In this 2025 guide, we compare the top crypto algo trading platforms, include real user reviews, and share a simple example strategy you can test right away.

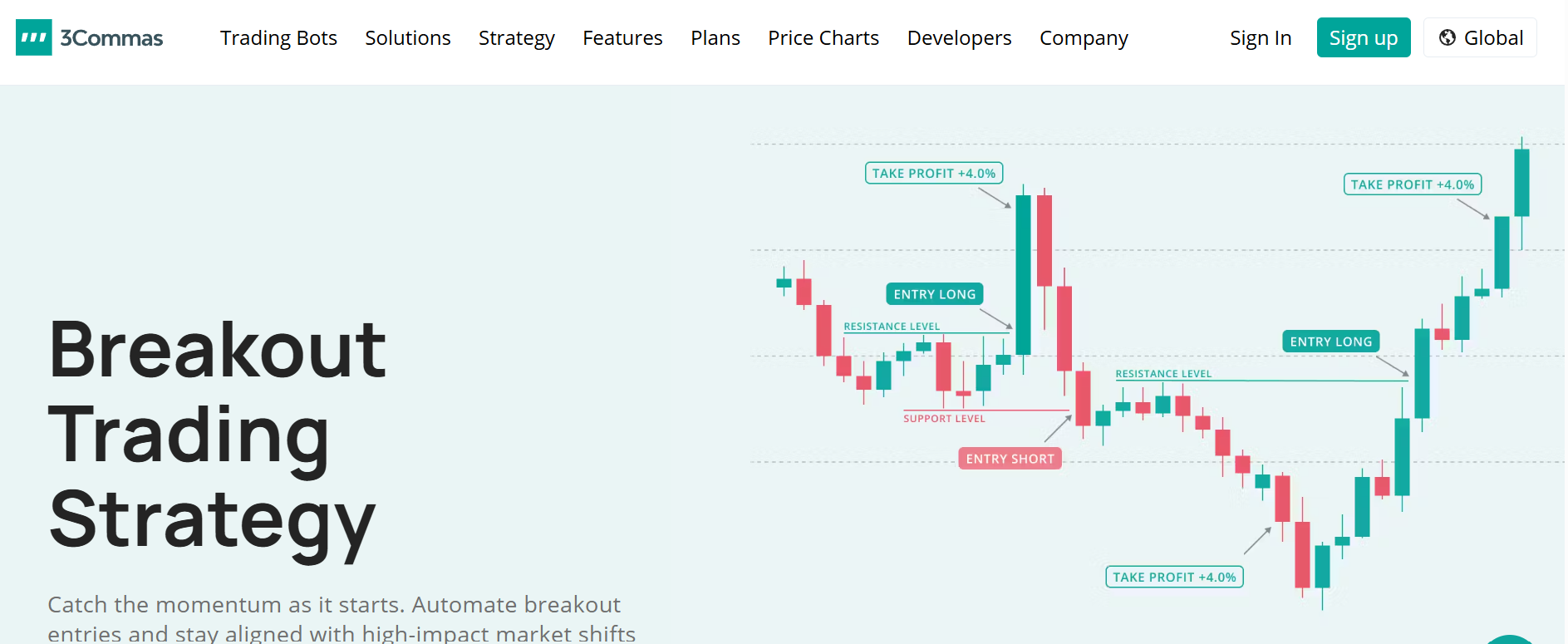

1. 3Commas — Multi-Exchange Automation

Best for: Active traders managing multiple exchange accounts.

3Commas offers a clean, centralized interface to deploy bots, manage portfolios, and execute trades across Binance, Coinbase, OKX, and others. Its SmartTrade terminal lets you pre-set entries and exits, while DCA and grid bots automate execution.

Pros: intuitive UI, wide exchange coverage, backtesting, and ready-made bot templates.

Cons: API setup can be complex; support can lag during high-traffic periods.

User Reviews:

-

Trustpilot (4.4/5, 1,700+ reviews): Users praise SmartTrade and automation simplicity — “Being able to preset take profit and stop loss saves me from staring at screens all night.”

-

G2 (4.5/5): “Excellent automation tools but requires time to master. The UI is sleek and integrations are strong.”

-

Critiques: A few traders mention bot errors during volatile markets or delayed responses from support.

Verdict: 3Commas remains the most feature-rich retail platform for multi-exchange automation. It rewards users who invest time learning its system.

