Farmland has quietly re-entered serious portfolio conversations in India. Not as a lifestyle indulgence or speculative punt—but as a scarcity-driven, long-duration real asset that behaves very differently from apartments, REITs, or equities.

The Bangalore-plotted farmland opportunity developed by Green Lakes and offered through Alt DRX is a good case study of how farmland investing is evolving: from fragmented, opaque ownership into a structured, investable asset class.

This article focuses primarily on the opportunity itself—the land, the location, the economics, and the risk–reward profile—before explaining how Alt DRX improves execution and access.

1. The Real Question: Why Farmland at All?

Land is the only major asset class with absolute supply constraints. You can build more apartments, issue more bonds, or create new financial instruments—but you cannot manufacture land near a growing city.

Farmland, in particular, sits at an interesting point on the risk spectrum:

-

It does not depend on rental yields

-

It is not sensitive to interest-rate cycles in the same way as housing

-

It has low mark-to-market volatility

-

Returns are driven by time, scarcity, and development spillover

Historically, the highest land returns are earned before zoning conversion or visible urbanisation—when land is still classified as agricultural but demand dynamics are already shifting.

That is the precise window this opportunity targets.

2. Why Bangalore Farmland Is Structurally Attractive

Bangalore’s growth has followed a predictable pattern:

-

Core city saturation

-

Infrastructure expansion

-

Employment decentralisation

-

Residential demand spillover

-

Land re-rating in peripheral corridors

We are currently between stages 2 and 3 in many outer regions.

Key long-term drivers:

-

National highways and ring-road connectivity

-

Airport-led development

-

Satellite town planning

-

Industrial, logistics, and tech spillover

-

Severe scarcity of large land parcels closer to the city

Importantly, Karnataka’s 2020 reform, allowing non-farmers to buy agricultural land, unlocked a structural demand pool that simply did not exist earlier. This was not a cyclical change—it was a regime change.

Since then, farmland appreciation around Bangalore has been steady, not speculative, which is exactly what long-term capital prefers.

3. Why This Is Not “Generic Farmland”

Most farmland investments fail because they are:

-

Too remote

-

Poorly documented

-

Illiquid

-

Operationally unmanaged

The Green Lakes plotted farmland differs in three critical ways.

(a) Plotted, Not Raw Land

Raw farmland often looks cheap but comes with:

-

Boundary disputes

-

Encroachment risk

-

Extremely poor resale liquidity

Plotted farmland introduces:

-

Clear demarcation

-

Standardised plot sizes

-

Easier transferability

-

Higher buyer acceptance at exit

This materially changes the risk profile.

(b) Gated & Managed Development

Unmonitored land degrades in value. Access, boundaries, and basic upkeep matter more than most investors realise.

This opportunity includes:

-

Gated layout

-

Defined access roads

-

Ongoing professional management by Green Lakes

That turns land from a static asset into a maintained, marketable one.

(c) Located in an Active Growth Corridor

Land returns are location-specific, not asset-class-generic.

This project benefits from:

-

Proximity to Bangalore’s extended growth belt

-

National highway access

-

Low-density surroundings (limited competing supply)

-

Infrastructure visibility—not just promises

Land appreciates when demand arrives faster than supply. That condition already exists here.

4. The Core Return Engine: Pricing Asymmetry

Let’s be very clear:

Returns here do not come from farming income. They come from valuation re-rating.

Today

-

Entry pricing is materially below residential plotted land

-

No construction premium

-

No yield assumptions baked in

-

No leverage involved

Over Time

-

Infrastructure improves

-

Residential pricing in the micro-market rises

-

The scarcity of large land parcels increases

-

Farmland pricing converges upward

This creates a valuation gap closure opportunity.

Historically, the biggest land gains occur before land reaches its “final use.” Once zoning conversion and residential approvals are complete, most of the upside is already priced in. This opportunity is positioned before that point.

5. Risk Reality

Farmland is not risk-free. A serious investor should understand this clearly.

Key Risks

-

Long holding periods (5–10 years)

-

Slower infrastructure rollout than expected

-

Regulatory changes (low probability, high impact)

-

Limited short-term liquidity

Why Risk Is Still Contained

-

Low entry valuation

-

No leverage

-

No dependency on rental yield

-

An asset cannot structurally go to zero

-

Clear titles and gated layout

This produces a conservative asymmetry: Downside is capped by land value; upside compounds with time.

6. Liquidity: Improved, Not Instant

Traditional farmland liquidity is poor—often one buyer, one negotiation, months of friction.

