Key Financial Highlights for Aug 2025

-

Foreign Portfolio Investor (FPI) Sell-off Hits Critical High

August saw the largest FPI equity outflows in seven months—a staggering ₹34,993 crore (~$4 billion) exited Indian equities—driven by U.S. tariffs, high market valuations, and a weaker rupee. Nearly ₹21,000 crore of this came in the first half, pushing year-to-date FPI outflows past ₹1.16 trillion.

For context, in the week ending August 29, FPIs dumped another $1.48 billion, totaling $6.5 billion in seven weeks

-

U.S.–India Trade Tensions and Tariffs Escalation

The Trump administration imposed sweeping 50% tariffs on Indian exports, including a 25% “secondary tariff” specifically linked to India’s Russian oil purchases. This abrupt move deepened diplomatic strains and raised concerns over exports, investment, and investor sentiment.

-

Manufacturing Expansion Despite External Pressures

India recorded its fastest manufacturing expansion in 17 years in August—a rare positive amid tariff headwinds

-

Regulatory Initiatives to Boost Domestic Investor Participation

SEBI released a consultation paper proposing reforms to simplify the FPI framework and promote greater domestic (resident Indian) participation in global markets

-

Economic Stabilization Post High Base

India’s GDP grew 6.5% in FY2025, with a notable 7.4% expansion in Q4 offsetting a slower start to the year—signaling a stabilization rather than a slowdown

-

India’s GST 2.0 Reform: Simplified Structure & Targeted Cuts

The GST Council, in its 56th meeting held in early September, approved a sweeping overhaul of India’s GST system—streamlining the structure into a simpler two-tier system:

5% for essential goods and services

18% for most other items

A new 40% “de-merit” slab for luxury and sin goods (e.g., tobacco, aerated drinks, high-end cars) .These changes will come into effect from 22 September 2025—just ahead of Diwali

Randomdimes Youtube

Alternative Investments, Defaults, and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently, below are the key new updates on the various delays across Alternative Investment platforms.

- Grip LoanX Delay Update

- Grip BigSpoon Recovery

- Growpital Update

LoanX – Up Money Mar’26: Payment Delay Update

What Happened

-

Until July 2025, all payouts (interest + principal) were made on time, leading to 29.6% capital returned.

-

On 28 August 2025, Up Money failed to deposit collections into the Trust account despite reporting ~100% collection efficiency on underlying loans.

-

This breach of RBI securitization guidelines has delayed the scheduled interest and principal payouts.

-

Up Money also defaulted/delayed repayments to multiple other lenders (₹474 crore outstanding across ~50 institutions like Tata Capital, Shriram Finance, SBI, Bajaj Finance, SIDBI, etc.).

Current Situation

-

Promoters Ajit Singh Chawla and Sumel Singh Chawla cited operational and liquidity issues.

-

Up Money recently raised ~₹20 crore from SIDBI, MAS Financial, and Klay Finvest but still failed to meet commitments.

-

A cash collateral (₹94 lakh) is available with Capital Small Finance Bank, lien-marked to the Trust. If released, it could cover the remaining 8 interest payouts until Mar’26 (~6% capital recovery).

Actions Being Taken

-

Team stationed at Up Money’s Ludhiana office to probe the situation.

-

Coordination with Trustee (Catalyst), CRISIL, and legal counsel to:

-

Appoint a backup servicer to manage collections.

-

Invoke remedies under the securitization transaction documents.

-

Draft a legal action plan for breach of responsibilities.

-

What’s Next

-

Detailed recovery plan expected by 15 September 2025.

-

Trustee may initiate stronger enforcement if clarity from the promoters is not provided.

My View

This case highlights that even A-rated issuers (CRISIL A-) can face liquidity stress, and timely payouts are never guaranteed. The presence of cash collateral offers some cushion, but investor outcomes will hinge on how quickly enforcement and recovery measures can be activated.

Grip has been really proactive in taking actions and communicating transparently!

Recovery Update: Grip – Big Spoon Default Case

One of the long-standing default cases in my portfolio—Big Spoon (via Grip Invest, deal code BIG221001)—finally saw some closure this month.

Background

-

Big Spoon defaulted back in September 2023 on part of its lease rental obligations.

