India – Economic Indicators Positive

GDP growth

India remains the world’s fastest-growing major economy.

-

Q1 FY26 GDP growth came in at 7.8% YoY, powered by robust services and capex.

-

The IMF raised its 2025 forecast to 6.6%, while the RBI revised FY26 growth higher to 6.8%.

-

The World Bank echoed optimism, noting India contributes nearly 17% of global growth this year.

“India’s momentum is remarkable even amid global slowdown,” said IMF’s Kristalina Georgieva.

RBI stays cool, inflation fades

-

Repo rate: unchanged at 5.50% for a sixth straight meeting.

-

Inflation forecast: trimmed to 2.6%, the lowest in three years.

-

With core inflation cooling and liquidity stable, rate cuts are possible by early 2026.

IPO fever

October saw another burst of activity — 20+ IPOs worth over $7.5 billion are either listed or filed.

Strong debuts from logistics, fintech, and healthcare names signal sustained retail appetite.

Lenskart IPO Debate

In March 2025, Peyush Bansal (Founder & CEO of Lenskart) repurchased around 2.5% stake in Lenskart from early investors SoftBank Vision Fund, Chiratae Ventures, and Kedaara Capital.

-

Deal valuation: ≈ US $1 billion (₹8,300 crore)

-

Transaction size: ≈ ₹220–₹230 crore

That $1 billion price tag was a steep discount to Lenskart’s later IPO valuation range of $7.5–8 billion, meaning Peyush effectively bought back shares at nearly one-eighth of the IPO price

Capex > handouts

The government’s October update confirmed infrastructure spend remains the key fiscal focus.

Capex-to-GDP ratio is steady around 5%, despite pre-election pressures — a sign of fiscal discipline.

Risks on the radar

-

Brent > $94/bbl threatens import bill.

-

Rising US tariffs on Asian exports could dent India’s manufacturing outlook.

-

Still, corporate and tax revenues remain resilient.

Global – Slower, Riskier, Yet Not Without Hope

Fed Rate Cut

The Fed cut its benchmark federal funds rate by 25 basis points to a range of 3.75 % – 4.00 % in late October 2025.

More broadly, several Fed officials expect two or more additional rate cuts this year as the labour market softens and inflation remains manageable.

Some caution remains — the Fed flagged that inflation is still “somewhat elevated” and it will proceed cautiously.

Growth meh, debt mountain huge

Global growth for 2025 is tracking near 3.2%, per the IMF.

Developed markets are wobbling; emerging ones (especially Asia) are holding up.

Meanwhile, the global debt pile hit $338 trillion, triple world GDP — a warning shot for policymakers.

Tariff tantrums

The US election season has triggered a fresh wave of trade-barrier announcements.

China, the EU, and India are recalibrating supply chains and currency defenses.

M&A revival

Corporate boardrooms are buzzing again: $1.1 trillion in global M&A deals were announced in Q3, led by tech, pharma, and energy.

Private equity dry powder remains at record levels.

Alternative Investments, Defaults, and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently, below are the key new updates on the various delays across Alternative Investment platforms.

- Grip LeaseX Shield ATM SDI

- Grip LoanX Delay Update

- Afinue Evage Default

LeaseX Shield ATM SDI – Investor Update (October 2025) Summary

-

Background: The investment involved leasing ATMs to AGS Transact Technologies Ltd., originated by Connect Residuary Pvt Ltd.

-

Earlier progress:

-

The Originator executed a No-Objection Certificate for the sale of 163 ATMs to a private-sector bank already operating them.

-

The Bank confirmed the purchase price and received all operational details from AGS.

-

-

Recent developments:

-

AGS has been admitted into insolvency (CIRP) by NCLT on its lenders’ petition.

-

Although the ATMs are not AGS assets, the Bank seeks written confirmation from the Resolution Professional (RP) before completing the purchase.

-

Two meetings have been held between the Originator, Bank, RP, and major investors (Vivriti, Incred, Hinduja Leyland Finance, Grip Invest).

-

The RP will respond after consulting the Committee of Creditors (CoC) in November 2025.

-

If confirmation is withheld, the Originator plans to file a court application to secure a formal order.

-

The Bank remains interested and has spent on ATM upkeep and refurbishment.

-

-

Next step: Outcome expected after the November CoC meeting; investors will be updated once the RP or court provides clarity.

