Alt DRX Introduction

Real estate has long been known as one of the most rewarding asset classes to invest in. Arguably, since the beginning of human society, real estate has been a coveted possession. However, traditional real estate investing often requires significant capital and involves complex processes, limiting accessibility for many. The emergence of fractional ownership and blockchain technology is changing the game, making real estate investing more accessible than ever.

Platforms like Alt DRX are at the forefront of this shift, using tokenization to lower entry barriers. Now, investors can start with smaller amounts, easily diversify their portfolios, and enjoy greater liquidity in what was once an illiquid and highly restricted market. With this democratization of real estate playing out in real time, retail investors looking to diversify their portfolios beyond the traditional markets should understand and engage with this rewarding asset class.

Alt DRX has developed a distinctive digital contract that encapsulates the economic value of an underlying property and reflects the same in the form of a tradable SQFT token. This contract is then integrated into a stock market-like platform, where these digital assets can be listed, purchased, held securely, traded in real-time based on prices determined by machine learning algorithms, and settled instantly in fiat currency among users who have completed the KYC whitelisting process. To ensure the security of these digital assets, Alt DRX employs a proprietary zero-trust architecture that utilizes the IPFS Blockchain protocol to safeguard the custodial ledgers of the platform.

In this article, I will review my investment experience with the Alt DRX platform which is one of the few platforms in the market that allows to invest in prime land, an asset class that has done much better than Commercial Real Estate and Residential properties.

We had done a detailed review of Alt DRX more than a year back. New investors can go through it to understand how this platform works!

Alt DRX Journey

Alt DRX, short for Alt Digital Real Estate Exchange, is a Bangalore-based fintech startup revolutionizing real estate investment through blockchain-powered tokenization. Launched in 2021, the platform makes buying and selling fractional ownership in residential properties possible, bringing transparency, security, and efficiency to real estate transactions. With investment options starting as low as one square foot, Alt DRX is opening doors for a wider audience, including middle-income investors who can start investing on the platform upon a simple KYC-based registration and for as little as INR 10,000.

The platform raised around 4 Million USD from Times Group and other investors.

Team Behind Alt DRX

Found by Anand Narayanan and Avinash Rao back in 2021, the team behind Alt DRX now boasts several industry experts with years of experience in real estate investing and technology, bringing the best of these two worlds together.

Before starting Alt DRX, Anand Narayanan worked as the Managing Director for DAMAC Properties and worked with reputed financial institutions like ICICI Bank, Knight Frank India, etc. Similarly, before founding Alt DRX, Avinash Rao held positions with ruptured organizations like Provident Housing, Knight Frank India, Samsung India, Reliance Infocom, etc. Co-founder and CTO Sachin Joshi spearheads the technology side of the business and has experience working with reputed organizations like TCS, Cognizant, and Mphasis.

The platform now boasts of a strong advisory board with personnel like GN Bajpai, Ex SEBI Chief, and Mr. Jitendra Balakrishna, Ex IDBI MD

Investment Opportunities on Alt DRX

Alt DRX lets you invest in different types of real estate properties, allowing you to explore what suits you the best based on the benefits of investing in commercial and residential real estate. Some of these include:

- Prime Land: Allows you to invest in high-value real estate properties in high-growth micro markets within large cities.

- Rental Housing: Residential properties allow you to benefit from regular rental yields as well as appreciation in the value of the property over time.

- Alternate Housing: Alternate housing such as hostels, retirement homes, holiday homes, and service apartments caters to niche markets with rising demand. They offer better rental yields than traditional residential properties.

- GrowthX: Allows you to invest in under-construction RERA-approved residential properties that offer the potential for high returns and capital growth at lower entry prices.

Alt DRX offers a structured investment approach with various stages, including Private Opportunities (PO) and First Square Foot Opportunities (FSO). These stages provide investors with multiple entry points into real estate investments, catering to different risk appetites and investment goals. The platform targets a range of real estate assets, including land, residential flats, commercial properties, and hostels. Alt DRX’s use of a proprietary machine-learning algorithm ensures real-time asset valuation, enhancing pricing transparency and accuracy.

