India’s investment landscape has evolved far beyond traditional mutual funds and PMS. For HNIs, family offices, and corporate treasuries, Alternative Investment Funds (AIFs) and the newer Specialised Investment Funds (SIFs) have become essential portfolio tools.

But these products are often misunderstood — leading to wrong expectations, liquidity shocks, and poor outcomes.

This guide explains:

-

What AIFs and SIFs really are

-

How each category works

-

Real examples of strategies and funds

-

Clear comparisons so you know what to choose and why

What Are AIFs in India?

Alternative Investment Funds (AIFs) are privately pooled investment vehicles regulated by the Securities and Exchange Board of India.

They allow investment strategies not permitted in mutual funds, such as:

-

Private equity & venture capital

-

Private credit & distressed assets

-

Real estate

-

Long–short equity & derivatives

-

Quant and arbitrage strategies

AIFs are meant only for sophisticated investors, not retail.

SEBI Classification of AIFs (Big Picture)

SEBI classifies AIFs into three categories, based on risk, strategy, and asset type:

| Category | Core Purpose |

|---|---|

| Category I | Early-stage & impact investing |

| Category II | Private equity, credit & real assets |

| Category III | Hedge-fund-like trading strategies |

Let’s go deep into each.

CATEGORY I AIF – Venture Capital, Early Stage & Infrastructure

What Category I AIFs Do

Category I AIFs invest in early-stage, unlisted, illiquid assets that need long-term capital.

These include:

-

Venture Capital funds

-

Angel funds

-

SME funds

-

Infrastructure funds

-

Social venture funds

How Returns Are Generated

Returns come from equity value creation, not regular income:

-

Business growth

-

Market share expansion

-

Valuation multiple increase

-

Exit via IPO or strategic sale

There is no steady cash flow.

Example

A VC fund invests in 20 startups

• 10 fail completely

• 7 return 1–2x

• 3 deliver 10–20xThe entire fund’s return depends on those 3 winners

Popular Category I AIF Examples

-

Peak XV Partners

- Blume Ventures

Risks You Must Understand

-

Extremely high failure rate

-

No liquidity for years

-

Valuations are subjective

-

One bad vintage year can hurt permanently

Category I vs Category II

| Aspect | Category I | Category II |

|---|---|---|

| Asset stage | Early | Mature |

| Cash flows | None | Possible |

| Failure rate | Very high | Moderate |

| Risk | Extreme | High |

Who should invest:

✔ Family offices with surplus capital

❌ Anyone needing visibility or liquidity

CATEGORY II AIF – Private Equity, Credit & Real Assets

(The Core of India’s AIF Market)

Category II is the largest and most widely used AIF category.

Sub-Types Within Category II

1️⃣ Private Equity / Growth Capital

-

Invests in profitable, growing unlisted companies

-

Focus on scaling operations and governance

Return driver:

EBITDA growth + exit valuation

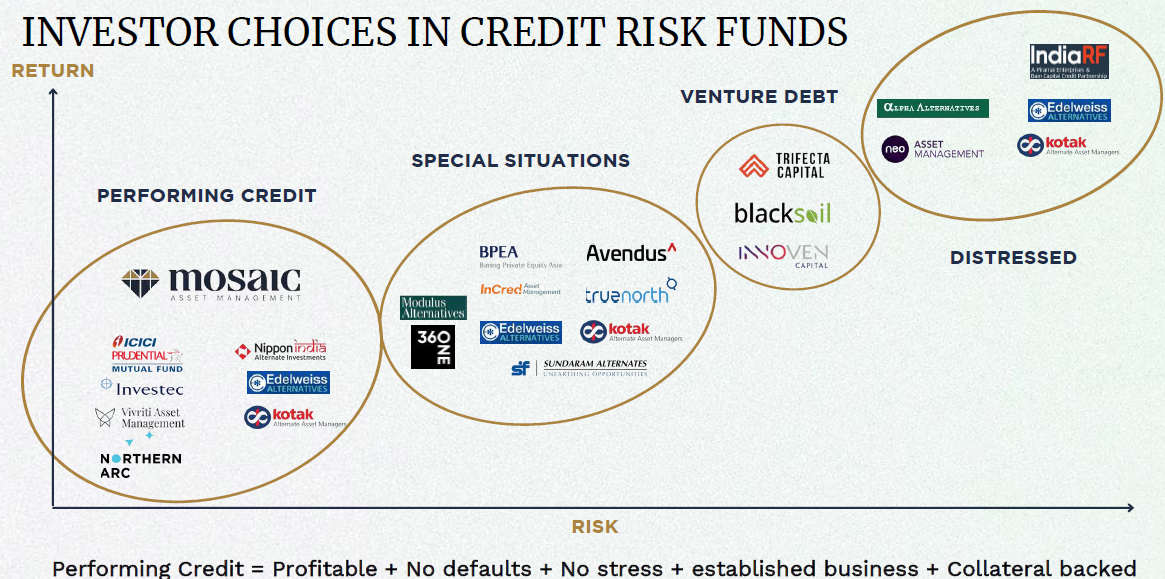

2️⃣ Private Credit / Structured Debt

-

Lends to companies outside banks

-

Often secured or structured

Return driver:

Contractual yield (12–22%) + downside protection

3️⃣ Real Estate AIFs

-

Commercial & residential projects

-

Rental yield + price appreciation

Return driver:

Project execution + real estate cycle

Example (Private Credit)

AIF lends ₹100 crore at 15% secured yield

Quarterly interest flows

Principal returned at maturity

Returns are yield-driven, not market-driven.

Typical Category II AIF Examples

-

Neo Special Situation Fund

- Edelweiss Alternatives

Risks (Often Underestimated)

-

Credit defaults

-

Real estate execution delays

-

Illiquidity

-

Manager risk

Many high-profile AIF issues in India happened in credit funds, not VC.

Category II vs Category III

| Aspect | Category II | Category III |

|---|---|---|

| Asset type | Unlisted | Listed |

| Leverage | ❌ | ✅ |

| Liquidity | Very low | Periodic |

| Returns | Growth / Yield | Alpha |

Who should invest:

✔ Family offices, corporate treasuries

❌ Investors chasing headline IRRs

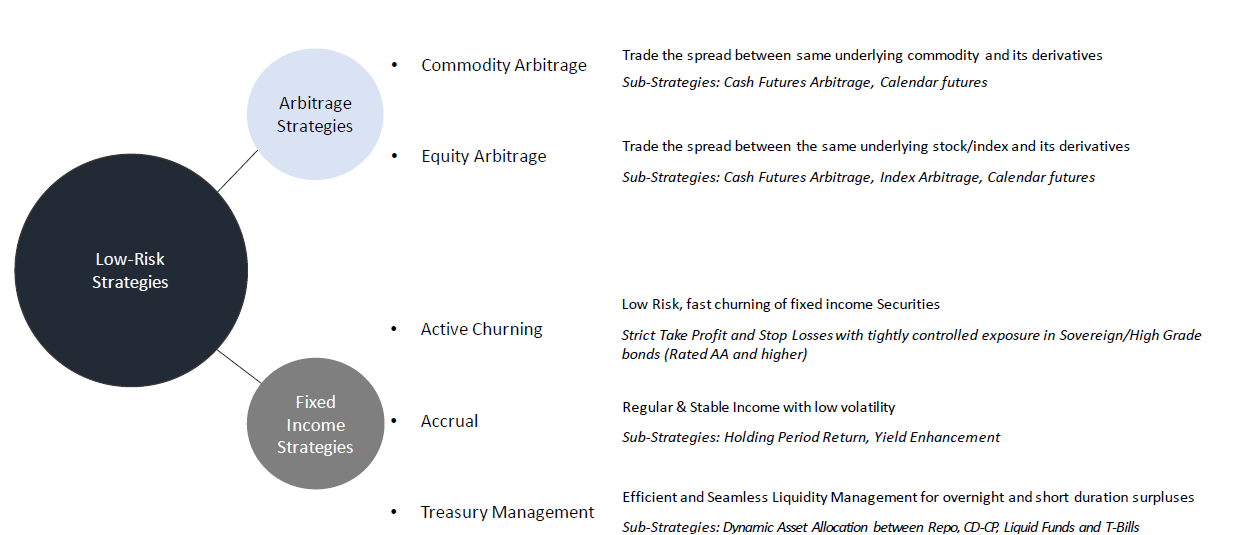

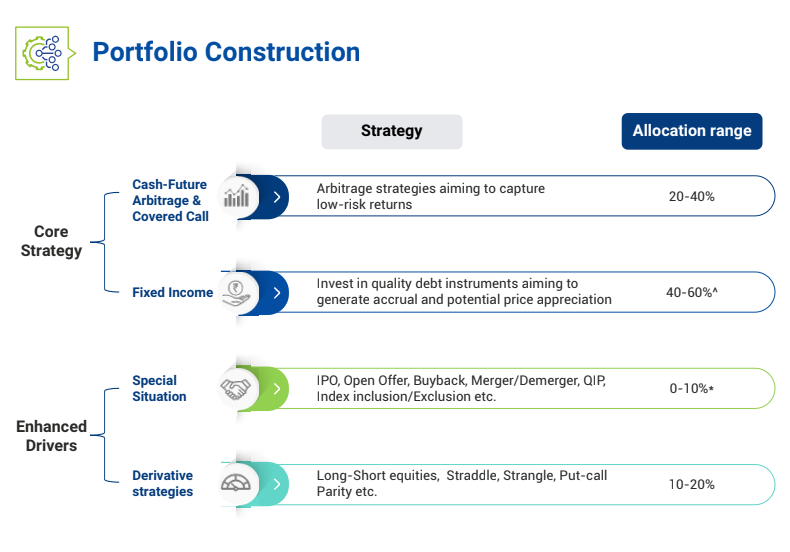

CATEGORY III AIF – Hedge Fund & Trading Strategies

Category III AIFs are closest to global hedge funds.