LoanX Up Money Apr’26 – Investor Update (October 2025) Summary

-

Background:

Up Money Limited (“Originator”) had been making timely payouts until July 2025. In August 2025, it failed to remit pool collections to the Trust account despite reporting them, breaching both transaction documents and RBI securitization norms. -

Partial recovery:

The Cash Collateral (CC) was liquidated in September 2025, resulting in a 35.5% partial payout (including interest) to investors. However, the instrument remains in default as no further remittances or reports were received for September. -

Wider default issue:

Up Money has defaulted on loans with 55+ lenders and is negotiating a restructuring/settlement plan with them. -

Promoter meeting (10 Oct 2025):

-

Promoter Ajit Singh Chawla cited liquidity and operational challenges from farmer agitations, the withdrawn Punjab Land Pooling Policy, and regional flooding.

-

Up Money intends to resume repayments and is seeking support from lenders for a revised schedule.

-

Lenders have given partial waivers in some cases.

-

The Trustee and investors reiterated that SDIs cannot be restructured under RBI’s securitization framework.

-

A follow-up meeting is scheduled later in October for a concrete repayment plan.

-

-

Action plan updates:

-

Collection deposit plan: Promoters have been urged in multiple meetings (Aug–Oct 2025) to restart remittances. A revised payout schedule may be shared by 31 Oct 2025.

-

Loan pool verification: Independent review of 4,100+ loans by CRIF HighMark is ongoing but delayed due to data-sharing and authorization hurdles.

-

Backup servicer: One financial institution has been shortlisted; discussions on feasibility and commercials continue.

-

Legal escalation: Trustee has filed a formal complaint with RBI for breach of guidelines and is preparing police and other legal actions against Up Money and its promoters.

-

Status:

-

Default continues, with no collections received post-August.

-

Partial recovery (35.5%) achieved via collateral liquidation.

-

Next steps: Awaiting repayment plan from Up Money, CRIF pool-analysis outcome, and possible backup-servicer appointment.

Afinue EVAGE Mobility Pvt Ltd – Default & Recovery Update (October 2025)

This update covers the ongoing default recovery process involving the following LLPs:

-

UPSD Leaseown 19

-

UPSD Leaseown 24

-

UPSD Leaseown 26

Key Developments Since Last Update (Past 30 Days)

-

Court Summons under Section 138 (Negotiable Instruments Act):

-

Summons to the Directors of EVAGE Mobility Pvt Ltd have been confirmed for 7 November 2025.

-

-

NCLT Proceedings:

-

The Insolvency and Bankruptcy Code (IBC) notice was issued via NCLT Chandigarh on 8 October 2025.

-

EVAGE has two weeks to respond or settle dues; failing which, the NCLT may appoint an Insolvency Professional to take control of the company’s operations.

-

The next hearing is scheduled for 17 November 2025.

-

The NCLT case has been filed under UPSD Leaseown 26 LLP, but the outcome will impact all related LLPs.

-

-

Police Complaint Prepared (if delays occur):

-

Should the NCLT proceedings face delays, a police complaint under the Bharat Nyay Sanhita will be filed for breach of trust and intent to defraud.

-

Liaison works to ensure jurisdictional acceptance of the complaint is already complete.

-

Outlook

The recovery process now hinges on the court outcomes of the ongoing Section 138 and NCLT cases.

November 2025 is a crucial month to determine whether these legal actions will drive a resolution or compel enforcement through insolvency proceedings.

The team continues to pursue every legal and regulatory avenue to secure recovery and protect investor interests.

Status: Legal process advancing; both NCLT and criminal proceedings are active with key hearings due in November 2025.

Bonds Risk Status Update

Bonds where covenant breaches occurred this year

- Sammunati

- Spandana Spoorthy

- Moneyboxx

- Trucap

- Finkurve

- Criss Financials – Early Repayment Done

- Dvara KGF

- Lendingkart

- Satin

- Reasolution – Trucap

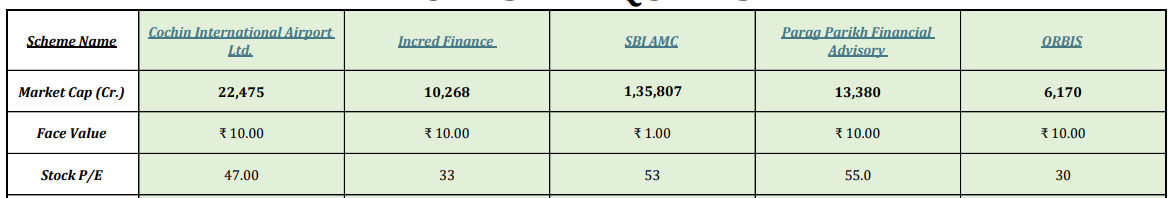

Alternative Investment Funds and PMS

In our endeavor to enhance knowledge about Alternative Investment Funds and PMS in India, we covered sessions with experts on various funds. We recently arranged a webinar with the experts as well.

