Introduction

Over the past few years, fractional ownership in real estate has gone from a niche concept to a legitimate investment category. Instead of buying an entire property, investors can collectively own a part (fraction) and earn returns from rental cash flows plus eventual capital appreciation.

AltDRX is a leading fractional real estate platform that has enabled many such fractional opportunities. We had invested in few opportunities and also exited some with profits upwards of 20% IRR! Detailed review – 1 Year AltDRX experience.

Read this article to understand how AltDRX works.

In 2024, AltDRX (a fractional real estate platform) listed a hospitality real estate asset portfolio in Kerala called, the Kerala and the first set of assets were bought asset in Munnar — Aveda Mountains & Mist, consisting of four premium private pool villas. I participated in the opportunity.

This Munnar investment is part of their larger Fractional Holiday Home Investment Portfolio in Kerala!

A few months later, I got the opportunity to visit the resort and stay there as an investor-guest.

This article documents:

-

My research & rationale for investing

-

Real estate appreciation and tourism numbers for Munnar

-

Insights from independent valuation + legal due diligence

-

The experience of staying on-site

-

Risks and who this type of investment is suitable for

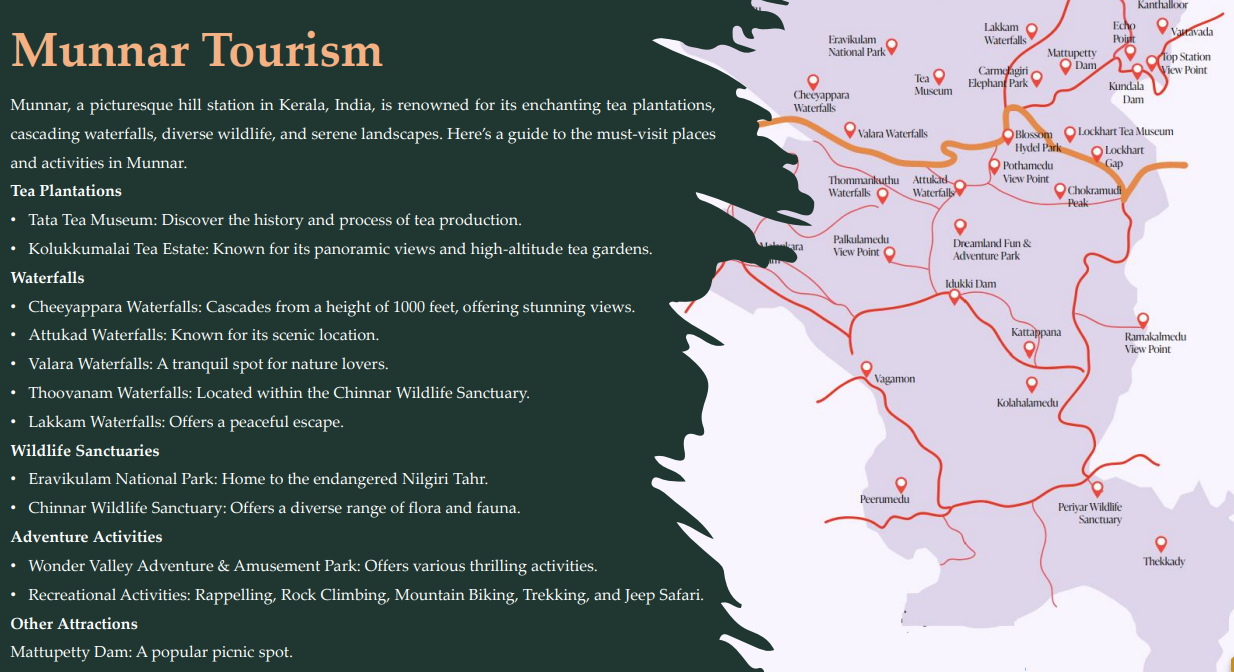

1. Why Kerala and Munnar? Market Data & Real Estate Appreciation

Kerala has emerged as one of India’s most resilient and investment-friendly real estate markets due to its unique blend of tourism, NRI-driven demand, and infrastructure development.

Key growth drivers include:

Consistent NRI Investments: Nearly 40% of Kerala’s real estate inflows come from NRIs in the Gulf and Europe, providing steady capital even when domestic markets slow down.

Tourism-Backed Micro Markets: Kerala attracts 1.88 crore domestic and international tourists annually (2023), creating strong rental demand for resorts, homestays, and second homes.

Policy Push & Infrastructure Upgrades: Projects like the SilverLine semi high-speed rail, Vizhinjam International Seaport, and NH-66 coastal corridor are improving connectivity and boosting regional property values.