-

Over the past two years, Grip pursued multiple recovery avenues:

-

Monetization of leased assets

-

Civil recovery proceedings

-

Legal action against the company, promoters, and non-cooperative kitchen owners

-

Recovery Progress

As of 4 September 2025, an additional payout was made to investors. The full recovery status is shown below:

| Investment Amount | Paid by Company (incl. Security Deposit) | Asset Monetisation (Nov’23, Jan’24, Feb’24) | Payout on Sep’25 | Total Paid to Date | % Recovered |

|---|---|---|---|---|---|

| ₹40,000 | ₹13,120 | ₹3,058 | ₹3,403 | ₹19,581 | 49.0% |

Key Takeaways for Investors

-

Nearly half the capital has been recovered, which is a meaningful outcome given the promoters have left the country and no significant assets remain.

-

Recoveries in distressed cases are usually slow, uncertain, and partial, highlighting why diversification is critical in alternative assets.

-

Grip has announced that further recovery is unlikely, and investor updates on this deal will be paused unless there’s a breakthrough.

My View

While this has been a frustratingly long process, I appreciate Grip’s persistence in legal and enforcement actions, which at least salvaged ~50% of the investment. This episode is a reminder that credit risk in high-yield products is real, and platform selection + diversification are non-negotiable.

Growpital Update

We have the same usual update for Growpital – the hearing got postponed again. It seems there is no seriousness to close this case any time soon.

Bonds Risk Status Update

Some recent bond covenant breaches are

- Sammunati

- Spandana Spoorthy

- Moneyboxx

- Trucap

- Finkurve

- Criss Financials – Early Repayment Done

- Dvara KGF

- Lendingkart

- Satin

- Defaults – Trucap

TruCap Finance Default: What’s Next for Investors (August 2025)

What Happened

-

On 18 July 2025, CareEdge Ratings downgraded approximately ₹150 crore worth of TruCap Finance NCDs to D (default), alongside another ₹750 crore of long-term bank facilities due to non-payment of principal and interest on non-convertible debentures (NCDs) due that day.mint

-

These NCDs were largely distributed via online bond platforms like Golden Pi, Grip Invest, Alitifi (Northern Arc), and BondsIndia. Investors were lured by attractive 13–13.5% yields, rated around BBB, but the defaults have starkly highlighted the risks underlying such high-return instruments.mintReddit

Immediate Fallout & Recoveries

-

The default affected around 1,100 retail investors, with outstanding principal of roughly ₹55 crore.

-

TruCap initiated partial repayments—about 15% was paid between 18 and 21 July

Underlying Causes

-

TruCap struggled with escalating debt and asset-quality deterioration. FY2025 saw a net loss of ₹66.6 crore vs. a profit of ₹11.7 crore in FY2024, largely due to loan defaults—credit costs surged from ₹4.1 crore to ₹72.8 crore. NPA levels climbed sharply.

-

Liquidity was severely stressed: as of May 31, 2025, TruCap had ₹103 crore in debt due over the next three months but only ₹57 crore in cash. It was counting on ₹92 crore in collections and pledges from promoters (₹10 crore) and the Marwadi Chandrana Group (₹100 crore, with ₹50 crore expected by mid-June). These funds did not materialize, prompting the defaults.

Broader Implications

-

A meeting of the debenture holders was convened on 8 August 2025 to chart the way forward

Summary Table

| Aspect | Details |

|---|---|

| Default Date | 16 July 2025 (CareEdge downgrade reported 18 July) |

| Affected Investors | ~1,100 retail investors |

| Outstanding Principal | ~₹55 crore |

| Initial Recovery | 15% paid between 18–21 July |

| Key Cause | Liquidity crunch after failed funding commitments |

| Next Steps | Debenture holders’ meeting held on 8 August |

| Investor Insight | High-yield bonds carry real credit risk—diversification is key |

Alternative Investment Funds and PMS

In our endeavor to enhance knowledge about Alternative Investment Funds and PMS in India, we covered sessions with experts on various funds. We recently arranged a webinar with the experts as well.

