Wishing all our readers a Happy New Year!

Let’s look back at the key global and Indian Market and Economy Events for 2024.

Global Markets and Economy in 2024

The year 2024 brought remarkable shifts in global markets and economies. Here are the key takeaways:

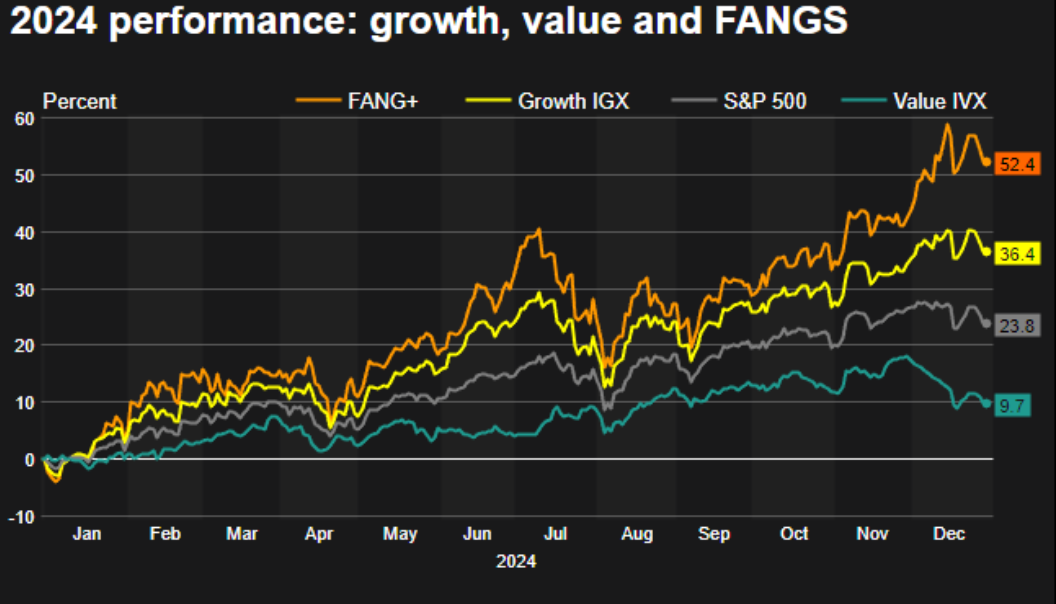

- Tech-Led Stock Market Surge: The S&P 500 soared past 20% gains for the second consecutive year, driven by tech giants like Nvidia and Tesla, riding the AI wave.

- Bitcoin Breakthrough: Cryptocurrency took center stage as Bitcoin crossed $100,000, signaling broader adoption and regulatory tailwinds.

- Federal Reserve Pivot: Three interest rate cuts by the Fed fueled market optimism and economic momentum.

- Gold Shines Bright: Amid global uncertainties, gold prices surged by 26.7%, reaffirming its safe-haven status.

- Real Estate Rebalancing: U.S. office vacancies hit 20%, while existing home sales fell as high mortgage rates reshaped the housing market.

- Emerging Market Struggles: Currency devaluations and trade pressures challenged emerging economies, while European markets lagged amid weak economic indicators.

- Bond Market Surprises: High-risk bonds from nations like Lebanon and Ukraine delivered outsized returns, capturing investor interest.

Key Financial Events in India – 2024

- General Elections: Surprise results brought post-election volatility followed by a strong recovery

- Union Budget 2024: Tax changes and increased capital gains tax was the highlight

- IPO Boom: Record IPO activity with a 34.83% rise in the BSE IPO Index, reflecting strong investor confidence.

- RBI Policies: The tight monetary stance early in the year shifted to easing post-elections, influencing liquidity and banking stocks.