Steady Price Growth: Even without speculative spikes, Kerala’s property markets show 5–8% annual price appreciation, supported by tourism, NRIs, and limited land availability due to environmental regulation.

Kerala’s combination of stable appreciation, sustainable tourism, and eco-sensitive zoning makes it a low-volatility, long-term real estate play — ideal for resort, villa, and fractional investment models.

Munnar is one of the most sought-after tourism and second-home micro-markets in Southern India. Unlike typical hill stations, Munnar has:

-

Vast tea plantations

-

Limited buildable land (ecological / slope restrictions)

-

High year-round tourism (not only peak season)

-

Strong drive-to demand from Kochi, Bangalore, and Coimbatore

1.1 Tourism Growth

Kerala Tourism & Knight Frank market study indicates:

| Year | Tourist Footfalls (Eco-tourism centres – Munnar region) |

|---|---|

| 2021 | 17.61 lakh visitors |

| 2022 | 36.35 lakh visitors |

| Growth | +106% YoY |

Government initiatives also play a role:

-

New NH stretch connecting Munnar–Bodimettu (improved road access)

-

Bridge upgrades are increasing vehicle flow

-

Proposal of a tourism township project (investment discussion with the UAE govt)

1.2 Real Estate Appreciation (Munnar)

To understand whether resort/villa assets appreciate, I pulled price trend data from Housing.com, 99acres, Kerala real estate portals, and local broker surveys.

Average property listing price in Munnar (2024–25): ₹5,303 / sq ft

YoY appreciation (2023 → 2024): ~5.68%

However, boutique resorts/holiday villas appreciate at a different trajectory than residential plots.

1.3 Historical appreciation estimate (Munnar)

| Year | Avg listing price (\₹ per sq ft)** | Yearly change | Remarks |

|---|---|---|---|

| 2016 | ~₹2,200 – 2,600 | — | Raw land + local demand only |

| 2018 | ~₹3,000 – 3,500 | ↑ 12–15% CAGR | Tourism-based inquiries increasing |

| 2020 | ~₹4,000 – 4,400 | ↑ COVID travel boom | Rise of short stay/homestays |

| 2023 | ~₹4,900 – 5,200 | ↑ 5–7% | Infrastructure upgrades |

| 2024–2025 | ₹5,300+ | ↑ 5.68% YoY | Stable, tourism-supported |

For premium hospitality/holiday villas, brokers quoted 12–15% annual appreciation (especially for view-facing, privately managed properties).

Summary:

✅ Land/residential: 5–7% annual appreciation

✅ Hospitality/premium villas: 12–15% when well-operated and branded

This aligns with how resort real estate behaves globally — brand + occupancy drives value.

