Invoice discounting is a new asset class for most investors in India, hence there are lot of doubts and queries on the various aspects . Many platforms have come up over the last couple of years such as Altgraaf, Tapinvest , Tyke, Tradecred and Monytics that list these products.

Initially, in the first generation version of invoice discounting, there were few defaults. Some platforms like Kredx had more defaults than others. The platforms have now tried to make more innovative structures with stronger risk management to reduce these instances. To learn about these platforms you can check our article.

We got an opportunity to ask the Altgraaf team questions about their Invoice discounting process. Below are the key questions with the answers provided by Altgraaf.

-

What is the lifecycle of the invoice discounting process?

The lifecycle of the invoice discounting process begins with the onboarding of the borrower, which typically takes about 2-3 months. This phase includes vetting the borrower’s creditworthiness, and market feedback, setting up necessary compliance, understanding the legal aspects, and establishing terms and conditions. Once onboarded, the borrower can present invoices for discounting based on their financing needs. The invoices are then discounted for a short period, generally ranging from 30 to 90 days. The duration depends on the nature of the transactions and the counterparty’s requirements. This allows borrowers to access immediate liquidity while awaiting payment from their customers, optimizing cash flow and business continuity. The cycle repeats as borrowers generate new invoices, continuing a dynamic and flexible financing solution.