Popular AIF in various categories for August

- High Yield Debt (20-25)% – Neo Special Credit Opportunity Fund

- Incred Credit Opportunity Fund (15-17%)

- Real Estate Funds for CRE (18-21%) – ICICI CRE Fund

- Absolute Return Funds (13-15%)- ASK

You can register below to get access to the webinar and details about the product

Telegram channel for *the Latest Alternative Investment News

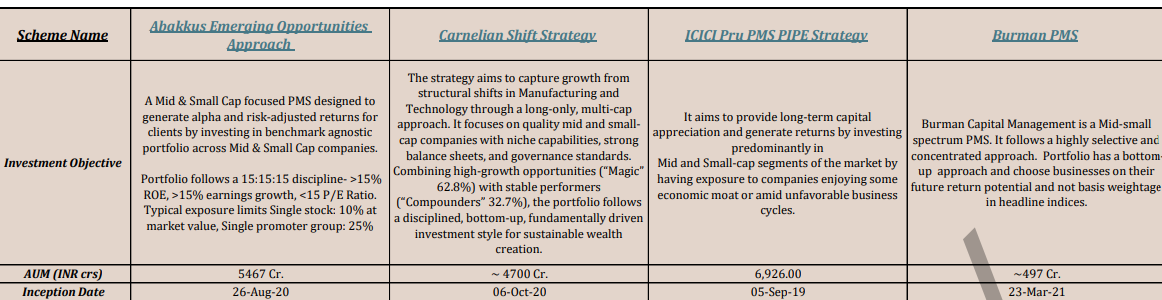

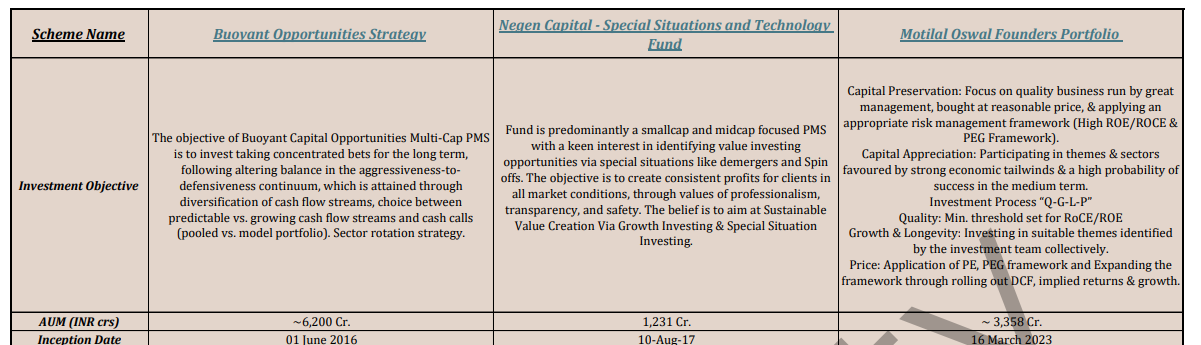

Top PMS Platforms

Below is a snapshot of the popular PMS in India. Investors can also explore global investing through Bayfort. Fill out the form below to download the latest information available on the funds below.

