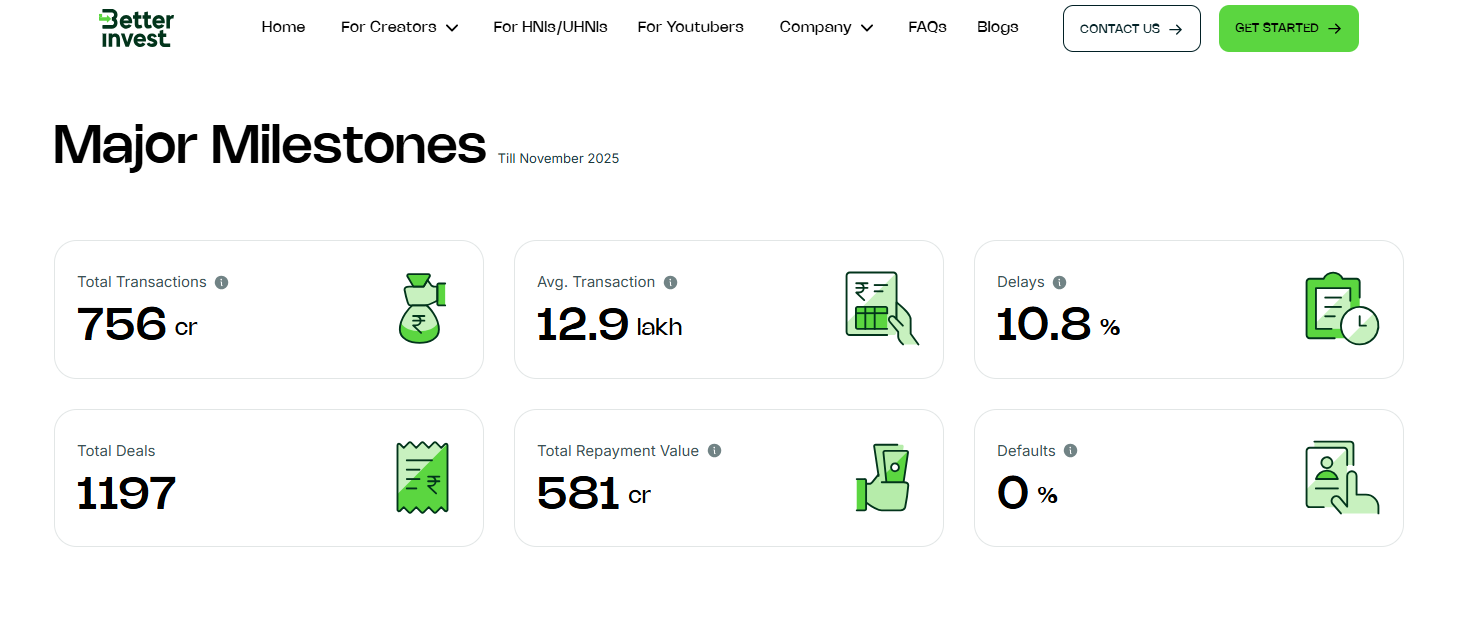

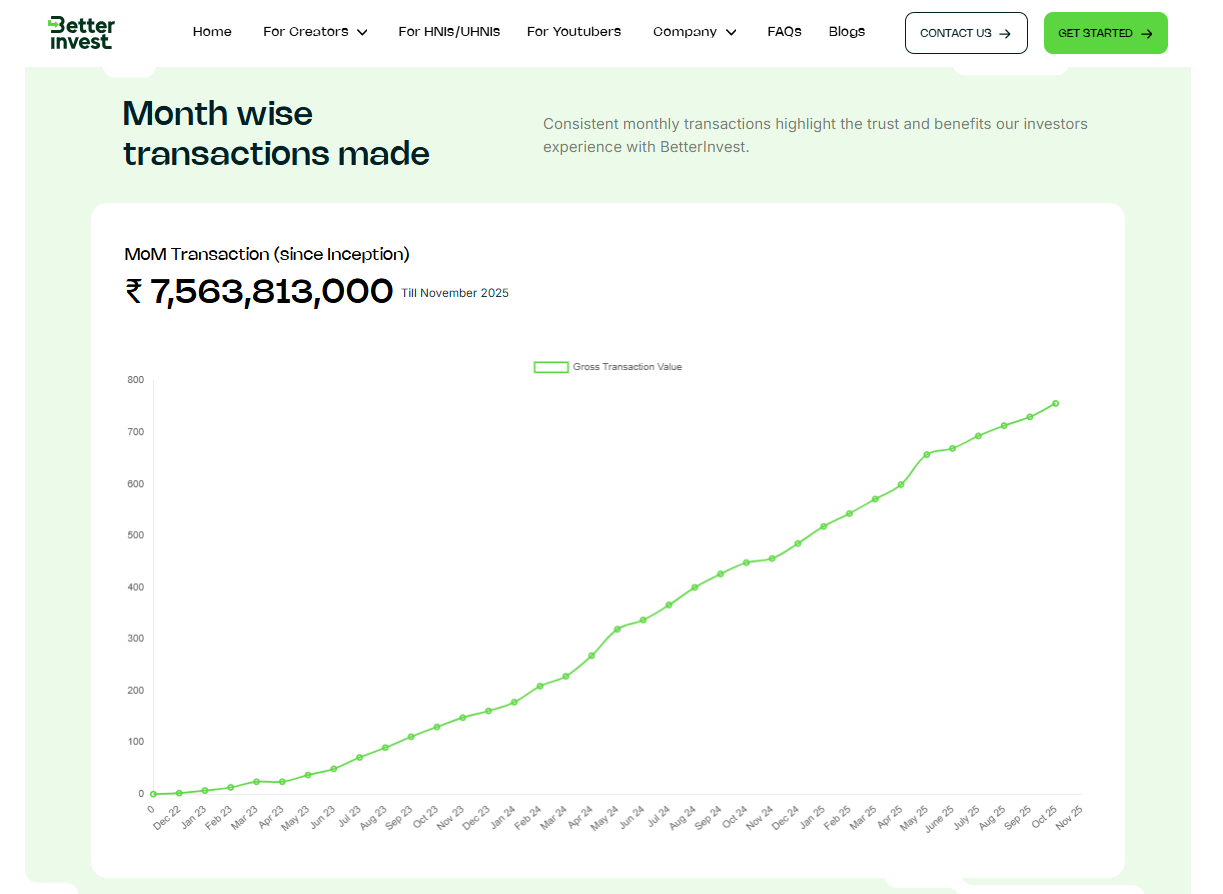

Since its launch in 2021, BetterInvest has financed over 1197 deals, amounting to over INR 756 crores in total transaction values. The alternative investment platform has served the funding requirements of over 114 content producers, and at the same time, has given investment opportunities to over 5862 customers.

Over these years, BetterInvest has remained one of India’s foremost alternative investment platforms that lets investors invest in invoice discounting opportunities in the media and entertainment industry for as little as INR 50,000. In this article, we will review BetterInvest’s performance over the last three years. We will start with a brief overview of the platform, explaining how BetterInvest works, its key features, and then we will look at how the platform has fared in recent past in terms of deals, defaults, delays and other parameters. At the end, I will share my personal investment experience on BetterInvest.

Read Detailed review on Betterinvest!

What is BetterInvest?

BetterInvest is an alternative investment platform that enables investors to participate in invoice discounting in the media and entertainment industry. The platform is addressing financing challenges in the entertainment industry by fulfilling the funding requirements in post-production stages, while giving retail investors access to a high-return alternative investment, which has traditionally been restricted to High-Net-Worth Individuals and big production houses.

The core idea behind BetterInvest’s business is very simple. Once a movie or web series is completed, the production house sells its rights (OTT rights, audio rights or satellite rights) to buyers, such as OTT platforms, record labels, etc. The production house enters into a sale agreement with the buyer. While a contract is signed, the actual payment from the OTT/Label often arrives 3 to 12 months later. To fulfill the many financing requirements of the production house during this post-production stage, the production house comes to BetterInvest, which allows investors, like you and me, to “discount” these invoices, providing the production house with immediate liquidity while investors earn a fixed return of up to 18% p.a.