-

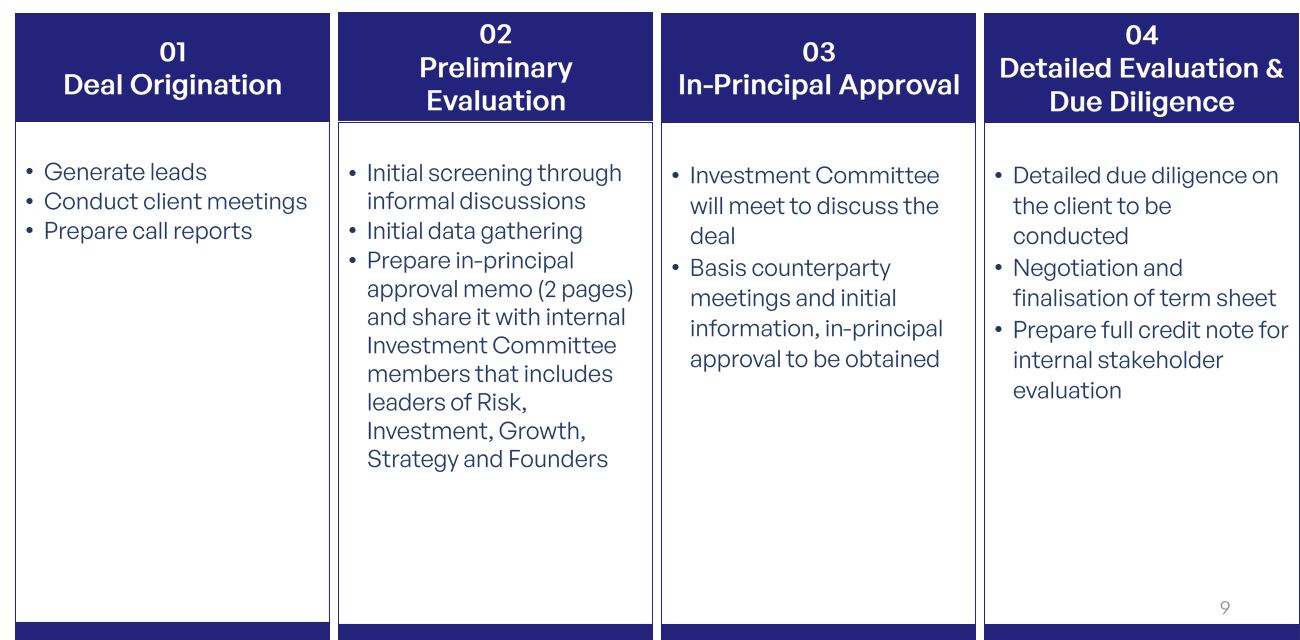

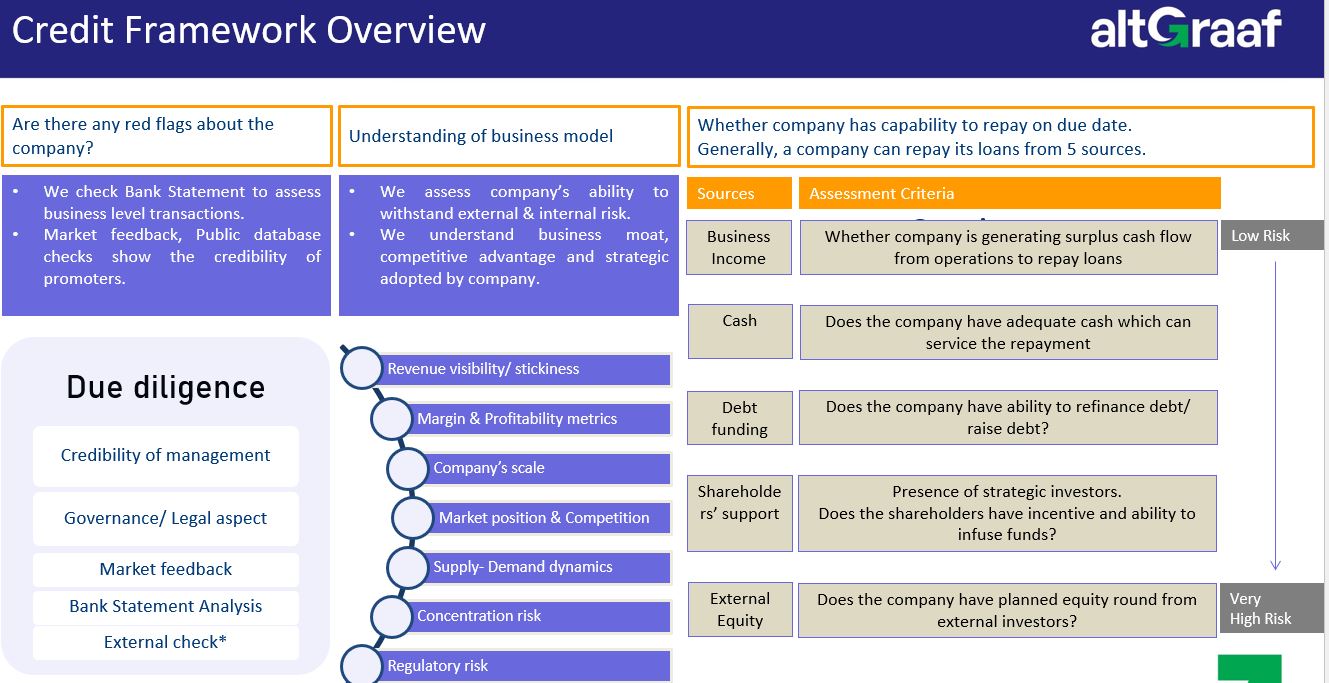

How do you onboard a new company for Invoice Discounting (ID)? What is the risk management process followed when listing an ID opportunity?

When a company approaches us for an invoice discounting deal, it undergoes a thorough credit assessment process involving several key steps. Only after meeting rigorous criteria do deals qualify for listing, with just about 7% of all incoming deals making it live on our platform. Attached are the slides that explain the process in detail. Do reach out to us in case you need any further clarifications.