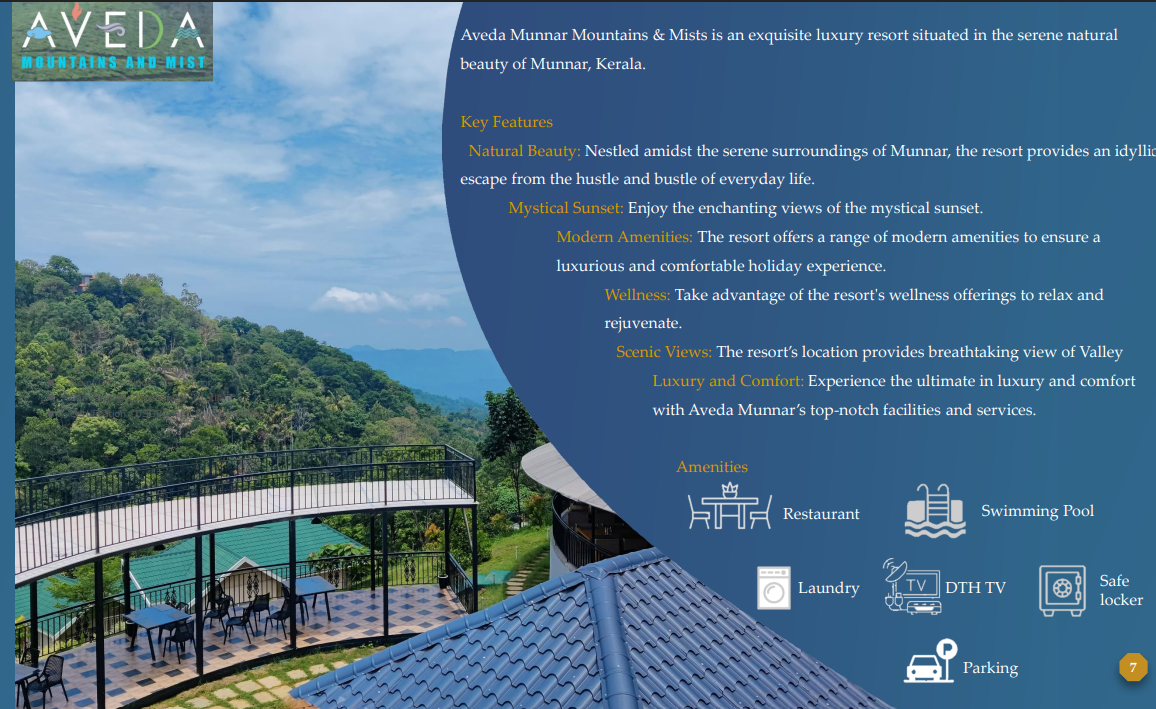

2. Understanding the Asset: Aveda Mountains & Mist (Resort)

The fractional investment was offered in:

➡️ 4 premium pool villas (each ~935 sq ft)

➡️ Category: Boutique luxury

➡️ Amenities: Pool, restaurant, wellness, valley views

When you hear private pool villa, visualize this:

-

Wood-finish interiors

-

Edge-facing balconies

-

Pool overlooking the hills

Not a generic hotel. A boutique, experiential stay.

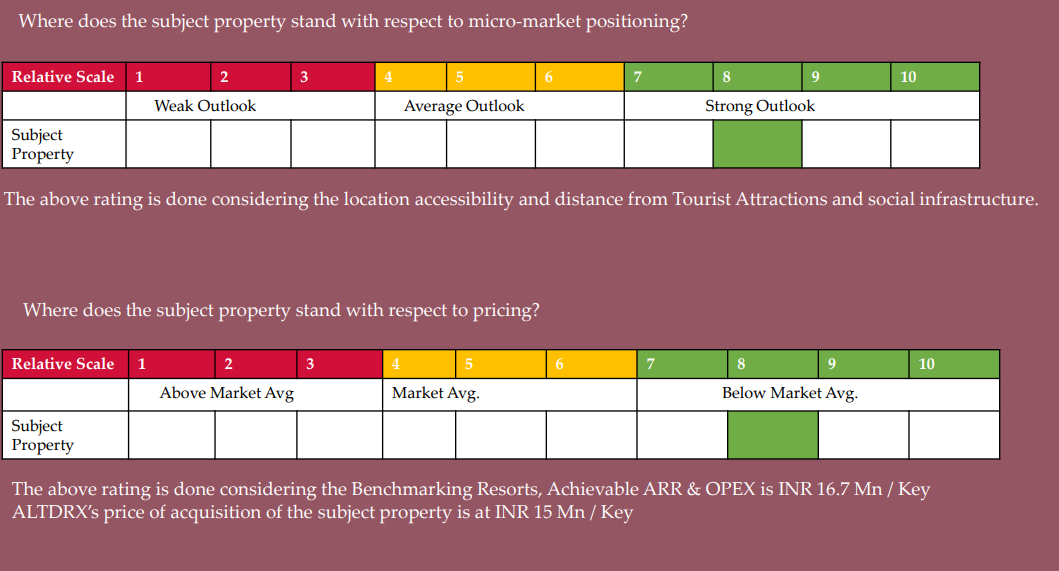

3. Due Diligence (Independent + Platform Level)

AltDRX due diligence was based on the Valuation and Legal Report:

✅ Valuation Report — Knight Frank (Global Real Estate Firm)

Key outcomes:

-

Market valuation using the DCF (discounted cash flow) model

-

Market price ~₹1.5–2 crore per villa

(industry terms: ₹15–20M per key)

In hotel investing, 1 key = one room/villa

So price per key = cost per room/villa

✅ Legal Title Report — King Stubb & Kasiva (Top-tier law firm)

Reviewed 60+ documents, including:

-

Sale deeds over 40 years

-

Encumbrance certificates

-

Panchayat licenses for running a resort

-

Pollution Control Board certification

-

FSSAI food service license

-

Property tax & possession certificates

Outcome:

“Clear and marketable title in the name of current owner.”

This gave comfort that the underlying land and building ownership is traceable, legally compliant, and transferable.