List of Investment Opportunites

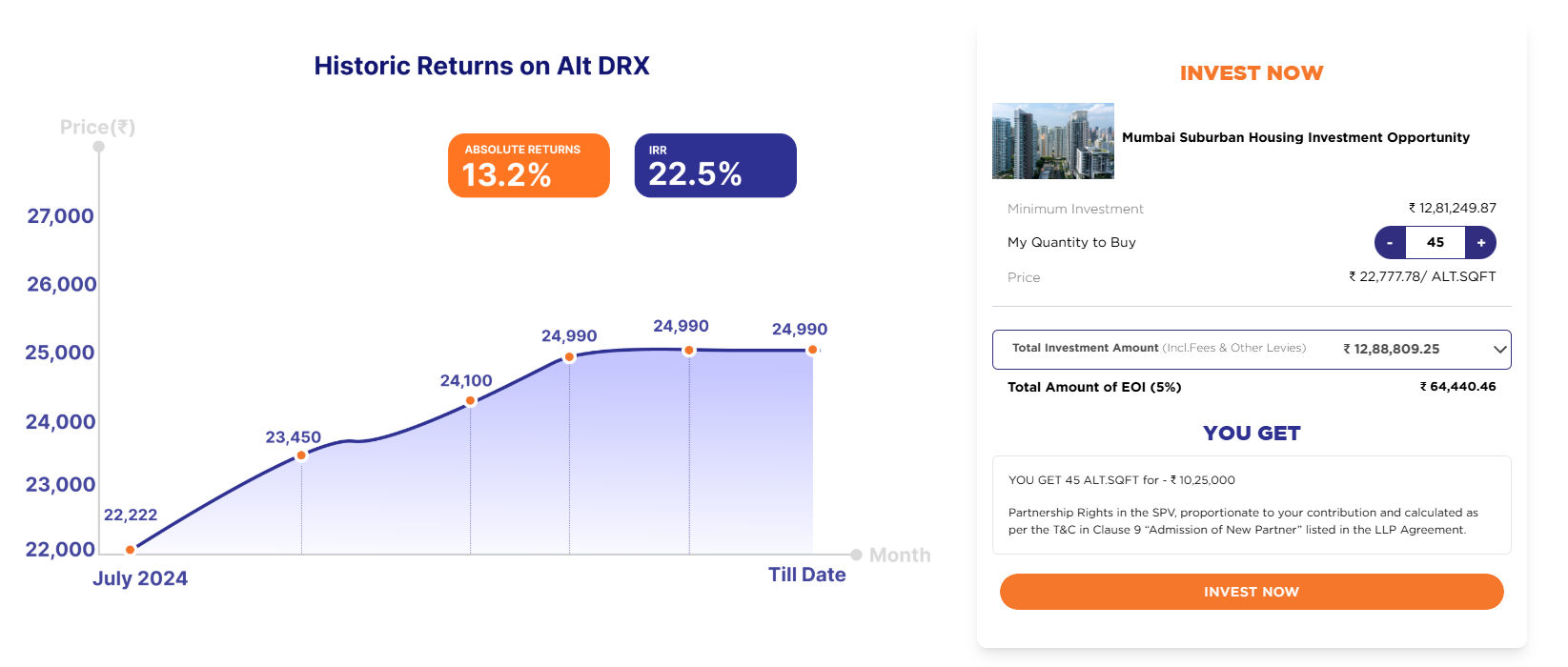

Mumbai Suburban – 22% IRR Delivered

Co-invest in a portfolio of Residential Apartments in prominent gated communities that is given for Residential Rental Occupancy.

- Residential Apartments with Occupancy certificates developed by renowned Real Estate players shall be purchased in Suburban, Well-connected locations in Mumbai after thorough market and title due diligence.

- Investments shall be made in residential apartments sequentially for 4 years

- Lodha Amara in Thane was the first investment.

