Key Financial Highlights for July 2025

FPI Outflows Driven by Trade Tensions

Foreign Portfolio Investors pulled out ₹5,524 crore from Indian equities in July, raising total 2025 outflows to ₹83,245 crore. Analysts attribute the exit to heightened U.S.–India trade uncertainty and tepid corporate earnings.

Market Slump: Worst July Since 2019

Indian equities fell significantly, making it the worst month for the Nifty since 2019. This decline was fueled by weak first-quarter earnings, delay in a formal trade deal, and softness in IT stocks.

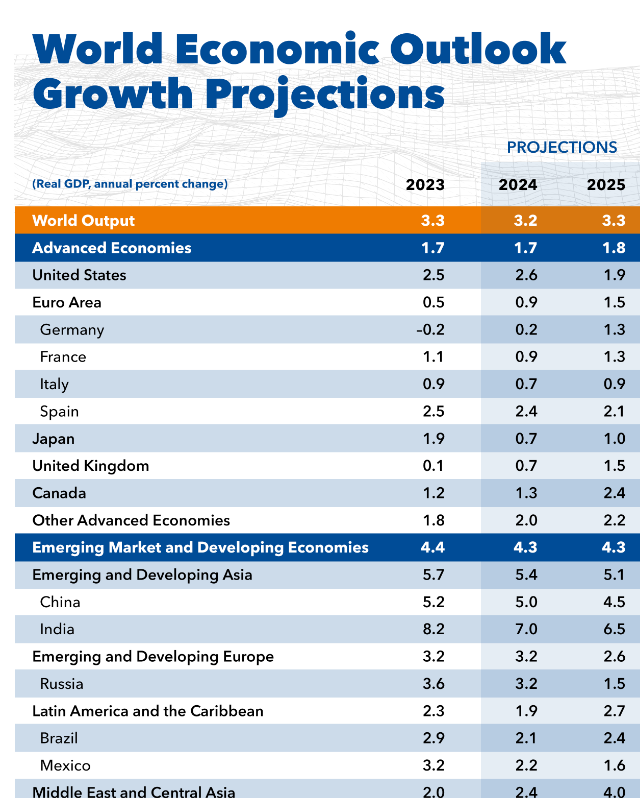

IMF Raises Global Growth Forecast

The IMF bumped up its global GDP forecast: 2025 growth to 3.0% and 2026 to 3.1%, noting resilience in consumer spending and front‑loaded trade ahead of U.S. tariff deadlines. Risks from trade wars and rising fiscal deficits persist. The forecast for India is still one of the highest in the world!

Randomdimes Youtube

Alternative Investments, Defaults, and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | - SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | - Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol | Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment | -Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer - ED froze Gensol acccounts |

| Gripinvest | Bigspoon Loanx UP | Partial Recovery Delay | - 50%% asset recovery pending. One tranche recovered August 2025 - Investigating Delay |

| kredx | Multiple deals BIRA bonds VVPL | Litigation | - Delay in multiple deals such as TCS, Dairy Power, CBRE etc Bira Interest delay VVPL 2 months delay |

| Tradecred | Bizongo Clensta | tradecred files complaint | - INR 69 cr fraud complaint filed on Bizongo |

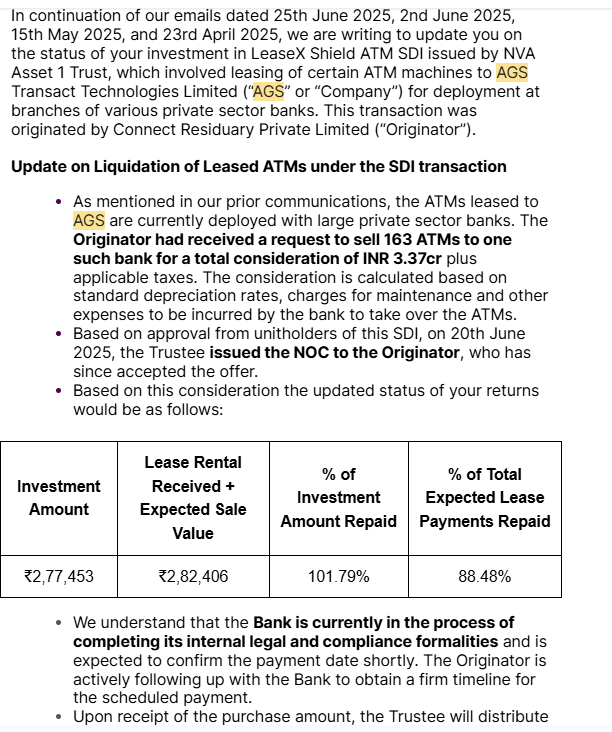

| Bonds | Trucap AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF | Trucap Default AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland - Covenant Breached(NPA, PAT etc) | - Partial Recovery - Grip Monitoring SDI of AGS - Coupon increased by 2% - Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | - Payment expected by March End for few - Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | - Last tranche delayed |

| Afinue | Evage | Partial Repayment | - Legal Proceedings to start |

Currently, below are the key new updates on the various delays across Alternative Investment platforms.