-

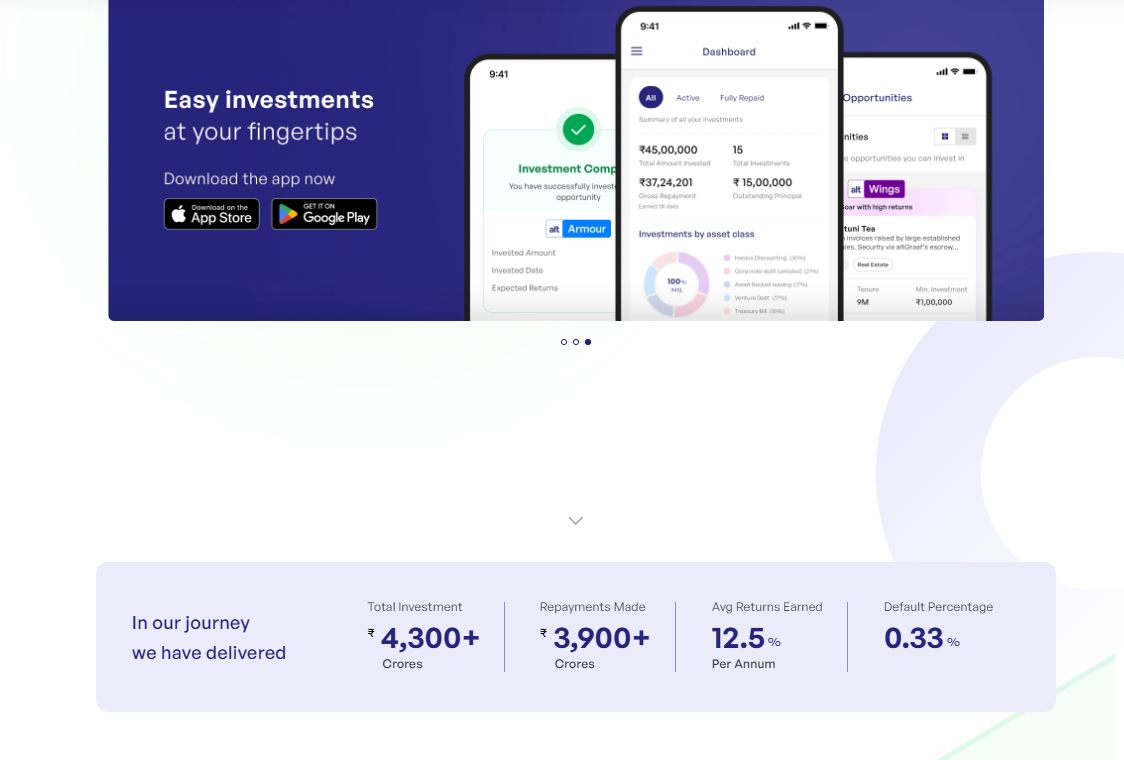

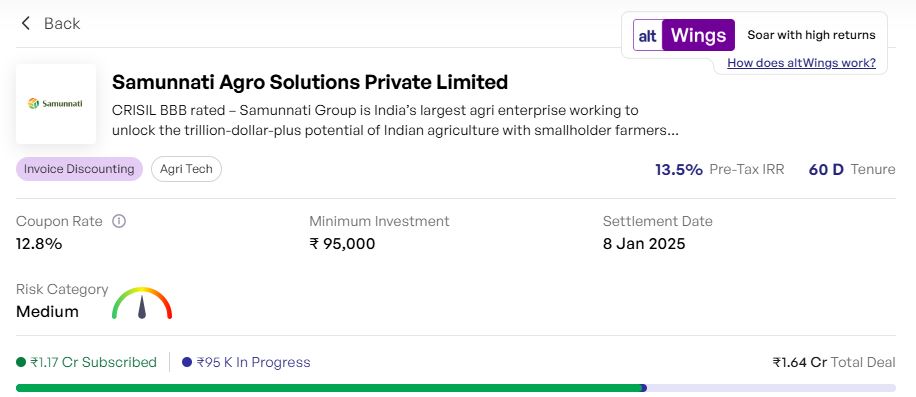

Can you elaborate on the type of Invoice discounting opportunities currently on the platform?