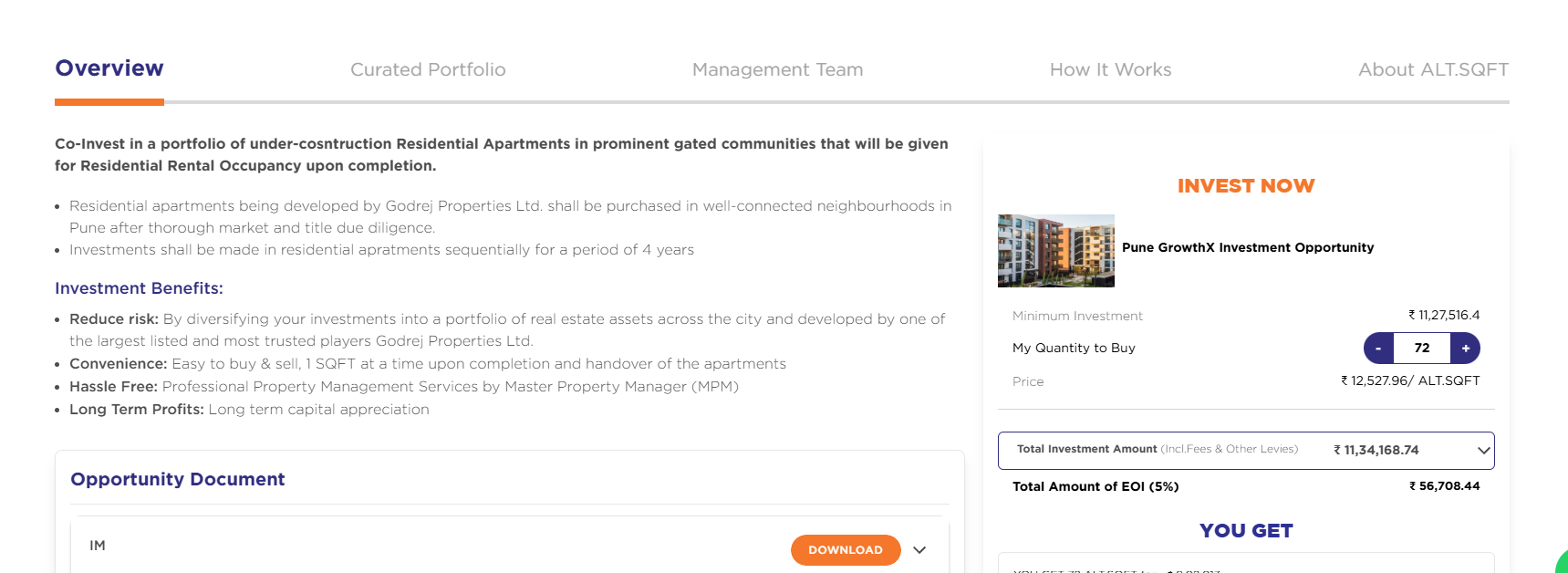

Pune Under Construction – Prime Developer

Co-invest in a portfolio of under-construction Residential Apartments in prominent gated communities that will be given for Residential Rental Occupancy upon completion.

- Residential apartments being developed by Godrej Properties Ltd. shall be purchased in well-connected neighborhoods in Pune after thorough market and title due diligence.

- Investments shall be made in residential apartments sequentially for a period of 4 years