- Kredx Vvpl Delay

- Grip AGS Transact Update

- Growpital Update

Kredx Vvpl Delay

Customer / Buyer: ICICI Bank Limited

Vendor / Seller: VVP Business Logistics Pvt. Ltd., Mumbai, Maharashtra

Originally Expected Maturity Date: 16-May-2025

This deal, facilitated via KredX, has been experiencing delays. While the vendor has made minor part-payments till 10-June-2025, a significant portion of the repayment remains outstanding.

According to communications with the KredX Investor Service Desk, the delay is attributed to “operational reasons” on the vendor’s side. However, no firm timeline has been provided for the pending payment.

Concerns About the Escrow Mechanism

Typically, KredX operates using an Escrow Account mechanism to protect investor interests:

-

The Enterprise (buyer) — in this case, ICICI Bank — is expected to deposit invoice payments into an Escrow Account managed by KredX.

-

This account is designed to act as a neutral intermediary. Neither the buyer nor the vendor should have direct control over it.

-

After funds are received in the Escrow, KredX should disburse them directly to investors.

However, in this particular case, it appears that the funds may have been routed directly to the vendor, bypassing the escrow mechanism. This raises two key concerns:

-

Why was the Escrow protocol not followed for this transaction?

-

If the buyer has already paid, why is the vendor delaying onward payments to investors?

Such deviations undermine the core structure designed to ensure timely and secure repayments.

Takeaway

As of now:

-

A substantial portion of the funds is still pending.

-

KredX has not committed to a clear repayment timeline.

-

The working of the escrow structure in this deal appears unclear or bypassed, which is concerning from a risk management standpoint.

This case highlights the importance of consistent enforcement of platform protocols, particularly in Escrow-based invoice discounting deals, and the need for greater transparency from intermediaries.

Growpital Update

We have the same usual update for Growpital – the hearing got postponed for 12th August again

At this point, it seems that there is no end in sight, and this case is not on the priority list of any regulator or court!

Bonds Risk Status Update

Some recent bond covenant breaches are

- Sammunati

- Spandana Spoorthy

- Moneyboxx

- Trucap

- Finkurve

- Criss Financials – Early Repayment Done

- Dvara KGF

- Lendingkart

- Satin

- Defaults – Trucap

TruCap Finance Bond Default – July 2025

Default & Downgrade Highlights

-

On July 16, 2025, CARE Ratings downgraded ₹150 crore worth of TruCap Finance NCDs (Non-Convertible Debentures) to “D”, indicating a formal default. This was accompanied by a downgrade of its ₹750 crore long‑term debt facilities.

-

The default stems from a liquidity crunch, with ₹72.28 crore in pending NCD payments, translating into severe strain on cash flows.

Impact on Investors

-

Approximately 1,100 retail investors faced a sudden cessation of interest and principal repayments. Many were promised fixed returns of 13–13.5%, based on earlier BBB or BB+ ratings

Alternative Investment Portfolio Updates

In our endeavor to enhance knowledge about Alternative Investment Funds and PMS in India, we covered sessions with experts on various funds. We recently arranged a webinar with the experts as well.

