Introduction

Real estate and infrastructure are among the most reliable long-term wealth-creating asset classes. They generate predictable cash flows, benefit from economic growth, and offer strong inflation protection.

However, direct investment in these assets is difficult for most investors because:

- Commercial real estate requires ₹50 lakh to ₹5 crore or more

- Infrastructure assets like highways and power grids are inaccessible

- Properties are illiquid

- Asset management requires expertise

This is where REITs and InvITs come in.

They allow investors to own institutional-grade real estate and infrastructure assets through liquid, exchange-traded instruments with low investment minimums.

Today, REITs and InvITs have become essential portfolio components for income-focused investors. There are other real estate investment options, like Altdrx, if someone is interested in land or residential assets!

What is a REIT?

A Real Estate Investment Trust (REIT) is a SEBI-regulated trust that owns income-generating commercial real estate.

Instead of buying a physical office building, investors buy units of a REIT, which owns multiple office buildings.

The REIT collects rent from tenants and distributes income to investors.

Types of properties owned by REITs

- Office parks

- IT campuses

- Commercial buildings

- Shopping malls

- Corporate campuses

Key regulatory requirement

REITs must distribute at least:

90% of distributable cash flow to investors

This makes REITs income-focused investment instruments.

What is an InvIT?

An Infrastructure Investment Trust (InvIT) is similar to a REIT but invests in infrastructure assets instead of real estate.

Types of infrastructure owned by InvITs

- Power transmission lines

- Highways

- Renewable energy assets

- Telecom towers

InvITs generate income from usage fees and distribute it to investors.

Why REITs and InvITs Exist

REITs and InvITs are often explained from the investor perspective, but they were primarily created to help asset owners unlock capital and improve capital efficiency.

Real estate developers and infrastructure companies typically own mature assets that generate steady income but tie up large amounts of capital. REITs and InvITs allow them to monetize these assets without fully selling or losing operational control.

1. Unlocking capital from mature assets

Commercial real estate and infrastructure assets are highly valuable but illiquid.

By transferring assets into a REIT or InvIT, sponsors can raise capital from public investors.

For example:

-

A developer owns office parks worth ₹10,000 crore

-

Transfers them into a REIT

-

Raises ₹10,000 crore from investors

-

Uses capital for new developments

This converts illiquid assets into usable capital.

2. Recycling capital to fund growth

REITs and InvITs allow sponsors to recycle capital efficiently.

Typical cycle:

Build asset → Lease asset → Transfer to REIT/InvIT → Raise capital → Build new assets

This accelerates growth without increasing debt.

3. Reducing debt and improving the balance sheet

Developers and infrastructure companies often carry significant debt.

By monetizing assets through REITs or InvITs, they can reduce leverage and strengthen their balance sheets.

This improves financial stability and credit ratings.

4. Retaining ownership while raising capital

Sponsors typically retain partial ownership in the REIT or InvIT.

This allows them to:

-

Continue earning income

-

Benefit from future appreciation

-

Maintain strategic control

For example, sponsors of Embassy REIT and PowerGrid InvIT continue to hold significant stakes.

5. Lower cost of capital compared to traditional funding

REITs and InvITs provide access to public equity capital, which is often cheaper than private equity or high-cost debt.

This reduces overall financing costs and improves long-term profitability.

REITs and InvITs were created to solve major limitations of direct real asset investing.

Why do investors invest in REITS and InvITs?

Problem 1: Large capital requirement

Direct commercial real estate investment typically requires:

- ₹50 lakh to ₹5 crore

REIT investment can start with:

- ₹500–₹1,000

Problem 2: Illiquidity

Selling property can take months.

REITs and InvITs can be sold instantly on stock exchanges.

Problem 3: Lack of diversification

Buying one property creates concentration risk.

REITs and InvITs own diversified portfolios.

Problem 4: Operational complexity

Direct ownership requires:

- Tenant management

- Maintenance

- Legal compliance

REITs and InvITs are professionally managed.

Legal Structure of REITs and InvITs

REITs and InvITs operate using a four-layer structure.

Layer 1: Sponsor

The sponsor creates the REIT or InvIT and transfers assets.