- Godrej Emerald first property

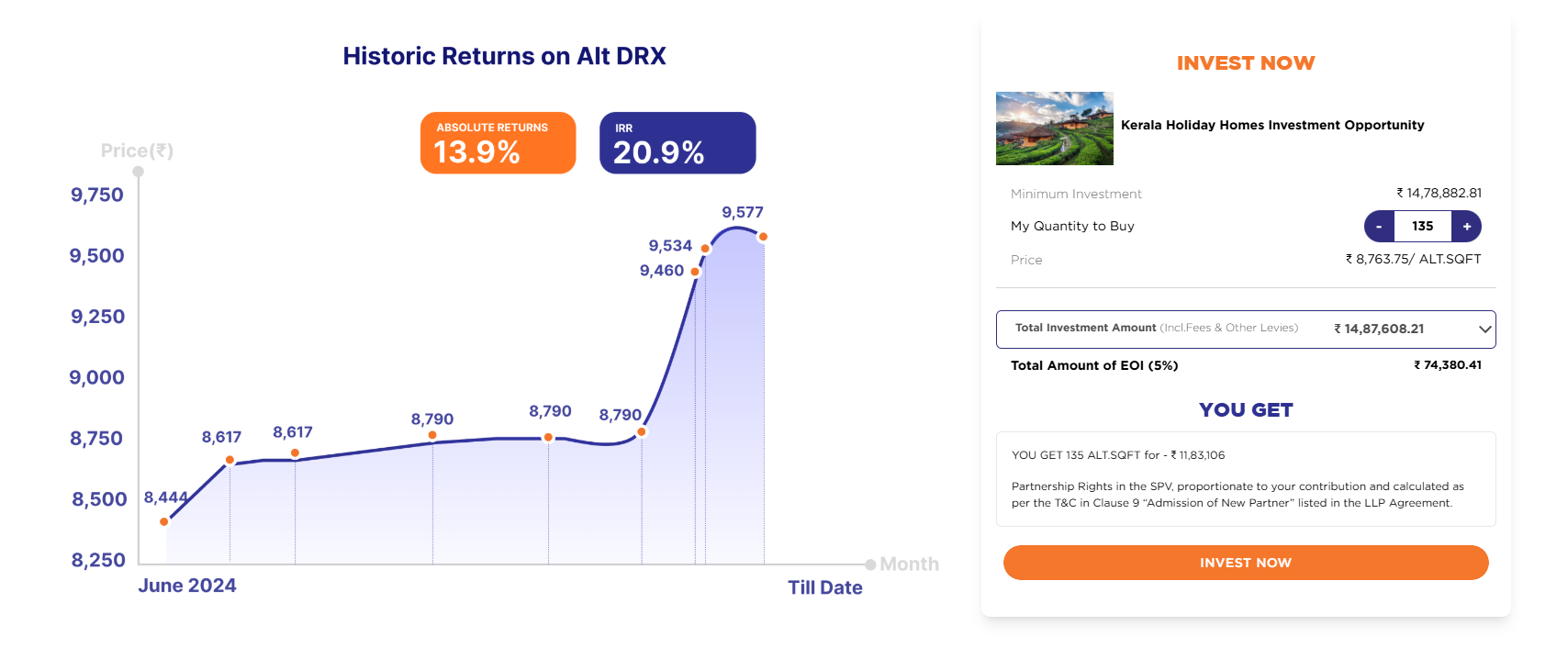

Holiday Homes Investment – 20.9% IRR Delivered

Co-invest in Developed, Ready to Occupy, Holiday Homes in prominent developments that will be given for Rental Occupancy

- The targeted locations in which properties shall be acquired are detailed in the Information Memorandum

- Investments shall be made in Holiday Homes sequentially for a period of 4 years

- Kerala Munnar Holiday Home is the first investment.