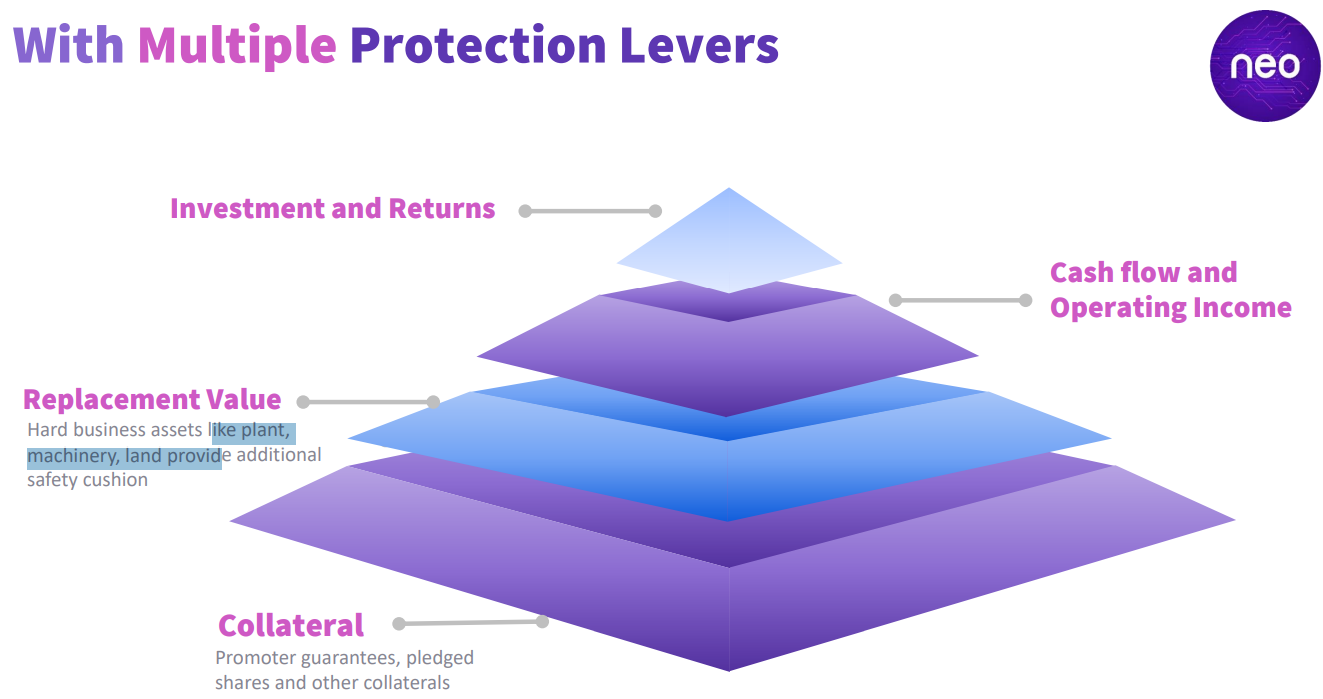

Neo Special Credit Opportunities Fund

The fund is positioned as a high-yield, mid-market private credit vehicle, offering structured, collateral-backed lending to companies in need of tailored capital solutions. With an experienced team, substantial fundraising, and early deployment momentum, it targets attractive risk-adjusted returns (~22–24% gross) over a 5-year horizon. It suits investors seeking yield-rich, private debt exposure, with an emphasis on security and active management, but comes with meaningful illiquidity and execution risks.

Fund Overview

-

Category: SEBI‑registered Category II AIF

-

Maiden fund launched by Neo Asset Management Pvt Ltd.

-

Target fund size: ₹2,000 cr; successfully closed at ₹2,575 cr from HNIs and MFOs over ~15 months

-

Objective: Provide customized credit to mid‑market corporates facing special-situation funding needs, aiming for portfolio diversification and yield enhancement.

Return Profile & Term

-

Target gross IRR: ~22–24% p.a.; cash coupon: ~14–16% p.a. over 5-year tenor

-

Tenure: ~5 years.

-

Fund structures drawdowns and deploys capital via 3–4 scheduled drawdowns over a 12-month deployment phase

Investment Strategy

-

Focus on operating, EBITDA-positive, mid-market companies requiring bespoke credit — e.g., capex, acquisition, working capital, bridge, mezzanine/holdco financing

-

Investments are secured, often with collateral, including inventory, receivables, fixed assets, and personal guarantees.

-

Preference for strong promoters and structured risk mitigation: rigorous due diligence, strong documentation, external oversight, and active asset monitoring.

Fund Activity & Track Record

-

Deployed capital into 12 investments with 2 successful exits within the first 15 months

-

Example deal sizes: ~₹40–70 cr initiations with expected IRRs ranging 14–17%.

Risk & Disclaimer Highlights

-

Fund carries high risk, including the potential for total capital loss.

-

IRR figures are gross, before fees, carry, taxes,a expenses

-

Investments are long-term, illiquid, and target sophisticated investors only.

