Sep 2025 Finance Wrap: India & the World

India – Still the Fast Horse

-

GDP gallop: India’s charging ahead at ~6.5–6.8% growth, fastest among big economies.

-

RBI cool & calm: Repo steady at 5.5%, inflation under control. Rate cuts? Maybe on the menu later this year.

-

IPO carnival: Year-end blitz with $8B+ in IPOs lined up – Dalal Street is buzzing.

-

Capex > freebies: Govt. sticking with infrastructure push, keeping fiscal deficit near 4.8%.

-

Risks: Oil spikes + tariff wars (hello U.S.!) could spoil the party.

Global – Choppy but Interesting

-

Growth meh: World crawling at ~3%, advanced economies slowing, EMs keeping the lights on.

-

Debt mountain: Global IOU pile hits $338 trillion – that’s 3x world GDP.

-

Tariff tantrums: New U.S. trade barriers shaking supply chains, sparking tit-for-tat responses.

-

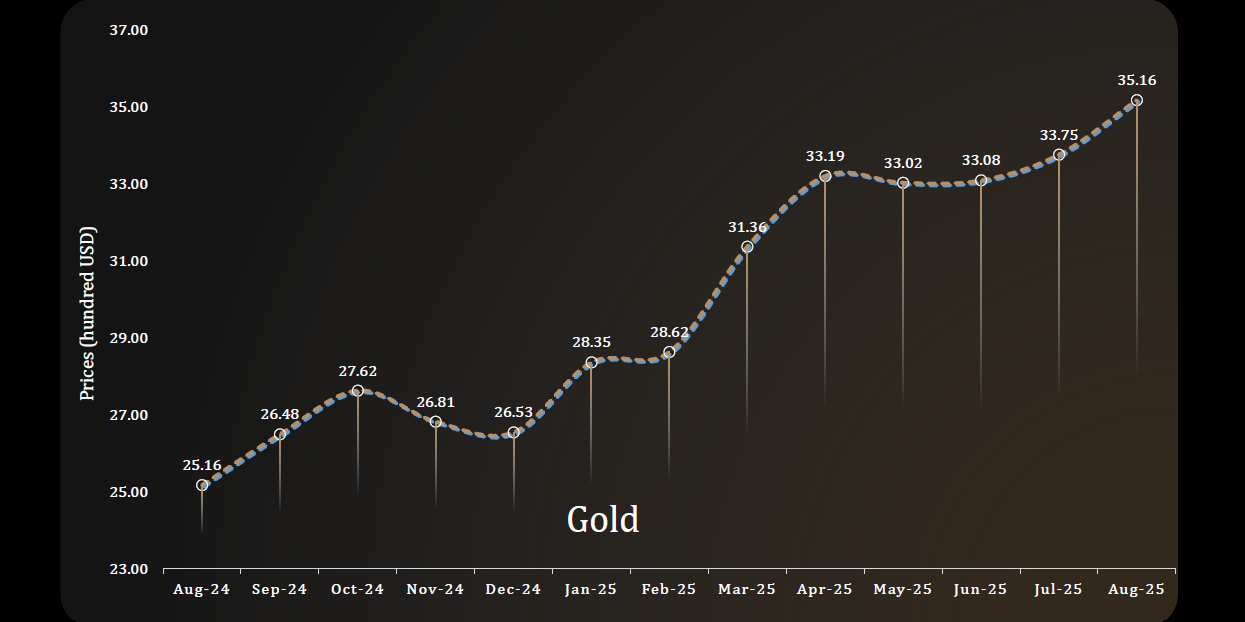

Silver lining (literally): Silver prices broke out big as investors hunt safe havens + green energy metals.

-

M&A mania: Over $1T deals in Q3 alone – boardrooms are busier than stock traders.

Why is Silver Outshining Gold?

Both silver and gold have valuable industrial roles. Gold finds its way into aerospace, electronics, and even dentistry. But silver takes the crown for utility — nearly 50% of global silver demand comes from industrial use, versus only ~12% for gold.

What makes silver especially exciting in 2025 is its role at the heart of two booming sectors:

-

AI infrastructure ️ – data centers need silver-heavy components for conductivity and cooling.

-

Green energy ☀️ – solar panels and EVs rely on silver as a critical input.

That mix of safe-haven demand plus surging industrial use explains why silver is stealing the spotlight from gold.

Randomdimes Youtube

Alternative Investments, Defaults, and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently, below are the key new updates on the various delays across Alternative Investment platforms.

- Grip LoanX Delay Update

- Afinue Evage Default

- Growpital Update

Update on LoanX Up Money Apr’26 (as of Sept 2025)

Background

-

Until Jul’25, all payouts (interest + principal) were on track.

-

In Aug’25, Up Money failed to remit pool collections despite submitting reports → payouts missed.

-

This breached both transaction documents and RBI’s securitization rules.

-

Cash Collateral was liquidated in Sept’25 → 35.5% of investment (incl. interest) returned so far.

-

No Sept’25 collection reports or transfers received.

-

Up Money is also defaulting with 55+ other lenders, seeking restructuring.

Actions Underway

-

Engagement with Promoters – Ongoing discussions, but no credible restructuring plan yet. Over-collateralisation (16%) & EIS remain unusable without remitted collections.

-

Loan Pool Assessment – Independent CRIF HighMark analysis of 4,100+ loans (vehicle + MSME) in progress; results due 10 Oct’25.

-

Backup Servicer – One institution shortlisted; legal process to replace Up Money is being evaluated.

-

Legal Measures – Formal complaints to SEBI & RBI are being filed this week; preparing further remedies, including a potential police complaint.

⚠️ Key Point: Up Money continues to default, with only partial recovery achieved. Trustee and lenders are pursuing backup servicing, independent loan verification, and regulatory/legal escalation.

My View

The independent loan pool analysis (due 10 Oct’25) will be crucial to determine the true health of the underlying assets and guide next steps. Meanwhile, regulatory and legal escalation is necessary to protect investor interests.

In short: we are in recovery mode, not resolution mode — expect progress to be slow, but structured actions are underway.

Afinue EVAGE Lease Default (Update September 2025)

EVAGE leasing default is under active legal and recovery proceedings.

