The craft brewery industry has been fermenting impressive growth over the past decade, offering investors a unique alternative asset class that combines steady revenue streams with potential for capital appreciation. Today, I’m excited to introduce a first-of-its-kind investment opportunity in India’s burgeoning craft beer market – the Brewpub Startup investment through an Alternative Investment Fund AIF structure by Accred Alts. This Category 1 AIF offers qualified investors direct exposure to the rapidly expanding brewpub sector, with attractive projected returns and a structure designed to mitigate typical industry risks while capitalizing on the growth potential of craft brewing operations.

Understanding the Brewpub Investment Landscape

The brewery industry represents a fascinating intersection of manufacturing, hospitality, and consumer trends. Unlike traditional investment vehicles, brewpubs generate revenue through multiple streams: on-site consumption, distribution partnerships, merchandise sales, and experiential offerings like brewery tours and special events. This diversification creates resilience against market fluctuations while offering exposure to one of the fastest-growing segments of the food and beverage industry.

Brewpubs differs from standard microbreweries by combining brewing operations with restaurant services, creating integrated experiences that command premium pricing and foster brand loyalty. This model has proven particularly successful in urban markets with disposable income and appreciation for craft products.

The Market Opportunity

The Indian craft beer market has witnessed exponential growth in recent years, driven by changing consumer preferences, rising disposable incomes, and growing appreciation for premium beverages. Unlike saturated Western markets, India’s craft brewing industry is still in its early growth phase, offering early investors substantial upside potential.

Key market indicators supporting this opportunity include:

- Expanding urban consumer base with increasing preference for premium experiences Limited competition in the high-end craft brewery segment

- Rising tourism creates demand for authentic local beverage experiences

- Regulatory environment increasingly favorable to craft brewing operations Growing export potential for Indian craft beers

Structure and Opportunity

The Brewpub investment opportunity is structured through a Category 1 Alternative Investment Fund, designed specifically for investors seeking exposure to this growing sector. This innovative investment vehicle combines the potential high returns of brewery ownership with professional management and risk mitigation strategies typically unavailable to individual investors.

Key Highlights of Brewpub

Category 1 AIF Structure: Regulated investment vehicle with transparent governance

Portfolio Approach: Investment can be spread across multiple brewpub operations to diversify operational risk the choice of the investor

Professional Management: Experienced brewery operators and financial experts managing daily operations

Revenue Diversification: Income from multiple streams including direct sales, events, and hospitality.

Exit Strategy: Clear pathways to liquidity through strategic sale, IPO, or buyback provisions

Unlike direct brewery ownership which requires specialized knowledge and daily operational involvement, the Brewpub AIF allows passive investment while professional managers handle the complex aspects of brewery operations, including regulatory compliance, production scaling, and distribution expansion.