You can register below to get access to the webinar and details about the product

Telegram channel for *the Latest Alternative Investment News

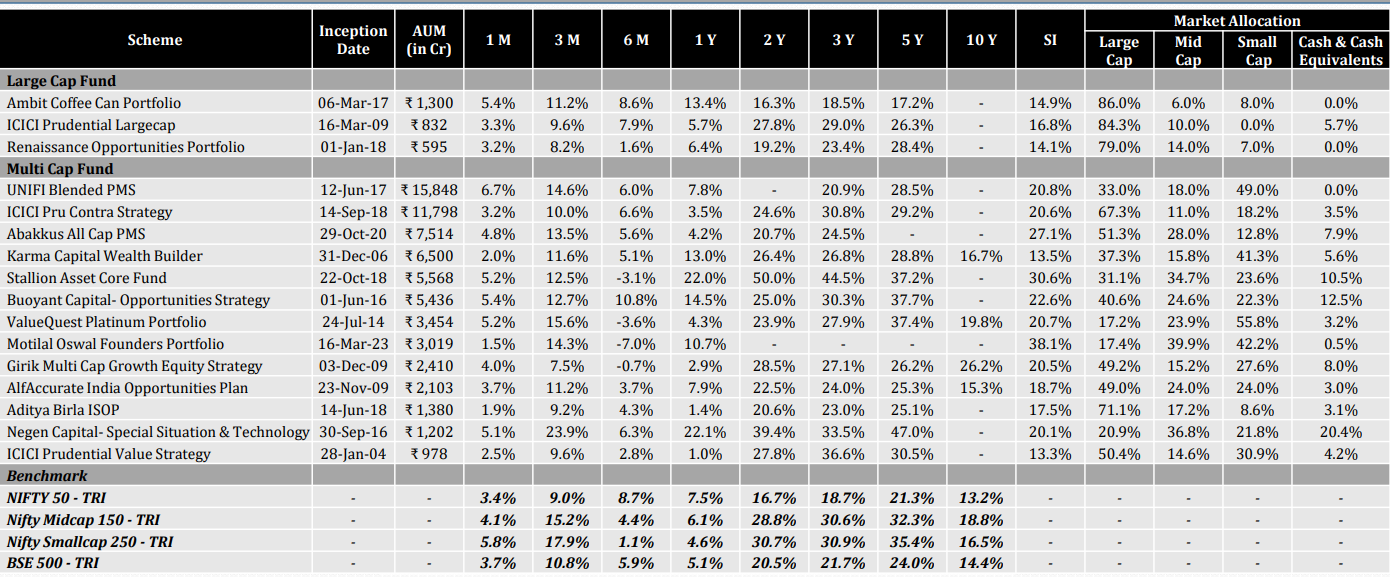

PMS Performance July

Below is the snapshot of top top-performing PMS in India for July. Fill up the form below to download the latest information available on the funds below.