Popular AIF in various categories for August

- High Yield Debt (20-25)% – Neo Special Credit Opportunity Fund

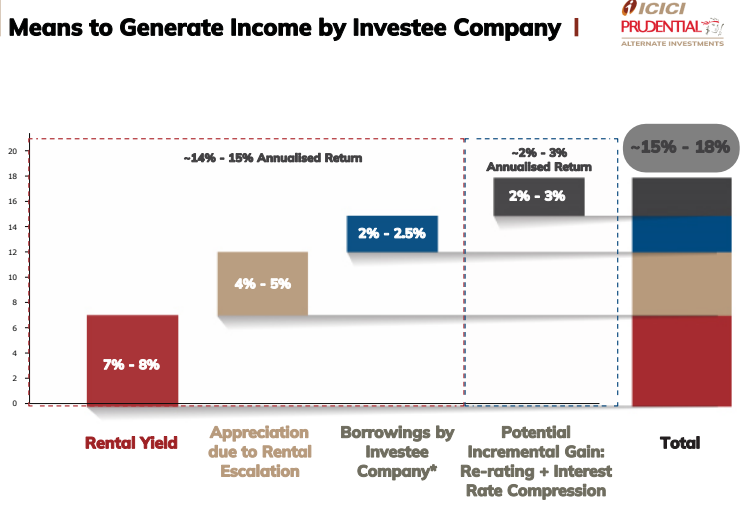

- Real Estate Funds for CRE (18-21%) – ICICI CRE Fund

- Absolute Return Funds (14-15%)- Nuvama and Tata Capital Absolute Fund

You can register below to get access to the webinar and details about the product

Telegram channel for *the Latest Alternative Investment News

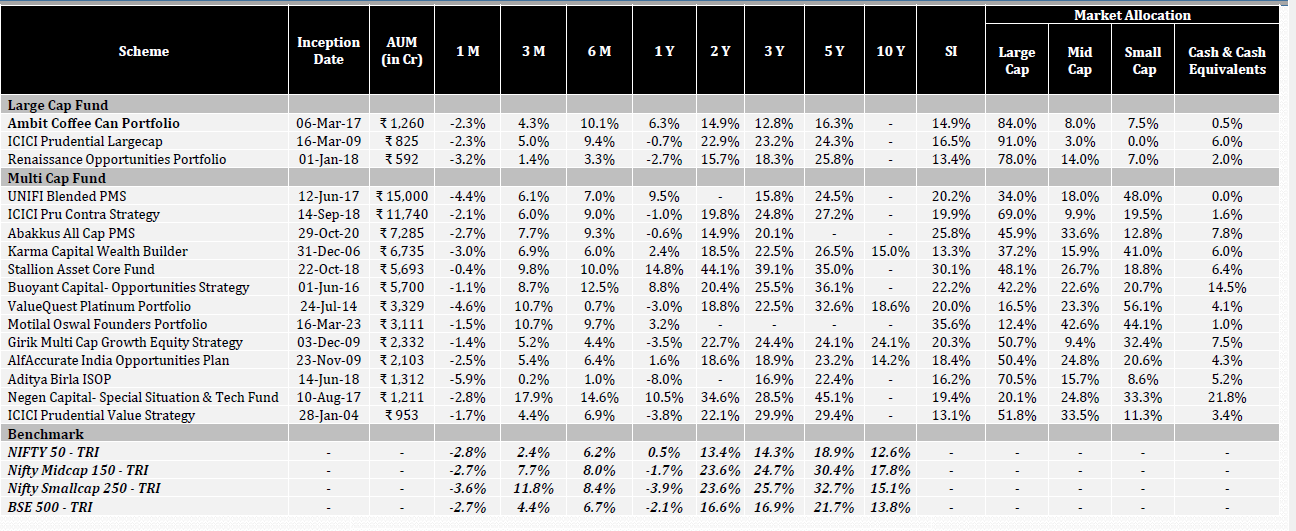

PMS Performance August

Below is the snapshot of top top-performing PMS in India for August. Fill out the form below to download the latest information available on the funds below.

Real Estate Investments

Per Annum Mahindra Opportunity

A new Mahindra opportunity is available on Per Annum. Minimum requirement is INR 5 Lakh. Property is worth INR 12 cr. Investment horizon is 2-3 years with a target gross return of 40%

We did a detailed article on Estates – How does Estate work?