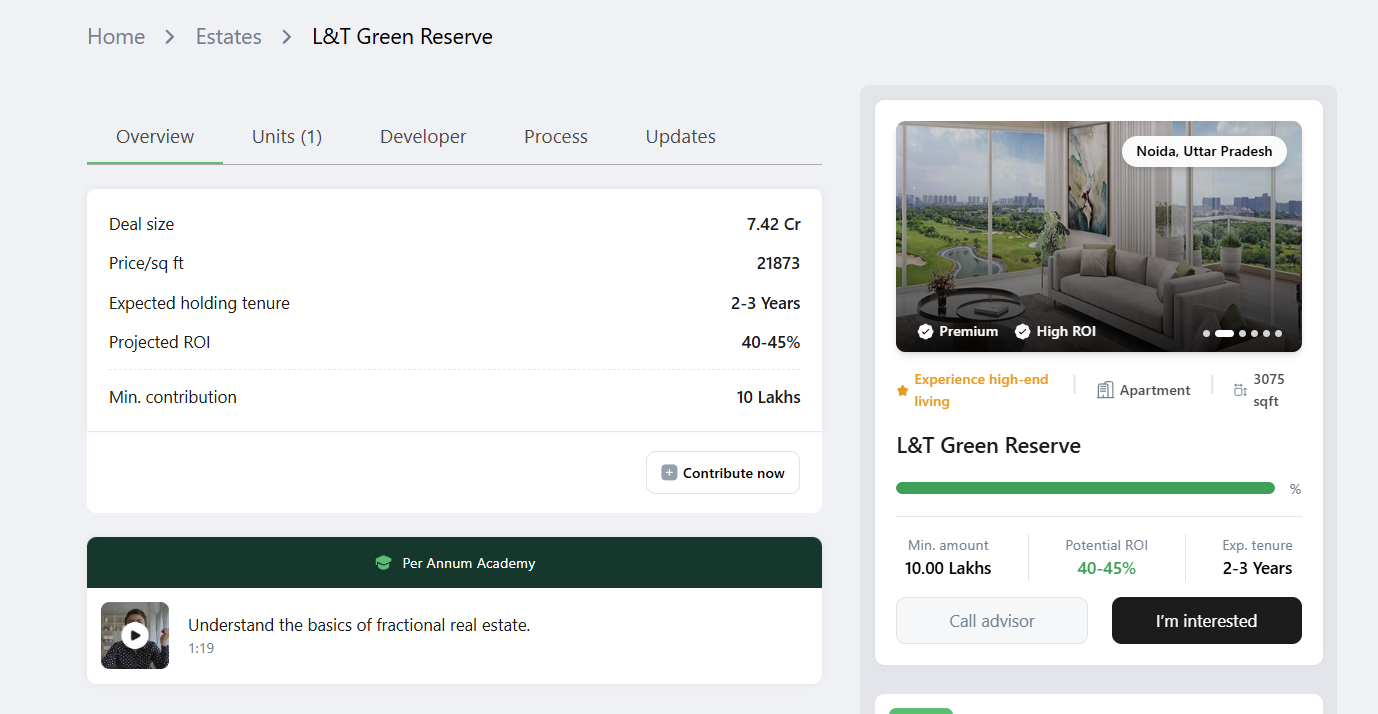

Real Estate Investments

Per Annum New Opportunities

There are 4 opportunities on Per Annum by three prominent builders

- Max

- L&T – 2 Properties

- Lodha

Investment horizon is 2-3 years with a target gross return of 40%

We did a detailed article on Estates – How does Estate work?