Examples

- Embassy Group → Embassy REIT

- PowerGrid Corporation → PowerGrid InvIT

- Brookfield → Brookfield REIT, Altius InvIT

Sponsors usually retain ownership, aligning incentives.

Layer 2: Trust (Listed Entity)

This is the entity listed on NSE or BSE.

Investors buy units of this trust.

Layer 3: SPVs (Special Purpose Vehicles)

SPVs legally own the assets.

Examples

- Office buildings

- Highways

- Transmission lines

- Telecom towers

SPVs generate income.

Layer 4: Asset Level

This is where income originates.

Income sources include

- Office tenant rent

- Transmission charges

- Government annuity payments

- Telecom tower lease payments

Cash Flow Structure

The income flow works as follows:

Tenant / Utility / Telecom Operator

↓

SPV earns income

↓

Trust receives income

↓

Trust distributes income

↓

Investor receives distribution

By regulation, at least 90% of distributable cash flow must be paid to investors.

Taxation of REITs and InvITs

REIT and InvIT distributions consist of multiple components.

Each component is taxed differently.

Understanding this is essential.

Component 1: Interest Income

SPVs borrow money from the trust.

Interest payments are distributed to investors.

Tax treatment

- Taxed at a slab rate

Example

Interest received: ₹10,000

Tax slab: 30%

Tax payable: ₹3,000

Net income: ₹7,000

Component 2: Dividend Income

SPVs may distribute dividends.

Tax treatment depends on the SPV tax regime

- Maybe tax-free

- Or taxed at a slab rate

Most InvIT distributions are taxable.

Component 3: Rental Income (REITs specific)

Rental income is distributed to investors.

Tax treatment

Taxed at the slab rate.

Component 4: Capital Repayment (Return of Capital)

This is the most tax-efficient component.

Key feature

Not taxed immediately.

Instead, reduces purchase cost.

Example

Purchase price: ₹100

Capital repayment received: ₹20

New cost basis: ₹80

Tax is paid only when selling.

Capital Gains Tax

| Holding period | Tax rate |

|---|---|

| Less than 1 year | 15% |

| More than 1 year | 10% |

Detailed Business Model of Each REIT in India

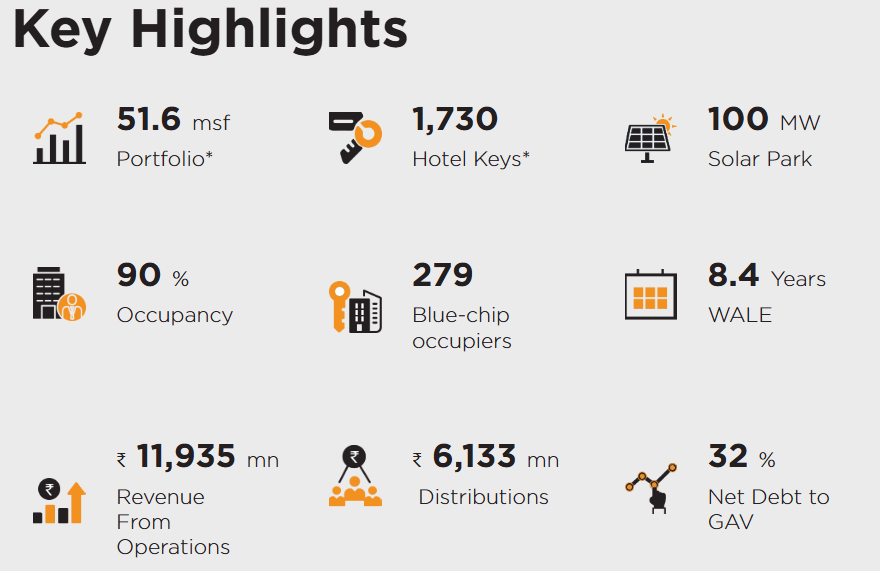

Embassy Office Parks REIT

Sponsor: Embassy Group, Blackstone

Asset type: Commercial office real estate

Portfolio size: 50+ million sq ft

Locations

- Bangalore

- Mumbai

- Pune

- NCR

Major tenants

- Microsoft

- IBM

Business model

Companies lease office space under long-term contracts.

Revenue flow:

Corporate tenant

↓

Pays rent

↓

Embassy REIT

↓

Investor receives distribution

Risk level

Low

Investor suitability

Income-focused investors seeking stable income.

