In a world where most investors stick to domestic equities, BayFort Capital is quietly proving that true diversification—and alpha—comes from thinking global. Founded in 2021 by Ketul Sakhpara, CFA, BayFort Capital has quickly carved a niche as one of the few Indian firms offering globally managed portfolios that rival the sophistication of Wall Street strategies.

A Proven Mind Behind the Strategy

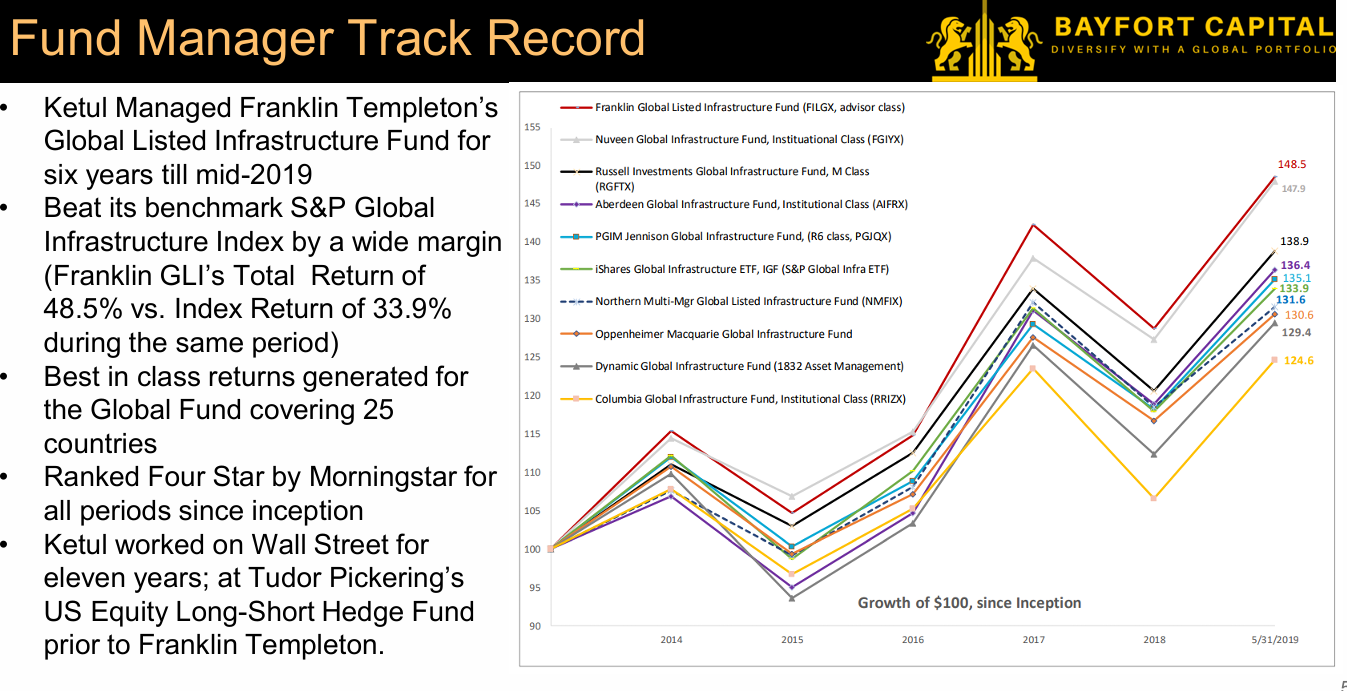

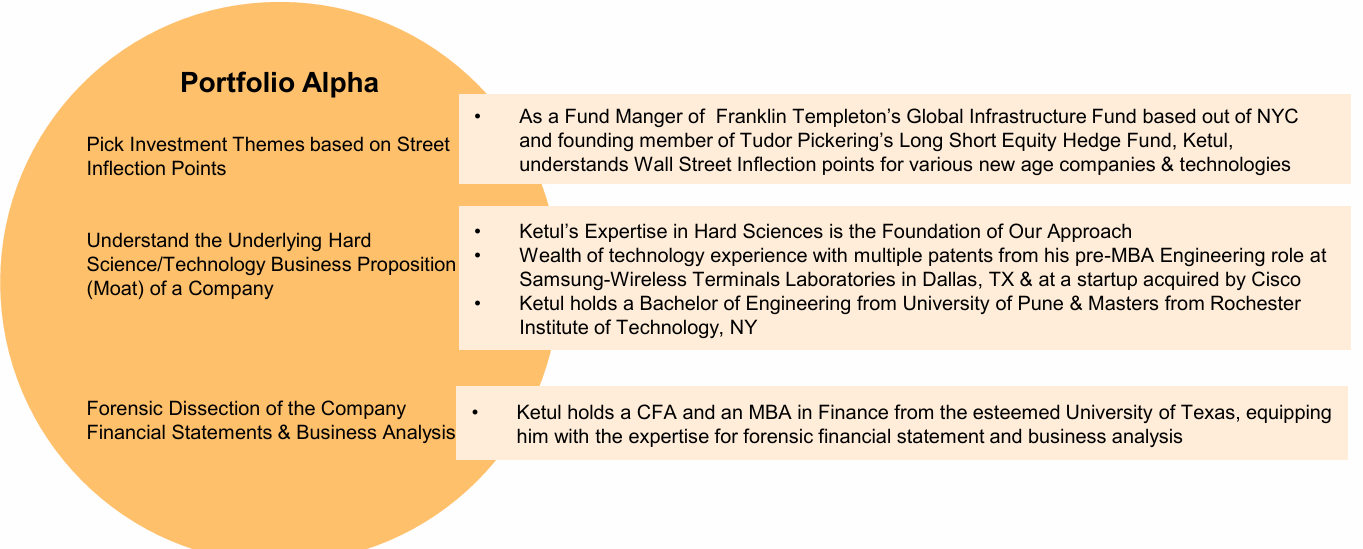

At the heart of BayFort Capital’s success lies its founder, Ketul Sakhpara, whose global experience spans over two decades across the U.S., Europe, Asia, and Australia. Before setting up BayFort, he served as Head of Equity Research at Mahindra Manulife Mutual Fund and was previously a Fund Manager at Franklin Templeton’s Global Infrastructure Fund in New York.