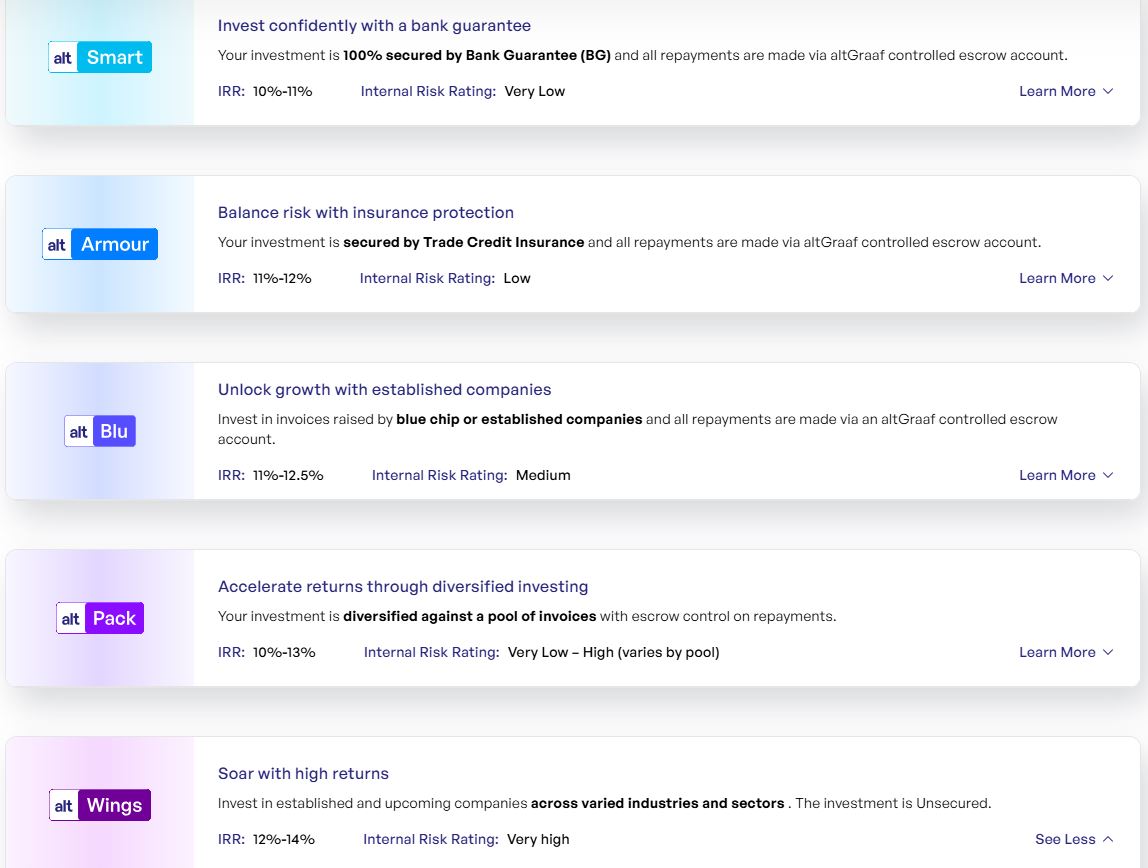

- altSmart (IRR: 10% – 10.5%): Investment is 100% secured by Bank Guarantee (BG) and all repayments are made via altGraaf controlled escrow account.

- altArmour (IRR: 11% – 11.5%): Investment is secured by Trade Credit Insurance and all repayments are made via altGraaf controlled escrow account.

- altBlu (IRR: 11.5% – 12%): Invest in invoices raised on established companies and all repayments are made via an altGraaf-controlled escrow account.

- altPack (IRR: 10% – 13%): Investment is diversified against a pool of invoices with escrow control on repayments. This is a PTC instrument.

- altWings (IRR: 12% – 14.5%): Invest in established and upcoming companies across varied industries and sectors . The investment is Unsecured.

-

What is Trade insurance? Can you illustrate benefit with an example

TCI assures investment protection and reduces losses due to non-repayment of trade debts on the occurrence of a covered event. Example of how it works:

- Goods Delivered: The seller delivers goods or services to the buyer.

- Invoice Issued: After delivery, the seller sends an invoice to the buyer for payment.

- Trade Credit Insurance: The seller is protected by TCI, which ensures they’re covered in case the buyer doesn’t pay.

- Funds to Seller: AltGraaf manages an escrow account where funds are safely held. Using this account, investors help provide upfront funds to the seller, allowing them immediate cash flow.

- Repayment: The buyer then repays the invoice amount into the escrow account controlled by AltGraaf.

- Repayment Distribution: Finally, the escrow account distributes the repayment to the investors who initially funded the receivables.

-

What is BG-based Invoice Discounting, Illustrate with an example. How is it different from trade insurance?

BG-based ID (Bank Guarantee-based Invoice Discounting) refers to an invoice discounting process that is secured by a Bank Guarantee (BG). In this arrangement, a bank provides a guarantee to the seller (beneficiary) that the buyer’s payment obligations will be met. If the buyer defaults on their payment, the bank steps in to honor the payment to the seller.

-

How BG-Based ID Differs from Trade Insurance

-

Source of Guarantee:

o BG: The bank provides an enforceable commitment to make payment if the buyer fails to pay.

o Trade Insurance: Provided by an insurance company, covering the risk of default, but it acts as a safety net rather than an upfront guarantee.

-

Time to Honor:

o Bank Guarantee: Typically, a bank guarantee is honored within 20 business days once a claim is made due to the buyer’s default.

o Trade Insurance: In the case of trade insurance, it can take significantly longer upto 6 months for the claim to be processed and paid out.

Key Differences:

- Speed: BGs are faster to settle, typically within a month, while trade insurance takes much longer.

- Issuer: BGs are issued by banks, while trade insurance is provided by insurance companies.

Here is an example of how BG works:

- Goods Delivered: The seller/vendor delivers goods or services to the buyer/anchor.

- Invoice Issued: After delivering the goods or services, the seller issues an invoice to the buyer for the payment.

