Waya Introduction

The Indian stock market has undergone a remarkable transformation in recent years, driven by technological innovation and a new generation of investors seeking smarter, data-backed ways to grow their wealth.

As investing becomes more accessible, the challenge shifts from simply entering the market to making timely, informed decisions, knowing what to buy, when to sell, and how to manage risk in a volatile environment.

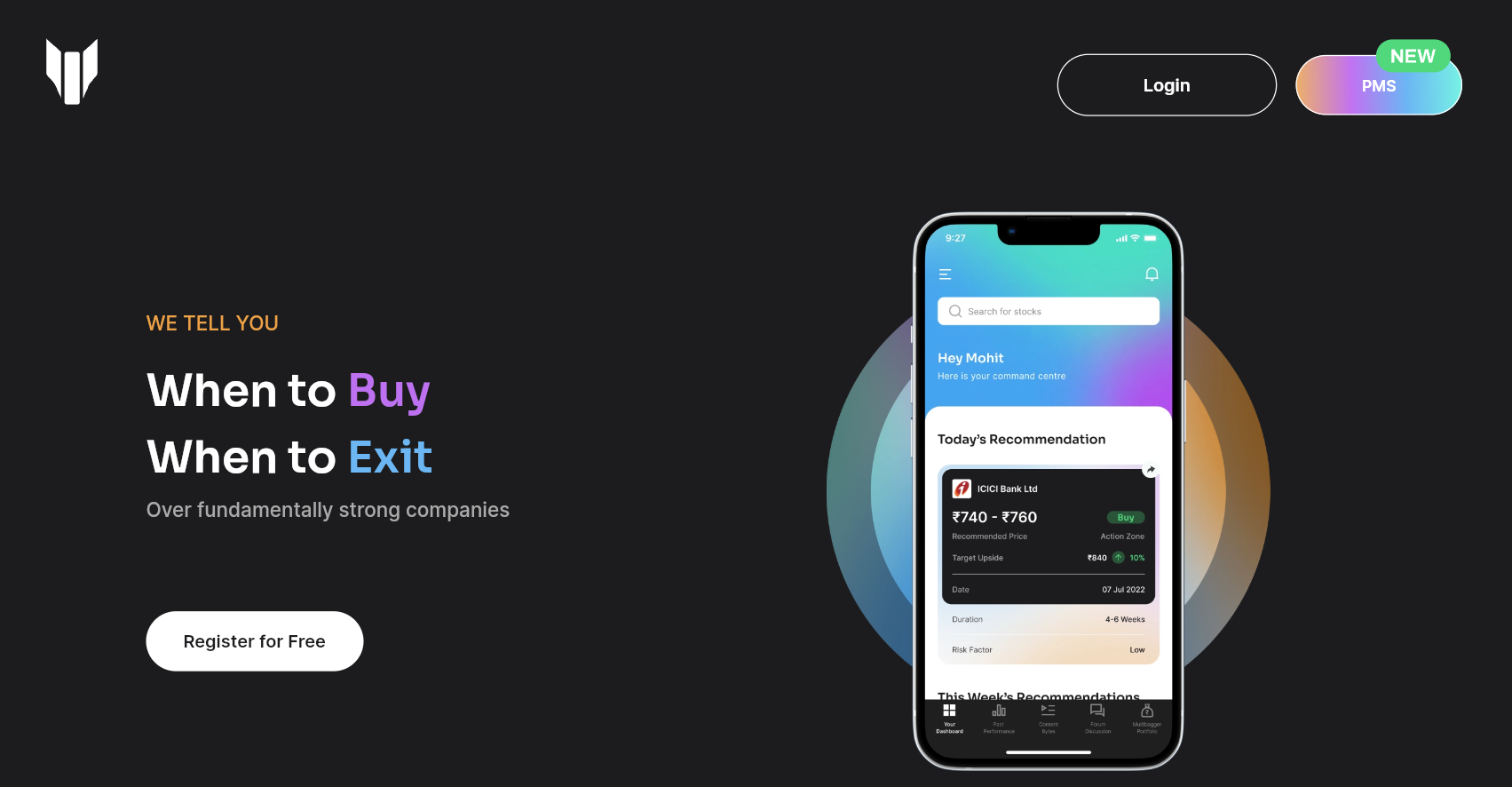

This is where platforms like Waya step in, aiming to bridge the gap between complex market data and actionable advice. Waya leverages predictive models and machine learning to offer personalised investment guidance, making it easier for young and tech-savvy Indians to navigate the equity markets.