Mindspace Business Parks REIT

Sponsor: K Raheja Corp

Asset type: Office parks

Locations

- Mumbai

- Hyderabad

- Pune

- Chennai

Business model

Office leasing to corporate tenants.

Revenue flow:

Tenant rent → Mindspace REIT → Investor

Risk level

Low

Brookfield India REIT

Sponsor: Brookfield Asset Management

Locations

- Gurgaon

- Mumbai

- Noida

- Kolkata

Business model

Commercial office leasing.

Revenue flow:

Corporate tenant → Rent → Brookfield REIT → Investor

Risk level

Low

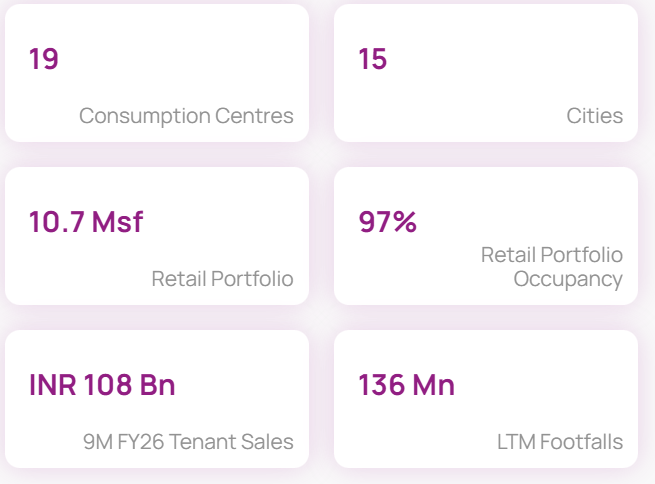

Nexus Select Trust REIT

Sponsor: Blackstone

Asset type: Retail malls

Business model

Retail stores lease space.

Revenue flow:

Retail store → Rent → Nexus REIT → Investor

Risk level

Moderate

Detailed Business Model of InvITs in India

InvITs generate income from infrastructure assets such as power transmission lines, highways, and telecom towers. These assets typically operate under long-term contracts, making cash flows predictable.

PowerGrid Infrastructure Investment Trust (PGINVIT)

Sponsor: PowerGrid Corporation of India (Government of India)

Sector: Power transmission

Risk level: Very low

Typical yield: 8–10%

Assets owned

Power transmission lines across India.

These lines transport electricity from generators to distribution companies.

Business model

PowerGrid earns revenue by charging transmission fees.

Revenue flow:

Electricity generator / distribution company

↓

Pays transmission fee

↓

PowerGrid InvIT

↓

Investor receives distribution

Key strength

Revenue is regulated and backed by long-term contracts.

Investor relevance

One of the safest InvITs in India.

IndiGrid Infrastructure Trust (INDIGRID)

Sponsor: KKR, Sterlite Power

Sector: Power transmission and renewable infrastructure

Risk level: Low

Typical yield: 9–12%

Assets owned

Power transmission infrastructure across multiple states.

Business model

Revenue comes from electricity transmission charges.

Revenue flow:

Electric utility

↓

Transmission fee

↓

IndiGrid InvIT

↓

Investor receives distribution

Key advantage

Higher yield compared to PowerGrid InvIT.

