This month has been all about the Trump Tariff and its impact on the economy. So what is the whole fuss about?

Trump’s Tariffs: Global Shockwaves from ‘America First’ Trade Push

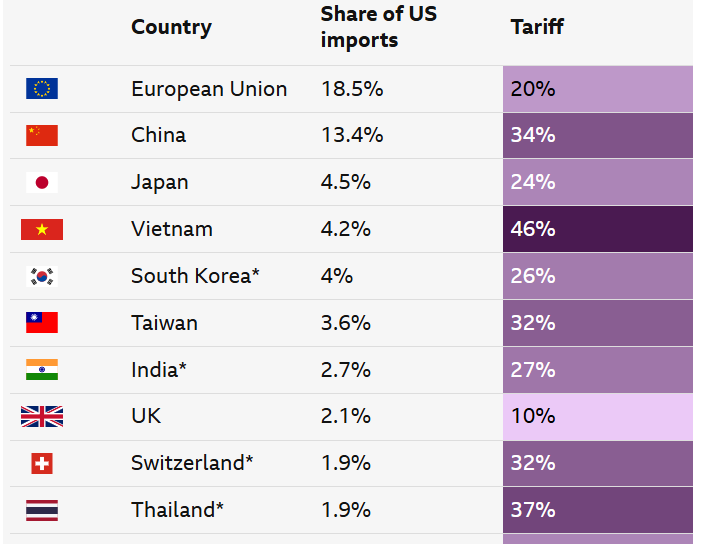

U.S. President Donald Trump has announced sweeping new tariffs on global imports, with a 10% base rate on all nations and up to 50% on targeted countries. Trump claims this will boost domestic manufacturing, protect American jobs, and reduce trade deficits. But critics warn the move will raise consumer prices, strain global supply chains, and risk a worldwide economic slowdown.

What Are Tariffs and How Do They Work?

Tariffs are taxes on imported goods, usually calculated as a percentage of the product’s value. Importers pay these fees, often passing the cost onto consumers or reducing their reliance on foreign products.

Why Is Trump Using Tariffs?

Trump has long favored tariffs, arguing they:

-

Encourage buying American-made products

-

Raise government revenue

-

Attract investment and manufacturing back to the U.S.

-

Close trade gaps with “cheating” nations

He claims other countries have taken advantage of the U.S. and now must face economic consequences. Earlier tariffs were also tied to unrelated demands, such as curbing immigration and drug trafficking.

What’s New This Time?

From April 5, all countries face a 10% tariff. From April 9, harsher rates hit “worst offenders”:

-

Cambodia: 49%

-

Vietnam: 46%

-

China: 34% (in addition to previous 20%)

-

EU: 20%

-

Other nations like India, South Korea, and Japan also face steep increases.

The White House calls these “reciprocal tariffs,” but many were calculated solely to erase U.S. trade deficits, not based on actual foreign tariff levels.

Impact on Prices and the Economy

Economists expect prices to rise for many goods, including:

-

Cars, electronics, and fuel

-

Alcohol (beer, whisky, tequila)

-

Food items like avocados and maple syrup

U.S.-made goods using foreign parts will also get pricier—car costs could rise by $4,000–$10,000, according to the Anderson Economic Group.

The risk of recession has increased, and even Trump officials admit the tariffs may slow growth—but they argue it’s worth it for long-term gains.

Global Reactions

-

EU: Finalizing retaliation. Von der Leyen called the move “dire for millions.”

-

China: Hitting back with 34% tariffs on U.S. goods.

-

UK: Prime Minister Keir Starmer warned of “economic impact,” but continues trade talks.

-

Canada, Japan, South Korea, Australia, and others condemned the move as unjustified and harmful to allies.

While some may argue that it doesn’t impact India too much but a full-fledged global recession can cause significant damage to our economy. Many believe that countries will come to an agreement and that this tariff will be only for the short term.

However, the stock market, especially the US market, has suffered a lot. Nasdaq is down almost 20%+ from its peak level, which may give new investors an opportunity to start accumulating.

Alternative Investments Defaults and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently below are the key new updates on the various delays across Alternative Investment platforms.