- Bank Issues a Bank Guarantee (BG): The buyer’s bank issues a Bank Guarantee (BG) in favor of the seller, providing assurance of payment in case the buyer defaults.

- Assignment of Bank Guarantee: The seller assigns the Bank Guarantee to AltGraaf, giving the platform the right to act if needed.

- Funds to Seller: The funds raised from investors are transferred to the seller, providing them upfront liquidity.

- Repayment: The buyer repays the amount owed for the goods or services to the escrow account controlled by AltGraaf.

- Repayment Distribution: Once the payment is received from the buyer, the escrow account distributes the repayment to the investors who funded the receivable, along with their returns.

-

What new initiative have you taken after the issue with Arzoo Invoice default?

We have originated over INR 4,500+ crore in investments, maintaining an industry-leading NPA rate of just 0.34%. The 0.34% NPA was tied to invoice discounting in the product category with only one borrower. However, we understand that investors are diverse, and some seek very low-risk products. To address this, we have introduced new structures within our invoice discounting deals:

- AltArmour: Backed by trade credit insurance, offering full protection with 100% coverage of both principal and interest.

- AltBlu: Insured for 90% of the principal amount, providing a high level of security.

- AltSmart: Secured by a bank guarantee, ensuring both principal and interest are fully covered.

Additionally, we originated thousands of crores via unlisted bonds (NCDs) all secured by underlying collateral, with a strong track record of timely paybacks. These instruments show up in investor’s demat account. Unlike listed bonds, these are not traded on exchanges and investment risk can be from very low to high depending on the borrower’s credit risk.

Each of these initiatives is designed to bring options to investors based on risk preferences and can help investors build a diversified portfolio.

-

Is there still any risk that is not completely covered in Invoice Discounting?

All investments carry risk including Equity, MFs, Bonds, Real Estate, Gold, and FDs. While our BG and TCI-backed invoice discounting deals are structured to significantly reduce default risk, some residual risk remains. There is a possibility that the bank or insurance provider may not honor their commitment if the circumstances of default do not meet their specific payout criteria. In the case of traditional invoice discounting, while altGraaf screens and approves selected borrowers combined with added risk structures and risk controls/mitigants, there is no underlying security in the form of insurance or bank guarantee. We encourage investors to read all information carefully before investing.

-

How are deals on your platform different from others? We see a few issuers raising money across platforms.

With a leadership team bringing over 100 years of cumulative experience in the BFSI industry, our platform stands out for its origination, underwriting, and monitoring strengths, enabling us to offer some of the finest fixed-income products in the Indian market. We provide a diverse range of securities with XIRRs from 8-20% and tenures spanning 30 days to 3 years, supporting corporations & Institutions, MSMEs, startups, and real estate players. The scale of our platform also allows us to secure favorable terms and structures, delivering ideal risk-adjusted returns for our investors.

While some borrowers do raise capital on additional platforms outside us, structuring of investment opportunities is not same from platform to platform. We take pride in our ability to efficiently structure transactions to maximize protection for investors with strong risk adjusted returns, a capability that distinguishes us from other platforms.

-

How do you monitor the companies after deal closure, Is there a provision to manage risk before default?

After deal closure, our Credit and Investment Teams rigorously monitor each company in our portfolio. Through formal monthly meetings, we assess critical factors such as business performance, unit economics, profitability, and the status of collateral or security. This ongoing review enables us to proactively manage risk by identifying any necessary adjustments, such as setting or tightening limits for counterparties, reducing exposure, or even fully exiting the partnership if warranted.

Additionally, if a borrower demonstrates consistent business growth and financial strength, we consider continuing the partnership. This proactive approach allows us to act early, effectively managing, and mitigating risk before any default risk materializes, ensuring stability for our investors.

-

What is the process in case a default happens?

In the event of a default, our top priority is to work closely with the borrower to resolve the issue and get repayments back to borrowers with added interest. We focus on solutions that support swift resolution. However, in a very worst-case scenario where these efforts are unsuccessful, altGraaf will initiate legal actions to recover the funds. This approach underscores our commitment to safeguarding our investors’ interests while maintaining a responsible solution-oriented process.

Closing Remarks

Invoice discounting is a new asset class in India for the retail investors that has good potential to grow. Platforms like Altgraaf are creating new products with enhanced risk management to protect investors however it is important that investors do their research before investments. We provide monthly update on these platforms and highlight any delay or defaults . We have been investing in multiple platforms and share our portfolio performance as well.