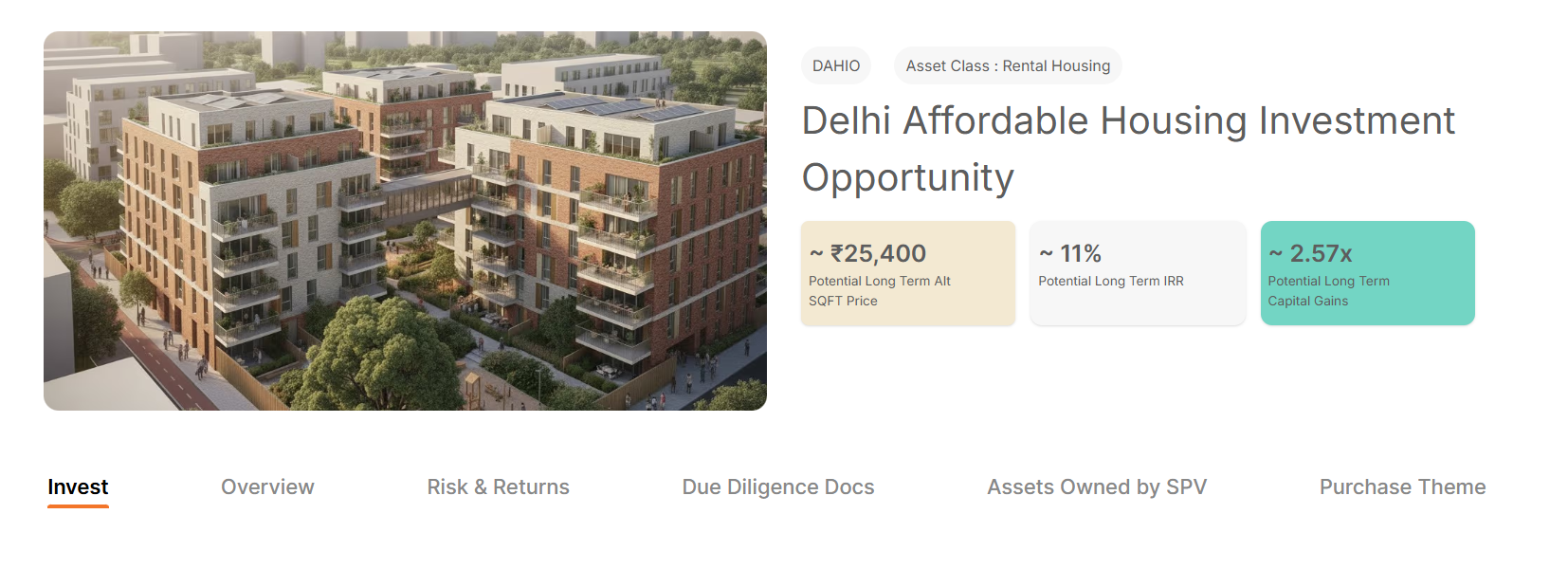

Alt DRX Private Opportunity

AltDRX has launched a new property in Delhi. Opportunities allow co-investment in a mix of developed and select under-construction residential apartments in Delhi-NCR, shortlisted and analyzed by Colliers from top developers, ensuring best-in-class quality, amenities, and specifications.

Last month, I visited one of the investment opportunities highlighted on their website in Munnar that many people had participated in – Aveda Munnar.

It was a great experience, and I will cover the details in my new post.

AltDRX has also revamped its website. You can now view details, along with a performance chart, of your investments on the platform portal. Investors looking to get an offer on a private opportunity can reach out through Randomdimes.com

Altdrx OpportunityBond Investment

Below are the top-listed and unlisted bonds currently available in the market. We try to get the best rates from the platforms and funds that sell these bonds. For the listed bonds, you can use the link below to buy. For the unlisted, please add your details in the form, and we will connect you to the seller.

Listed Bonds List

For listed bonds, you can check the bonds from the link below. Best yields in the market!

Aspero Randomdimes Page| Issuance | Rating | Coupon | Yield (XIRR) | Issuance Date | Maturity Date |

| AKARA CAPITAL ADVISORS PRIVATE LIMITED | ICRA BBB | 9.85% papm | 15.00% | 30-Apr-2025 | 30-Oct-2026 |

| Indel Money Limited | CRISIL BBB+ | 11% papm | 13.95% | 11-Apr-2025 | 11-Nov-2026 |

| Indel Money Limited | CRISIL BBB+ Stable | 11.00% papm/11.57% XIRR | 13.95% | 7-Mar-2025 | 7-Oct-2026 |

| Satya Microcapital Limited | ICRA BBB+ | 10.40% papm | 13.00% | 23-Aug-2024 | 23-Feb-2026 |

| Spandana Sphoorty Financial Limited | CARE A+ | 9.84% papm/10.30% XIRR | 12.75% | 12-Sep-2024 | 28-Jun-2026 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 2-Apr-2025 | 2-Apr-2028 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 12-Mar-2025 | 12-Mar-2028 |

| Criss Financial Limited | IND A | 10.50% papm/11.02% XIRR | 12.60% | 30-Aug-2024 | 30-Aug-2026 |

| Satin Finserv | ICRA A– | 10.80% papq/11.25% XIRR | 12.60% | 20-Sep-2024 | 20-Sep-2026 |

| Navi Finserv Limited (“Navi”) | CRISIL A (Stable) | 10.60% papm | 11.70% | 21-Feb-2025 | 21-May-2027 |