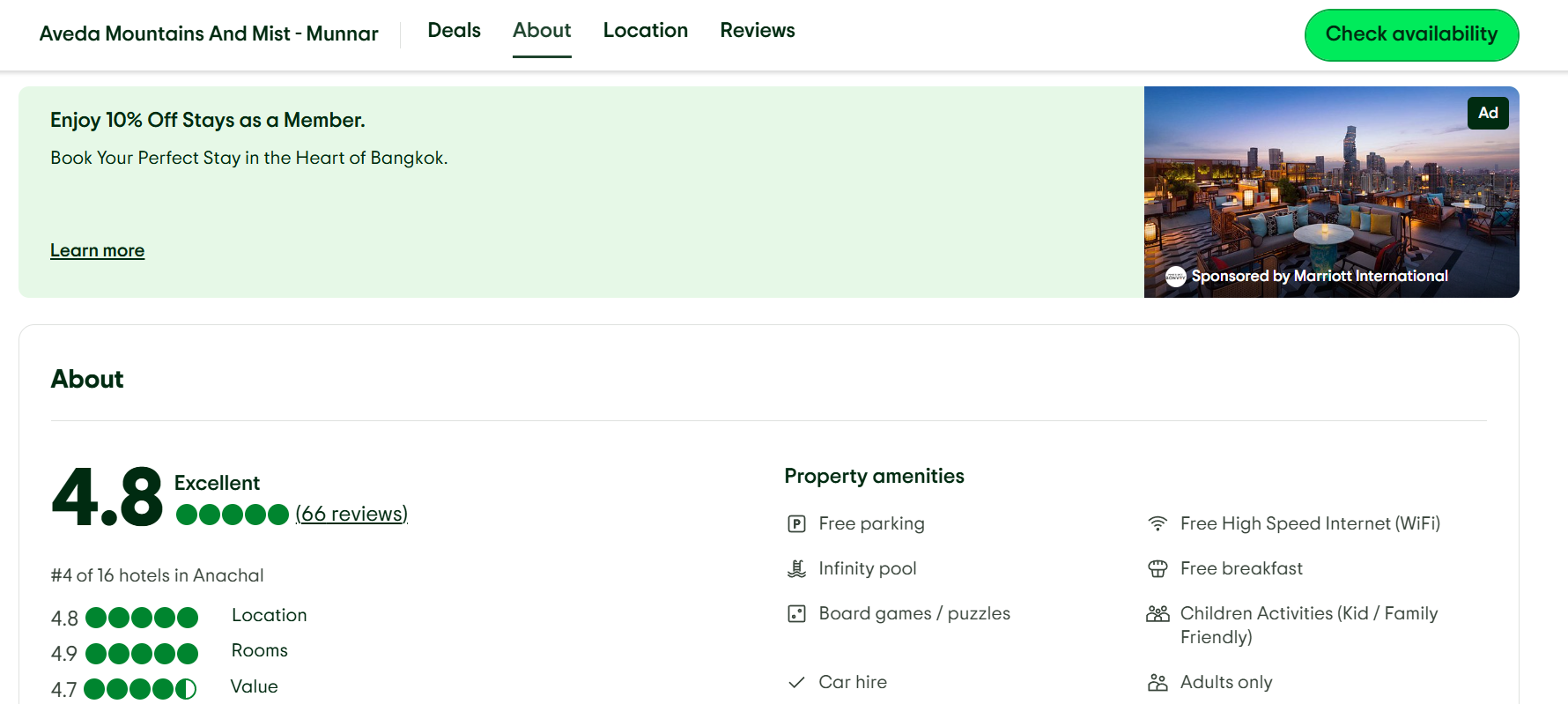

✅ Online Review

Aveda Mountain and Mist consistently receives excellent reviews across platforms, making it one of the most sought-after stays for travelers visiting Munnar.

Aveda Resort & Spa Munnar – Review Highlights

⭐ 4.4–4.6/5 average rating across major platforms

Stunning lake-facing infinity pool, large rooms, excellent hospitality, and personalised service

(full text ready to insert)

4. Investment Rationale

Here were my objective reasons — minus any emotional excitement.

✅ Reason 1: Exposure to hospitality cashflows

Traditional real estate gives either:

-

Rental income, or

-

Appreciation

But resorts + hospitality assets give:

Cash flow + Appreciation potential

Revenue drivers:

-

ARR (Average Room Rate)

-

Occupancy

-

Branding + guest experience = pricing power

Nearby premium resorts charge:

| Resort Name | Typical Nightly Rate (₹) |

|---|---|

| Haze & Kites | ₹10,000 – ₹16,000 |

| Sprise Spa Resort | ₹12,000 – ₹22,000 |

| The Leaf | ₹9,000 – ₹28,000 |

| Aveda (subject property) | Premium positioning (private pool villas) |

✅ Reason 2: Fractional reduces ticket size

Instead of buying a ₹6–8 crore resort myself, I could deploy much smaller capital.

