The last few years have completely changed trading. AI is everywhere—every platform claims to offer “AI-powered signals.”

But when you test them, most are just repackaged indicators with an AI label slapped on top.

Tickeron is different.

Tickeron is one of the only trading platforms that uses machine learning, neural networks, and real statistical modelling to generate trade ideas, identify patterns, forecast trends, and even run fully automated AI trading robots.

But the real question is:

Is Tickeron worth the price? Can these AI signals actually help you trade better?

This is the most complete, honest, and detailed Tickeron review online, crafted to outperform every existing article in depth, clarity, and usability.

Table of Contents

-

What is Tickeron?

-

Key Features Explained

-

AI Pattern Recognition

-

AI Trend Forecasting

-

AI Trade Ideas

-

AI Robots (Automated Trading Models)

-

Screener vs Finviz, TradingView, TrendSpider

-

Portfolio Analysis & Risk Tools

-

Pricing Explained

-

Who Should Use Tickeron

-

Pros & Cons

-

Final Verdict

-

FAQ (Schema Ready)

What Is Tickeron?

Tickeron is an AI-driven trading platform designed to help traders identify:

-

High-probability trade setups

-

AI-confirmed patterns

-

Trend reversals

-

Backtested breakouts

-

Automated strategy signals

-

Portfolio optimization

-

Stock, ETF, crypto & forex opportunities

Unlike Finviz or TradingView, Tickeron focuses on AI-generated insights, not just charting or filtering.

Think of it as a hybrid of:

Finviz (screening) + TrendSpider (patterns) + Quant models (signals) + Portfolio analytics — all powered by AI.

Tickeron Features: Full Breakdown

1. AI Pattern Recognition (Tickeron’s Core Strength)

Tickeron’s AI scans the entire market and detects chart patterns such as:

-

Head & Shoulders

-

Cup & Handle

-

Triangles

-

Channels

-

Pennants

-

Flags

-

Double Top/Bottom

-

Trendline Breaks

For every pattern, Tickeron does something no other platform does:

✔ Gives historical success rate

✔ Provides AI confidence score

✔ Suggests stop loss

✔ Predicts price target

✔ Shows expected success probability

✔ Displays backtested outcomes

This is invaluable for swing traders.

2. AI Trend Prediction (Highly Underrated Feature)

Tickeron identifies:

-

Trend reversals

-

Trend continuation

-

Short-term momentum

-

Medium-term direction

Each prediction includes:

-

Probability score

-

Expected holding period

-

Profit target

-

Likely drawdown

-

Past accuracy for similar market conditions

This makes trend following systematic instead of guesswork.