Current Legal & Recovery Actions

-

Section 138 NI Act case – Filed in Mumbai; summons for EVAGE directors expected by end of September (before Diwali holidays).

-

NCLT Proceedings (Chandigarh) – Case registered at the Punjab & Haryana High Court bench of NCLT. First hearing took place on 4th Sept; next hearing scheduled for 6th Oct. A resolution professional has been recommended, and EVAGE has not contested the proceedings.

-

Settlement Talks – EVAGE’s CEO has made informal overtures for a settlement through legal intermediaries, though no binding offer has materialized yet. Importantly, EVAGE has not denied its liabilities.

-

Business Revival Claims – EVAGE claims progress on restarting sales in domestic and international markets, but these statements remain unverified.

-

Parallel Action – Police complaint prepared; Afinue team has engaged with senior Punjab police officials for additional enforcement if needed.

Investor Outlook

-

With summons expected under Sec 138 and bankruptcy proceedings moving forward, pressure is mounting on EVAGE management to arrive at a resolution.

-

While timelines remain uncertain, investors can take some comfort in the two-pronged approach (legal + regulatory) that Afinue and its legal partners are pursuing

Growpital Update

On 25th September, the SAT hearing was listed as item 26, but the matter was not discussed. It appears that SEBI has submitted an affidavit to Growpital.

It is high time that SAT proceeds with the hearing so that investors can finally get their money back.

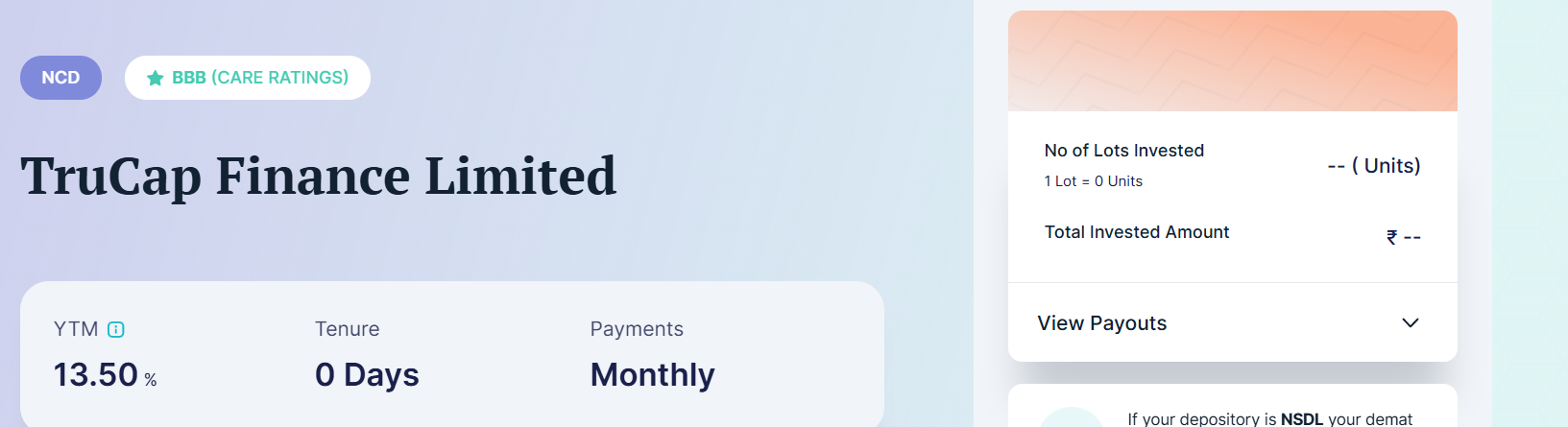

Bonds Risk Status Update

Some recent bond covenant breaches are

- Sammunati

- Spandana Spoorthy

- Moneyboxx

- Trucap

- Finkurve

- Criss Financials – Early Repayment Done

- Dvara KGF

- Lendingkart

- Satin

- Reasolution – Trucap

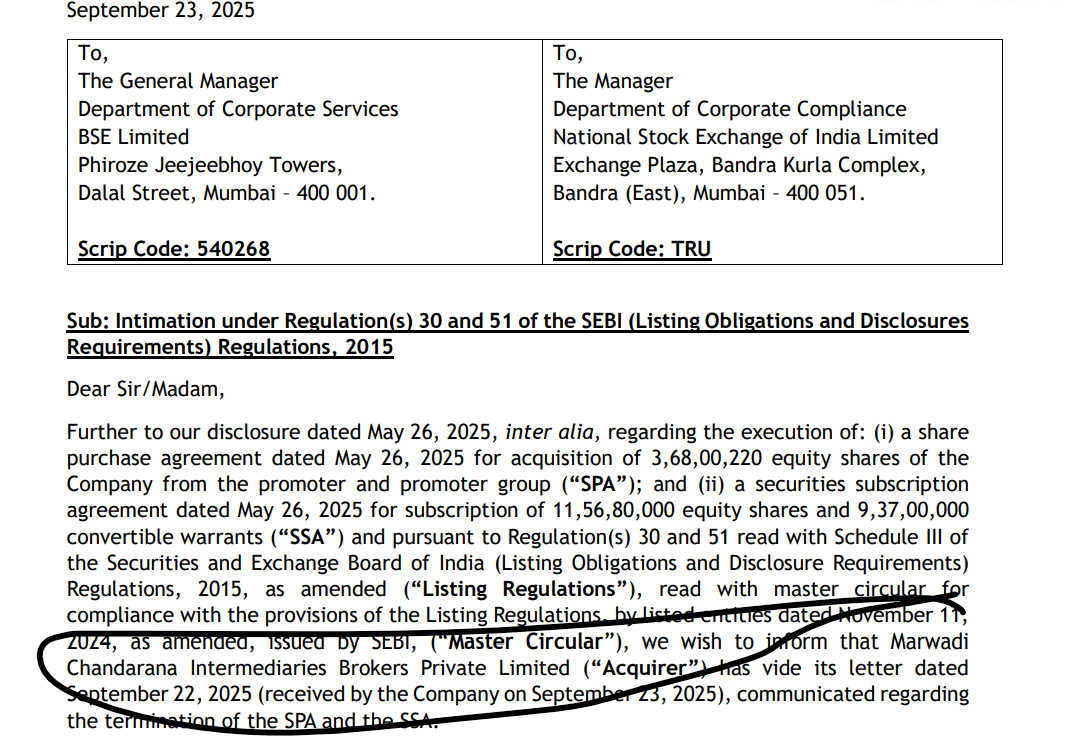

TruCap Finance – Default & Marwadi Deal Update

TruCap Finance, which defaulted on ~₹150 crore of NCDs in July 2025 (impacting ~1,100 retail investors), had partially repaid investors and was expected to be rescued through a planned equity infusion by Marwadi Chandarana Intermediaries Brokers Pvt. Ltd. via a Share Purchase Agreement (SPA) and Securities Subscription Agreement (SSA).