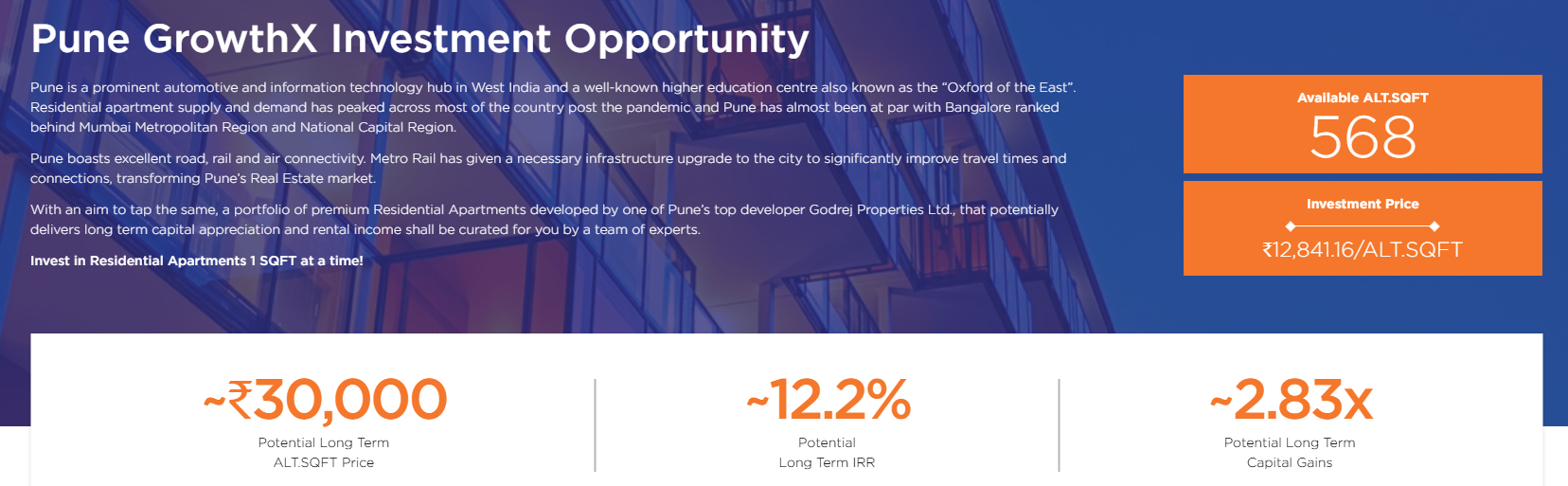

Alt DRX Bulk Opportunity

AltDRX reduced the minimum investment to INR 2.5 Lakh for bulk Tradex investment is still available for all Randomdimes investors. The platform has land opportunities, Holiday Homes, Residential homes, along with an under-construction gated community.

Altdrx also has the India Land project, which is an interesting opportunity for investors who want to diversify across various geographies in India.

Altdrx Pune OpportunityBond Investment

Below are the top-listed and unlisted bonds currently available in the market. We try to get the best rates from the platforms and funds that sell these bonds. For the listed bonds, you can use the link below to buy. For the unlisted, please add your details in the form, and we will connect you to the seller.

Listed Bonds List

For listed bonds, you can check the bonds from the link below. Best yields in the market!

Aspero Randomdimes Page| Issuance | Rating | Coupon | Yield (XIRR) | Issuance Date | Maturity Date |

| AKARA CAPITAL ADVISORS PRIVATE LIMITED | ICRA BBB | 9.85% papm | 15.00% | 30-Apr-2025 | 30-Oct-2026 |

| Indel Money Limited | CRISIL BBB+ | 11% papm | 13.95% | 11-Apr-2025 | 11-Nov-2026 |

| Indel Money Limited | CRISIL BBB+ Stable | 11.00% papm/11.57% XIRR | 13.95% | 7-Mar-2025 | 7-Oct-2026 |

| Satya Microcapital Limited | ICRA BBB+ | 10.40% papm | 13.00% | 23-Aug-2024 | 23-Feb-2026 |

| Spandana Sphoorty Financial Limited | CARE A+ | 9.84% papm/10.30% XIRR | 12.75% | 12-Sep-2024 | 28-Jun-2026 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 2-Apr-2025 | 2-Apr-2028 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 12-Mar-2025 | 12-Mar-2028 |

| Criss Financial Limited | IND A | 10.50% papm/11.02% XIRR | 12.60% | 30-Aug-2024 | 30-Aug-2026 |

| Satin Finserv | ICRA A– | 10.80% papq/11.25% XIRR | 12.60% | 20-Sep-2024 | 20-Sep-2026 |

| Navi Finserv Limited (“Navi”) | CRISIL A (Stable) | 10.60% papm | 11.70% | 21-Feb-2025 | 21-May-2027 |

