Credit risk mutual funds were a very popular category of mutual funds in yesteryear, mainly due to the higher returns they provided by investing in high-yield, lower-rated corporate bonds. At a time when interest rates were falling and liquidity was abundant, fund managers were able to generate attractive yields by buying instruments rated AA-, A+, or even lower, which typically offered a 2–3% premium over AAA-rated papers.

However, in the current times, these funds are not as popular amongst investors. There are several reasons for this change in sentiment. Today, many investors prefer the safety of banking products like fixed deposits or high-rated bond funds. However, credit risk funds can still enhance portfolio yield and serve a role in a well-diversified portfolio.

In this article, we’ll explore what credit risk funds are, how SEBI regulatory changes have reshaped them, whether DIY bond portfolios (bond baskets) can replace them, their advantages and drawbacks, and finally best credit risk mutual funds in India.

What Are Credit Risk Mutual Funds?

Credit risk mutual funds are essentially a type of debt funds that predominantly invest in lower-rated corporate bonds and debt instruments, typically rated AA-, A+, or even lower, in a bid to earn higher returns than debt funds that invest in risk-free or lower-rated instruments.

In simple words, these funds aim to generate additional yield by taking on a slightly higher risk of default or delay in payments.

Pros & Cons of Credit Risk Mutual Funds

Pros

- Attractive returns – Often outperform bank FDs and regular debt funds.

- Diversification – Reduces default risk by holding dozens of corporate bonds.

- Liquidity – Redeem any day (though a small exit load may apply depending on the scheme).

- Professional management – Professionals are a part of the fund management team who are more experienced and have better resources compared to a standard DIY investor.

- Better risk control – Thanks to SEBI guidelines on concentration and ratings.

Cons / Risks

- Credit risk – A Default or rating downgrade can dent NAV temporarily or permanently. These funds are at higher risk as they are designed to take advantage of this situation.

- Interest rate risk – Bond prices move inversely with yields, impacting NAV in the short term.

- Expense ratio – May reduce gross yield by 0.5–1.5,% depending on the type of scheme.

- Potential for negative returns in the short term – In unstable rate or credit cycles, funds can see NAV drawdowns.

Why Credit Risk Funds are No Longer Popular?

These funds were once popular for their ability to give higher returns by investing in lower-rated bonds. But in recent years, their appeal has gone down due to a few key factors:

Some high-profile bond defaults (like IL&FS and DHFL) resulted in losses for many funds and shook investor confidence.

SEBI introduced stricter norms — tighter exposure limits, more disclosure, and stress testing — to make these funds safer and more transparent. While this was good for stability, it meant fund managers could no longer chase high-risk instruments as earlier to boost returns.

BOI Axa Credit Risk Fund: A Cautionary Tale in Indian Credit Investing

Launched in February 2015 with the backing of BOI and advisory from global PE giant KKR, the BOI Axa Credit Risk Fund was once seen as a smart bet in the credit space. By August 2018, it had delivered a healthy CAGR of 9.49%. But things unraveled quickly post the IL&FS crisis.

The fund was hit hard by a series of credit downgrades—including DHFL and Sintex BAPL—and failed to recover. The breaking point came in April 2020 when it marked down several securities overnight, wiping out over 50% of its value in a single day.

From ₹1,700 crore at its peak, the fund’s AUM is now down to just ₹167 crore. A ₹100 investment at launch would now be worth ₹36, translating to a -17.86% return since inception. Despite SEBI allowing side-pocketing in 2018, the fund delayed its implementation until 2020.

The fund remains open for redemptions but closed for new investments. What remains is a largely low-risk portfolio of bank CDs and top-rated commercial paper, but the scars of poor credit calls remain.

Key Lesson: Even marquee partnerships and strong early returns can’t shield a credit fund from concentrated risks and delayed risk management responses.