Unlisted bonds List

| Issuance | Rating | Coupon | Yield(XIRR) | Issuance Date | Maturity Date |

| True Credits Private Limited | CRISIL BBB | 11.71%papm | 18.00% | 4-Apr-25 | 09-Apr-26 |

| Branch International Financial Services Private Limited | Acuite BBB- | 10% papm | 17.50% | 4-Mar-25 | 9-Mar-26 |

| True Credits Private Limited | CRISIL BBB | 11.71%papm/ 12.36% XIRR | 17.50% | 8-Nov-2024 | 13-Nov-25 |

| Smartpaddle Technology Private Limited (Bizongo) | Unrated | 11.50% papm/12.12% XIRR | 17.50% | 22-Feb-2024 | 22-Feb-2026 |

| Akara Capital | ICRA BBB | 9.85% papm | 16.40% | 30Apr25 | 30Oct26 |

| Hella Chemical | IND A- | 11.80% papm/ 12.46% XIRR | 15.00% | 28-Feb-2025 | 28-Feb-2028 |

| Evernest Infratech Private Limited (“Strata”) | Unrated | 13.50% papm/14.37% XIRR | 15.00% | 5-Sep-2024 | 5-Sep-2026 |

| Si Creva Capital Services Private Limited | CRISIL BBB+ | 10.40% papm/10.91% XIRR | 14.80% | 29-Jul-2024 | 3-Aug-2025 |

Register to get details of unlisted bonds

Short-Term Investments

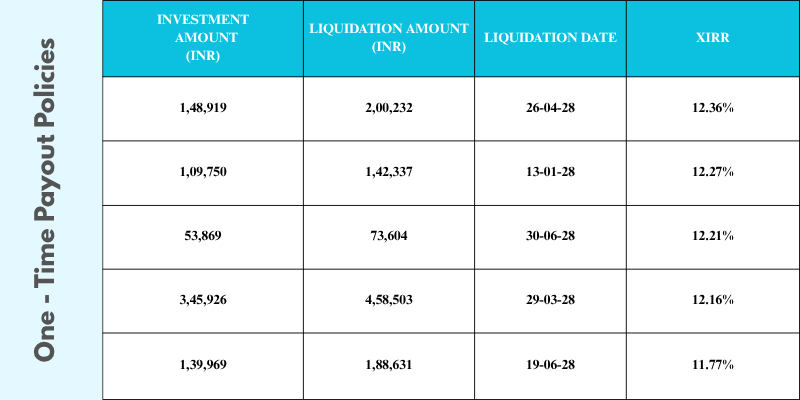

PolicyExchange seems like a decent product to target a 12% tax-free investment in a portfolio of Government bonds. Considering the lacklustre performance of Indian Equities, we plan to invest some amount of fixed income allocation to it.

I will be participating in some of these opportunities. Latest post on Policyexchange.

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.45% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.25% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.50% |

| Altifi | 12.50% | 0.00% | 0.30% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Tradecred | 11.50% | 0% | 0.8% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