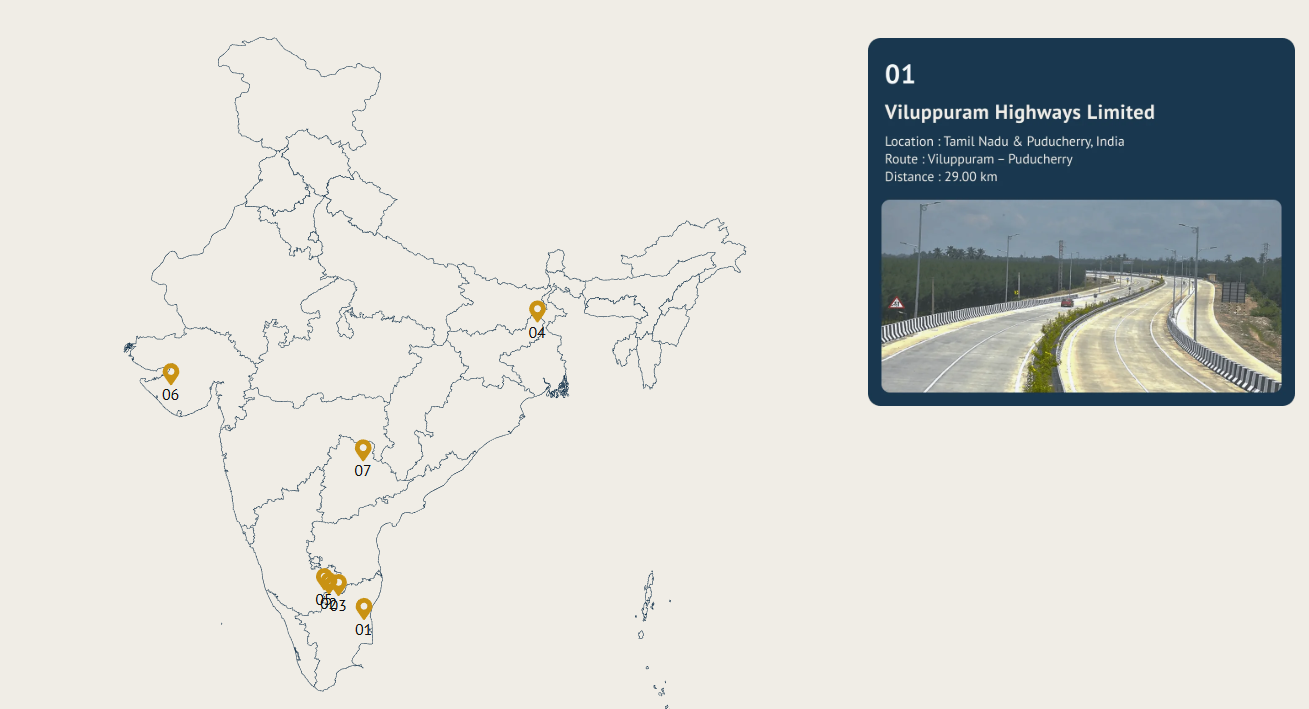

Cube Highways Trust (CUBEINVIT)

Sponsor: Cube Highways

Sector: Highway infrastructure

Risk level: Moderate

Typical yield: 9–12%

Assets owned

Highways across India.

Revenue sources

Two main sources:

- Toll collections

- Government annuity payments

Revenue flow:

Vehicles / Government

↓

Pays toll or annuity

↓

Cube InvIT

↓

Investor receives distribution

Indus Infra Trust (INDUSINVIT)

Sponsor: GR Infraprojects

Sector: Highway infrastructure

Risk level: Low

Typical yield: 8–10%

Business model

Operates annuity-based highways.

Revenue flow:

Government

↓

Annuity payment

↓

Indus InvIT

↓

Investor

Key strength

Revenue does not depend on traffic volume.

National Highways Infra Trust (NHIT)

Sponsor: National Highways Authority of India (Government of India)

Sector: Highway infrastructure

Risk level: Very low

Typical yield: 8–10%

Business model

The government pays a fixed annuity.

Revenue flow:

Government → NHIT → Investor

Extremely stable income profile.