In this review, we’ll take a close look at Waya’s offerings, its team, features, pricing, and how it stacks up against other advisory platforms, giving you a clear, unbiased perspective on whether it’s the right fit for your investment journey.

What is Waya?

Waya is a SEBI-registered investment advisory and portfolio management platform, launched in Mumbai, with a mission to help young Indians make smarter investment choices. The platform targets millennials and Gen-Zers and aims to simplify the trading and investment journey of these new generations of investors in the Indian equity market using technology.

Registered with SEBI (SEBI registration number INH000010876 as a Research Analyst and INP000008987 for PMS), Waya uses predictive models and back-tested algorithms to provide research-backed buy, hold, and sell recommendations on listed equities.

The platform’s vision is to create a trustworthy, technology-driven investment experience for young India, focusing on transparency, privacy, and ease of use. The platform notably offers short- and long-term buy-sell recommendations to its subscribers, advising on when to buy and when to sell.

Since its launch in 2022, Waya has attracted a growing user base by offering actionable advice, educational resources, and a digital-first approach that appeals to both novice and experienced investors. Its services span from advisory for retail clients to portfolio management services for high-net-worth individuals and institutions. The platform stands out by offering actionable advice on when to buy and sell stocks, using technology-driven, back-tested patterns that adapt to changing market cycles

Team behind Waya

Waya is led by Amit Vora, Director of Waya Financial Technologies Private Limited, who brings extensive experience in strategic management, business process implementation, and financial planning. He is responsible for the company’s overall direction, financial stability, and growth. CEO Amit Vora, is a technologist with extensive experience in product development and management across global firms like Motorola and Reliance Communications. Vora holds a Bachelor’s in Electronics & Telecommunications from the University of Mumbai, an MBA from Benedictine University, and further management credentials from IIM Bangalore and Michigan State University.

Supporting him is Rupesh Patil, the CTO and Principal Architect of Waya, who holds over 10 years of experience and has significant expertise in technological developments in the financial realm. Shubham Gandhi, the Research Head at Waya, holds an MBA in Finance and Financial Management Services and specialises in technical analysis and equity advisory, bringing deep market insight and analytical rigour to the team. Together, these leaders combine technical, financial, and operational expertise to drive Waya’s mission of making investing accessible and effective for a new generation of Indians.

Key Features of Waya

AI-Driven Advisory Platform

Waya provides actionable investment advice using predictive models and machine learning algorithms, which have been back-tested on historical data from 2017 to 2021 and have been live since 2022. The platform scans the market to identify optimal buy, hold, and sell opportunities, aiming to maximise returns and minimise risks for subscribers.

The platform offers short-term calls with a hold period ranging from 2 to 45 days; multibagger portfolio recommendations with durations of up to 30 months and return potential of 3 to 10 times; Short trade recommendations; and educational content for financial learning and timely market updates. Waya’s predictive models analyse fundamentally strong stocks to offer buy-sell recommendations based on back-tested algorithms.

Personalised Recommendations

Waya’s algorithms consider your risk profile, investment horizon, and preferences to tailor advice to your specific needs. This helps both beginners and experienced investors make decisions aligned with their goals.

Option Traders

Waya also offers trade recommendations in the FnO segment through the Waya: Futures and Options app, available on the Play Store and App Store.

User-Friendly Experience

The platform is designed to be intuitive and accessible, with a digital-first approach that prioritises privacy and security. Users can easily access recommendations, track their portfolios, and receive real-time updates.

Educational Resources

Waya offers a range of educational materials and tutorials to help users understand investment concepts, market trends, and financial terminology, empowering them to make informed choices.

Referral Program

Subscribers can refer friends to Waya and earn rewards for each successful subscription, adding a community-driven incentive to the platform.

SEBI-Registered Compliance

Waya operates under strict SEBI guidelines, ensuring regulatory compliance and transparency in all its advisory and portfolio management services.

Waya PMS (Portfolio Management Service)

Waya’s PMS is tailored for high-net-worth individuals, corporates, and NRIs, offering both discretionary and non-discretionary portfolio management. The PMS focuses on long-term, India-centric growth themes, investing only in listed equities with a buy-and-hold approach.

Clients benefit from personalised asset allocation, regular performance updates, and direct access to experienced fund managers. The PMS is structured to align with India’s growth story, targeting sectors like power, engineering, capital goods, and pharma, and follows best practices for fee calculation, including high-water marks and hurdle rates.

How to use Waya

To start using Waya, users can sign up directly on the platform’s website or mobile app. The onboarding process involves basic registration, KYC verification, and risk profiling to ensure personalised recommendations.