During his tenure at Franklin Templeton, Ketul managed a fund that delivered 48.5% total return versus the 33.9% benchmark return—earning a four-star Morningstar rating since inception. Earlier, as part of Tudor Pickering’s Long-Short Equity Hedge Fund, his strategies consistently outperformed the Credit Suisse Hedge Fund Index.

In short, he brings the rare combination of deep fundamental research, global sector expertise, and forensic financial analysis—traits that now form the foundation of BayFort’s investment process.

The BayFort Global Leaders Portfolio: Consistent Outperformance

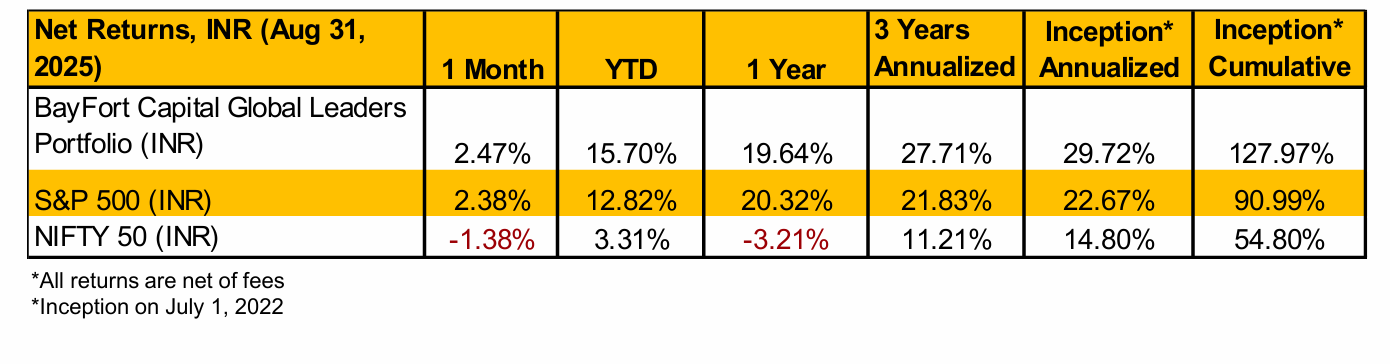

Launched in July 2022, the BayFort Capital Global Leaders Portfolio invests in large-cap U.S.-listed companies with a focus on innovation, high return on equity, and scalability. The performance speaks for itself:

| Period (as of Aug 31, 2025) | BayFort Capital Global Leaders (INR) | S&P 500 (INR) | NIFTY 50 (INR) |

|---|---|---|---|

| 1 Month | 2.47% | 2.38% | -1.38% |

| YTD | 15.7% | 12.82% | 3.31% |

| 1 Year | 19.64% | 20.32% | -3.21% |

| Since Inception (Annualized) | 29.72% | 22.67% | 14.8% |

| Since Inception (Cumulative) | 127.97% | 90.99% | 54.8% |

Even after accounting for fees, BayFort’s returns have consistently beaten both the S&P 500 and Indian benchmarks, demonstrating that selective exposure to U.S. large-cap innovators can dramatically improve portfolio outcomes.

The portfolio’s beta of 1.14 and Sharpe ratio of 1.26 (vs. the S&P 500’s 1.18) also reflect a solid risk-adjusted performance. During the COVID crash, the strategy declined -12.9% vs. -19.4% for the S&P 500—evidence of strong downside protection.

Why Global Investing Matters Now

BayFort Capital’s philosophy is simple: “Protect your portfolio and boost returns with global diversification—no insurance needed.”

In India, investors are often overexposed to local equities that rise and fall with domestic cycles. However, as BayFort highlights, even rapidly growing economies like China have delivered weak long-term stock returns. Between 2000 and 2021, China’s GDP rose from $1.1 trillion to $17.7 trillion, yet the Hang Seng Index grew just 1.05% CAGR.

This shows why GDP growth doesn’t always translate into equity returns—and why spreading exposure globally can reduce “single-country risk.”

BayFort’s approach allows Indian HNIs and NRIs to access U.S. and global leaders—companies driving the future of AI, healthcare, cloud computing, and renewable energy—through a single, actively managed portfolio.

The “RIGHT Analysis” Investment Process

What truly sets BayFort apart is its proprietary investment process called “RIGHT Analysis”, a disciplined framework for stock selection refined over decades of global investing.

Each stock in the portfolio is evaluated through five lenses:

-

R – Right to Win: Does the company have a defensible moat—such as a network effect, intellectual property, or switching costs—that gives it an edge?

-

I – Innovation: Is it pioneering technological, operational, or cost innovation that can reshape industries?

-

G – Growth: Is there at least 15%+ CAGR potential in revenues and earnings?

-

H – High TAM (Total Addressable Market): Can the company expand into adjacent markets or new geographies?

-

T – Total Return (Valuation): Are we paying a fair price for the growth and quality offered?

For example, BayFort’s investment in Airbnb fits the RIGHT framework perfectly. Airbnb combines a strong network moat, a tech-driven innovation model, consistent revenue growth even post-pandemic, and a large global market. As operating leverage improves, it is set to become a cash-flow powerhouse.

Themes Driving the Portfolio

The BayFort Global Leaders Portfolio typically holds 15–20 high-conviction stocks, each representing the top innovators within their sectors. The fund focuses on 8–10 sub-sectors within AI, Healthcare, Cloud Infrastructure, Biotech, Renewables, and Consumer Technology.

Here’s a look at some of the current themes:

1. Artificial Intelligence (AI) – The Great Wealth Transfer

BayFort believes AI represents the largest transfer of wealth from labor to software in history. By investing across the AI ecosystem—from hardware and data infrastructure to software platforms—the portfolio aims to capture value across the stack.