- Tradecred Delay

- Growpital SEBI Order Update

- Satincare Covenant Breach

- Leasify Sharepal Delay

Tradecred Delay

Currently, 2 deals on Tradecred are facing a delay

- Bizongo

- Clensta

Based on the latest discussion with some investors and the RMs it seems the Bizongo fundraise outcome is awaited and the platform expects it to happen by June 2025.

Clensta was apparently a debt deal. The company had raised INR 75 Cr and was also backed by Parineeti Chopra.

Growpital SEBI Outcome

Last month RPJ Tea had proposed to take over the liabilities of Growpital. In the subsequent discussion, they requested to give access of the INR 52 Cr lying in the escrow.

Obviously, this was not acceptable to SEBI. In a new proposal RPJ team requested INR 10 Cr for running the business. They mentioned that they would return the capital to investors in the NEXT 30 YEARS!!!

This seems ludicrous to say the least. Now the only hope seems that SEBI return the money lying in the escrow to investors. Below is the detailed video of the last hearing.

The next hearing is scheduled in June. It is really disheartening to see so much loss of accrued interest since Jan 2024!

Growpital Update – 28-March-2025 – YouTube

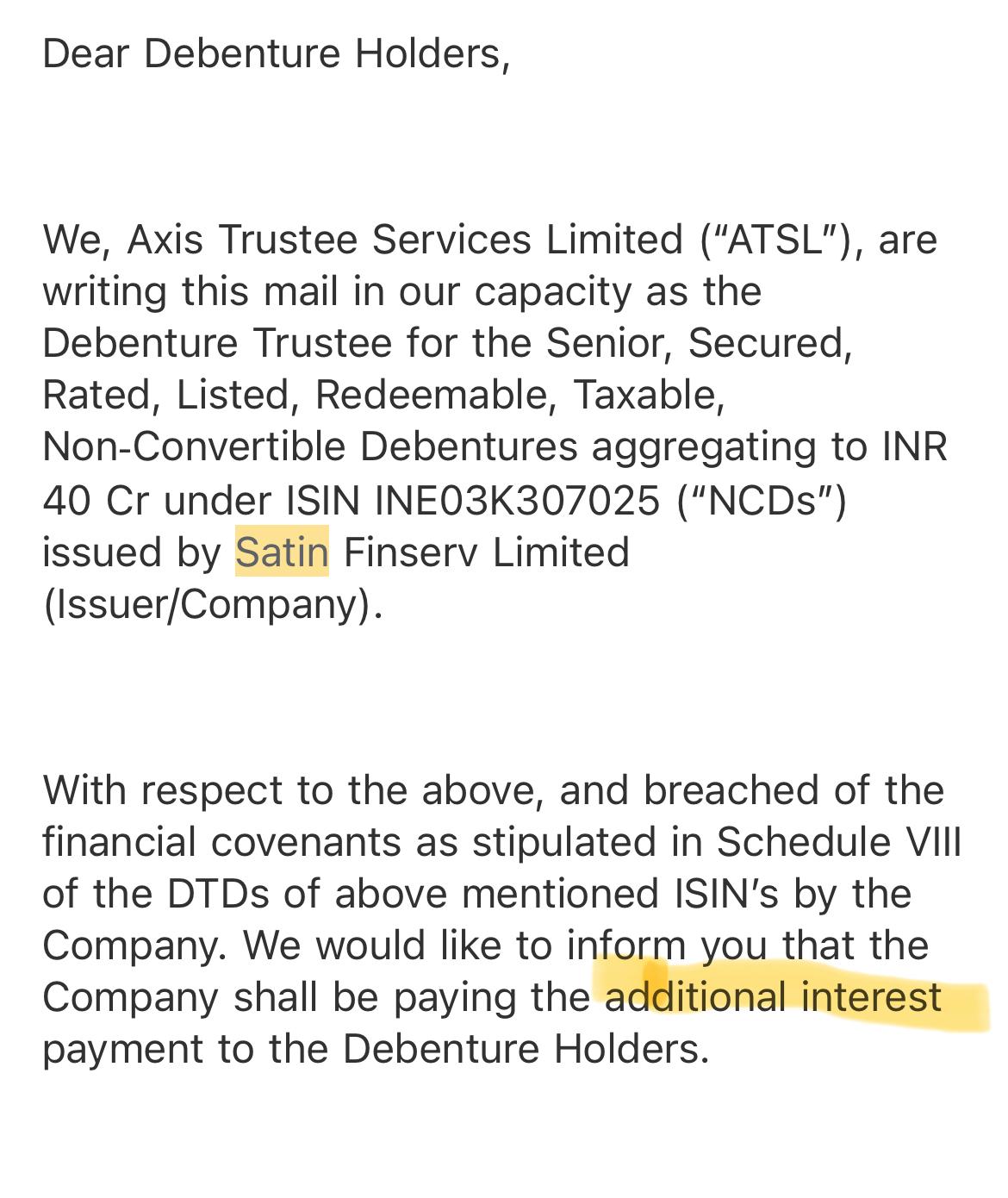

Satincare Covenant Breach

Satin breached the NPA and GNPA maximum limit as provided in the financial covenants that were set in Debenture Trustee Documents. Now it’s Debenture holders who can decide whether they want to continue or liquidate.