Use Code TXRHTH for Early Access

Team Behind BetterInvest

BetterInvest was founded by Pradeep Somu, Sedhumanikandan, and Sriram Ananx back in 2021. Before starting their alternative investment platform dedicated to fulfilling funding crunches in the entertainment industry, the founders were closely engaged in the entertainment space. Pradeep co-founded and ran HeroTalkies, a Tamil OTT platform for the global audience in 2013, even prior to the launch of major OTT players such as Netflix, Hotstar, etc. Sethu Rajendran was a core team member at HeroTalkies and thereafter worked along with Pradeep on multiple ventures, including a short stint as political consultants. The team behind BetterInvest has combined their knowledge of finance and experience in the entertainment industry to bring together the platform.

How does BetterInvest Work?

BetterInvest uses a revenue-based financing model tailored specifically for the entertainment industry. While traditional royalty-based financing often involves fluctuating returns, BetterInvest operates more like invoice discounting, offering investors fixed, predictable cash flows.

The shift in the entertainment landscape has moved beyond reliance on box-office performance. Production houses now secure significant revenue through the sale of OTT and audio rights to platforms like Netflix and Amazon Prime. Crucially, BetterInvest focuses exclusively on outright sale agreements rather than “pay-per-view” models. In these arrangements, the OTT rights buyer pays a predetermined fee regardless of the content’s commercial performance, ensuring that future cash flows remain unaffected by box office results.

The process is straightforward:

- Agreements: A production house secures an outright sale agreement with a major buyer.

- Due Diligence: After the platform and BetterInvest conduct rigorous due diligence, BetterInvest purchases the invoice at a discounted rate.

- Investment: Investors fund these invoices, providing the production house with immediate capital.

- Payout: Once the OTT platform settles the full invoice (typically 30 to 90 days post-release), investors receive their principal plus interest, usually within a 3 to 18-month horizon.

How BetterInvest Manages Risks

BetterInvest follows a five-prong approach to deal evaluation, beginning with an onboarding phase that selects only movies with rights already sold to established OTT or audio platforms. During the evaluation stage, the firm assesses the project’s scale, production progress, and the track record of both the production house and its relationship with rights buyers. To manage risk, the discounting eligibility is capped at 60% to 70% of the total contract value, typically featuring a short-term horizon of 5 to 12 months. The verification process involves a rigorous review of proof of advance payments and the formal assignment contract with the rights buyer. Finally, the investment is secured through a robust framework including direct collection letters, post-dated cheques, indemnities, and personal guarantees.

BetterInvest acquires a Direct Collection Letter from the production house that the OTT buyer would directly pay the proceeds into the escrow account, which will be controlled by BetterInvest at all times. This ensures that the invoice amount is directly transferred to the investors through an escrow account.

