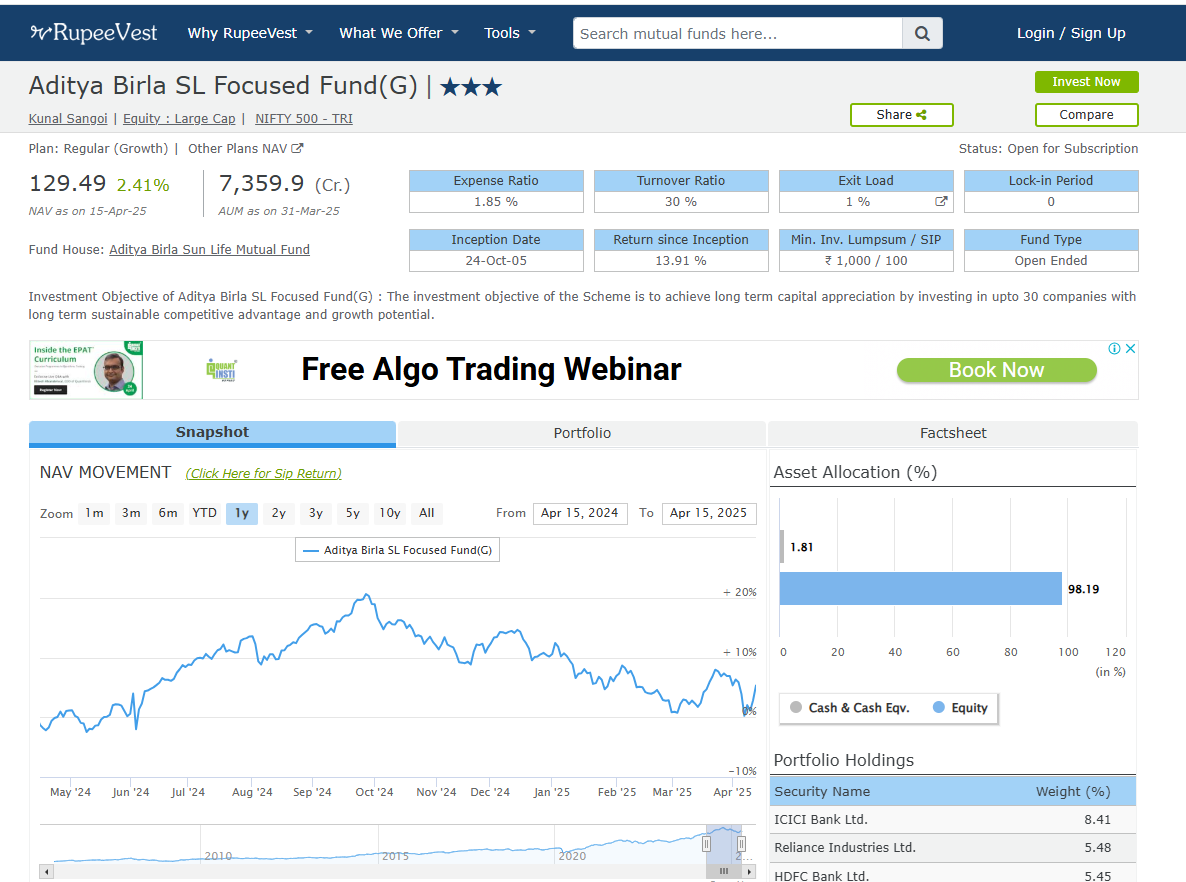

2. RupeeVest (Website: RupeeVest.com) for mutual funds

RupeeVest is a no-nonsense but powerful mutual fund research platform that offers deep analytics and practical tools for retail investors and financial advisors.

Key Features

- Quantitative Ratings: Funds are scored on multiple parameters like performance, risk, consistency, etc.

- Advanced Fund Screener: Filter mutual funds using several basic metrics like AMC, returns, expense ratio, etc., as well as advanced filters like alpha, Sharpe, Sortino, standard deviation, expense ratio, etc.

- Fund Comparison: Compare up to 4 mutual funds side by side on various parameters like minimum investment, several ratios, AUM, expense ratio, exit load, top holdings, etc.

Pros

- Non-nonsense platform- no need to sign/login to access most features, no limit on pageviews for non-signed-up users, etc.

- Most features are free to use.

- All important points are visible on a single page.

- Several tools and calculators make analysis easy for advanced investors.

Cons

- Basic UI, not very mobile-friendly

- Recommended mutual fund suggestions for each category might not necessarily be the best.

- Lesser known compared to some other popular platforms.