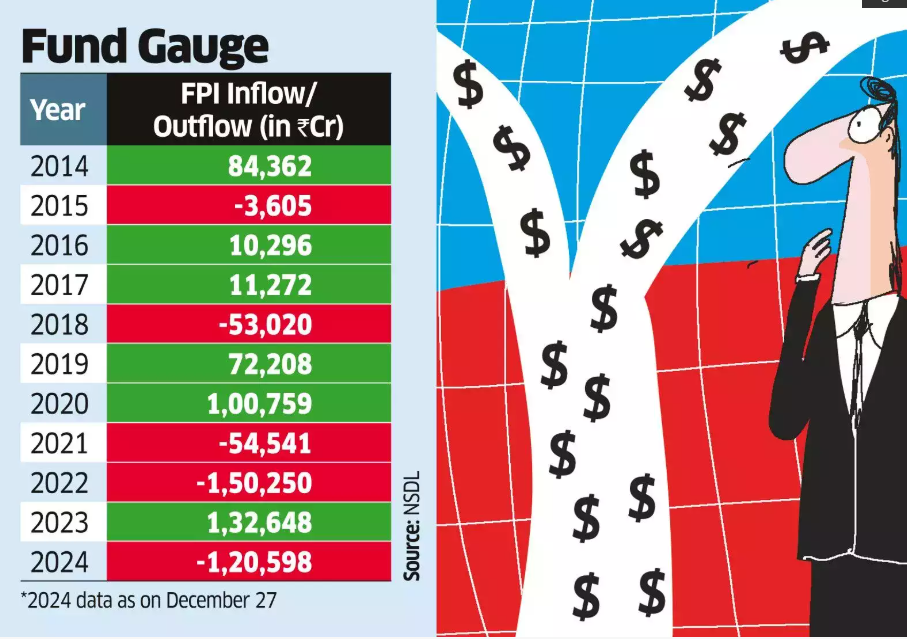

- Stock Market Swings: Sharp dips and recoveries offered significant opportunities for investors, highlighting market resilience. Record outflow of FII but support through record Mutual fund SIPS.

Key Alternative Investment Events in 2024

- RBI brought new regulations and norms for P2P investing leading to a knee-jerk impact on their current business model.

- Reduction in Bond ticket size to 10,000 to enhance retail participation.

- SM REIT framework was created to bring new, smaller real estate to the financial market.

- The SEBI framework for launching the Specialized Investment fund can be a game-changer. A minimum ticket of INR, 10 Lakh will allow access to credit and investing strategies accessible only to UHNI till now.