Deals, Delays, and Defaults

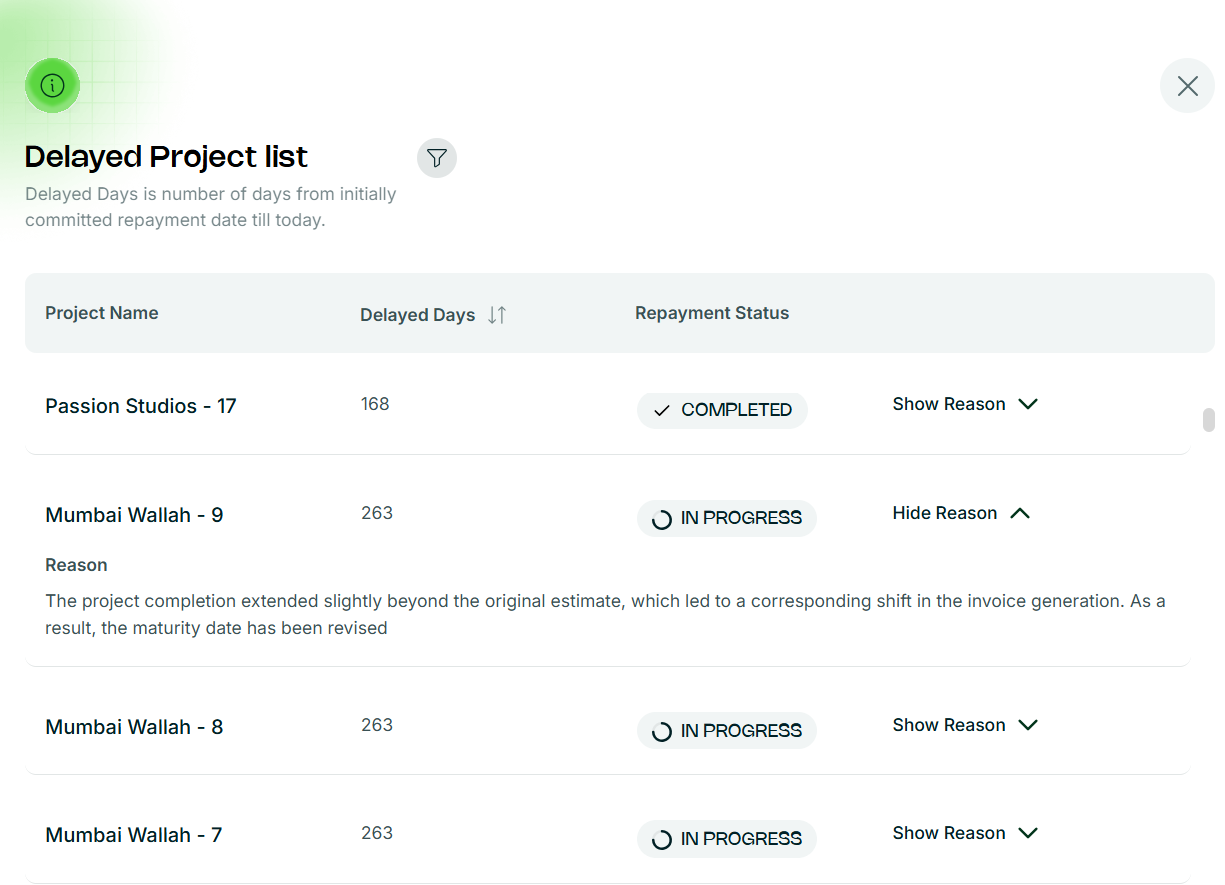

BetterInvest boasts a track record of 0% default rate so far; however, there have been delays in repayments. 10.8% of the platform’s total deals have experienced delayed repayments. BetterInvest’s website publishes a transparency report, where you can find details of all delayed projects, including the number of days of delay.