The firm expects the AI software market to grow 15–18% annually over the next few years, with productivity tools like ChatGPT enhancing profitability across industries by up to 30%.

2. Healthcare Ecosystem – Innovation Beyond Borders

The healthcare theme spans medical devices, diagnostics, cell therapy, and biotech. Companies like Novo Nordisk, with its leadership in diabetes and obesity care, exemplify this focus.

BayFort sees massive tailwinds as aging populations, AI-driven drug discovery, and precision medicine transform the healthcare landscape globally.

3. Cloud & Digital Transformation

With companies like Microsoft and Intuit in the portfolio, BayFort taps into the secular trend of cloud migration and enterprise automation. These businesses exhibit strong pricing power, sticky customer bases, and expanding margins—core ingredients of compounding growth.

Portfolio Metrics and Top Holdings

As of December 31, 2024, the BayFort portfolio had:

-

21 stocks

-

Weighted average ROE: 50%

-

EPS CAGR (2024–26): 22%

-

Forward P/E (2025): 36.8x

Some notable holdings include:

| Company | Gross Margin | EBITDA Margin | ROE | EPS CAGR (2024–26) |

|---|---|---|---|---|

| Microsoft | 69% | 54% | 36% | 15% |

| Intuit | 80% | 27% | 17% | 18% |

| KLA Corp | 60% | 41% | 91% | 16% |

| Novo Nordisk | 85% | 49% | 89% | 25% |

| Sea Limited | 42% | 4.8% | 1.4% | 98% |

The portfolio’s balance between high-quality compounders (Microsoft, Novo Nordisk) and emerging leaders (Sea Limited) offers both stability and growth optionality.