This opportunity improves that reality by:

-

Fractional ownership

-

Smaller exit denominations

-

Platform-facilitated secondary transfers

Liquidity is enhanced, not guaranteed. That is the correct framing—and still a meaningful improvement over direct ownership.

7. Why Green Lakes Matters as a Developer

Land investing is execution-sensitive. Green Lakes’ role is not cosmetic; it directly affects outcomes through:

-

Land aggregation and due diligence

-

Layout planning and demarcation

-

Ongoing asset management

-

Long-term development discipline

Their broader portfolio, including lifestyle-oriented farmland developments, demonstrates on-ground capability, not just financial structuring.

This reduces one of the biggest hidden risks in land investing: execution drift.

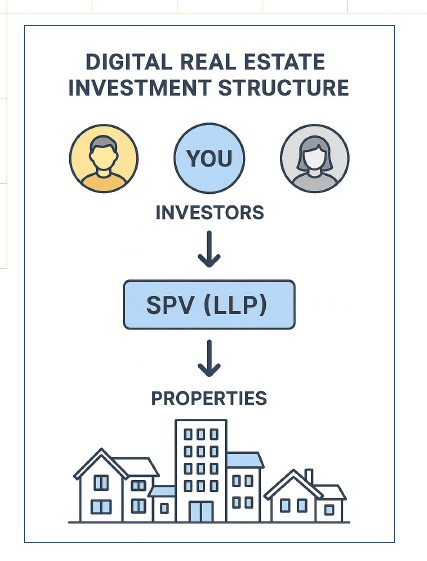

8. Where Alt DRX Fits In Farmland Investment

Only now does the platform come into focus. AltDRX does not create the return. It enables access, governance, and exits.

What AltDRX Adds

-

Lower minimum investment (~₹10 lakh)

-

SPV-based ownership structure

-

Digital representation of land ownership

-

Transparent disclosures

-

Fractional exit optionality

Each opportunity is housed in a separate LLP, with investor capital deployed directly into the asset—not pooled or leveraged elsewhere.

This makes farmland institutionally consumable for retail and HNI investors.

9. Track Record Perspective on Alt DRX

Alt DRX’s platform philosophy is conservative by design:

-

Real assets, not synthetic exposure

-

Asset-backed structures

-

No yield promises

-

Focus on capital preservation and appreciation

This aligns well with farmland, which rewards patience and discipline, not financial engineering.

10. Who This Opportunity Is For (and Who It Isn’t)

Suitable For

-

Investors seeking hard-asset diversification

-

Long-term allocators (5–10 year horizon)

-

Those wanting land exposure without operational hassle

-

Portfolios already heavy in equities or residential property

Not Suitable For

-

Short-term traders

-

Income-seeking investors

-

Those needing guaranteed liquidity

-

Investors are uncomfortable with illiquid assets

11. Portfolio Context

In a diversified portfolio, farmland works best as:

-

A volatility dampener

-

An inflation hedge

-

A scarcity-driven appreciation asset

A reasonable allocation:

-

5–10% of total net worth within alternatives

-

Alongside REITs, gold, or private credit

Final Takeaway on Farmland

The Bangalore plotted farmland opportunity by Green Lakes is compelling on its own merits—even before layering Alt DRX on top.

What makes it investable is not hype, yield projections, or leverage—but:

-

Location-led scarcity

-

Early-stage pricing asymmetry

-

Structured execution

-

Risk containment

Alt DRX improves access and governance, but the land economics do the heavy lifting.

For investors who understand that the best real-asset returns come from time, not timing, this opportunity fits squarely into a long-term wealth framework.

Frequently Asked Questions (FAQ): Bangalore Plotted Farmland via Green Lakes & Alt DRX

1. What exactly am I investing in?

You are investing in plotted farmland near Bangalore, developed and managed by Green Lakes. The underlying asset is physical land with a clear title, not a financial derivative or synthetic exposure. Your ownership is represented digitally through Alt DRX, but the value is backed by real, on-ground farmland.

2. Is this agricultural land or residential land?

This is agricultural land (farmland) that is:

-

Plotted

-

Demarcated

-

Gated

-

Professionally managed

It is not residential-approved land today.

The investment thesis relies on long-term appreciation from infrastructure growth and urban spillover, not immediate residential use.

3. Can non-farmers legally invest in this farmland?

Yes. Following Karnataka’s 2020 land reforms, non-farmers are legally allowed to purchase agricultural land, subject to defined conditions.