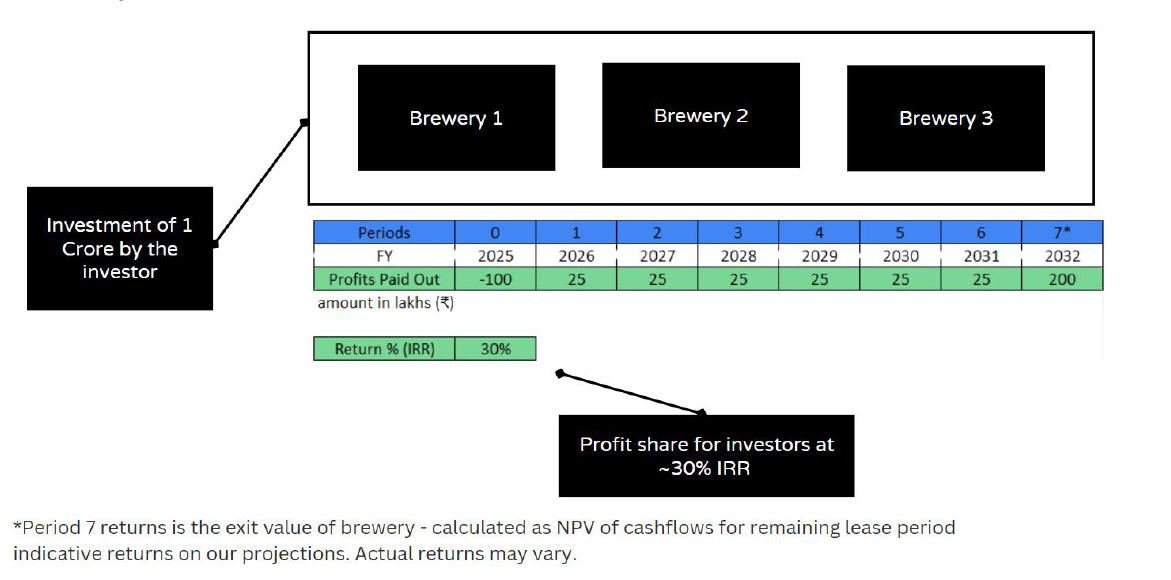

Investment Parameters

| Feature | Details |

| Fund Category | SEBI Registered Category 1 AIF |

| Minimum Investment | ₹10,00,000 per asset (25 Lac total) |

| Overall Target Fund Size | ₹200 Crore |

| Expected Returns | 18-24% IRR Target |

| Investment Horizon | 5-7 Years |

| Distribution Structure | Quarterly Returns + Exit Upside |

| Risk Profile | Moderate – High |

| Tax Benefits | As per AIF Category 1 regulations |

Why Brewpub Investments Outperform Traditional Assets

Brewpub investments offer several advantages over traditional asset classes that make them particularly attractive in today’s economic environment:

- Inflation Resistance. Food and beverage products typically maintain pricing power during inflationary periods. Premium alcoholic beverages in particular have demonstrated strong pricing resilience and margin protection capabilities even during economic downturns.

- Tangible Asset Backing. Unlike many alternative investments, brewpub operations are backed by tangible assets including real estate, brewing equipment, and inventory. The Accred Alts Brewpub AIF provides investors partial ownership of these physical assets, creating a value floor for the investment.

- Multiple Value Creation Avenues . The brewpub model creates value through multiple diversified avenues like food, own brew, other beverages, events etc.

- Experiential Economy Exposure. As consumer preferences shift from products to experiences, brewpubs sit at the intersection of manufacturing, hospitality, and experiential retail—three sectors with strong growth trajectories in the Indian market.

Key Differentiators

What separates this offering from other alternative investments is their methodical approach to brewery selection, operational improvement, and value creation:

- Strategic Location Selection: Targeting high-growth urban areas with optimal demographic profiles for craft beer consumption

- Operational Excellence: Implementing industry best practices for production efficiency, quality control, and waste reduction based on established international standards

- Sustainability Focus: Incorporating advanced water conservation, energy efficiency, and waste management systems that improve both environmental impact and operational margins

- Brand Development: Creating distinctive, premium brewery brands with strong intellectual property protection and expansion potential

How to Invest

The opportunity is available to qualified investors with a minimum investment of ₹10 lacs per asset (Total 25 lacs).

To participate in this exclusive opportunity just fill out the form and a representative will share the details

Important: The current subscription window closes soon, and allocation is limited to maintain optimal deployment efficiency. Early investors receive priority allocation and potential preferential terms.

Conclusion

The craft brewery industry in India represents a rare convergence of consumer trends, market timing, and investment potential. The Accred Alts Brewpub AIF offers qualified investors structured access to this opportunity through a regulated vehicle with professional management.

For investors seeking portfolio diversification beyond traditional assets and conventional alternative investments, the Brewpub AIF presents a compelling option with attractive risk-adjusted return potential. The combination of revenue diversification, tangible asset backing, and potential brand value appreciation creates a unique investment profile not easily replicated in other asset classes.

Disclaimer: Alternative investments are risky. This is only information & NOT investment advice. Returns mentioned are only indicative and can vary. The content on this blog is merely for information purposes. You are requested to research and analyze your goals & requirements before investing. Investments in Alternative Investment Funds AIFs) are subject to market risks and there is no assurance or guarantee that the objectives of the fund will be achieved.