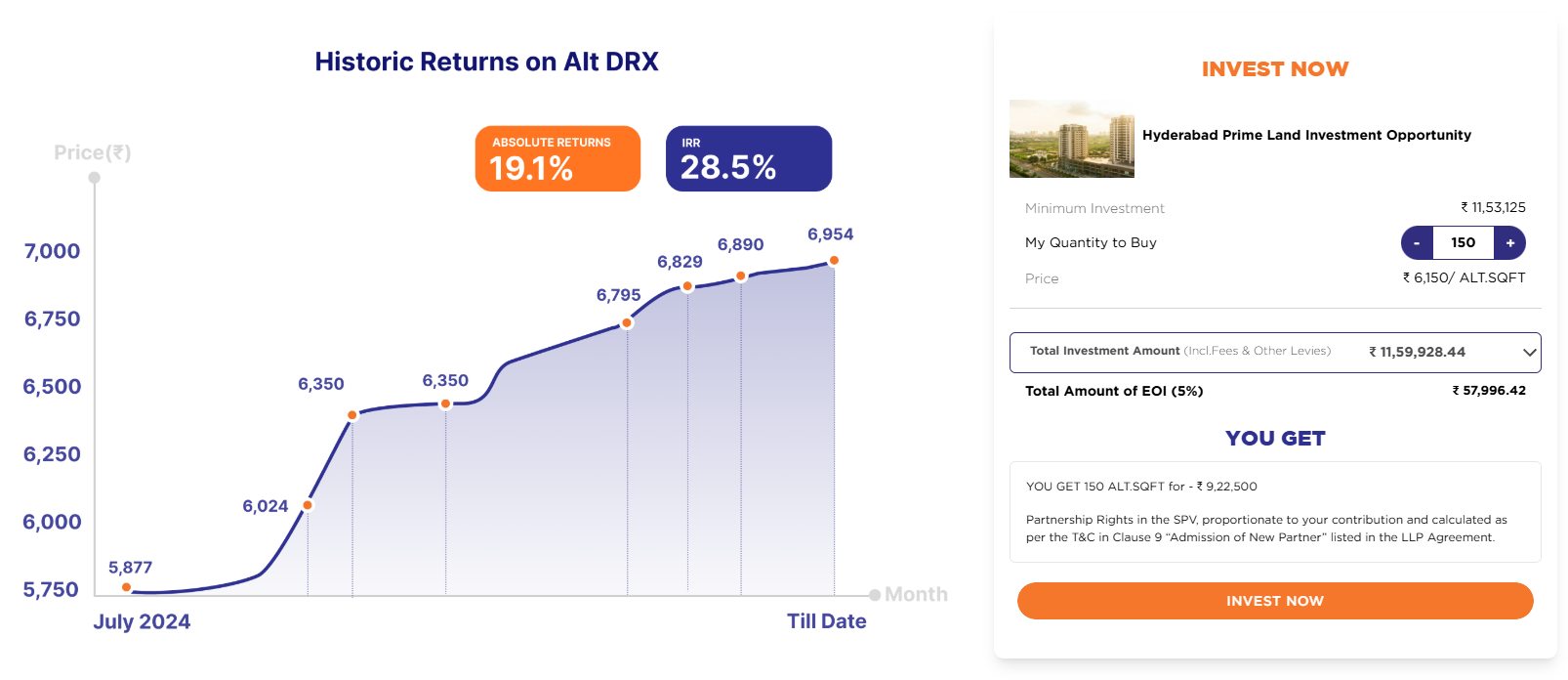

Hyderabad Prime Land Investment – 29% IRR delivered

Co-invest into a portfolio of approved, developed, and released orders received. Demarcated residential prime land (Developed plots) is located within Hyderabad.

- The targeted projects where plots shall be purchased are shortlisted based on a detailed analysis by Experts