However, on 23 September 2025, TruCap disclosed that Marwadi has terminated both agreements, effectively withdrawing from the deal. This cancellation removes a key source of anticipated capital support, leaving TruCap’s financial position uncertain despite earlier repayments.

Investor takeaway: While some recovery has occurred, the default highlights the risks in high-yield NBFC NCDs. With the Marwadi deal off the table, TruCap must now seek alternative funding or restructuring routes to protect remaining investor interests.

Surprisingly, for my ISIN Trucap has completed the repayment this month. Please comment on the post and update the status of your repayment.

Summary Table

| Aspect | Details |

|---|---|

| Default Date | 16 July 2025 (CareEdge downgrade reported 18 July) |

| Affected Investors | ~1,100 retail investors |

| Outstanding Principal | ~₹55 crore |

| Initial Recovery | 15% paid between 18–21 July |

| Key Cause | Liquidity crunch after failed funding commitments |

| Next Steps | Debenture holders’ meeting held on 8 August |

| Investor Insight | High-yield bonds carry real credit risk—diversification is key |

Alternative Investment Funds and PMS

In our endeavor to enhance knowledge about Alternative Investment Funds and PMS in India, we covered sessions with experts on various funds. We recently arranged a webinar with the experts as well.

Popular AIF in various categories for August

- High Yield Debt (20-25)% – Neo Special Credit Opportunity Fund

- Incred Credit Opportunity Fund (15-17%)

- Real Estate Funds for CRE (18-21%) – ICICI CRE Fund

- Absolute Return Funds (14-15%)- ASK

You can register below to get access to the webinar and details about the product

Telegram channel for *the Latest Alternative Investment News

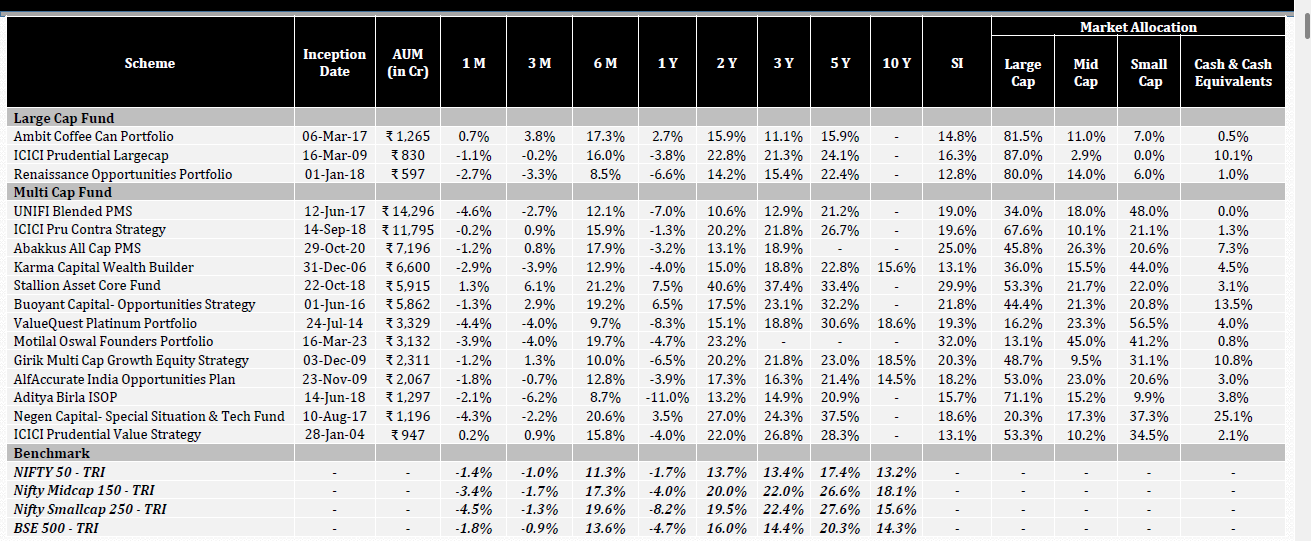

PMS Performance September

Below is the snapshot of top top-performing PMS in India for September. India-focused funds have underperformed global peers .Fill out the form below to download the latest information available on the funds below.