Apparently lot of microfinance companies are suffering due to high NPA that is because of the high supply of loans disbursed in the last couple of years.

While creating a Bond portfolio investors should factor in that the correlation of Stock market volatility and bond default can go up during turbulent times hence it is important to be more cautious while selecting bonds as currently we are going through a rough patch in the global economy.

Leasify Sharepal Delay

The last tranche of Sharepal repayment has been delayed for Leasify investors. They have communicated that they are in touch with the company to resolve the issue.

Alternative Investment Portfolio Updates

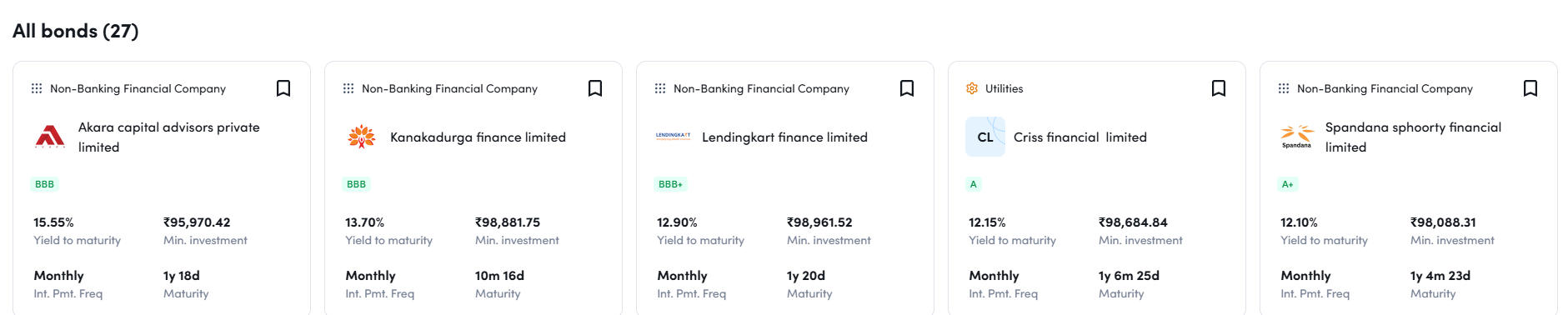

We are planning to provide you with details on the yield on unlisted bonds available in the market on a regular basis and connect you to the sellers who have these bonds. This will help you to make informed decisions while purchasing these bonds.

Currently, there are 2 opportunities to buy high-yield credit

- True Credit secured bond for 5 months tenor at 18% IRR.

- Bhanix Finance 2 months bond with 17.5% IRR

If someone is interested they can ping us and we can connect to the seller.

For listed bonds, you can check Randomdimes<> Aspero collaboration . You can use the randomdimes registration link to avail best prices.