- Investments shall be made in plots sequentially for a period of 4 years

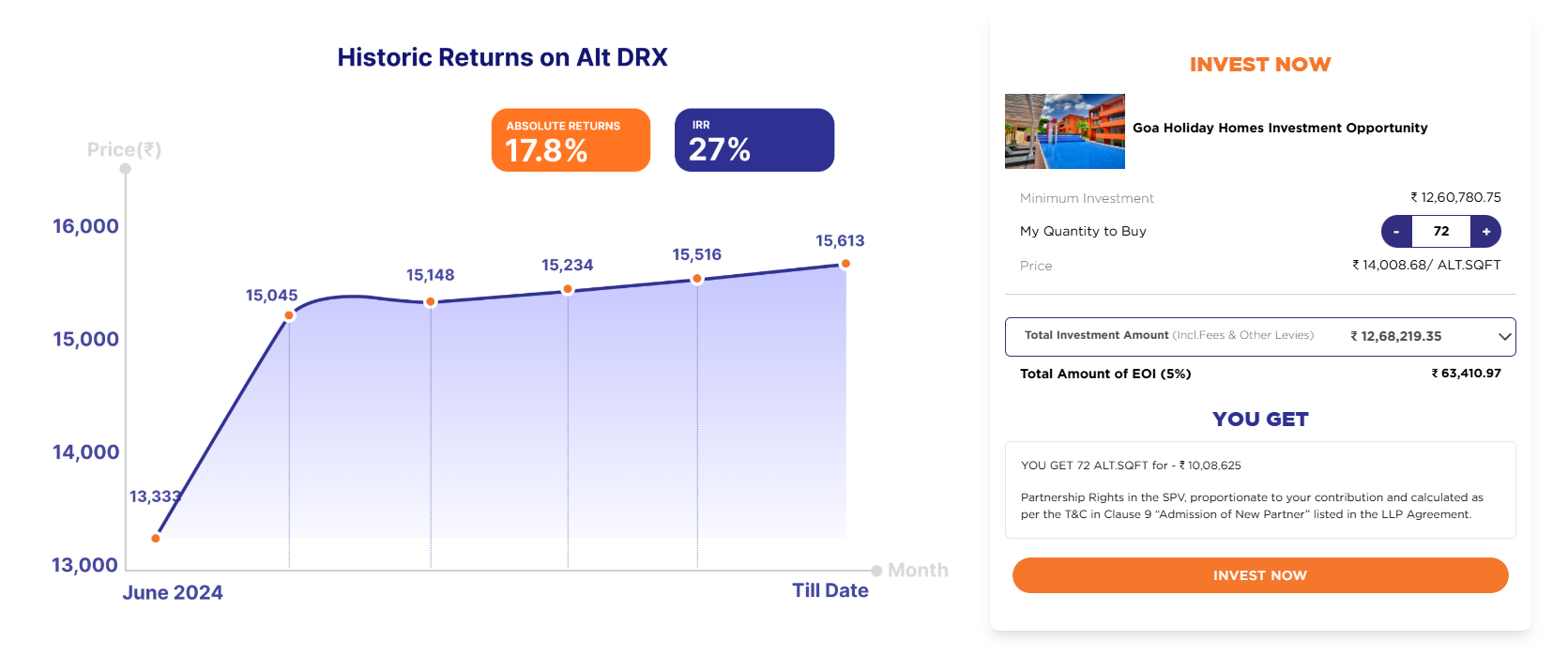

Goa Holiday Homes – 27% IRR delivered

Co-invest in Developed, Ready to Occupy, Holiday Homes in prominent developments that will be given for Rental Occupancy

- The targeted locations in which properties shall be acquired are detailed in the Information Memorandum

- Investments shall be made in Holiday Homes sequentially for a period of 4 years