What Category III AIFs Do

They invest in listed markets using:

-

Long–short equity

-

Arbitrage

-

Quant & systematic strategies

-

Volatility & options trades

Returns aim to be independent of market direction.

Example (Long–Short Equity)

Long high-quality stocks

Short weak balance-sheet stocks

Net market exposure: 20–30%

Goal: absolute returns across cycles

Example (Arbitrage / Quant)

Capture pricing inefficiencies

Use leverage carefully

Many small trades, low per-trade risk

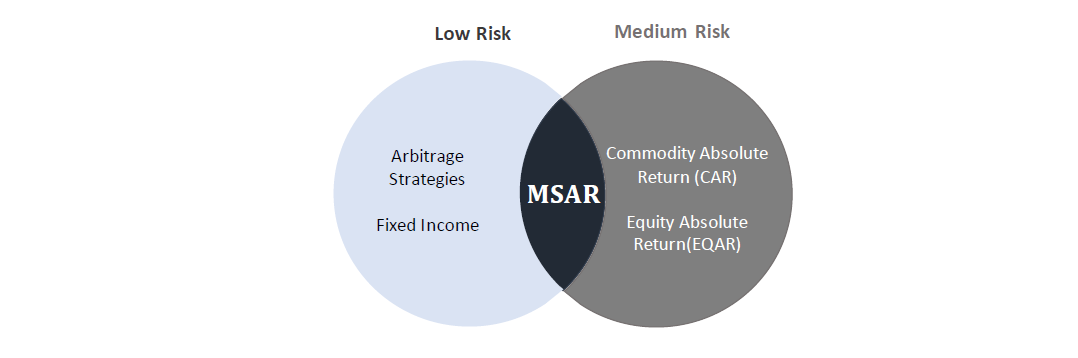

Typical Category III AIF Examples

-

TATA Absolute Fund

-

ASK Absolute Returns Fund

- Alpha Alternative Multi-Strategy Absolute Return Fund

Risks You Must Respect

-

Drawdowns can be sharp

-

Leverage amplifies mistakes

-

Strategy complexity

-

Liquidity gates during stress

Smooth return curves are often a red flag, not a comfort.

*Please note that some PMS have also taken AIF licenses to run long-only strategies

Category III vs SIF

| Aspect | Category III AIF | SIF |

|---|---|---|

| Min investment | ₹1 crore | ₹10 lakh |

| Leverage | High | Limited |

| Regulation | Flexible | Tight |

| Risk | High | Moderate–High |

SPECIALISED INVESTMENT FUNDS (SIFs) – The Middle Layer

SIFs were introduced to bridge the gap between mutual funds and AIFs.

What Is a SIF?

A Specialised Investment Fund (SIF) is:

-

Offered by mutual fund houses

-

Allowed advanced strategies

-

Under strong MF-style governance

Think of SIFs as:

AIF-lite with guardrails

Strategies Commonly Used

-

Long–short equity (low net exposure)

-

Index option income strategies

-

Arbitrage & carry

-

Quant factor portfolios

Leverage exists — but tightly controlled.

Example (Option Yield SIF)

Sell index options within risk limits

Earn steady premium

Losses capped via rules

Typical SIF Examples

-

Edelweiss Altiva

-

SBI Magnum Hybrid Long Short

SIF vs PMS

| Aspect | SIF | PMS |

|---|---|---|

| Transparency | High | Medium |

| Rules | Defined | Discretionary |

| Min investment | ₹10 lakh | ₹50 lakh |

| Risk control | Systematic | Manager-driven |

Who Should Invest in SIFs

✔ Investors graduating from mutual funds

✔ HNIs below ₹1 crore per strategy

✔ Corporate treasuries

❌ Investors expecting MF-like stability

Minimum Investment & Process

Minimum Investment

-

AIF: ₹1 crore

-

SIF: ₹10 lakh

Process

1️⃣ Strategy & manager selection

2️⃣ Due diligence (PPM / SID)

3️⃣ KYC & documentation

4️⃣ Capital commitment/investment

5️⃣ Ongoing monitoring

How AIFs & SIFs Fit in a Portfolio

A realistic allocation approach:

-

60–70% → Mutual funds & direct equity

-

10–20% → SIFs (strategy diversification)

-

10–20% → AIFs (illiquidity & alpha)

Almost no sophisticated investor puts 100% in alternatives.