Best Alternative Investment for Randomdimes in 2024

Unlisted Equities

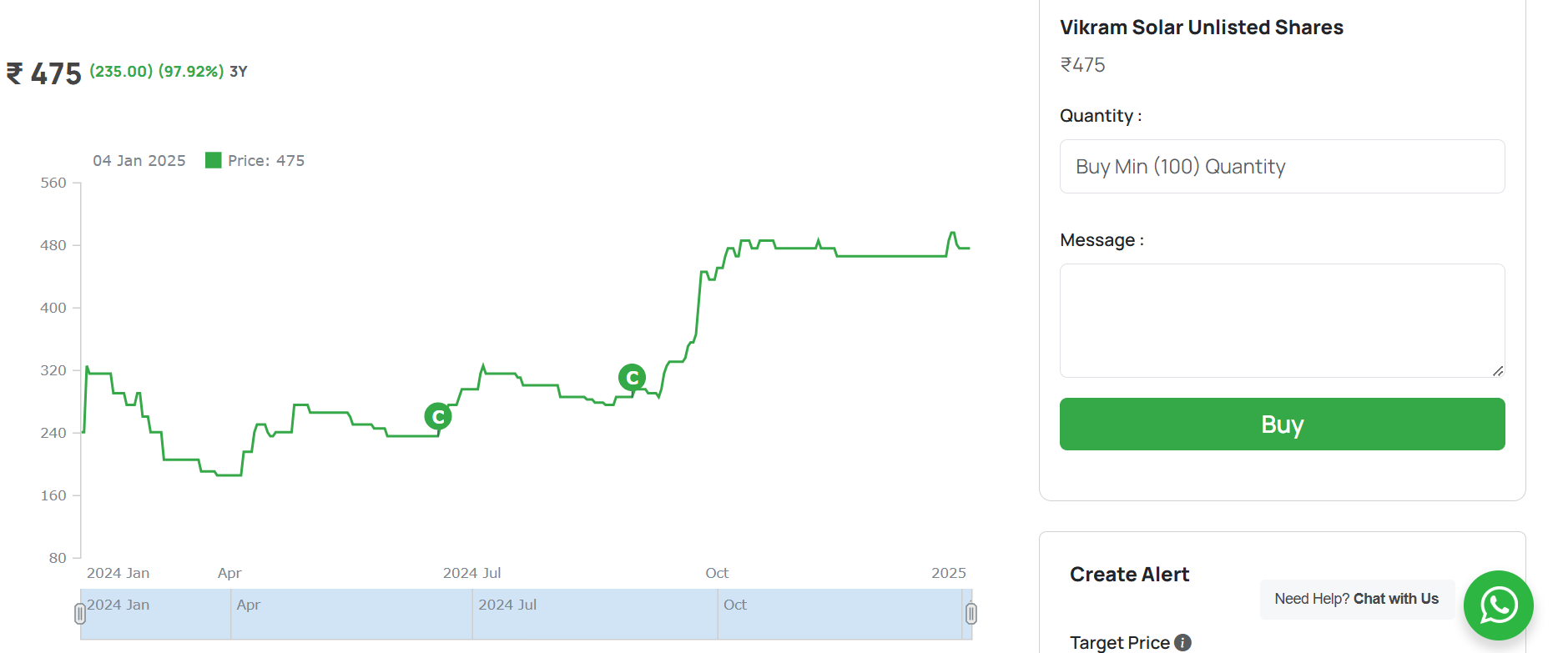

Many investors could access Swiggy(370), Vikram Solar(150), and NSE(2500) at lower prices than those available on online platforms. We were able to procure these from various sources. All 3 are currently more than 50% higher than the invested price.

Global Stocks (US and China)

We had been doing a systematic investment in China and had invested in Nasdaq in 2022-2023 when it had gone down 40-50 % from the top. Both bets proved to be good giving 50% and 100% return respectively.

Crypto

This has been a great year for Crypto investors with Bitcoin making a new high. Even Solana also went 10 times from its bottom level this year. Ethereum is still below its top. We were buying crypto after the 2022 crash. It took 2 years for it to come out of the bear phase but the returns have been phenomenal and worth the wait.