Real Estate Investments

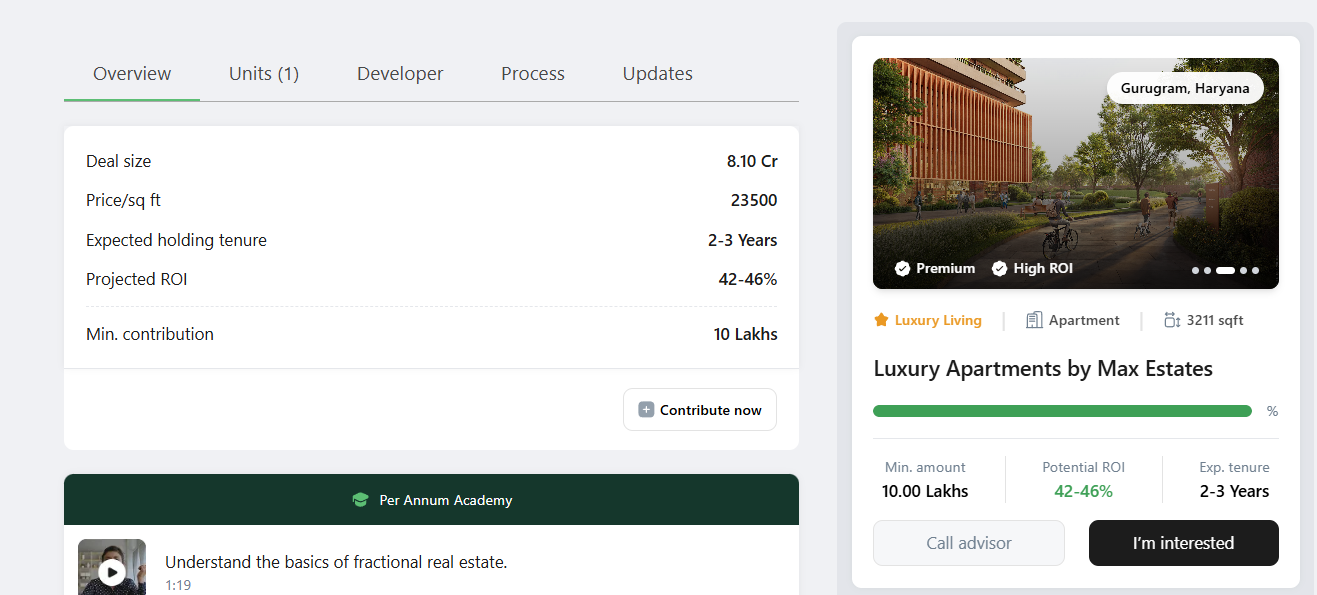

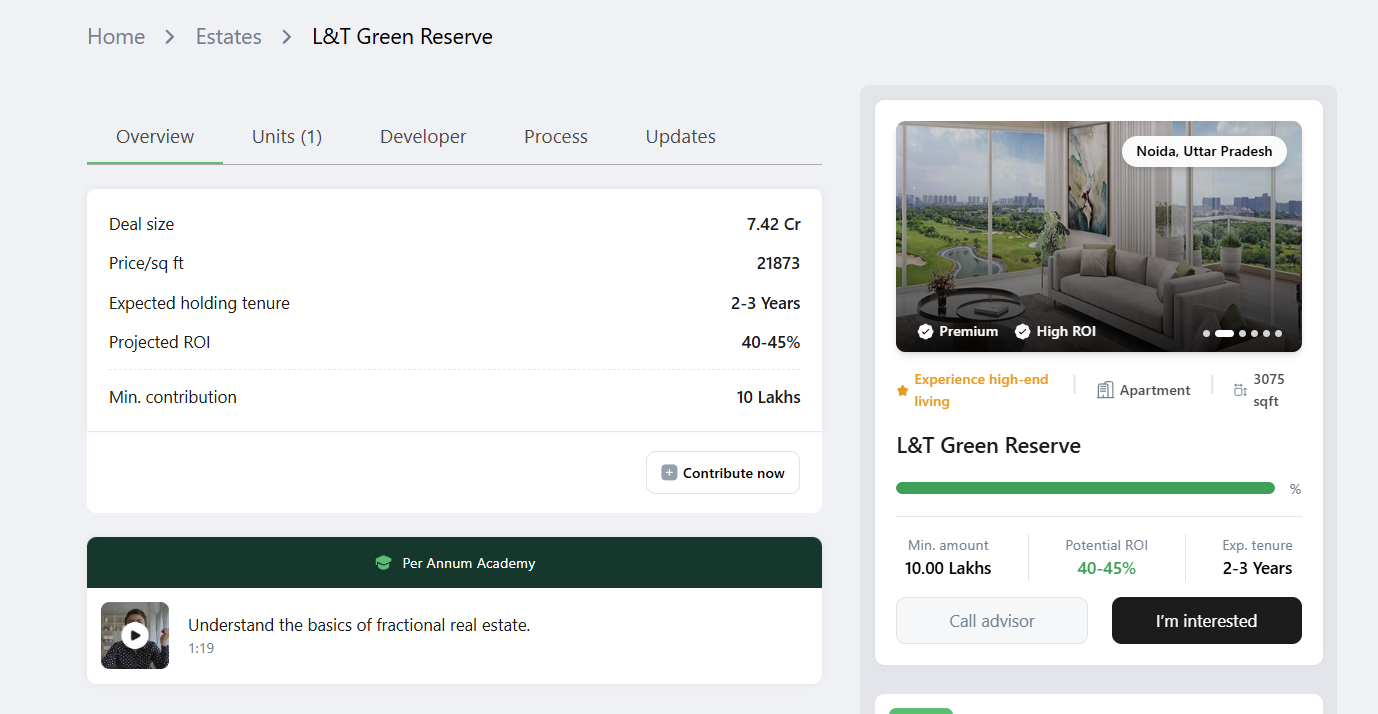

Per Annum New Opportunities

There are 3 new opportunities on Per Annum by three prominent builders

- Max

- L&T

- Lodha

Investment horizon is 2-3 years with a target gross return of 40%

We did a detailed article on Estates – How does Estate work?