Unlisted bonds List

| Issuance | Rating | Coupon | Yield(XIRR) | Issuance Date | Maturity Date |

| True Credits Private Limited | CRISIL BBB | 11.71%papm | 18.00% | 4-Apr-25 | 09-Apr-26 |

| Branch International Financial Services Private Limited | Acuite BBB- | 10% papm | 17.50% | 4-Mar-25 | 9-Mar-26 |

| True Credits Private Limited | CRISIL BBB | 11.71%papm/ 12.36% XIRR | 17.50% | 8-Nov-2024 | 13-Nov-25 |

| Smartpaddle Technology Private Limited (Bizongo) | Unrated | 11.50% papm/12.12% XIRR | 17.50% | 22-Feb-2024 | 22-Feb-2026 |

| Akara Capital | ICRA BBB | 9.85% papm | 16.40% | 30Apr25 | 30Oct26 |

| Hella Chemical | IND A- | 11.80% papm/ 12.46% XIRR | 15.00% | 28-Feb-2025 | 28-Feb-2028 |

| Evernest Infratech Private Limited (“Strata”) | Unrated | 13.50% papm/14.37% XIRR | 15.00% | 5-Sep-2024 | 5-Sep-2026 |

| Si Creva Capital Services Private Limited | CRISIL BBB+ | 10.40% papm/10.91% XIRR | 14.80% | 29-Jul-2024 | 3-Aug-2025 |

Register to get details of unlisted bonds

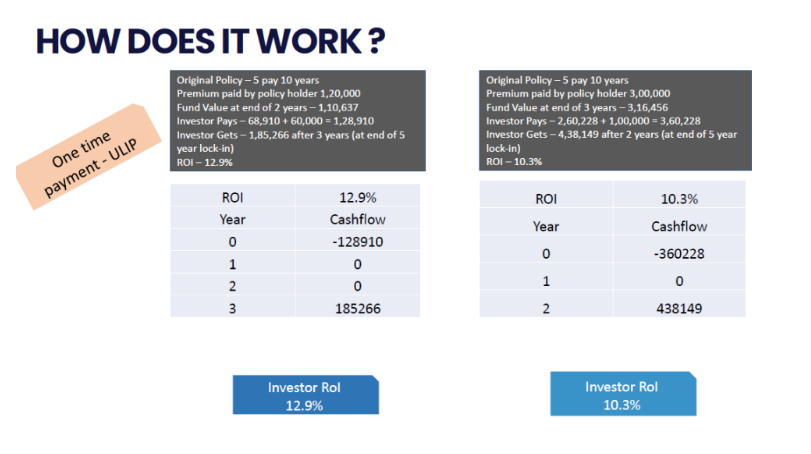

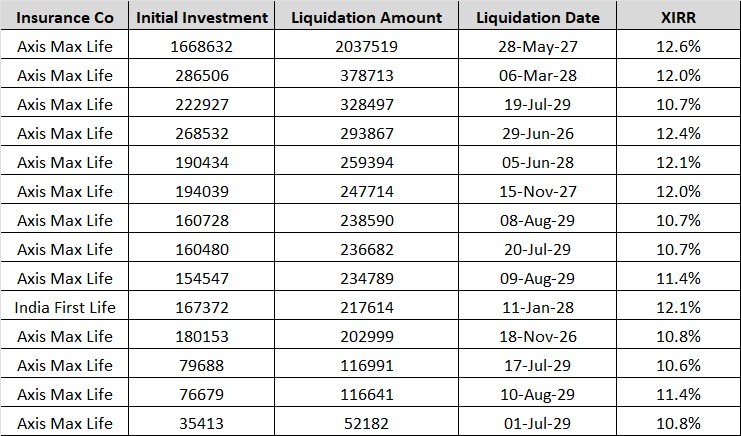

Short-Term Investments

PolicyExchange is finally back with new High Yield Deals. We will be sharing the deals on a daily basis in our groups. The good part is that using PolicyExchange, you can get a 12% tax-free investment in a portfolio of Government bonds through policy assignment!