Once registered, users gain access to the dashboard, where they can view stock recommendations, track portfolio performance, and access educational resources. The app is designed for ease of use, with real-time notifications and a clean interface that allows investors to act quickly on advisory calls. Waya’s digital-first approach ensures that even those new to investing can navigate the platform confidently and securely.

Any new recommendations are notified on WhatsApp as well as through Waya App notifications. Waya indicates a certain price range in which investors can purchase a stock, called “Buy Zone”, and is indicated by “Buy” on the dashboard’s action zone. Similarly, when the price of the stock goes beyond the buy range, the dashboard would display “Hold”, implying that the users ought to keep the stock until an “Exit” indication is given in the action zone.

Waya Pricing

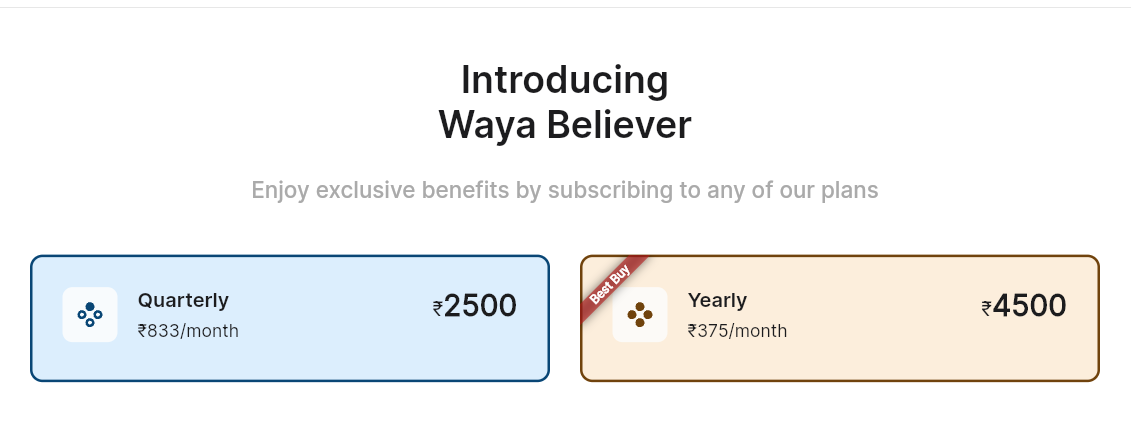

Waya offers multiple subscription plans to suit different investor needs. While the basic plan grants access to core advisory features, premium plans unlock advanced analytics, priority support, and more personalized services. The platform has introduced its premium plan called “Waya Believer”, available at a Quarterly cycle of INR 2500 billed at INR 833 per month, and Yearly at INR 4500, billed at INR 375 per month.

For PMS clients, fees are typically structured as a fixed percentage of assets under management (up to 2.5% annually), or as a performance-based fee (15–20%) above a hurdle rate (10%), with additional charges for brokerage, custodian, and exit loads as detailed in the PMS disclosure document. All charges are transparent, and users are encouraged to review the terms before subscribing.

Waya Alternatives

Waya faces competition from several Indian investment advisory platforms, including Liquide, Jarvis, and Univest.

- Liquide offers AI-driven stock recommendations and real-time alerts, but may not match Waya’s educational focus.

- Jarvis is strong in automated portfolio rebalancing and caters to investors who prefer a hands-off approach, though its interface can be complex for newcomers.

- Univest stands out for its multi-asset coverage and sentiment analysis, but its pricing for premium features can be higher.

Compared to these, Waya’s strengths lie in its user-friendly design, personalised recommendations, and focus on education and compliance. However, investors seeking broader asset classes or more automation may find Jarvis or Univest more suitable, while those prioritising simplicity and actionable advice may prefer Waya.

Is Waya Real or a Scam?

Based on our analysis, Waya is not a scam. However, we feel most of these platforms use AI and Machine learning jargon as marketing tricks. These techniques can assist you in making better decisions, but they can not guarantee profit.

I am surprised how they have gamified option trading through a simple direction based approach. Options are highly complex instruments that have multiple parameters without which trading is highly risky.

Waya can, however, help you to analyse your strategy better through its research and content, and can be used as a tool to improve your skills.

Conclusion

Waya stands out as a tech-driven, SEBI-registered investment advisory platform tailored for the new generation of Indian investors. Its blend of AI-powered recommendations, educational resources, and transparent pricing makes it a strong contender for those seeking guidance in the equity markets. While it may not offer the breadth of asset classes or automation found in some competitors, Waya’s focus on simplicity, compliance, and actionable advice makes it a compelling choice for both beginners and experienced investors looking for a reliable, user-friendly platform.