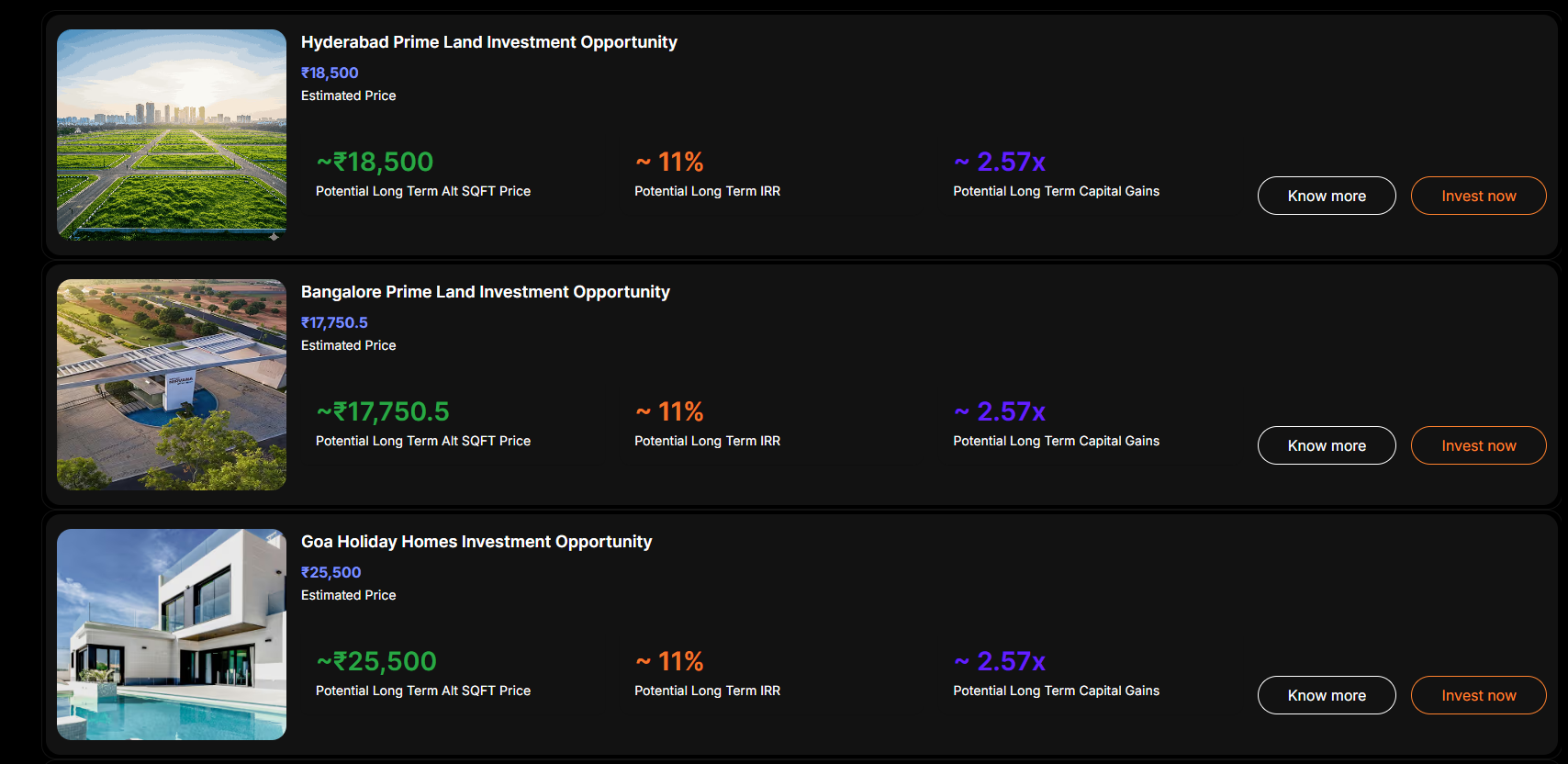

Alt DRX Private Opportunity

AltDRX has revamped its website. You can now view details, along with a performance chart, of your investments on the platform portal. Investors looking to get an offer on a private opportunity can reach out through Randomdimes.com

Altdrx OpportunityBond Investment

Below are the top-listed and unlisted bonds currently available in the market. We try to get the best rates from the platforms and funds that sell these bonds. For the listed bonds, you can use the link below to buy. For the unlisted, please add your details in the form, and we will connect you to the seller.

Listed Bonds List

For listed bonds, you can check the bonds from the link below. Best yields in the market!

Aspero Randomdimes Page| Issuance | Rating | Coupon | Yield (XIRR) | Issuance Date | Maturity Date |

| AKARA CAPITAL ADVISORS PRIVATE LIMITED | ICRA BBB | 9.85% papm | 15.00% | 30-Apr-2025 | 30-Oct-2026 |

| Indel Money Limited | CRISIL BBB+ | 11% papm | 13.95% | 11-Apr-2025 | 11-Nov-2026 |

| Indel Money Limited | CRISIL BBB+ Stable | 11.00% papm/11.57% XIRR | 13.95% | 7-Mar-2025 | 7-Oct-2026 |

| Satya Microcapital Limited | ICRA BBB+ | 10.40% papm | 13.00% | 23-Aug-2024 | 23-Feb-2026 |

| Spandana Sphoorty Financial Limited | CARE A+ | 9.84% papm/10.30% XIRR | 12.75% | 12-Sep-2024 | 28-Jun-2026 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 2-Apr-2025 | 2-Apr-2028 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 12-Mar-2025 | 12-Mar-2028 |

| Criss Financial Limited | IND A | 10.50% papm/11.02% XIRR | 12.60% | 30-Aug-2024 | 30-Aug-2026 |

| Satin Finserv | ICRA A– | 10.80% papq/11.25% XIRR | 12.60% | 20-Sep-2024 | 20-Sep-2026 |

| Navi Finserv Limited (“Navi”) | CRISIL A (Stable) | 10.60% papm | 11.70% | 21-Feb-2025 | 21-May-2027 |

Unlisted bonds List

| Issuance | Rating | Coupon | Yield(XIRR) | Issuance Date | Maturity Date |

| True Credits Private Limited | CRISIL BBB | 11.71%papm | 18.00% | 4-Apr-25 | 09-Apr-26 |

| Branch International Financial Services Private Limited | Acuite BBB- | 10% papm | 17.50% | 4-Mar-25 | 9-Mar-26 |

| True Credits Private Limited | CRISIL BBB | 11.71%papm/ 12.36% XIRR | 17.50% | 8-Nov-2024 | 13-Nov-25 |

| Smartpaddle Technology Private Limited (Bizongo) | Unrated | 11.50% papm/12.12% XIRR | 17.50% | 22-Feb-2024 | 22-Feb-2026 |

| Akara Capital | ICRA BBB | 9.85% papm | 16.40% | 30Apr25 | 30Oct26 |

| Hella Chemical | IND A- | 11.80% papm/ 12.46% XIRR | 15.00% | 28-Feb-2025 | 28-Feb-2028 |

| Evernest Infratech Private Limited (“Strata”) | Unrated | 13.50% papm/14.37% XIRR | 15.00% | 5-Sep-2024 | 5-Sep-2026 |

| Si Creva Capital Services Private Limited | CRISIL BBB+ | 10.40% papm/10.91% XIRR | 14.80% | 29-Jul-2024 | 3-Aug-2025 |