Real Estate Investments

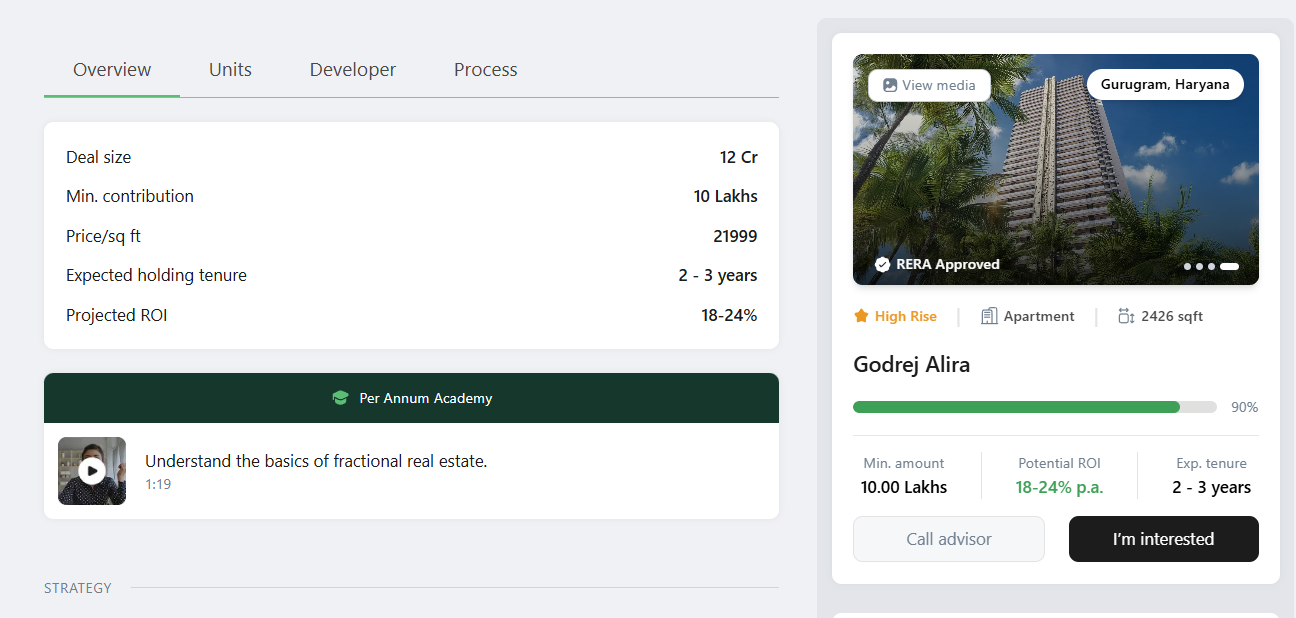

Per Annum Godrej Al Opportuity

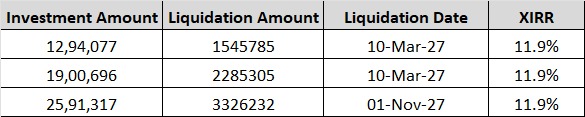

A new Godrej Alira property investment opportunity is available on Per Annum. Minimum requirement is INR 10 Lakh. Property is worth INR 12 cr. Investment is to be paid in 3 tranches.

We did a detailed article on Estates – How does Estate work?

Alt DRX Bulk Opportunity

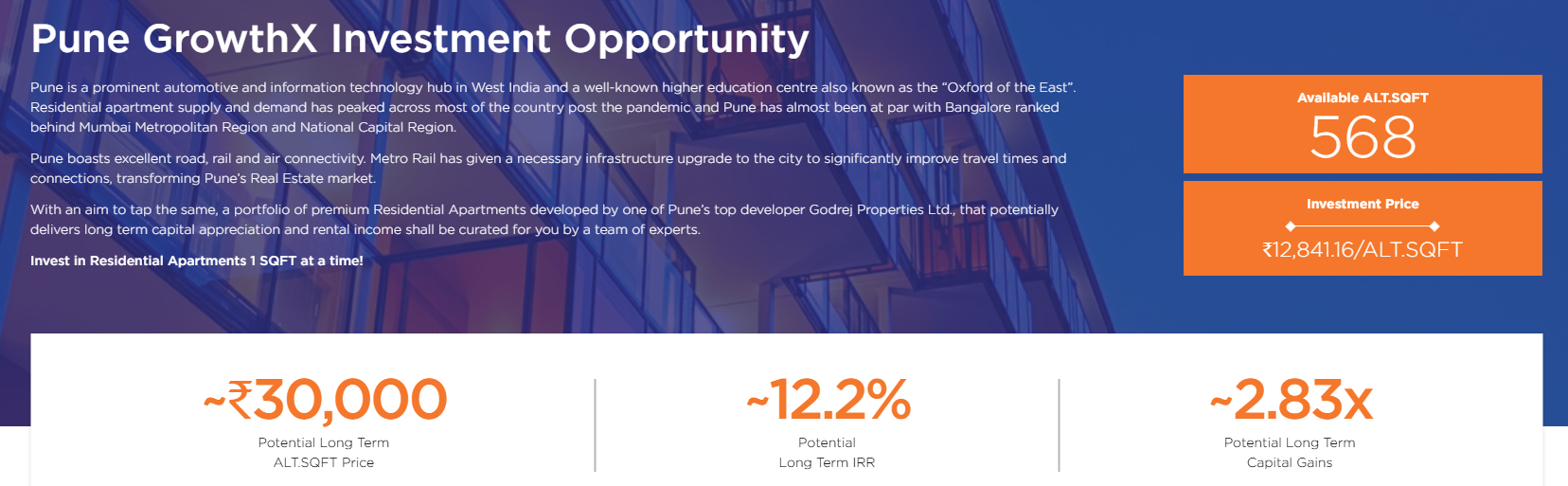

AltDRX reduced the minimum investment INR 2.5 Lakh for bulk Tradex investment is still available for all Randomdimes investors. The platform has land opportunities, Holiday Homes, Residential homes, along with an under-construction gated community.

Altdrx also has the Pune Godrej project, which is an interesting opportunity for investors looking to benefit from the price differential between under-construction and completed projects.

Altdrx Pune OpportunityBond Investment

Below are the top-listed and unlisted bonds currently available in the market. We try to get the best rates from the platforms and funds that sell these bonds. For the listed bonds, you can use the link below to buy. For the unlisted, please add your details in the form, and we will connect you to the seller.