2. Pionex — Built-In Exchange Bots

Best for: Beginners who want plug-and-play bots without coding.

Pionex is an exchange with 16+ pre-built bots — including grid, DCA, and rebalancing strategies — that run natively on its servers. This makes it one of the easiest ways to automate trades instantly.

Pros: extremely low barrier to entry; no extra bot fees; strong mobile app.

Cons: limited to Pionex markets and predefined strategies.

User Reviews:

-

Trustpilot (4.3/5): “Best entry-level platform. The bots are easy, low fees, and I can run them 24/7 without setup headaches.”

-

Google Play: “Excellent UI, countless bots, and accurate profit tracking.”

-

Critiques: Some Reddit users report limited profitability — “Grid bots make small profits, but over time high volatility cancels gains.”

Verdict: Pionex is unbeatable for simplicity. It’s perfect for newcomers testing automation before moving to custom logic.

3. Coinrule — No-Code Conditional Rules

Best for: Traders who want to design custom strategies without programming.

Coinrule lets you build rule-based automation (“If price drops 5% and RSI < 40 → Buy BTC”). Its drag-and-drop logic connects to major exchanges and supports historical backtesting.

Pros: intuitive rule engine; wide exchange support; strong educational tutorials.

Cons: limited flexibility for multi-factor strategies; backtests assume ideal fills.

User Reviews:

-

Trustpilot (4.1/5): “Easy to start; my DCA and breakout rules work well. Backtests are straightforward.”

-

Reddit feedback: users appreciate templates, but note the pricing tiers could be cheaper for high-frequency setups.

Verdict: Coinrule is ideal for non-coders who want structure and logic without scripting. A great entry point before moving to Trality or Freqtrade.

4. Cryptohopper — Cloud Bots & Marketplace

Best for: Traders seeking automation with community strategies.

Cryptohopper runs fully in the cloud — no server setup. You can design your own bot, subscribe to trading signals, or copy from a marketplace of professional traders.

Pros: hosted bots, paper trading, community marketplace, integration with TradingView signals.

Cons: marketplace quality varies; webhook trading has occasional glitches.

User Reviews:

-

Trustpilot (3.7/5): “It helps trade without emotion, but it’s not a money-printing machine. You still need a strategy.”

-

G2 (4.3/5): praised for automation breadth and integration; criticized for minor UI bugs.

-

Reddit: “After a year, I’m around break-even — great tool, but you still need to tune your strategy.”

Verdict: Cryptohopper is versatile and cloud-ready, great for traders who prefer managed hosting and social strategy sharing.

5. Zignaly — Copy Trading & Profit-Sharing

Best for: Passive investors who want pro traders to manage capital.

Zignaly connects users to experienced traders who trade on their behalf for a success fee. It’s essentially social trading meets hedge-fund-style profit sharing.

Pros: success-fee model (pay only when profitable), transparency of trader stats.

Cons: variable manager quality; occasional withdrawal or performance complaints.

User Reviews:

-

Trustpilot (4.0/5): “Beginner-friendly, easy to allocate to traders and learn.”

-

Another user warns: “Some fund managers went inactive, and withdrawals got delayed.”

Verdict: Excellent for those seeking passive exposure — but always diversify across multiple managers to reduce dependency risk.

6. Bitsgap — Grids, Arbitrage & Multi-Exchange Control

Best for: Intermediate to advanced traders seeking cross-exchange capabilities.

Bitsgap acts as a hub for bots, arbitrage opportunities, and portfolio management across 20+ exchanges.

Pros: strong arbitrage scanner, intuitive grid bot configuration, unified dashboard.

Cons: Arbitrage profits depend on fast execution; setup can be heavy for newcomers.

User Reviews:

-

Capterra (4.6/5): “Provides awesome tools — signals, arbitrage, and grid bots in one place.”

-

Reddit discussions: traders like the interface and stability, but caution about overfitting grid spacing.

Verdict: Bitsgap is an excellent multi-exchange workbench. It’s especially good for traders running parallel grids or arbitrage across venues.

7. Kryll — Visual Strategy Builder

Best for: Visual learners who prefer a drag-and-drop strategy design.

Kryll replaces code with flowcharts — connect indicators and triggers visually, backtest, and deploy. It also has a strategy marketplace where you can share or rent flows. Kryll is a decentralized platform and is compatible with Metamask.