I will be participating in some of these opportunities. Read about policyexchange in our blog post

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.40% |

| Altifi | 12.50% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Tradecred | 11.50% | 0% | 0% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

- Finally got some new policies on Policyexchange with high irr

- Currently invested in 3 Invoice deals on Tapinvest

- Invested in 1 deal on Amplio

- Invested in Altsmart (bank Guarantee deal) on Altgraaf

Crypto Investing

We recently covered an Altcoin research platform –Tokenmetrics, where you can find all metrics and information required for analyzing altcoins.

Market Overview

-

Bitcoin started the month strong, hitting new highs above $124,000, driven by optimistic Federal Reserve signals and a boost in institutional participation

-

Mid-month, a major whale selling 24,000 BTC triggered a sharp market reaction—Bitcoin fell from around $117K to $111K in short order.

-

Ethereum outperformed peers, rallying over 20% in August. It briefly crossed $4,900, with strong ETF and institutional inflows underpinning its strength

Institutional Activity & Market Rotation

-

There was a clear rotation from BTC to altcoins, particularly ETH, Solana, and other Layer-2 and DeFi assets. These segments gained prominence as investors sought yield and utility

-

DeFi Total Value Locked (TVL) rose, ending the month at approximately $152.8 billion. Stablecoin market cap crossed $284.6 billion, and daily trading volumes on DEXes stayed robust

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

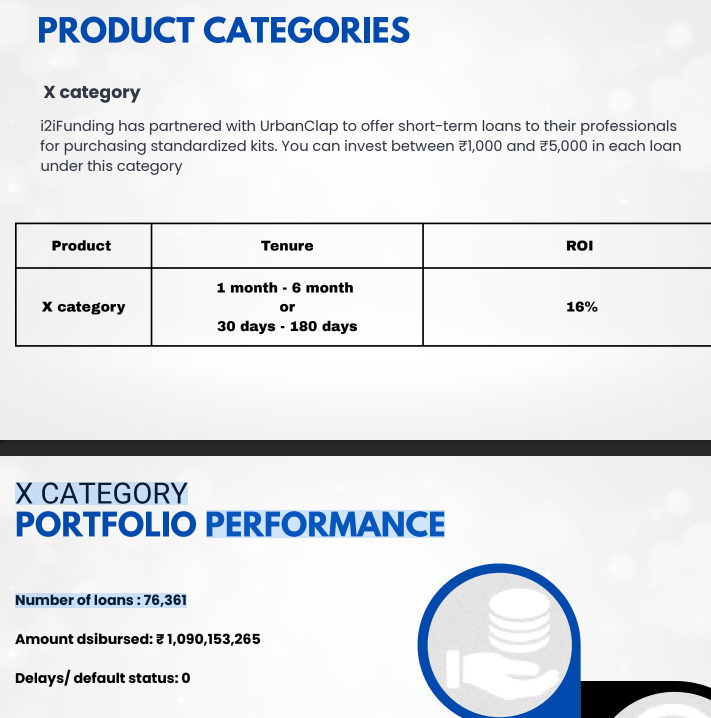

We recently received the performance report from I2Ifunding. Below is a snapshot of the deals.

Current allocation:

- India P2P – 35%

- I2IFunding- 48%

- Lendbox -17%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 13% | 5.5% |

| Lendbox Per Annum | Paused | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category, i.e, Urban Clap Loans.

- There are fresh deals available on I2ifunding now.