Telegram channel for *the Latest Alternative Investment News

Real Estate Investments

Fundbezzie is the new addition to our alternative investment portfolio. Some of the salient features of this platform are

- Part of Pantomath Group, an established capital market company

- Unique High Yield Opportunities across asset classes.

Dwarka opportunity is closed now for new investments. However a small chunk of Ayodhya opportunity is left for investment. Any investor who wants to explore it in detail can fill the below form.

Details on the opportunity are covered in our article – Ayodhya Opportunity Explained

Fundbezzie has allowed this to be possible as they allow investment as low as INR 5 Lakh.

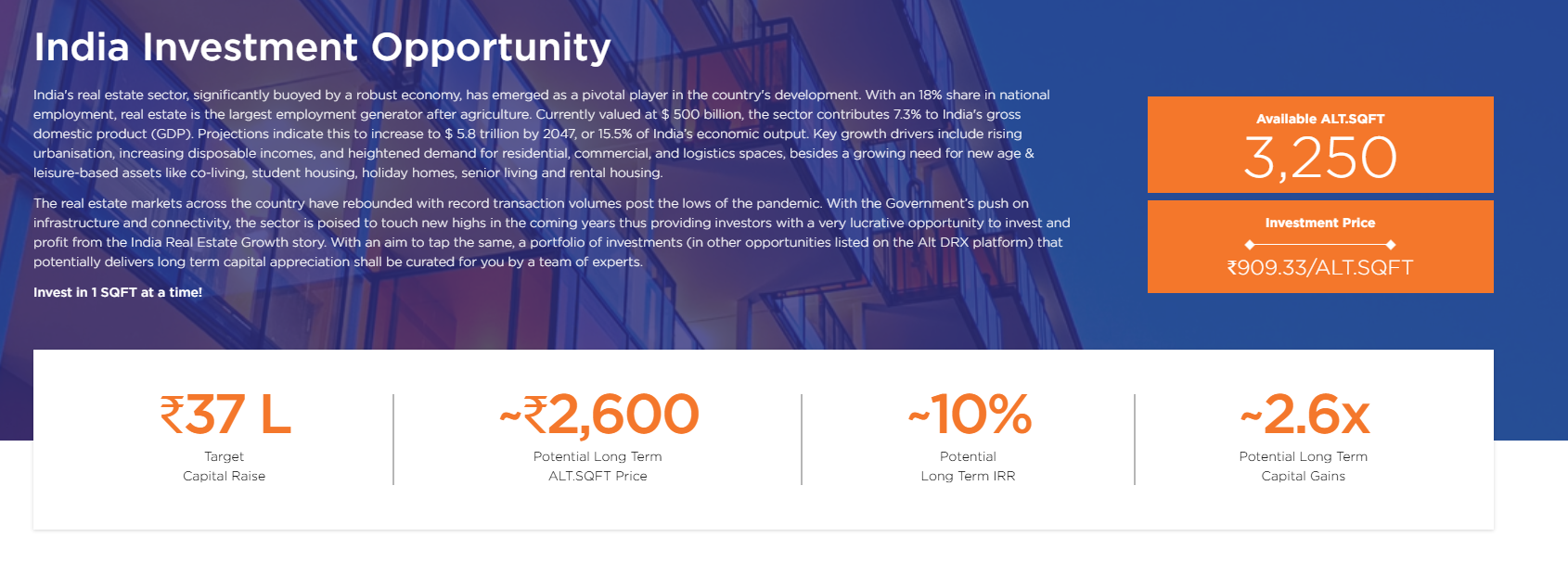

Alt DRX March Discount

AltDRX was giving 2% cashback for all Randomdimes investors of ALTDRX as a year end offer. They have recently listed a new opportunity that will cover complete India for choosing the property hence can give better diversification.

Assetmonk New Opportunity

Assetmonk has recently launched a new series with 17% IRR. Investors who are interested can get in touch and we will share details of our RM for deal documents etc.

Medium Term Investment

Policy Exchange new listing has been deferred to April as they are currently onboarding new partners. Some of the top high-yield opportunities for this month

- Randomdimes<>Aspero – 15.55% Akara

- Grip Invest – 12.5% vedika SDI

- True Credit – 18% (Fund Selling)

Below is the list of bonds currently Offered on Randomdimes<>Aspero.