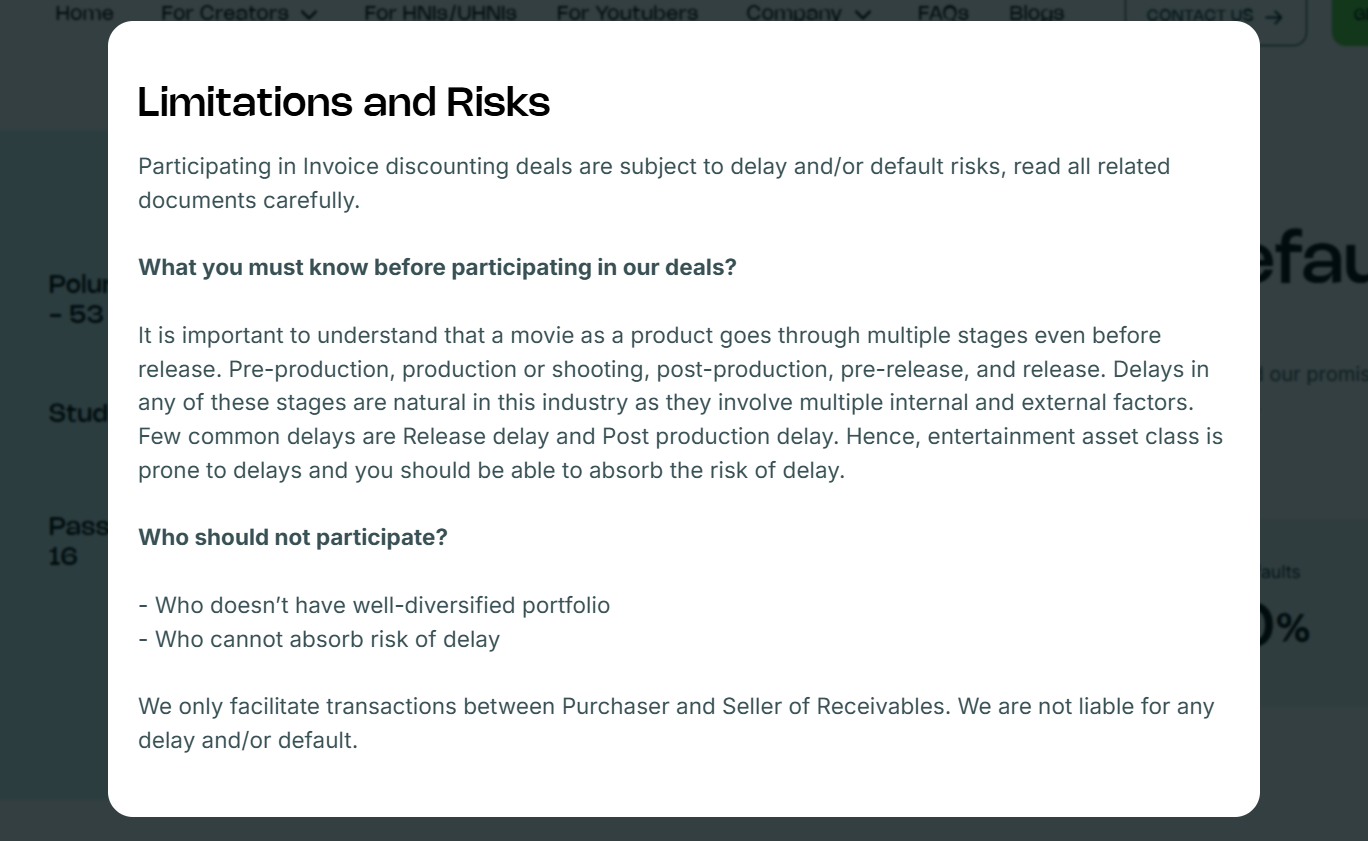

While BetterInvest has so far had a track record of zero defaults, 1 in 10 deals offered on the platform have experienced delayed payments. However, the platform is quite transparent and frank about the risk of delays, which it considers natural in the entertainment industry due to multiple internal and external factors. At the same time, BetterInvest goes as far as to suggest that investors who cannot absorb the risk of delay should not participate in the opportunities listed.

So far, BetterInvest has processed deals amounting to a total transaction value of INR 756 crore. Month-wise transactions on the platform since its inception show consistent interest, including 60% repeat customers among over 5862 investors they have served so far.

While the platform initially focused on movies and OTT shows, it is now increasingly shifting towards becoming a comprehensive financing solution for different aspects of the media and entertainment industry. This stretches from OTT rights, music rights, and TV shows (satellite rights) and services, Production Houses, TV Producers, YouTube, and Social Media creators.