Listed Bonds List

For listed bonds, you can check the bonds from the link below. Best yields in the market!

Aspero Randomdimes Page| Issuance | Rating | Coupon | Yield (XIRR) | Issuance Date | Maturity Date |

| AKARA CAPITAL ADVISORS PRIVATE LIMITED | ICRA BBB | 9.85% papm | 15.00% | 30-Apr-2025 | 30-Oct-2026 |

| Indel Money Limited | CRISIL BBB+ | 11% papm | 13.95% | 11-Apr-2025 | 11-Nov-2026 |

| Indel Money Limited | CRISIL BBB+ Stable | 11.00% papm/11.57% XIRR | 13.95% | 7-Mar-2025 | 7-Oct-2026 |

| Satya Microcapital Limited | ICRA BBB+ | 10.40% papm | 13.00% | 23-Aug-2024 | 23-Feb-2026 |

| Spandana Sphoorty Financial Limited | CARE A+ | 9.84% papm/10.30% XIRR | 12.75% | 12-Sep-2024 | 28-Jun-2026 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 2-Apr-2025 | 2-Apr-2028 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 12-Mar-2025 | 12-Mar-2028 |

| Criss Financial Limited | IND A | 10.50% papm/11.02% XIRR | 12.60% | 30-Aug-2024 | 30-Aug-2026 |

| Satin Finserv | ICRA A– | 10.80% papq/11.25% XIRR | 12.60% | 20-Sep-2024 | 20-Sep-2026 |

| Navi Finserv Limited (“Navi”) | CRISIL A (Stable) | 10.60% papm | 11.70% | 21-Feb-2025 | 21-May-2027 |

Unlisted bonds List

| Issuance | Rating | Coupon | Yield(XIRR) | Issuance Date | Maturity Date |

| True Credits Private Limited | CRISIL BBB | 11.71%papm | 18.00% | 4-Apr-25 | 09-Apr-26 |

| Branch International Financial Services Private Limited | Acuite BBB- | 10% papm | 17.50% | 4-Mar-25 | 9-Mar-26 |

| True Credits Private Limited | CRISIL BBB | 11.71%papm/ 12.36% XIRR | 17.50% | 8-Nov-2024 | 13-Nov-25 |

| Smartpaddle Technology Private Limited (Bizongo) | Unrated | 11.50% papm/12.12% XIRR | 17.50% | 22-Feb-2024 | 22-Feb-2026 |

| Akara Capital | ICRA BBB | 9.85% papm | 16.40% | 30Apr25 | 30Oct26 |

| Hella Chemical | IND A- | 11.80% papm/ 12.46% XIRR | 15.00% | 28-Feb-2025 | 28-Feb-2028 |

| Evernest Infratech Private Limited (“Strata”) | Unrated | 13.50% papm/14.37% XIRR | 15.00% | 5-Sep-2024 | 5-Sep-2026 |

| Si Creva Capital Services Private Limited | CRISIL BBB+ | 10.40% papm/10.91% XIRR | 14.80% | 29-Jul-2024 | 3-Aug-2025 |

Register to get details of unlisted bonds

Short-Term Investments

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.40% |

| Altifi | 12.50% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Tradecred | 11.50% | 0% | 0% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

- Finally got some new policies on Policyexchange with high irr

- Currently invested in 3 Invoice deals on Tapinvest

- Invested in 1 deal on Betterinvest. We share the latest deal details on Telegram.