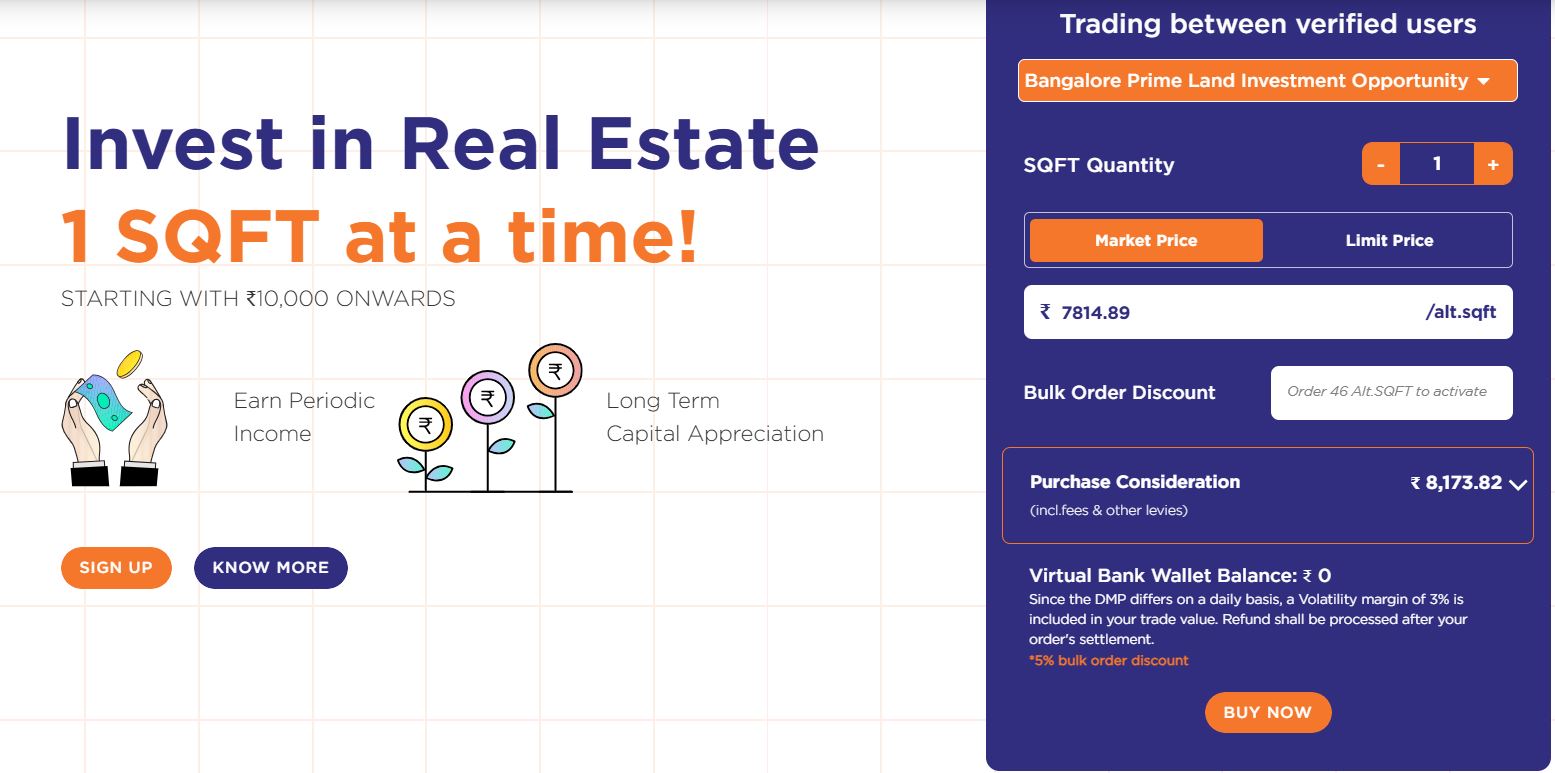

Real Estate (Altdrx)

We were able to get 30% on our real estate investment through Altdrx. It was a private opportunity in Bangalore land. We prefer investing in land over Rental properties as there is less hassle on tenant management/leasing etc. We will do a detailed post on our investment.

High Yield Debt (Altifi , grip,asset monk)

We invested in 12-17% range debt across platforms. All the invested credits have been performing well.

Top Challenges Faced by Alternative Investors in 2024

- Growpital Fiasco – This is the first platform where we lost capital along with other investors. Due to Sebi freezing, the capital is still stuck in escrow. One of the key learning from this is to avoid any platform that is managing capital unless regulated. We have decided to only invest in assets from now onwards. Managed platform not only regulatory risk but also significant corporate governance risk

- Single Invoice discounting /Leasing exposure- Some investors had large exposure on individual deals like Arzoo which caused significant capital erosion when they defaulted. We have reiterated that it is important to restrict exposure to one deal not more than 3-4% of your capital. Even in case of default, it should not impact your networth significantly. Platforms like Kredx had multiple defaults made us quit them!

What would be our Alternative Investment Focus for 2025?

Bonds, Equity, and Real Estate have a high correlation during adverse market conditions hence it is difficult to target a highly uncorrelated asset. We would be exploring some assets that can really diversify our portfolio. Insurance assignment is one asset that has such a feature. You invest in Gsec security with a fixed locked return. We have been using Policy Exchange for this. Will be evaluating it in more detail before increasing exposure.

Moon shot assets with risk

Crypto and unlisted equities are assets that can give 3 digit returns if invested at the right time but it does come with the risk of ruin and significant volatility. We will be allocating a small budget for these every month with the capital we are ok with taking high-risk

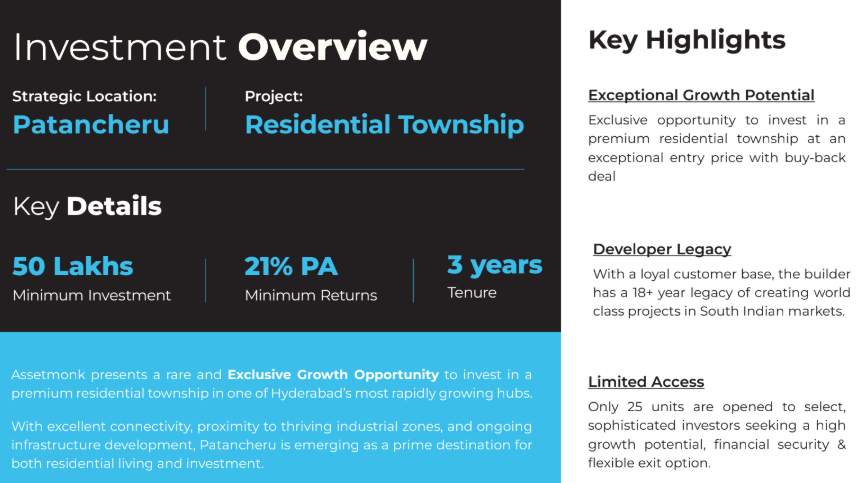

High Yield potential assets

Real Estate Equity and debt if played well can give really good returns. we will create a portfolio of debt and equity in these assets to target a 15-20% return. We will also invest in high-yield debt on different platforms. We are collaborating with an originator of bonds to provide access at best yields for our readers! Will be doing a post on it very soon.

Trading strategies for incremental alpha

As our equity exposure becomes higher we get access to more margin. Deploying trading strategies on these can generate returns if risk is managed well.

Playing Poker

This is something we would be exploring in depth. Many people in my network have done well playing online poker, generating significant returns on capital. It is a game of skill and needs a lot of effort to be able to reach a stage where you can win. We would start with a small capital and share our results and journey.

Please do comment what is your investment strategy for 2025!