Best Credit Risk Mutual Funds in India

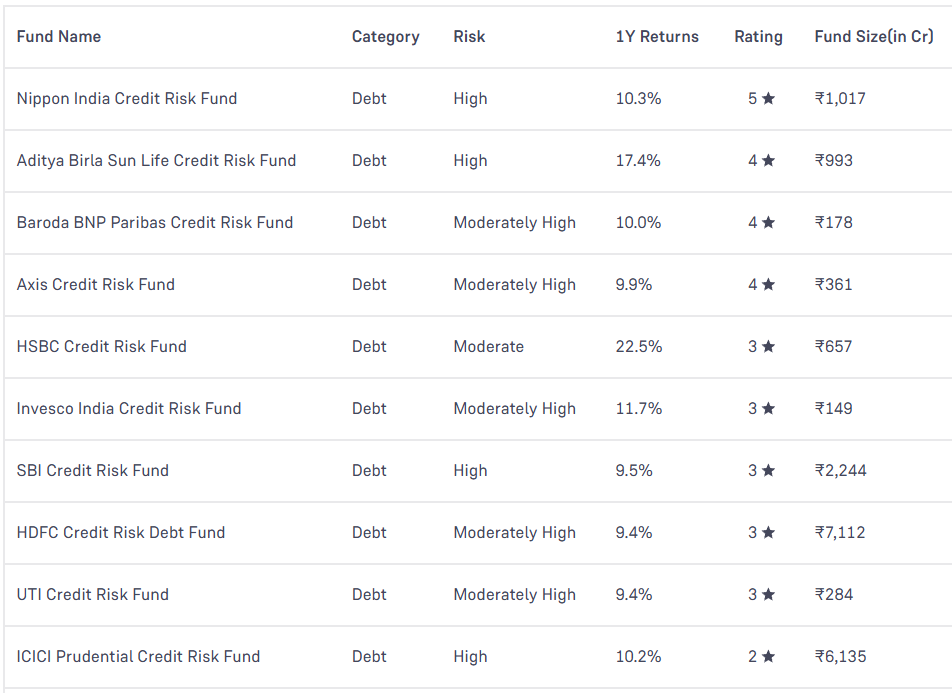

Below are some of the most popular and well-performing mutual fund schemes (scheme names only; performance & ratings change frequently):

- Aditya Birla Sun Life Credit Risk Fund

- ICICI Prudential Credit Risk Fund

- Axis Credit Risk Fund

- Nippon India Credit Risk Fund

- HDFC Credit Risk Fund

- SBI Credit Risk Fund

- Kotak Credit Risk Fund

Note: Performance, AUM size, and risk parameters vary; always check recent factsheets, CRISIL/Morningstar ratings, and portfolio holdings before investing.

DIY Bond Basket vs. Credit Risk Mutual Funds

With the rise of online bond platforms, investors can now easily research and buy bonds of their choice with just a few clicks. So the question arises — should you build your own bond portfolio (bond basket) by choosing NCDs, commercial papers, or corporate bonds yourself, or opt for a professionally managed credit risk mutual fund instead to boost your returns?

Here are a few points to consider:

| DIY Bond Portfolio | Credit Risk Mutual Fund | |

| Management | Individual Investor picks and monitors bonds directly | A professional fund manager handles selection and portfolio |

| Research required | High – need to research companies, ratings, and sectors | Lower – fund team performs due diligence |

| Diversification | Limited to the number of bonds you buy (with the capital you have) | Higher fund typically holds 30-50 instruments |

| Liquidity | May be illiquid; selling a bond quickly can be tough | Higher fund units can be redeemed daily |

| Risk control | Investors must manage risk by choosing issuances carefully | SEBI regulations and fund oversight help control risk |

| Costs/Fees | Mainly brokerage or transaction charges | 0.5–1.5% expense ratio |

| Transparency | The investor has full visibility over holdings | Monthly portfolio disclosure by fund |

| Suitable for | Sophisticated, well-informed investors | Average investors, medium-risk tolerance |

| Expected Returns | Comparatively higher due to more freedom to choose bonds (without any restrictions) & saving of expense ratios | Typically lower considering expense ratios |

If you’re a sophisticated investor with knowledge of bond markets, the ability to research companies, and enough capital to buy a diversified basket of bonds directly, a DIY bond portfolio might be a good fit for you. It lets you select exactly which issues you want (without any direct regulation from the market regulator), avoid fund management expenses, and control your holdings.

However, for average investors or those with limited time and expertise, a credit risk mutual fund is often a smarter choice. It provides professional management, diversification, liquidity, and oversight under SEBI’s regulations.

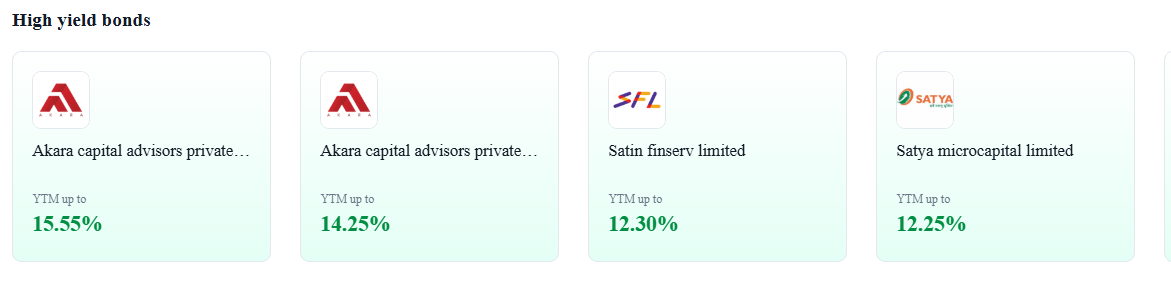

Best Platform to buy Bonds

We have tied up with Aspero to provide the highest yields to our readers. You can go through the details of the platform here – Aspero Review

Registered using the link below to get access to top bonds.

Other platforms like Gripinvest allow you to buy Securitized Debt Instruments that can be an alternative to bonds!

Conclusion

Credit risk mutual funds can be a decent way to earn slightly higher returns by investing in lower-rated bonds. However, they come with their own set of risks — from defaults to market volatility.

For experienced investors who want more control, buying a basket of bonds directly might be a better choice. But for most people, credit risk funds managed by experts are a convenient way to add some higher-yield instruments to their portfolio without having to do all the hard work themselves. Ultimately, it’s all about choosing the option that fits your goals, knowledge, and risk tolerance.

How about taxation part if we compare platform investment vs. credit risk mutual fund ?

Hi,

Taxation of bond mutual fund is similar to individual bonds! marginal tax rate