- 1 SDI on Gripinvest

- Invested in 2 deal on Amplio

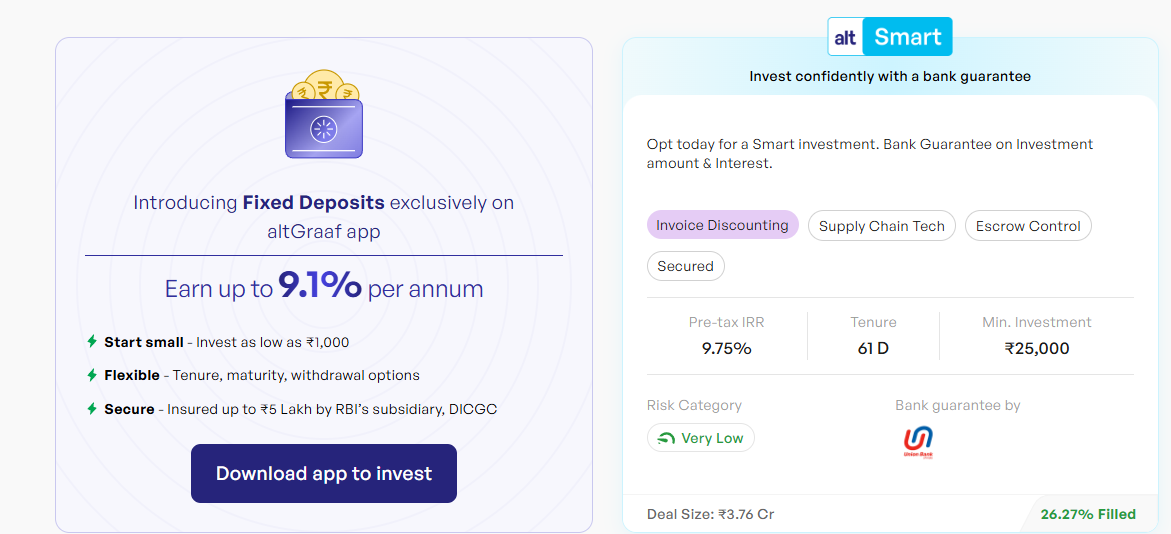

- Invested in Altsmart (bank Guarantee deal) on Altgraaf

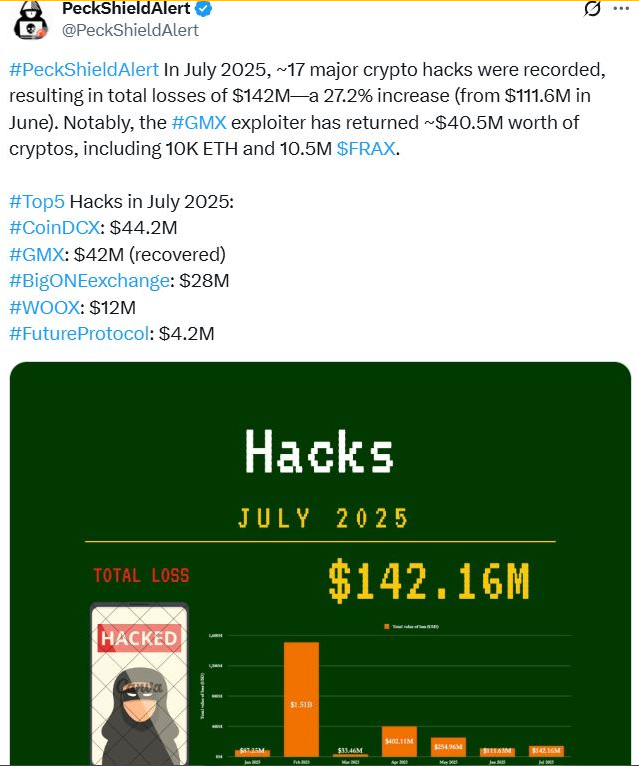

Crypto Investing

Bitcoin soared past $120,000, reaching a new all-time high around $122K–123K in mid-July, driven by global ETF inflows and favorable U.S. regulatory shifts

CoinDCX, India’s largest crypto exchange, suffered a $44 million hack on July 19 targeting an operational wallet. User funds were secure, as losses were covered by corporate reserves

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 35%

- I2IFunding- 48%

- Lendbox -17%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 13% | 5.5% |

| Lendbox Per Annum | Paused | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category, i.e, Urban Clap Loans.

- There are fresh deals available on I2ifunding now.