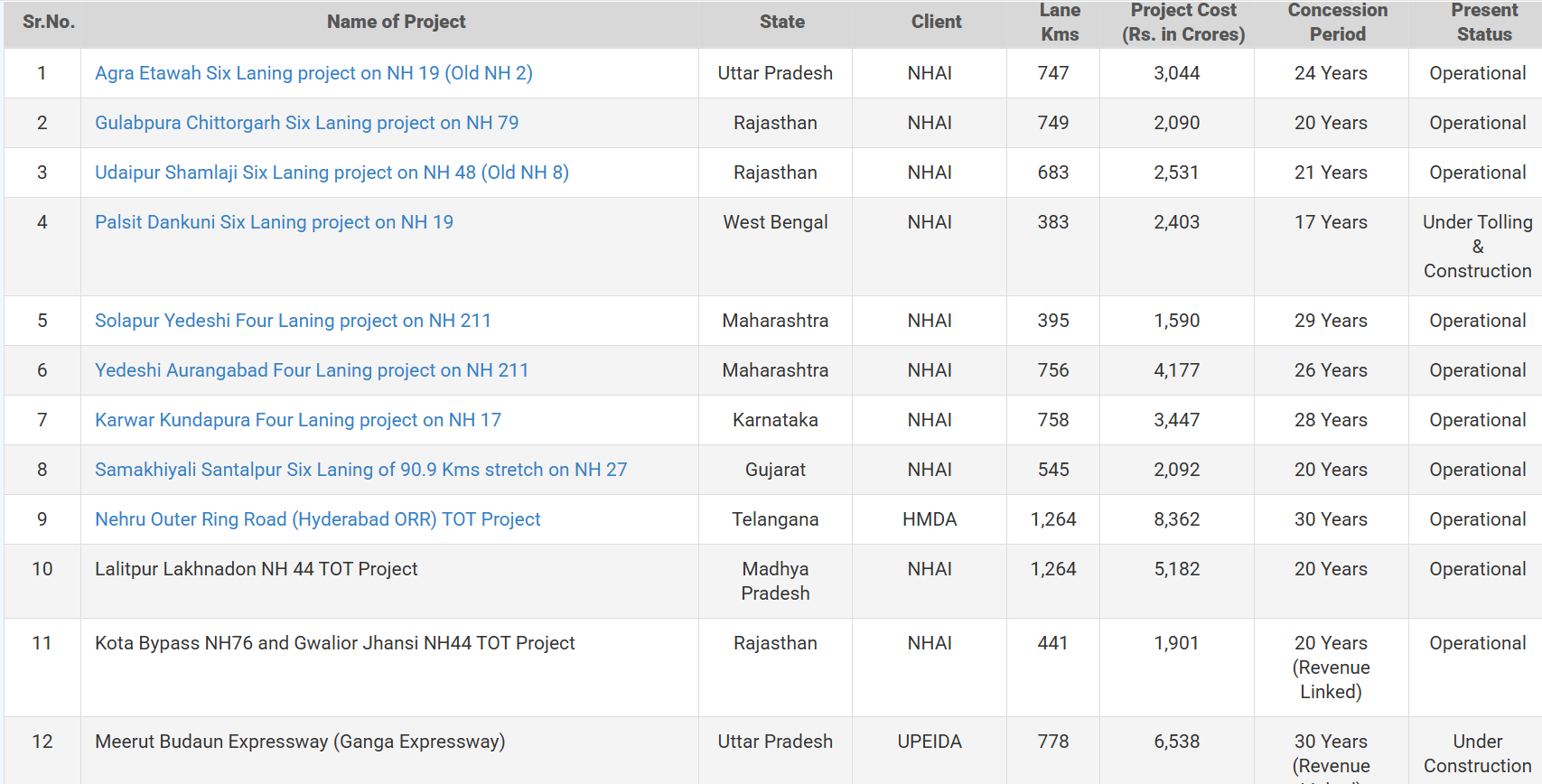

IRB Infrastructure InvIT (IRBINVIT)

Sponsor: IRB Infrastructure

Sector: Toll roads

Risk level: Moderate

Typical yield: 10–12%

Business model

Revenue comes from toll collection.

Revenue flow:

Vehicle toll → IRB InvIT → Investor

Risk factor

Revenue depends on traffic volume.

Anantam Highways Trust InvIT

Sponsor: Alpha Alternatives

Sector: Highway annuity infrastructure

Risk level: Low

Typical yield: 8–11%

Business model

Government annuity payments.

Revenue flow:

Government → Anantam InvIT → Investor

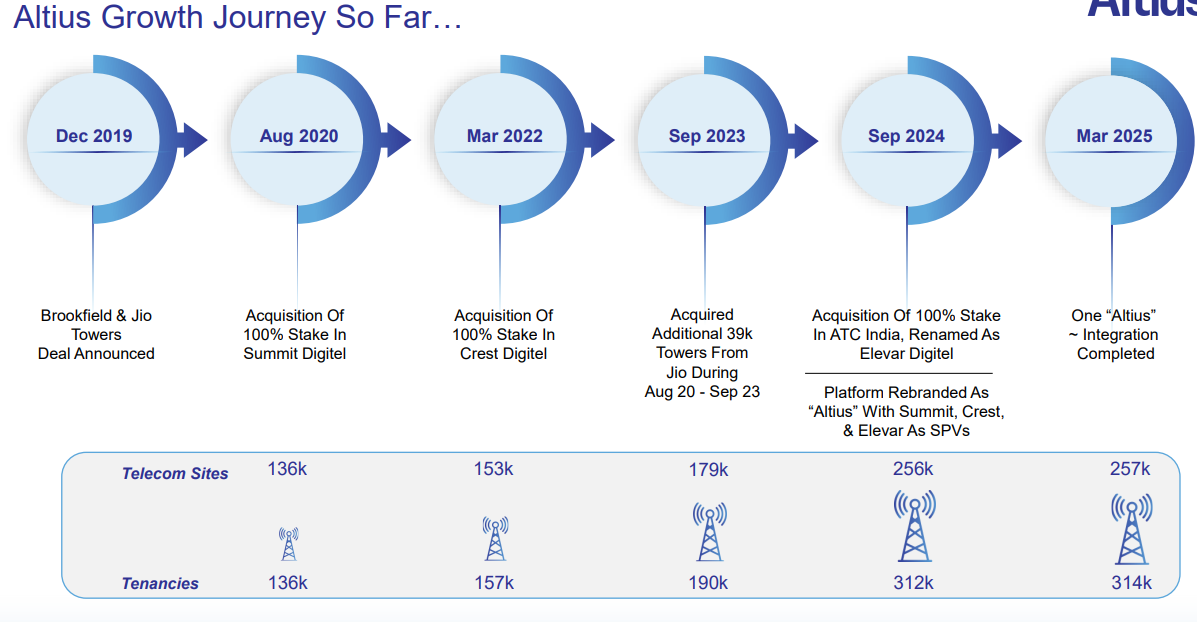

Altius Telecom Infrastructure Trust

Sponsor: Brookfield Asset Management

Sector: Telecom infrastructure

Risk level: Low

Typical yield: 8–10%

Assets owned

Telecom towers are leased to telecom operators.

Revenue flow

Telecom operators (Airtel, Jio, Vodafone Idea)

↓

Lease payments

↓

Altius InvIT

↓

Investor receives income

Cube Highways Trust InvIT (CUBEINVIT)

Sponsor: Cube Highways and Infrastructure (backed by global institutional investors)

Listed on: NSE and BSE

Sector: Highway infrastructure

Risk level: Moderate

Typical yield: 9–12%

1. Toll revenue

Vehicles using toll roads pay toll charges.

Revenue flow:

This revenue depends on traffic volume and economic activity.

2. Government annuity income

Some highway projects operate under the Hybrid Annuity Model (HAM).

Under this model, the government pays a fixed annuity regardless of traffic volume.

Revenue flow:

This provides stable and predictable cash flows.

Valuation of REITs and InvITs (How to Determine Fair Value)

Unlike stocks, REITs and InvITs are valued primarily based on income.

The most important valuation metrics are:

- Distribution yield

- Net Asset Value (NAV)

- Price to NAV ratio

Method 1: Distribution Yield (Primary Valuation Metric)

Formula:

Distribution Yield = Annual Distribution ÷ Current Price

Example: PowerGrid InvIT

Price: ₹95

Annual distribution: ₹9.5

Yield:

Yield = 9.5 / 95 = 10%

Compare with government bonds (7%).

Higher yield indicates an attractive valuation.

Method 2: NAV-Based Valuation

NAV represents asset value per unit.

Formula:

NAV = (Asset value − Debt) ÷ Units

If price < NAV → undervalued

If price > NAV → premium

Method 3: Yield Spread vs Government Bonds

Example:

Government bond yield: 7%

InvIT yield: 10%

Spread: 3%

This spread compensates for risk.

Historical Performance of REITs and InvITs in India

| Instrument | Yield | Total Return |

|---|---|---|

| Embassy REIT | 6–7% | 11–13% |

| Mindspace REIT | 6–7.5% | 10–12% |

| Brookfield REIT | 6–8% | 11–14% |

| IndiGrid InvIT | 9–12% | 12–15% |

| PowerGrid InvIT | 8–10% | 8–10% |

| Cube InvIT | 9–12% | 11–14% |

InvITs typically provide higher income.

REITs provide slightly better capital appreciation.