Register to get details of unlisted bonds

Short-Term Investments

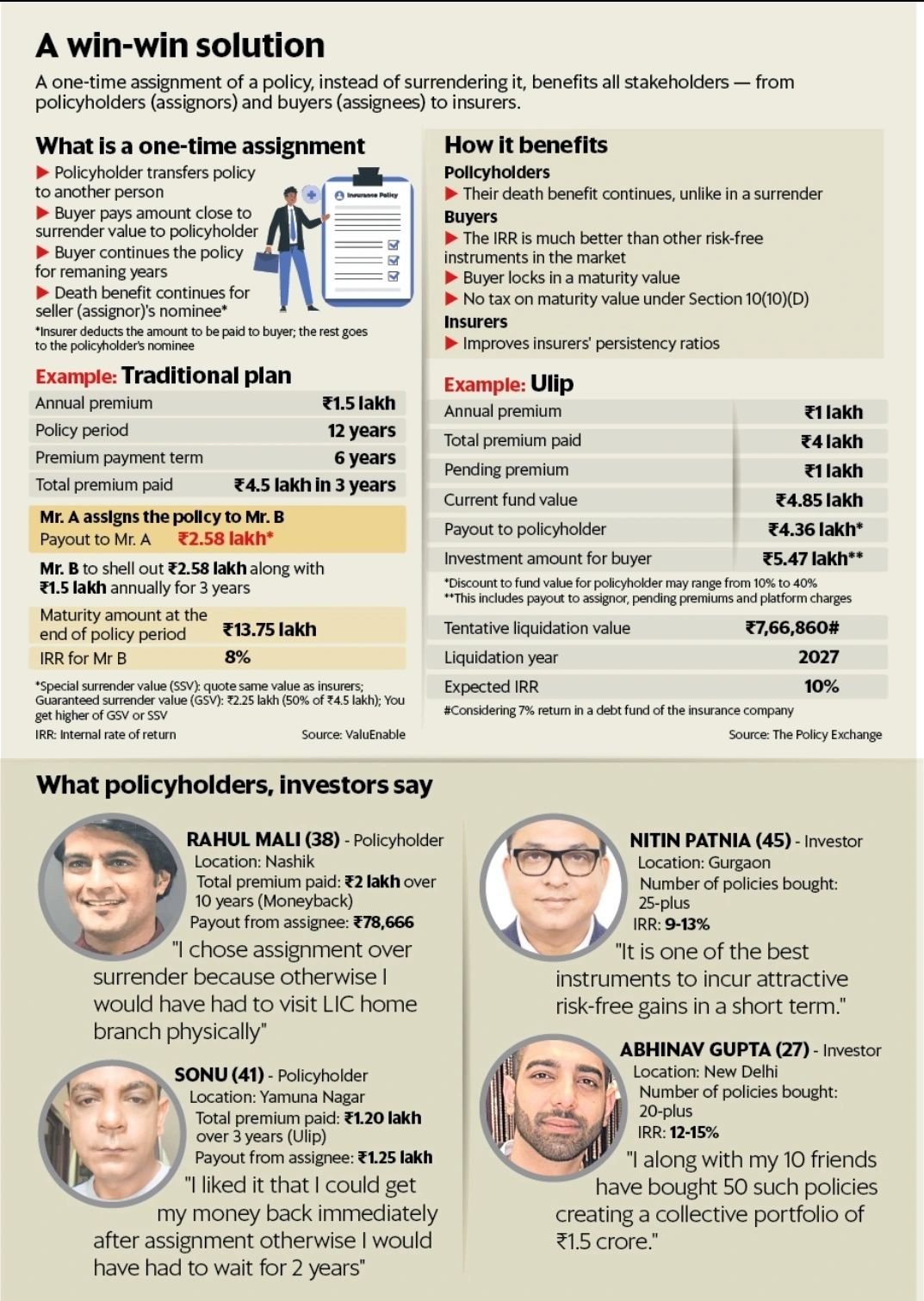

We recently did a post on our 1-year experience with PolicyExchange. The good part is that using PolicyExchange, you can get a 12% tax-free investment in a portfolio of Government bonds through policy assignment!

I will be participating in some of these opportunities. Latest post on Policyexchange.

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.40% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.2% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.40% |

| Altifi | 12.50% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Tradecred | 11.50% | 0% | 0% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

- Finally got some new policies on Policyexchange with high irr

- Currently invested in 2 Invoice deals on Tapinvest

- Invested in 1 deal on Amplio

- Invested in Altsmart (bank Guarantee deal) on Altgraaf

Crypto Investing

We recently covered an Altcoin research platform –Tokenmetrics, where you can find all the metrics and information required for analyzing altcoins.

-

Bitcoin (BTC) blasted past $122K, riding ETF inflows and safe-haven demand. Traders are eyeing $125K as the next breakout level.

-

Ethereum (ETH) surged above $4,400, supported by strong institutional staking flows and expanding DeFi activity.

-

Altcoins were mixed: Solana gained on DeFi traction, while meme tokens cooled after the summer rally.

-

Macro driver: Optimism around Fed rate cuts and a softer dollar keeps liquidity flowing into digital assets.

-

Street view: Citi trimmed its BTC year-end target to ~$133K, but sentiment remains broadly bullish as crypto cements its place alongside gold as a macro hedge.