Equity Market

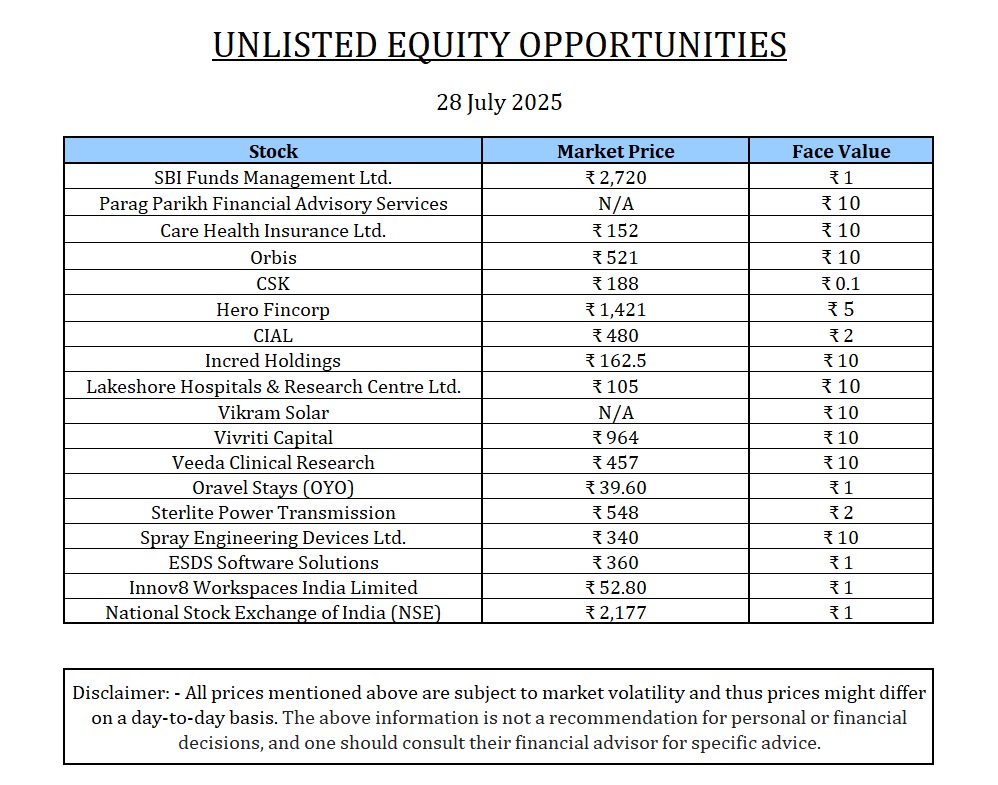

Pre-IPO Stocks

Indic Wisdom – Elevating Traditional Wellness Through Cold-Pressed Oils

Overview:

Indic Wisdom is a fast-growing D2C brand modernizing India’s ancient food wisdom. We specialize in 100% natural, wood-pressed edible oils and plant-based byproducts (like peanut protein) that are clean-label, sustainable, and health-focused.

Traction & Highlights

-

INR 21.1 Cr Net Revenue in FY25; 2.4x volume growth YoY

-

Products available in 1.8K+ retail outlets & across top Quick Commerce platforms (Zepto, Blinkit, BigBasket)

-

27 SKUs across 9+ oil variants; top sellers: Groundnut, Coconut, Mustard, Sunflower

-

Strong manufacturing backbone (Virar + Mysore) with 4.2L litre/month capacity

Innovation & Edge

-

In-house R&D and automation ensure quality, cost-efficiency, and traceability

-

Launched India’s first oil-based spray with a 3-in-1 nozzle (NAVA)

-

Commercializing Peanut Protein Powder with 60%+ protein content for B2B use

-

Trials underway with an MNC, nutraceutical company & snack firms

Market Opportunity

-

Cold-pressed oil market projected to grow at ~6% CAGR, touching ₹11.5K Cr by 2032

-

Backed by consumer shift to premium, healthy, natural F&B

-

First-mover advantage in protein recovery from oilcake → margin uplift + B2B diversification

Funding Ask – INR 8 Cr (+₹4 Cr greenshoe)

Use of Funds:

-

35% Channel Expansion (South India retail, quick commerce)

-

30% Brand Marketing

-

25% Capex / Operational scale

-

10% Working Capital

Valuation: ₹90 Cr pre-money

Team

-

Founders: Kaustubh & Prajakta Khare – ex-SAP consultants turned food entrepreneurs

-

Backed by Rockstud Capital, IPV, and marquee angels

-

CFO ex-Parag Milk | Ops Head with 17+ yrs experience in manufacturing

Indic Wisdom Strengths

✅ Category leader in premium cold-pressed oils

✅ Backward-integrated, scalable, tech-enabled operations

✅ Strong customer love – 4.8★ avg rating & growing brand loyalty

✅ Expanding into high-margin functional nutrition via protein-based products

Listed Stocks

While the indian market suffered, the US market was on a roll!

-

The S&P 500 rose ~3.25% in July, building on earlier gains (May +5.09%, June +5.23%)—though this was not its best month of the year statmuse.com.

-

The index hit 10 record closes in July, with the Nasdaq hitting 12 record highs—yet none of the daily moves exceeded 1%, highlighting a low‑volatility environment

India is still an expensive market, hence a cautious approach to investing is required.

Option Trading

July was a decent month with total returns of 3%. The option premiums have dropped considerably over the last few weeks. We would be testing new strategies.

I will be covering some platforms that provide good backtesting infrastructure for retail traders.

Quantinsti is also one of the top quant trading course providers in India. Planning to cover a few more excellent trading courses.

Starters can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.