- Finally got some new policies on Policyexchange with high irr

- Currently invested in 3 Invoice deals on Tapinvest

- Invested in 1 deal on Amplio

- Invested in Altwings on Altgraaf

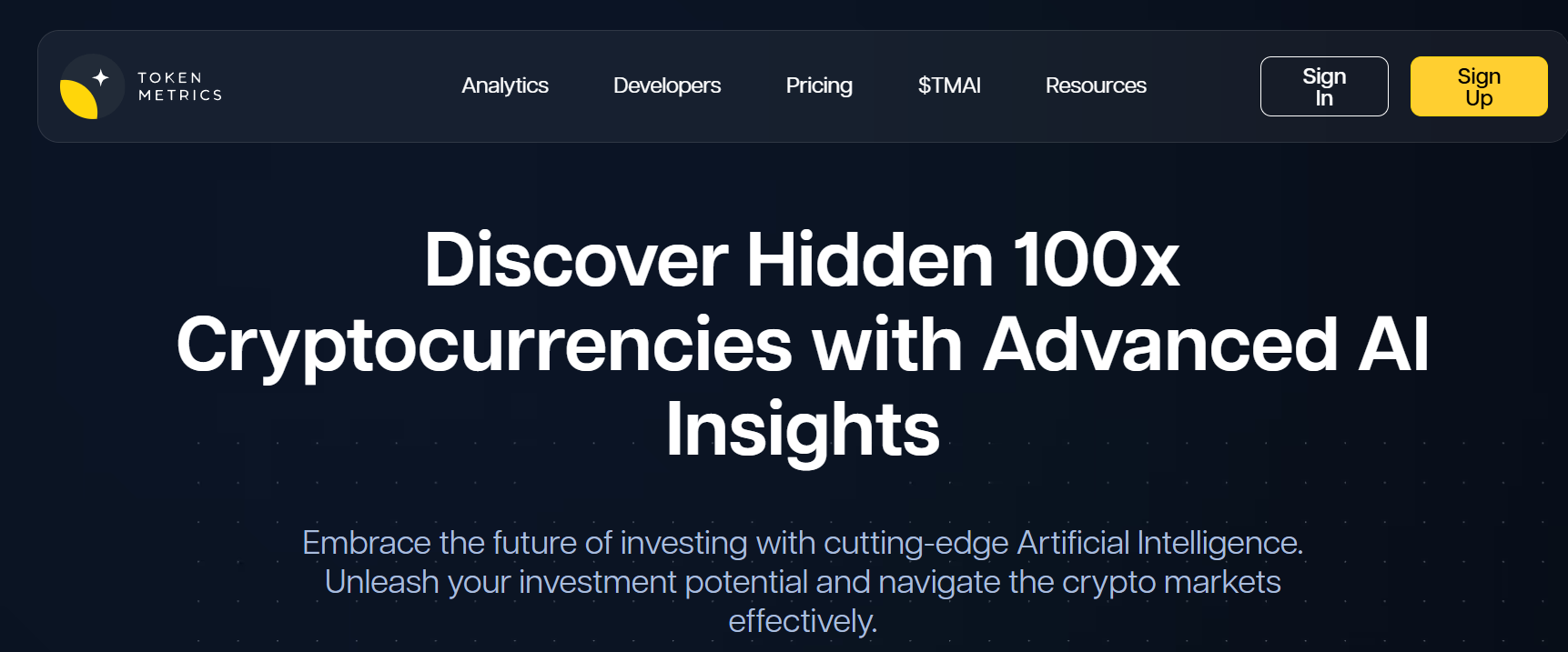

Crypto Investing

We recently covered an Altcoin research platform –Tokenmetrics, where you can find all the metrics and information required for analyzing altcoins.

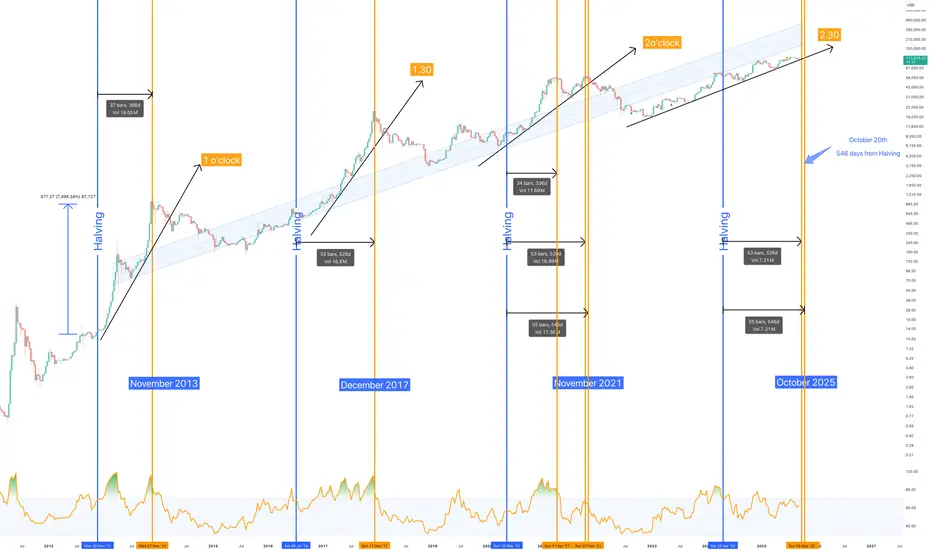

-

During early October, the crypto market experienced a major correction: more than US $19 billion in leveraged positions were liquidated in one weekend (Oct 10-11). For example, Bitcoin dropped from above ~US $126,000 to below ~US $105,000 in the span of days.

-

The global crypto market-cap stands around US$3.69 trillion at the end of October, with BTC dominance rising (~59.3%) — indicating consolidation toward the major coins.

-

Meanwhile, institutional demand continues to grow despite volatility. A key crypto‐research report in October noted strong on-chain activity and shifting leverage norms.

Key drivers

-

Leverage unwind: The heavy drop was triggered by cascading liquidations, showing how fragile the highly‐leveraged parts of the crypto market remain.

-

Macro & risk sentiment: The dollar, interest‐rate expectations, and global risk appetite still influence crypto sharply. When risk appetite pulls back, crypto leads.