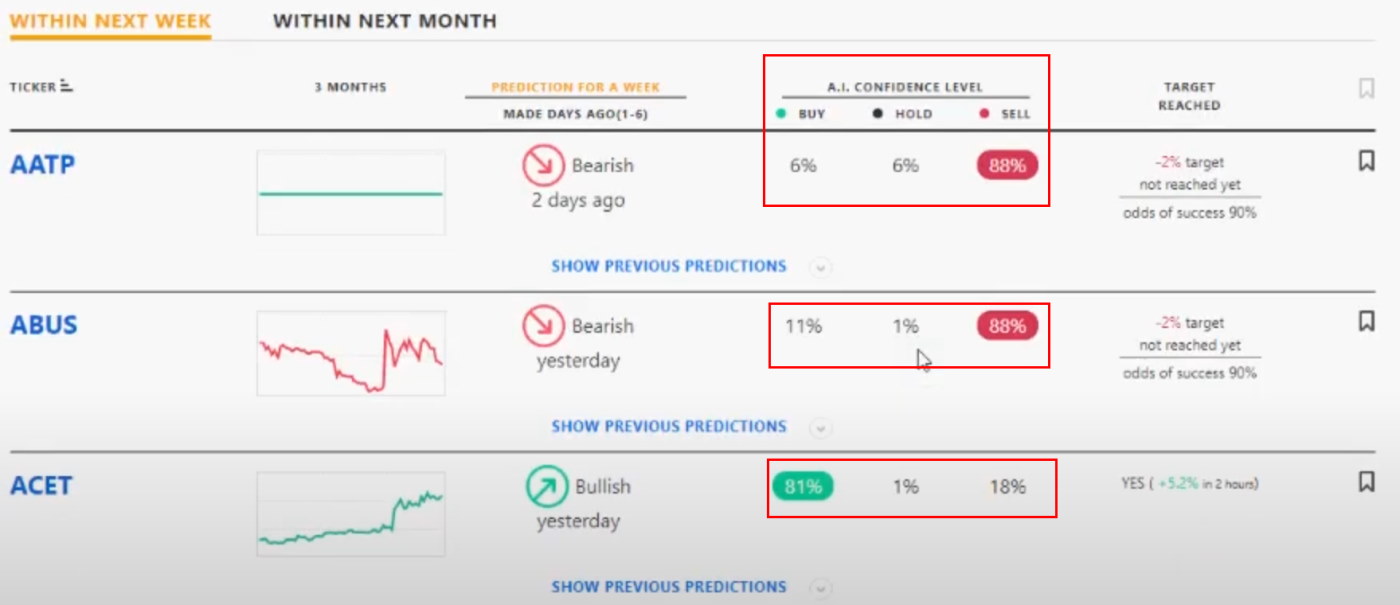

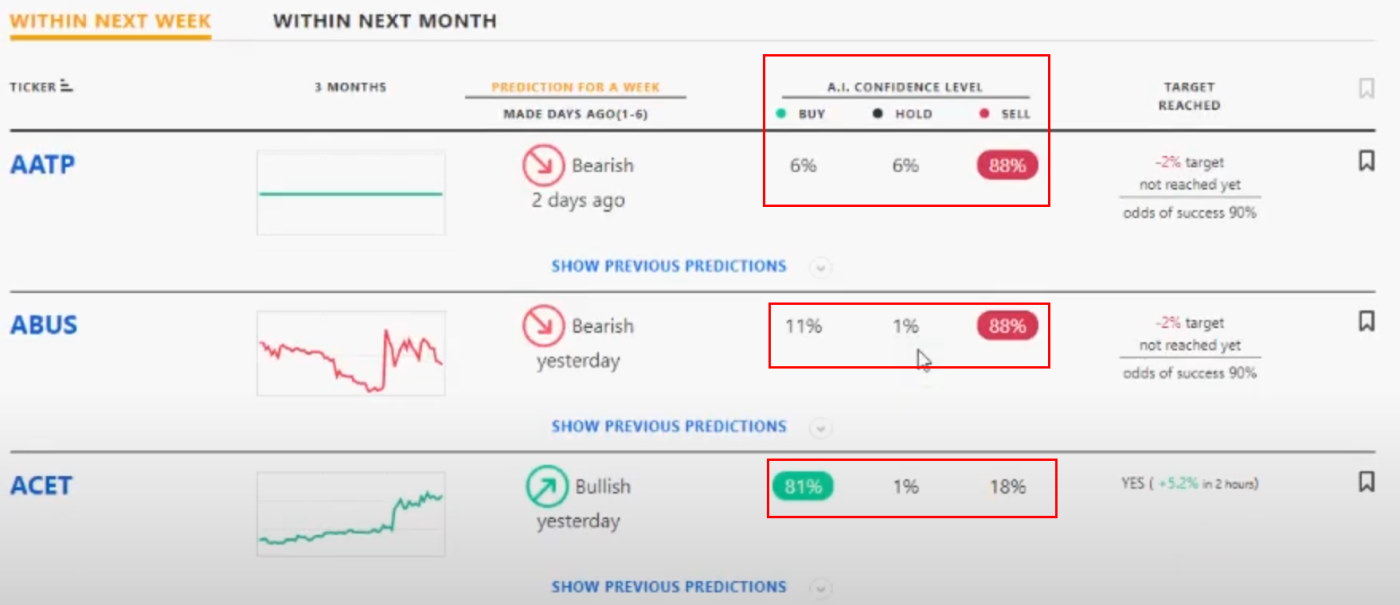

3. AI Trade Ideas (Daily, Backtested & Ranked)

Tickeron gives AI-verified daily trade ideas in:

-

Stocks

-

ETFs

-

Crypto

-

Forex

-

Options

Each idea comes with:

-

Entry level

-

Stop loss

-

Target price

-

Confidence score

-

Time horizon

-

Backtested success rate

These are not random picks — they come from AI pattern detection + historical outcome analysis.

4. AI Robots (Automated Trading Models)

AI Robots are pre-built quantitative trading strategies that include:

-

Momentum rotation

-

Dip buying

-

Breakout momentum

-

Pattern-based swing trades

-

Short-selling

-

Options strategy robots

Each robot displays:

-

Detailed backtests

-

CAGR

-

Win rate

-

Drawdown

-

Number of trades

-

Annual performance

-

Risk level

If you want plug-and-play algorithmic trading without coding, this is one of the best retail options.