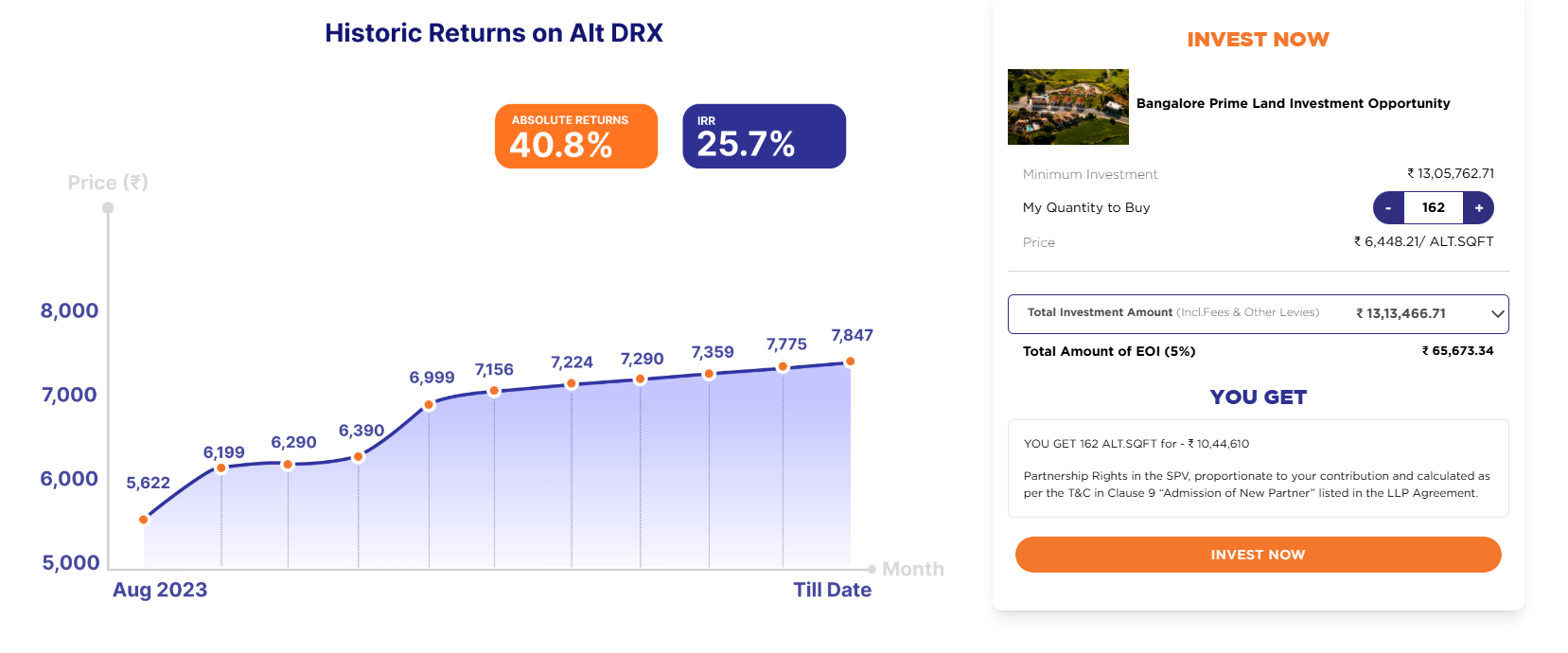

Bangalore Prime Land – 25% IRR delivered

Co-Invest into a portfolio of Approved, Developed, and Release orders received Demarcated – Residential prime land(Developed Plots) located within the Greater Bangalore Region.

- The targeted projects where plots shall be purchased are shortlisted based on a detailed analysis by Knight Frank

- Investments shall be made in plots sequentially for a period of 2 years.

- Godrej Reserve Devanhalli is the first property

Most of the investments have given more than 20% IRR in the last 1 year.

Our Investment investing Alt DRX

We have invested in a couple of properties to date on Alt DRX. We were able to partially exit one of the properties – Bangalore Prime land. Below are the details of our investment journey.

Investment Timeline & Returns

I invested in the Alt DRX Bangalore Land Portfolio in December 2023 and successfully exited in February 2025 with strong returns.

Why we Chose Alt DRX

I discovered Alt DRX, a digital real estate investment platform, in 2023 and was drawn to it for two key reasons:

- Diversified Land Portfolio: My investment of ₹10 lakh was spread across multiple land parcels, significantly reducing the risks associated with direct land investments.

- Strong Promoter Background: The team had deep expertise in both financial services and real estate, which gave me confidence in the platform’s credibility.

These factors convinced me to invest in the Bangalore Land Index through Alt DRX.

Why Bangalore Prime Land?

Land investments have historically outperformed many traditional asset classes. Alt DRX provided an opportunity to tap into Bangalore’s fast-growing land market with a structured and transparent approach.

Investment Pricing & Returns

- Entry Price: ₹5,762 per sq. ft.

- Investment Size: 144 sq. ft.

- Exit Price: ₹7,190 per sq. ft. (after a bulk liquidation discount of 6% from the prevailing market rate of ₹7,638 per sq. ft.)

- Return on Partial Exit: 25% in 14 months

The increase in land values drove the index’s performance, and despite a slight discount on bulk liquidation, the returns were impressive.

Seamless Investment & Exit Experience

My journey with Alt DRX was smooth and hassle-free:

Fully Digital Process: From investment to exit, everything was paperless and streamlined.

Transparent Documentation: All property details and due diligence documents were easily accessible.

Effortless Exit: I simply placed a sell order for my holdings, and the platform matched it with a buyer. The proceeds were transferred to my virtual wallet, ready for withdrawal.

Final Thoughts

Alt DRX provided a secure, efficient, and transparent way to invest in Bangalore’s high-growth land market. With a solid return of 25% in just over a year, I’d consider exploring more opportunities on the platform in the future. The Tradex feature is still growing and will make the exit more efficient in the future.

The investment horizon may vary depending on the property you choose. It makes sense to diversify across properties. The platform can improve some features, such as

- Better user Interface to navigate

- Operations can be streamlined more efficiently. Considering the platform is new, they are still fixing shortcomings on this front.

If you’re looking to start investing in digital real estate on Alt DRX, you can start by simply signing up on the platform and completing the KYC verification process. For Randomdimes Investors, they are offering up to 2% cashback on new investments!

One key benefit of investing in Alt DRX is its liquidity and hassle-free exit for a traditionally illiquid and highly restricted asset class. Once you have made an investment, you can easily sell or trade your digital SQFT token on Alt DRX, giving you complete control over when and at what conditions you wish to exit your investments or get into new ones.