-

Institutional flows: Despite the crash, the deeper narrative of institutional adoption and tokenised assets remains intact — helping to sustain a baseline of demand.

-

Consolidation: With dominance increasing and market-cap relatively stable, the market seems to be in a “reset + build” phase rather than free-fall.

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

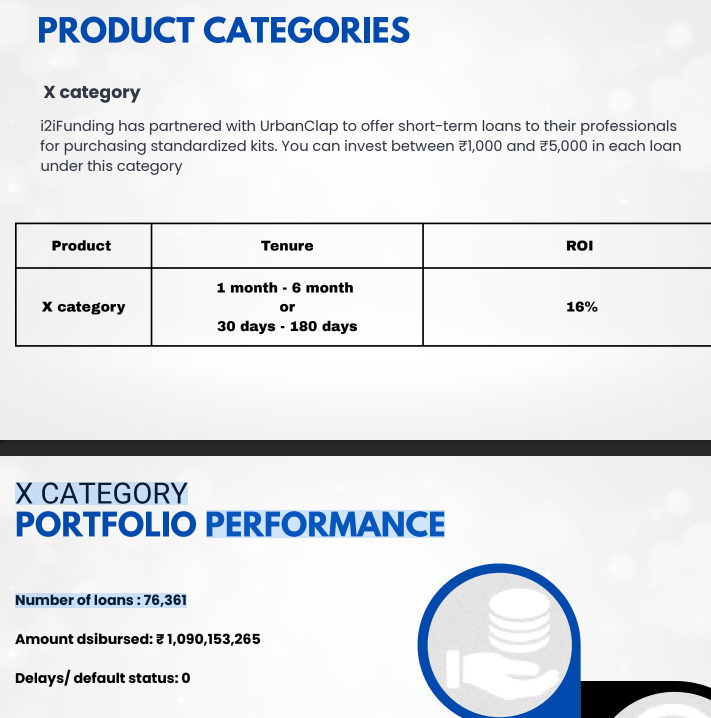

We recently received the performance report from I2Ifunding. Below is a snapshot of the deals.

Current allocation:

- India P2P – 30%

- I2IFunding- 55%

- Lendbox -15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 12.8% | 5.7% |

| Lendbox Per Annum | Paused | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category, i.e, Urban Clap Loans.

- There are fresh deals available on I2ifunding now. Other P2P only does redemption and no fresh deployment!

Equity Market

Pre-IPO Stocks

Below are some popular pre ipo stocks in the market that do not have insane valuations

It seems the Pre IPO market stocks are trading at a frothy valuation, hence it is important to exercise some caution while investing. Many times, stocks get listed at prices lower than the Pre IPO prices!

Listed Stocks

-

The BSE Sensex rose ~5.9% during October, according to data showing the index at ~84,997 on Oct 29 after climbing ~5.89% over the month.

-

On Diwali (~Oct 20), the indices posted a sharp gain: Nifty crossed ~25,900; Sensex gained 400+ points.

-

The rally is partly attributed to FII (foreign institutional investor) participation returning, buoyed by hopes of an India-US trade deal and recovery in earnings.

-

That said, other data shows persistent concerns: e.g., FPIs had pulled ~US$2.7 billion from Indian equities in September.

Key drivers

-

Trade deal optimism: News of potential tariff reductions and stronger export prospects boosted sentiment.

-

Earnings & banking/PSU strength: Sector rotation into financials, PSUs (public sector units), helped the market breadth.

-

Valuations & foreign flows: Indian equities had underperformed peers; this means recovery could have “catch-up” potential.

-

Domestic investor participation: With foreign capital volatile, domestic flows (MFs, SIPs) also played a stabilizing role.

What to watch

-

Continue monitoring foreign flows — size, direction, and sectors being bought/sold.

-

Earnings growth — India needs more than sentiment; underlying earnings have to improve for a sustained up-move.

-

Macro risks — global interest rates/dollar/commodity inflation still matter to Indian equities.

-

Valuation discipline — after the rally, cautious positioning is advisable (some profit-booking signs are already emerging). For example, a recent article noted markets “turning selective” after the rally.

We recently did an article on how tactical leverage can improve returns of portfolio

Option Trading

Oct was not a great month with total returns of 0.5%. There was a lot of intraday volatility during the second half of October, which made it difficult to achieve higher returns.

Quantinsti is one of the top quant trading course providers in India. Beginners can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.