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

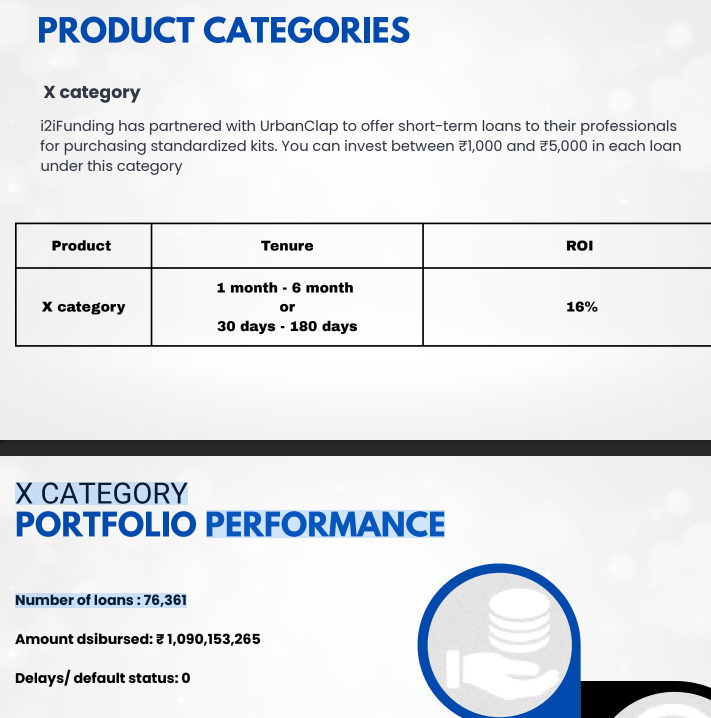

P2P Investment

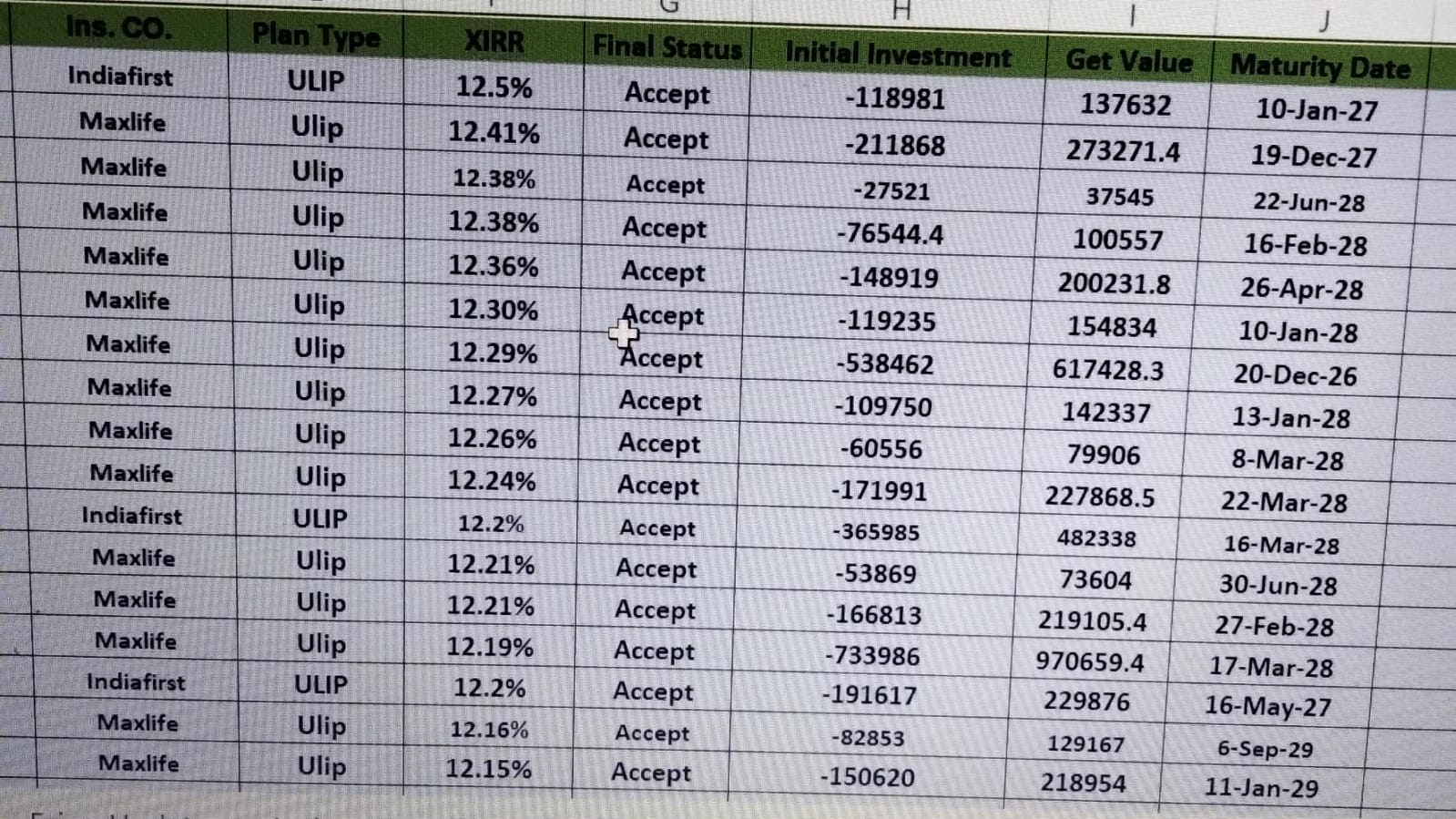

We recently received the performance report from I2Ifunding. Below is a snapshot of the deals.

Current allocation:

- India P2P – 33%

- I2IFunding- 50%

- Lendbox -17%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 12.8% | 5.7% |

| Lendbox Per Annum | Paused | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category, i.e, Urban Clap Loans.

- There are fresh deals available on I2ifunding now. Other P2P only doing redemption and no fresh deployment!