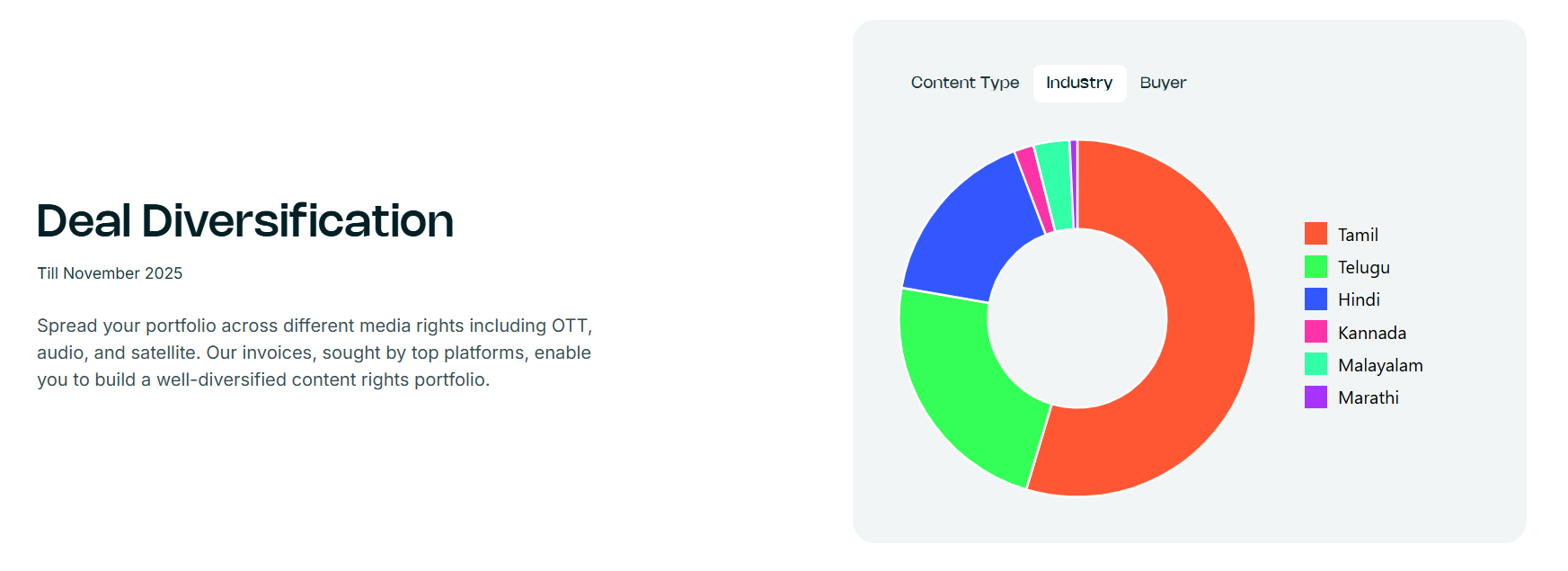

Over the years, BetterInvest has forayed into a well-diversified portfolio of deals in the entertainment space, covering all different media rights. While the Tamil entertainment industry continues to dominate the deals available on BetterInvest, Telugu, Hindi, and other major regional entertainment industries are increasingly becoming accessible on BetterInvest.

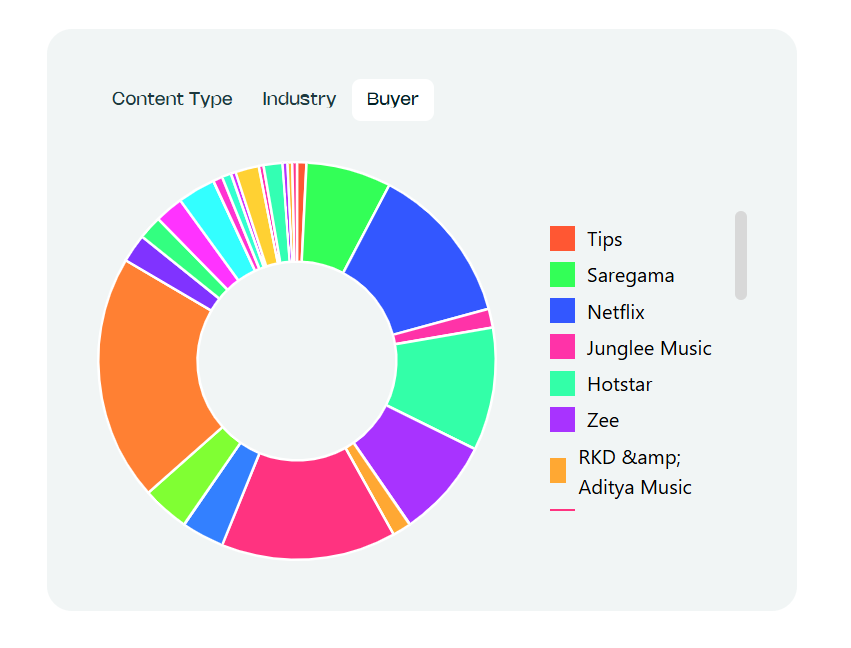

Besides, a large number of OTT buyers backing the deals offered on BetterInvest are large OTT players who can be expected to be regular with payments. This also acts as a risk mitigation strategy.

Investors have shared their experiences investing through BetterInvest on various platforms, and a common observation is that, while there are no defaults, delays are very common. One key downside investors have faced is inconsistent returns. The platform sometimes does not specify an exact repayment date. However, most investors acknowledge receiving additional interest for the delayed payments. Regarding post-tax returns, investors note that the returns advertised on BetterInvest are pre-tax returns, subject to a 10% TDS, and the post-tax return is usually between 10-15%, depending on the investor’s tax slab. The platform is a lucrative alternative investment avenue for diversification, with an average post-tax return of above 10%.

Use Code TXRHTH for Early Access

My Personal Investment Experience

When you move beyond equities, mutual funds, and ETFs, the next real challenge isn’t returns — it’s finding alternative products that actually exist in the real economy and not just on pitch decks.

I started investing via BetterInvest.club about three years ago, primarily to gain exposure to non-market-linked cash-flow assets. This post is a candid breakdown of how the platform works, how deals behave in practice, and what long-term investors should realistically expect.

This is not a sponsored review — just a practical investor’s perspective.