✅ Reason 3: Emotional ROI

A hospitality asset gives something stocks never will:

“I can stay in what I own.”

5. My Stay Experience (The Human Part)

Location

The resort is in a quiet part of Munnar, with zero commercialization around the property.

The last stretch of road is narrow, but the view is worth the moment of discomfort.

️ Villa Experience

-

Wooden interiors

-

Temperature-controlled plunge pool

-

Balcony that opens to the valley

I woke up to the sound of wind and silence — rare in today’s world.

️ Food

-

Kerala-style seafood

-

Freshly made appams

-

Breakfast with mist rolling in

Not “Michelin-starred”, but clean, flavorful, and fresh.

Places to Visit Around the Resort (Close Proximity from Aveda Mountains & Mist)

One of the underrated strengths of the Aveda property is that it sits in a pocket of Munnar that is quiet yet close to key sightseeing points. You’re not stuck in a remote forest where everything requires a long drive, nor are you in the congested “town center chaos.”

Here are easy-to-reach attractions within 10 mins – 45 mins:

Within 10–20 minutes

| Attraction | Distance from resort | Why visit |

|---|---|---|

| Chenkulam Dam (Viewpoint) | ~6 km / 12 mins | Quiet viewpoint with boating options, less touristy. |

| Anachal Town | ~7 km / 15 mins | Nearest convenience hub (ATMs, medicals, bakeries, tea shops). |

| Wonder Valley Adventure Park | ~8 km / 18 mins | Ziplining, ATV rides — good for families/couples. |

| Dreamland Adventure Park | ~9 km / 20 mins | One of the most popular activity parks in Munnar. |

➡️ These are ideal for half-day plans without exhausting travel.

⛰️ Within 30–45 minutes

| Attraction | Distance from resort | Highlight |

|---|---|---|

| Tea Museum (Tata) | ~16 km / 35 mins | History of tea in India + tasting sessions. |

| Attukad Waterfalls | ~17 km / 35 mins | Narrow bridge + mist views — great photos. |

| Eravikulam National Park | ~21 km / 45 mins | Home to the endangered Nilgiri Tahr. Pre-booking recommended. |

| Mattupetty Dam | ~23 km / 45 mins | Scenic boating + sunset shots. |

| Photo Point (Tea Gardens) | ~20 km / 40 mins | Probably the most Instagrammed location in Munnar. |

➡️ These are the “classic Munnar postcard” places.

☕ “Experiential” / Slow Travel Spots

| Experience | What to do |

|---|---|

| Kolukkumalai Tea Estate (Sunrise Jeep trail) | World’s highest tea estate; sunrise here is surreal. Requires an early morning jeep ride. |

| Local spice gardens & plantations | Cardamom + pepper gardens + live demos. |

| Kerala Ayurvedic spa | Many boutique spas offer 60–90-minute deep tissue or potli massages. |

If your goal is serenity + slow travel, this zone of Munnar is ideal.

️6. Risks (Because every investment has them)

| Risk | Reality / Mitigation |

|---|---|

| Not liquid like stocks | You hold until asset exit or secondary resale |

| Seasonality (off-peak months) | ARR is higher in peak months and balances |

| Operator risk | Aveda runs multiple properties (not a first-time operator) |

| Real estate cycles | Tourism-led assets are less correlated to office/residential cycles |

Fractional real estate isn’t for:

❌ People who want monthly liquidity

❌ People who chase quick returns

7. Who Should Consider Fractional Resort Investing

✅ Frequent travelers

✅ Investors seeking diversification

✅ Those wanting exposure to real assets

✅ People who value usage benefit (stays)

Not ideal for:

❌ Short-term traders

❌ Investors needing immediate exit certainty

Final Conclusion

For me, investing in Aveda Munnar wasn’t about squeezing maximum IRR from an Excel sheet.

It was about:

-

Diversifying into real assets

-

Participating in the tourism-hospitality economy

-

Having a place I can physically visit, experience, and emotionally connect to

To get Cashback in your next AltDRX investment, use the link below

Hello Sir,

What is your view on the India investment opportunity on Altdrx.

Regards

Dhanpal

If someone wants to diversify through one investment then its a good bet. Returns would be average of returns

Query : Do they offer discounted stay for the people who invest in these? (Referring to Reason 3 and point 7, Frequent traveler )

Hi,

They provide free stay upto 3 days for investors in the resort,