Pros: visual editor, flexible components, pay-as-you-go model.

Cons: limited advanced math; visual logic can feel slow for complex systems.

User Reviews:

-

Trustpilot (4.2/5): “The drag-and-drop builder is the easiest way I’ve built strategies.”

-

YouTube creators highlight Kryll’s marketplace transparency and active Discord community.

Verdict: Ideal for educational or demo purposes. A strong midpoint between ease and customization.

8. Trality — Python in the Browser

Best for: Developers who want to code but prefer managed hosting.

Trality provides a full Python IDE inside your browser. It lets you backtest, version control, and even rent out strategies via its marketplace.

Pros: true coding flexibility without server setup; excellent documentation.

Cons: requires Python familiarity; limited to supported data intervals.

User Reviews:

-

Trustpilot (4.5/5): “Love coding bots without managing servers. Backtests are accurate and stable.”

-

Some developers request faster data updates and more exchanges.

Verdict: The perfect stepping stone for coders who want full control but minimal infrastructure work.

9. Freqtrade — Open-Source Framework

Best for: Advanced traders and quants building institutional-grade systems.

Freqtrade is a self-hosted Python framework that supports custom strategies, hyper-parameter optimization, and paper/live trading via exchange APIs.

Pros: full transparency, community support, detailed logging.

Cons: setup and maintenance require technical knowledge (Docker, cron, servers).

User Reviews:

-

GitHub (19k+ stars): users commend its active community and regular updates.

-

Reddit: “Best for serious algo traders. It’s not plug-and-play but it’s professional.”

Verdict: If you want the deepest control, Freqtrade is the benchmark open-source solution.

10. Quick Comparison Table

| Platform | Best For | Skill | Multi-Exchange | Backtesting | Demo/Paper | Avg Rating |

|---|---|---|---|---|---|---|

| 3Commas | Multi-exchange automation | Intermediate | ✅ | Good | ✅ | ★★★★☆ |

| Pionex | Built-in on-exchange bots | Beginner | ❌ | Basic | Limited | ★★★★☆ |

| Coinrule | Rule-based automation | Beginner | ✅ | Simplified | ✅ | ★★★★ |

| Cryptohopper | Cloud bots + copy | Intermediate | ✅ | Variable | ✅ | ★★★½ |

| Zignaly | Profit-sharing | Beginner | ✅ | N/A | Allocations | ★★★★ |

| Bitsgap | Grids & arbitrage | Intermediate | ✅ | Advanced | ✅ | ★★★★½ |

| Kryll | Visual strategies | Beginner | ✅ | Built-in | ✅ | ★★★★ |

| Trality | Python scripting | Developer | ✅ | High | ✅ | ★★★★½ |

| Freqtrade | Open-source control | Developer | ✅ | Highest | Sim/Live | ★★★★★ |

Example Strategy — DCA + Momentum Filter

A straightforward, risk-controlled framework that works across most platforms.

Goal: accumulate during dips, pause in volatile surges.

-

Pair: BTC/USDT

-

Signal: RSI(14) on 1-hour candles

-

Rules:

-

Buy 2% of portfolio every 4 hours when RSI < 35

-

Stop when RSI > 50

-

Pause if 1-hour ATR > 1.8× its 90-day average

-

-

Risk limits: per trade 2%; weekly exposure ≤15%; stop after 3 failed API calls

Platforms supported:

-

Coinrule — rule-based logic

-

3Commas — DCA bot with conditions

-

Pionex — grid/DCA setup

-

Trality / Freqtrade — Python code for full automation

This combination balances patience (DCA) with discipline (momentum filter), reducing drawdowns during whipsaws.

What Users Agree On

Across all reviews, three themes stand out:

-

Ease matters: most users start with Pionex, Coinrule, or 3Commas before moving to advanced tools.

-

Expect learning curve: profitable automation requires iteration — bots amplify discipline, not luck.

-

Support and transparency: platforms that respond quickly and show strategy results clearly earn the highest trust.

Final Thoughts

-

If you’re new: start with Coinrule — quick setup and simple logic.

-

If you trade multiple exchanges, use 3Commas or Bitsgap.

-

If you prefer copy trading, explore Zignaly or Cryptohopper.

-

If you code, build on Trality or Freqtrade for ultimate control.

Whatever you choose, begin with paper mode, measure results, and treat bots as structured research tools — not shortcuts to instant profit.