5. AI Screener (More Advanced Than Finviz)

Tickeron allows filtering based on:

-

AI bullish signals

-

Bearish signals

-

High-probability patterns

-

Probability thresholds

-

Trend predictions

-

Options AI signals

-

Volume vs historical level

-

Breakouts with high predicted accuracy

Finviz provides descriptive + fundamental filters.

Tickeron adds AI predictive filters, which is a massive upgrade.

6. Portfolio AI (For Investors & Wealth Managers)

Tickeron’s portfolio tools include:

-

Risk scoring

-

Stress testing

-

Crash simulations

-

Correlation heatmaps

-

Drawdown models

-

Risk-adjusted optimization

-

Smart rebalancing suggestions

For long-term investors, this feature alone justifies the subscription.

Tickeron Pricing – Full Breakdown

Tickeron is a premium tool. Prices vary by module:

| Plan | Ideal For | Price Range |

|---|---|---|

| Pattern Recognition | Swing traders | $50–$100/mo |

| AI Trend Forecasting | Momentum traders | $40–$80/mo |

| AI Robots | Algo-style traders | $90–$250/mo |

| Premium/Bundle | Serious traders | $199–$500/mo |

Tickeron is not cheap — but the depth of AI modelling makes it worth it for active traders.

Tickeron vs Competitors (Clear & Honest Comparison)

Tickeron vs Finviz

| Feature | Tickeron | Finviz |

|---|---|---|

| AI | ✔ Advanced | ✘ None |

| Screening | AI + technical | Basic filters |

| Pattern detection | Best | Moderate |

| Portfolio tools | Excellent | Limited |

| Price | High | Affordable |

| Best For | Traders | Beginners |

Tickeron vs TradingView

| Feature | Tickeron | TradingView |

|---|---|---|

| AI signals | ✔ | ✘ |

| Charting | Good | Best |

| Alerts | Good | Excellent |

| Patterns | Automated | Manual |

| Community | Small | Huge |

| Best For | Systematic traders | Chartists & retail traders |

Tickeron vs TrendSpider

| Feature | Tickeron | TrendSpider |

|---|---|---|

| AI | Strong | Weak |

| Automation | High | Very high |

| Pattern accuracy | Higher | High |

| Backtests | AI-driven | TA-driven |

| Best For | Pattern traders | Technical analysts |

Who Should Use Tickeron?

✔ Perfect For:

-

Swing traders

-

Day traders

-

AI-assisted trading

-

Pattern traders

-

Momentum & breakout traders

-

Quant-style retail traders

-

Investors with multi-asset portfolios

❌ Not Ideal For:

-

Absolute beginners

-

Small accounts (<$2,000)

-

People who dislike probabilities

-

Casual long-term investors

Pros & Cons

Pros

-

Best AI trading engine for retail users

-

Real, transparent probability scoring

-

Deep backtests on every signal

-

Accurate pattern recognition

-

AI Robots = plug-and-play quant strategies

-

Works on stocks, ETFs, crypto, and forex

-

high risk and portfolio tools

Cons

-

Expensive

-

Learning curve

-

No mobile app

-

Could overwhelm beginners

Final Verdict — Is Tickeron Worth It in 2025?

Yes — if you are an active trader who values AI-powered trade ideas, Tickeron is one of the best tools you can buy.

It’s far more advanced than typical trading screeners.

Its edge lies in:

-

AI probability modelling

-

Pattern recognition with statistical scores

-

Backtested robots

-

Predictive trend analysis

But if you are a long-term, low-frequency investor, Tickeron may feel expensive and unnecessary.

FAQ

Q1: Is Tickeron really based on AI?

Yes. Tickeron uses neural networks, machine learning models, and large datasets to generate pattern recognition and prediction signals.

Q2: Are Tickeron signals accurate?

Each signal includes a historical accuracy percentage. Many patterns show 60–80% historical success, but markets are unpredictable.

Q3: Does Tickeron work for beginners?

It’s powerful, but beginners may find it overwhelming. It’s best for intermediate to advanced traders.

Q4: What markets does Tickeron cover?

Stocks, ETFs, crypto, forex, and options.

Q5: Is Tickeron worth the price?

For active traders or systematic traders, yes. For passive investors, no.