Equity Market

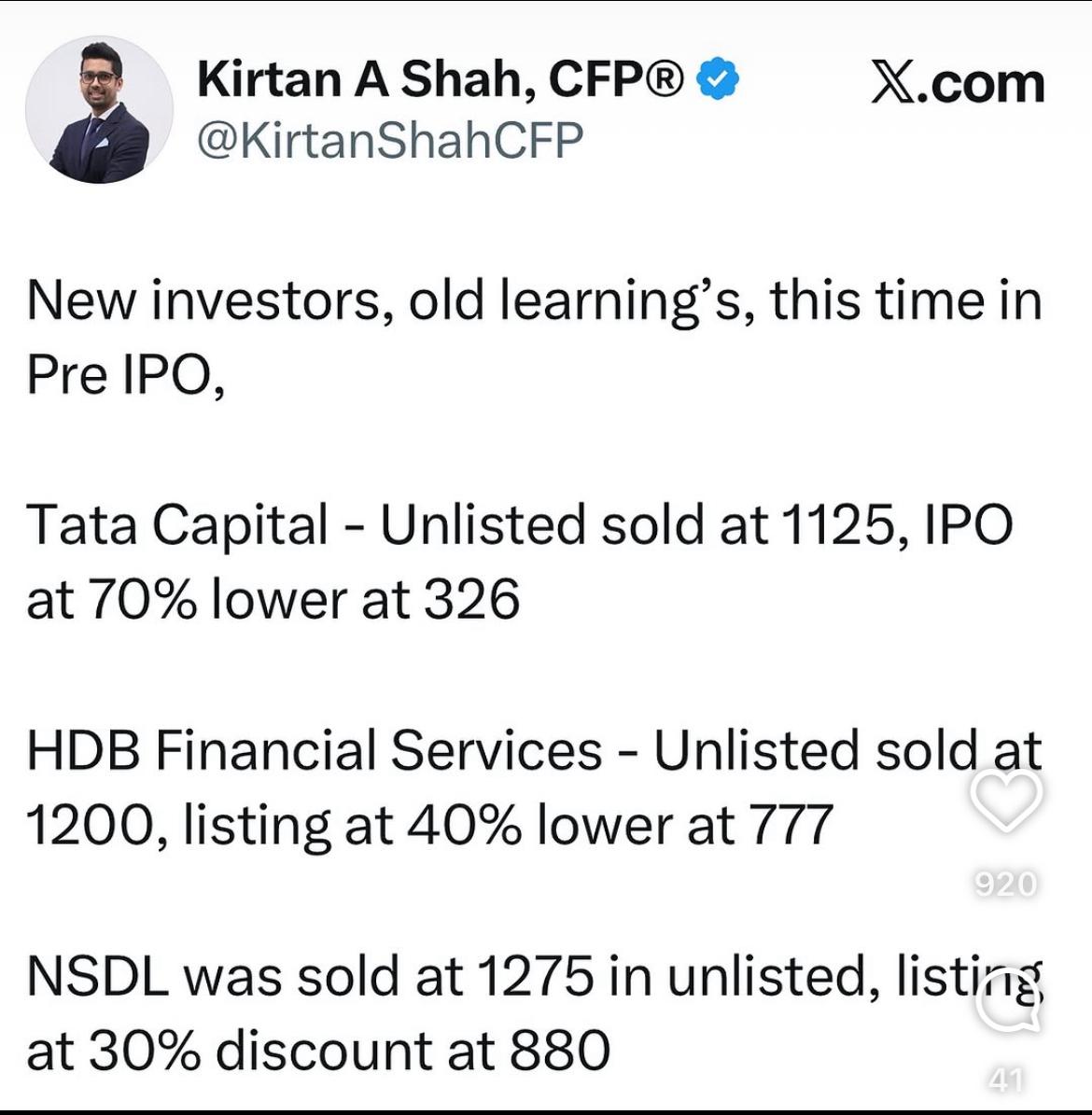

Pre-IPO Stocks

A key concern I’ve noticed with pre-IPO opportunities is that many investors are driven more by FOMO and market buzz than by a real understanding of the underlying business. It’s important to remember that most of the popular names being circulated are often already significantly overvalued, yet investor enquiries keep pouring in. The performance of several recent IPOs is a clear testimony to this trend.

On the other hand, the real value often lies in the less-hyped opportunities. We have seen this play out first-hand — our early investments in Waaree, NSE, and Vikram Solar turned out to be excellent value buys, delivering strong gains once they entered the spotlight and prices surged.

The lesson: avoid chasing the noise, and instead focus on fundamentals and value before the frenzy begins.

Listed Stocks

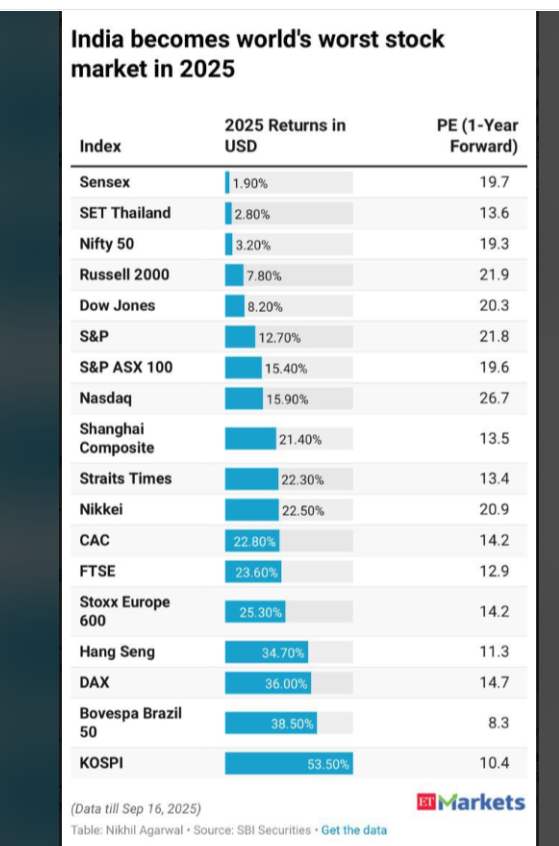

Foreign markets have been better placed than Indian market. We covered some international investing options for investors.

-

FPI outflows continue: Foreign portfolio investors pulled about ₹7,945 crore from Indian equities in September.

-

Sustained net selling trend: This marks the sixth month out of nine in 2025 when FPIs were net sellers in the equity markets.

-

Global share shrinking: India’s share of global equity market capitalization fell to 3.5%, a two-year low, as other markets surged ahead.

-

Tech/IT got a boost: Shares gained momentum after Infosys announced plans for a share buyback, lifting sentiment in the sector.

We recently did an article on how tactical leverage can improve returns of portfolio

Option Trading

Sep was an average month with total returns of 1.%. The option premium has become so low these days that yields have really dropped for most strategies!

Quantinsti is one of the top quant trading course providers in India. Beginners can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.