Aspero Randomdimes Page

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Klubworks (stopped) | 20%+ | 0.15% | 1.25% |

| WintWealth (paused) | 10-11.5% | 0.00% | 0.00% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Sustvest | 10-11% | 0.00% | 0.00% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Earnnest.me | 15% | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.4% |

| Altifi | 12.5% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Incred Money | 11.0% | 0% | 0% |

Randomdimes Youtube

Short Term Investments

| Platform | Returns | RD NPA | Investor NPA |

| Liquiloans (Stopped) | 9% | 0% | 0% |

| Tradecred | 11.50% | 0% | 0% |

| Lendbox Per Annum | 11.50% | 0% | 0% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

| Faircent (paused) | 11% | 0% | 0% |

| KredX (Stopped) | 10% | 0% | 2% |

| 13 Karat (Paused) | 13% | 0% | 0% |

- Currently Invested in 2 Invoice deals on Tapinvest

- Invested in 1 deal on Amplio

Crypto Investing

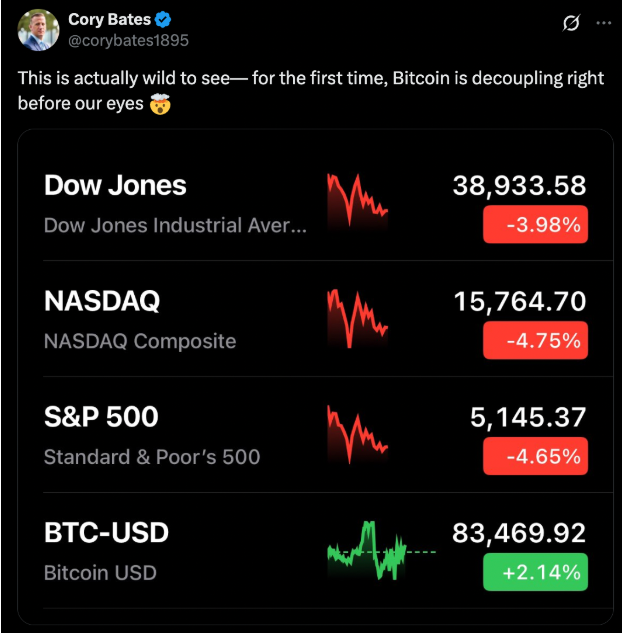

Bitcoin has shown great resilience in the current equity market crash and is currently trading at 83000 USD!

The “gold leads, Bitcoin follows” relationship is starting

Bitcoin has shrugged off the market jitters caused by US President Donald Trump’s April 2 global tariff announcement. While BTC initially dropped over 3% to around $82,500, it eventually rebounded by roughly 4.5% to cross $84,700. In contrast, the S&P 500 plunged 10.65% this week, and gold—after hitting a record $3,167 on April 3—has slipped 4.8%.

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 40%

- I2IFunding- 45%

- Lendbox -15%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 13% | 5.5% |

| Lendbox Per Annum | Paused | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category i.e Urban Clap Loans

- I am pausing Per annum investments for the moment as do not wish to increase exposure to P2P now.

Equity Market

PreIPO Stocks

The price of NSE shares has come down a bit due to the impact of current market volatility. The latest price available for NSE is around 1580 -1600 INR.

Investors who want to buy large quantities should avoid online platforms to procure these shares as they are generally inflated on these platforms.

Listed Stocks

With the global market in Jitters, We see a good opportunity for investors who missed the earlier rally. With broad markets being down by 20-25%, the market valuation seems much better than what it was a few months back. However, investors should expect more volatility to persist.

We will be adding more investments if the market tanks more from current levels.

OptionTrading

March was a month with long rallies hence for non-directional it was tough to make significant returns. We are happy to close the month in positive.

We have started covering some top traders and firms on YouTube. We will be soon creating a repository with trading material for easy access.

We covered Quantinsti one of the top quant trading course providers in India. It is really helpful for someone looking to enter this field.

Starters can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.