REIT vs InvIT Comparison

| Feature | REIT | InvIT |

|---|---|---|

| Asset type | Real estate | Infrastructure |

| Yield | 5–8% | 8–12% |

| Risk | Low | Low–moderate |

| Growth potential | Moderate | Moderate |

| Income stability | High | Very high |

Portfolio Allocation Strategy

Recommended allocation:

Beginner investor: 5–10%

Intermediate investor: 10–15%

Income-focused investor: 15–20%

REITs and InvITs are ideal income-generating portfolio components.

Comparative Analysis of all Listed REITS and InvITS

| Name | Type | Sector | Key Assets | Portfolio Size / Assets | Revenue Source | Typical Yield | Historical Total Return | Risk Level |

|---|---|---|---|---|---|---|---|---|

| Embassy Office Parks REIT | REIT | Office Real Estate | Office parks in Bangalore, Mumbai, Pune, NCR | 51+ million sq ft office space | Office rent from tenants like Microsoft, Google | 6–7% | 11–13% | Low |

| Mindspace Business Parks REIT | REIT | Office Real Estate | Office parks in Mumbai, Hyderabad, Pune, Chennai | Large Grade-A office portfolio across major cities | Office leasing income | 6–7.5% | 10–12% | Low |

| Brookfield India REIT | REIT | Office Real Estate | Office campuses in Gurgaon, Mumbai, Noida | Premium office assets in prime commercial locations | Corporate office leasing | 6–8% | 11–14% | Low |

| Nexus Select Trust REIT | REIT | Retail Real Estate | Shopping malls and retail centers | Retail mall portfolio across major urban centers | Retail lease income, revenue share | 5–7% | 9–12% (early stage) | Moderate |

| PowerGrid Infrastructure InvIT | InvIT | Power Transmission | Power transmission lines across India | Transmission infrastructure owned and operated nationwide | Regulated transmission fees | 8–10% | 8–10% | Very Low |

| IndiGrid Infrastructure Trust | InvIT | Power Transmission | Transmission and renewable infrastructure | Nationwide transmission asset portfolio | Transmission charges, renewable contracts | 9–12% | 12–15% | Low |

| Cube Highways Trust InvIT | InvIT | Highways | Toll and annuity road infrastructure | Diversified highway portfolio across India | Toll revenue + government annuity | 9–12% | 11–14% | Moderate |

| Indus Infra Trust | InvIT | Highways | Highway infrastructure projects | Highway annuity asset portfolio | Government annuity income | 8–10% | 9–12% | Low |

| National Highways Infra Trust (NHIT) | InvIT | Highways | National highway infrastructure | Government highway asset portfolio | Government annuity payments | 8–10% | 9–11% | Very Low |

| IRB Infrastructure InvIT | InvIT | Toll Roads | Toll road infrastructure | Toll highways across India | Toll collection income | 10–12% | 10–14% | Moderate |

| Anantam Highways Trust | InvIT | Highways | Highway annuity infrastructure | SEBI-registered highway InvIT platform | Government annuity | 8–11% | Early stage | Low |

| Altius Telecom Infrastructure Trust | InvIT | Telecom Infrastructure | Telecom towers across India | Telecom tower infrastructure portfolio | Tower lease income from telecom operators | 8–10% | Early stage | Low |

FAQ: REIT and InvIT Investing

Are REITs and InvITs safe from a regulatory perspective?

Yes, they are regulated by SEBI and backed by real assets.

Safest examples:

- PowerGrid InvIT

- Embassy REIT

However, there is no guarantee of returns as they are market-driven

Why does the PowerGrid InvIT price not increase much?

Most returns come from distributions.

Capital appreciation is secondary.

How do investors make money?

Through:

- Income distributions

- Capital appreciation

Are REITs better than fixed deposits?

REITs offer:

- Higher potential returns

- Inflation protection

But higher risk.

Final Conclusion

REITs and InvITs provide one of the best ways to access institutional-grade real estate and infrastructure assets.

They offer:

- Stable passive income

- Tax efficiency

- Liquidity

- Diversification

For intermediate investors, allocating 5–10% of the portfolio to REITs and InvITs can significantly improve income stability and diversification.

Looking beyond REITs? Check out other alternative Investments below