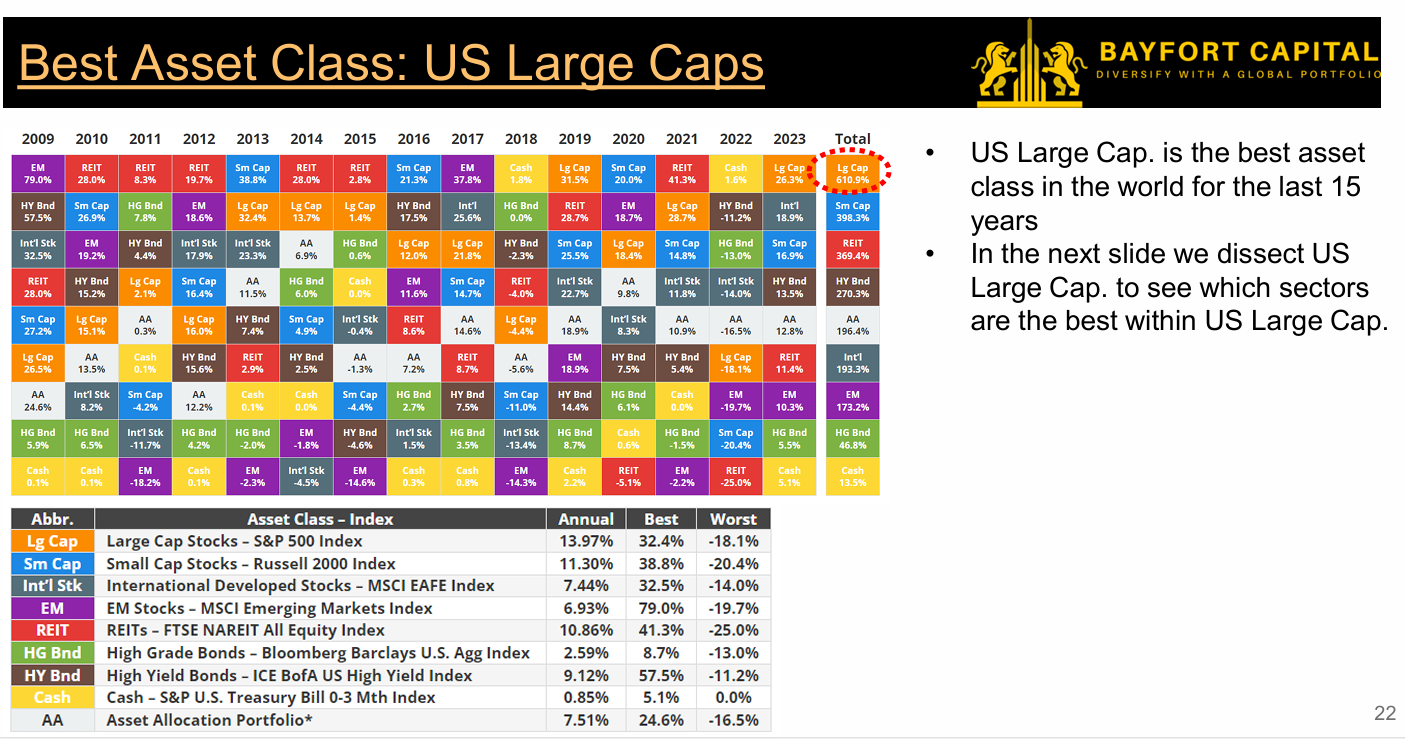

Why U.S. Large Caps Remain the Best Asset Class

Over the past 15 years, U.S. large-cap equities have outperformed nearly every major asset class. BayFort attributes this dominance to three main factors:

-

Global Revenue Exposure: S&P 500 companies earn a significant portion of revenues internationally, making them beneficiaries of global growth—not just U.S. GDP.

-

R&D Intensity: Sectors like tech, healthcare, and consumer discretionary—with R&D spend exceeding 10% of sales—have delivered the best returns.

-

Corporate Governance and Innovation: The U.S. continues to attract capital due to strong institutions and shareholder-friendly policies.

Advisory Structure and Taxation

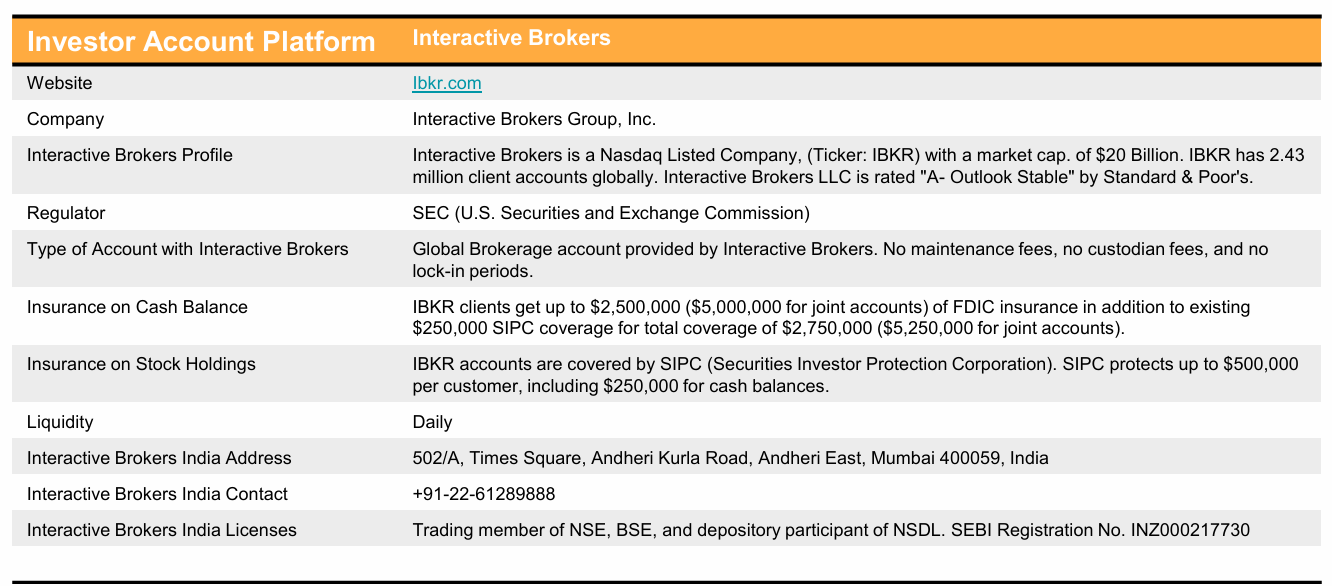

The BayFort Capital Global Leaders Portfolio is structured as a PMS/Separately Managed Account (SMA), allowing investors direct ownership of underlying global stocks through Interactive Brokers (IBKR)—a Nasdaq-listed firm with A- rating by S&P and $20 billion market cap.