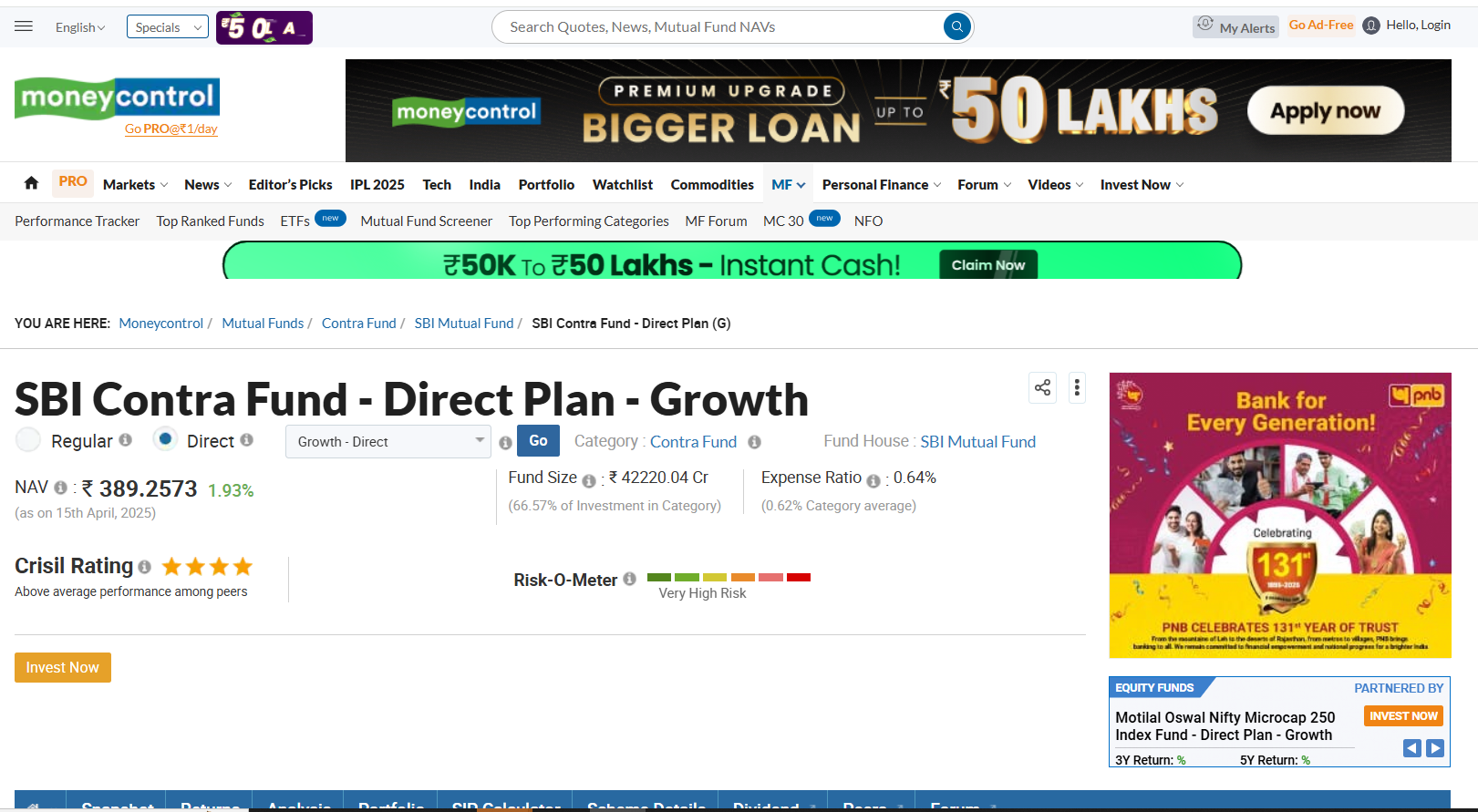

3. Money Control (Website: MoneyControl.com)

Moneycontrol, owned by Network18, is a financial news platform that offers exhaustive mutual fund analysis and tools.

Key Features

- Fund Overview: Quick glance at fund NAV, AUM, returns, and category rank at other required parameters.

- Performance Graphs: Charts for visual comparison of a mutual fund scheme’s performance across time periods

- Excellent source for business & finance news, stocks, etc. Very active forum for stocks as well.

- Portfolio Tracker: Track your mutual fund portfolio in real-time

Pros

- Helps stay updated with the latest news in finance & business domains.

- Useful for both beginners and intermediate investors

- Shows tax treatment for each fund

Cons

- The platform is ad-heavy- several ad units on every page- impacting the smooth user experience.

- Comparatively fewer tools & calculators compared to specialized platforms

Some more websites for mutual fund analysis in India

Following are some more mutual fund analysis and comparison websites in India, which you can also explore.

- ET Money

- Kuvera

- Groww

- Tickertape

- Morningstar India

- IND Money

- AdvisorKhoj

Conclusion

In the age of digital investing, choosing the right platform to analyse & compare mutual funds is equally important, just as important as selecting the mutual fund itself. With platforms like Value Research, RupeeVest, ET Money, Groww, Moneycontrol, etc. Indian investors now have access to tools for analysis that were once upon a time available only to financial professionals.

Use these platforms not just to analyse & pick mutual funds suited for your goals but to track, refine, and review your investments periodically. After all, informed investing is smart investing!

If you want to explore other alternative investment opportunities, visit our blog randomdimes.com

Which platform gives in depth analyses of scrip overlap across mf portfolio?

Hi Try thefundoo.com it provides good analysis.