My Betterinvest Investment Portfolio Performance

Total Deals Invested – 27

Gross IRR – 17.2%

Total Delays -5

Total Defaults (Currently 0)

Why This Product Caught My Attention

Three years back, my thinking was straightforward:

-

Equity markets already dominate my portfolio

-

Fixed income returns were compressing

-

AIFs required large, long lock-ins

-

Startup investing was too binary

BetterInvest.club offered:

-

Short-duration, defined-return structures

-

Non-market correlation

-

Exposure to a niche (entertainment financing) that retail investors usually never see

That risk-return asymmetry was interesting enough to try, but with controlled allocation.

Types of Deals I’ve Seen Over 3 Years

1. OTT & Satellite Receivable Deals

These are the most common.

-

Payments due from OTT platforms or broadcasters

-

Tenures ranging from a few months to over a year

-

Fixed return expectation disclosed upfront

Investor reality:

The payment date is expected, not guaranteed to the day.

2. Music & Digital Rights Receivables

Often smaller ticket sizes but similar structure.

-

Revenue tied to contracted distribution rights

-

Slightly higher variability in timelines

3. Rolling / Repeat Producer Deals

Some production houses raise funding repeatedly.

This is useful because:

-

You can track historical repayment behavior

-

Risk assessment improves over time

Real Investor Experience: What Actually Happens

This is where marketing ends, and reality begins.

1. Returns vs Timelines

Returns advertised on deals often look attractive (mid-teens IRR). But payouts are not clockwork.

Across forums and investor discussions:

-

Delays of weeks or months are not unusual

-

Extensions are communicated, but they do happen

-

Cash-flow planning becomes important

If you expect FD-like certainty, you’ll be disappointed.

Some example where delay happened

-

Hindi Rights of South Indian Movie 7, 8, & 9 – Post-production (CG work) delayed; projected release moved to September 2025.

-

Stone Bench Creations – 3 – Original maturity date (Dec 19, 2024) extended due to rights buyer requested adjustments.

-

Escape Artists Motion Picture – 11 – Quality and technical checks continuing; release planned September.

-

Escape Artists Motion Picture – 10 – Additional song shoot needed before technical checks; maturity revised to April 15, 2025.

-

Paarth Productions (multiple tranches) – Invoice raising delayed due to quality check processes (expected soon).

2. Communication & Updates

On balance, BetterInvest.club does communicate delays and updates, which matters.

What you typically get:

-

Deal notes

-

Status updates when timelines shift

-

Clear acknowledgement of risks in documentation

This doesn’t eliminate risk, but it avoids surprises.

3. Liquidity Reality

There is no instant exit button.

-

Capital is locked until receivable realization

-

Secondary exits are not frictionless

-

Investors must assume full tenure hold

This product punishes over-allocation.

Risk: Let’s Be Very Clear

Based on disclosures and investor experience:

-

This is not capital-protected

-

Delays ≠ defaults, but delays are common

-

Returns depend on counterparties honoring contracts

-

Platform is a facilitator, not a guarantor

This behaves more like private credit than “investment products” sold to retail users.

What I Like After 3 Years

✔ Genuine non-market-linked returns

✔ Exposure to real cash-flow assets

✔ Structured deals with documentation

✔ Niche asset class unavailable via brokers

✔ Good diversification when sized correctly

What You Must Be Careful About

❌ Timing uncertainty

❌ Illiquidity

❌ Not suitable for emergency capital

❌ Requires deal-by-deal analysis

❌ Returns are expected, not promised

This is allocation capital, not core capital.

Who Should Consider BetterInvest.club?

Good fit if:

-

You already invest in equities and funds

-

You understand private credit risk

-

You can lock money without stress

-

You’re allocating a small % of net worth

-

You want diversification beyond markets

Not suitable if:

-

You want a predictable monthly cash flow

-

You’re new to investing

-

You dislike uncertainty in timelines

Use Code TXRHTH for Early Access

Final Verdict After 3 Years

After three years, I’d summarize BetterInvest.club like this:

A legitimate alternative investment platform — but only for investors who understand illiquidity, timing risk, and allocation discipline.

Used carefully, it can:

-

Improve diversification

-

Add yield outside public markets

-

Reduce equity correlation

Used aggressively, it can create anxiety.

Use Code TXRHTH for Early Access