Key Investor Terms

-

Minimum Investment: ₹10 lakh (for Indian residents) or USD 25,000 (for others)

-

Benchmark: S&P 500

-

Fees: 2.5% (all-inclusive)

-

Lock-in / Exit Load: None

-

Stock Cap: <20% per holding

-

Depository: U.S. DTC (part of the Federal Reserve system)

Taxation

-

LTCG on International Equities: 12.5% (holding >24 months)

-

STCG: As per the slab

-

TCS on Foreign Remittance: 20% beyond ₹10 lakh (adjustable against tax payable, not a cost)

BayFort’s Market Outlook: Fiscal Tailwinds Ahead

BayFort’s macro view on the U.S. economy leans optimistic. With fiscal stimulus (“One Big Beautiful Tax Bill”) and rate cuts expected, they foresee strong earnings growth in 2025–26. While the bears highlight slowing job creation and weak housing starts, BayFort believes the combined force of fiscal and monetary easing is an “almost unbeatable formula” for equity performance.

A Balanced Approach: Forensic Rigor Meets Global Vision

Perhaps what truly differentiates BayFort is its forensic accounting lens. Before buying any company, the team scrutinizes adjusted EPS quality, revenue recognition practices, leverage ratios, inventory build-up, and cash flow yield—a process honed from Ketul’s engineering and Wall Street background.

This forensic framework, combined with an understanding of inflection points in industries, helps identify companies about to experience a step-change in earnings or valuation.

Final Verdict: For Investors Ready to Think Global

BayFort Capital represents a new breed of global investment managers emerging from India—combining deep research, transparency, and performance.

For investors seeking:

-

Exposure to U.S. and global innovators

-

Superior risk-adjusted returns

-

A disciplined, data-driven approach

…the BayFort Capital Global Leaders Portfolio is a compelling proposition.

Its consistent outperformance since inception, low drawdowns, and access to companies shaping the world’s future make it an ideal “core global equity” holding for HNIs and NRIs alike.

How to Open an Account with BayFort Capital via Interactive Brokers

BayFort partners with Interactive Brokers (IBKR)—one of the world’s largest and most trusted brokerage firms—to provide direct stock ownership to its clients.

About IBKR:

-

Listed on NASDAQ (Ticker: IBKR) with a $20 billion market cap

-

2.4 million client accounts worldwide

-

Rated A- (Stable) by Standard & Poor’s

-

Regulated by the U.S. SEC

-

Provides $500,000 SIPC insurance and FDIC coverage up to $2.5 million on cash balances

Step-by-Step Account Opening Process

Once you contact BayFort, they’ll share a secure IBKR link to start your application.

Here’s how it works:

-

Click the link provided here (do not go directly to IBKR’s homepage).

-

Create a username and a strong password.

-

Select Account Type: Choose “Joint” if you want a co-holder (requires both holders’ PAN and Aadhaar). Recommended to open a joint account as it makes transfer of shares easy in case of any transfer required!

-

Fill in the contact details exactly as per the Aadhaar address.

-

Enter personal details and employment information.

-

Select base currency: USD.

-

Verify mobile number via OTP.

-

Enter financial profile (approximate annual income is fine).

-

Answer regulatory and tax-residency questions.

-

Set up your digital signature.

-

Upload PAN and Aadhaar cards (for both holders in case of a joint account).

-

Submit your application and wait for verification (usually within 24 hours).

-

Once verified, log in and click “Fund My Account” to transfer USD via your bank’s LRS (Liberalized Remittance Scheme) route.

BayFort’s operations team will guide you through every step and ensure the setup is compliant, fast, and error-free.