Equity Market

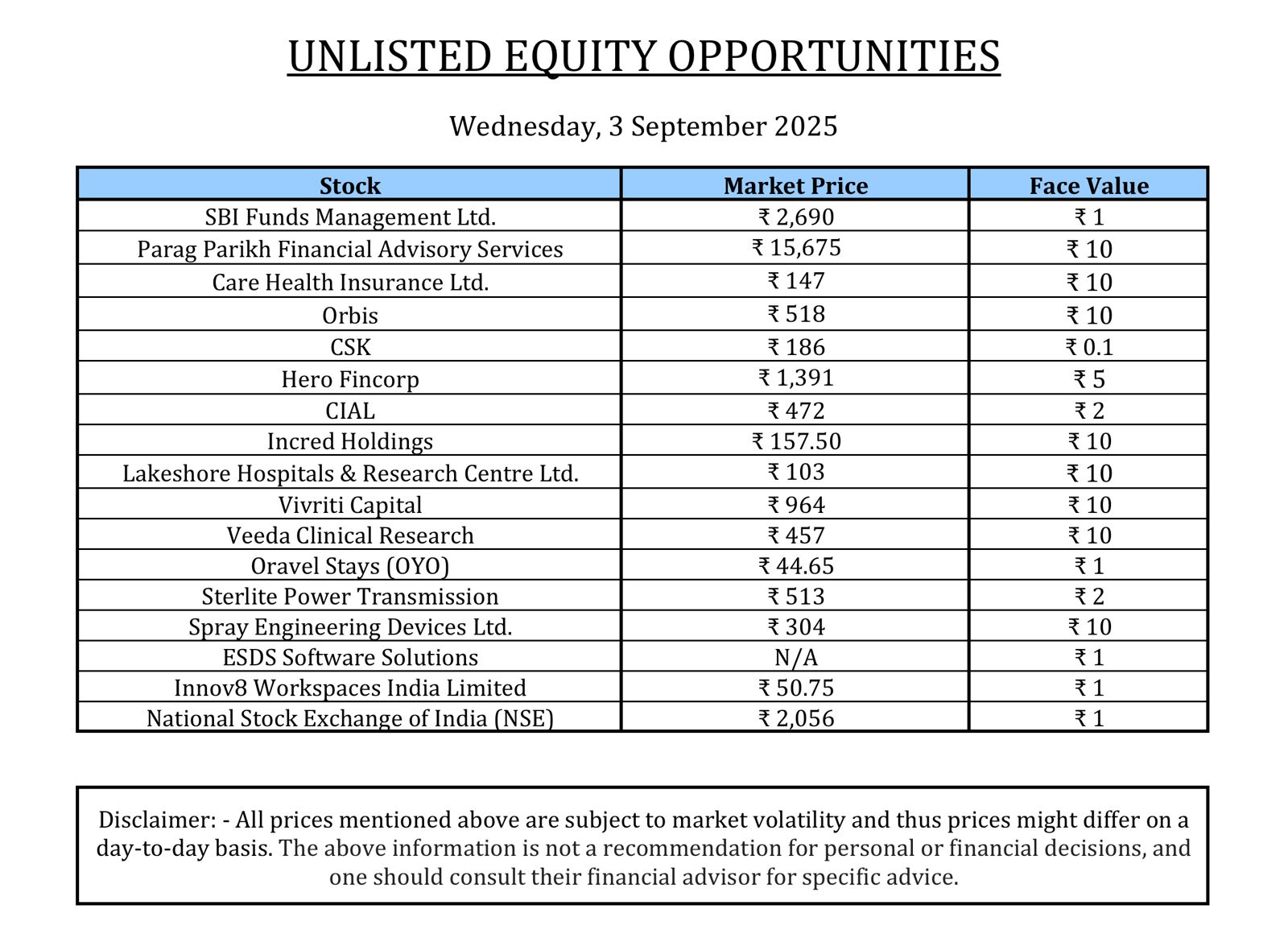

Pre-IPO Stocks

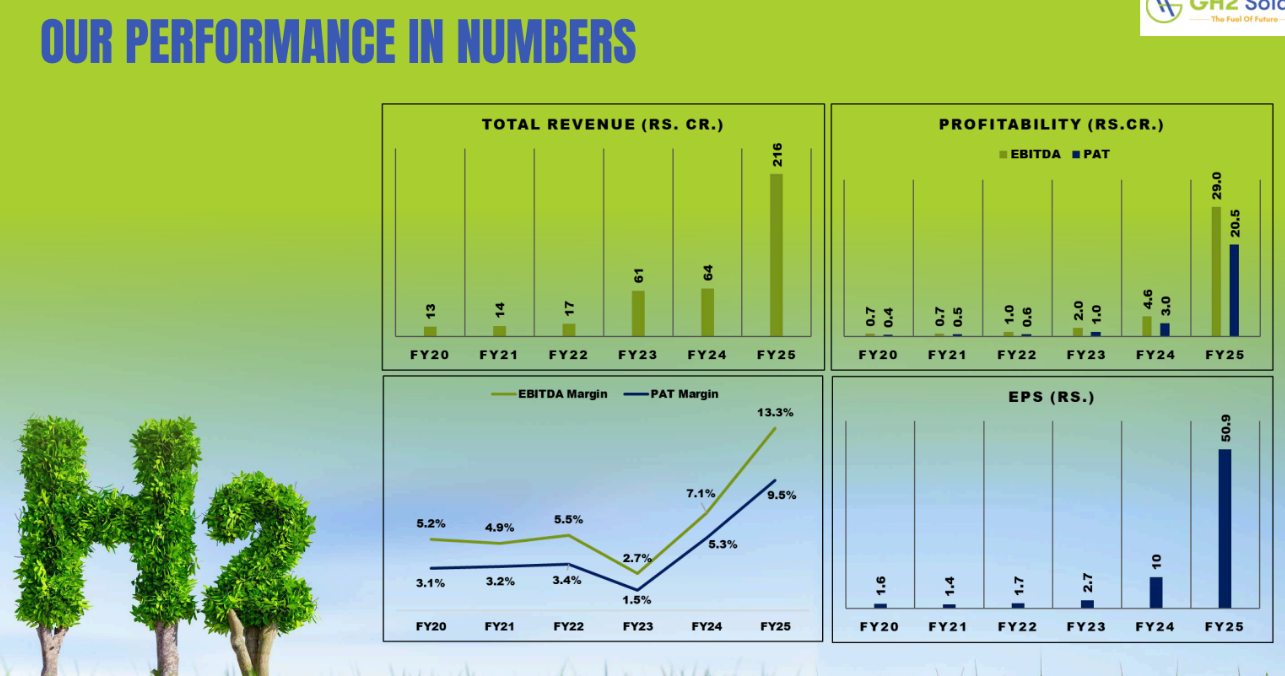

GH2 Solar – Snapshot

-

Focus: Expanding from solar EPC into green hydrogen production and electrolyser manufacturing.

-

Government Support: Beneficiary of India’s PLI Scheme (105 MW electrolyser capacity) and SIGHT Scheme (10,500 MT/year green hydrogen facility with ₹47 Cr annual incentive).

-

Projects:

-

EPC execution for NHPC’s Leh microgrid and VOC Port Tuticorin demo plant.

-

₹600 Cr order book to convert into revenue over 2 years.

-

-

Electrolyser Manufacturing:

-

Plant planned in Rajasthan (105 MW → expandable to 500 MW).

-

Uses pressurized alkaline electrolysis (cheaper, scalable vs PEM).

-

Project cost ₹480 Cr (Phase 1: ₹160 Cr by Dec 2026, Phase 2: ₹320 Cr by 2028).

-

JV with AHES (South Korea) and technical support from Rhizome2 (UK).

-

-

Financials (FY25):

-

Revenue: ₹216 Cr

-

EBITDA Margin: 13.4%

-

Current order book: ₹600 Cr

-

-

Future Plans:

-

Scale electrolyser manufacturing to 500 MW.

-

Achieve 250 MW solar + hydrogen project capacity.

-

Go public via IPO in FY26.

-

Listed Stocks

- The Nifty 50 fell roughly 1–1.4%, extending a multi-month downtrend. This was fueled by a flurry of factors: steep U.S. tariffs, weak Q2 earnings, and elevated foreign outflow.

- Major indices like the S&P 500 posted gains (~1.9%) amid Fed rate-cut signaling and strong earnings, notably from tech firms. Globally, equity performance was solid, with developed-market equities up 2.6% and the MSCI ACWI rising around 2.5%

We recently did an article on how tactical leverage can improve returns of portfolio

Option Trading

Aug was a decent month with total returns of 1.5%. The overall volatility has been low, but intraday market moves are large. We are exploring commodities also.

Quantinsti is one of the top quant trading course providers in India. Beginners can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.