This regulatory change is one of the main reasons farmland demand around Bangalore has increased structurally.

4. Where do returns come from if there is no rental income?

Returns come from capital appreciation, not farming income or rent.

Specifically:

-

Scarcity of land near Bangalore

-

Infrastructure-led demand

-

Gradual convergence of farmland prices toward residential land prices

-

Long-term re-rating of the micro-market

This is a price appreciation asset, not a yield product.

5. Is any farming income generated or distributed?

The primary investment thesis does not depend on farming income.

Any agricultural activity, if undertaken, is secondary and should be viewed as:

-

Land upkeep

-

Optional income

-

Not guaranteed or central to returns

Investors should assume zero cash flows during the holding period.

6. What is the minimum investment amount?

The minimum ticket size is approximately ₹10 lakh, enabled through fractional ownership.

This is significantly lower than buying an entire farmland plot directly, which typically requires much higher capital.

7. How is ownership structured?

-

Each investment opportunity has a separate SPV (LLP)

-

Investors own economic rights in the LLP

-

The LLP owns the farmland

-

Ownership is represented digitally in square-foot units

This ensures:

-

Asset ring-fencing

-

Transparency

-

No cross-contamination with other projects

8. Is my investment leveraged?

No. There is no debt or leverage used at the asset level.Returns are purely driven by land appreciation, not financial engineering.

This significantly reduces downside risk.

9. How is land title risk addressed?

Before acquisition:

-

Full legal due diligence is conducted

-

Historical ownership checks are completed

-

Only clear-titled land is included

Additionally:

-

Plots are demarcated

-

The development is gated

-

Centralised management reduces encroachment risk

10. Who manages the land after investment?

Green Lakes is responsible for:

-

On-ground asset management

-

Boundary protection

-

Layout maintenance

-

Long-term development discipline

Investors are not required to manage the land themselves.

11. How long should I expect to stay invested?

This is a long-term investment.

A realistic holding period is:

-

5 to 10 years, or longer

Land appreciation works best with time.

This is not suitable for short-term capital deployment.

12. How liquid is this investment?

Farmland is inherently illiquid, but this structure improves liquidity relative to direct ownership.

Liquidity options:

-

Fractional exits

-

Platform-facilitated secondary transfers

-

Ability to sell smaller units instead of entire plots

However:

-

Liquidity is not guaranteed

-

Exit timing depends on buyer demand

This should be treated as a semi-illiquid asset.

13. Can I exit partially or only fully?

You can exit partially, selling a portion of your holdings rather than the entire investment.

This is a major advantage over traditional farmland ownership, where only full-plot exits are possible.

14. What are the main risks I should be aware of?

Key risks include:

-

Long holding period

-

Slower-than-expected infrastructure development

-

Regulatory or zoning changes

-

Limited short-term liquidity

Risk mitigants:

-

Low entry valuation

-

No leverage

-

Clear titles

-

Professional management

-

Asset-backed structure

15. Is this safer than buying farmland directly?

For most urban investors, yes.

Compared to direct farmland ownership, this structure offers:

-

Better documentation

-

Lower operational risk

-

Smaller ticket size

-

Improved exit flexibility

-

Centralised management

It does not remove risk, but it reduces execution and governance risk materially.

16. How does this compare to REITs or apartments?

-

REITs offer liquidity and yield but are market-linked

-

Apartments depend on rental income and occupancy cycles

-

Farmland offers low volatility and scarcity-driven appreciation

Farmland works best as a portfolio diversifier, not a replacement for yield assets.

17. Are returns guaranteed?

No.There are no guaranteed returns.This is a real-asset investment where outcomes depend on:

-

Time

-

Location

-

Infrastructure progress

-

Market demand

Any guaranteed-return promise in farmland should be treated as a red flag.

18. Who should consider this investment?

This is suitable for:

-

Long-term investors

-

HNIs and professionals

-

Investors seeking alternatives to equities and housing

-

Portfolios needing real-asset diversification

It is not suitable for investors who need:

-

Regular income

-

Short-term liquidity

-

Capital certainty over short horizons

19. How should this fit into my overall portfolio?

A common framework:

-

Allocate 5–10% of net worth to alternatives

-

Farmland can be one component alongside REITs, gold, or private credit

It should complement—not dominate—your portfolio.

20. What is the single biggest reason to invest?

You are buying scarcity early, before the highest-value use is priced in.

That asymmetry—not yield, leverage, or speculation—is the core reason farmland works over long periods.